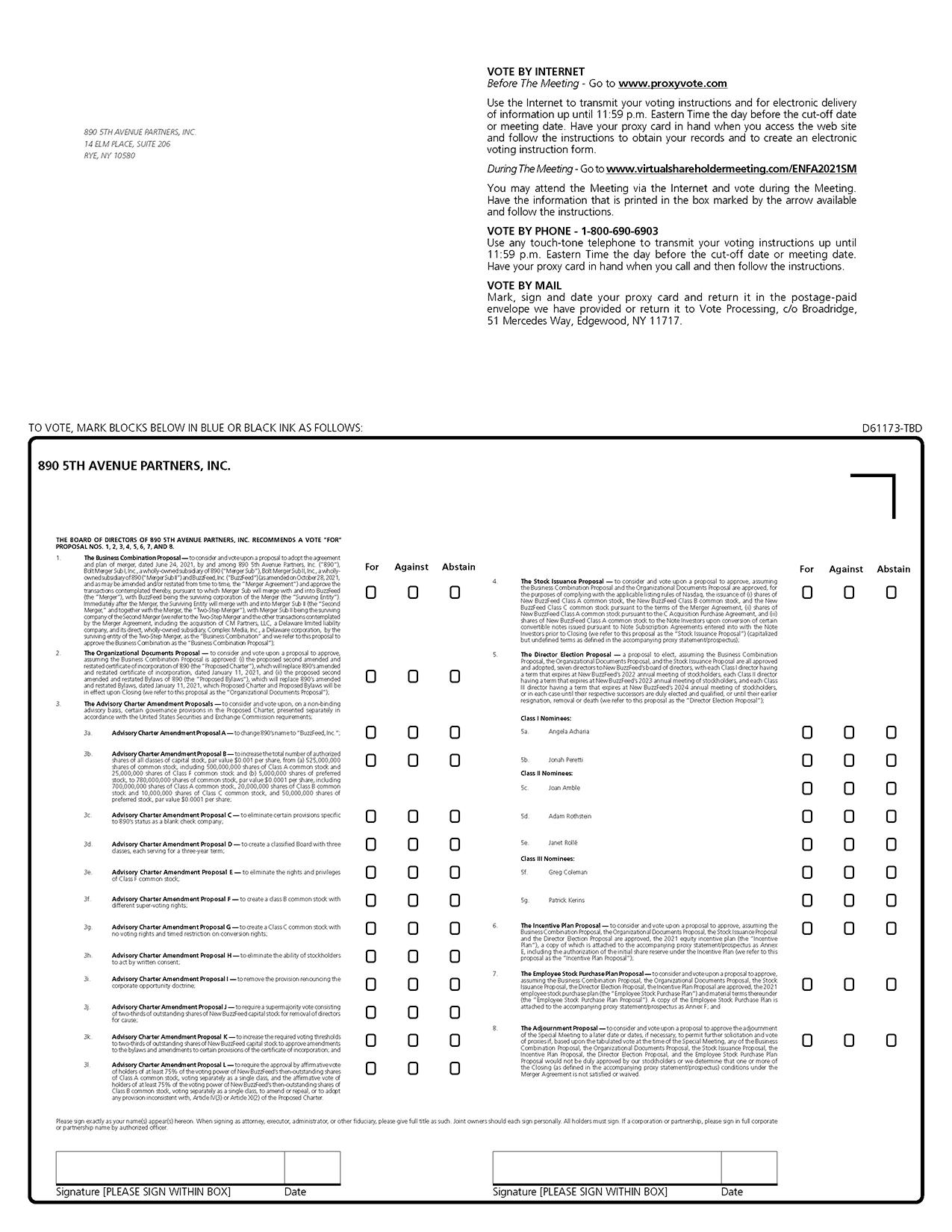

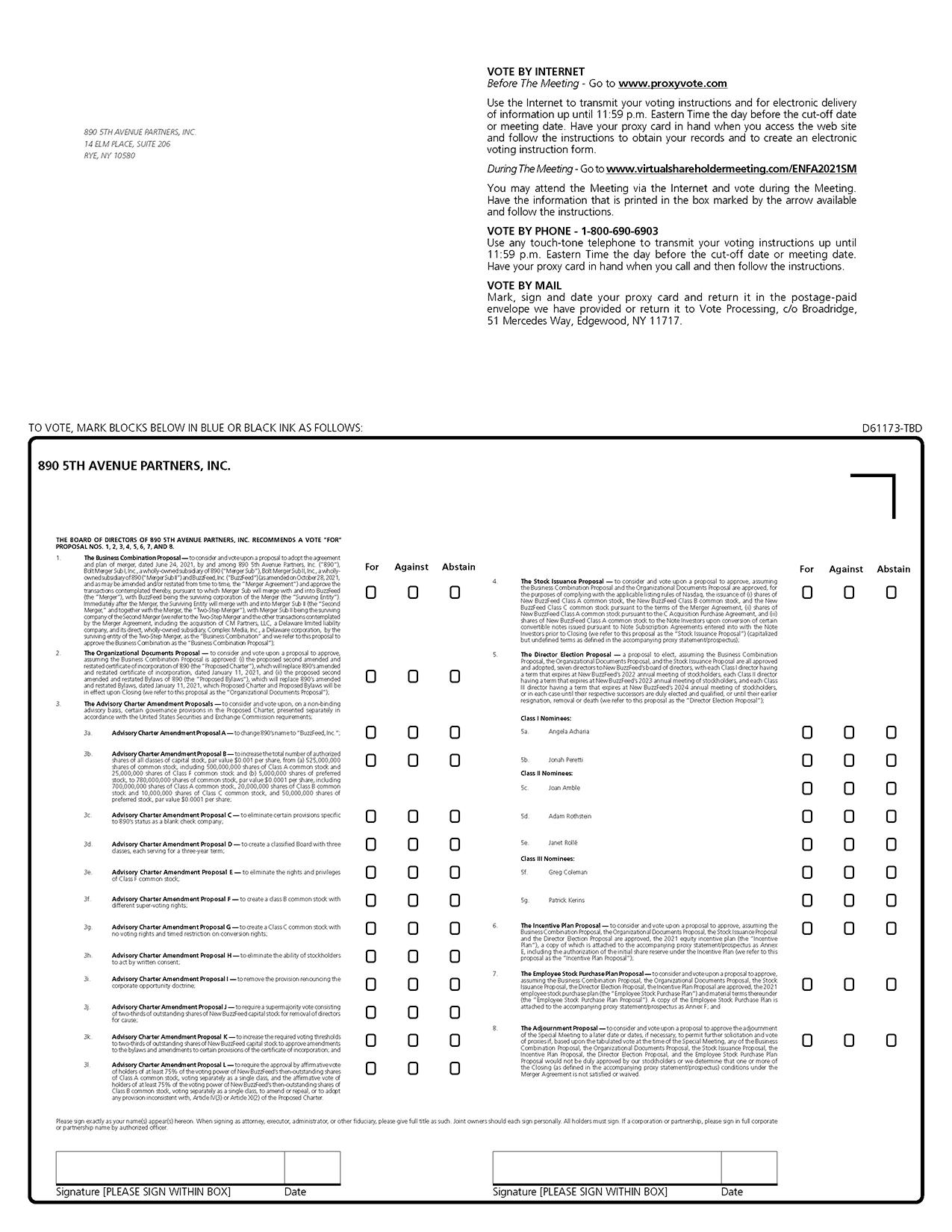

| VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/ENFA2021SM You may attend the Meeting via the Internet and vote during the Meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. 890 5TH AVENUE PARTNERS, INC. 14 ELM PLACE, SUITE 206 RYE, NY 10580 TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: D61173-TBD 890 5TH AVENUE PARTNERS, INC. THE BOARD OF DIRECTORS OF 890 5TH AVENUE PARTNERS, INC. RECOMMENDS A VOTE “FOR” PROPOSAL NOS. 1, 2, 3, 4, 5, 6, 7, AND 8. 1. The Business Combination Proposal — to consider and vote upon a proposal to adopt the agreement and plan of merger, dated June 24, 2021, by and among 890 5th Avenue Partners, Inc. (“890”), Bolt Merger Sub I, Inc., a wholly-owned subsidiary of 890 (“Merger Sub”), Bolt Merger Sub II, Inc., a wholly-owned subsidiary of 890 (“Merger Sub II”) and BuzzFeed, Inc. (“BuzzFeed”) (as amended on October 28, 2021, and as may be amended and/or restated from time to time, the “Merger Agreement”) and approve the transactions contemplated thereby, pursuant to which Merger Sub will merge with and into BuzzFeed (the “Merger”), with BuzzFeed being the surviving corporation of the Merger (the “Surviving Entity”). Immediately after the Merger, the Surviving Entity will merge with and into Merger Sub II (the “Second Merger,” and together with the Merger, the “Two-Step Merger”), with Merger Sub II being the surviving company of the Second Merger (we refer to the Two-Step Merger and the other transactions contemplated by the Merger Agreement, including the acquisition of CM Partners, LLC, a Delaware limited liability company, and its direct, wholly-owned subsidiary, Complex Media, Inc., a Delaware corporation, by the surviving entity of the Two-Step Merger, as the “Business Combination” and we refer to this proposal to approve the Business Combination as the “Business Combination Proposal”); The Organizational Documents Proposal — to consider and vote upon a proposal to approve, assuming the Business Combination Proposal is approved: (i) the proposed second amended and restated certificate of incorporation of 890 (the “Proposed Charter”), which will replace 890’s amended and restated certificate of incorporation, dated January 11, 2021, and (ii) the proposed second amended and restated Bylaws of 890 (the “Proposed Bylaws”), which will replace 890’s amended and restated Bylaws, dated January 11, 2021, which Proposed Charter and Proposed Bylaws will be in effect upon Closing (we refer to this proposal as the “Organizational Documents Proposal”); The Advisory Charter Amendment Proposals — to consider and vote upon, on a non-binding advisory basis, certain governance provisions in the Proposed Charter, presented separately in accordance with the United States Securities and Exchange Commission requirements; For Against Abstain For ! Against ! Abstain ! 4. The Stock Issuance Proposal — to consider and vote upon a proposal to approve, assuming the Business Combination Proposal and the Organizational Documents Proposal are approved, for the purposes of complying with the applicable listing rules of Nasdaq, the issuance of (i) shares of New BuzzFeed Class A common stock, the New BuzzFeed Class B common stock, and the New BuzzFeed Class C common stock pursuant to the terms of the Merger Agreement, (ii) shares of New BuzzFeed Class A common stock pursuant to the C Acquisition Purchase Agreement, and (iii) shares of New BuzzFeed Class A common stock to the Note Investors upon conversion of certain convertible notes issued pursuant to Note Subscription Agreements entered into with the Note Investors prior to Closing (we refer to this proposal as the “Stock Issuance Proposal”) (capitalized but undefined terms as defined in the accompanying proxy statement/prospectus); ! ! ! 2. 5. The Director Election Proposal — a proposal to elect, assuming the Business Combination Proposal, the Organizational Documents Proposal, and the Stock Issuance Proposal are all approved and adopted, seven directors to New BuzzFeed’s board of directors, with each Class I director having a term that expires at New BuzzFeed’s 2022 annual meeting of stockholders, each Class II director having a term that expires at New BuzzFeed’s 2023 annual meeting of stockholders, and each Class III director having a term that expires at New BuzzFeed’s 2024 annual meeting of stockholders, or in each case until their respective successors are duly elected and qualified, or until their earlier resignation, removal or death (we refer to this proposal as the “Director Election Proposal”); ! ! ! 3. Class I Nominees: ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! 3a. Advisory Charter Amendment Proposal A — to change 890’s name to “BuzzFeed, Inc.”; 5a. Angela Acharia 3b. Advisory Charter Amendment Proposal B — to increase the total number of authorized shares of all classes of capital stock, par value $0.001 per share, from (a) 525,000,000 shares of common stock, including 500,000,000 shares of Class A common stock and 25,000,000 shares of Class F common stock and (b) 5,000,000 shares of preferred stock, to 780,000,000 shares of common stock, par value $0.0001 per share, including 700,000,000 shares of Class A common stock, 20,000,000 shares of Class B common stock and 10,000,000 shares of Class C common stock, and 50,000,000 shares of preferred stock, par value $0.0001 per share; 5b. Jonah Peretti Class II Nominees: 5c. Joan Amble ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! 3c. Advisory Charter Amendment Proposal C — to eliminate certain provisions specific to 890’s status as a blank check company; 5d. Adam Rothstein 5e. Janet Rollé 3d. Advisory Charter Amendment Proposal D — to create a classified Board with three classes, each serving for a three-year term; Class III Nominees: 3e. Advisory Charter Amendment Proposal E — to eliminate the rights and privileges of Class F common stock; 5f. Greg Coleman 3f. Advisory Charter Amendment Proposal F — to create a class B common stock with different super-voting rights; 5g. Patrick Kerins 6. The Incentive Plan Proposal — to consider and vote upon a proposal to approve, assuming the Business Combination Proposal, the Organizational Documents Proposal, the Stock Issuance Proposal and the Director Election Proposal are approved, the 2021 equity incentive plan (the “Incentive Plan”), a copy of which is attached to the accompanying proxy statement/prospectus as Annex E, including the authorization of the initial share reserve under the Incentive Plan (we refer to this proposal as the “Incentive Plan Proposal”); 3g. Advisory Charter Amendment Proposal G — to create a Class C common stock with no voting rights and timed restriction on conversion rights; 3h. Advisory Charter Amendment Proposal H — to eliminate the ability of stockholders to act by written consent; 7. The Employee Stock Purchase Plan Proposal — to consider and vote upon a proposal to approve, assuming the Business Combination Proposal, the Organizational Documents Proposal, the Stock Issuance Proposal, the Director Election Proposal, the Incentive Plan Proposal are approved, the 2021 employee stock purchase plan (the “Employee Stock Purchase Plan”) and material terms thereunder (the “Employee Stock Purchase Plan Proposal”). A copy of the Employee Stock Purchase Plan is attached to the accompanying proxy statement/prospectus as Annex F; and ! ! ! 3i. Advisory Charter Amendment Proposal I — to remove the provision renouncing the corporate opportunity doctrine; 3j. Advisory Charter Amendment Proposal J — to require a supermajority vote consisting of two-thirds of outstanding shares of New BuzzFeed capital stock for removal of directors for cause; 8. The Adjournment Proposal — to consider and vote upon a proposal to approve the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, any of the Business Combination Proposal, the Organizational Documents Proposal, the Stock Issuance Proposal, the Incentive Plan Proposal, the Director Election Proposal, and the Employee Stock Purchase Plan Proposal would not be duly approved by our stockholders or we determine that one or more of the Closing (as defined in the accompanying proxy statement/prospectus) conditions under the Merger Agreement is not satisfied or waived. ! ! ! 3k. Advisory Charter Amendment Proposal K — to increase the required voting thresholds to two-thirds of outstanding shares of New BuzzFeed capital stock to approve amendments to the bylaws and amendments to certain provisions of the certificate of incorporation; and 3l. Advisory Charter Amendment Proposal L — to require the approval by affirmative vote of holders of at least 75% of the voting power of New BuzzFeed’s then-outstanding shares of Class A common stock, voting separately as a single class, and the affirmative vote of holders of at least 75% of the voting power of New BuzzFeed’s then-outstanding shares of Class B common stock, voting separately as a single class, to amend or repeal, or to adopt any provision inconsistent with, Article IV(3) or Article XI(2) of the Proposed Charter. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature [PLEASE SIGN WITHIN BOX] Date

|