development and commercialization of treatments in neurodegenerative diseases, including AD. While we believe that our focus, expertise, scientific knowledge and intellectual property provide us with competitive advantages, we face competition from several different sources, including large and small biopharmaceutical companies, academic research institutions, government agencies and public and private research organizations, that conduct research, seek patent protection, and establish collaborative arrangements for research, development, manufacturing and commercialization.

No products have been approved to treat ALSP, and we are not aware of any in clinical development other than VGL101. Academics have investigated the use of hematopoietic stem cell transplantation in a small number of ALSP patients, however, we believe this modality has limited benefits and several key limitations.

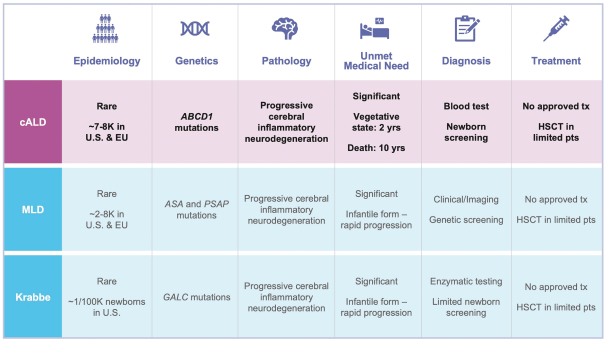

We are aware of one company, bluebirdbio, Inc., which received marketing approval for SKYSONA™ (elivaldogene autotemcel) in July 2021 in the European Union for a cALD treatment. In October 2021, the company announced it will withdraw its regulatory marketing authorization for SKYSONA™ from the European Union. In the U.S., development of elivaldogene autotemcel was put on clinical hold in August 2021 following a report that one treated patient developed myelodysplastic syndrome (MDS), a type of blood cancer. Two additional cases of MDS have been subsequently reported. In December 2021, bluebirdbio announced that the FDA has accepted its BLA for elivaldogene autotemcel for cALD. As of December 2021, a second company, Minoryx Therapeutics, Inc. is developing a small molecule therapeutic for the treatment of cALD in a Phase 2/3 trial.

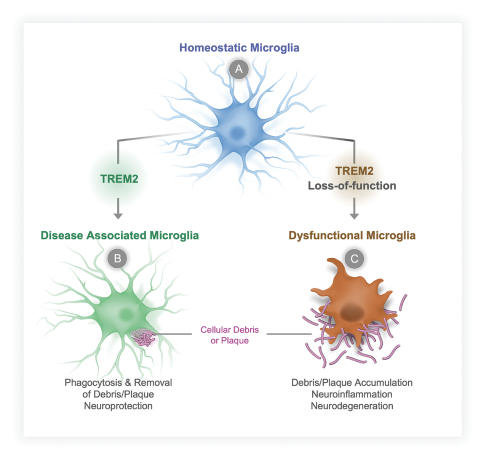

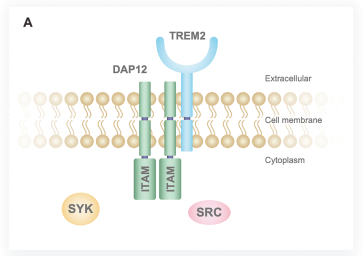

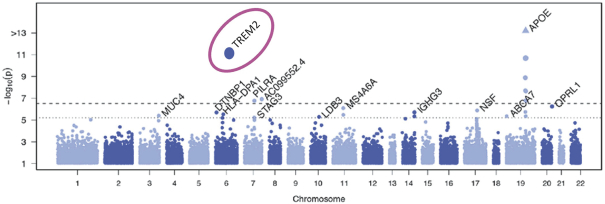

Currently, there are two other companies that are in the early stages of developing TREM2 agonists for the treatment of AD. We consider our direct competitors to be Alector, Inc. and its corporate partner, AbbVie Inc., Denali Therapeutics, Inc. and its corporate partner, Takeda Pharmaceutical Company, Cognyxx Pharmaceuticals, Inc. and Muna Therapeutics, Inc.

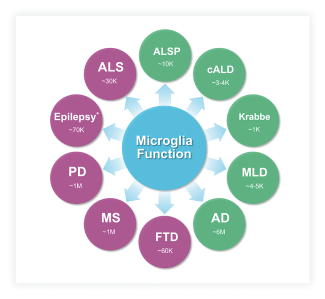

There are several existing treatments marketed today for the treatment of AD, which primarily provide symptomatic relief. Notably, Biogen Inc., recently received FDA accelerated approval for a product based on reduction of amyloid beta plaques, a biomarker that may predict a reduction in clinical decline; continued approval may require demonstration of disease-modifying benefits. Other pharmaceutical and biotechnology companies are pursuing disease-modifying treatments for AD and other common neurodegenerative disorders by seeking to modulate a range of targets. Companies pursuing microglia-targeted therapeutics include Janssen Pharmaceuticals, Inc., Alector Inc., Denali Therapeutics, Inc., Elixiron Therapeutics, Inc., Muna Therapeutics, Inc., Cognyxx Pharmaceuticals, Inc., and CAMP4 Therapeutics Corporation, Inc.

Many of our competitors have significant financial, technical, manufacturing, marketing, sales and supply resources or experience. These competitors also compete with us in recruiting qualified scientific and management personnel as well as establishing clinical trial sites and patient registration for clinical trials, and in acquiring new technologies. If we successfully obtain approval for any therapeutic candidate, we will face competition based on many different factors, including the safety and effectiveness of our therapeutics, the ease with which our therapeutics can be administered, the timing and scope of regulatory approvals for these products, the availability and cost of manufacturing, marketing and sales capabilities, price, reimbursement coverage and patent position. Competing products could present superior treatment alternatives, including by being more effective, safer, more convenient, less expensive or marketed and sold more effectively than any products we may develop. Competitive products or technological approaches may make any products we develop obsolete or noncompetitive before we recover the expense of developing and commercializing our therapeutic candidates. If we are unable to compete effectively, our opportunity to generate revenue from the sale of the therapeutics we may develop could be adversely affected.

We will incur increased costs as a result of operating as a public company, and our management will devote substantial time to related compliance initiatives.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company, and these expenses may increase even more after we are no longer an “emerging growth

64