The Duckhorn Portfolio, Inc. and subsidiaries

Notes to consolidated financial statements

1. Description of business

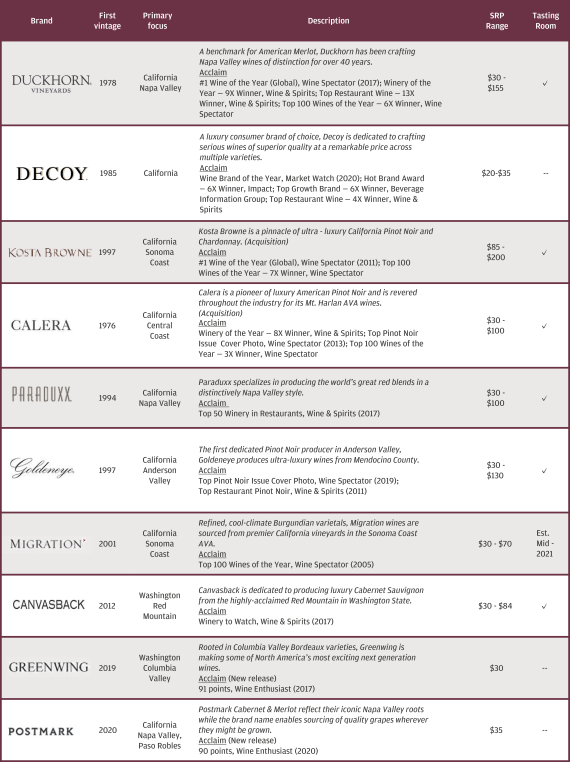

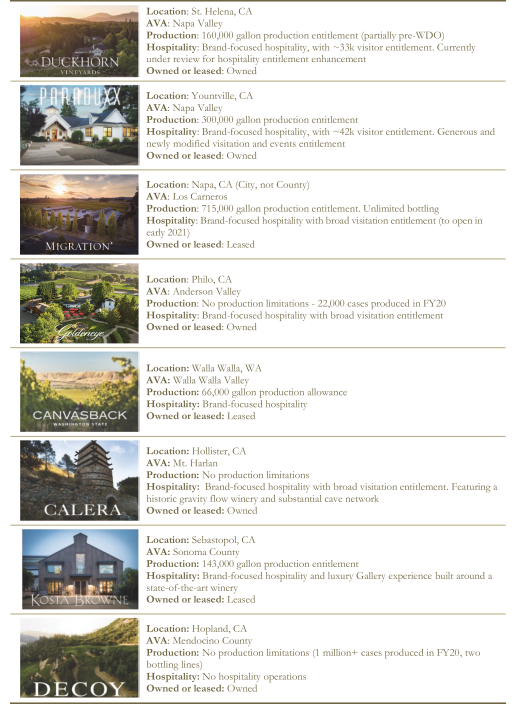

The Duckhorn Portfolio, Inc. (formerly known as Mallard Intermediate, Inc. until its legal name change on February 23, 2021), a Delaware Corporation headquarted in St. Helena, CA, produces luxury and ultra-luxury wine across a portfolio of winery brands, including Duckhorn Vineyards, Paraduxx, Goldeneye, Migration, Decoy, Canvasback, Calera, Kosta Browne, Greenwing and Postmark.

Unless the context indicates otherwise, references to the “Company” or “Management” refer to The Duckhorn Portfolio, Inc. and its subsidiaries, which include Mallard Buyer Corp., Heritage Wine, LLC, Duckhorn Wine Company, Inc., Canvasback Wine LLC, Waterfowl Wine LLC, Heritage Vineyard LLC, KB Wines Corporation, Selway Wine Company and Domaine M.B., LLC, which wholly owns Chenoweth Graham LLC, an entity holding a majority interest in Bootlegger’s Hill, LLC (“Bootlegger’s”).

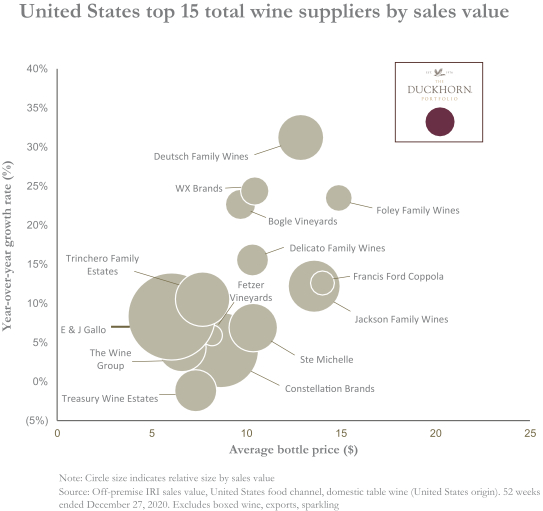

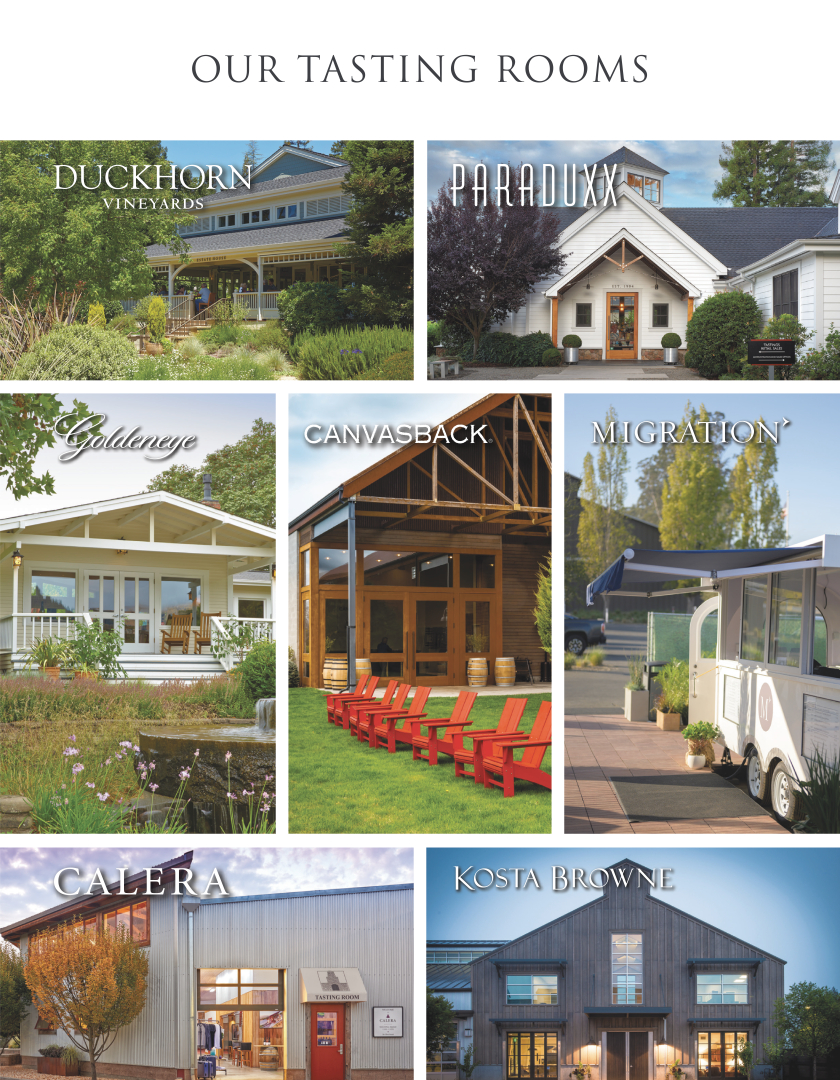

The Company’s revenue is comprised of wholesale and direct to consumer (“DTC”) sales. Wholesale revenue is generated through sales directly to California retailers and restaurants, sales to distributors and agents located in other states throughout the United States (“U.S.”) and sales to export distributors that sell internationally. DTC revenue results from individual consumers purchasing wine directly from the Company through club membership, the Company’s website or tasting rooms located in Napa Valley, California; Anderson Valley, California; Sebastopol, California; Hollister, California; and Walla Walla, Washington.

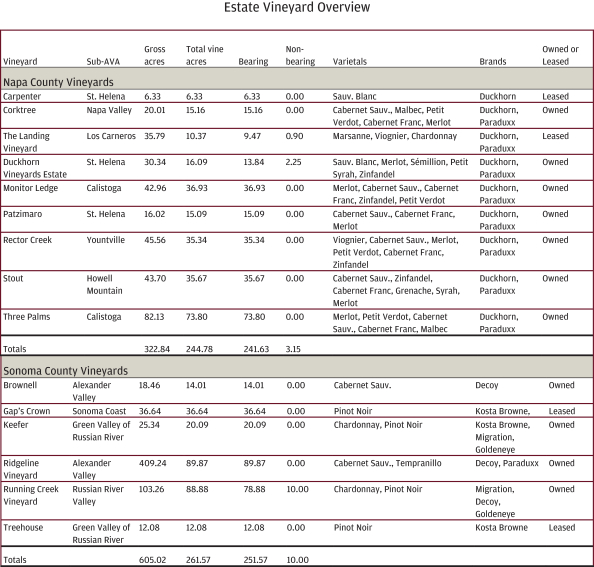

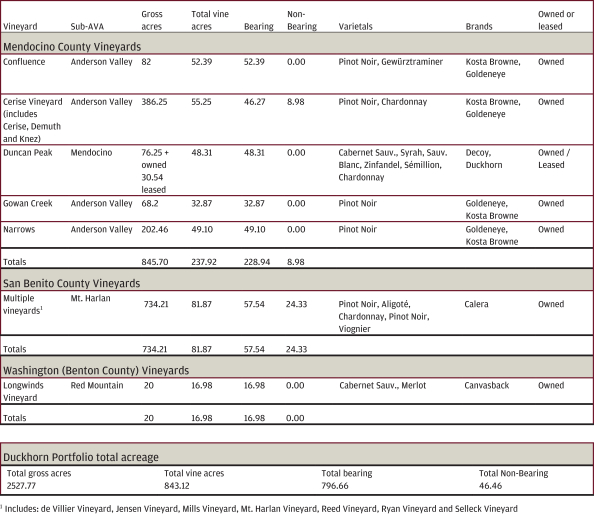

The Company owns or controls through long-term leases certain high-quality vineyards throughout Northern and Central California and Washington. Vinification takes place at wineries owned, leased or under contract with third parties in Napa Valley, California; Anderson Valley, California; Hopland, California; Hollister, California; Sebastopol, California; and Walla Walla, Washington.

2. Basis of presentation and significant accounting policies

Basis of presentation

The Company’s consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Principles of consolidation

The consolidated financial statements include the accounts of The Duckhorn Portfolio, Inc. and its subsidiaries, including a consolidated variable interest entity (“VIE”) of which the Company has determined it is the primary beneficiary.

The Company evaluates its ownership structure, contractual relationships and other interests in entities to determine the nature and extent of the interests, whether such interests are variable interests and whether the entities are VIEs in accordance with Accounting Standards Codification (“ASC”) ASC 810, Consolidations. Based on these evaluations, if the Company determines that it is the primary beneficiary of a VIE, the entity is consolidated into the financial statements.

All intercompany balances and transactions are eliminated in consolidation.

Functional currency

The Company and all subsidiary legal entities are domiciled in the U.S. The functional and reporting currency of the Company and its subsidiaries is the U.S. dollar.

F-7