competitive advantages. We face potential competition from many different sources, including major pharmaceutical, specialty pharmaceutical and biotechnology companies, academic institutions, governmental agencies, and public and private research institutions. Any product candidates that we successfully develop and commercialize may compete with existing therapies and new therapies that may become available in the future.

Many of the companies which we are competing against, or which we may compete against in the future, have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals, and marketing approved products than we do. In addition, we face a constantly changing competitive landscape because of numerous mergers and acquisitions in the pharmaceutical and biotechnology industry, which will concentrate resources among a smaller number of large pharmaceutical companies. Smaller or early stage companies may also prove to be significant competitors, particularly through collaborative arrangements and co-development deals with large and established companies. These competitors also compete with us in establishing clinical trial sites and patient registration for clinical trials necessary to advance the clinical development of our product candidates.

Although our novel approach is unique from most other existing or investigational therapies across the disease areas where we are focusing our development, we will need to compete with currently approved therapies, and potentially those currently in development if they are approved. We are aware of several marketed and investigational products in our leading disease areas, including but not limited to:

We compete in the segments of the pharmaceutical, biotechnology, and other related markets that develop cancer therapies. There are many other companies that have commercialized or are developing cancer therapies, including large pharmaceutical and biotechnology companies, such as AstraZeneca/MedImmune, Bristol Myers Squibb, Merck, Novartis, Pfizer, and Roche/Genentech. We face significant competition from pharmaceutical and biotechnology companies that target specific tumor-associated antigens using immune cells or other cytotoxic modalities. These generally include immune cell redirecting therapeutics (e.g., T cell engagers), adoptive cellular therapies (e.g., CAR-Ts), antibody drug conjugates, targeted radiopharmaceuticals, targeted immunotoxin, and targeted cancer vaccines.

As we expand to other indications, we will focus on the treatment of fibrotic diseases, including idiopathic pulmonary fibrosis (“IPF”) and NASH. There are currently two (2) approved products for the treatment of IPF; Esbriet, marketed by Roche Holding AG (“Roche”) and Ofev, marketed by Boehringer Ingelheim GmbH. Companies currently developing product candidates in IPF include AbbVie, Galapagos, Indalo, Kadmon Holdings, Inc., Galecto Biotech, Inc., Roche, Liminal BioSciences. Inc., and Pliant Therapeutics. There are currently no FDA approved therapies for the treatment of NASH. There are a number of companies developing product candidates for the treatment of NASH including Intercept, Pfizer Inc., Gilead, Allergan, Novartis, AstraZeneca plc, Eli Lilly & Company, GlaxoSmithKline plc, Amgen, Inc., BMS, Johnson & Johnson, Merck & Co., Inc., Roche, Sanofi S.A., Takeda Pharmaceuticals, Novo Nordisk, Genfit SA, Madrigal Pharmaceuticals, Inc., Viking Therapeutics, Inc., Cirius Therapeutics, Inc., NGM Biopharmaceuticals, Akero Therapeutics, Inc., and Metacrine, Inc. Most of the drugs currently in development for NASH are focused on decreasing liver fat or improving liver inflammation as opposed to direct liver anti-fibrotic approaches.

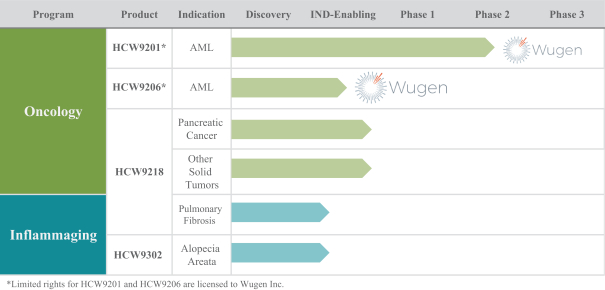

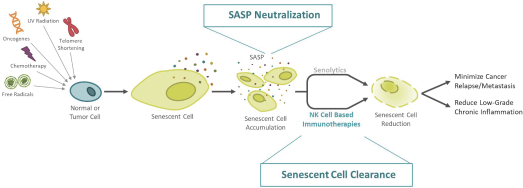

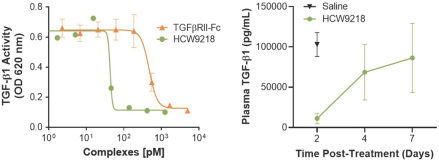

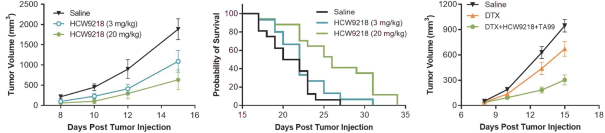

With respect to our lead internally-developed product candidate, HCW9218, we are not aware of any other competing clinical-stage companies with a first-in-class immunotherapeutic that utilizes multiple mechanisms of action, including the cytokine-based activation of immune cells and neutralization of TGF-ß immunosuppression.

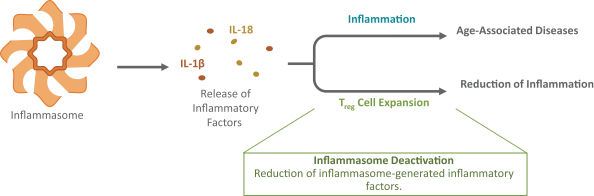

We are aware of several other companies developing programs that utilize IL-2 for the selective expansion of Treg cells, including Amgen Inc., Nektar Therapeutics (in partnership with Eli Lilly & Company), Roche, and Celgene Corporation (“Celgene”). We are also aware of other companies with research or preclinical-stage programs in this area, including Synthorx, Inc., Moderna, Inc., and Xencor, Inc. We are also aware of other companies with PD-1 agonist programs for the treatment of autoimmune diseases, including AnaptysBio, Inc., Celgene, and Eli Lilly & Company.

116