deposited in the Trust Account could become subject to the claims of the Company’s creditors, if any, which could have priority over the claims of the Company’s public stockholders.

Business Combination

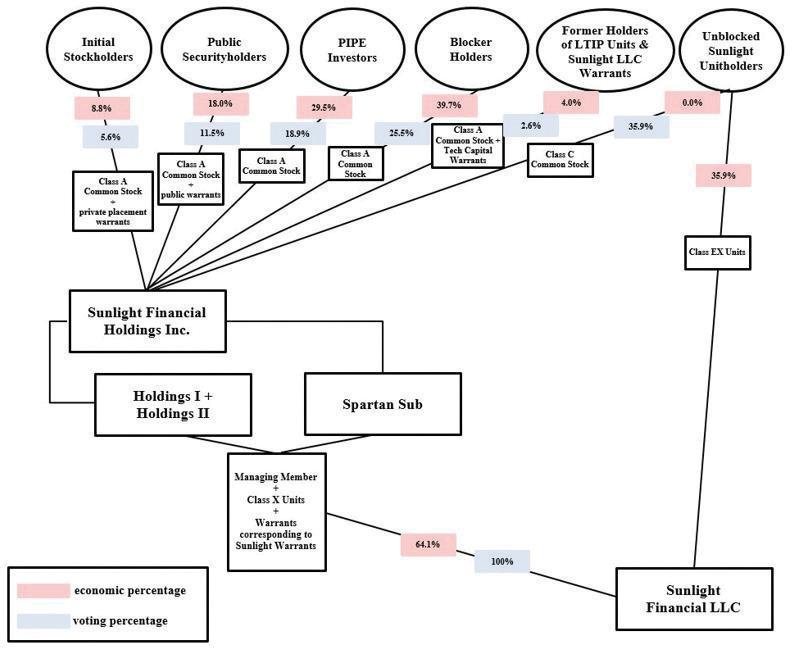

On July 9, 2021 (the “Closing Date”), Sunlight Financial Holdings Inc., a Delaware corporation (formerly known as Spartan Acquisition Corp. II), consummated the previously announced business combination pursuant to that certain Business Combination Agreement (the “Business Combination Agreement”), dated January 23, 2021, by and among Spartan Acquisition Corp. II, a Delaware corporation (“Spartan”), SL Invest I Inc., a Delaware corporation and wholly-owned subsidiary of Spartan (“MergerCo1”), SL Invest II LLC, a Delaware limited liability company and wholly-owned subsidiary of Spartan (“MergerCo2”), SL Financial Investor I LLC, a Delaware limited liability company and wholly-owned subsidiary of Spartan (“Holdings I”), SL Financial Investor II LLC, a Delaware limited liability company and wholly-owned subsidiary of Spartan (“Holdings II”), SL Financial Holdings Inc., a Delaware corporation and wholly-owned subsidiary of Spartan (“Spartan Sub”), SL Financial LLC, a Delaware limited liability company and wholly-owned subsidiary of Spartan Sub (“OpCo Merger Sub” and collectively with MergerCo1, MergerCo2, Holdings I, Holdings II and Spartan Sub, the “Spartan Subsidiaries”), Sunlight Financial LLC, a Delaware limited liability company (“Sunlight”), FTV-Sunlight, Inc., a Delaware corporation (“FTV Blocker”), and Tiger Co-Invest B Sunlight Blocker LLC, a Delaware limited liability company (“Tiger Blocker,” and collectively with FTV Blocker, the “Blockers”). The transactions contemplated by the Business Combination Agreement are collectively referred to herein as the “Business Combination.”

Upon the completion of the Business Combination and the other transactions contemplated by the Business Combination Agreement (collectively, the “Transactions,” and such completion, the “Closing”), the post-combination company is organized in an “Up-C” structure, such that all of the material assets of the combined company are held by Sunlight, and the only material asset of the Company (together with its wholly-owned subsidiaries, Spartan Sub, Holdings I and Holdings II) is its indirect equity interests in Sunlight.

Founders Stock Agreement

In connection with the entry into the Business Combination Agreement, but effective as of the Closing of the Transactions, the Company and the initial stockholders entered into a Founders Stock Agreement (the “Founders Stock Agreement”), pursuant to which, among other things, subject to and effective immediately prior to the Closing of the Transactions, the Sponsor agreed to surrender up to 25% of the Class B common stock held by the Sponsor (at a 1:4 ratio to the percentage, if any, of redemptions by holders of Class A common stock); provided that no such surrender shall occur unless more than 5% of the outstanding shares of Class A common stock are actually redeemed by the Company.

Liquidity and Capital Resources

As of June 30, 2021, the Company had approximately $140,000 in its operating bank account and a working capital deficit of approximately $6.0 million.

Through June 30, 2021, the Company’s liquidity needs have been satisfied through a payment of $25,000 from the Sponsor to pay for certain offering costs in exchange for issuance of the Founder Shares (as defined in Note 4), the loan under the Note (see Note 4) of approximately $235,000 (see Note 4), and the net proceeds from the consummation of the Private Placement not held in the Trust Account. The Company fully repaid the Note on December 3, 2020. In addition, in order to finance transaction costs in connection with an Initial Business Combination, the Company’s officers, directors and initial stockholders may, but are not obligated to, provide the Company Working Capital Loans (see Note 4). As of June 30, 2021, there were no amounts outstanding under any Working Capital Loans.

In connection with the execution of the Business Combination Agreement, on January 23, 2021, Spartan entered into the Subscription Agreements with the New PIPE Investors (as defined in the Proxy Statement) pursuant to which the New PIPE Investors agreed to purchase, and Spartan agreed to sell to the New PIPE Investors, an aggregate of 25,000,000 shares of Class A Common Stock (the “PIPE Shares”), for a purchase price of $10.00 per share, or an aggregate purchase price of $250.0 million, in a private placement (the “PIPE Financing”). Upon closing of the Business Combination, the Company retained $50 million net of transaction expenses as working capital.

Upon closing of the Business Combination, the Company’s immediate sources of liquidity include cash generated from operations, accounts receivable, and existing credit facilities of Sunlight. Based on the foregoing, management believes that the Company will have sufficient working capital and borrowing capacity to meet its needs through one year from this filing.