DESCRIPTIONOF SHARE CAPITAL

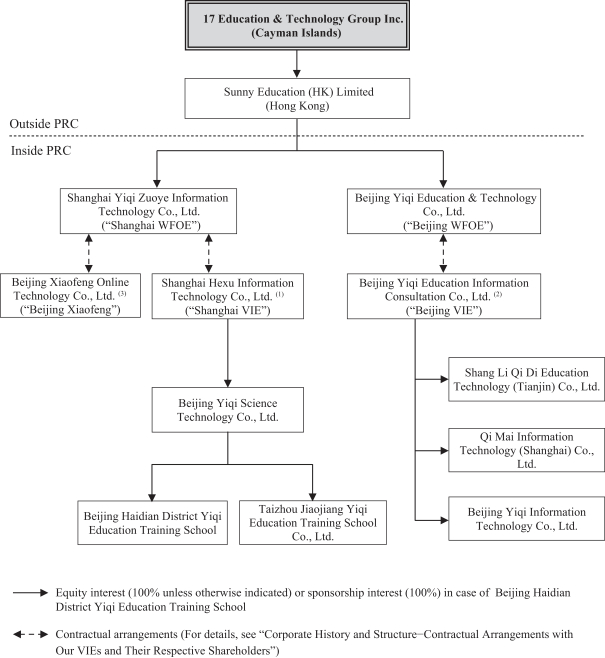

We are a Cayman Islands exempted company incorporated with limited liability and our affairs are governed by our memorandum and articles of association, the Companies Law (2020 Revision) of the Cayman Islands, which we refer to as the Companies Law below, and the common law of the Cayman Islands.

As of the date of this prospectus, our authorized share capital is US$80,000 divided into 800,000,000 shares with a par value of US$0.0001 each, comprising of 476,181,955 ordinary shares, 22,257,215 Series A preferred shares, 34,815,112 Series B preferred shares, 54,083,288 Series B+ preferred shares, 50,195,203 Series C preferred shares, 50,193,243 Series D preferred shares, 79,087,225 Series E preferred shares and 33,186,759 Series F preferred shares. As of the date of this prospectus, 77,884,732 ordinary shares, 17,085,275 Series A preferred shares, 34,544,762 Series B preferred shares, 54,083,288 Series B+ preferred shares, 50,195,203 Series C preferred shares, 50,193,243 Series D preferred shares, 78,824,567 Series E preferred shares and 33,186,759 Series F preferred shares are issued and outstanding. All of our issued and outstanding shares are fully paid.

Immediately prior to the completion of this offering, our authorized share capital will be changed into US$150,000 divided into 1,500,000,000 shares comprising of (i) 1,300,000,000 Class A ordinary shares of a par value of US$0.0001 each, (ii) 100,000,000 Class B ordinary shares of a par value of US$0.0001, and (iii) 100,000,000 shares of a par value of US$0.0001 each of such class or classes (however designated) as the board of directors may determine in accordance with our post-offering memorandum and articles of association. Immediately prior to the completion of this offering, all of our issued and outstanding ordinary shares and preferred shares will be converted into, and/or re-designated and re-classified, as Class A ordinary shares on a one-for-one basis, save and except that the 50,017,212 ordinary shares and 3,305,651 preferred shares held by Fluency Holding Ltd. will be converted into, and/or re-designated and re-classified as, Class B ordinary shares. Following such conversion and/or re-designation and upon the completion of this offering, we will have 411,211,902 Class A ordinary shares issued and outstanding and 58,453,168 Class B ordinary shares issued and outstanding (inclusive of the 5,130,305 Class B ordinary shares issuable upon full vesting of the 5,130,305 outstanding restricted share units granted to Mr. Andy Chang Liu, our founder, chairman and chief executive officer, under the 2020 Plan, all of which will become fully vested upon the completion of this offering and 36,936 Class A ordinary shares to be held by China Equities HK Limited upon the completion of this offering, all of which will have been converted and re-designated from 36,936 Series E preferred shares to be issued to China Equities HK Limited immediately prior to the completion of this offering pursuant to the cashless exercise of the warrant we issued to China Equities HK Limited as described in “Description of Share Capital—History of Securities Issuances—Warrants” in this prospectus), assuming the underwriters do not exercise their option to purchase additional ADSs. All of our shares issued and outstanding prior to the completion of the offering are and will be fully paid, and all of our shares to be issued in the offering will be issued as fully paid. After this offering, the holder of Class B ordinary shares will have the ability to control matters requiring shareholders’ approval, including any amendment of our memorandum and articles of association. Any future issuances of Class B ordinary shares may be dilutive to the voting power of holders of Class A ordinary shares. Any conversions of Class B ordinary shares into Class A ordinary shares may dilute the percentage ownership of the existing holders of Class A ordinary shares within their class of ordinary shares. Such conversions may increase the aggregate voting power of the existing holders of Class A ordinary shares. In the event that we have multiple holders of Class B ordinary shares in the future and certain of them convert their Class B ordinary shares into Class A ordinary shares, the remaining holders who retain their Class B ordinary shares may experience increases in their relative voting power. After this offering, Class B ordinary shares will need to represent at least 6.25% of the total issued and outstanding ordinary shares for the holder of Class B ordinary shares to have the voting power for controlling the outcome of matters submitted to the shareholders for approval by way of a special resolution, which requires the affirmative vote of no less than two-thirds of the votes cast attaching to our issued and outstanding ordinary shares under our post-offering seventh amended and restated memorandum and articles of association.

183