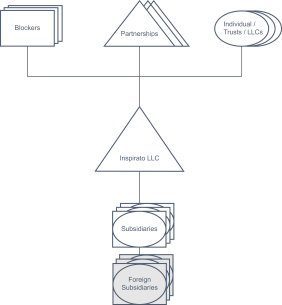

“Subsidiaries” means, of any Person, any corporation, association, partnership, limited liability company, joint venture or other business entity of which more than fifty percent (50%) of the voting power or equity is owned or controlled directly or indirectly by such Person, or one (1) or more of the Subsidiaries of such Person, or a combination thereof.

“Tax” or “Taxes” means all net or gross income, net or gross receipts, net or gross proceeds, payroll, employment, excise, severance, stamp, occupation, windfall or excess profits, profits, customs, capital stock, withholding, social security, unemployment, disability, real property, personal property (tangible and intangible), sales, use, transfer, value added, alternative or add-on minimum, capital gains, user, leasing, lease, natural resources, ad valorem, franchise, gaming license, capital, estimated, goods and services, fuel, interest equalization, registration, recording, premium, environmental or other taxes, assessments, duties or similar charges, including all interest, penalties and additions imposed with respect to (or in lieu of) the foregoing, imposed by (or otherwise payable to) any Governmental Entity, and, in each case, whether disputed or not.

“Tax Returns” means returns, declarations, reports, claims for refund, information returns, elections, disclosures, statements, or other documents (including any related or supporting schedules, attachments, statements or information, and including any amendments thereof) filed or required to be filed with a Governmental Entity in connection with, or relating to, Taxes.

“Tax Sharing Agreement” means any agreement or arrangement (including any provision of a Contract) pursuant to which any Group Company is or may be obligated to indemnify any Person for, or otherwise pay, any Tax of or imposed on another Person, or indemnify, or pay over to, any other Person any amount determined by reference to actual or deemed Tax benefits, Tax assets, or Tax savings.

“Taxing Authority” means any Governmental Entity having jurisdiction over the assessment, determination, collection, administration or imposition of any Tax.

“Total Per Blocker Equity Consideration” means, with respect to each Blocker (a) a number of shares of Buyer Class A Common Stock equal to (i) the quotient of (A)(1) the sum of (w) the Equity Merger Consideration, plus (x) with respect to each Blocker, such Blocker’s Cash and Cash Equivalents (if any), minus (y) with respect to each Blocker, such Blocker’s Blocker Indebtedness, minus, (z) with respect to each Blocker, such Blocker’s unpaid Transaction Expenses, divided by (2) the Reference Price, divided by (B) the Fully Diluted Number, multiplied by (ii) the number of Company Units held by such Blocker as of immediately prior to the Blocker Effective Time, and after giving effect to the Company A&R LLCA.

“Total Per Blocker Cash Consideration” means, with respect to each Blocker (a) an amount in cash equal to the quotient of (i) the Distributed Cash Amount divided by (ii) the Fully Diluted Number, multiplied by (b) the number of Company Units held by such Blocker as of immediately prior to the Blocker Effective Time, and after giving effect to the Company A&R LLCA.

“Transaction Expenses” means, with respect to any Buyer Party, Blocker or any Group Company, to the extent not paid as of the Closing by such Buyer Parties, any Blocker, or any Group Company:

(a) all fees, costs and expenses (including fees, costs and expenses of third-party advisors, legal counsel, accountants, investment bankers (including the Deferred Discount, as such term is defined in the Trust Agreement), or other advisors, service providers, representatives) including brokerage fees and commissions, incurred or payable by the Buyer Parties or the Sponsor through the Closing in connection with the preparation of the financial statements in connection with the filings required in connection with the transactions contemplated by this Agreement, the negotiation and preparation of this Agreement, the Ancillary Agreements and the Form S-4 and the consummation of the transactions contemplated hereby and thereby (including due diligence) or in connection with Buyer’s pursuit of a Business Combination, and the performance and compliance with all agreements and conditions contained herein or therein to be performed or complied with;

A-18