UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 10-K

__________________________________

(Mark One)

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____to _____

Commission file number: 001-39799

__________________________________

Certara, Inc.

(Exact name of registrant as specified in its charter)

__________________________________

| | | | | |

| Delaware | 82-2180925 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

4 Radnor Corporate Center, Suite 350 Radnor, Pennsylvania | 19087 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (415) 237-8272

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange

on which registered |

| Common stock, par value $0.01 per share | | CERT | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer x | Accelerated filer o |

| |

Non-accelerated filer o | Smaller reporting company o |

| |

| Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the registrant’s outstanding voting common stock held by non-affiliates on June 30, 2024, determined using the per share closing price on that date on The Nasdaq Stock Market, LLC was $1.7 billion. There is no non-voting common equity of the registrant outstanding. Shares held by each executive officer and director and by each other person or entity deemed to be an affiliate have been excluded in such calculation. The determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 17, 2025, the registrant had 161,017,775 shares of common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for the registrant’s 2025 Annual Meeting of Stockholders to be held May 21, 2025, which will be filed with the Securities and Exchange Commission within 120 days after the end of the 2024 fiscal year, are incorporated by reference in Part III of this Annual Report on Form 10-K.

Table of Contents

Certara, Inc.

Unless otherwise indicated, references to the “Company,” “Certara,” “we,” “us” and “our” refer to Certara, Inc. and its consolidated subsidiaries.

Our registered trademarks include Certara™, Phoenix™, Simcyp™, Pinnacle 21™, CoAuthor™, GlobalSubmit™, Certara D360™ and VyasaTM. Such terms, when first mentioned in this report, appear with the trade name, trademark or service mark notice and then throughout the remainder of this report without trade name, trademark or service mark notices for convenience only and should not be construed as being used in a descriptive or generic sense.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. All statements (other than statements of historical facts) in this Annual Report regarding the prospects of the industry and our prospects, plans, financial position and business strategy may constitute forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “should,” “expect,” “might,” “intend,” “will,” “estimate,” “anticipate,” “plan,” “seek,” “believe,” “predict,” “potential,” “continue,” “suggest,” “project,” “future,” “likely,” or “target” or the negatives of these terms or variations of them or similar terminology. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot provide any assurance that these expectations will prove to be correct. Such statements reflect the current views of our management with respect to our operations, results of operations and future financial performance and are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors include but are not limited to those described in Part I, “Item 1A-Risk Factors.” These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Annual Report. Certara undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law.

SUMMARY OF RISK FACTORS

An investment in shares of our common stock involves substantial risks and uncertainties that may materially adversely affect our business, financial condition and results of operations. Some of the more significant challenges and risks relating to an investment in our Company are summarized below. The following is only a summary of the principal risks that may materially adversely affect our business, financial condition, and results of operations. The following should be read in conjunction with the more complete discussion of the risk factors we face, which are set forth in Part I, “Item 1A- Risk Factors” in this Annual Report.

•Deceleration in, or resistance to, the acceptance of model-informed biopharmaceutical discovery and development could reduce the demand for our products and services.

•We compete in a competitive and highly fragmented market.

•Changes or delays in government regulation relating to the biopharmaceutical industry could decrease the need for some of the services we provide.

•Reduction in research and development (“R&D”) spending by our customers, as well as delays in the drug discovery and development process, may reduce demand for our products and services.

•Consolidation within the biopharmaceutical industry may reduce the pool of potential customers for our products and services or reduce the number of licenses for our software products.

•Our continued revenue growth depends on our ability to successfully increase our customer base, expand our relationships and the products and services we provide, and enter new markets.

•We depend on key personnel and may not be able to retain these employees or recruit additional qualified personnel, which could harm our business.

•If our independent contractors are characterized as employees, we could be subject to material adverse effects on our business and employment and withholding liabilities.

•Delays or defects in the release of new or enhanced software or other biosimulation tools may result in increased cost to us, delayed market acceptance of our products, diminished demand for our products, delayed or lost revenue, and liability.

•Issues relating to the implementation, use and development of artificial intelligence (“AI”) and machine learning in our products and services may result in reputational harm, regulatory action, or legal liability, and any failure to adapt to such technological developments or industry trends could adversely affect the competitiveness of our business.

•If our existing customers do not renew their software licenses, do not buy additional solutions from us or renew at lower prices, our business and operating results will suffer.

•We have government customers and have received government grants, which subject us to risks including early termination, audits, investigations, sanctions, or penalties.

•Our historic growth rates may not be sustainable or indicative of future growth.

•We regularly evaluate potential acquisitions and other strategic transactions that we deem beneficial and strategic to our long-term growth and profitability, which could divert our management’s attention, result in additional dilution to our stockholders, and otherwise disrupt our operations and adversely affect our operating results.

•Our estimated addressable market is subject to inherent challenges and uncertainties.

•Adverse global economic conditions could have a negative effect on our business, results of operations and financial condition and liquidity.

•We are subject to economic, political and other risks associated with the operation of a global business that could negatively affect our business, results of operations and financial condition.

•We are subject to the Foreign Corrupt Practices Act (“FCPA”) and the U.K. Bribery Act of 2010 (“U.K. Bribery Act”) and similar anti-corruption laws and regulations in other countries.

•Our failure to comply with trade compliance and economic sanctions laws and regulations could materially adversely affect our reputation and results of operations.

•If we fail to perform our services in accordance with contractual requirements, regulatory standards and ethical considerations, we could be liable for significant costs or penalties and our reputation could be harmed.

•The loss of one or more of our major customers could materially and adversely affect our business, results of operations and/or financial condition.

•Our bookings might not accurately predict our future revenue, and we might not realize all or any part of the anticipated revenue reflected in our bookings.

•Our business may be subject to risks arising from catastrophic events, including natural disasters, significant or extreme weather events, outbreaks of war or terrorism, epidemic diseases, pandemics, and public health crises.

•We rely upon third-party providers of cloud-based infrastructure to host our software solutions. Any disruption in the operations of these third-party providers, limitations on capacity or interference with our use could adversely affect our business.

•If we are not able to reliably meet our data storage and management or other information technology requirements, or if we experience any technology failures in the delivery of our services over the internet or in the administration of our business, customer satisfaction and our reputation could be harmed and customer contracts may be terminated.

•Our software solutions utilize third-party open source software, and any failure to comply with the terms of one or more of these open source licenses could adversely affect our business.

•If our cybersecurity measures are breached or unauthorized access to customer or other proprietary data is otherwise obtained, customers may reduce the use of or stop using our solutions and we may incur significant liabilities and/or loss of customer confidence.

•We are subject to numerous privacy and data security laws and related contractual requirements and our failure to comply with those obligations could cause us significant harm.

•We may be unable to adequately enforce or defend our ownership and use of our intellectual property and other proprietary rights.

•Third parties may initiate legal proceedings alleging that we are infringing their intellectual property rights, which could have a material adverse effect on our business.

•Our indebtedness could materially adversely affect our financial condition and our ability to operate our business.

•Impairment of goodwill and other tangible assets may adversely impact future results of operations.

Channels for Disclosure of Information

Investors and others should note that we may announce material information to the public through filings with the U.S. Securities and Exchange Commission (the “SEC”), our Investors Relations website (https://ir.certara.com), press releases, public conference calls and public webcasts. We use these channels to communicate with the public about us, our products, our services and other matters. We have used, and intend to continue to use, our Investor Relations website and our corporate website located at www.certara.com as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. We encourage our investors, the media and others to review the information disclosed through such channels as such information could be deemed to be material information. The information on or available through such channels, including on our website, is not incorporated by reference in this Annual Report and shall not be deemed to be incorporated by reference into any other filing under the Securities Act or the

Exchange Act, except as expressly set forth by specific reference in such a filing. Please note that this list of disclosure channels may be updated from time to time.

Statistical and Other Industry and Market Data

This Annual Report includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We have not independently verified the information contained in such sources.

PART I

Item 1. Business.

Our Company

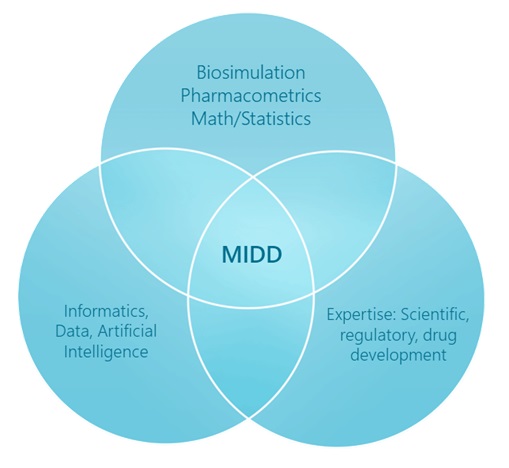

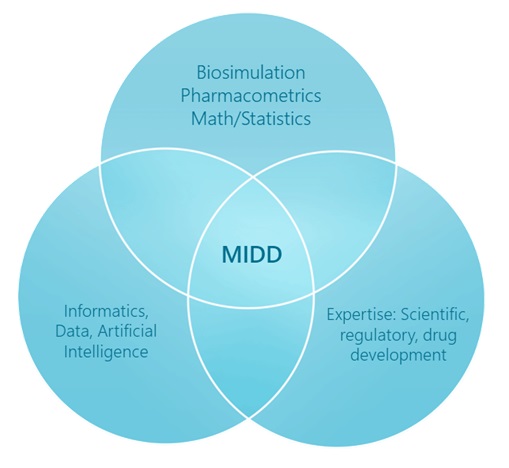

We are a global leader in biosimulation technology and solutions for using Model-Informed Drug Development (“MIDD”) in the global biopharmaceutical industry. MIDD is an approach that utilizes biological and statistical models derived from preclinical and clinical data to inform decision-making in drug development and commercialization. Biosimulation is a critical component of MIDD that uses computer-aided mathematical simulation of biological processes and systems to understand the action of a drug in a human body or a population of humans.

Biosimulation and MIDD can increase the probability of success in bringing a new drug to market and decrease the costs of drug development. There are many examples of currently approved drugs where models were successfully used in discovery, preclinical, first-in-human dose predictions, clinical trial design, and for drug interaction label claims. Biosimulation is also used to support drug development beyond the approval stage; examples include determining formulation or manufacturing changes and label extensions. In addition, MIDD strategies are increasingly utilized to help predict commercial success, a critical part of the drug development process as new products must be both approved by regulators and adopted by the market.

The diagram below shows the different areas of expertise that come together to enable MIDD. Our organization has been purposefully designed to include all of these capabilities to collectively enable a new model of drug development for our clients.

Our goal is to enable the life sciences industry to use data, modeling, and analytics to make better decisions during drug development and commercialization to increase productivity rates and vastly reduce development costs. The pharmaceutical industry spends more than $270 billion annually on research and development. On average, it takes 10-15 years and costs $6.2 billion to develop one new medicine, including the cost of failures. Drug development is necessarily a highly regulated process involving the collection of vast amounts of laboratory, clinical and evidence data, and there are many failures at every step along the way that add to total cost. Our software and scientists incorporate modern advances in scientific understanding, drug development experience, data analysis, and AI, resulting in significant opportunities to decrease the cost and increase the odds of new drug approval and commercial success.

Our proprietary biosimulation platforms are built on biology, chemistry, and pharmacology principles with proprietary mathematical algorithms that model how medicines and diseases behave in the body. For over two decades, our scientists have developed and validated our biosimulation technology using data from scientific literature, laboratory research, preclinical and clinical studies. To do this, we have developed solutions for the collection, standardization, validation, storage, and analysis of the preclinical and clinical data needed for MIDD. These data solutions are used internally and by global life sciences companies.

The scientific principles underlying our work must be transparent and fully explainable during the regulatory process, so we have developed expertise in incorporating data and results into regulatory documents. Our software and regulatory services streamline the creation of regulatory filings and speed regulatory data flow to maximize the chances of successful commercialization.

AI and machine learning technologies are being incorporated across our software and services portfolios, providing opportunities to expand the number of data sources utilized, better predict outcomes, and streamline reporting. For example, we are using machine learning to automate and speed the process of biosimulation, and we have created an AI application to aid in drafting regulatory documents from scientific analyses and clinical data. We believe that AI predictive models will continue to enhance the accuracy and usefulness of biosimulation models and will be utilized broadly across drug development.

We leverage our validated software applications to deliver technology-enabled services. Our services are delivered by scientists with extensive drug development experience who aid our customers in applying biosimulation and MIDD to their specific projects.

According to our internal data, Certara’s customers have received 90% or more of all novel drug approvals by the U.S. Food and Drug Administration (the “FDA”) from 2014 through 2024. We have worked with more than 2,400 life sciences companies and academic institutions and have collaborated on more than 9,000 customer projects in the last decade across a wide variety of therapeutic areas ranging from cancer and hematology to diabetes and hundreds of rare diseases. Our software products are licensed by more than 94,000 users and are also used by 23 global drug regulatory agencies, including the FDA, Japan’s Pharmaceuticals and Medical Devices Agency (the “PMDA”), and China’s National Medical Products Administration (the “NMPA”).

Our Solutions

We offer differentiated and comprehensive solutions for MIDD, which include software and technology-enabled services. Customers use our solutions to implement MIDD with the aim of improving certainty, accuracy, commercial success and the speed at which decisions can be made during the drug development process.

Life sciences companies make many decisions during the MIDD process that have regulatory considerations. We help support these decisions with comprehensive regulatory science solutions that include technology platforms along with regulatory submission and regulatory writing expertise. In addition, recognizing that time to approval is one of the most valuable components of the drug development journey, we designed our regulatory solutions to accelerate the regulatory writing and filing process.

By offering both software and services solutions, we provide flexible offerings for life sciences companies of all sizes and requirements. Services are complemented by scientific and regulatory expertise to conduct and interpret biosimulation results and make recommendations on the next best action to move a program forward. In 2023, we extended the capabilities of MIDD and regulatory offerings with the launch of an AI platform designed for life sciences, Certara.AI. Certara.AI is a secure, flexible platform for deploying life science-specific Generative Pre-Trained Transformers (“GPTs”) across an organization’s data, enabling faster search, connectivity, and content generation. Additionally, in 2024, we launched the next generation of our CoAuthor regulatory writing software, which combines generative AI, data integration, and structured content authoring tools to enable writers to create and assemble regulatory submissions and medical publications faster and with confidence in the quality of their results.

Our Biosimulation Solutions

Our biosimulation solutions are designed to predict both pharmacokinetics (how the body interacts with drugs) and pharmacodynamics (how a drug affects the body). We offer both mechanistic and empirical biosimulation solutions providing clients with a comprehensive offering based on their therapy goals, mechanism of action, and available data sources. Mechanistic biosimulation models are built by experts using known scientific principles and facts, while empirical biosimulation solutions are typically statistical models built using preclinical and clinical data. Our customers use biosimulation results to improve the design of clinical trials, reduce trial size and complexity, and in some cases obtain clinical trial waivers to replace clinical testing.

Simcyp™ Simulator

The Simcyp Simulator is a mechanistic biosimulation platform for physiologically based pharmacokinetic (“PBPK”) simulation. It is frequently utilized for determining first-in-human dosing, optimizing clinical study design, evaluating new drug formulations, setting the dose in untested populations, performing virtual bioequivalence analyses, and predicting drug-drug interactions (“DDIs”). The Simcyp Simulator has been applied to small molecules, biologics, antibody-drug conjugates (“ADCs”), generics, and new modality drugs. Simcyp was started over 20 years ago and has been expanded each year with extensions and additions to its biosimulation models and is designed to produce “regulatory quality” results that customers can use in their drug approval applications. The Simcyp Simulator family includes various add-on modules, as well as products focused on specific aspects of drug development that can benefit from its mechanistic simulation approach. The major Simcyp products are described below.

•Simcyp Discovery – Targeted to scientists working on pre-Investigational New Drug (“IND”) and translational stages.

•Simcyp Biopharmaceutics – Tailored for formulation scientists, who use it to identify and refine promising drug formulations in a cost-effective manner.

•Simcyp Secondary Intelligence – Integrates toxicology with quantitative analysis of large networks of molecular and functional biological changes to identify drug toxicity and adverse drug reactions earlier.

Empirical Biosimulation Software Platform

In addition to mechanistic modeling, MIDD requires empirical statistical modeling to account for all the data available on a drug including population variability. We have a large group of pharmacometrics scientists, who use clinical and preclinical data to quantify the impact of drugs on diseases and predict clinical efficacy and safety outcomes across various patient populations. These analyses are utilized to support the design of clinical trials and other drug development and/or regulatory decisions and are generally expected by regulators to support the justification of approved dosage regimens.

We provide customers with a powerful combination of scientific expertise, bringing experts with experience in thousands of projects across the industry, together with our industry-standard software applications. Our Phoenix™ PK/PD suite is the life sciences industry’s premier software for managing, analyzing and reporting pharmacokinetic (“PK”), pharmacodynamic (“PD”), and toxicokinetic (“TK”) data. Phoenix has four modules that support pharmacometrics and workflow.

•Phoenix WinNonlin – A platform for non-compartmental analysis, PK/PD, and TK modeling with a proven 30-year history and extensive use across the biopharmaceutics industry.

•Phoenix Hosted – A hosted (i.e., online) version of Phoenix, which provides a secured and validated Certara Amazon Web Services (“AWS”) workspace allowing for much quicker transit time from compliant data sources. It enhances productivity and supports compliance requirements by managing complex time-based drug data, the foundation for all PK/PD modeling.

•Phoenix NLME – A population modeling and simulation software for nonlinear mixed effects (“NLME”) models, a type of pharmacometric model often used by pharmacometricians to model absorption effects.

•Pirana Modeling Workbench – A workbench providing modelers with a structure to facilitate the iterative processes used to create population PK/PD models and perform simulations using AI and machine learning resulting in more efficient analysis.

Scientific Informatics for Improving Drug Discovery and In-Silico Development

In 2024, Certara acquired Chemaxon, a software company that develops leading software products for chemical property prediction, search, and analysis. Used by research scientists globally, Chemaxon software helps to digitize the design, make, test and analyze lifecycle to discover the best new chemical leads. Certara and Chemaxon have had a long-term partnership spanning ten years, providing integrated solutions to the life sciences industry. The acquisition strategically positions Certara in the drug discovery biosimulation market and is intended to complement Certara’s existing biosimulation portfolio which is widely used in later phases of drug development. Together, Certara and Chemaxon offer life sciences companies a more complete data and predictive analytics platform, helping to advance the decision-making from discovery through commercialization.

The major Chemaxon and Certara products focused on supporting more efficient chemical related information and workflows throughout drug discovery and development are described below.

Chemaxon JChem Engines – A widely used chemical search engine that integrates chemical intelligence into research informatics systems. It provides highly accurate single and combined search results rapidly providing researchers with the insights and data needed to move research projects forward.

Chemaxon Compound Registration – Compound Registration supports a streamlined lead optimization process workflow by comparing the uniqueness of new small molecules against those already stored in a database.

Chemaxon Design Hub – A compound design and tracking platform for drug discovery teams and their external collaborators that connects scientific hypotheses, candidate compound selection and computational capabilities. Design Hub has been integrated with the Certara D360 solution for more than eight years to provide an optimal end user experience throughout the lead optimization stage of discovery.

Certara D360™ Software – D360 is a scientific informatics system for small molecule and biologics discovery research. It provides researchers with self-service data access, integrated data visualizations, analysis and collaboration tools for prioritization, development of Structure Activity Relationship (“SAR”) and many other scientific data workflows to improve the effectiveness of data-driven research.

Chemaxon Marvin – Marvin is a universal chemical drawing tool for chemists involved in research and drug discovery. Marvin includes chemical intelligence to catch errors and perform live calculations and predictions and has a wide range of built-in tools to create publication-worthy chemical schemes.

Preclinical & Clinical Data Pipeline and Automation Suite

Our data suite allows customers to efficiently standardize preclinical and clinical data during the drug development process, utilize that data to support MIDD, and efficiently submit it to regulatory authorities for approval. Our customers typically collect large quantities of data from many sources during the drug development process, and our products allow them to reduce the cost of creating scientifically valid and analyzable data sets, speeding time to scientific insights and enabling better and faster decisions. The Certara suite of applications replaces costly manual processes in which pharmaceutical companies collect laboratory and clinical data from many sources, standardize, validate, analyze the data, and include it in reporting and downstream systems. Our principal clinical data suite is the Pinnacle 21™ family of products.

•Pinnacle 21 – A cloud-based platform for clinical data automation, standardization, and validation with industry standards. Pinnacle 21 is widely utilized across the pharmaceutical industry and by its regulators to validate that clinical data meets the required standards for regulatory submittal. We support two versions of Pinnacle 21 – a fully featured enterprise version, which contains workflow and reporting tools needed by large-scale drug development customers, and a more basic free community version designed for small organizations who want to try the software.

•Pinnacle 21 Data Exchange – Allows sponsors and data providers to define data standards and specifications (metadata) and ensure that data adheres to these specifications to make the process of acquiring external data from laboratory and clinical sources more efficient and predictable.

•Metadata Repository – A cloud-based Clinical Metadata Repository & Study Data Tabulation Model automation suite to enable faster study design using controlled and standardized data.

Regulatory Science

Our comprehensive regulatory science solutions help provide our customers the coordinated technology-enabled regulatory submission and regulatory writing expertise they need to accelerate the regulatory writing and filing process.

•CoAuthor™ Software – Structured and Assisted Content Authoring with Generative AI – Approval for a new drug or biologic requires expert development of numerous regulatory documents, which is a time intensive process often requiring inputs from a variety of data sources and types. CoAuthor powers efficient and expedited creation of regulatory documents and medical communications. Combining data integration, structured content authoring and AI, CoAuthor enables writers to create and assemble regulatory submissions and medical publications faster and with confidence in the quality of their results.

•GlobalSubmit™ eCTD Submissions Management – The Electronic Common Technical Document (“eCTD”) is a standard format required for submitting applications to regulatory authorities. Our

GlobalSubmit eCTD submissions management software provides regulatory teams with the tools they need to efficiently publish, validate, and review eCTD submissions.

Technology-Enabled Services

In addition to core software platforms, our scientists utilize our software to offer a broad range of technology-enabled services to help clients interpret biosimulation results, increase scientific insights related to the therapy, streamline drug submission and approval, and support the overall drug development process. We also provide the drug development expertise needed to ensure quality study execution and oversight along with preparation of commercialization plans and the evidence generation needed to ensure product launch success post approval.

Quantitative Systems Pharmacology (“QSP”): One of the most scientifically innovative areas of biosimulation is QSP, an approach which combines computational modeling and experimental data to examine the relationships between a drug, the biological system, and the disease process. We believe that Certara has one of the largest teams of QSP experts in the pharmaceutical industry. The insights delivered by our QSP team help answer critical questions about novel therapies required for development progression, including “which drug candidate is optimal” and “which patient populations are most likely to respond.”

We have differentiated our approach to QSP by building robust, regulatory-ready software platforms for reproducible model development that are further enabled by Certara.AI. Currently, QSP platforms are available for immunogenicity, immuno-oncology, and capabilities for neurodegenerative diseases are in development. This unique approach has been shared with U.S., European Union (“EU”), and Japanese regulators, all committed to advancing the use of QSP in drug discovery, development, and regulatory review.

Drug Development and Regulatory Strategy: Our experts develop and deliver drug development and regulatory plans and provide high-level regulatory input to customer projects, incorporating biosimulation and supporting decision making through critical development and investment stage gates.

Pharmacometrics: Pharmacometrics uses mathematical and statistical models to quantify drug, disease, and trial information to help address these decisions. The data used to build pharmacometrics models comes from both internal preclinical and clinical data as well as external data on competitor drugs.

Data Science: As the volume, variety, and velocity of data available in research has grown rapidly, so has the complexity of collecting, analyzing, and publishing data. Certara offers biometrics and data sciences services to help clients analyze and standardize data for faster time to insight and for submission readiness, in addition to preparing and transforming data for use in biosimulation and pharmacometrics models.

Clinical Pharmacology: Certara has numerous industry leaders and experts that guide drug developers in clinical pharmacology decisions. They provide early-phase development plans and study designs across the development life cycle, often incorporating biosimulation along with regulatory support.

Regulatory Science: Certara provides expert services for regulatory submissions from early-stage INDs, new drug applications, and MAAs that require Chemistry, Manufacturing, and Controls (“CMC”), nonclinical, and clinical expertise. Submission programs require the coordinated technology-enabled expertise that Certara regulatory writing solutions offers delivering quality and speed at scale.

Regulatory Operations: We manage the submission of regulatory documents using our GlobalSubmit platform. Submission management services include submission leadership, program management and planning, due diligence and readiness preparation, submission compilation, and eCTD publishing using Global Submit. Certara supports applications to all major health agencies, including the FDA, the European Medicines Agency (the “EMA”), Health Canada, Japan’s PMDA, and China’s NMPA.

Our Markets

Our markets within the biopharmaceutical industry are large and growing. Traditional drug discovery and development is costly and prone to failure. The biopharmaceutical industry was estimated to have spent a total of approximately $270 billion in 2024 on R&D. Currently, over 90% of drug candidates fail during the drug development process, many after significant expenditures of resources and time.

We believe that biosimulation solutions can improve these success rates. A small percentage increase in success rates has a large impact on the costs of the overall system; research shows that a modest increase of just three percent in the success rates at each development phase could save almost three hundred million dollars in total costs per approved drug. Additionally, there are often new ways that biosimulation is used to create value as the simulation and modeling capabilities are constantly expanding.

With increasing adoption of technology across all stages of drug discovery and development, we believe our end-to-end platform and growth strategies position us to further penetrate the rapidly growing technology-driven biopharmaceutical R&D market of the future that leverages advanced modeling and analytics.

With greater investment dollars being spent and increasing competition in the race to develop novel medicines, the speed and efficiency with which drugs are developed and brought to market have never been more critical. As a result, the demand for and willingness to adopt innovative approaches to discovery, development, and commercialization are rapidly increasing. Continued development and innovation in software and technology such as biosimulation, virtual trials, and real-world evidence tools are helping biopharmaceutical companies increase efficiency and decrease costs. This is further bolstered by regulatory agencies that have increasingly issued guidance supporting the adoption of many of these innovations. For example, the FDA announced in 2021 its Project Optimus initiative to reform the dose selection and optimization paradigm in oncology drug development to maximize both efficacy and safety. Biosimulation’s use cases in dose finding and optimization are well-suited to help biopharmaceutical companies navigate this evolving regulatory landscape.

As technology and analytics become increasingly powerful along with AI and the application of new solutions is validated, we anticipate further demand for these innovations. We believe we are still in the early stages of a long-term trend that will continue to advance traditional drug discovery and development into a technology-driven era of advanced modeling, analytics, and AI enabled solutions.

Our Growth Strategy

Our growth strategy is to build upon our platforms creating more value through increased automation and connectivity. We continue to innovate in biosimulation, develop more AI-enabled offerings across our portfolio, engage with regulatory agencies, and land and expand our customer relationships. We remain focused on reducing the cost, time, and probability of failure of clinical trials for our customers so that they may potentially accelerate and lower overall cost of the delivery of future therapies that are needed by patients worldwide. As new research and technologies areas and opportunities arise, we seek to attract and hire specialized talent and acquire complementary businesses to expand our offerings accordingly.

Advance Our Technology

The science, technology, and data behind biosimulation continue to advance rapidly, and our top investment priority is to develop additional functionality and uses for biosimulation to improve decision making and patient outcomes. We aim to release new software, additional features, and upgrades on a frequent and regular basis, with a focus on cloud-based solutions, as a means to integrate and connect access to our products within an end-to-end platform. In 2024, we introduced 36 new software applications and upgrades, including Phoenix Version 8.5, next-generation CoAuthor and Certara Cloud.

Grow Within Our Existing Customer Base

As we continue to expand our portfolio of offerings, we integrate our solutions and sell more across our end-to-end platform. We actively cross-sell our software and technology-enabled services throughout our end-to-end platform. Our scientists and regulatory and market access experts, business developers, marketing professionals, and business leaders work together to provide a high-quality customer experience and nurture long-term partnerships. Ultimately, one of our goals is to facilitate customer growth over time through higher adoption of biosimulation with additional user licenses and more modules.

Expand Our Customer Base Globally

We have invested in an international footprint to effectively serve the global biopharmaceutical industry. There are more than 5,500 biopharmaceutical companies worldwide with active R&D pipelines as of January 2023, up from nearly 2,400 in 2011. As of December 31, 2024, we had employees in 30 countries, including approximately 576 in the US, 688 in Europe, and 180 in Asia.

Scale Through Acquisitions

Part of our strategy to date has been to pursue strategic acquisitions to accelerate our development roadmap. Since 2013, we have acquired 21 companies, 14 of which include software or technology, with such key acquisitions including Simcyp, the core of our mechanistic biosimulation platform, Pinnacle 21, which enhances our software offerings in data management and the regulatory drug approval process, and VyasaTM, which brings state-of-the-art AI capabilities to our end-to-end platform. More recently, in 2023, we also acquired Formedix, which added a metadata repository and clinical data flow automation to our data platform, and Applied Biomath, a company focused on QSP to expand and complement our existing QSP capabilities. In 2024, we acquired Chemaxon, a leading provider of cheminformatics software to expand and complement our existing prediction and analytical capabilities in drug discovery.

Our Customers

Our customers include life sciences companies of all sizes along with contract research organizations, academic institutions, and global regulators. Certara software and services have been used by more than 2,400 biopharmaceutical companies and academic institutions across 70 countries, including 38 of the top 40 biopharmaceutical companies by R&D spend in 2023. We also derive limited revenue from contracts with U.S. government agencies, including the FDA and the Center for Disease Control and Prevention within the Department of Health and Human Services, as well as foreign governments. For example, our software products are licensed by 23 global drug regulatory agencies, including the FDA, Health Canada, Japan’s PMDA, China’s NMPA and the UK’s Medicines and Healthcare Products Regulatory Agency (“MHRA”). In addition to life sciences, Certara serves customers in animal health, crop science, bio science, medical devices, and public sector industries. No single customer accounted for more than 10% of our revenues in 2024. Our ten largest customers accounted for 27% and 28% of revenues for each of the years ended December 31, 2024 and 2023, respectively.

Sales and Marketing

Our sales and marketing functions pursue a coordinated approach with a global commercial team of business development, product management, and marketing experts. Our global commercial team collaborates with our scientists, subject matter experts, and technologists to engage with customers and prospects to understand their needs and offer tailored solutions with our biosimulation software and technology-enabled services. In support of our presence and authority within our fields, our scientists and experts have authored thousands of scientific

publications, posters, and articles to share biosimulation knowledge and methods to advance adoption. Additionally, in an effort to further expand our reach to potential customers, we may partner with software distributors in regions or categories where we may have less dedicated presence or activity today.

Competition

The market for our biosimulation products and related services for the biopharmaceutical industry is competitive and highly fragmented. The solutions offered by our competitors vary in size, capabilities and breadth. In addition to competition from other solution providers, another challenge is that some biopharmaceutical industry participants may still rely on or over-index the status quo method of conducting research without fully leveraging the benefits of modeling, simulation, AI, dataflow and analytics platforms to inform and de-risk decisions across each phase of research and development.

In our view, the principal competitive factors in our market are the functionality and quality of models, the breadth of molecular types, therapeutic areas, and modalities supported, regulator acceptance of our solutions, ease of use and functionality of applications, depth of experience in drug development, brand awareness and reputation, total cost, and the ability to securely integrate with other enterprise applications and the overall drug development process in the customer. We believe that we compete favorably based on these factors and that the time, effort, and investment necessary to develop validated models, modeling solutions, enterprise software and extensive MIDD experience presents a significant barrier to new entrants. Our ability to remain competitive depends on our ability to continue to invest in innovation as MIDD and drug development science advances.

In the biosimulation software market, we compete with other technology companies including Mathworks, Dassault Systemes, Ansys, Simulations Plus, and NONMEM, a division of ICON. Other competitors include open-sourced solutions such as R and PK-Sim and internally developed software from biopharmaceutical companies. There are also many clinical research organizations that provide various data, decision tools, and advice on drug candidates and drug trial decisions. Our technology-enabled services generally compete with in-house teams at biopharmaceutical companies. Additionally, we compete with other specialized service providers including Metrum Research, qPharmetra, and Pharmetheus. We compete in both the biosimulation software market and technology-enabled services markets, with outcomes typically based on the quality and capabilities of our products, our scientific, technical and regulatory expertise, our ability to innovate and develop solutions attractive to customers, our regulatory agency partnerships, and price, among other factors.

Intellectual Property

We safeguard and enhance our innovative technology platforms, systems, processes, and databases with a full array of intellectual property rights, including copyrights, trade secrets, know-how, patents, and tradenames/trademarks. Our proprietary software products are copyright protected, and may be further defined by contractual provisions in our software license agreements limiting permitted uses and also prohibiting specific acts of infringement, such as reverse engineering, deriving, or otherwise using the source code and underlying algorithms in all cases or beyond the terms of a license, as the case may be. Embedded within some of our biosimulation tools, including the Simcyp Simulator, are several decades’ worth of proprietary data that have been compiled and collated from both public and private sources. These data, in tandem with our proprietary source code and algorithms, create powerful modeling tools that cannot be easily or practically duplicated independently. Continual ongoing development of source code and algorithms as well as new version release of modeling tools also contribute to the competitive value of our proprietary software products. Our processes and systems are further protected by trade secrets principles and expert knowledge bases, which we seek to secure by requiring and enforcing confidentiality obligations with our employees, contractors, customers, and other third parties, and invention assignment agreements with our employees, in collaboration with administrative and technical safeguards.

We maintain a portfolio of issued and pending patents in several jurisdictions in which we do business. As of December 31, 2024, our patent portfolio consists of 29 issued patents, which expire and may be renewed by us on a rolling basis as available and determined by us, between November 2026 and August 2044, and 16 pending patent applications related to our software and technology. We do not currently consider any of our issued patents to be independently material to our business.

We maintain registration in the United States and other countries for numerous trademarks, including Certara, Simcyp, Phoenix, Pinnacle 21, Virtual Twin, WinNonlin, Vyasa, and BaseCase. We pursue trademark registrations to the extent we believe doing so would be beneficial to our competitive position. We are not presently a party to any legal proceedings relating to intellectual property that, in the opinion of our management, would individually or taken together have a material adverse effect on our business, financial condition, results of operations or cash flows.

Human Capital

We are a global team united in our purpose to accelerate medicine to patients. Challenging the status quo, our talented team of scientists, software developers, and subject matter experts strive to understand our customers’ most difficult business challenges and apply cutting edge technology and rigorous scientific thinking to inform solutions. As of December 31, 2024, we employed 1,546 professionals in 30 countries, including 1,487 full-time employees and 59 part-time employees, of which 408 held PhD or doctor of medicine degrees in their respective disciplines, including clinical pharmacology and pharmacometrics. Most of the senior management team and the members of our board of directors also hold PhDs and/or other advanced degrees. We also rely on independent contractors to address discrete parts of our business and provide expertise in certain specialized areas or focus on projects. In 2024, we again received the “Great Place to Work” award (from the Great Place to Work® Institute, Inc.).

Our over 1,500 employees are the key to our success. The breadth and depth of expertise, experience, and backgrounds fuel innovation by bringing rich ideas, problem-solving capabilities, and mutual respect. We are dedicated to attracting, retaining, and growing leading scientists and experts, who are passionate about developing medicines that matter. We strive to encourage intellectual curiosity and offer a variety of professional development opportunities to enable our colleagues to grow their skills. We have traditionally offered job training programs covering technical and soft skills for employees who want to refine specific skills, and all employees participate in a formal performance management process and receive career coaching and counseling as we may determine from time to time. We seek to offer our people competitive compensation packages, depending on role or market, and varying by location we may make available on group terms pension/retirement savings programs, benefits, life insurance, income protection, and healthcare offerings. We strive to provide all staff opportunities for career advancement by posting and announcing openly all promotion opportunities, regularly reviewing pay to ensure fair practices and providing training to all new hires.

Government Regulation

Regulation of Biopharmaceutical Products

The development, testing, manufacturing, labeling, approval, promotion, distribution and post-approval monitoring and reporting of biopharmaceutical products are subject to regulation by numerous governmental authorities at both the national and local levels, including the FDA in the United States, as well as those of other countries, such as the EMA in the EU and the MHRA in the United Kingdom. Although our biosimulation software products and platforms are not approved by the FDA or other government agencies, our customers’ products are subject to these regulations, which may be applicable to us to the extent that the services and deliverables we provide to our customers are used in their marketing applications. Consequently, we must

comply with relevant laws and regulations relating to certain aspects of the drug and biologic development and approval process. For example, our customers may require that documents or records we produce that may be used in the approval process be compliant with part 11 of Title 21 of the U.S. Code of Federal Regulations, which relates to the creation, modification, maintenance, archival, retrieval, transmittal or distribution of electronic records under records requirements in FDA regulations and submitted to the FDA. Further, certain portions of our business, such as the biosimulation work we conduct in connection with designing clinical trials, must comply with current Good Laboratory Practices (“GLP”) and Good Clinical Practices (“GCP”) requirements as established by the International Council on Harmonisation of Technical Requirements for Registration of Pharmaceuticals for Human Use, as adopted by the FDA and similar regulatory authorities in other countries, which helps ensure the quality and integrity of the data we produce. To help ensure compliance with GLP and GCP, we have established a robust quality management system that includes standard operating procedures, working practice documents and processes, and quality assurance personnel to audit deliverables intended to be used in our customers’ drug and biologic approval applications.

Privacy and Cybersecurity Laws

The collection, use, disclosure, disposal, protection, and other processing of information about individuals, in particular healthcare data, is highly regulated both in the U.S., EU and other jurisdictions, including but not limited to: the U.S. Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), as amended by the Health Information Technology for Economic and Clinical Health Act (“HITECH”) and other U.S. privacy, security and breach notification and healthcare information laws; the European Union’s General Data Protection Directive (“GDPR” and its national implementing laws) and other European privacy laws; and additional privacy laws in other jurisdictions around the world.

We generally require that the clinical data we receive from our customers is de-identified within the meaning of HIPAA (or pseudonymized within the meaning of GDPR), although in limited cases we may encounter personal health and other information processed by our customers. The collection, retention, use, disclosure and other processing of such information is highly regulated, including under the laws described above. In each use case, we examine and apply the data privacy and cybersecurity laws that may govern our potential processing of any subject data.

In the United States, the Federal Trade Commission (the “FTC”) is active in regulating health-related privacy and security. The FTC has taken enforcement actions against companies for statements or promises made about the privacy or security of health information through Section 5 of the Federal Trade Commission Act, which prohibits unfair or deceptive acts or practices. We may also be subject to scrutiny by Federal and state regulators, partners, and consumers of our collection, use and disclosure of consumer personal data, including consumer health data.

Twenty states have also adopted robust data privacy laws, with several other states considering similar laws. For example, the California Consumer Privacy Act (“CCPA”), which became effective on January 1, 2020, as amended by the California Privacy Rights Act, which became effective on January 1, 2023, imposes obligations and restrictions on businesses regarding their collection, use, and sharing of personal information and provides new and enhanced data privacy rights to California residents, such as affording them the right to access and delete their personal information and to opt out of certain sharing of personal information. The interpretation and application of these new state privacy laws and their pending regulations are uncertain.

The processing of any personal data regarding individuals in the European Economic Area (“EEA”) is subject to the GDPR. The GDPR and the UK’s post-Brexit equivalent of the GDPR (“UK GDPR”) is wide-ranging in scope and imposes numerous requirements on companies that process personal data, including requirements relating to processing health and other sensitive personal data, cross-border transfers, notice and consent and contractual obligations with vendors and service providers. Data protection authorities are authorized to impose

large administrative penalties for violations of the GDPR or UK GDPR, including potential fines of up to €20 million or 4% of annual global revenues, whichever is greater, for each law.

Legal developments in Europe have created complexity and uncertainty regarding transfers of personal data from the EEA to the United States, including the European Commission’s adequacy decision with respect to the transfer of personal data from the EU to the United States and establishment of the EU-U.S. Data Privacy Framework (“EU-U.S DPF”), the UK Extension to the EU-U.S DPF, and the Swiss-U.S. Data Privacy Framework. We also currently rely on the standard contractual clauses to transfer personal data outside the EEA, including to the United States, among other data transfer mechanisms pursuant to the GDPR. While the Court of Justice of the European Union (the “CJEU”) has upheld the adequacy of the standard contractual clauses (a standard form of contract approved by the European Commission as an adequate personal data transfer mechanism), it made clear that reliance on them alone may not necessarily be sufficient in all circumstances; this has created uncertainty.

In response to the data privacy laws discussed above and those in other countries in which we do business, we have implemented a multi-disciplinary privacy management program that includes technological safeguards, processes, contractual third-parties provisions, and employee trainings to help ensure that we handle information about our employees and customers in a compliant manner. Concurrently, we observe a trend toward expanding privacy data protection law both in number and scope that will expand our obligations. We may need to modify our practices and incur expenses to accommodate this evolving privacy compliance landscape.

Bribery, Anti-Corruption and Other Laws

We are subject to compliance with the U.S. Foreign Corrupt Practices Act (“FCPA”) and similar anti-bribery laws, such as the U.K. Bribery Act of 2010 (“U.K. Bribery Act”), which generally prohibit companies and their intermediaries from making improper payments to foreign government officials for the purpose of obtaining or retaining business. In addition, in the United States, we may also be subject to certain state and federal fraud and abuse laws, including the federal Anti-Kickback Statute and False Claims Act, that are intended to reduce waste, fraud and abuse in the health care industry. Our employees, distributors, and agents are required to comply with these laws, and we have implemented policies, procedures, and training, to minimize the risk of violating these laws.

Seasonality

Our business has experienced seasonality, including quarterly unevenness in software sales driven primarily by the timing of customer sales and renewal cycles, and services contracts based on project and development activity within our customer base. Customer contract acquisitions and renewals, as well as our revenue, are typically highest in the fourth quarter.

Our Corporate Information

In 2008, Tripos International and Pharsight Corporation came together to form Certara. Certara, Inc. was incorporated in Delaware on June 27, 2017. Our principal business office is located at 4 Radnor Corporate Center, Suite 350, Radnor, Pennsylvania 19087, and the telephone number of our principal business office is (415) 237-8272. Our internet address is www.certara.com. Our internet website and the information contained therein or connected to or linked from our internet website are not incorporated information and do not constitute a part of this Annual Report or any amendment thereto.

Available Information

The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information about reporting issuers, like us, that file electronically with the SEC. The following filings are available through our Investor Relations website as soon as reasonably practicable after we file them with, or furnish them to, the SEC: Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and our Proxy Statement for our annual meeting of stockholders, as applicable (as well as any amendments to those reports). These documents are also available for download free of charge through a link on our Investor Relations website. Further corporate governance information, including our Code of Conduct, Corporate Governance Guidelines, and committee charters, as well as our Environmental, Social and Governance (“ESG”) Report, are also available on our website. Our internet website and the information contained therein or connected to or linked from our internet web site are not incorporated information and do not constitute a part of this Annual Report.

Item 1A. Risk Factors.

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors together with other information in this filing, including our consolidated financial statements and related notes included elsewhere in this filing, before deciding whether to invest in shares of our common stock. The occurrence of any of the events described below could harm our business, financial condition, results of operations and growth prospects. In such an event, the trading price of our common stock may decline and you may lose all or part of your investment.

Risks Related to Our Industry

Deceleration in, or resistance to, the acceptance of model-informed biopharmaceutical discovery and development by regulatory authorities or academic institutions could damage our reputation or reduce the demand for our products and services.

There has been a steady level of recognition by regulatory and academic institutions of the role that modeling and simulation can play in the biopharmaceutical development and approval process, as demonstrated by regulations and guidance documents describing and encouraging the use of modeling and simulation in the biopharmaceutical discovery, development, testing and approval process, which has directly led to an increase in the demand for our services. Nonetheless, significant changes in government or regulatory policy, or a reversal in the level of adoption and reliance upon in silico data (trials, studies, or experiments conducted via computer or computer simulation) in the drug approval process, could result in the decrease in demand for our products and services or lead regulatory authorities to cease use of, or to recommend against the use of, our products and services. These factors, in turn, could ultimately have a material adverse effect on our business, financial condition and results of operations.

Our software products are licensed by the FDA and other regulatory authorities, who may use them in assessing new drug applications. These licenses are typically renewed on an annual basis, and there is no obligation for these regulatory authorities to renew these licenses at the same or any level. While these licenses account for a small amount of our annual revenue, a reduction or the elimination of the use of any of our software products that are currently licensed by regulatory authorities could diminish our reputation and negatively impact our ability to effectively market and sell our software products, particularly if such action were part of a wider reversal of government or regulatory acceptance of in silico data.

We also work closely with the global academic community on research, publications, and training of the next generation of biopharmaceutical scientists. Our software products are used in many academic institutions, often free of charge, where students, including PhD candidates, are first exposed to the types of tools and models that we offer. Upon graduating, these students frequently become employed by biopharmaceutical companies, where

they may continue to use our products and advocate for their continued use. If academic institutions decide to use competitive products, develop their own biosimulation products, or reduce their exposure to biosimulation tools in general, familiarity with our products by the future generations of pharmacometricians and clinical pharmacologists may be diminished, which could ultimately result in a reduction in demand for our products over time.

We compete in a competitive and highly fragmented market.

The market for our biosimulation products and related services for the biopharmaceutical industry is competitive and highly fragmented. In biosimulation software, we compete with other scientific software providers, technology companies, in-house development by biopharmaceutical companies, and certain open source solutions. In the technology-driven services market, we compete with specialized companies, in-house teams at biopharmaceutical companies, and academic and government institutions. In some standard biosimulation services, and in regulatory and market access, we also compete with clinical research organizations. Some of our competitors have longer operating histories in certain segments of our industry than we do and could have greater financial, technical, marketing, R&D and other resources, and can use such resources to develop or adapt products, services or technologies that are comparable, or superior to, or could render obsolete, the products, services and technologies we offer. Some of our competitors offer products and services directed at more specific markets than those we target, enabling these competitors to focus a greater proportion of their efforts and resources on those specific markets. Some competing products are developed and made available at lower cost by government organizations and academic institutions, and these entities may be able to devote substantial resources to product development. Some clinical research organizations or technology companies may decide to enter into or expand their offerings in the biosimulation area, whether through acquisition or internal development. We also face continued competition from open source software initiatives, in which developers provide software and intellectual property free of charge, such as R and PK-Sim software. In addition, some of our customers spend significant internal resources in order to develop their own solutions. Any material decrease in demand for our technologies or services may have a material adverse effect on our business, financial condition and results of operations.

Changes or delays in government regulation, executive action or administrative decision-making relating to the biopharmaceutical industry could decrease the need for some of the services we provide.

Governmental agencies throughout the world strictly regulate the biopharmaceutical development process. Our business involves assisting biopharmaceutical companies strategically and tactically to navigate the regulatory approval process. New or amended regulations could result in higher regulatory standards and potentially additional revenues for companies that service these industries. However, some changes in regulations, such as a relaxation in regulatory requirements or the introduction of streamlined or expedited approval procedures, or an increase in regulatory requirements that we have difficulty satisfying or that make our regulatory strategy services less competitive, could eliminate or substantially reduce the demand for our regulatory services. Regulatory developments that could potentially increase demand for our services could also be postponed or not fully implemented.

Also, over time, but also with relatively short notice, governmental agencies could make different decisions or change standards with respect to all of the foregoing within their administrative oversight functions and authorities. There continue to be business and operational variables across regions and changes in governments that may adopt different strategies and priorities in approaches to the regulation of the biopharmaceutical industry. The biopharmaceutical industry may experience a change in the traditional approaches to government support and funding for drug development, in particular for public sector and academic organizations, dependent on outside funding to develop early-stage research. Any material decrease or delay in demand for our technologies or services, or regulatory restrictions or requirements placed on them, may have a material adverse effect on our business, results of operations and financial condition.

We cannot predict the likelihood, nature or extent of government regulation or intervention that may arise from future legislation or administrative or executive action, or changes to governmental regulation that may be required as a result of judicial decisions or change in administration, either in the United States or abroad. If we are slow or unable to adapt to changes in existing requirements or the adoption of new requirements or policies, or if we are not able to maintain regulatory compliance, our business may be harmed.

Reduction in R&D spending by our customers for a variety of reasons, as well as delays in the drug discovery and development process, may reduce demand for our products and services and negatively impact our results of operations and financial condition.

We provide biosimulation software platforms and services to the biopharmaceutical industry, including both private and public companies, as well as government and academic institutions. Because our products and services often depend on our customers’ R&D expenditures, our revenues may be materially negatively affected by any economic, competitive, regulatory, demand, or other market impact that decreases our customers’ financial performance, access to funds or their ability to raise capital, which may cause them to decrease or delay R&D spend. In such an event, our revenues may be reduced through increased downward pricing pressure, reduction in the scope of projects, delays or cancellations of ongoing projects, or our customers shifting away from using third parties for their modeling and simulation work. Our customers’ expenses and obligations could continue to increase as a result of the higher costs of developing more complex drugs and biologics and complying with more onerous government regulations. Furthermore, our customers may finance their R&D spending from both private and public sources, including the capital markets. As a result, our revenues and financial performance may be adversely impacted if our customers are unable to obtain sufficient capital on acceptable terms to finance their R&D spending. Government and university-based funding of scientific research can vary for a number of reasons, including general economic conditions, political priorities, changes in the number of students and other demographic changes.

Our customers’ revenue and/or profitability could decline as a result of efforts by government and third-party payors to reduce the cost of healthcare. Governments worldwide have increased efforts to expand healthcare coverage while at the same time curtailing and better controlling the increasing costs of healthcare. If cost-containment efforts or other measures substantially change existing insurance models and limit our customers’ profitability, our customers may decrease R&D spending, which could decrease the demand for our services and materially adversely affect our growth prospects.

Likewise, drug price controls are a topic subject to governmental intervention and regulation, and may vary by region, market and administration, and when applied could lead to reduced R&D spending by pharmaceutical companies, with one assumption being that they may have less financial incentive to develop new drugs, particularly for niche or complex therapeutic areas. For example, in the United States, specific drug price control provisions, allowing for negotiation of certain categories of drug prices through government executive agencies, were included in the Inflation Reduction Act of 2022, and the extent of their application may have an economic impact on the incentive structure related to drug development R&D spending by our customers. In addition, industry trends, economic factors, regulatory developments, patent protection and political and other events and circumstances that decrease our customers’ R&D spending also affect us.

Drug development cycles and investment in trials may also be impacted by a shift in government priorities, increased regulatory enforcement, more rigorous standards applied to public funding or reductions in philanthropic allocations or budgets. In such events, delays in the biopharmaceutical development cycle, particularly related to clinical trials being paused or canceled, could also impact the demand or timing for our products and services.

Furthermore, our financial success depends upon the creditworthiness and ultimate collection of amounts due from our customers. If we are not able to collect amounts due from our customers in a timely fashion due to funding or liquidity challenges or for any other reason, we may be required to write-off significant accounts

receivable and recognize bad debt expenses, which could materially and adversely affect our operating results. All of these events could have a material adverse effect on our business, financial condition and results of operations.

Consolidation within the biopharmaceutical industry may reduce the pool of potential customers for our products and services or reduce the number of licenses for our software products.

A significant portion of our customer base consists of biopharmaceutical companies, and our revenue is dependent upon expenditures by these customers. Consolidation through mergers or contraction through business failures within the biopharmaceutical industry may reduce the number of potential customers, particularly larger customers, for our products and services. Consolidation of major biopharmaceutical companies could result in consolidation of software licenses used by those companies, reduction of the number of individual user licenses, or increased pressure to negotiate price discounts or other terms for service that are less favorable to us, which may have a material adverse effect on our revenue and financial condition. Personnel redundancies and layoffs by merged companies to achieve deal synergies would result in a commensurate reduction in total users of our software, reducing the license fees we charge based on the number of users.

Evolving corporate governance and public disclosure regulations and expectations, including with respect to sustainability matters, could expose us to risks.

In recent years, there has been heightened interest from regulators, customers, investors, employees and other stakeholders on sustainability matters and related disclosures. Such attention to sustainability matters, including expanding mandatory and voluntary reporting, diligence, and disclosure on topics such as climate, human capital, labor and risk oversight, could expand the nature, scope, and complexity of matters that we are required to control, assess and report on.

At the same time, regulators and other stakeholders have increasingly expressed or pursued opposing views, legislation and investment expectations with respect to sustainability initiatives. Conflicting regulations and a lack of harmonization of ESG legal and regulatory environments across the jurisdictions in which we operate may create enhanced compliance risks and costs. If our sustainability practices do not meet evolving stakeholders’ expectations and standards, or if we are unable to satisfy all stakeholders, our reputation, ability to attract or retain employees, financial condition, results of operations and cash flows could be negatively impacted.