This SUBSCRIPTION AGREEMENT (this “

”) is entered into this 19th day of September, 2021, by and among Cartesian Growth Corporation, an exempted company incorporated under the laws of the Cayman Islands (the “

”), and the undersigned (“

” or “

”, and together with the Issuer, the “

”, and each a “

”). Defined terms used but not otherwise defined herein shall have the respective meanings ascribed thereto in the Business Combination Agreement (as defined below).

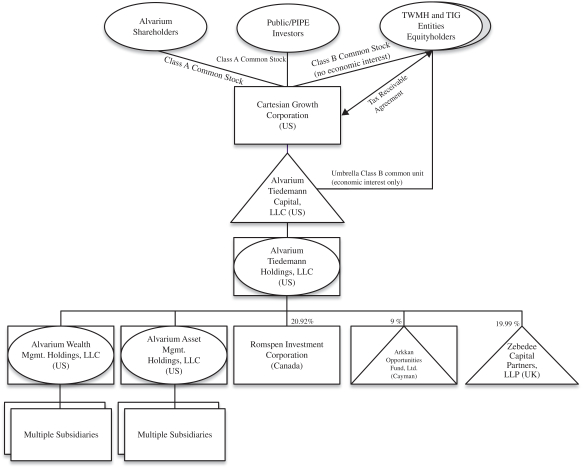

WHEREAS, the Issuer, Rook MS LLC, a Delaware limited liability company (“

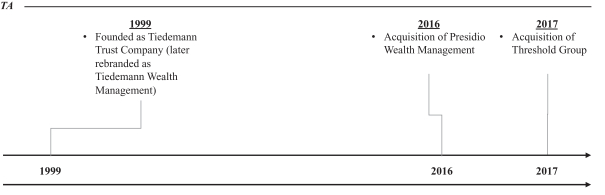

”), Tiedemann Wealth Management Holdings, LLC, a Delaware limited liability company (“

”), TIG Trinity GP, LLC, a Delaware limited liability company (“

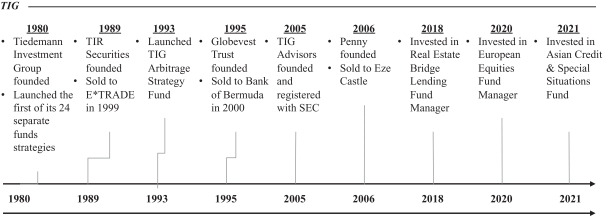

”), TIG Trinity Management, LLC, a Delaware limited liability company (“

” and, together with TIG GP, the “

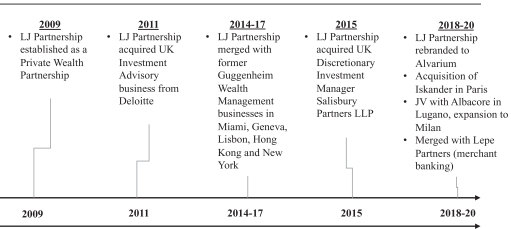

”), Alvarium Investments Limited, an English private limited company (“

” and, together with TWMH and the TIG Entities, the “

” and each a “

”), and Alvarium Tiedemann Capital, LLC, a Delaware limited liability company (“

”), are, concurrently with the execution of this Subscription Agreement, entering into that certain Business Combination Agreement, dated as of the date hereof (as amended, modified, supplemented or waived from time to time in accordance with its terms, the “

Business Combination Agreement

”), pursuant to which, among other things, (i) prior to the Closing (as defined in the Business Combination Agreement), TWMH and the TIG Entities shall take, or cause to be taken, all actions necessary to implement the TWMH/TIG Entities Reorganization such that, upon completion of the TWMH/TIG Entities Reorganization, TWMH and the TIG Entities shall be wholly owned subsidiaries of Umbrella and Umbrella shall be owned solely by the TWMH Members, the TIG GP Members and the TIG MGMT Members; (ii) prior to the Closing, Alvarium will take, or cause to be taken, all actions necessary to implement the Alvarium Reorganization such that, upon completion of the Alvarium Reorganization, Alvarium will be the wholly owned indirect subsidiary of Alvarium Topco, a newly formed Isle of Man entity, and Alvarium Topco will be owned solely by the Alvarium Shareholders, (iii) on the Business Day prior to the Closing Date, the Issuer will domesticate as a corporation formed under the laws of the State of Delaware and deregister as an exempted company incorporated under the laws of the Cayman Islands (the “

”) and each Class A Ordinary Share (as defined below) outstanding (including the Subscribed Shares (as defined below)) shall be converted into the right to receive one share of Class A common stock of the Issuer, par value $0.0001 per share (the “

”); (iv) at the Closing, following the completion of the TWMH/TIG Entities Reorganization, the Alvarium Reorganization and the Domestication, (a) TIG MGMT will distribute to Umbrella all of the issued and outstanding shares and partnership interests that TIG MGMT holds in its Affiliated Managers, (b) TIG GP will distribute to Umbrella all of the issued and outstanding equity interests that TIG GP holds in its Affiliated Manager; (c) each Alvarium Shareholder will exchange his, her or its (x) Alvarium Ordinary Shares and (y) Alvarium Class A Shares for Class A Shares (the “

”) and upon the consummation of the Alvarium Exchange, Alvarium Topco will become a direct wholly-owned subsidiary of the Issuer; (d) immediately following the effective time of the Alvarium Exchange, Umbrella Merger Sub will merge with and into Umbrella, with Umbrella surviving such merger as a direct subsidiary of the Issuer (the “

”); and (e) following the Alvarium Exchange and the Umbrella Merger, the Issuer will contribute all of the issued and outstanding shares of Alvarium that it holds to Umbrella (the “

”) and upon the consummation of the Alvarium Contribution, Alvarium Topco will become a wholly-owned subsidiary of Umbrella; and (v) and following the Closing, Alvarium Topco will be liquidated and Alvarium Holdings LLC (to be renamed Alvarium Tiedemann Holdings, LLC) will become the wholly owned direct subsidiary of Umbrella (collectively, the “

”);

WHEREAS, certain other “qualified institutional buyers” (as defined in Rule 144A under the Securities Act of 1933, as amended (the “

”)) or “accredited investors” (within the meaning of Rule 501(a) under the Securities Act) (each, an “

”) have, severally and not jointly, entered into separate subscription agreements with the Issuer (the “

Other Subscription Agreements

”), pursuant to which such investors have agreed to purchase Shares on the Closing Date at the same per share purchase price as the Subscriber, and the aggregate amount of securities to be sold by the Issuer pursuant to this Subscription Agreement and the Other Subscription Agreements equals, as of the date hereof, 11,734,675 Shares.