UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 29, 2024

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from__________to __________

Enovix Corporation

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39753 | | 85-3174357 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

3501 W Warren Avenue

Fremont, California 94538

(Address of Principal Executive Offices) (Zip Code)

(510) 695-2350

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | ENVX | | The Nasdaq Global Select Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | o |

| Emerging growth company | o | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

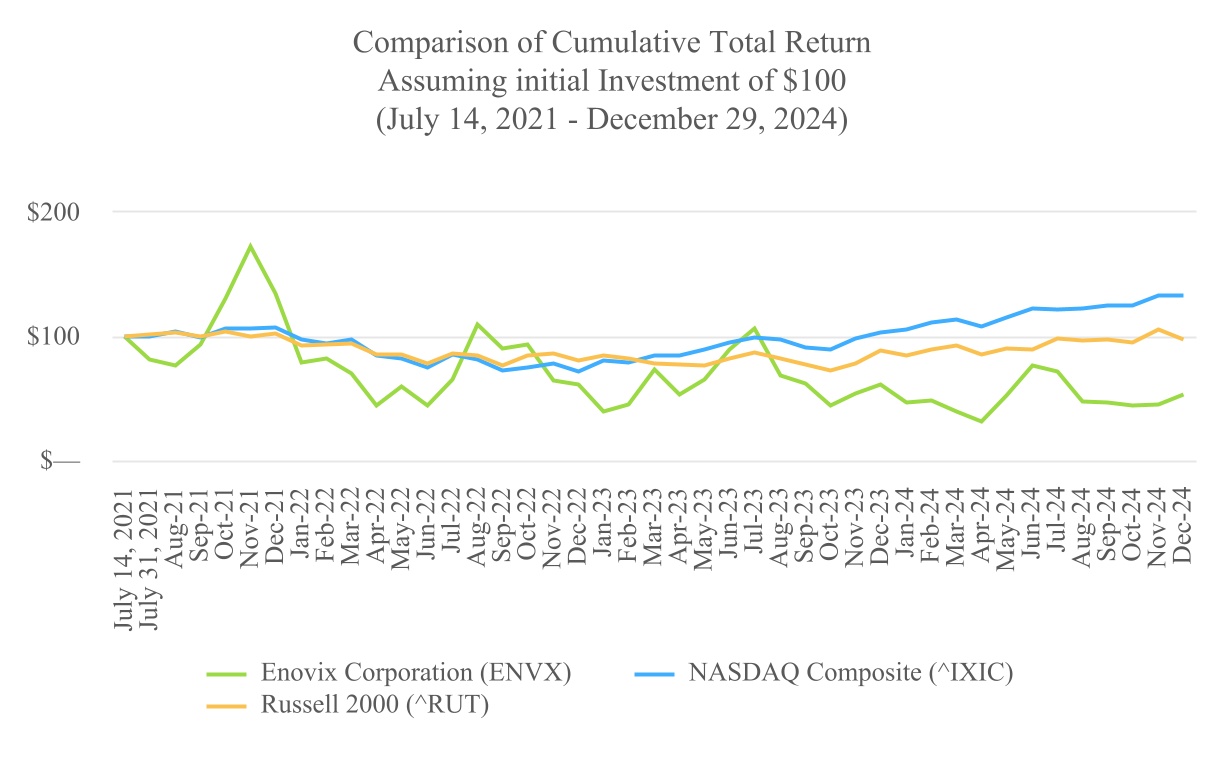

The aggregate market value of the voting and non-voting common equity held by non-affiliates on June 28, 2024 based on the closing price of the shares of common stock on such date as reported on The Nasdaq Global Select Market, was approximately $2.28 billion. Shares of voting stock held by each officer, director and each person known by the registrant to beneficially own 10% of more of the registrant’s outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This assumption regarding affiliate status is not necessarily a conclusive determination for other purposes.

As of February 19, 2025, 191,273,833 shares of common stock, par value $0.0001 per share, were issued and outstanding.

Portions of the registrant's Proxy Statement for its 2025 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K are incorporated by reference into Part III of this Annual Report on Form 10-K.

Enovix Corporation

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 29, 2024

Table of Contents

| | | | | | | | |

| | Page |

| PART I | | |

| | |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| PART II | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| PART III | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| PART IV | | |

| Item 15. | | |

| Item 16. | | |

| Signatures | |

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The statements contained in this Annual Report on Form 10-K that are not purely historical are forward-looking statements. Forward-looking statements generally relate to future events or our future financial or operating performance and can be identified by words such as anticipate, believe, continue, could, estimate, expect, intend, may, might, plan, possible, potential, predict, project, should, would and similar expressions that convey uncertainty about future events or outcomes. In addition, any statements that refer to projections, forecasts, management’s expectations, hopes, beliefs, intentions or strategies regarding the future, are forward-looking statements. may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Examples of forward-looking statements in this Annual Report on Form 10-K include, without limitation, statements about our:

•ability to respond to customer and market demand;

•ability to scale manufacturing lines for our lithium-ion batteries, as well as production and commercialization timelines, and our ability to have adequate capacity to satisfy customer demands;

•ability to meet milestones and customer acceptance of key products, such as EX-1M and EX-2M, and the ability to design and sample EX-3M in 2025, as well as the market readiness of such products and the effectiveness of our product design team;

•expectations and estimations of the total addressable market for our batteries, including the demand for more energy dense batteries and the suitability of our products to address this demand;

•expectations relating to the timing of the launch of commercial smartphone and commercial smart glasses products, the possible expansion of sales to defense customers, and expectations with respect to potential customer purchases, safety testing and customer qualification of our products;

•ability to manage our expenses and realize our cost savings goals;

•ability to manage and achieve the benefits of our restructuring efforts;

•products, technologies, business model and growth strategy, including commercialization opportunities, market opportunity and the expansion of our customer base;

•product strategy for our conventional lithium-ion battery products;

•ability to meet the expectations of new and current customers, including safety and qualification requirements, and our ability to achieve market acceptance for our products;

•financial performance, including revenue from the sale of batteries and battery pack products and engineering revenue contracts, as well as expenses and projections thereof;

•operational capabilities of our manufacturing lines, including the anticipated growth and benefits of our growing R&D teams to support product innovation;

•ability to attract and hire additional personnel, including for our international locations and to facilitate the build-out of existing and additional production lines;

•ability to optimize our manufacturing process and execute on our future product development strategy and roadmap to profitability, including projected improvements in our commercialization and R&D activities in support of our manufacturing operations;

•expectations regarding our development and other collaboration agreements with potential customers, including in the smartphone, IoT and defense categories;

•ability to validate the advantages of our cell architecture in the portable electronics and electric vehicle battery customer markets through our recent development agreements, as well as our expectations relating to the recognition of revenue from these markets, and our ability to expand our relationships with partners in the electric vehicle battery space; and

•ability to align with increasing customer demand for geodiversity and supply chain resilience.

The forward-looking statements contained in this Annual Report on Form 10-K are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements, and the assumptions underlying such statements, involve a number of risks, uncertainties, some of which are beyond our control. These risks and uncertainties include, but are not limited to, those factors described in Part I, Item 1A of this Annual Report on Form 10-K, and include, but are not limited to, those summarized on the following page. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

SUMMARY RISK FACTORS

Below is a summary of material factors that make an investment in our securities speculative or risky. Importantly, this summary does not address all of the risks and uncertainties that we face. Additional discussion of the risks and uncertainties summarized in this risk factor summary, as well as other risks and uncertainties that we face, can be found under Part I, Item 1A of this Annual Report on Form 10-K below.

•We will need to improve our energy density, cycle life, fast charging, capacity roll off and gassing metrics in order to stay ahead of competition over time, which is difficult and we may not be able to do.

•We rely on a new and complex manufacturing process for our operations, and achieving volume production involves a significant degree of risk and uncertainty in terms of operational performance such as yield and costs.

•If we cannot successfully scale our manufacturing facilities to produce our lithium-ion battery cell in sufficient quantities to meet expected demand, improve productivity and bring additional facilities online, we may be unable to achieve our profitability targets and our business will be negatively impacted and could fail.

•We rely on a manufacturing agreement with a Malaysia-based company for some of the facilities, procurement, and personnel needs of our operations. Changes to our relationship with such third-party contract manufacturer, expected or unexpected, may result in delays or disruptions that could harm our business.

•Our operations in international markets, including our manufacturing operations, expose us to operational, financial and regulatory risks, as well as risks relating to geopolitical tensions and conflicts, including changes to trade policies and regulations.

•We may not be able to source or establish supply relationships for necessary components and raw materials, or may be required to pay costs for components and raw materials that are more expensive than anticipated, including as a result of trade barriers, trade sanctions, export restrictions, tariffs, embargoes or shortages and other general economic and political conditions, which could delay the introduction of our product and negatively impact our business.

•We may be unable to adequately control the costs associated with our operations and the components necessary to build our lithium-ion battery cells.

•Lengthy sales cycles, unpredictable safety risks and certain provisions of defense and other customer contracts may negatively impact our ability to maintain and grow our customer base, which could adversely affect our business and future prospects.

•If our batteries fail to perform as expected, our ability to develop, market and sell our batteries could be harmed.

•We have a concentration of customer accounts in the defense sector and dependence on these customer accounts may create a risk to our financial stability.

•Our future growth and success depend on our ability to qualify new customers and the customer qualification cycles can take years to complete.

•We may not be able to accurately estimate the future supply and demand for our batteries, which could result in a variety of inefficiencies in our business and hinder our ability to generate revenue. If we fail to accurately predict our manufacturing requirements, we could incur additional costs or experience delays.

•We have a history of financial losses and expect to incur significant expenses and continuing losses for the foreseeable future.

•If we are unable to develop our business and effectively commercialize our products as anticipated, we may not be able to generate revenue or achieve profitability.

•We face significant barriers in our attempts to produce our products, our products are still under development, and we may not be able to successfully develop our products at commercial scale. If we cannot successfully overcome those barriers, our business will be negatively impacted and could fail.

•We have acquired and may continue to acquire other businesses, which could require significant management attention, disrupt our business, and dilute stockholder value.

•Fluctuations in foreign currency exchange rates or interest rates have had, and could continue to have, an adverse impact on our financial condition and results of operations.

•Operational problems with our manufacturing equipment subject us to safety risks which, if not adequately addressed, could have a material adverse effect on our business, results of operations, cash flows, financial condition or prospects.

•The battery market continues to evolve and is highly competitive, and we may not be successful in competing in this industry or establishing and maintaining confidence in our long-term business prospects among current and future partners and customers.

•Our failure to keep up with rapid technological changes and evolving industry standards may cause our batteries to become less marketable or obsolete, resulting in a decrease in demand for our batteries and harm our ability to grow revenue and expand margins.

•If we are unable to attract and retain key employees and qualified personnel on a global basis, our business and prospects could be harmed.

•We have previously been, currently are, and may in the future be involved in class-action lawsuits and other litigation matters that are expensive and time-consuming. If resolved adversely, lawsuits and other litigation matters could seriously harm our business.

•We may not have adequate funds to finance our operating needs and our growth, and may need to raise additional capital, which we may not be able to do.

•Servicing our debt requires a significant amount of cash, and we may not have sufficient cash flow from our business to pay our substantial debt.

•We rely heavily on our intellectual property portfolio. If we are unable to protect our intellectual property rights, our business and competitive position would be harmed.

•The trading price of our common stock may be volatile, and the value of our common stock may decline.

•Changes in tax laws or regulations that are applied adversely to us or our customers may have a material adverse effect on our business, cash flow, financial condition or results of operations.

PART I

Item 1. Business

Company Overview

Enovix Corporation (the “Company,” “we,” “us,” “our” and “Enovix”) is on a mission to deliver high-performance batteries that unlock the full potential of technology products. We do this by designing, developing, manufacturing, and commercializing next generation Lithium-ion, or Li-ion, battery cells that significantly increase the amount of energy density and storage capacity relative to conventional battery cells. Our battery’s mechanical design, or “architecture,” allows us to use high performance chemistries while enabling safety and charge time advantages.

Enhanced batteries for the mobile, IoT and defense sectors enable the development of devices that can accommodate user preferences for more advanced features and a slimmer design. Electric Vehicles (“EVs”) that use advanced batteries charge faster with lower system costs.

Enovix was established in 2006 based on the fundamental premise that improving battery performance would require a reinvention of the battery’s architecture. Our architecture allows us to use 100% active silicon and no graphite in the battery’s anode, which is the negative electrode that stores lithium ions when a battery is charged. The advantage of silicon over graphite is that a battery can theoretically store more than twice as much lithium as graphite, which increases a battery’s energy density and overall capacity. The battery industry has historically struggled to incorporate more than a small amount of silicon in the anode because silicon can swell and crack in conventional architectures, impacting safety and performance. By contrast, our architecture is designed to accommodate silicon’s swelling and apply stack pressure that alleviates the cracking problem.

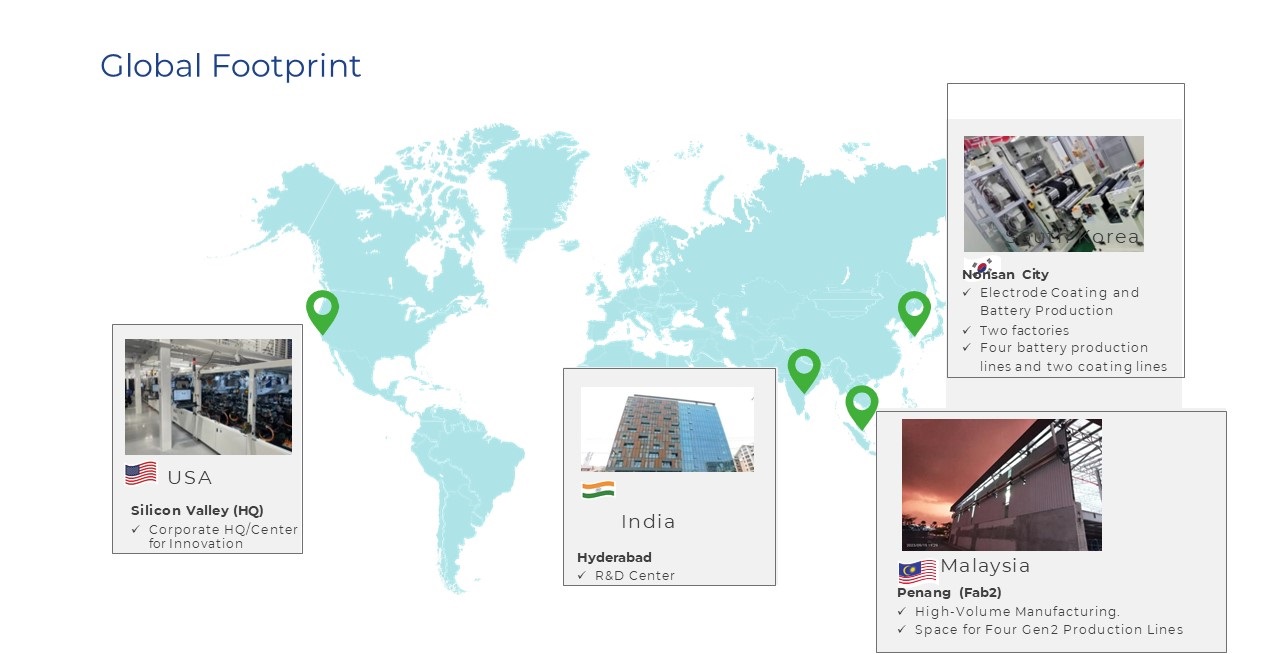

We have devoted significant funds and resources to develop our battery’s architecture and the unique patterning and stacking assembly process for manufacturing our cells. This was done in conjunction with partnership and investment from several strategic partners in the solar and semiconductor industries. Since 2018, we have sampled batteries to customers that have validated the performance of our products. In 2020, we started procuring equipment for our first production line (“Fab1”) at our headquarters in Silicon Valley. We recognized our first production revenue in the second quarter of 2022 from Fab1. In 2023, we identified a facility in Malaysia (“Fab2”) for high-volume production and acquired Routejade, Inc. (“Routejade”), a battery manufacturer in South Korea. The acquisition of Routejade allowed us to vertically integrate electrode coating and battery pack manufacturing and expand our battery offerings to include conventional graphite battery technology to service the IoT, industrial and defense markets.

Between May and July of 2024, we relocated our Fab1 R&D pilot line equipment to Fab2 in Malaysia. In August 2024, we officially opened our Fab2 production facility, located at the Penang Science Park in Malaysia. We have three manufacturing lines at Fab2, including the R&D focused pilot production line, the Agility line and the High-Volume (“HVM”) line. In October 2024, we commenced shipping battery cells from the Agility line and as of the end of 2024, we had completed Site Acceptance Testing (“SAT”) for the Agility and HVM lines.

Following the opening of Fab2 in Malaysia, our corporate functions, and certain sales, operations and engineering activities, are located at our U.S. headquarters, while our manufacturing and research and development activities are conducted primarily in Malaysia, Korea and India. As of December 29, 2024, we operate in one segment.

Industry Background

Battery Technology Innovation - Historical Overview

Sony developed the first Li-ion battery for consumer electronics to power its newly invented handheld video recorder in 1991, which needed smaller and lighter batteries with more energy than those available at the time. This battery architecture, sometimes referred to as a “Jelly Roll”, consists of an anode (A) in a long strip format, a long strip cathode (C) and two long strip separators (S), all on rolls, which are interleaved and then wound together into a Jelly Roll in this order: ASCSASCS.

The Jelly Roll is placed in a hermetic package and filled with electrolyte, an organic liquid through which the lithium ions repeatedly travel back and forth between the battery’s anode and the cathode. During charging, the lithium ions cycle from the cathode - the positive electrode, through tiny holes in the separator, and into the anode - the negative electrode. This basic construct of the Li-ion battery has remained unchanged for nearly 30 years.

Battery Technology Innovation - Our Approach

Historically, advancements in battery performance have been primarily driven by improvements in materials and manufacturing capability. These efforts have led to significant increases in metrics such as energy density over time, but as the industry moves toward next generation materials, such as silicon anodes, limitations in traditional cell design hinder progress. Enovix has re-imagined the lithium-ion cell design and assembly process to address the unique challenges of the next generation of active materials, maximizing their potential and value. The Enovix cell design improves the electrochemical, mechanical, thermal and safety performance of lithium-ion batteries.

A Fundamentally Different Design for Batteries

Our founders conceived a completely different design for a battery. Rather than focusing solely on the materials inside the battery, we began development of a novel 3D physical battery design, one that could both improve the packing efficiency of the active materials in the battery, as well as accommodate the use of a 100% active silicon anode. Our founders leveraged their knowledge from over 25 years in the hard disk drive and semiconductor industries to develop a battery architecture based on stacking instead of rolling. Rather than interleaving and winding long anode, cathode and separator strips into a roll, our founders proposed an architecture in which many short anodes and cathodes were stacked side by side, with a separator between each anode-cathode pair.

Uniquely Enabling Silicon Anodes

Looking at a problem from a different perspective often yields new opportunities and solutions that would otherwise not be possible. This is the case with our cell architecture. Rather than having long, wound electrodes that run parallel to the face of the battery, our cells have many small electrodes that are orthogonal to the largest face of the battery. This seemingly small difference has huge benefits. Specifically, our cell architecture is well-suited to accommodate the use of a silicon anode and therefore capitalize on the higher energy density it provides, as described below.

Silicon has long been heralded as the next important anode material. Silicon anodes can theoretically store more than twice as much lithium per unit volume than the graphite anode that is used in nearly all Li-ion batteries today.

Silicon’s high energy density, however, creates four significant technical problems that must be solved:

•Formation expansion. “Formation” is the term for the first charging of the battery, when lithium moves from the cathode, through the separator, to the anode. When fully charged, a silicon anode can more than double in thickness, resulting in significant swelling that can physically damage the battery, causing failure.

•Formation efficiency. When first charged, a silicon anode can absorb and permanently trap as much as roughly 40% to 50% of the original lithium in the battery, reducing the battery’s capacity by about 50% to 60%.

•Cycle swelling. A silicon anode will swell and shrink when the battery is charged and discharged, respectively, causing damage to both the package and the silicon particles in the anode, which can crack, and further trap lithium on the fresh silicon surfaces exposed by the crack.

•Cycle life. Silicon particles can become electrically disconnected from the electrode when the silicon anode is in its shrunken state and can crack when the silicon anode is swollen, both of which can lower cycle life. In addition, when silicon particles become disconnected from the electrode, they are no longer able to accept lithium and neighboring particles must absorb the excess, causing over charging and further opportunities for physical damage.

Left unaddressed, these four problems have limited the practical application of silicon anodes in conventional lithium-ion battery cells. Our cell architecture uniquely solves these four technical problems to enable 100% active silicon anodes.

Problem 1 — Formation expansion

In a conventional graphite anode, lithium atoms slip into the vacant spaces between the graphite layers, forming LiC6, resulting in very little graphite anode swelling during cycling (<10%). In a silicon anode, however, lithium atoms form a lithium-silicon alloy that does not have such vacant spaces, forming Li15Si4. While this alloying process results in an increased ability to store lithium, it also causes significant expansion of the anode material during charging, creating high pressure within the battery (1,500 psi).

If a silicon anode were used in a conventional battery architecture, the pressure of anode swelling would act on the large face of the battery, creating a force as large as 1.7 tons for a battery in a 50mm x 30mm x 3mm size battery. This force is analogous to a car standing on top of a cell phone sized battery.

By contrast, when silicon anodes are used in our cell architecture, the anodes do not face the largest side of the battery; instead the anodes face a short side of the battery. Because these anode faces are small in area, this same 1,500 psi pressure, therefore, creates a force of only 210 pounds in the same size battery.

To manage this force, we invented a very thin (50-micron) stainless steel constraint system to surround the battery. This constraint system limits the battery from swelling and growing in size. Moreover, the constraint system keeps the anode and cathode materials under constant compression, maintaining excellent particle-to-particle connection.

Problem 2 — Formation Efficiency

The first time a Li-ion battery is charged or formed, some of the lithium is permanently trapped in undesired side-reactions and surface layers on the anode and cathode particles. These losses proportionately reduce the capacity of the battery by removing lithium.

During formation of a conventional Li-ion battery with a graphite anode, approximately 5% of the lithium from a lithium cobalt oxide cathode will get permanently trapped in the graphite anode, never to return to the cathode.

A silicon anode, by contrast, can have a formation efficiency of roughly 50% to 60%, meaning that about 40% to 50% of the lithium is trapped in the silicon anode during formation and is no longer available for repeated cycling, reducing the battery’s capacity in half.

Our cell architecture uniquely enables a practical solution to this problem. Our cell assembly process has an added step called “pre-lithiation,” in which a thin lithium source is placed on top of the cell, within the package. By electrochemically coupling this lithium source to the electrodes, additional lithium can be dosed into the cell, replenishing the lithium lost during formation. Moreover, additional lithium beyond the initial replenishment can be dosed, providing a reservoir of lithium to a) counteract the normal lithium consumption that occurs in every battery during its life and b) provide the proper voltage balance to keep the minimum discharge voltage in the regime to be useful for devices.

The physical process by which the added lithium moves into the battery is called diffusion. The time required for lithium atoms to diffuse is proportional to the square of the diffusion distance. In a conventional battery architecture, the length of the electrode can be on the order of dozens of millimeters resulting in a pre-lithiation process that could take weeks to accomplish if a thin lithium source were placed on top of the cell. In our cell architecture, however, the lithium is required to travel a short distance, which can be accomplished in hours.

Problems 3 & 4 — Swelling and Cycle Life

When conventional Li-ion batteries with graphite anodes are cycled (charged and discharged), they exhibit a modest amount of cyclic swelling (<10%). Silicon anodes, by contrast, can swell by 20%, or more. The continuous swelling and shrinking during charging and discharging can fracture the anode silicon particles and/or electrically disconnect them and limit cycle life to less than 100 cycles, which is not commercially viable in many applications. Additionally, any swelling in the cell over its lifetime must be accommodated by larger cavity volume, effectively reducing the practical energy density of the cell.

Our unique structural constraint system applies a uniform engineered pressure on the silicon particles within the anode, limiting their fracture and maintaining electrical contact between them for an extended number of cycles. Cycle swelling is thus kept under 2%, outperforming even conventional graphite anodes. Our cells that have been cycled over 500 times show minimal expansion by contrast.

By addressing swelling, our cell architecture with its constraint system is designed to enable silicon anodes to achieve a minimum of 500 complete charge/discharge cycles to 80% remaining capacity.

Benefits of Our Advanced Li-ion Battery

Mobile — The Li-ion battery also provided the increase in energy density needed for cell phones to evolve from their original “brick-size” into today’s sleek, sophisticated smartphone. Energy requirements continue to become more demanding as original equipment manufacturers (“OEMs”) seek to launch heavy workload applications such as 4K and

8K video upload/download, multi-player gaming, enhanced camera capabilities and on-device AI. Just as it was 30 years ago, a significant increase in battery energy density will enable OEMs to continue improving user experience, functionality and battery life while keeping devices sizes small enough to fit in a pocket.

Computing — The Li-ion battery can also be credited for helping to usher in an era of portable PC computing. Users are now demanding higher performance from their portable PCs to accommodate everything from gaming to enterprise applications such as video conferencing. Ultimately users want “always on, all day” battery life, like that which they experience with their smartphones. Increased energy density is needed for this task, along with enabling more power-hungry features and AI.

IoT – The Internet-of-Things (“IoT”) market includes many types of devices powered by a Li-ion battery, including wearables, health/wellness devices, camera-based devices, power banks, location trackers, portable networking devices, augmented reality/virtual reality devices (“AR/VR”), and computing accessories, among others. Products in this market are often power budget constrained due to size. There is also a constant appetite in this market for power-hungry features such as sensors, high-speed connectivity, and the increasing integration of AI and generative AI (“Gen AI”) capabilities. AI-enabled workloads and on-device Gen AI applications require significantly more power to deliver enhanced functionality and user experience. All of these features can be enabled by a higher energy density battery.

Electric Vehicles — According to BloombergNEF's Electric Vehicle Outlook 2024, the number of EVs will grow from 13.9 million in 2023 to 30.0 million in 2027. Replacing internal combustion engine vehicles with EVs can reduce emissions that contribute to smog and climate change, but mass adoption of EVs hinges on lower cost vehicles and faster charging times that resemble the gas station experience of filling up quickly. The orientation of the electrodes in our battery allows for significantly higher thermal conductivity, enabling a faster-charging EV battery.

Producing Our Battery

In addition to designing our battery, we also develop the advanced manufacturing processes needed to produce our batteries in high volume and at low cost.

We use the conventional Li-ion battery cell manufacturing techniques for processes such as electrode coating, cell packaging, test and aging. We then use our own proprietary tools on steps such as cell assembly where we laser pattern and stack the electrodes and then apply a stainless steel constraint.

Standard Li-ion battery production involves: 1) electrode fabrication, 2) cell assembly and 3) battery packaging and formation.

Electrode Fabrication — Sony developed and commercialized the first Li-ion battery in 1991 to meet the power requirements of its new handheld camcorder. Sony’s battery division adapted its existing magnetic recording tape production equipment to make batteries: 1) to mix chemical anode and cathode slurries, 2) to coat them onto metal foil current collectors, 3) to “calender” (flatten) the surface, 4) to slit the coated metal foil into electrode sheets and 5) to roll them up for packaging in cylindrical metal cans. While there have been process improvements over the years, electrodes for conventional Li-ion batteries are still fabricated using this standard method developed almost 30 years ago. In 2023, we acquired Routejade to bring this electrode fabrication capability in-house.

Cell Assembly — Li-ion cells were initially assembled by winding electrodes and separators into a naturally cylindrical Jelly Roll configuration, packaged in a cylindrical metal can. While some Li-ion batteries still use cylindrical metal cans, low-profile portable electronic devices require thinner, flatter cell formats, like the flat Jelly Roll described earlier. Li-ion cell assembly first addressed this need with a wind-and-flatten process introduced in the early 1990s. Today, it is common to wind the Jelly Roll onto a flat–rather than round–metal form. We have developed a more precise roll-to-stack cell assembly process to enable a silicon anode that increases Li-ion cell energy density and maintains high cycle life.

Wind-and-Flatten Cell Assembly — Wind-and-flatten cell assembly, introduced in the early 1990s, essentially flattens the cylindrical Jelly Roll into a thin, flat package for use in portable electronic devices such as laptop computers and mobile phones. The wind-and-flatten electrode assembly can be packaged in a metal case, but it is most often packaged in a polymer pouch for portable electronic device applications. It can also be produced in larger formats, with welded aluminum housings for electric powertrains in EVs.

Cut-and-Stack Cell Assembly — Cut-and-stack cell assembly was introduced in 1995. Instead of winding and flattening, electrodes and separators are cut (or punched) into sheets, which are stacked horizontally. Cut-and-stack assembly provides better spatial efficiency than Jelly Roll wind-and-flatten assembly because the volume lost from the core is

eliminated and space at the outside edges is reduced. Cut-and-stack cells are used in consumer, defense and EV applications.

Enovix Roll-to-Stack Cell Assembly — We have designed proprietary tools, produced for us by precision automated equipment suppliers, which incorporate patented methods and processes to achieve precise laser patterning and high-speed roll-to-stack cell assembly.

Instead of cutting or punching, electrodes and separators are laser patterned and stacked. An in-line laser precisely patterns the electrodes and separators, which are then fed directly to a high-speed stacking tool.

Battery Packaging and Formation — Our battery uses the same battery packaging and formation process as a conventional Li-ion battery with the exception of the pre-lithiation process noted above. In our manufacturing process, we add an incremental lithium source during packaging which is then diffused into the cell during the formation process.

Our Products

Our product strategy is built on close collaboration with customers to understand their specific performance requirements such as energy density, cycle life, charge rate, and battery size. In 2023, we shifted from a horizontal business strategy, which focused on serving hundreds of customers with standard-sized batteries, to a vertical business strategy targeting a smaller group of large customers that require custom cells. We believe this transition provides the most efficient path to scale while optimizing battery performance for our target applications, including smartphones, computing, and IoT. We directly engage with OEMs to fine-tune our battery technology for maximum performance within the constraints of their devices.

To achieve this, we develop battery "nodes" that share a common set of active materials and mechanical design, enabling us to produce batteries in various sizes. Our technology roadmap is built around a structured progression of these nodes, with each new generation such as EX-1M, EX-2M, EX-3M and so on, delivering substantial improvement in energy density. By leveraging both material and design innovations, we aim to push the boundaries of Li-ion battery performance Continuous innovation will allow us to introduce higher-performing battery nodes over time, delivering meaningful performance gains for our customers ahead of market trends.

In 2023, we acquired Routejade, a leading battery manufacturer in South Korea that supplies batteries for wearables, medical devices, headsets, activity trackers, and industrial equipment. Routejade's patented encapsulation technology provides for design flexibility and structural safety, enabling high-energy-density Li-ion batteries primarily for IoT and wearable applications. The company also produces high-power batteries using Z-Folding technology, serving customers in the medical, industrial, aviation, and defense sectors. Routejade offers three main product categories. The PD series consists of rechargeable coin cells commonly used in healthcare and IoT applications. The FLPB and ASDB series utilize encapsulation technology—FLPB providing structural safety and ASDB maximizing design flexibility for compact devices—both primarily used in wearables and medical applications. The SLPB series features high C-Rate Z-Folding batteries optimized for high-power applications in the medical, industrial, aviation, and defense markets. One of Routejade’s key strengths is its in-house pack assembly, serving over 50 global end-user customers with a wide range of customized solutions to meet diverse market demands.

Our Competitive Strengths

100% Active Silicon Maximizes Anode Energy Density and Battery Capacity — Conventional Li-ion battery architecture only allows small amounts of silicon to be blended with graphite in the anode, limited by swelling. Our proprietary cell architecture enables use of silicon instead of graphite as the cycling material to achieve 100% active silicon anode that increases energy density and battery capacity.

Proprietary Manufacturing Process — In order to commercialize our unique architecture, we invented a customized manufacturing process that is not available “off-the-shelf” to conventional battery cell OEMs. In developing this process over multiple generations, we have accumulated significant intellectual property and trade secrets.

Full-Depth of Discharge Cycle Life — We have internally built and verified battery cells based on our proprietary cell architecture with an integrated structural constraint capable of 1,000 cycles, opening mass-market opportunities that were previously unobtainable with silicon anodes that failed to reach this number of cycles.

Architecture Enables Safety Innovation — Our architecture enables multiple parallel cell-to-busbar connections, which allow us in certain applications to apply a resistor at the busbar junction that can be utilized to regulate current flux in the

event of an internal short. Our BrakeFlowTM system is designed to limit a shorted area from overheating and inhibits thermal runaway.

Architecture Enables Fast Charge — We demonstrated a 0-80% state-of-charge in 5.2 minutes and a 0-98% state-of-charge in just under 10 minutes on 0.27Ah test cells. This fast charging is enabled by the fact that heat only has to travel a small distance from the center of our electrodes to the stainless steel constraint on the exterior.

Customer Tested in Multiple Form Factors — We have sampled pilot-production cells in several different sizes as part of product development programs. Applications cover a range of portable electronic products, including wearables, mobile handsets and laptop computers.

Practical Path to EV Market — We will initially validate our silicon anode Li-ion battery technology and production process in the quality-conscious, high-volume portable electronic device market. This will help mitigate technology and production risks as we look to commercialize our product for the EV market.

Home Grown IP — Unlike many advanced battery startups, which have licensed core technology from government or academic research laboratories, we have developed and own all our intellectual property. We received our first patents in 2011.

Supply Chain Geodiversity — Our manufacturing footprint in Korea and Malaysia aligns with increasing customer demand for geodiversity and supply chain resilience.

Research and Development

Our global research and development (“R&D”) programs are focused on driving improvements in the performance and cost of our batteries and manufacturing equipment.

Current R&D activities include the following:

Energy Density and Capacity — Increase the energy density and capacity of batteries by increasing the percent by volume of active cathode material inside the core, minimizing packaging overhead, maximizing the voltage of the cell, using cathode materials with higher specific capacity, and scaling the size of the battery while maintaining battery safety.

Cycle Life and Temperature — Improve the cycle life and high and low temperature performance of batteries by developing new electrolyte chemistries.

Fast Charge — Enable battery charging at a higher rate for reduced charge time, while minimizing heating.

Safety — Improve battery safety by developing techniques to regulate current flux in the event of a battery short and limit overheating to inhibit thermal runaway.

Anodes and Cathodes — Develop batteries with next-generation anodes and cathodes that increase energy density.

Cost and Throughput — Develop toolsets and processes to produce batteries with lower cost and higher manufacturing throughput.

Mechanical Design — Improve energy density, cycle life, safety, manufacturability and yield.

EV Batteries — Develop batteries targeted to the unique requirements of the EV industry.

Manufacturing and Supply Chain

We historically manufactured batteries at our Fab1 manufacturing facility at our headquarters in Fremont, California. In 2023, we selected a site for Fab2 in Penang, Malaysia at the Penang Science Park. In the third quarter of 2023 we initiated a plan to locate all manufacturing operations in Asia to be closer to customers and suppliers, and transition Fab1 to focus on new product development. In October 2023, we completed the acquisition of Routejade, which has two factories in Nonsan City, South Korea, that house a total of four automated battery production lines and two electrode coating lines.

In the second quarter of 2024, we undertook a restructuring plan that included a relocation of Fab1 manufacturing to Malaysia. In the third quarter of 2024, we formally opened Fab2 in Penang, Malaysia and began operating our Agility line at this site. We subsequently commenced shipping EX-1M battery cells to customers from the fully operational

Agility line in Malaysia. In addition, we completed SAT for our second generation (“Gen2”) HVM line in late December 2024 and began sampling EX-2M battery cells to smartphone customers.

We source materials for our batteries from third party suppliers globally. We have executed master supply agreements with many of our suppliers and have qualified second sources for certain of our battery materials. We seek second sources for materials that are high cost or where a risk to supply has been identified. On long-lead items we intend to keep safety stock on hand to mitigate interruptions to supply.

Intellectual Property

We operate in an industry in which innovation, investment in new ideas and protection of our intellectual property rights are critical for success. We protect our technology through a variety of means, including through patent, trademark, copyright and trade secrets laws in the U.S. and similar laws in other countries, confidentiality agreements and other contractual arrangements. As of December 29, 2024, we had approximately 65 issued U.S. patents, approximately 145 issued foreign patents, approximately 29 public and pending U.S. patent applications and approximately 132 public and pending foreign patent applications.

We continually assess the need for patent protection for those aspects of our technology that we believe provide significant competitive advantages. A majority of our patents relate to battery architectures, secondary batteries, and related structures and materials.

With respect to proprietary know-how that is not patentable and processes for which patents are difficult to enforce, we rely on trade secret protection and confidentiality agreements to safeguard our interests. We believe that many elements of our secondary battery manufacturing processes involve proprietary know-how, technology or data that are not covered by patents or patent applications, including technical processes, test equipment designs, algorithms and procedures.

We own or have rights to various trademarks and service marks in the U.S. and in other countries, including Enovix and the Enovix design mark. We rely on both registration of our marks as well as common law protection where available.

All of our research and development personnel have entered into confidentiality and proprietary information agreements with us. These agreements address intellectual property protection and require our employees to assign to us all of the inventions, designs and technologies they develop during the course of employment with us.

We also require our customers and business partners to enter into confidentiality agreements before we disclose any sensitive aspects of our technology or business plans. As part of our overall strategy to protect our intellectual property, we may take legal actions to prevent third parties from infringing or misappropriating our intellectual property or from otherwise gaining access to our technology.

For more information regarding the risks related to our intellectual property, including the above referenced intellectual property proceedings, see Part I, Item 1A of this Annual Report on Form 10-K.

Competition

The Li-ion battery supplier market is highly competitive, with both large incumbent suppliers and emerging new suppliers.

Prospective competitors of ours include major manufacturers currently supplying the mobile device, IoT, defense, EV and battery energy storage systems (“BESS”) industries, and potential new entrants to the industry. Incumbent suppliers of Li-ion batteries include Amperex Technology Ltd., Panasonic Corporation, Samsung SDI, Contemporary Amperex Technology Co. Ltd. and LG-Energy Solution Ltd. These companies supply conventional Li-ion batteries and, in some cases, Li-ion batteries with some silicon added to the anode. In addition, because of the importance of EVs, many automotive OEMs are researching and investing in advanced Li-ion battery efforts including battery development and production.

There are also several emerging companies investing in developing improvements to conventional Li-ion batteries or new technologies for Li-ion batteries, including silicon anodes and solid-state architectures. Some of these companies have developed relationships with incumbent battery suppliers, automotive OEMs and consumer electronics brands. These emerging companies are also exploring new chemistries for electrodes, electrolytes and additives.

Our ability to compete successfully will rely on factors both within and outside our control, including broader economic and industry trends. Factors within our control include driving competitive pricing, cost, energy density, safety and cycle life.

We believe that our ability to compete against this set of competitors will be driven by a number of factors, including product performance, cost, reliability, product roadmap, customer relationships and ability to scale manufacturing. We believe we will compete well on each of these factors based on advanced battery innovation to date and the ability to continue to design, develop and manufacture higher performing products for the customers served in our targeted markets.

Government Regulation and Compliance

Our business activities are global and are subject to various federal, state, local, and foreign laws, rules and regulations. For example, there are various government regulations pertaining to battery safety, transportation of batteries, use of batteries in cars, factory safety, and disposal of hazardous materials. In addition, substantially all of our import and export operations are subject to complex trade and customs laws, export controls, regulations and tax requirements such as sanctions orders or tariffs set by governments through mutual agreements or unilateral actions. Further, the countries into which our products are imported or are or will be manufactured may from time to time impose additional duties, tariffs or other restrictions on our imports or adversely modify existing restrictions. For example, recent tensions in U.S.-China trade relations, increased tariffs, and the possibility of additional tariffs, have created uncertainty and may negatively impact our key partners and suppliers. Changes in export controls, tax policy or trade regulations, the disallowance of tax deductions on imported merchandise, or the imposition of new tariffs on imported products, could have an adverse effect on our business and results of operations.

Prior to transitioning our Fab1 manufacturing equipment to Fab2 in Malaysia, our Fremont, California facility operated as a foreign trade zone through qualification with U.S. Customs. During its active period, this foreign trade zone status allowed us to defer certain U.S. duties and tariffs on materials received at the Fremont facility, until such time as those materials entered U.S. commerce. The operation of our foreign trade zone required compliance with applicable regulations and support from U.S. Customers with respect to the foreign trade zone program. While we previously may have benefited from reduced duties, deferral of certain duties and tariffs, and reduced processing fees through the foreign trade zone program, these benefits have been phased out as manufacturing operations are now located at Fab2 in Malaysia.

Privacy and Security Laws

In the ordinary course of our business, we may process personal or sensitive data. Accordingly, we are or may become subject to numerous data privacy and security obligations, including federal, state, local, and foreign laws, regulations, guidance, and industry standards related to data privacy, security, and protection. Such obligations may include, without limitation, the Federal Trade Commission Act, the Telephone Consumer Protection Act of 1991, the Controlling the Assault of Non-Solicited Pornography And Marketing Act of 2003.

The California Consumer Privacy Act of 2018, as amended by the California Privacy Rights Act of 2020 (collectively, “CCPA”) the European Union’s General Data Protection Regulation 2016/679 (“EU GDPR”), the EU GDPR as it forms part of United Kingdom (“UK”) law by virtue of section 3 of the European Union (Withdrawal) Act 2018 (“UK GDPR”), and the ePrivacy Directive. Furthermore, several states within the United States, including Colorado, Connecticut, Utah and Virginia, have enacted or proposed data privacy laws. Additionally, we are, or may become, subject to various U.S. federal and state consumer protection laws which require us to publish statements that accurately and fairly describe how we handle personal data and choices individuals may have about the way we handle their personal data.

The CCPA, UK GDPR, and EU GDPR are examples of the increasingly stringent and evolving regulatory frameworks related to personal data processing that may increase our compliance obligations and exposure for any noncompliance. For example, the CCPA imposes different obligations on covered businesses, including affording privacy rights to consumers, business representatives and employees who are California residents, requires covered businesses to provide specific disclosures to California residents in privacy notices, and provides such individuals with certain privacy rights to their personal data. The CCPA provides for administrative fines of up to $7,500 per violation and allows private litigants affected by certain data breaches to recover significant statutory damages.

Foreign data privacy and security laws (including but not limited to the EU GDPR and UK GDPR) impose significant and complex compliance obligations on entities that are subject to those laws. As one example, the EU GDPR applies to any company established in the EEA and to companies established outside the EEA that process personal data in connection with the offering of goods or services to data subjects in the EEA or the monitoring of the behavior of data subjects in the EEA. These obligations may include limiting personal data processing to only what is necessary for specified, explicit, and legitimate purposes; requiring a legal basis for personal data processing; requiring the appointment of a data protection officer in certain circumstances; increasing transparency obligations to data subjects; requiring data protection impact assessments in certain circumstances; limiting the collection and retention of personal data; increasing rights for data subjects; formalizing a heightened and codified standard of data subject consents; requiring the implementation and maintenance of technical and organizational safeguards for personal data; mandating notice of certain personal data breaches to the relevant supervisory authority(ies) and affected individuals; and mandating the appointment of representatives in the UK and/or the EU in certain circumstances. These developments further complicate compliance efforts and increase legal risk and compliance costs for us and the third parties upon whom we rely.

Our actual or perceived failure to comply with such obligations could lead to regulatory investigations or actions, litigation, fines and penalties, disruptions of our business operations, reputational harm, loss of revenue or profits, loss of customers or sales, and other adverse business consequences.

The EU GDPR, UK GDPR, CCPA, and other laws exemplify the obligations our business may have in responding to the evolving regulatory environment related to personal data. Our compliance costs and potential liability may increase with this scattered regulatory environment.

See the section titled “General Risk Factors” for additional information about the laws and regulations to which we are or may become subject and about the risks to our business associated with such laws and regulations.

Human Capital

Our human capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing and integrating our existing and new employees. The principal purposes of our equity incentive plans are to attract, retain and motivate our people through the granting of equity-based compensation awards, in order to increase stockholder value and our success by motivating such individuals to perform to the best of their abilities and achieve Enovix’s objectives. As of December 29, 2024, we employed approximately 570 full-time employees. Approximately 18% of our employees are located in the United States, and 82% of our employees are located in Asia Pacific, which includes South Korea, Malaysia, India and China.

Culture and Benefits

Our people are our greatest asset. We strive to live up to our Core Values every day: integrity, respect, innovation, resilience, excellence and customer focus. Employees carry these Core Values with them on their access badge. Our Core Values are also displayed in conference rooms at Enovix offices globally, and are reinforced in new hire training and rewards and recognition programs. Our team at Enovix is comprised of a diverse group of dedicated technicians, engineers, scientists, and business professionals who are all driven to create a better, low-carbon world through innovation in energy storage. We could not be where we are today without the dedication of our workforce, and we prioritize pathways for career development, employee feedback and competitive compensation and benefits packages. Our benefits program includes an employee stock purchase plan, paid time off, team building events and talent development opportunities. The program is designed, and periodically evaluated, to ensure we continue to motivate, strengthen and empower our workforce.

Employee Engagement and Training

We are engaged in community building by collaborating with local non-profit organizations in both the U.S. and Asia. We regularly engage with our employees via quarterly All Hands meetings, employee engagement surveys and through team building events. These activities help advance employees’ cultural awareness and social responsibility and promote employee wellness and safety, as well as facilitate a collaborative and transparent working environment. We have engaged with top universities in Malaysia to build out a talent pipeline.

We have established a learning platform with both internal and external content to provide employees with on demand technical training programs and programs focused on developing soft skills. Our broader training program

covers leadership topics, safety and compliance, processes and systems. The trainings are done online and in person, in brown bag formats and in more formal settings.

Building a company where everyone feels that they belong is a priority at Enovix. Our Core Values are reinforced in new hire training, employee engagement activities and everyday interactions.

Corporate Information

Our principal executive offices are located at 3501 W. Warren Avenue, Fremont, CA 94538.

Available Information

We file or furnish periodic reports and amendments thereto, including our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, proxy statements and other information with the Securities and Exchange Commission (“SEC”). The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically. Copies of our SEC filings are made available, free of charge, on our investor relations website at https://ir.enovix.com as soon as reasonably practicable after we electronically file or furnish such information with the SEC. We may also use our investor relations website to announce important business and financial information to investors, including webcasts, podcasts, and press releases. In addition, we use various social media channels, such as X, LinkedIn, YouTube, Instagram and Facebook as a means of communicating with investors, and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor these channels, in addition to following our SEC filings, webcasts, press releases and blogs published on our website. The information posted on our website and through various social media channels is not incorporated by reference into this Annual Report on Form 10-K or in any other filings we make with the SEC.

Item 1A. Risk Factors

RISK FACTORS

Investing in our securities involves a high degree of risk. Before you make a decision to buy our securities, you should carefully consider the risks and uncertainties described below together with all of the other information contained in this Annual Report on Form 10-K, including our financial statements and related notes and in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” If any of the events or developments described below were to occur, our business, prospects, operating results and financial condition could suffer materially, the trading price of our securities could decline and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

You should not interpret our disclosure of any of the following risks to imply that such risks have not already materialized.

Risks Related to Our Manufacturing and Scale-Up

We will need to improve our energy density, cycle life, fast charging, capacity roll off and gassing metrics in order to stay ahead of competition over time, which is difficult, and we may not be able to do.

Our roadmap to improve our energy density, cycle life, fast charging, capacity roll off and gassing metrics requires us to implement higher energy density materials for both cathodes and anodes, and electrolyte and separator materials. To successfully use these materials, we will have to optimize our cell designs including, but not limited to formulations, thicknesses, geometries, materials, chemistries and manufacturing tolerances and techniques. It could take us longer than we anticipate to incorporate these new materials, or we might not be able to achieve certain cell performance specifications required by customers. Further, we will need to make improvements in our technology to achieve our energy density, cycle life, fast charge, capacity roll off and gassing metrics improvement roadmap. These improvements may not be possible, or could take longer, or be more difficult than forecasted. If we are unable to improve our packaging technology, this could reduce the performance of our products and delay the availability of products to customers, which would negatively impact our competitive potential.

We rely on a new and complex manufacturing process for our operations, and achieving volume production involves a significant degree of risk and uncertainty in terms of operational performance such as yield and costs.

Although we have developed our lithium-ion battery technology, we rely heavily on a new and complex manufacturing process for the production of our lithium-ion battery cells, which is not currently operating at scale. To meet our projected future demand, we need to increase our manufacturing throughput and yield metrics. We expect that meeting our goals to improve throughput and yield will be a multi-quarter or potentially longer endeavor. We have in the past, and may in the future, experience delays in meeting these goals. We have more than one solution to improve manufacturing throughput and yield metrics, and it is uncertain which solution will be optimized for commercial scale. We use numerous vendors for subcomponents of the battery; changes in materials or vendor selection, or the failure of our solutions to improve yield, could negatively impact our ability to meet our throughput and yield metric goals.

The work required to develop these manufacturing processes and integrate equipment into the production of our lithium-ion battery cells, including achieving our goals for throughput and yield, is time intensive and requires us to work closely with numerous equipment and tooling providers to ensure that the equipment works properly for our unique battery technology. The integration of new equipment into our production process involves a significant degree of uncertainty and risk, and we have not in the past and may not in the future be able to achieve our goals for throughput and yield. Further, the integration work may result in the delay in the scaling up of production or result in additional costs to our battery cells, particularly if we encounter issues with performance or if we are unable to customize products for certain of our customers. We expect that certain customers may require several months or longer to complete technology qualification before accepting a product that is manufactured at high volume on the Gen2 lines, if at all. In addition, even if we are able to achieve volume production for the existing uses of our batteries, we may face challenges relating to the scaling up of production for new uses of our batteries, including in the EV market.

Our large-scale Gen2 manufacturing lines require large-scale machinery. We need one or more tooling vendors to produce custom products for our customers. Such machinery or tooling equipment has in the past suffered, and may in the future suffer, unexpected malfunctions from time to time and will require repairs and spare parts to resume operations, which may not be available when needed. Our tooling vendors may be new to the battery space or to producing silicon batteries and it may take longer to qualify and effectively utilize such tooling to make custom batteries. Further, our tooling may not be adequate for the various products our customers may demand and we may have to procure new or additional tooling to make products suitable for the market.

In addition, unexpected malfunctions of our production equipment have in the past significantly affected, and may in the future significantly affect, the intended operational efficiency. Qualified labor is needed to remedy any such equipment malfunction, which may not be readily available. Because this equipment has not previously been used to build lithium-ion battery cells, the operational performance and costs associated with the maintenance and repair of this equipment can be difficult to predict and may be influenced by factors outside of our control, such as, but not limited to, (i) failures by suppliers to deliver necessary components of our products in a timely manner and at prices and volumes acceptable to us, (ii) environmental hazards and remediation, (iii) difficulty or delays in obtaining governmental permits, (iv) damages or defects in systems, (v) cybersecurity intrusion and related disruptions; and (vi) industrial accidents, fires, seismic activity and other natural disasters. Further, we have in the past experienced power outages at our facilities, and may again in the future. If outages are more frequent or longer in duration than expected, it could impact our ability to manufacture batteries in a timely manner. If our production equipment does not achieve the projected levels of its output or our production equipment becomes obsolete, it may be necessary to record an impairment charge to reduce the carrying value of our machinery and equipment, which would adversely affect our results of operations and financial condition.

Even if we are able to successfully complete development of and modify, as necessary, this new and complex manufacturing process, we may not be able to produce our lithium-ion batteries in commercial volumes in a cost-effective manner.

If we cannot successfully scale our manufacturing facilities to produce our lithium-ion battery cell in sufficient quantities to meet expected demand, improve productivity and bring additional facilities online, we may be unable to achieve our profitability targets and our business will be negatively impacted and could fail.

In May 2024, we initiated a restructuring plan to relocate our Fab1 manufacturing operations in Fremont, California to Malaysia and to accelerate manufacturing operations at Fab2 in Malaysia. In 2024 we completed site acceptance testing (“SAT”) and began production of batteries on our Agility line, and completed factory acceptance testing (“FAT”), and SAT, for our High-Volume Manufacturing (“HVM”) line in Malaysia. However, our profitability targets rely on our ability to aggressively reduce the capital costs of our production lines and implement productivity improvements. If such efficiency gains are unsuccessful, we may be unable to achieve our target margin and profitability goals. We expect that

our current manufacturing lines will be sufficient to produce batteries in commercial scale, but not in high enough volumes to meet our expected customer demand. Therefore, we anticipate bringing additional facilities online at Fab2 and further refining our approach to improve yields over time. To the extent we continue to experience challenges with improving yields, we may have difficulty accepting additional customers due to capacity constraints, which could delay our growth. If we are unable to successfully build and manage such additional manufacturing lines, or otherwise further refine our approach to improve yields, our business will be negatively impacted and could fail.

Even if we overcome the manufacturing challenges and achieve volume production of our lithium-ion battery, if the cost, performance characteristics or other specifications of the battery fall short of our or our customers’ expectations and targets, our sales, product pricing and margins would likely be adversely affected. Our long-term target economics at scale assume we are able to obtain certain pricing levels for our batteries. If these assumptions are incorrect and/or customer demand is lower than expected, we may fail to achieve our target revenue and profitability goals.

We rely on a manufacturing agreement with a Malaysia-based company for some of the facilities, procurement, and personnel needs of our operations. Changes to our relationship with such third-party contract manufacturer, expected or unexpected, may result in delays or disruptions that could harm our business.

In July 2023, we entered into a 10-year manufacturing agreement (as amended, the “YBS Agreement”) with YBS International Berhad (“YBS”), a Malaysia-based investment holding company with operational segments including electronic manufacturing and assembly, high-precision engineering, precision machining and stamping, among others. If we are able to overcome the challenges in designing and refining our manufacturing process, YBS will have multiple lines to produce commercial volumes of our lithium-ion batteries to meet our expected customer demands.

On October 29, 2024, we entered into an amendment to the YBS Agreement, which modified certain payment terms and responsibilities of the parties. Pricing under the YBS Agreement is set on a cost-plus basis and we are subject to a minimum purchase commitment, which was mutually agreed to be reduced by the parties. Regardless of the level of manufacturing services YBS provides to us under the Agreement, we are obligated to pay a certain threshold amount each month during the term of the YBS Agreement. The ten-year term of the YBS Agreement expires in July 2033, subject to customary termination provisions.

Our manufacturing arrangement with YBS creates risks due to our reliance on YBS for certain aspects of our manufacturing facility operations, including procurement and personnel. Further, manufacturing in Malaysia is subject to possible disruptions due to power outages, equipment malfunction and failures, and supply chain disruptions relating to raw materials or components, among others. Our manufacturing operations may also be adversely affected by natural disasters and climate change. Other events, including political or public health crises, may affect our production capabilities or that of our suppliers, including lack of supplies. As a result, in addition to disruptions to operations, our insurance premiums may increase, or we may not be able to fully recover any sustained losses through insurance. If this manufacturing arrangement does not perform as expected, it may materially and adversely affect our results of operations, financial condition and prospects.

In addition, the YBS Agreement exposes us to risks because it limits our control and oversight over the management of manufacturing processes, capacity constraints, delivery timetables, product quality assurance and costs. If we fail to effectively manage our relationship with YBS; if YBS is unable to meet our manufacturing requirements in a timely manner; or if we experience delays, disruptions or quality control problems, it may materially and adversely affect our business, prospects, financial condition and results of operations.

Our operations in international markets, including our manufacturing operations, expose us to operational, financial and regulatory risks, as well as risks relating to geopolitical tensions and conflicts, including changes to trade policies and regulations.

In 2023 we acquired Routejade, a battery manufacturer in South Korea, and established a research and development center in Hyderabad, India, which supports the product and manufacturing teams in our other locations. In the second half of 2024, we relocated all manufacturing activities to Malaysia and established a subsidiary in Shenzhen, China. Following the shift of our manufacturing facilities to Malaysia and a reduction in force that primarily affected our U.S. operations, a higher percentage of our employees and a significant portion of our business operations are located overseas, while our leadership team is primarily located in the U.S. Additionally, relationships with customers and potential customers outside of the U.S. accounted for a significant portion of our revenues during 2024.

While we are continuing to adapt to and develop strategies to address international markets and to manage our international activities and geographically diverse workforce, there is no guarantee that such efforts will have the desired

effect. We have in the past and may continue to experience operational challenges associated with global business operations and a globally dispersed workforce, such as coordinating activities across multiple time zones and cultures and maintaining consistent operations standards across diverse locations. In addition, effective collaboration between R&D and manufacturing teams located overseas, and other parts of the organization, may be hindered by distance, language and cultural differences, which may have a negative impact on product innovation.

We expect that our international activities will continue to grow for the foreseeable future as we continue to pursue opportunities in existing and new international markets, which will require significant dedication of management attention and financial resources.

As a result of having significant international operations, including our manufacturing operations, we are subject to a number of risks, including:

• burdens of complying with a wide variety of laws and regulations;

• unexpected changes in regulatory requirements;

• exposure to political or economic instability and general economic fluctuations in the countries we operate;

• changes in currency exchange rates;

• changes in diplomatic and trade relationships;

• trade restrictions;

• terrorist activities, natural disasters, epidemics, pandemics and other outbreaks, including the regional or local impacts of any such activity;

• political, economic and social instability, war or armed conflict;

• differing employment practices and laws and labor disruptions, including strikes and other work stoppages, strains on the available labor pool, labor unrest, changes in labor costs and other employment dynamics;

• the imposition of government controls;

• lesser degrees of intellectual property protection;

• tariffs and customs duties, or other barriers to some international markets, and the classifications of our goods by applicable governmental bodies; and

• a legal system subject to undue influence or corruption.

Given our international operations, we face heightened risks relating to trade policies and disputes that could result in increased tariffs, trade barriers, and other trade restrictions and protectionist measures, If the United States or other countries impose tariffs or other trade barriers, trade restrictions and protectionist measures, the costs of our products could increase, and the demand for our products could decrease. Further, tariffs, trade restrictions and other protectionist measures could restrict our ability to source components or raw materials. The current geopolitical climate has created uncertainty regarding and fluctuations in trade policies, and our operations and business are subject to these uncertainties given the extent of our international operations and dependencies on international supply chains and access to international employees.