The information in this prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission, of which this prospectus is a part, is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 20, 2022

PROSPECTUS

Up to $150,000,000 of American Depositary Shares

Representing Ordinary Shares

Connect Biopharma Holdings Limited

Connect Biopharma Holdings Limited, a holding company incorporated in the Cayman Islands in November 2015 (“Connect,” the “Company,” the “Group,” “we,” “us,” “our,” “our company” and “Connect Biopharma”) has entered into a sales agreement (the “Sales Agreement”), with SVB Securities LLC (“SVB Leerink”) and Cantor Fitzgerald & Co. (“Cantor”), dated April 15, 2022, relating to the American Depositary Shares (“ADSs”) offered by this prospectus. Each ADS represents one of our ordinary shares, par value $0.000174 per share (“Ordinary Shares”). Under this prospectus, we may offer and sell ADSs having an aggregate offering price of up to $150.0 million from time to time through SVB Leerink and Cantor (the “Sales Agents”), acting as our agents, in accordance with the Sales Agreement.

Sales of the ADSs, if any, under this prospectus may be made by any method permitted that is deemed an “at the market” offering as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended (the “Securities Act”), including sales made directly on or through the Nasdaq Global Market (“Nasdaq”), on or through any other existing trading market for our Ordinary Shares or ADSs or to or through a market maker. If expressly authorized by us, the Sales Agents may also sell the ADSs in privately negotiated transactions. The Sales Agents are not required to sell any specific number or dollar amount of securities but will act as our sales agents using commercially reasonable efforts consistent with their normal trading and sales practices and applicable state and federal laws, rules and regulations and the rules of the Nasdaq, on mutually agreed terms between the Sales Agents and us. There are no minimum sale requirements, and there is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The compensation payable to the Sales Agents for sales of ADSs sold pursuant to the Sales Agreement will be an amount up to 3.0% of the gross proceeds of any ADSs sold under the Sales Agreement. See “Plan of Distribution” beginning on page S-47 for additional information regarding the compensation to be paid to the Sales Agents. In connection with the sale of the ADSs on our behalf, each Sales Agent will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation paid to the Sales Agents will be deemed to be underwriting compensation. We have also agreed in the Sales Agreement to provide indemnification and contribution to the Sales Agents with respect to certain liabilities, including liabilities under the Securities Act or the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The ADSs are listed on the Nasdaq under the symbol “CNTB.” On May 19, 2022, the last reported sale price of the ADSs on the Nasdaq was $0.88 per ADS.

Our principal executive offices are located at Science and Technology Park, East R&D Building, 3rd Floor, 6 Beijing West Road, Taicang, Jiangsu, the People’s Republic of China 215400, and our telephone number is +86 512 5357 7866. Our registered address in the Cayman Islands is located at the offices of Maples Corporate Services Limited at PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands.

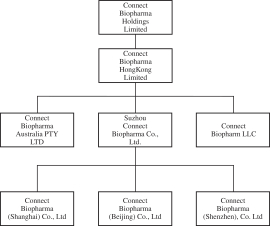

We are not a Chinese operating company but a holding company incorporated in the Cayman Islands. As a holding company with no material operations of our own, we conduct operations primarily through our direct and indirect wholly owned subsidiaries, some of which were established in the People’s Republic of China, or the PRC. The securities offered in this prospectus are securities of our Cayman Islands holding company, not of our operating subsidiaries.

Additionally, we are subject to certain legal and operational risks associated with our subsidiaries’ operations in the PRC. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material negative change in our subsidiaries’ operations, significant depreciation of the value of our ADSs, or a complete hindrance of our ability to offer or continue to offer our securities to investors, which could cause the value of your securities to become worthless. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in the PRC with little advance notice, including cracking down on illegal activities in the securities