As submitted on April 22, 2021 to the Securities and Exchange Commission

For confidential review pursuant to the Jumpstart our Business Startups Act of 2012

This draft registration statement has not been publicly filed with the Securities and Exchange Commission and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

________________________

Amendment No. 1

to

Form F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

________________________

EWPG HOLDING AB (publ)

(Exact name of registrant as specified in its charter)

________________________

Sweden | 4911 | Not Applicable | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer |

Inna Braverman (Address, including zip code, and | Puglisi & Associates (Name, address, including zip code, and |

________________________

Copies to:

Oded Har-Even, Esq. | Rick A. Werner, Esq. |

________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date hereof.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. S

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company S

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 7(a)(2)(B) of the Securities Act. £

____________

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Proposed | Amount of | ||||

Common Shares, par value SEK 0.02 per share, as represented by American Depositary Shares(2)(3) | $ | $ | ||||

Representative Warrants(6) |

|

| ||||

Common Shares, as represented by American Depositary Shares issuable upon exercise of the representative’s warrants(5) |

| — |

| — | ||

Total Registration Fee | $ |

| $ |

| ||

____________

(1) Estimated solely for purposes of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended, or the Securities Act. Includes the offering price of common shares that the Underwriters have the option to purchase to cover over-allotments, if any.

(2) The common shares will be represented by American Depositary Shares, or ADSs, each of which currently represents common shares. A separate Registration Statement on Form F-6 (File No. 333- ) will be filed for the registration of ADSs issuable upon deposit of the common shares.

(3) Pursuant to Rule 416 under the Securities Act, the common shares registered hereby also include an indeterminate number of additional common shares as may from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transactions.

(4) Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

(5) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. The representative’s warrants are exercisable at a per ADS exercise price equal to % of the public offering price. As estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the representative’s warrants is equal to % of $ (which is % of $ ).

(6) No additional registration fee is payable pursuant to Rule 457(g) under the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED , 2021 | ||

American Depositary Shares

| ||||

EWPG Holding AB (publ) is offering American Depositary Shares, or ADSs, in an initial public offering of its common shares, underlying the ADSs, in the United States. The estimated initial public offering price is between $ and $ per ADS. Each ADS represents the right to receive common shares.

Our common shares are traded on the Nasdaq First North Growth Market, or Nasdaq First North, under the symbol “ECOWVE.” The closing price of our shares on Nasdaq First North on April 20, 2021 was SEK 8.50 per share, which equals a price of $1.015 per share based on the SEK/U.S. dollar exchange rate of SEK 8.3722 to $1.00 as of such date. Our share price on Nasdaq First North may not be indicative of actual offering price. This offering constitutes our initial public offering of common shares, underlying the ADSs, in the United States, and while our common shares have been traded on the Nasdaq First North since 2019, no public market currently exists on a U.S. national securities exchange for our common shares or the ADSs. The final offering price per ADS will be determined through negotiations between us and the underwriters.

We have applied to list the ADSs on the Nasdaq Capital Market, or Nasdaq, under the symbol “WAVE.”

We are an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and may elect to do so in future filings.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Per ADS | Total | |||||

Initial public offering price | $ |

| $ |

| ||

Underwriting discounts and commissions(1) | $ |

| $ |

| ||

Proceeds to us (before expenses) | $ |

| $ |

| ||

____________

(1) In addition, we have agreed to reimburse the underwriters for certain expenses and issue warrants to the representative of the underwriters, or the Representative, in an amount equal to 5% of the aggregate number of ADSs sold in this offering, or the Representative Warrants. See the section titled “Underwriting” beginning on page 110 of this prospectus for additional disclosure regarding underwriter compensation and offering expenses.

We have granted the underwriters an option to purchase from us, at the public offering price, up to additional ADSs, less the underwriting discounts and commissions, within 45 days from the date of this prospectus to cover over-allotments, if any. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable will be $ , and the total proceeds to us, before expenses, will be $ .

The underwriters expect to deliver the ADSs to purchasers in the offering on or about , 2021.

Sole Book-Running Manager

A.G.P.

The date of this prospectus is , 2021

Page | ||

1 | ||

12 | ||

41 | ||

42 | ||

43 | ||

44 | ||

45 | ||

46 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 48 | |

57 | ||

81 | ||

Beneficial Ownership of Principal Shareholders and Management | 87 | |

89 | ||

90 | ||

93 | ||

100 | ||

102 | ||

105 | ||

110 | ||

116 | ||

116 | ||

116 | ||

117 | ||

118 | ||

F-1 |

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We or the underwriters have not authorized anyone to provide you with information that is different. We and the underwriters are offering to sell the ADSs, and seeking offers to buy the ADSs, only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the ADSs.

For investors outside of the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to this offering and the distribution of this prospectus outside the United States.

In this prospectus, unless the context provides otherwise, “we,” “us,” “our,” the “Company” and “EWPG” refer to EWPG Holding AB (publ), after the date that it acquired its operating subsidiary, Eco Wave Power Ltd., or EWP Israel, or the Acquisition (see “Prospectus Summary — Corporate Information” for additional information), while such references, before the time of the Acquisition, refer to EWP Israel.

Our functional currency is the Swedish Kronor. Our reporting currency is the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references in this prospectus to “dollars,” “USD” or “$” mean U.S. dollars, references to “SEK” are to the Swedish Kronor and references to “NIS” are to the New Israeli Shekel. Unless otherwise indicated, certain SEK amounts contained in this prospectus have been translated into U.S. dollars at the applicable exchange rate on the dates of the transactions using the exchange rates provided by the Sveriges RiksBank, the central bank of Sweden. These translations should not be considered representations that any such amounts have been, could have been or could be converted into USD at that or any other exchange rate as of that or any other date.

i

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them. Our historical consolidated financial statements present the consolidated results of operations of EWPG Holding AB (publ) and its majority-owned subsidiaries.

This prospectus includes statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information. Although we believe that these sources are reliable, we have not independently verified the information contained in such publications. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Note Regarding Forward-Looking Statements.”

We report under International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB. None of the financial statements were prepared in accordance with generally accepted accounting principles in the United States.

ii

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. Before you decide to invest in our securities, you should read the entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our audited consolidated financial statements and related notes appearing at the end of this prospectus.

Our Company

We are a wave energy company primarily engaged in the development of a smart and cost-efficient wave energy conversion, or WEC, technology that converts ocean and sea waves into clean electricity. Our corporate mission is to revolutionize energy production with our proprietary wave technologies, and to become a leader in the renewable energy industry, which, according to an analysis by Frost & Sullivan, is expected to see $3.4 trillion in new investment in the next decade. Our WEC technology is implemented onshore or nearshore, as opposed to offshore systems, and draws energy from incoming waves by converting the rising and falling motion of the waves into an efficient and clean energy generation process.

In addition to our WEC technology, we are also building out a pipeline of ancillary technology services that we may provide to our customers and other parties, such as other companies and research institutions. These services currently include feasibility studies for potential clients of our WEC technology. We are also developing a smart Wave Power Verification, or WPV, software, intended to provide real-time production verification that is expected to allow preventative-predictive and corrective measures to be taken. We believe that by providing these complementary services, we will be better positioned to be a leader of the wave energy industry.

Today, more than ever, a WEC solution such as ours is needed. Global energy production is expected to continue growing, where there is strong economic growth, to meet increasing global energy demand, with the U.S. Energy Information Administration projecting global energy consumption expected to rise by 50% between 2018 and 2050, led by growth from countries that are not in the Organization for Economic Cooperation and Development, or the OECD, and focused in regions where strong economic growth is driving demand, particularly in Asia. Historically, the world has relied on traditional polluting energy sources that come from fossil fuels, such as coal and oil. Fossil fuels have been the preferred energy source over time mainly because they have been cheaper than renewable energy sources like solar and wind even though fossil fuels pollute the earth and are limited in supply.

While the world continues to rely on fossil fuels, we believe that in recent years solar and wind power have crossed a new threshold, moving from mainstream to preferred energy sources across much of the globe. As they reach price and performance parity with conventional sources, demonstrate their ability to enhance grids, and become increasingly competitive via new technologies, deployment obstacles and ceilings are dissolving. Already among the cheapest energy sources globally, solar and wind have the potential to advance much further, as we believe that the enabling trends have not run their full course yet. Costs are continuing to fall, and successful integration is proceeding apace, undergirded by new technologies that are bringing even greater efficiencies and capabilities. Meanwhile, according to the International Energy Agency, or IEA, the demand for renewables is growing and, according to a report from Deloitte, solar and wind power now come closest to meeting three energy consumer priorities: reliability, affordability, and environmental responsibility. However, we believe that marine energy, and specifically wave energy, remains largely unexploited, due to high implementation, operation and maintenance costs, and that marine energy technologies remain at an early stage of development, especially in the case of wave power.

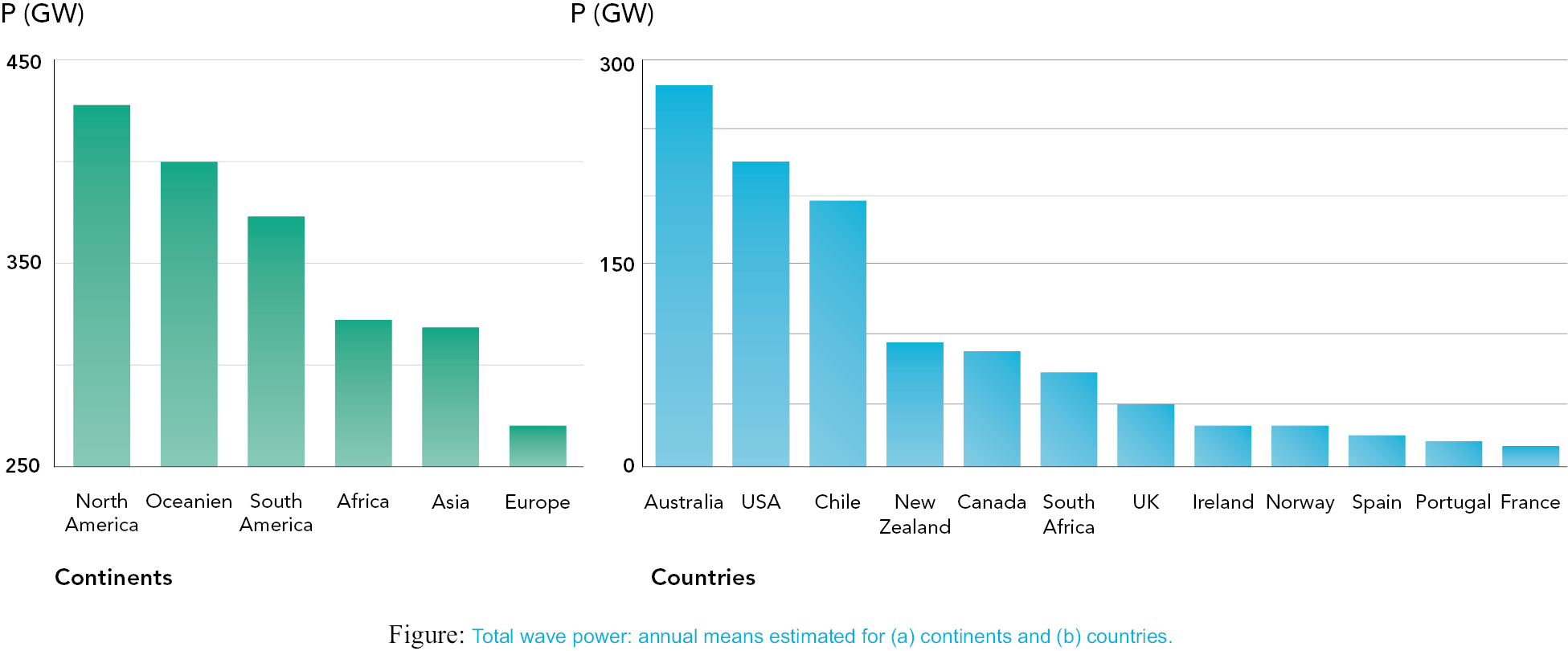

Wave energy is considered to have the highest energy production rate of any renewable energy source. According to the 2020 paper, “Electrical Power Generation from the Oceanic Wave for Sustainable Advancement in Renewable Energy Technologies” from the peer review journal, Sustainability, ocean wave energy has the highest energy production compared to other renewable energy sources as it can produce energy 90% of the time, and which, according to an article “On the reversed LCOE calculation: Design constraints for wave energy commercialization” from the International Journal of Marine Energy, also has the potential capacity to become one of the cheapest and cleanest. According to an estimate from the Intergovernmental Panel on Climate Change, approximately 32,000 terawatt-hours per year could theoretically be produced from the oceans’ waves (subject to there being sufficient wave energy technologies), which is approximately double the world’s electricity production in 2008. However, we believe that many companies trying to develop WEC systems have been struggling to move beyond research

1

and development and into commercialization primarily due to the fact that most WEC systems are designed for offshore application where wave heights are of a higher nature. However, we believe that offshore installations typically give rise to certain critical issues that may make commercialization difficult. According to our research and based on reports from the International Renewable Energy Agency, or IRENA, and research papers from Chalmers University of Technology, we believe that there are four primary issues challenging the commercialization of offshore installation. The first issue is the high capital expenses implicit in the installation, maintenance, and grid-connection of offshore technologies which require the use of ships, divers, underwater electrical transmission cables, and underwater mooring, which are all highly capital intensive. The second issue is the lack of reliability for these offshore technologies due to the extremely harsh weather conditions which are prevalent in the offshore sea/ocean environment. The stationary manmade equipment has no way of avoiding the extreme loads caused by the offshore storms, and many offshore wave energy developers had their equipment dislodged and broken down after a short time of operation. The third issue we believe is both in its difficulty to reach insurability and, if insurance is available, to obtain the applicable insurance policy at a reasonable cost. Developers with offshore wave energy technologies struggled to secure insurance as insurance companies were hesitant to risk insuring such technologies (which are deemed “pre-commercial”) due to the aforementioned high capital expenses and low survivability. The final issue is environmental, as many environmental organizations object the deployment of offshore WEC technologies as many of them require mooring to the ocean floor, which has the potential to disturb the ecological balance.

Our WEC Technology

We believe that our WEC technology has the potential to accelerate the viability of wave power in a way that was previously not achievable because our WEC technology is more cost-efficient, reliable, insurable and environmentally friendly compared to offshore systems. Our WEC technology employs units of point absorber floating devices, referred to as floaters, which are installed on existing marine structures such as (but not limited to) piers, breakwaters and jetties, or in locations in which such marine structures are required. Our specially designed floaters move accordingly with the movement of the waves pressing hydraulic pistons, which creates pressure in land located accumulators, of between 50 and 160 bar or more (metric unit of pressure, which may vary in accordance with the programming of the system), depending on wave heights, which is rotating a hydromotor, that then rotates a generator, which sends the clean electricity to the grid via an inverter. Our WEC technology usually begins producing electricity from wave heights as low as 50 cm.

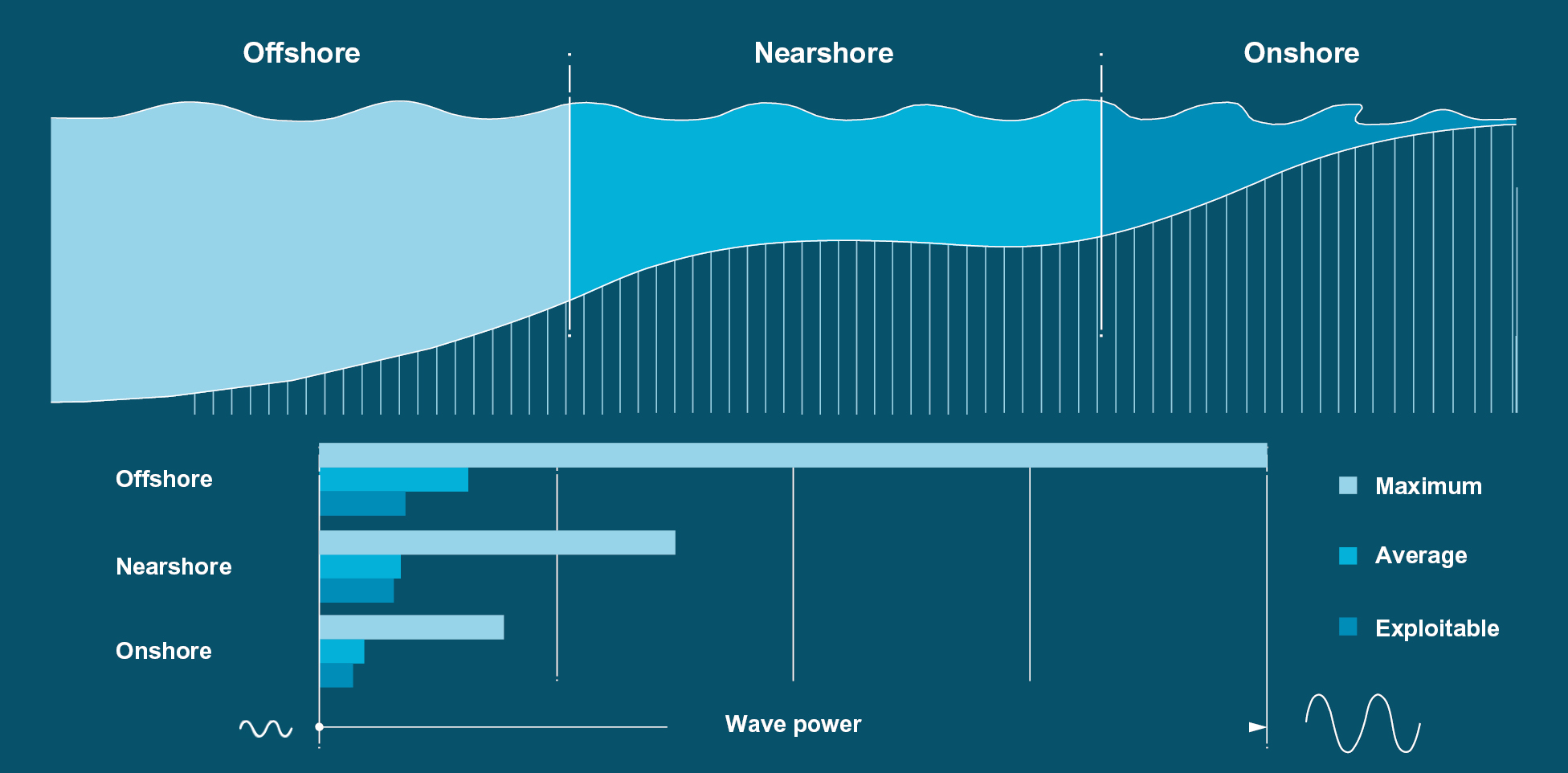

WEC solutions placed closer to shore, such as our WEC technology, generally encounter waves coming from the same direction, thereby boosting the quantity of energy captured. In deep water, where offshore solutions are usually placed, waves can travel in almost any direction, making it difficult to extract energy due to the fact that these waves are more difficult to predict and more complex to account for in system design. So, although the maximum wave power is higher offshore, the exploitable level of power nearshore may be practically the same level as in offshore locations.

Different parts of the system are measured by sensors, which collect and transmit various information in real-time and allows the system to be continuously monitored and controlled by a central control system, which automatically optimizes the electricity production in order to ensure continuous power generation. In addition, when the waves are too high for the system to handle, the floaters automatically lift above the water level and remain in the upward position until the wave heights return to pre-storm levels, at which time, the system automatically commences operation. In the event that the automation system is not available, this action can also be performed manually.

Our WEC technology is also fully modular, allowing us to more easily scale projects. Our system does not connect to the ocean floor or create a new presence in the surrounding marine environment. Furthermore, we have submitted a patent and have been testing the ability to add solar panels to our WEC technology, which we believe will allow our system to generate larger amounts of electricity from multiple renewable energy sources.

We believe our WEC technology design significantly reduces construction and production prices while increasing reliability and insurability.

2

Our Pipeline Projects and Achievements

We have entered into a variety of agreements with parties interested in the utilization of our WEC technology. These agreements consist of Power Purchase Agreements, Concession Agreements and other agreements in various stages, including letters of intent. Based on the terms of the agreements and our own calculations, we believe that we have a total worldwide pipeline of projects that may be up to 316.7 megawatts in size. In addition, we have entered into agreements to conduct feasibility studies. Although the majority of the megawatts included in our pipeline are subject to preliminary agreements, we have a limited amount of megawatts that are subject to more advanced agreements, such as our Power Purchase Agreement in Gibraltar for up to five megawatts, a Concession Agreement in Portugal for up to 20 megawatts, an Interconnection Agreement in Mexico for up to 25 megawatts and Pioneering Technology approval from the Israeli Ministry of Energy, or the Ministry of Energy, to construct a 100 kilowatt WEC array, which is in advanced construction in the Jaffa port in Israel. Although some of these agreements may be deemed to be definitive, there is no guarantee that we will complete the construction of any WEC systems for such projects (or any others), as we will need to meet certain conditions and obtain certain licenses to reach the actual construction stage of such projects, of which there can be no guarantee. See “Risk Factors — Risks Related to Our Business Operations” for risks associated with our pipeline projects and “Business — Project Pipeline” for additional information.

Preliminary agreements, including letters of intent and other similar agreements that require the parties to enter into definitive documents, are subject to ongoing negotiation and there can be no guarantee that we are able to enter into definitive agreements with these parties. As a result, the total aggregate megawatt of our project pipeline does not reflect only those projects covered by definitive agreements. We are continuously working to expand our pipeline, including efforts to enter into definitive agreements to cover projects that are not covered by definitive agreements.

We currently operate a grid-connected proof-of-concept wave energy array in Gibraltar, which is a part of a five megawatt Power Purchase Agreement that we signed with the Government of Gibraltar and Gibraltar’s National Electric Company, or GibElectric.

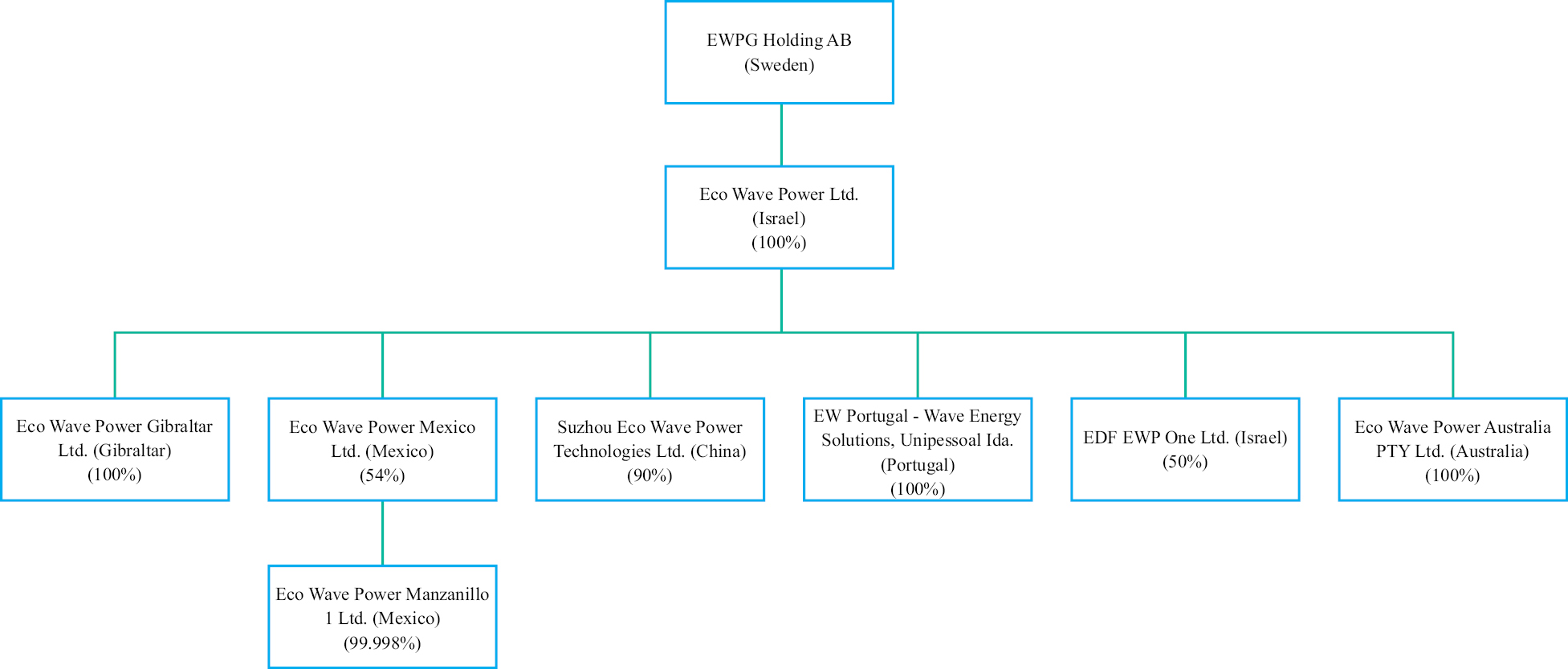

EDF EWP One Project — This project involves installation and operation of a 100 kilowatt installed capacity project in the Jaffa Port in Israel in a partnership with EDF Energies Nouvelles Israel Ltd., or EDF Renewables IL, a subsidiary of the French multinational electric utility company Électricité de France S.A., or EDF, pursuant to which we co-own, in equal parts, the joint venture EDF EWP One Ltd., or EDF EWP One. In addition to the shared funding of this project pursuant to our joint venture agreement with EDF Renewables IL, we also received co-funding from Ministry of Energy, which recognized our technology as a “pioneering technology”. Pioneering technology recognition is a designation granted by the Chief Scientist of the Ministry of Energy to renewable energy technologies, which grants such companies with a production quota to connect their technology to Israel’s national electricity grid in accordance with the guidelines established for Pioneering Technologies. We previously operated an off-grid pilot power station, in the same place, mainly for research and development purposes. In August 2020, we secured the engineering coordination permit required for the deployment of the grid connection work for the project, and in February 2021, we obtained the engineering coordination permit for the cement works and conversion unit and floaters installation.

Portugal Planned Project — In 2020, we entered into a Concession Agreement with the Port of Leixões, or APDL, to use an area potentially suitable for the construction, operation and maintenance of a wave energy power plant of up to 20 megawatts in four locations owned and operated by APDL. Pursuant to the Concession Agreement with APDL, APDL will provide us with the concession for its breakwaters for a period of between 25 to 30 years, while we will be responsible for securing all the licenses, constructing and commissioning the power plant and selling the electricity to be generated by the power plant in accordance with an approved production quota, to be determined for each site. The power plant is planned to be constructed and commissioned in several stages starting with a one megawatt station, and subject to certain conditions, to be followed by the construction, operation and maintenance of the remaining capacity of the plant (19 megawatts). In order to commence the licensing, EWP Israel incorporated a wholly owned subsidiary company in Portugal under the name EW Portugal-Wave Energy Solutions, Unipessoal Ida., or EW Portugal. EW Portugal has initiated the process for obtaining the necessary licenses required in order to commence construction of the first megawatt of the project.

Our achievements in 2020 include a collaboration agreement with Meridian Energy Australia Pty Ltd., or MEA, which is a wholly owned subsidiary of Australasia’s largest renewable energy generator Meridian Energy Limited. The purpose of the collaboration is to jointly investigate the development of commercial wave energy power projects in the Australian National Electricity Market. We also signed several letters of intent with various ports and are currently working on entering into definitive agreements to commence these new projects.

3

Once we complete this offering, we plan to continue to develop the projects in our pipeline, specifically our EDF EWP One project, and to work towards the completion of the licensing required for our megawatt project in Portugal, further expand our project pipeline, conduct research and development aimed at continuing to upgrade and improve our WEC technology, continue the reinforcement of our patent portfolio, and to expand the team that will help us achieve our growth strategy. Prioritized countries for our project pipeline include those with significant wave heights, governmental support for renewable energy projects, short and clear licensing procedures, favorable feed-in-tariffs or subsidy schemes, high electricity demand, strong promotion of renewable energy and/or lack of electricity access and available grid-capacity. In addition, we will be prioritizing growth in specific high-potential target markets. Primarily, we are concentrating on growth in Europe, North America and Oceania, where there is high wave energy potential and growing support for renewable energy technologies.

During 2020, we received several high profile awards and industry accolades for our technology and activities in the wave energy field. These include:

• The 2020 Energy Globe Award, for our combined wave and solar project in Gibraltar;

• Meaningful Business, a global platform for leaders combining profit and purpose, recognized us as a Meaningful Business 100 (MB100) leader for 2020;

• We were shortlisted for the Falling Falls Science Breakthrough of the year in the Engineering and Technology Category;

• We were selected to be featured on RE:TV by the Sustainable Markets Initiative, curated by editor-in-chief, His Royal Highness Prince Charles of Wales, which showcases inspiring innovations and ideas that point towards a sustainable future;

• We have been invited to join 14 other leading entrepreneurs from across the UK and Europe for the first ever virtual iteration of the Unreasonable Impact program, an innovative multi-year multi-geographic partnership between Barclays and Unreasonable Group to launch the world’s first global network focused on scaling up entrepreneurial solutions that will help employ thousands worldwide in the emerging green economy; and

• In 2021, we won the public vote for the Global Innovation Award at Abu Dhabi Sustainability Week in the category of Life Bellow Water and the Blue Invest People’s Choice Award by the European Commission.

In addition, Inna Braverman, our Chief Executive Officer, was selected by Fast Company as one of the world’s 74 “Most Creative People in Business for 2020”, recognized as one of the “European tech pioneers shaping the post-pandemic world” by Sifted.eu, selected as a finalist of the “European Commission’s Prize for Women Innovators” 2020, received the “Green Innovation Award” by the UK Department of International Trade and named to the list of “50 of the World’s Most Influential Jews” by Jerusalem Post.

Recent Developments

COVID-19

In the short term, the effects of the ongoing global coronavirus pandemic, or COVID-19, were not positive, as it disrupted our ability to travel, and governments across the world imposed restrictions on movement that adversely impacted our ability to carry out our operations as usual in Israel, Gibraltar, Portugal and other countries. As a result of restrictions implemented by governments in counties within which we operate, we experienced certain delays in project execution as most of our projects are with ports, governments and public organizations, which put a priority, in the short term, on fighting the pandemic rather than putting in resources intended to promote innovative projects. For example, we have experienced delays in getting certain licenses required in order to commence construction of the first megawatt in the Portugal project.

The full extent to which COVID-19 will impact our business will depend on future developments, which are highly uncertain and cannot be predicted. However, in the long term, we believe that COVID-19 will have a positive overall impact on the renewable energy industry, as we believe that the renewable energy sector will come out of the

4

COVID-19 pandemic stronger than it was beforehand, based on the emphasis on sustainability in various plans for recovery from the pandemic. For example, the Rockefeller Foundation committed to invest $1 billion over the next three years to catalyze a more inclusive, green recovery from the COVID-19 pandemic. Other prominent leaders, governments, and organizations are also rising to the occasion and have committed to advancing significant and ground-breaking green recovery plans. For example, in June 2020, the EU launched a 750 billion Euro COVID-19 recovery package, of which 37% of the funding was to be allocated towards climate friendly measures. Additionally, The Sustainable Markets Initiative was launched by His Royal Highness Prince Charles of Wales, in response to the increasing threats posed by climate change and biodiversity loss. In addition, we believe COVID-19 has acted as a catalyzer to decarbonization; the world invested unprecedented amounts in low-carbon assets last year, from renewables to cleaner transport, energy storage to electric heat. A new, broad measure of ‘energy transition investment’ compiled by BloombergNEF, or BNEF, shows that the world committed a record $501.3 billion to decarbonization in 2020, beating the previous year by 9% despite the economic disruption caused by the COVID-19 pandemic.

A geographical split of BNEF’s energy transition investment data shows that Europe accounted for the biggest slice of global investment, at $166.2 billion (an increase of 67% in comparison to 2019). BNEF further reported that Europe’s impressive performance was driven by a record year for electric vehicle sales, and the best year in renewable energy investment since 2012. Globally, renewables capacity investment increased in 2020 as compared to 2019. For instance, as highlighted by BNEF, renewables capacity investment increased by 10% in Japan to $19.3 billion, 177% in the U.K. to $16.2 billion, 221% in the Netherlands to $14.3 billion, 16% in Spain to $10 billion, 23% in Brazil to $8.7 billion, Vietnam 89% higher at $7.4 billion, France 38% up at $7.3 billion, and Germany 14% up at $7.1 billion. Other markets seeing $3 billion-plus totals included Taiwan, Australia, South Korea, Poland, Chile, Turkey and Sweden.

However, although opportunities have arisen in our industry as a result of the COVID-19 pandemic, COVID-19 has also presented a number of challenges for all businesses around the world, including ours.

We believe that we reacted quickly to COVID-19 and we have come up with a clear and responsible plan, which we refer to as EPIC-M, which at its core we believe maintains the safety of our employees, while intended to help us achieve our operational targets. The EPIC-M plan, includes five main components:

• Efficient remote operation of our Gibraltar power plant;

• Progressing projects which are under construction (for example, the EDF EWP One project);

• �� Increasing pipeline project intake;

• Creating trust among our shareholders, while improving brand awareness; and

• Minimizing expenses.

Efficient remote operation of our Gibraltar power plant. We have changed our ways of working and for the time being, we are not sending staff to Gibraltar and other locations in our projects pipeline. Nevertheless, our Gibraltar power plant has continued operation and is being monitored by our local power plant manager with ongoing online support from our engineering team in our office in Israel. In addition, measures have been taken to ensure all employees can work remotely and are equipped with proper tools necessary to attend remote meetings. We also implemented new sales and business development strategies were implemented, which we expressed to our business development and marketing employees quickly, in order to enable quick adjustment to the new situation and allow us to finalize new deals remotely.

Progressing projects which are under construction. We worked and continue to work on the second power plant that we expect to connect to the electricity grid — the EDF EWP One project in Jaffa Port, Israel. In a significant regulatory milestone, we secured the engineering coordination permit from the Municipality of Tel-Aviv Jaffa required for the deployment of the grid connection works of the EDF EWP One project in the Jaffa Port, Israel. The permit allows us to proceed with the path towards electric cable laying work, for the electric transmission cables that will connect the EDF EWP One project and with the Israel Electric Company sub-station. In February 2021, we secured the engineering coordination required for cements works, floaters installation on the breakwater and location of the WEC unit.

5

Increasing pipeline project intake. As part of our long-term vision, we have taken steps to secure new sites that are potentially interested in our WEC technology. Including a newly entered Concession Agreement for an up to 20 megawatt wave energy power plant with APDL, our overall project pipeline is estimated to be 316.7 megawatts, consisting of Power Purchase Agreements, Concession Agreements and other agreements in various stages, including letters of intent. In addition, we have entered into agreements to conduct feasibility studies. See “Risk Factors — Risks Related to Our Business Operations” for risks associated with our pipeline projects and “Business — Project Pipeline” for additional information.

Preliminary agreements, including letters of intent and other similar agreements that require the parties to enter into definitive documents, are subject to ongoing negotiation and there can be no guarantee that we are able to enter into definitive agreements with these parties. As a result, the total aggregate megawatt of our project pipeline does not reflect only those projects covered by definitive agreements. We are continuously working to expand our pipeline, including efforts to enter into definitive agreements to cover projects that are not covered by definitive agreements. We believe that our progress was made possible due to both the newly implemented business development and sales strategies and due to the positive attention that our WEC technology has received across the globe.

In addition, we are planning to expand our product portfolio by providing increased project development products and services, specifically, conducting additional feasibility studies for our potential customers and by launching our WPV software, both of which are expected to add customer value and provide a potential revenue stream for us. With respect to feasibility studies, we signed two such agreements in 2020, one of which is with MSMART Future Technology in Vietnam. With respect to our WPV software, once we complete its development, we intend to add it to our product portfolio. We believe that by adding the WPV software to our product portfolio, we will be able to position ourselves as not only as a leading WEC technology provider, but also as a world-leader in a proprietary software for the growth of the whole industry.

Creating trust among our shareholders, while improving brand awareness. During the COVID-19 pandemic it has also been important to us to reassure our shareholders that we are taking all appropriate measures to meet our operational targets, in a clear and responsible manner. As a result, we have also come up with a new communication plan, which is expected to improve our brand awareness, while establishing better communication channels with our existent and new shareholders. One of the items of such a plan was changing the Company’s ticker symbol on Nasdaq First North to “ECOWVE”. This new symbol is expected to be easier to find, while clearly more appropriately reflecting our brand. We have also launched a monthly newsletter and started a policy of frequent updates to our shareholders and the market, via press releases and other means available to us. We hope that this will reinforce the connection between us and our shareholders, while aligning our operational steps with understanding from the market.

Minimizing expenses. The last step of our response plan to the COVID-19 pandemic is financial. Although we believe we currently have sufficient capital and financial resources to undertake our current level of operations and maintain our current burn rate through at least the next 15 months, or July 2022, we will require additional financing in order to undertake efforts to fully commercialize and scale our WEC technology and to commence construction of new projects. In addition, the consequences of COVID-19 are still hard to grasp, and everything indicates that this might be a lengthy recovery process for us and the entire world. As a result, to ensure our long-term financial situation, we have been able to reduce certain capital expenditures. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information.

Summary of Risks Associated with Our Business

Our business is subject to numerous risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. You should read these risks in full before you invest in our securities. A summary of our risks include the following:

• we have not generated revenue from our wave energy technology or power stations and may never be profitable;

• the ongoing COVID-19 pandemic may adversely affect our operations and financial condition;

• we may not be able to receive the regulatory approvals and permits needed in order to commercialize our WEC technology in the jurisdictions in which we wish to operate;

6

• we have a history of operating losses and may not achieve or maintain profitability and positive cash flow;

• the reduction or elimination of government subsidies, grants and other economic incentives for various renewable energy applications may have an adverse impact on our operations and financial condition;

• we will need additional sources of financing even if this offering is completed;

• our revenues, if any, and efforts to become profitable, may be impacted by our need to pay royalties on government grants and other agreements;

• our Chief Executive Officer, directors and shareholders who own more than 5% of our outstanding common shares before this offering currently own, in the aggregate, approximately 73% of our outstanding common shares and will own approximately % of our common shares upon the completion of this offering of ADSs (based on the midpoint of the estimated price range of the ADSs set forth on the cover of this prospectus) (assuming no exercise of the underwriters’ over-allotment option) and therefore, if they acted together, could significantly influence or even unilaterally approve matters requiring approval by our shareholders;

• even if we are issued patents, because the patent positions of our technology are complex and uncertain, we cannot predict the scope and extent of patent protection for our products;

• there can be no assurance that our patent applications will result in issued patents;

• if we are unable to maintain effective proprietary rights for our products, we may not be able to compete effectively in our markets;

• we could be held liable if our business operations harmed the environment and a failure to maintain compliance with environmental laws could severely damage our business;

• wave energy is relatively new and is unproven which could mean that we may never be successful in commercializing our technology;

• we will be subject to intense competition in the renewable energy business by competitors with substantially greater resources and/or more cost-effective technology;

• changes in technology may have a material adverse effect on our results of operations;

• if we fail to manage our future growth effectively, our business could be materially adversely affected. We may also face difficulties as we expand our operations into countries in which we have no prior operating experience;

• we are or will be subject to international regulations that could adversely affect our business and results of operations;

• an amendment to the employment agreement that we have with our Chief Executive Officer may provide for certain payments in the event of a change of control of us (as defined), which may discourage, delay, or prevent a change in control;

• the rights of our shareholders may differ from the rights typically offered to shareholders of a U.S. corporation; and

• our securities will be traded on more than one exchange and this may result in price variations.

Corporate Information

We are a company incorporated in Sweden and were incorporated in 2019. Our principal executive offices are located at 52 Derech Menachem Begin St., Tel Aviv-Yafo, Israel 6713701. Our telephone number in Israel is +972-3-509-4017. Our website address is https://www.ecowavepower.com/. The information contained on, or that can be accessed through, our website is not part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

7

EWP Israel was incorporated in 2011. EWP Israel was the parent and operating company until the Acquisition. In connection with the Acquisition, we acquired EWP Israel and its subsidiaries through an issue in kind (no cash consideration was involved, but rather EWP Israel shareholders exchanged their shares in EWP Israel for our shares) in May 2019. We refer to this transaction in this prospectus as the “Acquisition.” The purpose of the Acquisition was to have a parent company incorporated under Swedish law prior to the listing on Nasdaq First North. Prior to the Acquisition, EWPG had no assets or operations. As a result of the Acquisition, we became the parent company of EWP Israel. Since the Acquisition, our operations have been carried out by EWP Israel and its subsidiaries and we expect to continue to follow this practice.

Following the Acquisition, on May 21, 2019, our shareholders approved a 50 for 1 split of our common shares, or the Share Split.

The Securities and Exchange Commission, or the SEC, also maintains an Internet website that contains reports, proxy and information statements and other information regarding issuers that we will file electronically with the SEC. Our filings with the SEC will also be available to the public through the SEC’s website at http://www.sec.gov.

Implications of Being an “Emerging Growth Company”

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the JOBS Act. As such, we are eligible to, and intend to, take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not “emerging growth companies” such as not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act. We could remain an “emerging growth company” for up to five years, or until the earliest of (a) the last day of the first fiscal year in which our annual gross revenue exceeds $1.07 billion, (b) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our ADSs that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (c) the date on which we have issued more than $1 billion in nonconvertible debt during the preceding three-year period.

Implications of being a “Foreign Private Issuer”

We are subject to the information reporting requirements of the Exchange Act that are applicable to “foreign private issuers,” and under those requirements we file reports with the SEC. As a foreign private issuer, we are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, we are not required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We also have four months after the end of each fiscal year to file our annual report with the SEC and are not required to file current reports as frequently or promptly as U.S. domestic reporting companies. Our officers, directors and principal shareholders are exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we are not subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. In addition, as a foreign private issuer, we are permitted to follow certain home country corporate governance practices instead of those otherwise required under the Nasdaq Stock Market rules for domestic U.S. issuers and are not required to be compliant with all Nasdaq Stock Market rules as of the date of our initial listing on Nasdaq as would domestic U.S. issuers. For example, as a Swedish company, and pursuant to applicable Swedish law, we will not have a compensation committee at the time of our initial listing on Nasdaq. See “Risk Factors — Risks Related to this Offering and the Ownership of the ADSs and Our Common Shares.” These exemptions and leniencies will reduce the frequency and scope of information and protections available to you in comparison to those applicable to a U.S. domestic reporting company. We intend to take advantage of the exemptions available to us as a foreign private issuer during and after the period we qualify as an “emerging growth company.”

8

THE OFFERING

ADSs offered by us | ADSs representing common shares (or ADSs representing common shares if the underwriters exercise in full their option to purchase additional ADSs). | |

Common shares to be outstanding after this offering |

| |

The ADSs | Each ADS will represent of our common shares, par value SEK 0.02 per share. The ADSs may be evidenced by American Depositary Receipts, or ADRs. | |

The depositary will be the holder of the common shares underlying the ADSs and you will have the rights of an ADS holder as provided in the deposit agreement among us, the depositary and owners and beneficial owners of ADSs from time to time. | ||

To better understand the terms of the ADSs, you should carefully read the section in this prospectus entitled “Description of American Depositary Shares.” We also encourage you to read the deposit agreement, which is incorporated by reference as an exhibit to the registration statement that includes this prospectus. | ||

Over-allotment option | The underwriters have an option for a period of 45 days to purchase up to additional ADSs to cover over-allotments, if any. | |

Use of proceeds | We estimate that the net proceeds from our issuance and sale of the ADSs in this offering will be approximately $ million, assuming an offering price of $ per ADS, the midpoint of the estimated price range of the ADSs set forth on the cover of this prospectus, and after deducting underwriting discounts and commissions and offering expenses payable by us. If the underwriters exercise the over-allotment option in full, we estimate that the net proceeds from this offering will be approximately $ million, assuming an offering price of $ per ADS, and after deducting underwriting discounts and commissions and offering expenses payable by us. We currently expect to use the net proceeds from this offering as follows: • approximately $ million towards research and development and the development, licensing and construction of additional WEC arrays, as well as the development of the projects in our pipeline, which may include expenditures for feasibility studies, and testing and demonstrations of our WEC technology; • approximately $ million to advance the development of new products; and • the remainder, if any, for working capital and general corporate purposes. The exact amounts and timing of these expenditures will depend on a number of factors, such as the timing, scope, progress and results of our research and development efforts, the timing and progress of any partnering efforts, and the regulatory and competitive environment. | |

See “Use of Proceeds” on page 42 of this prospectus for a more complete description of the intended use of proceeds from this offering as well as “Risk Factors — Risks Related to this Offering and Ownership of the ADSs and Our Common Shares.” |

9

Risk factors | You should read the “Risk Factors” section starting on page 12 of this prospectus for a discussion of factors to consider carefully before deciding to invest in our securities. | |

Proposed Nasdaq Capital Market Trading Symbol and Listing |

| |

Nasdaq First North Symbol | “ECOWVE” |

The number of our common shares to be outstanding immediately after this offering is based on 35,194,844 common shares outstanding as of April 20, 2021. Unless otherwise indicated, this number excludes 1,583,767 common shares reserved for future issuance under our long-term incentive plan.

Unless otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of the over-allotment option and no exercise of the warrant to purchase up to ADSs (or ADSs if the underwriters exercise in full their option to purchase additional ADSs) to be issued to the Representative in connection with this offering.

Except as otherwise indicated:

• all information in this prospectus reflects our 50 for 1 Share Split; and

• references to our articles of association in this prospectus, unless the context provides otherwise, refer to our amended and restated articles of association as currently expected to be in force immediately after the completion of this offering.

10

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table summarizes our consolidated financial data. We have derived the following statements of operations data for the years ended December 31, 2020 and 2019 and balance sheet data as of December 31, 2020 and 2019 from our audited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future. The following summary financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this prospectus.

Our financial statements included in this prospectus were prepared in accordance with IFRS, as issued by the IASB.

Year Ended December 31, | ||||||

U.S. dollars in thousands, except share and per share data | 2020 | 2019 | ||||

Research and development expenses | 366 |

| 184 |

| ||

Sales and marketing expenses | 348 |

| 392 |

| ||

General and administrative expenses | 1,104 |

| 1,370 |

| ||

Total operating expenses | 1,818 |

| 1,946 |

| ||

Operating loss | (1,818 | ) | (1,946 | ) | ||

Financial expenses | (151 | ) | (83 | ) | ||

Loss before income tax | (1,969 | ) | (2,029 | ) | ||

Income tax | 1 |

|

| |||

Loss on conversion of debt |

|

|

|

| ||

Net loss | �� | (1,970) |

| (2,029 | ) | |

Other comprehensive loss: |

|

| ||||

Exchange differences on translation | 1,397 |

| 74 |

| ||

Comprehensive loss | (573 | ) | (1,955 | ) | ||

Basic and diluted net loss per common share | (0.06 | ) | (0.06 | ) | ||

Weighted average common shares used in computing basic and diluted net loss per common share | 35,194,844 |

| 31,609,746 |

| ||

As of December 31, | ||||||||

U.S. dollars in thousands | 2020 | 2019 | ||||||

Balance Sheet Data: |

|

|

|

| ||||

Cash and cash equivalents | $ | 10,734 |

| $ | 11,702 |

| ||

Total assets |

| 12,699 |

|

| 13,576 |

| ||

Total non-current liabilities |

| (1,319 | ) |

| (1,321 | ) | ||

Accumulated deficit |

| (6,036 | ) |

| (4,077 | ) | ||

Total shareholders’ equity |

| 10,795 |

|

| 11,357 |

| ||

11

An investment in our securities involves a high degree of risk. We operate in a dynamic and rapidly changing industry that involves numerous risks and uncertainties. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including the audited consolidated financial statements and the related notes included elsewhere in this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding whether to invest in our securities. If any of the risks discussed below actually occurs, our business, financial condition, results of operations or cash flows could be materially adversely affected. This could cause the trading price of the ADSs to decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations and the trading price of the ADSs.

Risks Related to Our Financial Position and Capital Requirements

We have not yet generated revenue from sales of our WEC technology or power stations and may never be profitable.

Our ability to become profitable depends upon our ability to generate revenue. To date, we have not generated any revenue from our WEC technology, and we do not know when, or if, we will generate any such revenue. We do not expect to generate significant revenue unless or until we are able to prove the impact and benefits of implementing our WEC technology and then successfully enter into agreements for the sale of our products and services to countries, states and private customers that carry out a transition to an energy production source that is based on our technology. Our ability to generate future revenue from our WEC technology, services or power stations depends heavily on our success in many areas, including but not limited to:

• our ability to enter into and carry out agreements for the sale of our products and services or collaboration agreements;

• our ability to connect to the technology of a country’s national grid or micro grids;

• our ability to enter into long-term contracts for the sale of electricity generated from our WEC technology;

• the implementation of rules or standards by governments and/or by quasi-government agencies regarding the use of alternative sources of clean energy, and specifically, wave energy and our ability to receive feed-in-tariffs for wave energy;

• our ability to obtain financing on terms favorable to us;

• our ability to obtain the necessary permits or regulatory consents, including our ability to enter into concession agreements or other agreements for the use of land and ocean space for the construction and utilization of our WEC technology;

• our ability to protect our intellectual property; and

• business interruptions resulting from a local or worldwide pandemic, such as COVID-19, geopolitical actions, including war and terrorism, or natural disasters.

If we fail to enter agreements for the sale of products and services or collaboration on terms favorable to us, or if such agreements lead to delays or expenses or if payments according to the agreements are delayed or not made at all, it could have a material adverse effect on our business, results and financial position.

We have a history of operating losses and may not achieve or maintain profitability and positive cash flow.

We have incurred net losses since EWP Israel began its operations, and we have incurred net losses of $1.97 million and $2.03 million in our fiscal years ended December 31, 2020 and 2019, respectively. As of December 31, 2020, we had an accumulated deficit of $6.04 million. To date, our activities have consisted primarily of activities related to the development and testing of our technologies and efforts to commercialize our products. Thus, our losses to date have resulted primarily from costs incurred in our research and development programs

12

and from our selling, general and administrative costs. As we continue to develop our proprietary technologies, we expect to continue to have a net use of cash from operating activities unless or until we achieve positive cash flow from the commercialization of our products and services.

We do not know whether we will be able to successfully commercialize our products or whether we can achieve profitability. There is significant uncertainty about our ability to successfully commercialize our products in our targeted markets. Even if we do achieve the commercialization of our products and become profitable, we may not be able to achieve or, if achieved, sustain profitability on a quarterly or annual basis.

Even if this offering is successful, we will need to raise substantial additional funding before we can expect to complete the development of our products and services. This additional financing may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

As of December 31, 2020, our cash and cash equivalents were approximately $10.7 million. Based upon our currently expected level of operating expenditures, we expect that our existing cash and cash equivalents will be sufficient to fund operations through at least the next 15 months, or July 2022. Even if this offering is completed, we will require substantial additional capital to commercialize our products and services (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information). In addition, even if we believe that we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

In addition, our operating plans may change as a result of many factors that may currently be unknown to us, and we may need to seek additional funds sooner than planned. Our future funding requirements will depend on many factors, including but not limited to:

• our research and development efforts, including our ability to finish research and development projects or product development within the allotted or expected timeline;

• the cost, timing and outcomes of seeking to commercialize our products and services in a timely manner;

• the announcement of new products, new developments, services or technological innovations by our competitors in the traditional and renewable energy industry;

• global policies and feed-in-tariffs for wave energy;

• licensing costs and timelines;

• our ability to generate cash flows;

• economic weakness, including inflation, or political instability in particular foreign economies and markets;

• the length of the COVID-19 pandemic and its impact on our research and development, operations and financial condition;

• government regulation in our industry, and more specifically, the costs and timing of obtaining regulatory approval or permits to launch our technology in various geographical markets; and

• the costs of, and timing for, strengthening our manufacturing agreements for production of our WEC technology.

Any additional fundraising efforts may divert our management from its day-to-day activities, which may adversely affect our ability to develop and commercialize our products and services. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all, during or after the COVID-19 pandemic. Moreover, the terms of any financing may adversely affect the holdings or the rights of holders of our securities and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our common shares or the ADSs to decline, even if we believe that the terms of such financing are favorable, or, in the event of an equity financing, may be at a price per ADS lower than the one paid in this offering and could dilute your ownership in our Company. The incurrence

13

of indebtedness could result in increased fixed payment obligations, and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights, limitations on our ability to pay dividends and other operating restrictions that could adversely impact our ability to conduct our business; if we were to be in default of any such contractual limitations, this could further adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable, and we may be required to relinquish rights to some of our technologies or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results and prospects. In addition to the material adverse effects listed above, if our ability to finance our operations on terms and timing favorable to us, this could also result in placing us at a disadvantage against our competitors.

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the development or commercialization, if any, of any products or be unable to expand our operations or otherwise capitalize on our business opportunities, as desired, which could materially affect our business, financial condition and results of operations.

The reduction or elimination of government subsidies, grants and other economic incentives for various renewable energy applications could make it more difficult for us to complete the development of our products and subsequently seek to commercialize them, which, if commercialized, could lead to a reduction in our net sales and harm our financial condition.

The renewable energy industry benefits from and is made more competitive due to various government subsidies, grants, feed-in-tariffs and other economic incentives. The reduction, elimination or expiration of such government subsidies, grants, feed-in-tariffs and other economic incentives for various renewable energy applications in hydropower, solar, wind, biofuel, biomass, geothermal and/or wave/tidal energy, could result in the diminished competitiveness of such alternative energy sources relative to conventional sources of energy. Not only would this negatively affect the growth of that particular renewable energy industry, but it could make it more difficult for us to complete development of our technology and products and subsequently seek to commercialize them, which, if commercialized, could lead to a reduction in our net sales and harm our financial condition.

In addition, a portion of our ongoing and future projects related to developing wave power plants is intended to be partly financed through grants, for example within the framework of the European Commission’s Horizon 2020 program (described below), funding from the Ministry of Energy, or the European Regional Development Fund, or the ERDF. There is no assurance that we will receive a grant or receive the full amount of the grant, especially if there is a very competitive submission process or if we do not fulfill the conditions imposed on us or our projects in connection with the grants received. If we violate any of the conditions stipulated in any of our grant agreements, for example, if we fail to file the requested updates on the development of the project, to keep separate records for our expenses funded by the grant, to observe a grant’s publicity requirements or to meet the timeline proposed in the grant, this may result an obligation to repay the contributions already received.

If we do not receive the full grant within any of our current or future grants, or if we otherwise do not qualify as eligible for future grants or do not receive future grants, even if eligible, or are required to repay grants already received, this could have a material adverse effect on our ongoing and future projects, as well as our business, reputation and financial position.

Our revenues, if any, and efforts to become profitable, may be impacted by our need to pay royalties on government grants and other agreements, which may also include terms subjecting us to penalties if we are default of material terms.

We have received royalty-bearing grants from the Chief Scientist of the Ministry of Energy’s office and a loan agreement with the Management Committee of Jiangsu Changshu High-tech Development Zone, or the Committee, Changshu Shirat Enterprise Management Co. Ltd., or CS, each of which require that we (or our subsidiaries) pay royalties on certain projects (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Financing Activities” for additional information on our loan agreement with the Committee and CS, including the terms of repayment). Pursuant to our agreement with CS, if we default on any payments due under such agreement, we are obligated to pay a default interest rate of 5%, or if such rate is not permissible under Chinese law (the law governing such agreement), at the maxim amount allowed by law.

14

If we are able to generate revenues from the commercialization of our WEC technology, the requirement that we pay royalties on certain projects will impact the amount of revenue that we generate and may delay our efforts to become profitable. In addition, the repayment terms of the agreement with the Committee and CS, and similar terms in future agreements, if any, may also impact our ability to turn revenues, if any, into profit.

Risks Related to Our Intellectual Property

We have filed multiple patent applications and have a number of issued patents. There can be no assurance that any of our patent applications will result in issued patents. As a result, we may not be able to adequately protect our proprietary technology in the marketplace.

We have filed patent applications in the United States, the European Union, or the EU, and Israel and have the ability to file our Patent Cooperation Treaty, or PCT, international patent applications in many countries worldwide. Unless and until our pending patent applications are issued, their protective scope is impossible to determine. Practically, it is impossible to predict whether or how many of our patent applications will result in issued patents. Even if pending applications are issued, they may be issued with coverage significantly narrower than what we currently seek or third parties may challenge their validity.

Even if we are issued patents, because the patent positions of our technology are complex and uncertain, we cannot predict the scope and extent of patent protection for our products.

Any patents that may be issued to us will not ensure the protection of our intellectual property for a number of reasons, including without limitation the following:

• any issued patents may not be broad or strong enough to prevent competition from other products including identical or similar products;

• if we are not issued patents or if issued patents expire, there would be no protections against competitors making generic equivalents;

• there may be prior art of which we are not aware that may affect the validity or enforceability of a patent claim;

• there may be other patents existing in the patent landscape that will affect our freedom to operate;

• if our patents are challenged, a court or relevant tribunal could determine that they are not valid or enforceable;

• a court could determine that a competitor’s technology or product does not infringe our patents even if we believe it does;

• our patents could irretrievably lapse due to failure to pay fees or otherwise comply with regulations, or could be subject to compulsory licensing; and

• if we encounter delays in our development, the period of time during which we could market our products under patent protection would be reduced.

We may not be able to enforce our intellectual property rights throughout the world.

Filing, prosecuting and defending patents on products in all countries throughout the world would be prohibitively expensive, and our intellectual property rights in some countries outside the United States, Europe and Israel can be less extensive than those in the United States, Europe and Israel. In addition, the laws of some foreign countries do not protect intellectual property to the same extent as laws in the United States, Europe and Israel. Consequently, we may not be able to prevent third parties from practicing our inventions in all countries outside the United States, Europe, or Israel, or from selling or importing products made using our inventions in and into the United States or other jurisdictions. Competitors may use our technologies in jurisdictions where we have not obtained patents to develop their own products and further, may export otherwise infringing products to territories where we have patents, but enforcement is not as strong as that in the United States, Europe, or Israel.

15

Many companies have encountered significant problems in protecting and defending intellectual property in foreign jurisdictions. The legal systems of certain countries, particularly in the People’s Republic of China, or China and certain other developing countries, do not favor the enforcement of patents, trade secrets and other intellectual property, which could make it difficult for us to stop the infringement of our patents or marketing of competing products in violation of our proprietary rights generally. To date, we have not sought to enforce any issued patents in these foreign jurisdictions. Proceedings to enforce our patent rights in foreign jurisdictions could result in substantial costs and divert our efforts and attention from other aspects of our business, could put our patents at risk of being invalidated or interpreted narrowly and our patent applications at risk of not issuing and could provoke third parties to assert claims against us. We may not prevail in any lawsuits that we initiate, and the damages or other remedies awarded, if any, may not be commercially meaningful. The requirements for patentability may differ in certain countries, particularly developing countries. Certain countries in Europe and developing countries, including China and India, have compulsory licensing laws under which a patent owner may be compelled to grant licenses to third parties. In those countries, we and our licensors may have limited remedies if patents are infringed or if we or our licensors are compelled to grant a license to a third party, which could materially diminish the value of those patents. This could limit our potential revenue opportunities. Accordingly, our efforts to enforce our intellectual property rights around the world may be inadequate to obtain a significant commercial advantage from the intellectual property that we develop or license.

If we are unable to maintain effective proprietary rights for our products, we may not be able to compete effectively in our markets.