The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| | |

PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION, DATED APRIL 29, 2022 |

$60,000,000

Bellevue Life Sciences Acquisition Corp.

6,000,000 Units

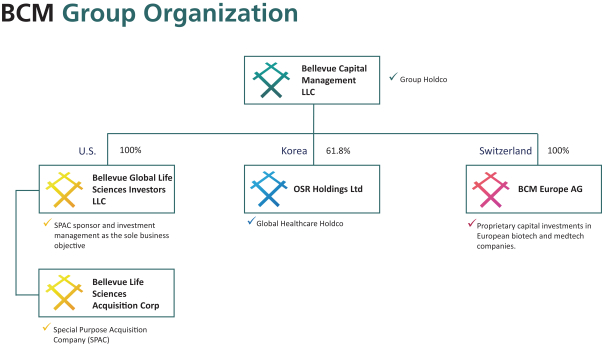

Bellevue Life Sciences Acquisition Corp., which we refer to as “we,” “us” or “our company” is a newly organized blank check company incorporated in Delaware and formed for the purpose of entering into a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or similar business combination with one or more businesses or entities, which we refer to throughout this prospectus as our “initial business combination.” We have not pre-selected any specific business combination target and we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any business combination target. Although we are not limited to a particular industry or geographic region for purposes of consummating an initial business combination, we intend to focus our search on companies in the healthcare industry.

This is an initial public offering of our securities. We are offering 6,000,000 units at an offering price of $10.00 per unit. Each unit consists of one share of our common stock, par value $0.0001, and one warrant. Each warrant entitles the holder thereof to purchase one share of common stock at a price of $11.50 per share, subject to adjustment as described in the prospectus. Each warrant will become exercisable 30 days after the consummation of an initial business combination, and will expire five years after the completion of an initial business combination, or earlier upon redemption or liquidation.

We have granted Chardan Capital Markets, LLC, the representative of the underwriters, a 45-day option to purchase up to an additional 900,000 units (over and above the 6,000,000 units referred to above) solely to cover over-allotments, if any.

We will provide the holders of our outstanding shares of common stock that were sold as part of the units in this offering with the opportunity to redeem their shares of common stock upon the consummation of our initial business combination at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account described below, including interest (net of taxes payable) divided by the number of then outstanding shares of common stock that were sold as part of the units in this offering, which we refer to as our “public shares”.

We have 12 months to consummate our initial business combination or such later time as may be approved by a majority of our stockholders voting on such extension. If we do not consummate our initial business combination within the above time period, we will distribute the aggregate amount then on deposit in the trust account, pro rata to our public stockholders, by way of the redemption of their shares and thereafter cease all operations except for the purposes of winding up of our affairs, as further described herein. In such event, the warrants will expire and be worthless.

Our sponsor, Bellevue Global Life Sciences Investors LLC, has agreed to purchase an aggregate of 390,000 placement units at a price of $10.00 per unit, which we refer to herein as “placement units,” for an aggregate purchase price of $3,900,000. Each placement unit will be identical to the units sold in this offering, except as described in the prospectus. The placement units will be sold in a private placement that will close simultaneously with the closing of this offering.

Our sponsor holds 1,437,500 shares, which we refer to herein as “founder shares” acquired from us for an aggregate purchase price of $25,000. On April 25, 2022, we executed a stock split, resulting in an aggregate of 1,725,000 founder shares held by our sponsor. The founder shares include an aggregate of up to 225,000 shares that are subject to forfeiture to the extent that the underwriters’ over-allotment option is not exercised in full or in part. If we increase or decrease the size of this offering, we will effect a share capitalization or share repurchase or redemption or other appropriate mechanism, as applicable, with respect to the founder shares immediately prior to the consummation of the offering in such amount as to maintain the ownership of our initial stockholders at 20% of our issued and outstanding common stock upon the consummation of this offering (excluding the placement shares).

There is presently no public market for our units, common stock or warrants. We intend to apply to have our units listed on the Nasdaq Global Market, or Nasdaq, under the symbol “BLACU” on or promptly after the date of this prospectus. We cannot guarantee that our securities will be approved for listing on Nasdaq. Once the securities comprising the units begin separate trading as described in this prospectus, the shares of common stock and warrants will be traded on Nasdaq under the symbols “BLAC” and “BLACW,” respectively. We cannot assure you that our securities will continue to be listed on Nasdaq after this offering.

We are an “emerging growth company” and a “smaller reporting company” under applicable federal securities laws and will therefore be subject to reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 27 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.