Filed Pursuant to Rule 424(b)(3)

Registration No. 333-256633

PROSPECTUS

152,276,690 Common Shares

This prospectus relates to the offer and sale from time to time by the selling securityholders or their permitted transferees (collectively, the “selling securityholders”) of up to 152,276,690 common shares in the capital of The Lion Electric Company. This prospectus also covers any additional securities that may become issuable by reason of share splits, share dividends or other similar transactions.

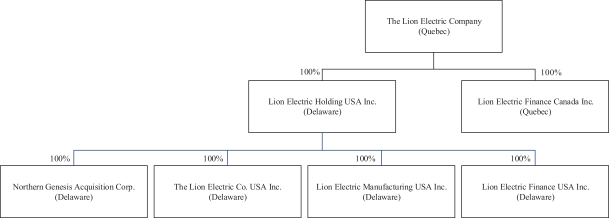

The shares covered by this prospectus include (i) 132,867,990 common shares held, or issuable upon exercise of the Specified Customer Warrant (as defined herein), by certain selling securityholders that were securityholders of The Lion Electric Company, a corporation existing under the Business Corporations Act (Québec) (“Lion”), prior to the closing of the business combination (the “Business Combination”) between Lion, Lion Electric Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of Lion, and Northern Genesis Acquisition Corp., a Delaware corporation and (ii) 19,408,700 common shares issued to certain securityholders in connection with the closing of a private placement offering at a price per share of $10.00, for gross proceeds of approximately $200,402,000, which closed concurrently with the Business Combination on May 6, 2021.

Lion is registering the offer and sale of the securities described above to satisfy certain registration rights they have granted. Lion is registering these securities for resale by the selling securityholders named in this prospectus, or their transferees, pledgees, donees or assignees or other successors-in-interest that receive any of the shares as a gift, distribution, or other non-sale related transfer. The selling securityholders may offer all or part of the securities for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. These securities are being registered to permit the selling securityholders to sell securities from time to time, in amounts, at prices and on terms determined at the time of offering. The selling securityholders may sell these securities through ordinary brokerage transactions, directly to market makers of Lion’s shares or through any other means described in the section titled “Plan of Distribution”. In connection with any sales of common shares offered hereunder, the selling securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”).

All of the common shares offered by the selling securityholders pursuant to this prospectus will be sold by the selling securityholders for their respective accounts. Lion will not receive any of the proceeds from such sales.

Lion will pay certain expenses associated with the registration of the securities covered by this prospectus, as described in the section titled “Plan of Distribution”.

Lion’s common shares are listed on the New York Stock Exchange (“NYSE”) and the Toronto Stock Exchange (“TSX”) under the symbol “LEV”. On April 7, 2022, the last reported sale price of Lion’s common shares as reported on the NYSE was $7.75 per share.

Lion may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

Lion is a “foreign private issuer” under applicable Securities and Exchange Commission rules and an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012 and, as such, is subject to reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of material risks of investing in our securities in “Risk Factors” beginning on page 5 of this prospectus and under “Risk Factors” under Item 3.D – “Risk Factors” in our most recent Annual Report on Form 20-F incorporated by reference in this prospectus.

Neither the Securities and Exchange Commission nor any state securities or Canadian securities regulator has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated April 8, 2022