REDBOX ENTERTAINMENT INC. (F/K/A SEAPORT GLOBAL ACQUISITION CORP.)

NOTES TO UNAUDITED CONDENSED

FINANCIAL STATEMENTS

NOTE 1. DESCRIPTION OF ORGANIZATION AND BUSINESS OPERATIONS

Note 1 — Organization and Business Operations

Redbox Entertainment Inc. (the “Company”) was incorporated in Delaware on July 24, 2020 under the name “Seaport Global Acquisition Corp.” The Company was formed for the purpose of entering into a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses (an “initial business combination”). The Company is an early stage and emerging growth company and, as such, the Company is subject to all of the risks associated with early stage and emerging growth companies. In conjunction with the Business Combination with Redbox, the Company formed a wholly-owned subsidiary, Seaport Merger Sub, LLC, a Delaware limited liability company (“Merger Sub”). Merger Sub did not have any activity as of September 30, 2021.

As of September 30, 2021, the Company had not commenced any operations. All activity through September 30, 2021 relates to the Company’s formation and initial public offering (the “Initial Public Offering”) which is described below, and working capital related to the consummation of an initial business combination.

The registration statement for the Company’s Initial Public Offering was declared effective on November 27, 2020. On December 2, 2020, the Company consummated the Initial Public Offering of 14,375,000 units (the “Units” and, with respect to the shares of Class A common stock included in the Units sold, the “Public Shares”), which included the full exercise by the underwriter of the overallotment option to purchase an additional 1,875,000 Units at $10.00 per Unit, generating gross proceeds of $143,750,000, which is described in Note 4.

Simultaneously with the closing of the Initial Public Offering, the Company consummated the sale of 6,062,500 warrants (each, a “Private Placement Warrant” and collectively, the “Private Placement Warrants”) at a price of $1.00 per Private Placement Warrant in a private placement to Seaport Global SPAC, LLC (the “Sponsor”) generating gross proceeds of $6,062,500, which is described in Note 5. Transaction costs amounted to $8,361,625, consisting of $2,875,000 of underwriting fees, $5,031,250 of deferred underwriting fees and $455,375 of other offering costs.

Following the closing of the Initial Public Offering on December 2, 2020, an amount of $145,187,500 ($10.10 per Unit) from the net proceeds of the sale of the Units in the Initial Public Offering and the sale of the Private Placement Warrants was placed in a trust account (the “Trust Account”) and invested in U.S. government securities, within the meaning set forth in Section 2(a)(16) of the Investment Company Act of 1940, as amended (the “Investment Company Act”), with a maturity of 185 days or less, or in any open-ended investment company that holds itself out as a money market fund meeting the conditions of Rule 2a-7 of the Investment Company Act, as determined by the Company, until the earlier of: (i) the consummation of an initial business combination or (ii) the distribution of the funds in the Trust Account to the Company’s stockholders, as described below.

Risks and Uncertainties

Management is continuing to evaluate the impact of the COVID-19 pandemic and has concluded that while it is reasonably possible that COVID-19 could have a negative effect on identifying a target company for an initial business combination, the specific impact is not readily determinable as of the date of these financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Business Combination Agreement

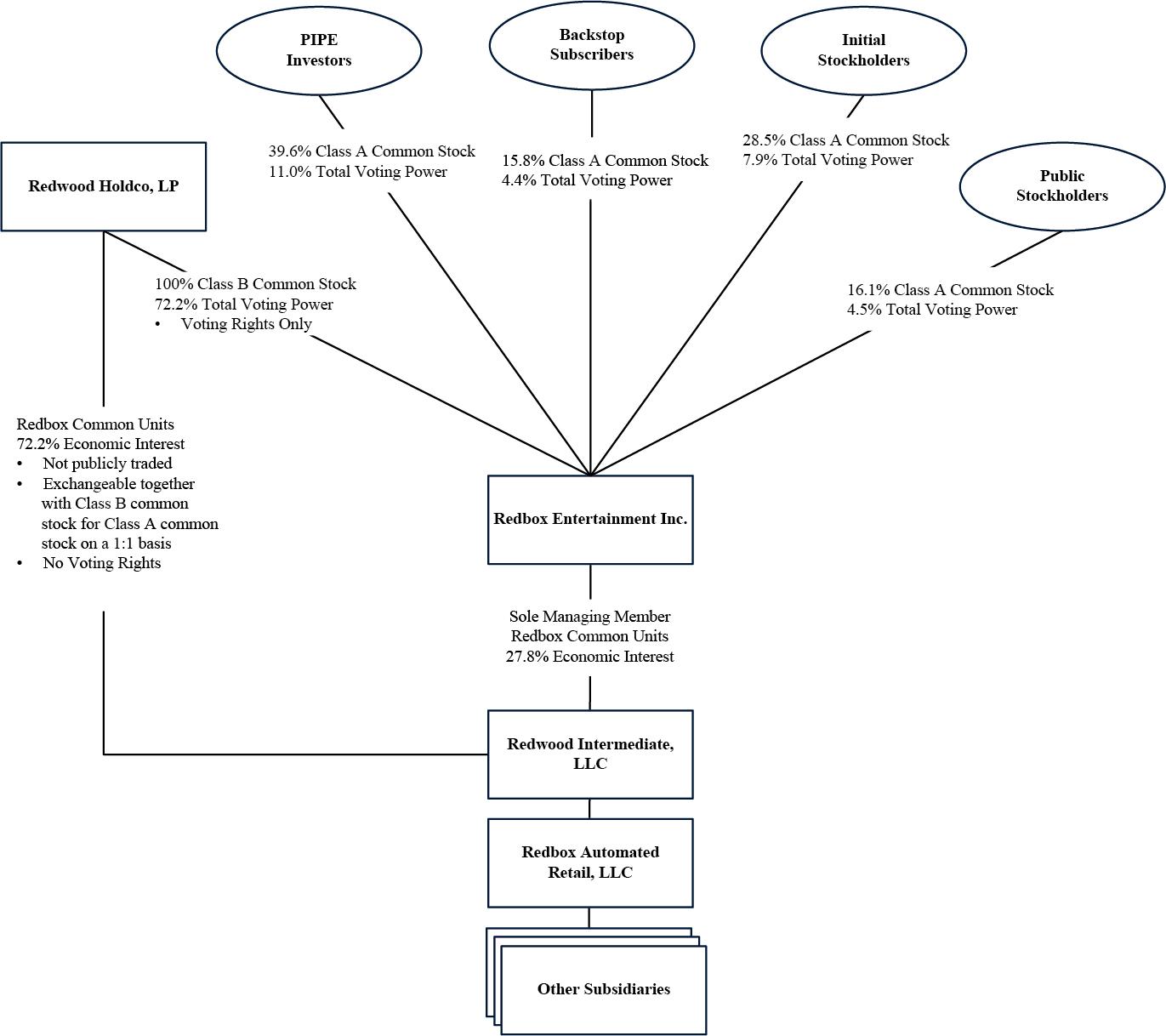

On May 16, 2021, the Company entered into a Business Combination Agreement (the “Business Combination Agreement”) by and among the Company, Merger Sub, Redwood Holdco, LP (“Parent”), and Redwood Intermediate, LLC (“Redbox”).

On October 22, 2021, SGAC, Parent and Redbox consummated the business combination (the “Business Combination”) pursuant to the terms of the Business Combination Agreement. Immediately upon the completion of the Business Combination, Merger Sub merged with and into Redbox. In connection with the consummation of the Business Combination, SGAC changed its name to “Redbox Entertainment Inc.”