UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 2, 2022

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-40605

Membership Collective Group Inc.

(Exact name of Registrant as specified in its Charter)

| |

Delaware | 86-3664553 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

180 Strand London, WC2R 1EA United Kingdom | WC2R 1EA |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +44 (0) 207 8512 300

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock, par value $0.01 per share | | MCG | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| | | |

Non-accelerated filer | | ☒ | | Smaller reporting company | | ☐ |

| | | | | | |

Emerging growth company | | ☒ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ No ☒

The aggregate market value of the common stock held by non-affiliates of the registrant, based on the closing price of the shares of Class A Common Stock on July 15, 2021 as reported by the New York Stock Exchange on such date was approximately $644,049,382. The registrant has elected to use July 15,2021, which was the date of its initial listing of Class A Common Stock, as the calculation date because on July 2, 2021 (the last business day of the registrant’s most recently completed second fiscal quarter), the registrant was a privately held company. Shares of the registrant’s common stock held by each executive officer and director and by each other person who may be deemed to be an affiliate of the registrant have been excluded from this computation. This calculation does not reflect a determination that certain persons are affiliates of the registrant for any other purpose. The number of shares of Registrant’s Class A Common Stock outstanding as of March 15, 2022 was 61,536,720.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's definitive Proxy Statement for the Registrant's 2022 Annual Meeting of Stockholders are incorporated by reference into Part III of this report. The Registrant expects to file such proxy statements within 120 days after the end of its fiscal year.

Table of Contents

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are based on our beliefs and assumptions and on information currently available to us. Forward-looking statements include information concerning our possible or assumed future results of operations and expenses, business strategies and plans, trends, market sizing, competitive position, industry environment, potential growth opportunities and product capabilities, among other things. Forward-looking statements include all statements that are not historical facts and, in some cases, can be identified by terms such as “aim,” “anticipates,” “believes,” “could,” “estimates,” “expects,” “goal,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “should,” “strive,” “will,” “would,” or similar expressions and the negatives of those terms.

As used in this report, any reference to ‘Membership Collective Group,’ ‘MCG,’ ‘our company,’ ‘the company,’ ‘us,’ ‘we’ and ‘our’ refers to: (i) if prior to the exchange of equity interests by equity holders in Soho House Holdings Limited for shares of Class A Common Stock or Class B Common Stock (as applicable) in Membership Collective Group Inc. as described in this report, to Soho House Holdings Limited and its consolidated subsidiaries, and (ii) if following such exchange, to Membership Collective Group Inc., together with its consolidated subsidiaries.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including those described in “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this report. Given these uncertainties, you should not place undue reliance on these forward-looking statements. The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

•the COVID-19 pandemic, including the outbreak of new or different variants thereof, or the future outbreak of any other highly infectious or contagious diseases, has caused, and will continue to cause, disruption to our business, liquidity, financial condition and results of operation. Further, the spread of the COVID-19 outbreak has caused severe disruptions in the global economy and financial markets and could continue to create business continuity issues of an unpredictable magnitude and duration;

•we have incurred net losses in each year since our inception, and we may not be able to achieve profitability;

•our planned growth could put strains on our senior management, employees, information systems and internal controls which may adversely impact our business, financial condition and operations;

•our success depends on the strength of our name, image and brands, and if the value of our name, image or brands diminishes, our business, financial condition and operations would be adversely affected;

•our intellectual property rights are valuable, and any failure to obtain, maintain, protect, defend and enforce our intellectual property, including due to ‘brand squatting,’ could have a negative impact on the value of our brand names and adversely affect our business, financial condition and operations;

•we depend on our senior management for the future success of our business, and the loss of one or more of our key personnel could have an adverse effect on our ability to manage our business, financial conditions and operations and implement our growth strategies;

•changes in consumer discretionary spending and general economic factors may adversely affect our business, financial condition and results of operation including but not limited to increased global inflationary pressures;

•increased use of social media could create and/or amplify the effects of negative publicity and have a material adverse effect on our business, financial condition or results of operation;

•we identified material weaknesses in connection with our internal controls over financial reporting. Although we are taking steps to remediate these material weaknesses, there is no assurance we will be successful in doing so in a timely manner, or at all, and we may identify other material weaknesses;

•our future performance depends in part on our ability to respond to changes in consumer tastes, preferences and perceptions;

•difficult conditions in the global financial markets and the economy generally could affect our ability to obtain capital or financing and materially adversely affect our business, financial condition and results of operation;

•our continued growth depends on our ability to expand our presence in new and existing markets and develop complementary properties, concepts and product lines;

2

•foreign currency fluctuations may reduce our net income and our capital levels, adversely affecting our business, financial condition and results of operation;

•Yucaipa, through its participation in the Voting Group, has significant influence over us, including control over decisions that require the approval of stockholders;

•we have substantial debt, and we may incur additional indebtedness, which may negatively affect our business and financial results as well as limit our ability to pursue our growth strategy;

•restrictions imposed by our outstanding indebtedness and any future indebtedness may limit our ability to operate our business and to finance our future operations or capital needs or to engage in other business activities;

•the use of joint ventures or other entities, over which we may not have full control, for development projects or acquisitions could prevent us from achieving our objectives;

•a cybersecurity attack, ‘data breach’ or other security incident experienced by us or our third-party service providers may result in negative publicity, claims, investigations and litigation and adversely affect our business, results of operation and financial condition;

•if we fail to properly maintain the confidentiality and integrity of our data, including member and other customer credit or debit card and bank account information and other personally identifiable information ("PII"), or if we fail to comply with applicable laws, rules, regulations, industry standards and contractual obligations relating to data privacy, protection and security, it may adversely affect our reputation, business, financial condition and operations;

•we could face costs, liabilities and risks associated with, or arising out of, environmental, health and safety laws and regulations;

•litigation concerning food quality, health and safety, employee conduct and other issues could require us to incur additional liabilities or cause customers to avoid our businesses;

•anticipated changes in effective tax rates or adverse outcomes resulting from our exposure to various tax regimes in the countries in which we operate; and

•the other factors discussed under “Risk Factors” in this annual report.

PART I

Item 1. Business.

As used in this annual report, unless the context otherwise indicates, any reference to ‘Membership Collective Group,’ ‘MCG,’ ‘our company,’ ‘the company,’ ‘us,’ ‘we’ and ‘our’ refers (i) prior to the exchange of equity interests by equity holders in Soho House Holdings Limited for shares of Class A Common Stock or Class B Common Stock (as applicable) in Membership Collective Group Inc. to Soho House Holdings Limited and its consolidated subsidiaries and (ii) following such exchange, to Membership Collective Group Inc., the issuer of the Class A Common Stock being referred hereby, together with its consolidated subsidiaries.

OUR BUSINESS

The Membership Collective Group (“MCG”) is a global membership platform of physical and digital spaces that connects a vibrant, diverse group of members from across the world. These members use the MCG platform to both work and socialize, to connect, create, have fun and drive a positive change.

We began with the opening of the first Soho House in London's Soho district in 1995 and remain the only company to have scaled a private membership platform with a global presence. Over the last 26 years, we have significantly expanded our membership expertise and diversified our offerings—both physically and digitally. As of January 2, 2022, we have over 155,800 members (including over 122,800 Soho House members) who engage with MCG through our global portfolio of 33 Soho Houses, 9 Soho Works, Scorpios Beach Club in Mykonos, Soho Home, The Ned in London, in addition to our digital channels. The LINE and Saguaro hotels in North America, which we operate under a hotel management contract, also form part of MCG’s wider portfolio.

The central pillar of MCG is Soho House, which drives the majority of our membership and revenue today. Since the opening of our first House in London in 1995, we have successfully identified the demand for a premium membership offering that caters to a progressive, creative and diverse global audience. Today, we believe our membership offering, consistently high standards of service, and our global footprint remain unparalleled. A Soho House membership offers access to a network of distinctive and carefully curated Houses, across North America, the United Kingdom, Europe and Asia, which serve as the cornerstone of our member

3

experience. We enhance our member experience through our digital channels, including the SH.APP and our website. Our vision for the SH.APP has always been for it to be like having a House in your pocket. It’s our destination for members to make bookings and payments, to connect with each other and access engaging video content and podcasts — made for our members, by our members. Annually, we host thousands of physical and digital member events worldwide, spanning film, fashion, art, food and drink, well-being, work and music—and help our members forge connections with each other to bring them closer together.

Our membership expertise, honed through the growth of Soho House, has led to our evolution into the Membership Collective Group, a home to numerous memberships including Cities Without Houses, Soho Works, Soho Friends, Soho House Digital, SOHO HOME+ and Ned’s Club. By designing, curating and growing our membership offering, our membership platform can respond to shifting lifestyle trends and the evolution of our members’ needs. Our memberships work together, allowing us to reach new audiences with a set of interconnected offerings.

Everything we do across these memberships begins and ends with our members. The foundation of our member experience has been crafted over our 26-year history and is built on the following pillars:

•Membership: We are in the business of forging connections and bringing people together. Our diverse global membership is the soul of our company. It is the people that define our culture and shape the experience – in turn attracting new members.

•Physical and digital spaces: We create and operate interconnected spaces. Each of our physical locations is designed to reflect our members and the local community that they serve. Our digital platforms extend our connection with members beyond our physical spaces, in turn significantly enhancing the member experience.

•Design: Our design DNA is instantly recognizable across all of our membership models, whether in our Houses, Soho Works, The Ned, Scorpios Beach Club or Soho Home. While each House is unique, they each have a consistency in their architectural and interior style that has come to define the Soho House experience. In each new House or site that we develop for our other brands, this style is interpreted for local tastes and preferences, reflecting the culture of the respective city.

•Services, products and experiences: Our member-obsessed culture drives us to relentlessly improve the quality of the services, products and experiences we offer to our members. We do not cut corners or compromise on quality, taking the long-term view that there is no substitute for the highest quality services, products and experiences when it comes to fostering loyalty from our members.

•Innovation: We have always strived to adapt and evolve by anticipating our members’ needs and wants. Innovation has always been part of our culture and approach, and we have used that mindset to create new memberships to serve a wider audience of people who desire personal connection via new channels.

•House Foundations: We are committed to integrating the pillars of our social responsibility and sustainability program, House Foundations, into everything we do.

Our membership has remained resilient through multiple economic cycles and the COVID-19 pandemic. When our physical sites were forced to close as a result of the COVID-19 pandemic, there was minimal impact on the retention of Soho House members. The power of our model is driven by the important role we believe that we play in our members’ lives and the value we consistently provide them for their membership fees. We believe our retention compares very favorably to leading consumer subscriptions or memberships—across music, media, fitness, entertainment and commerce—despite, in many cases, their significantly lower price points.

The demand for our membership is also demonstrated by our large and growing global wait list, which as of January 2, 2022 stands at over 70,000 applicants. Awareness of our distinct membership offerings and their scarcity is spread by our members organically through word of mouth, social media and press coverage.

There are multiple consumer forces at play that have increased the relevance of our memberships. We have observed a secular shift in the ways that people live and work—with less time spent in traditional corporate offices and more time in social spaces that encourage creativity and mutual engagement. We believe that these trends will only accelerate, and that the freedom to be able to choose where to live and work—particularly in light of the COVID-19 pandemic—will likely have a significant impact on our target market. We believe this will create an even greater demand for curated communities that can grow and thrive in a more deliberate environment.

Membership revenues are comprised of annual membership fees and one-time initial registration fees paid by members. In-House revenues include all revenues realized within our Houses, including food and beverage, accommodation, and spa products and treatments. Other revenues include all revenues not realized within our Houses, including Scorpios, Soho Works and standalone restaurants, design and procurement fees from Soho House Design and Soho Home among others. We view Membership revenues and In-House revenues as interrelated, insofar as although there is no minimum spend for any member on our In-House offerings that

4

generate In-House revenues. In practice the significant majority of In-House revenues are generated by our members, and the pricing of our In-House offerings reflects that accordingly, with pricing of such In-House offerings being identical for both members and non-members.

OUR ASSET LIGHT STRATEGY

Historically we have made significant investments in the development of our Houses, either in purchasing an ownership position and/or making material investment in the build out of the property alongside our landlords. Beginning several years ago, with the growing reputation of Soho House as a marquee tenant, we began making a conscious shift to an asset light development model to conserve and drive improved return on our capital. Under this model, our landlord agrees to fund a substantial portion, or all, of the development costs of a House, to our design specifications, leaving us to fund only pre-opening expenses (and art and other unique interior design elements). Virtually all of the Houses that we plan to open over the next three years reflect this asset-light model.

While our investment in our full-size Houses has historically approached, or in certain cases exceeded, $10 million, under our asset-light model we expect our contribution to open new Houses, comprised primarily of pre-opening expenses and art, will fall in the $3 million to $6 million range. Despite a modest increase in average rents from this strategy, we believe the considerably reduced capital investment will result in meaningfully improved cash-on-cash returns and capital efficiency.

A new Soho House membership incurs virtually no membership acquisition cost, since we do not conduct any paid marketing. Driven by consistently high retention and minimal costs associated with retaining or supporting our members, Soho House enjoys a very attractive member lifetime value. We believe new memberships will also provide compelling economics and be accretive to our profit, as they can be created and operated in an asset-light manner that leverages the existing platform.

REPORTABLE SEGMENTS

Our operations consist of three reportable segments and one non-reportable segment that we present as “all other”. Each of our segments includes all operations in that region including our Houses and all associated facilities, spas and stand-alone restaurants.

Our three reportable segments and our “other” segment are as follows:

United Kingdom. This segment encompasses operating units in the UK, including:

•Our eleven Soho Houses in and around London;

•Two townhouses encompassing bedrooms and public restaurants, twelve stand-alone restaurants and four Apartments; and

•Soho Friends – UK membership fees.

North America. This segment encompasses operating units in North America, including:

•Our nine US Houses, our Toronto (Canada) House, which is a joint venture entity, and the management fees from Soho Beach House Canouan;

•Four stand-alone US restaurants;

•Soho Friends – US membership fees; and

•The management fees under our hotel management contract for the operation of the LINE and Saguaro Hotels.

Europe and Rest of the World ("ROW"). This segment encompasses operating units in continental Europe and RoW, currently comprised of:

•Nine Houses in Europe including Soho House Barcelona and Little Beach House Barcelona, which are joint venture entities, and Soho House Istanbul which is under a management agreement;

•Soho House Hong Kong and the management fees from Soho House Mumbai;

•Our majority interest in Scorpios Beach Club Mykonos; and

•Soho Friends – Europe membership fees.

All Other. Includes the following:

•Our Soho Home retail offerings;

•Cowshed products and spa services outside of our Soho Houses;

•Our Cities Without Houses membership;

•Our Soho Works clubs; and

5

•Soho House Design which provides the design of our Houses, properties and other units.

OUR MEMBERSHIP PLATFORM

All of our memberships have been built to enrich the lives of their members, as well as expand our membership offering to a broader audience.

Soho House

Soho House remains at the core of our membership platform by creating a foundation upon which additional membership businesses can be built and scaled. While our physical Houses provide our foundation, the people inside them are the soul of Soho House. As a membership founded for the creative industries, we are proud to have championed members who have gone on to shape our cultural landscape as world class writers, artists, performers, directors, founders, designers, and producers – all reflecting the spirit and energy of Soho House.

The membership of each House is assembled by a select committee of influential creatives and innovators that represent the local area in which the membership is founded. Our members actively engage in creating the culture of each House, helping to shape and localize it by participating in member events and contributing to editorial and digital content. We believe this adds to the value of each House, enriching the membership and enhancing the attractiveness of membership to prospective members worldwide. With a US Every House annual membership fee as of February 28, 2022 of approximately $4,000, which provides access to all of our Houses globally, we believe our membership offering provides compelling value to our members that increases as we add new Houses and more members to our global community. Our Houses attract members from every demographic, with members from “Generation Z” (21 years old and younger) and “Millennials”(22- to 37-year-olds) constituting the fastest-growing cohorts. We also believe that the pricing of our In-House offerings represents great value to our members because of the level of quality provided, reinforcing the overall membership experience, rewarding their brand loyalty and creating opportunities for future and recurring revenues.

We created the following additional types of membership under Soho House to reach a broader audience and enhance the experience of our existing members:

In 2017, we introduced a new type of Soho House membership known as Cities Without Houses ("CWH"), which opens up the Soho House membership to people who live in cities where we do not yet have a physical House. This membership allows us to welcome members to our global community in new geographies, generates additional revenues on our existing base of Houses and provides intelligence for future growth, which we have employed to open new Houses in certain locations, including in Austin, Texas (May 2021), Tel Aviv (August 2021), Paris (September 2021) and Rome (October 2021). We had 4,652 CWH members across 44 cities as of January 2, 2022.

•Soho House Digital Membership

The ambition for Soho House has always been to create a truly global membership that brings creative people together, from all over the world. We believe that we will be able to achieve this through the introduction of Soho House Digital Membership—a new, paid digital-only membership that we are now actively working on. Not limited by our physical footprint, Soho House Digital Membership will expand our global reach, allowing us to move further into Asia, Africa and South America, adding fascinating creatives from dynamic cities to our membership.

Soho House Digital Membership will be subject to the same application and approval process as Soho House membership, allowing like-minded individuals to connect, communicate and collaborate with each other, in a purely digital space through the SH.APP. It will make our membership truly diverse, and will enable the best creatives from all over the world to make meaningful connections with each other. In the same way that we’ve grown Cities Without Houses membership, we will use our connections and liaisons on the ground in new cities to build awareness of digital membership, growing it organically through existing creative communities.

By leveraging our digital platforms in this way, and removing the reliance on physical spaces to experience the benefits of our membership, we have created a gateway to previously untapped growth opportunities. We believe this new membership type will be attractive to potential members who are already used to socializing, networking and working digitally. Existing Soho House members will also receive the full functionalities of the Soho House Digital Membership, and therefore, the introduction of the Soho House Digital Membership only serves to improve the richness of their membership experience, making it more valuable – with new opportunities to connect with and consume content from a truly global and diverse membership base.

6

There are a significant number of people who enjoy the Soho House way of living and who have already visited our Houses as guests, stayed in our bedrooms, or visited our public restaurants and spas, but do not currently have a Soho House membership. To respond to this audience, we launched Soho Friends in November 2020 for an annual subscription cost of $130. We offer access to physical spaces, including Soho House bedrooms, and Studio spaces (our new social spaces for Soho Friends and Soho House members) that host curated programs of events and screenings, with additional benefits from our restaurants, spas and online retail brands, although Soho Friends do not have full access to our Houses. As of January 2, 2022, we had 23,453 Soho Friends members. We intend to grow this membership brand in a measured way so that our Soho House members continue to account for the majority of visitors to our Houses and restaurants.

Soho Home

Soho Home was created as a result of requests from our members to recreate the look and feel of the Houses in their own homes. Soho Home is an interiors and lifestyle retail brand that offers handcrafted furniture, lighting, textiles, tableware and accessories through ecommerce. Over the past year, we have transformed Soho Home into a high growth retail business, and in October 2020, we launched SOHO HOME+, which is a subscription-based membership platform with 4,560 members as of January 2, 2022, that offers price discounts, free delivery, and expert design advice plus early access to new collections and seasonal sales for an annual price of $95. We opened two Soho.Home.Studios in 2021, in London and New York. These sites are retail spaces showcasing the latest Soho Home ranges.

Soho Works

First launched in 2015, Soho Works provides its members with the space and resources to work alongside other like-minded individuals and businesses—facilitating connections and providing the tools to flourish. Aimed at existing Soho House and Soho Friends members, Soho Works draws on the same design principles and membership ethos as Soho House, but is a space purposed entirely for work and creative collaboration.

Beginning with one location in London, we have since opened eight additional sites in London, New York and Los Angeles over the last two years and as of January 2, 2022, we had 5,016 members. Soho Works membership rates vary by location and Soho House membership status. For Soho House members, a US Soho Works membership ranges from $100 to $650 per month, depending on membership type.

Scorpios Beach Club

Set in a cove on the southern tip of Mykonos, Scorpios offers a one of a kind beach experience with a well-established globally recognized brand. With a restaurant, terraces and daybeds, and a distinctive wellness offering, Scorpios enriches the lives of its guests who are looking to escape from their daily lives. We believe the Scorpios concept has significant potential to expand into additional locations as a key part of our platform and we expect to open our second site in Tulum, Mexico at the end of 2022.

The Ned

The Ned has created a new space in the heart of the City of London for its members to meet, eat, drink and socialize. The Ned brand seeks to embody a “city within a city” full-service destination, by playing host to multiple restaurants, bedrooms, a range of grooming services, spa, gym and a full service members’ club. The membership offered by The Ned (“Ned’s Club”) is aimed at a broader group of professional people. As of January 2, 2022, Ned’s Club had just over 2,800 members, and intends to expand into additional cities beyond London. We have recently launched Ned Friends – a more accessible membership similar to Soho Friend for frequent visitors and customers of The Ned. We receive management fees under our hotel management contract for the operation of The Ned.

The LINE

On June 22, 2021, we acquired the operating agreements relating to the ‘The LINE’ and ‘Saguaro’ hotels. The hotels that are currently operational are located in Los Angeles, Washington, Austin, Scottsdale and Palm Springs, and among them offer a variety of food and beverage offerings together with approximately 1,470 hotel rooms. A further hotel is under development in San Francisco. We receive management fees under our hotel management contract for the operation of these hotels. We believe the transaction will broaden our geographic reach in North America. Refer to Item 8, Financial Statements and Supplementary Data, Note 3 - Acquisitions for further information.

OUR GROWTH PLAN

We are still in the early stages of our expansion and we believe our track record as well as our core capabilities have positioned us to achieve significant and sustained growth over the coming years through the following initiatives:

7

Open new Soho Houses

Expansion into new areas is exciting for us and our members, and both furthers the reach of and strengthens our brand. Opening Houses in existing cities satisfies unmet demand (as represented by our local wait lists), and leverages our existing infrastructure.

Since January 1, 2018, we have opened 14 new Houses, increasing our total House count to 33 Houses as of January 2, 2022. Our recent development pipeline has extended our global footprint to exciting cities such as Tel Aviv, Paris, Rome and Austin. Additionally, we plan new destination experiential Houses, such as a wellness retreat in Lake Arrowhead and a ranch in Sonoma. We continue to see substantial long-term growth opportunities in the Asia Pacific, Africa and South America regions. We currently anticipate a long-term growth target of five to seven Soho House openings annually over time. Our current pipeline anticipates our Soho House portfolio expanding to 46 Houses by year-end 2023.

Notably, aside from the temporary closure of certain Houses for public health and safety reasons (including the COVID-19 pandemic) or for refurbishment, we have never closed a House at any point in our 26-year history. We have a proven track record of consistently opening successful new sites that achieve member growth targets and generate strong long-term unit economics.

Continue to scale existing memberships

Expand Soho Friends membership

In 2019, there were over one million non-member guests who visited our Houses, many of whom visited frequently. Our intention is to continue to convert these customers into Soho Friends members. We recently introduced our House Guest system to collect data and better understand our customers and visitors, which has created a foundation to scale Soho Friends.

Expand Soho Home and Soho Home+ membership

In fiscal 2021, Soho Home grew its online sales by 61%, benefiting both from a newly designed product range, a reinvigorated website as well as a favorable market backdrop due to more customers shopping online and shopping for homeware. In October 2020 we launched SOHO HOME+, the UK’s first homeware subscription service, and gained over 4,500 members as of January 2, 2022, providing a recurring membership revenue stream. We believe Soho Home has significant potential to continue its strong digital-first growth, followed by the expansion of physical retail spaces. We opened two Soho.Home.Studios in 2021, in London and New York. These sites are retail spaces showcasing the latest Soho Home ranges.

Grow Soho Works

In recent years, we have expanded Soho Works by adding new locations as well as adding new members to the existing locations and developing our Soho Works digital platform. We believe there is a significant opportunity to grow Soho Works in locations that are primarily located next to existing Soho House sites, due to changes in the way that people live and work – with less time spent in traditional corporate offices and more time in social communities.

Open new Scorpios Beach Club Sites

Scorpios will play a critical role in providing a must-visit destination for many of our members, striving for a unique experience with a particular focus on wellness. Scorpios, in Mykonos, currently attracts an affluent, internationally diverse and loyal customer base, which gives us confidence in the appetite for future locations and a future membership brand. We plan to open one new Scorpios Beach Club per year from 2022 onwards with our second site due to open in Tulum, Mexico at the end of 2022.

Expand the Ned

The Ned has identified at least one additional site for opening in New York during 2022, and also plans to open another by the end of 2023. There are plans to continue opening one to two new sites for The Ned annually going forward. The Ned will play a meaningful role in broadening our target audience, who crave an authentic membership experience. We have a management contract for the existing operation of The Ned in London and receive management fees for our operation of The Ned.

Launch and grow new memberships

The digital-only membership will leverage our existing digital platform, which is being developed to include new features that enable meaningful digital exchange. Members with this membership will have an enriched profile, be able to search for other members, be recommended to other members, grow their digital network, and communicate through direct messaging, audio and video. Through proof of concept, we know that members see value in connecting for social, work and practical purposes. We are now building and finessing this membership type and are confident of launching a valuable digital product. Like our current membership types, the digital membership will continue to evolve post launch based on member feedback.

8

Our track record gives us the confidence to successfully scale new memberships globally, while providing us with the insight necessary to understand where to extend the Membership Collective Group Inc. platform. Our know-how of operating physical spaces and complementing that with sophisticated digital offerings, will help further extend our offer. For instance, the digital platform will extend Soho House’s digital assets – in connections, bookings, content and payments – through the SH.APP and our websites – to new memberships, business areas (e.g. wellness) and business acquisitions.

HOUSE FOUNDATIONS

House Foundations is our social responsibility and sustainability program that represent the foundations of our House built on the following pillars:

•Diversity and Inclusion: We are committed to building an inclusive culture and helping to make the creative industries more accessible. We value diversity and want our members and teams to be represented in places where everyone feels at home

•Soho Sustainability: We have a responsibility to play our part in building a more sustainable world. We are in the early stages of an ambitious sustainability program, covering everything from where we source our food to how we build our Houses

•Soho Mentorship: In partnership with Creative Mentor Network, Routes In and Creative Futures Collective, our mentoring program pairs members with young people pursuing creative careers

•Soho Talent: We provide opportunities for creative people to gain funding and support to bring their endeavors to life across art, design, music, film, and food and drink

•Soho Give: A foundation set up to support our chosen charitable initiatives

•Soho Chance: An annual award giving entrepreneurs and creatives the opportunity to work with our teams to launch a new business, concept or design in one of six areas

•Soho Apprenticeship: Apprenticeship programs for people living locally to our Houses was launched in 2021.

SEASONALITY

Our results are not materially subject to seasonality fluctuations as our revenues are typically consistent on a quarterly basis throughout the year.

INTELLECTUAL PROPERTY

Our portfolio of brand offerings, including Soho House, Soho Works, Scorpios, The Ned, Cowshed, Soho House Design, Soho Home and Cecconi’s are very important to us. We rely on trademarks, copyrights, know-how and expertise, registered domain names, license agreements, intellectual property assignment agreements, confidentiality procedures and nondisclosure agreements to establish and protect our intellectual property and proprietary rights. We seek to protect our intellectual property and proprietary rights, including our proprietary technology, know-how and brand, by relying on a combination of federal, state, and common law rights in the US and other jurisdictions, as well as on contractual measures. As of February 28, 2022, we owned approximately 78 registered US trademarks, 18 pending US trademark applications, 502 registered non-US trademarks and 67 pending non-US trademark applications. As of February 28, 2022, we owned approximately 710 US and international registered domain names, including www.sohohouse.com and www.membershipcollectivegroup.com.

Our strategy for opening any operation is to register national trademarks early in the process of expanding into new territories to prevent third parties from trademark squatting and registering their own competing trademarks before us. However, the efforts we take and have taken to protect our intellectual property rights may not be sufficient or effective. For example, brand squatting is an issue for us, particularly in places such as South America and Asia. In China and Australia, the presence of third-party rights holders with ‘Soho’ trademarks has made registering our ‘Soho House’ trademark a challenge. Where there are third-party rights in a particular jurisdiction, we generally assess the risk associated with such rights and take steps to oppose or negotiate with the trademark owner as appropriate, to protect our family of brands from dilution and customer confusion. Additionally, third parties have in the past and may in the future assert claims of infringement, misappropriation and other violations of intellectual property rights against us. Our trademarks have in the past and may in the future be opposed, contested, circumvented or found to be unenforceable, weak or invalid, and we may not be able to prevent third parties from infringing, misappropriating or otherwise violating them. To counter infringement or unauthorized use of our trademarks, we may deem it necessary to file infringement claims, which can be expensive and time consuming. For more information, see “Risk Factors—Risks Related to Our Business—Our intellectual property rights are

9

valuable, and any failure to obtain, maintain, protect, defend and enforce our intellectual property, including due to ‘brand squatting,’ could have a negative impact on the value of our brand names and adversely affect our business.

INFORMATION TECHNOLOGY, DATA PRIVACY AND CYBERSECURITY

We are committed to protecting the security of member data and other personally identifiable information ("PII"). We undertake measures to protect our systems, including the SH.APP, and the member data and other PII that our systems collect, store, share, transmit, disclose and otherwise process. We have developed policies and procedures designed to manage data security risks. We employ technical security defenses, monitor servers and systems, and use technical measures such as data encryption. We also use third parties to assist in our security practices as well as to prevent and detect fraud. We are subject to a number of stringent, complex and evolving federal, state and local data protection, privacy and security laws, rules, regulations, policies, industry standards and other legal obligations in the US and around the world. Any actual or perceived failure by us or our third-party service providers to comply with our posted privacy policies or with any applicable federal, state, local or similar foreign laws, rules, regulations, industry standards, policies, certifications or orders relating to data privacy and security, or any compromise of security, including in connection with the SH.APP, that results in the theft, unauthorized access, acquisition, use, disclosure, or misappropriation of PII or other member data, could result in significant awards, fines, civil and/or criminal penalties or judgments, proceedings or litigation by governmental agencies or customers, including class action privacy litigation in certain jurisdictions and negative publicity and reputational harm, one or all of which could have an adverse effect on our reputation, business, financial condition and results of operations. For more information, see “Risk Factors—Risks Related to our Technology and Data—A cybersecurity attack, ‘data breach’ or other security incident experienced by us or our third-party service providers may result in negative publicity, claims, investigations and litigation and adversely affect our results of operation and financial condition” and “Risk Factors—Risks Related to our Technology and Data—If we fail to properly maintain the confidentiality and integrity of our data, including member and customer credit or debit card and bank account information and other PII, or if we fail to comply with applicable laws, rules, regulations, industry standards and contractual obligations relating to data privacy, protection and security, it may adversely affect our reputation, business and operations.”

We expect to continue to invest in technology capabilities to support, protect and drive our business.

EMPLOYEES AND HUMAN CAPITAL RESOURCES

As of February 28, 2022, Soho House employed 6,353 individuals including in our support offices of whom 667 are based at our support offices in London, New York and Los Angeles.

Labor laws in the United Kingdom and European Union provide minimum standards regarding annual paid and unpaid leave, sick leave, maternity leave and other provisions regarding leave from work, severance pay, pension contributions and other terms of employment. We contribute to pension schemes (or similar type schemes) for our employees in the United Kingdom and European Union.

We are committed to a policy of recruitment, promotion and training on the basis of aptitude and ability. We have dedicated Diversity, Learning, and Inclusion teams across all four of our major regions of the Americas, United Kingdom, Europe, and Asia, and we offer a wide range of training and development programs. Training offered includes customer service and leadership courses to food tasting and cocktail training, first aid at work and health and safety courses. Diversity & Inclusion forms part of all training we conduct, as well as its own learning series designed for Senior Leadership to line staff level. We also operate dedicated Cook House and House Tonic training programs for our chefs and bartenders to ensure that each customer receives consistent food and drink across all of our Houses and restaurants. We are committed to encouraging people development and retention, including by providing sponsorship so that employees can increase know-how and widen their skill bases by attending third-party training and courses. We also operate a group-wide program that rewards employees that go the extra mile.

We have built a robust pledge and commitment to Diversity & Inclusion across all our functions in areas of representation, recruitment, culture, education, community engagement, and accountability. Our mission statement and values set have also been rewritten to support these initiatives. In our pledge we have committed to increasing the BIPOC representation in our leadership, as well as any underrepresented functions like Design and Retail — and we are able to achieve this by extensive outreach to diverse organizations and networks in our recruitment initiatives. We have rolled out a global training series on anti-racism and allyship and we have built an internal diversity steering committee consisting of a mix of employees from all levels across the global business to hold our executives accountable for the delivery of this pledge. Our employee handbook reflects progressive policies regarding Parental Leave, Flexible Working, and Company Sick Pay. We have developed a performance driven culture with feedback platforms that allow for objective evaluations of our staff and development plans for their growth.

10

With a view to building a strong community within our workforce, we have implemented dedicated communication channels for employees, led by Facebook Workplace.

COMPETITION

We believe that we are the only company to have pioneered and scaled a private membership club platform with global presence, and our first-mover advantage has created a significant barrier to entry.

Though we face direct competition from other private members’ clubs that exist in proximity to our own Houses (as well as in numerous segments of the restaurant, hotel, co-working spaces, fitness and beauty care services and products industries), we believe that we do not have a direct competitor given the combination of different sectors in which we operate, combined with our geographical reach. Some membership clubs use a similar model, but we do not believe that they have been able to replicate our reach across the multiple cities, continents, and spaces in which we operate. In our view, there is a high barrier to entry, as to catch up with the size of our platform would take significant time and investment.

We believe that these business sectors are each highly competitive. Primary competitive factors include name recognition, demographic considerations, effectiveness of public relations and brand recognition, level of service, convenience of location, quality of the property, pricing, product or service and range and quality of services and amenities offered.

We also compete with other restaurants, boutique hotels, co-working spaces, beauty care providers and retailers on a local level, as well as on a global level against certain larger chains with properties in the markets in which we operate.

REGULATION

We are subject to numerous foreign, federal, state and local government laws and regulations, including those relating to the preparation and sale of food and beverages, building, zoning and environmental requirements, health and safety and fire codes, data privacy, protection and security and general business license and permit requirements, in the various jurisdictions in which we design, construct, manage, lease and/or own properties. In addition, the retail nature of a portion of our business requires us to comply with laws and regulations concerning product safety and testing, as well as consumer rights. Our ability to develop new Houses and privately commissioned projects and to remodel, refurbish or add to our existing Houses is also dependent on obtaining permits from local authorities.

Regulations concerning the supply and sale of alcoholic beverages require us to apply to relevant local authorities for a license that must be renewed (usually on an annual basis) and which may be revoked or suspended for cause at any time. Applicable alcoholic beverage control regulations and licensing conditions apply to the supply of alcohol across our business, including in relation to the minimum age of patrons and employees, hours of operation, advertising, trade practices, wholesale purchasing, other relationships with alcohol manufacturers, wholesalers and distributors, inventory control and handling, storage and dispensing of alcoholic beverages.

We are also subject to laws governing our relationships with employees, including minimum wage requirements, overtime, working conditions, hiring and firing, non-discrimination for disabilities and other individual characteristics, work permits and benefit offerings. Federal, state and provincial laws and regulations require certain registration, disclosure statements, compliance with specific standards of conduct and other practices with respect to issuance of memberships.

ENVIRONMENTAL, HEALTH AND SAFETY MATTERS

We are committed to providing safe and healthy premises, that are compliant with environmental, health and safety regulations, for our members and other customers to enjoy and our colleagues to work in. Our operations and properties are subject to extensive laws and regulations relating to environmental, health and safety requirements in the UK, the US and every other country and locality in which we operate. We have an internal team of safety professionals who support the business through providing advice and guidance on compliance and best practices, auditing and monitoring site conditions along with compliance with both our safety management system and legislative requirements, and updating our environmental, health and safety management systems in light of new or changes to existing environmental and health and safety laws and regulations.

Since the beginning of 2020, the COVID-19 pandemic has been at the forefront of our minds. Working alongside our operations and people teams, and in collaboration with public health teams globally, the safety team supported the successful re-opening of all our sites in accordance with the relevant local restrictions in force. This included introducing new physical measures to create safe spaces that reduce the risk of transmission (screens, mask wearing, reduced capacities to increase distancing, enhanced ventilation and cleaning regimes and providing hand sanitizer throughout our spaces), training all our colleagues on the new measures to protect

11

themselves and our guests, and creating a robust internal contact tracing system to rapidly identify and isolate any colleagues (or guests) who may have been exposed to a COVID-19 positive individual.

From time to time, our operations or products have resulted in, or may result in, non-compliance with, or liability pursuant to, environmental, health and safety laws or regulations. Historically, the costs of achieving and maintaining compliance with environmental laws and regulations have not been material. However, we cannot assure you that future costs and expenses required for us to comply with any new, or changes to existing, environmental, health and safety laws and regulations or new or discovered environmental conditions will not have a material adverse effect on our business, results of operations and financial condition.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The following table sets forth information regarding our executive officers, their ages and positions as of January 2, 2022:

| | | | |

NAME | | AGE | | POSITION |

Ron Burkle . . . . . . . . . . . . . . . . . . . . | | 69 | | Executive Chairman and Director |

Nick Jones . . . . . . . . . . . . . . . . . . . . . | | 58 | | Chief Executive Officer and Director |

Andrew Carnie . . . . . . . . . . . . . . . . . | | 47 | | President and Director |

Humera Afzal . . . . . . . . . . . . . . . . . . | | 44 | | Chief Financial Officer |

Martin Kuczmarski . . . . . . . . . . . . . . | | 47 | | Chief Operating Officer |

Ron Burkle has been a member of the Soho House Board and the executive chairman since 2012. He founded The Yucaipa Companies in 1986 and is widely recognized as one of the most successful investors in the hospitality, retail, manufacturing and distribution sectors. He is a controlling stockholder of a number of businesses and a trustee of some key philanthropic organizations. We believe Ron is qualified to serve as a member of our Board due to his deep experience in the finance and hospitality industries.

Nick Jones is the founder and chief executive officer of Soho House and has been a member of the Soho House Board since its inception. He opened Cafe Boheme on Old Compton Street in 1992 in London’s Soho, and went on to open the first House, Greek Street, in the space above in 1995. Nick has overseen every step of the growth of Soho House. He was awarded an MBE in the Queen’s 2017 New Year’s Honours List. We believe Nick Jones is qualified to serve as a member of our Board as a long term founder of the business, and due to his deep experience across all areas of the business including his membership and hospitality experience.

Andrew Carnie has served as President of Soho House since September 2020. He previously served as the Chief Commercial Officer of Soho House from June 2019 to September 2020. From November 2013 to April 2019, Andrew worked in various positions at Anthropologie Group, including as President from April 2018 to April 2019. We believe Andrew is qualified to serve as a member of our Board due to his experience in the retail and consumer industries.

Humera Afzal has served as the Chief Financial Officer of Soho House since December 2020. From February 2019 to December 2020, Humera served as the Director of Finance and then the Chief Financial Officer of Backed, a London-based venture capital fund. Prior to her time at Backed, Humera served as the Director of Deals Finance Consulting at PwC from September 2017 to January 2019, and as the Director of Innovations from December 2013 to July 2017.

Martin Kuczmarski currently serves as the Chief Operating Officer of Soho House. Martin joined Soho House in 2008 as general manager of Electric House, and progressed to director of operations for the UK and Europe before assuming his current role in January 2012. Prior to Soho House, Martin was involved in the Concept and Special Projects at Campbell Gray Hotels from March 2005 to December 2007, where he worked on expansion and development of hotels like One Aldwych, London and Carlisle Bay in Antigua. Previously to that he worked at the Ritz in Paris and Four Seasons in Milan.

SOHO HOUSE ADVISORY BOARD

The Soho House Advisory Board was introduced in May 2021 and is designed to report to the Board on how to best support Soho House members around the world.

Consisting of existing members representing the different regions in which Soho House operates, the Advisory Board is responsible for sharing feedback on Soho House’s content and digital platforms, insights on local cultural and societal trends and holding leadership accountable to achieving the goals set out in Soho House’s Diversity & Inclusion Pledge, which launched in 2020.

The Advisory Board meet on a quarterly basis and are global ambassadors for Soho House who represent its values and long-time mission to continue making membership better.

12

AVAILABLE INFORMATION

Our final prospectus dated July 14, 2021 that forms a part of our Registration Statement on Form S-1 (File No. 333-257206), as filed with the SEC pursuant to Rule 424(b) under the Securities Act on July 16, 2021 (“Form S-1”), quarterly reports on Form 10-Q, current reports on Form 8-K and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934, as amended, are available free of charge on or through our website, www.membershipcollectivegroup.com, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (the "SEC"). The SEC’s website, http://www.sec.gov, contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Our web site and the information on it or connected to it are not a part of this Annual Report on Form 10-K.

13

Item 1A. Risk Factors.

Investing in our Class A Common Stock involves a high degree of risk, including the potential loss of all or part of your investment. Before making a decision to invest in our Class A Common Stock, you should carefully read and consider all of the risks and uncertainties described below, as well as other information included in this annual report, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and notes thereto included elsewhere in this annual report. The occurrence of any of the following risks or additional risks and uncertainties that are currently immaterial or unknown could materially and adversely affect our business, financial condition, liquidity, results of operations, cash flows or prospects. This annual report also contains forward-looking statements and estimates that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific factors, including the risks and uncertainties described below. See “Special Note Regarding Forward-Looking Statements and Market Data.”

Risks Related to our Business

The outbreak of COVID-19, including the outbreak of new or different variants thereof, or the future outbreak of any other highly infectious or contagious diseases, has caused, and will continue to cause, disruption to our business, financial condition, liquidity, results of operations, cash flows or prospects. Further, the spread of the COVID-19 outbreak has caused severe disruptions in the global economy and financial markets and may continue to create widespread business continuity issues of an unpredictable magnitude and duration.

The outbreak of COVID-19, including the outbreak of different variants thereof, has severely impacted global economic activity and caused significant volatility and negative pressure in financial markets during the past several years. The global impact of the outbreak has evolved rapidly and many countries, including the United Kingdom (the "UK") and the United States (the "US"), reacted by instituting quarantines, mandating business and school closures, and restricting travel, which along with other factors triggered a period of global economic slowdown.

The COVID-19 pandemic has adversely affected our near-term operating and financial results and will continue to adversely impact our long-term operating and financial results. As a result of the imposition of government-imposed lockdowns in many of the territories in which our properties are located, a majority of our sites have been forced to close or operate under restricted hours and with social distancing regulations in place throughout much of 2020, 2021 and into 2022. As a result of the forced closures and restricted hours, our In-House revenues declined significantly during these periods.

The forced closure of many of our Houses for extended periods of time has also resulted in an increase in attrition among existing members as well as an increase in the number of members freezing their memberships. Whilst our Houses were closed due to the COVID-19 pandemic, each member could request a temporary freeze to their membership on a six, nine- or twelve-month basis during which time the member was not required to pay membership fees but did not have access to the Houses or any of our membership Apps, and did not receive any communications from us. At the end of the freeze period the member either resumes their membership and continues paying membership fees, or their membership is cancelled. As of January 2, 2022, we had over 4,454 Frozen Members. Due to the continued uncertainty of the COVID-19 pandemic, we have seen higher levels of attrition and may continue to see those going forward to the extent it continues to persist, increasing delinquencies in the payment of member dues, or we may encounter difficulties in attracting new members, any of which may materially and adversely affect our business, financial condition, liquidity, results of operation, cash flows or prospects.

In light of the ongoing nature of COVID-19 and the continued uncertainty it has caused around the world, we do not believe it is possible to predict the COVID-19 pandemic’s cumulative and ultimate impact on our future business, results of operation, financial condition and cash flows. The extent of the continued impact of the COVID-19 pandemic on our business financial results and cash flows will depend largely on ongoing developments, including the continued duration and extent of the spread of COVID-19 globally, the emergence of new variants, the prevalence of local hospitality restrictions, the availability and adoption of effective vaccines (including any governmental or employer policies mandating their use), local, global and international travel restrictions, the impact on capital and financial markets and on the US and global economies, foreign currencies exchange, and governmental or regulatory orders that impact our business, all of which are highly uncertain and cannot be predicted. Moreover, even after restrictions are lifted, demand for our offerings may remain depressed for a significant length of time, and we cannot predict if and when demand will return to pre-COVID-19 levels. In addition, we cannot predict the impact the COVID-19 pandemic has had and will have on our business partners and third-party vendors and service providers, and we may continue to be materially adversely impacted as a result of the material adverse impact our business partners and third-party vendors suffer now and in the future.

In response to the economic challenges and uncertainty resulting from the COVID-19 pandemic and its impact on our business, we accelerated our cost efficiencies programs. During fiscal 2020, we implemented four rounds of redundancies; which reduced Group Support Office employee headcount by 19%, and we also implemented one further redundancy round in the first quarter of 2021. This reduction in headcount has resulted in the loss of institutional knowledge, relationships, and expertise for certain critical roles, which

14

may not have been effectively transferred to continuing employees and may divert attention away from operating our business, create personnel capacity constraints, and hamper our ability to grow, develop innovative products or membership platforms, and compete. Any of these impacts could materially adversely impact our business, financial condition and reputation and impede our ability to operate or meet our strategic objectives. This has led to increased attrition and could lead to reduced employee morale and productivity, as well as problems with retaining existing employees and recruiting future employees, all of which could have a material adverse impact on our business, results of operation, and financial condition.

To the extent the COVID-19 pandemic continues to materially adversely affect our business, results of operation, financial condition and cash flows, it may also have the effect of heightening many of the other risks described in these “Risk Factors” or elsewhere in this Annual Report on Form 10-K. Any of the foregoing factors, or other knock-on effects of the COVID-19 pandemic that are not currently foreseeable, will materially adversely impact our business, results of operation, and financial condition.

We have incurred net losses in each year since our inception, and we may not be able to achieve profitability.

We have incurred net losses of $269 million, $235 million, and $128 million in fiscal 2021, 2020, and 2019, respectively. As of January 2, 2022, we had an accumulated deficit of $1,022 million and as of January 3, 2021, we had an accumulated deficit of $757 million. Historically, we have invested significantly in efforts to open new Houses, launch and grow complimentary businesses, hire additional employees, and enhance our membership experience. Beginning in the second quarter of 2020 and throughout the remainder of fiscal 2020 and 2021, as a response to the COVID-19 pandemic we significantly reduced our fixed and variable costs including by reducing discretionary capital spend. Nevertheless, we have continued to make significant investments in our membership platforms, including through our digital platforms and in new Houses. These efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenue from these investments or otherwise sufficiently offset these expenses. While we have enacted measures to reduce our expenses, we incurred a net loss in fiscal 2021, and we are utilizing a significant portion of our cash to support our operations in fiscal 2021 as a consequence of suffering a material decrease in revenues.

Our planned growth could put strains on our senior management, employees, information systems and internal controls which may adversely impact our business and operations.

We have experienced significant growth in our business activities and operations in the past few years, including the number of Houses and new business areas that form part of our operations, and in fiscal 2021 we opened 6 new Houses in Canouan, St Vincent & The Grenadines (April 2021), 180 House London (April 2021), Austin, Texas (May 2021), Tel Aviv (August 2021), Paris (September 2021) and Rome (October 2021). Our past expansion has placed, and our planned future expansion, including our investments in our digital platforms and new Houses, will place, significant demands on our administrative, operational, financial and other resources. Any failure by us to manage growth effectively could seriously harm our business. To be successful, we will need to continue to implement management information systems and improve our operating, administrative, financial and accounting systems and controls.

As a result of our planned growth, we will need to recruit and train new employees and maintain close coordination among our executive, accounting, finance, legal, human resources, risk management, marketing, technology, sales, membership and operations functions. These processes may be extremely time consuming and expensive, increase management responsibilities and require significant management attention, and we may not realize a return on our investment in these processes and there can be no assurance that such processes will be successful.

Our success depends on the strength of our name, image and brands, and if the value of our name, image or brands diminishes, our business and operations would be adversely affected.

Our trademarks, trade names, image and brands, including Membership Collective Group, Soho House, Soho Home and Scorpios, have been associated with creativity, design, quality, exclusivity, service and style, and we have been recognized for providing our members with access to a community that provides curated member events programming and services, including high-quality food and beverage offerings, accommodation, working spaces, luxury beach settings, and wellness and beauty-care services. Our Houses have regularly attracted international press and social media coverage as a result of our association with leading cultural and creative influencers and innovators, exclusive events and—we believe—exceptionally high service standards. A key component of our image and brands lies in our ability to develop and offer dining, hospitality and lifestyle experiences that cater to our members and guests. There can be no assurance that we will continue to be successful in this regard or that we will be able to maintain such levels of quality and exclusivity and avoid the dilution, infringement, misappropriation or other violation of our names, image, brands, trademarks or other intellectual property rights, particularly as we continue to expand.

Our success largely depends on our membership bases. The strength of our name, images, brands, trademarks and other intellectual property rights are a fundamental part of our ability to attract new members and retain current members, and our businesses would be

15

adversely affected if our public image, reputation, brands, trademarks or other intellectual property rights were to be diminished, infringed, misappropriated or otherwise violated. If an event occurs that negatively affects our members’ perception of our name, images or brands, members may cancel their memberships or visit our properties and use our other offerings less frequently, or public perception of our names, images or brands may be negatively impacted which, in turn, could result in reduced traffic at our stand-alone restaurants, working spaces and/or spas, adversely affecting our business, financial condition, liquidity, results of operation, cash flows or prospects. Further, we are also at risk that the public may confuse our name, images, brands, trademarks and other intellectual property with other similarly-named brands. Such similarly-named brands may not operate at the same high standards that we do, resulting in negative goodwill for our name, images and brands.

In general, incidents that could be damaging to our brand may arise from events that are or may be beyond our ability to control, such as:

•actions taken (or not taken) by our employees relating to health, safety, construction, welfare, or otherwise;

•security or data breaches or incidents, fraudulent activities associated with our membership database or electronic payment systems or unauthorized access to or use or disclosure of confidential, sensitive or PII;

•litigation and legal claims, regardless of the merits or the outcome;

•third-party misappropriation, dilution, infringement or other violation of our intellectual property; and

•illegal activity targeted at us or others.

Our brand value could be diminished significantly if any such incidents or other matters erode confidence in our systems, which could result in fewer memberships being sold or renewed and ultimately lower Membership revenues, which may adversely affect our business, results of operations and financial condition.

Finally, if we expand too rapidly we are susceptible to the perceived erosion of the desirability of our brand. In any such event, attrition among existing members may increase markedly, and we may encounter difficulties in attracting new members, any of which may adversely affect our business, results of operation and financial condition.

We may have to significantly increase our advertising, communications and marketing costs to prevent our name, image and brand value from diminishing, which may adversely affect our business and operations.

We largely rely on our existing membership base and our members’ personal networks for public relations and advertising our products and services and, as a result, historically we have had virtually no marketing or sales costs associated with acquiring new members, and very low sales costs to market our products. However, as our business continues to grow and we seek to attract a larger membership or customer base for our different services and products, we may need to significantly increase and evolve our advertising, communications and marketing strategies, and more traditional advertising and marketing campaigns may not be successful, particularly in jurisdictions where the membership model for private members' clubs is not well known or is less developed. This may result in us incurring significantly more costs and expending other resources and investment to attract and retain members and other customers, which may adversely affect our business, results of operations and financial condition.

Our intellectual property rights are valuable, and any failure to obtain, maintain, protect, defend and enforce our intellectual property, including due to ‘brand squatting,’ could have a negative impact on the value of our brand names and adversely affect our business and operations.

We rely on intellectual property registrations and trademark, trade dress and copyright laws in the US and internationally, as well as technological measures and contractual provisions, such as confidentiality agreements with our employees, contractors and consultants, to establish and protect our brands, maintain our competitive position and protect our intellectual property from infringement, misappropriation or other violation. The success of our business depends partly upon our continued ability to obtain and use our trademarks, service marks and trade names to increase awareness of our brands and to assist with their roll out and expansion across the world. Effective protection of intellectual property rights is expensive and difficult to maintain, both in terms of application and registration costs as well as the costs of defending and enforcing those rights. It is challenging for us to monitor the unauthorized use of our intellectual property for every brand in our business across multiple jurisdictions, and we will not be able to protect our intellectual property rights if we are unable to enforce our rights or if we do not detect unauthorized use, infringement, misappropriation or other violation of our intellectual property rights. We rely on, and will continue to rely on, litigation and regulatory actions to enforce our intellectual property rights against third parties who infringe, misappropriate or otherwise violate our intellectual property rights, which could result in substantial costs and diversion of resources (particularly management time) for us, may result in counterclaims or other claims against us, and may also harm our reputation or limit our business operations.

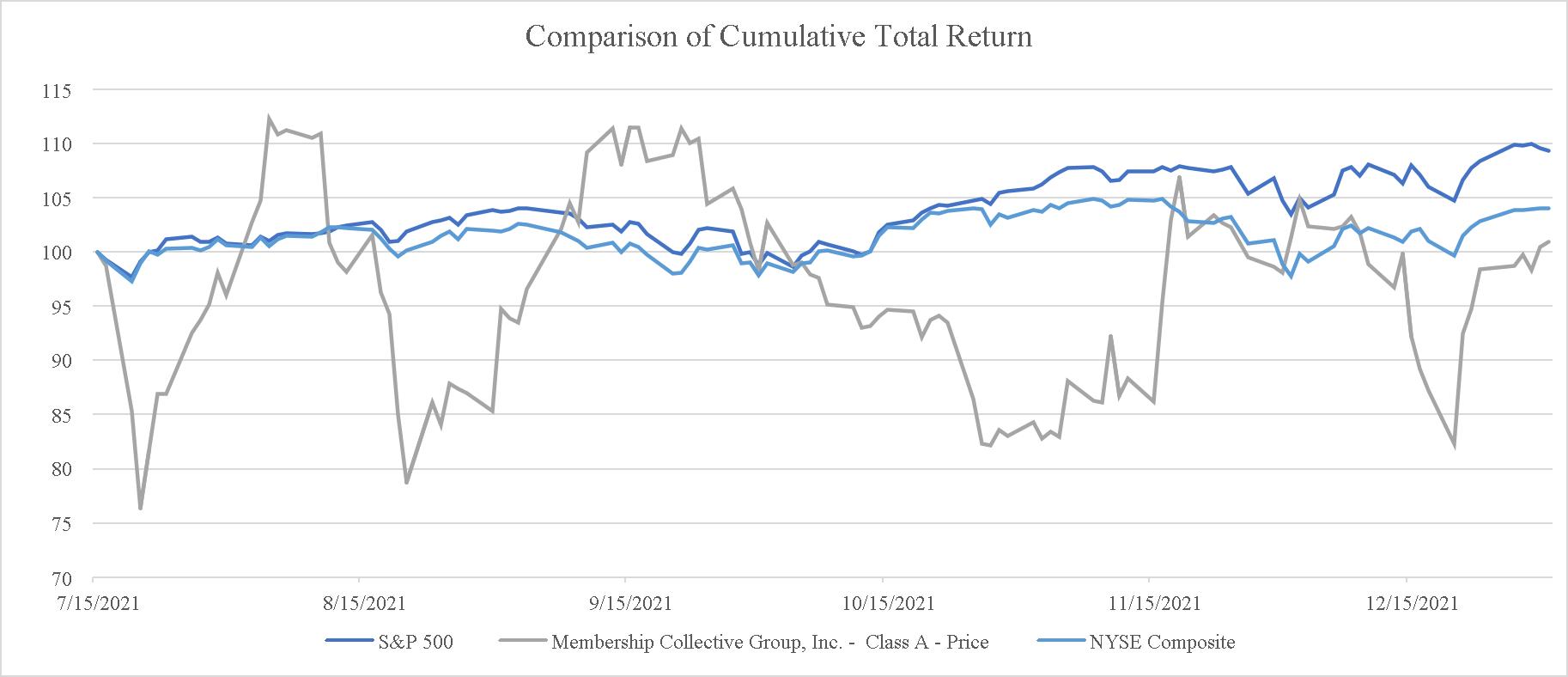

16