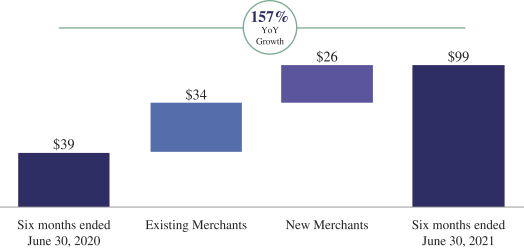

Revenues

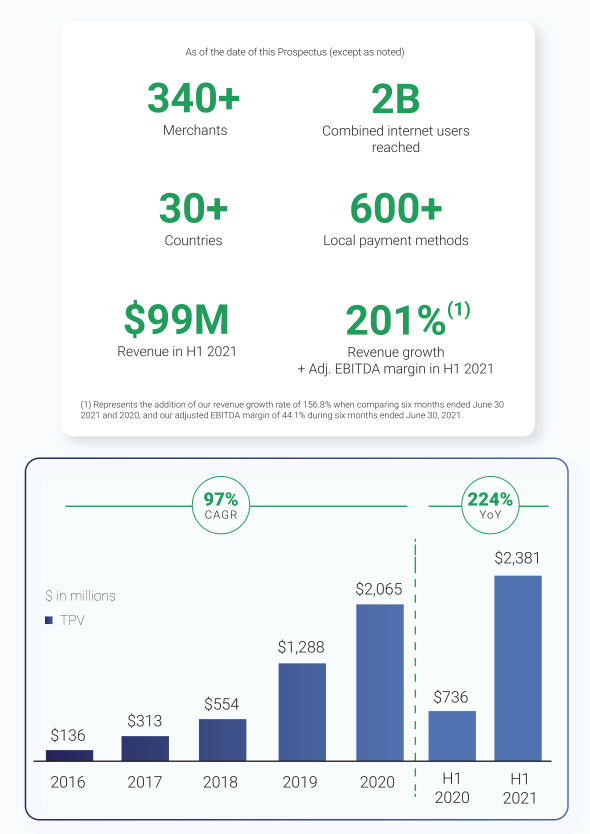

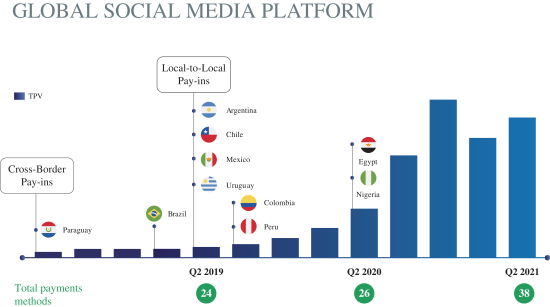

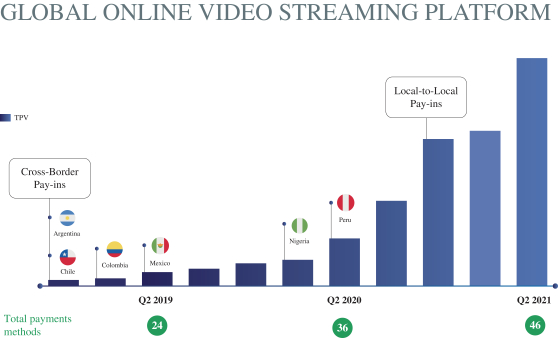

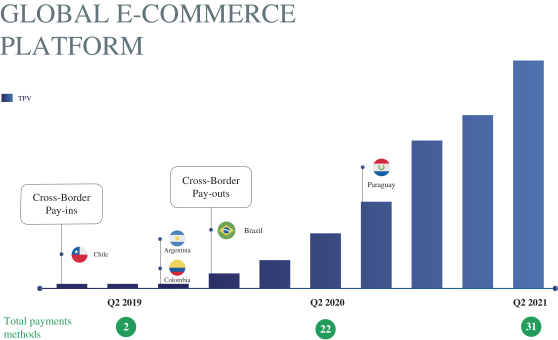

Revenues for the six months ended June 30, 2021 were US$99.2 million, an increase of US$60.6 million, or 156.8%, from US$38.6 million for the six months ended June 30, 2020, which is primarily attributable to the growth in revenues from existing merchants, demonstrated by our NRR of 189% for the six months ended June 30, 2021, equal to US$34.3 million and, to a lesser extent, to the growth in revenues from new merchants, which accounted for 68% of our revenues for the same period of 2020, or US$26.2 million. Growth in our revenues was primarily attributable to the performance and continued growth of our enterprise merchants across most verticals, with accelerated growth in ride hailing, travel, and financial services, and continued growth in advertising, streaming and retail.

Cost of services

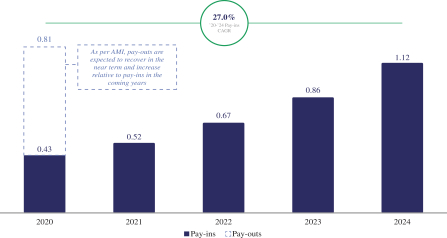

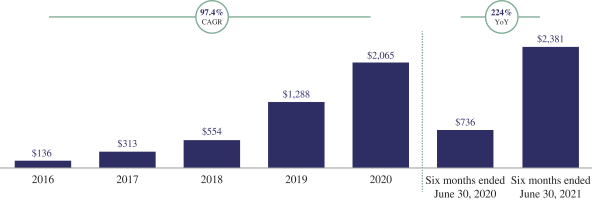

Cost of services for the six months ended June 30, 2021 were US$42.2 million, an increase of US$26.0 million, or 161.6%, from US$16.1 million for the six months ended June 30, 2020, primarily driven by the US$24.6 million increase in processing costs associated with our 224% TPV growth comparing the six months ended June 30, 2021 to the six months ended June 30, 2020, and by a reduction of the average processing cost from 2.1% of TPV in the six months ended June 30, 2020 to 1.8% of TPV in the six months ended June 30, 2021.

Gross profit

For the reasons described above, our gross profit for the six months ended June 30, 2021 was US$57.1 million, an increase of US$34.5 million, or 153.3%, from US$22.5 million for the six months ended June 30, 2020.

Technology and development expenses

Technology and development expenses for the six months ended June 30, 2021 were US$1.1 million, an increase of US$0.4 million, or 53.5%, from US$0.7 million for the six months ended June 30, 2020, which was primarily attributable to an increase in salaries and wages of our full-time equivalents, or FTEs, primarily as a result of higher information technology headcount to support our growth strategy.

Sales and marketing expenses

Sales and marketing expenses for the six months ended June 30, 2021 were US$2.2 million, an increase of US$0.9 million, or 69.1%, from US$1.3 million for the six months ended June 30, 2020, which was primarily attributable to increases of US$0.8 million and US$65 thousand in salaries and wages and marketing FTEs.

General and administrative expenses

General and administrative expenses for the six months ended June 30, 2021 were US$19.2 million, an increase of US$7.0 million, or 57.4%, from US$12.2 million for the six months ended June 30, 2020, which was primarily attributable to expenses related to the secondary portion of our initial public offering of US$3.7 million in the six month period ended June 30, 2021 and an increase in salaries and wages of US$4.6 millions as we doubled our headcount and brought key talent onboard. This increase in salaries and wages was partially offset by a decrease in stock-based compensation year over year of US$4.2 million. Finally, there was an increase of US$1.3 million related to the asset acquisition of PrimeiroPay (US$0.5 million in transaction expenses and US$0.8 million corresponding to the amortization of intangible assets) and an increase in other general and administrative expenses for US$1.6 million.

Net impairment (losses)/gain on financial assets

Net impairment losses on financial assets for the six months ended June 30, 2021 were US$0.2 million, primarily attributable to an increase in allowance for trade receivables for such amount. Net impairment gains on

98