As filed with the Securities and Exchange Commission on September 15, 2022

Registration No. 333-259692

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

To

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

China Jo-Jo Drugstores, Inc.

(Exact name of registrant as specified in its charter)

| Cayman Islands | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

Hai Wai Hai Tongxin Mansion Floor 6

Gong Shu District, Hangzhou City, Zhejiang Province

People’s Republic of China, 310008

+86-571-88219579

(Address and telephone number of registrant’s principal executive offices)

Pryor Cashman LLP

7 Times Square

New York, NY 10036

(212) 326 0199

(Name, address and telephone number of agent for service)

with a copy to:

Elizabeth Fei Chen, Esq.

Michael T. Campoli, Esq.

Pryor Cashman LLP

7 Times Square

New York, NY 10036

(212) 326 0199

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☒

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the post-effective amendment to registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated September 15, 2022

PROSPECTUS

$200,000,000.00

CHINA JO-JO DRUGSTORES, INC.

Ordinary Shares

Preferred Shares

Warrants

Subscription Rights

Debt Securities

Units

We may offer ordinary shares, par value $0.012 per share, preferred shares, warrants, subscription rights, debt securities and/or units of China Jo-Jo Drugstores, Inc. a holding company registered under Cayman Islands Laws from time to time. When we decide to sell securities, we will provide specific terms of the offered securities, including the offering prices of the securities, in a prospectus supplement. The securities offered by us pursuant to this prospectus will have an aggregate public offering price of up to $200,000,000.00.

The securities covered by this prospectus may be offered and sold from time to time in one or more offerings, which may be through one or more underwriters, dealers and agents, or directly to the purchasers. The names of any underwriters, dealers or agents, if any, will be included in a supplement to this prospectus.

This prospectus describes some of the general terms that may apply to these securities and the general manner in which they may be offered. The specific terms of any securities to be offered, and the specific manner in which they may be offered, will be described in one or more supplements to this prospectus. A prospectus supplement may also add, update or change information contained in this prospectus.

All references to “we,” “us,” “our,” “the Company,” “CJJD,” or similar terms used in this prospectus refer to China Jo-Jo Drugstores, Inc., a Cayman Islands exempted company with limited liability, including its consolidated wholly-owned subsidiaries, excluding the variable interest entities (“VIEs”) and the VIEs’ subsidiaries, unless the context otherwise indicates.

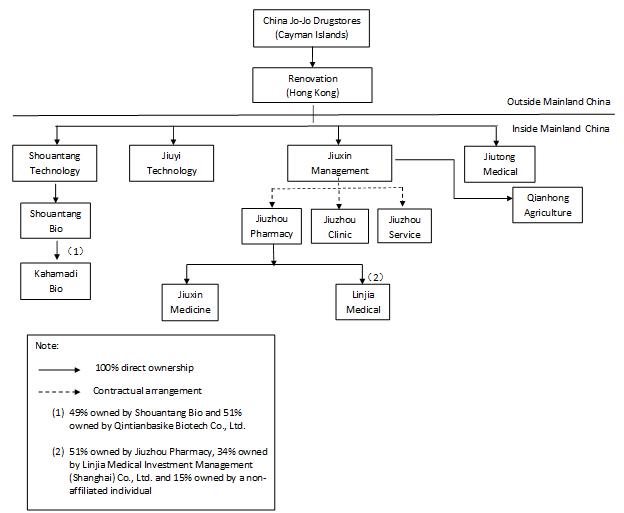

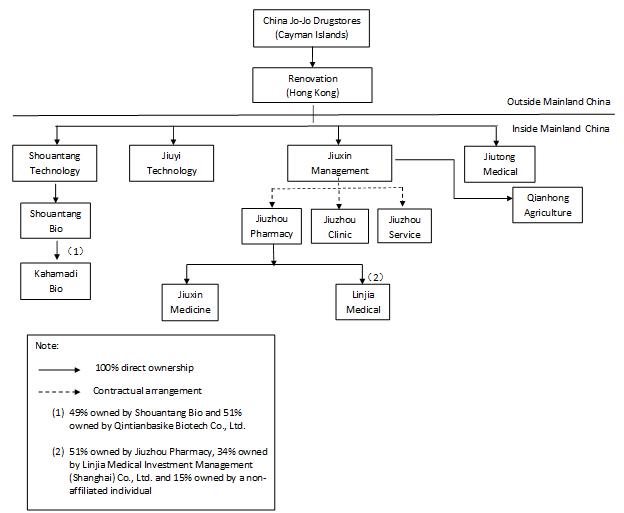

“WFOEs” or “PRC Subsidiaries,” which are wholly foreign owned entities and are corporations organized under the laws of the PRC which are wholly owned by us, through our subsidiaries. Our WFOEs are Zhejiang Jiuxin Investment Management Co., Ltd. (“Jiuxin Management”), Zhejiang Shouantang Medical Technology Co., Ltd. (“Shouantang Technology”) and Hangzhou Jiutong Medical Technology Co., Ltd (“Jiutong Medical”), and Hangzhou Jiuyi Medical Technology Co. Ltd. (“Jiuyi Technology”).

“VIE” or “consolidated VIE” is a variable interest entity whose financial statements are included in our consolidated financial statements as a result of a series of agreements which give us, through our WFOE, the ability to conduct the operations and retain economic benefits. The VIEs are Hangzhou Jiuzhou Grand Pharmacy Chain Co., Ltd. (“Jiuzhou Pharmacy”) (including its subsidiaries and controlled entities), Hangzhou Jiuzhou Clinic of Integrated Traditional and Western Medicine (“Jiuzhou Clinic”) and Hangzhou Jiuzhou Medical and Public Health Service Co., Ltd. (“Jiuzhou Service”) (collectively, “VIE Entities”, or “VIEs”).

Our ordinary shares are traded on the Nasdaq Capital Market under the symbol “CJJD”. On September 14, 2022, the last reported sale price for our ordinary shares was $2.24 per share. Pursuant to General Instruction I.B.5. of Form F-3, in no event will we sell the securities covered hereby in a public primary offering with a value exceeding more than one-third of the aggregate market value of our voting and non-voting common equity held by non-affiliates in any 12-month period so long as the aggregate market value of our outstanding voting and non-voting common equity held by non-affiliates remains below $75,000,000. During the 12 calendar months prior to and including the date of this prospectus, we have not offered or sold any securities pursuant to General Instruction I.B.5 of Form F-3.

We raised capital of $17.5 million in our IPO in April 2010. In addition, we raised capital for a total amount of $33.648 million from 2015 to 2020 through various financings. Renovation Investment (HK) Co., Ltd. (“Renovation”), our Hong Kong subsidiary, received funds from our investors in these financings. After receiving the proceeds, Renovation typically invested these funds into Jiuxin Management, a WFOE, which then exchanged the currency of the proceeds from U.S. dollar into Chinese Yuan (“RMB”) upon the approval from local banks. Jiuxin Management then distributed the RMB as loans to the operating entities including Jiuzhou Pharmacy, Jiuxin Medicine, Jiuzhou Service and Jiuzhou Clinic, which are the consolidated VIEs.

Additionally, Jiuxin Medicine is the major supplier to Jiuzhou Pharmacy and Jiuzhou Pharmacy transfers funds to pay off the debts owed to Jiuxin Medicine as a result of merchandise purchases. In the last three fiscal years, the annual amount of purchases by Jiuxin Medicine from Jiuzhou Pharmacy was $58,575,861 in the fiscal year of 2020, $73,239,387 in the fiscal year of 2021 and $80,712,044 in the fiscal year of 2022. Additional transfers between other VIEs and subsidiaries are as below:

| | | | | Amount | |

| Transfer from | | Transfer to | | 2020 | | | 2021 | | | 2022 | |

| Renovation | | Jiuxin Management | | $ | 8,705,000 | | | $ | 9,000,000 | | | $ | - | |

| Jiuxin Management | | Jiuzhou Pharmacy | | | 574,248 | | | | 1,860,573 | | | | 582,736 | |

| Jiuxin Management | | Jiuxin Medicine | | | - | | | | 2,622,495 | | | | 779,059 | |

| Jiuxin Management | | Qianhong Agriculture | | | 37,083 | | | | 31,433 | | | | 30,496 | |

| Jiuzhou Pharmacy | | Jiuzhou Service | | | 420,810 | | | | 425,345 | | | | 342,822 | |

All the sales and purchases between Jiuxin Medicine and Jiuzhou Pharmacy are eliminated as internal transactions. Furthermore, the ending balances owed to/from the VIEs are eliminated in the balance sheets.

As of the date of this prospectus, the Company did not have any distributions to our investors through either our holding company, subsidiaries or the consolidated VIEs, and does not intend to distribute any dividends in any forms in the near future. Please refer to “condensed consolidating schedule” and “consolidated financial statements” in Company’s annual report on Form 20-F filed with SEC on July 28, 2022, which is incorporated by reference to this registration statement.

Investing in these securities involves certain risks. China Jo-Jo Drugstores, Inc., offering securities under this prospectus, is not a Chinese operating company but a holding company incorporated in the Cayman Islands. The Cayman Islands holding company has no material operations of its own. We conduct a substantial majority of our operations through the operating entities established in the People’s Republic of China, or the PRC, primarily the variable interest entities and their subsidiaries, collectively, the VIEs. We do not have any equity ownership of the VIEs, instead we receive the economic benefits of the VIEs’ business operations through certain contractual arrangements and consolidate them into our financial statements under U.S. GAAP as a primary beneficiary. We, through contractual agreements, establish the VIE structure to provide exposure to foreign investment in such Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies, and that investors may never directly hold equity interests in the Chinese operating entities. Our securities offered in this prospectus are securities of our Cayman Islands holding company that maintains service agreements with the associated operating companies.

Additionally, we are subject to certain legal and operational risks associated with the VIEs’ operations in China, the risk being discussed could result in the value of our securities to significantly decline or be worthless. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in the VIEs’ operations, significant depreciation of the value of our ordinary shares, or a complete hindrance of our ability to offer or continue to offer our securities to investors. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact of such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. or other foreign exchange. These contractual agreements have not been tested in a court of law. The Chinese regulatory authorities could disallow our structure, which could result in a material change in our operations and the value of our securities could decline or become worthless. In addition, conducting the operations through contractual agreements may not be as effective as direct equity ownership, the VIEs and their shareholders may be unwilling or unable to perform its contractual obligations under our commercial agreements. Consequently, we would not be able to conduct our operations in the manner currently planned. Although we have entered into a series of agreements that provide us with substantial ability to manage the VIEs, we may not succeed in enforcing our rights under them insofar as our contractual rights and legal remedies under PRC law are inadequate. In addition, the VIEs may seek to renew their agreements on terms that are disadvantageous to us. If we are unable to renew these agreements on favorable terms when these agreements expire or enter into similar agreements with other parties, our business may not be able to operate or expand, and our operating expenses may significantly increase. Please carefully consider the “Risk Factors” contained in, or incorporated by reference into, this prospectus, including the “Risks Related to Our Corporate Structure and Doing Business in the PRC” starting on page 16 as well as the “Risk Factors” in any applicable prospectus supplement, for a discussion of the factors you should consider carefully before deciding to purchase these securities.

The PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of currency out of China. The majority of the VIEs’ and their subsidiaries’ income is received in RMB and shortages in foreign currencies may restrict our ability to pay dividends or other payments, or otherwise satisfy our foreign currency denominated obligations, if any. Relevant PRC laws and regulations permit the PRC companies to pay dividends only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Additionally, the Company’s PRC subsidiary and the VIE can only distribute dividends upon approval of the shareholders after they have met the PRC requirements for appropriation to the statutory reserves. As a result of these and other restrictions under the PRC laws and regulations, our PRC subsidiaries and the VIEs are restricted to transfer a portion of their net assets to the Company either in the form of dividends, loans or advances. To the extent cash or assets in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds or assets may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of you, your subsidiaries, or the consolidated VIEs by the PRC government to transfer cash or assets. Please see “Cash Transfer and Dividend Payment” and “Risk Factor - We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the Renminbi, especially with respect to foreign exchange transactions” for detailed discussion.

On May 20, 2020, the U.S. Senate passed the Holding Foreign Companies Accountable Act requiring a foreign company to certify it is not owned or controlled by a foreign government if the PCAOB is unable to audit specified reports because the company uses a foreign auditor not subject to PCAOB inspection. If the PCAOB is unable to inspect the Company’s auditors for three consecutive years, the issuer’s securities are prohibited to trade on a U.S. stock exchange. On December 2, 2020, the U.S. House of Representatives approved the Holding Foreign Companies Accountable Act. On December 18, 2020, the Holding Foreign Companies Accountable Act was signed into law. Pursuant to the Holding Foreign Companies Accountable Act, the PCAOB issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the PRC because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. On August 26, 2022, the PCAOB announced and signed a Statement of Protocol (the “Protocol”) with the China Securities Regulatory Commission and the Ministry of Finance of the People’s Republic of China. The Protocol provides the PCAOB with: (1) sole discretion to select the firms, audit engagements and potential violations it inspects and investigates, without any involvement of Chinese authorities; (2) procedures for PCAOB inspectors and investigators to view complete audit work papers with all information included and for the PCAOB to retain information as needed; (3) direct access to interview and take testimony from all personnel associated with the audits the PCAOB inspects or investigates. Our auditor is headquartered in Irvine, California and will be inspected by the PCAOB on a regular basis. Our auditor is not subject to the Determination. Our auditor is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess our auditor’s compliance with the applicable professional standards. In addition, our auditor, is also subject to inspection by PCAOB. The recent developments would add uncertainties to our offering, and we cannot assure you whether Nasdaq or regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach or experience as it relates to the audit of our financial statements. It remains unclear what the SEC’s implementation process related to the March 2021 interim final amendments will entail or what further actions the SEC, the PCAOB or Nasdaq will take to address these issues and what impact those actions will have on U.S. companies that have significant operations in the PRC and have securities listed on a U.S. stock exchange (including a national securities exchange or over-the-counter stock market). In addition, the March 2021 interim final amendments and any additional actions, proceedings, or new rules resulting from these efforts to increase U.S. regulatory access to audit information could create some uncertainty for investors, the market price of our ordinary shares could be adversely affected, and we could be delisted if we and our auditor are unable to meet the PCAOB inspection requirement or being required to engage a new audit firm, which would require significant expense and management time.

Neither the Securities and Exchange Commission nor any state or other securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated September [ ], 2022

CHINA JO-JO DRUGSTORES, INC.

Table of Contents

PROSPECTUS SUMMARY

All references to “we,” “us,” “our,” “the Company,” “CJJD,” or similar terms used in this prospectus refer to China Jo-Jo Drugstores, Inc., a Cayman Islands exempted company with limited liability, including its consolidated wholly-owned subsidiaries, excluding the variable interest entities (“VIEs”) and the VIEs’ subsidiaries, unless the context otherwise indicates.

“PRC” or “China” refers to the mainland of People’s Republic of China, and include, for the purpose of this prospectus, Hong Kong.

“PRC Counsel” refers to Zhejiang Minhe Law Firm.

“RMB” or “Renminbi” refers to the legal currency of China.

“VIE” or “consolidated VIE” is a variable interest entity whose financial statements are included in our consolidated financial statements as a result of a series of agreements which give us, through our WFOE, the ability to conduct the operations and retain economic benefits. The VIEs are Hangzhou Jiuzhou Grand Pharmacy Chain Co., Ltd. (“Jiuzhou Pharmacy”) (including its subsidiaries and controlled entities), Hangzhou Jiuzhou Clinic of Integrated Traditional and Western Medicine (“Jiuzhou Clinic”) and Hangzhou Jiuzhou Medical and Public Health Service Co., Ltd. (“Jiuzhou Service”) (collectively, “VIE Entities”, or “VIEs”).

“WFOE” or “PRC Subsidiary,” which is a wholly foreign owned entity and is a corporation organized under the laws of the PRC which is wholly owned by us, through our subsidiaries. Our WFOEs are Zhejiang Jiuxin Investment Management Co., Ltd. (“Jiuxin Management”), Zhejiang Shouantang Medical Technology Co., Ltd. (“Shouantang Technology”) and Hangzhou Jiutong Medical Technology Co., Ltd (“Jiutong Medical”), Hangzhou Jiuyi Medical Technology Co. Ltd. (“Jiuyi Technology”).

“$,” “US$” or “U.S. Dollars” refers to the legal currency of the United States.

Our reporting currency is the US$. The functional currency of our entities located in China is the RMB. For the entities whose functional currency is the RMB, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. As a result, amounts relating to assets and liabilities reported on the statements of cash flows may not necessarily agree with the changes in the corresponding balances on the balance sheets. Translation adjustments resulting from the process of translating the local currency financial statements into US$ are included in determining comprehensive income/loss. Transactions denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing on the transaction dates. Assets and liabilities denominated in foreign currencies are translated into the functional currencies at the exchange rates prevailing at the balance sheet date with any transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

The following summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our securities. You should read this entire prospectus carefully, including the section entitled “Risk Factors”, and our consolidated financial statements and the related notes thereto (as well as the related “Management’s Discussion and Analysis of Financial Condition and Results of Operations”), in each case, included in or incorporated by reference into this prospectus, before making an investment decision.

Overview

China Jo-Jo Drugstores, Inc., offering securities under this prospectus, is not a Chinese operating company but a holding company incorporated in the Cayman Islands. The Cayman Islands holding company has no material operations of its own. We conduct a substantial majority of our operations through our operating entities established in the PRC, including the VIEs. We do not have any equity ownership in the business of the VIEs. Instead, we receive the economic benefits of the VIEs’ business operations through certain contractual arrangements and therefore we incorporated these VIEs into our financial statements in conformity with U.S. GAAP as a primary beneficiary. The VIE structure is used to provide contractual exposure to foreign investment in Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies, and that investors may never directly hold equity interests in the Chinese operating entities.

Additionally, we are subject to certain legal and operational risks associated with the VIEs’ operations in China. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in the VIEs’ operations, significant depreciation of the value of our ordinary shares, or a complete hindrance of our ability to offer or continue to offer our securities to investors. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact of such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. or other foreign exchange. The Chinese regulatory authorities could disallow our structure, which could result in a material change in our operations and the value of our securities could decline or become worthless. Our current corporate structure and business operations and the market price of our ordinary shares may be affected by the newly enacted PRC Foreign Investment Law which does not explicitly classify whether VIEs that we have contractual arrangements with would be deemed as foreign-invested enterprises if they are ultimately “controlled” by foreign investors. Our securities offered in this prospectus are shares of our Cayman Islands holding company, and, as a shareholder of the Company, you will have an equity interest in an entity which does not have ownership of the VIEs, which generates a significant portion of the consolidated revenue, but you will never own any equity interest in any of the VIEs. Because we do not have ownership of the VIEs, we must rely on the shareholders of these VIEs to comply with their contractual obligations. The approval of PRC regulatory agencies may be required in connection with this offering under a PRC regulation or any new laws, rules or regulations to be enacted, and if required, we may not be able to obtain such approval.

We, through the operating VIEs in China, including Hangzhou Jiuzhou Grand Pharmacy Chain Co., Ltd. (“Jiuzhou Pharmacy”) (including its subsidiaries and controlled entities), Hangzhou Jiuzhou Clinic of Integrated Traditional and Western Medicine (“Jiuzhou Clinic”) and Hangzhou Jiuzhou Medical and Public Health Service Co., Ltd. (“Jiuzhou Service”, together with Jiuzhou Pharmacy and Jiuzhou Clinic, the “VIEs”), operate as a retailer and distributor of pharmaceutical and other healthcare products typically found in retail pharmacies in the PRC. Prior to acquiring Zhejiang Jiuxin Medicine Co., Ltd. (“Jiuxin Medicine”) in August 2011, we, through the VIEs, were primarily a retail pharmacy operator. Through the WOFEs and VIE entities, we currently have one hundred and nine (109 store locations under the store brand “Jiuzhou Grand Pharmacy” in Hangzhou city. Jiuzhou Pharmacy acquired four single drugstores in fiscal 2021. After the acquisition, we liquidated them and then opened four new stores with the four licenses of local government medical insurance reimbursement program. During the year ended March 31, 2021, we sold Lin’An Jiuzhou Pharmacy Co., Ltd (“Lin’An Jiuzhou”), which runs ten stores in Lin’an City, to local investors for total proceeds of $129,586. On the other side, Jiuzhou Pharmacy have been concentrating on new stores within the Hangzhou metropolitan area and opened eleven stores in the fiscal year 2021. Amidst the COVID-19 outbreak, the VIEs experienced a decline in the number of customer visits during the first three months of calendar year 2020 due to the implementation of the lockdown policy in China. However, as China has been able to control the spread of COVID-19, the negative impacts have become limited.

The VIEs currently operate in four business segments in China: (1) retail drugstores, (2) online pharmacy, (3) wholesale business selling products similar to those the VIEs carry in our pharmacies, and (4) farming and selling herbs used for traditional Chinese medicine (“TCM”). All of the above business are performed in China with no other international sales.

The VIEs’ stores provide customers with a wide variety of pharmaceutical products, including prescription and over-the-counter (“OTC”) drugs, nutritional supplements, TCM, personal and family care products, and medical devices, as well as convenience products, including consumable, seasonal, and promotional items. Additionally, the VIEs have doctors licensed in both western medicine and TCM on site for consultation, examination and treatment of common ailments at scheduled hours. Four (4) stores of the VIEs have adjacent medical clinics offering urgent care (to provide treatment for minor ailments such as sprains, minor lacerations, and dizziness that can be treated on an outpatient basis), TCM (including acupuncture, therapeutic massage, and cupping) and minor outpatient surgical treatments (such as suturing). Our stores vary in size, but presently average close to 200 square meters per store. The VIEs attempt to tailor each store’s product offerings, physician access, and operating hours to suit the community where the store is located.

We operate our pharmacies (including the medical clinics) through the following companies in China that we have contractual arrangements with:

| | ● | Jiuzhou Pharmacy operates “Jiuzhou Grand Pharmacy” stores; |

| | ● | Jiuzhou Clinic operates one (1) of our three (3) medical clinics; and |

| | ● | Jiuzhou Service operates our other medical clinics. |

Jiuzhou Pharmacy also offers OTC drugs and nutritional supplements for sale through a website (www.dada360.com). For the fiscal year ended March 31, 2021, retail revenue, including pharmacies, medical clinics accounted for approximately 57.2% of the VIEs’ total revenue, while online pharmacy revenue accounted for 16.8% of the VIEs’ total revenue.

Since August 2011, we have operated a wholesale business through Zhejiang Jiuxin Medicine Co., Ltd. (“Jiuxin Medicine”), distributing third-party pharmaceutical products (similar to those carried by our pharmacies) primarily to trading companies throughout China. Jiuxin Medicine is wholly owned by Jiuzhou Pharmacy. For the fiscal year ended March 31, 2021, wholesale revenue accounted for approximately 26.0% of our total revenue.

We also have an herb farming business cultivating and wholesaling herbs used for TCM. This business is conducted through Hangzhou Qianhong Agriculture Development Co., Ltd. (“Qianhong Agriculture”), a wholly-owned subsidiary. During the fiscal year ended March 31, 2021, Qianhong Agriculture generated no revenue from our herb farming business.

Redomicile Merger

At 9:00 a.m., Eastern Time, on July 30, 2021, China Jo-Jo Drugstores, Inc., a Nevada corporation (“Predecessor CJJD”), completed a corporate reorganization (the “Reorganization” or “Redomicile Merger”), resulting in the Company becoming the publicly held parent company of Predecessor CJJD, with Predecessor CJJD merged with and into the Company, pursuant to the Agreement and Plan of Merger, dated as of May 14, 2021, by and between Predecessor CJJD and the Company (the “Merger Agreement”). The Merger Agreement was approved by the stockholders of Predecessor CJJD at a special meeting of stockholders held on July 19, 2021. The Merger Agreement was filed with the Registration Statement on Form F-4 that we filed with the United States Securities and Exchange Commission (the “SEC” or the “Commission”) on May 15, 2021 which was declared effective by the SEC on May 28, 2021. On July 30, 2021, Predecessor CJJD issued a press release announcing the completion of the Reorganization.

Prior to the Reorganization, shares of Predecessor CJJD’s common stock were registered pursuant to Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and listed on the NASDAQ Capital Market under the symbol “CJJD.” As a result of the Reorganization, each issued and outstanding share of Predecessor CJJD’s common stock was converted into the right to receive one ordinary share of our company, which shares were issued by us as part of the Reorganization. On July 30, 2021, Predecessor CJJD filed a Form 15 with the SEC to terminate the registration of the shares of its common stock and suspend its reporting obligations under Sections 13 and 15(d) of the Exchange Act.

Our ordinary shares were approved for listing on the NASDAQ Capital Market and began trading under the symbol “CJJD,” the same symbol under which the shares of Predecessor CJJD’s common stock previously traded, on July 30, 2021. On August 9, 2021, we filed a Form 8-A to register our ordinary shares under Section 12(b) of the Exchange Act.

As of July 30, 2021, each of the directors and officers of Predecessor CJJD immediately prior to the Reorganization had been appointed to the same position(s) with the Company, with the directors to serve until the earlier of the next annual meeting of our shareholders or until their successors are elected or appointed (or their earlier death, disability or retirement).

Following the completion of the Reorganization and as of the date of this prospectus, the rights of shareholders of the Company are governed by our Second Amended and Restated Memorandum and Articles of Association.

As mentioned above, our securities offered in this prospectus are securities of our Cayman Islands holding company that maintains service agreements with the associated operating companies. Investors may never directly hold equity interests in our Chinese operating entities.

On December 24, 2021, the CSRC released the Administrative Provisions of the State Council Regarding the Overseas Issuance and Listing of Securities by Domestic Enterprises (Draft for Comments) (the “Draft Administrative Provisions”) and the Measures for the Overseas Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing Measures”, collectively with the Draft Administrative Provisions, the “Draft Rules Regarding Overseas Listing”), both of which have a comment period that expires on January 23, 2022. The Draft Rules Regarding Overseas Listing lay out the filing regulation arrangement for both direct and indirect overseas listing, and clarify the determination criteria for indirect overseas listing in overseas markets.

The Draft Rules Regarding Overseas Listing stipulate that the Chinese-based companies, or the issuer, shall fulfill the filing procedures within three working days after the issuer makes an application for initial public offering and listing in an overseas market. The required filing materials for an initial public offering and listing shall include but not limited to: record-filing report and related undertakings; regulatory opinions, record-filing, approval and other documents issued by competent regulatory authorities of relevant industries (if applicable); and security assessment opinion issued by relevant regulatory authorities (if applicable); PRC legal opinion; and prospectus. In addition, an issuer who issues overseas listed securities after overseas listing shall, within three working days after the completion of the issuance, submit required filing materials to the CSRC, including but not limited to: filing report and relevant commitment; and domestic legal opinion. Furthermore, an overseas offering and listing is prohibited under any of the following circumstances: (1) if the intended securities offering and listing is specifically prohibited by national laws and regulations and relevant provisions; (2) if the intended securities offering and listing may constitute a threat to or endangers national security as reviewed and determined by competent authorities under the State Council in accordance with law; (3) if there are material ownership disputes over the equity, major assets, and core technology, etc. of the issuer; (4) if, in the past three years, the domestic enterprise or its controlling shareholders or actual controllers have committed corruption, bribery, embezzlement, misappropriation of property, or other criminal offenses disruptive to the order of the socialist market economy, or are currently under judicial investigation for suspicion of criminal offenses, or are under investigation for suspicion of major violations; (5) if, in past three years, directors, supervisors, or senior executives have been subject to administrative punishments for severe violations, or are currently under judicial investigation for suspicion of criminal offenses, or are under investigation for suspicion of major violations; (6) other circumstances as prescribed by the State Council. The Administration Provisions defines the legal liabilities of breaches such as failure in fulfilling filing obligations or fraudulent filing conducts, imposing a fine between RMB 1 million and RMB 10 million, and in cases of severe violations, a parallel order to suspend relevant business or halt operation for rectification, revoke relevant business permits or operational license.

As of the date of this prospectus, the Draft Rules Regarding Overseas Listing have not been promulgated, and as advised by our PRC Counsel, we are not required to obtain any permissions or approvals from the government of China for any offering pursuant to this prospectus. The final version of the Draft Rules Regarding Overseas Listing are expected to be adopted in later 2022, and as advised by the PRC counsel, our subsidiaries and/or VIEs will then be required to comply with the filing requirements or procedures set forth in the Draft Rules Regarding Overseas Listing assuming the final rules contain no changes comparing to the draft rules previously circulated for comments.

On December 28, 2021, the Cyberspace Administration of China, or the “CAC”, and other PRC authorities promulgated the Cybersecurity Review Measures, which took effect on February 15, 2022. The Cybersecurity Review Measures further restates and expands the applicable scope of the cybersecurity review in effect. We do not believe we are among the “operator of critical information infrastructure” or “data processor” as mentioned above. Based on the above and our understanding of the Chinese laws and regulations currently in effect as of the date of this prospectus, we are not required to submit an application to the CSRC or the CAC for the approval of this offering and the listing and trading of our securities on the Nasdaq. However, the revised draft of the Measures for Cybersecurity Review is in the process of being formulated and the Opinions remain unclear on how it will be interpreted, amended and implemented by the relevant PRC governmental authorities. Thus, it is still uncertain how PRC governmental authorities will regulate overseas listing in general and whether we are required to obtain any permissions or specific regulatory approvals. Furthermore, if the CSRC or other regulatory agencies later promulgate new rules or explanations requiring that we obtain their permissions or approvals for this offering and any follow-on offering, we may be unable to obtain such permissions or approvals which could significantly limit or completely hinder our ability to offer or continue to offer securities to our investors. In the event that the CSRC approval or any regulatory approval is required for this offering, or if the CSRC or any other PRC government authorities promulgates any new laws, rules or regulations or any interpretation or implements rules before our listing that would require us to obtain the CSRC or any other governmental approval for this offering, we may face sanctions by the CSRC or other PRC regulatory agencies for failure to seek CSRC approval for this offering. These sanctions may include fines and penalties on our operations in the PRC, limitations on our operating privileges in the PRC, delays in or restrictions on the repatriation of the proceeds from this offering into the PRC, restrictions on or prohibition of the payments or remittance of dividends by our PRC subsidiary, or other actions that could have a material and adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ordinary shares. The CSRC or other PRC regulatory agencies may also take actions requiring us, or making it advisable for us, to halt this offering before the settlement and delivery of the securities that we are offering. Consequently, if you engage in market trading or other activities in anticipation of and prior to the settlement and delivery of the securities we are offering, you would be doing so at the risk that the settlement and delivery may not occur. Any uncertainties or negative publicity regarding such approval requirements could have a material adverse effect on our ability to complete this offering or any follow-on offering of our securities or the market for and market price of our ordinary shares.

According to PRC Counsel, neither the Company, nor any of its subsidiaries, including the VIEs are currently required to obtain any permissions or approvals from Chinese authorities, including the China Securities Regulatory Commission, or CSRC, or Cybersecurity Administration Committee, or CAC, to list on U.S exchanges or issue securities to foreign investors. We have not been denied any permissions or approvals either as of the date of this prospectus. However, if we were required to obtain any permissions or approvals in the future and were denied permissions from Chinese authorities to list on U.S. exchanges or issue securities to foreign investors, we will not be able to continue to list on U.S. exchanges or issue securities to foreign investors, which would materially affect the interest of the investors. It is uncertain when and whether the Company will be required to obtain any permissions or approvals from the PRC government to list on U.S. exchanges or issue securities to foreign investors in the future, and even when such permissions or approvals are obtained, whether they will be denied or rescinded. Although the Company is currently not required to obtain permissions or approvals from any of the PRC central or local government and has not received any denial to list on the U.S. exchange or issue securities to foreign investors, the VIEs’ operations could be adversely affected, directly or indirectly, by changes on any existing or promulgation of any future laws and regulations relating to its business or industry. In addition, based on the management belief, the Company has also have obtained all the requisite permissions and approvals for operating the business.

Our Current Corporate Structure

The following diagram illustrates our current corporate structure as of the date of this prospectus:

The table below summarizes the status of the registered capital of our PRC subsidiaries, controlled companies and joint ventures as of the date of this prospectus:

| Entity Name | | Entity Type | | Registered

Capital | | Registered

Capital Paid | | Due Date for

Unpaid Registered

Capital |

| Jiutong Medical | | Subsidiary | | USD 2,600,000 | | USD 2,600,000 | | N/A |

| Jiuzhou Clinic | | VIE | | N/A | | N/A | | N/A |

| Jiuzhou Pharmacy | | VIE | | USD 733,500 | | USD 733,500 | | N/A |

| Jiuzhou Service | | VIE | | USD 73,350 | | USD 73,350 | | N/A |

| Jiuxin Management | | Subsidiary | | USD 24,500,000 | | USD 23,500,000 | | N/A |

| Jiuxin Medicine | | Subsidiary of the VIE | | USD 1,564,000 | | USD 1,564,000 | | N/A |

| Qianhong Agriculture | | Subsidiary | | USD 1,497,000 | | USD 1,497,000 | | N/A |

| Shouantang Technology | | Subsidiary | | USD 11,000,000 | | USD 11,000,000 | | N/A |

| Shouantang Bio | | Subsidiary | | USD 162,900 | | USD 162,900 | | N/A |

| Jiuyi Technology | | Subsidiary | | USD 5,000,000 | | USD 2,500,000 | | September 25, 2026 |

| Linjia Medical* | | Subsidiary of the VIE | | USD 2,979,460 | | USD 1,489,730 | | N/A |

| Kahamadi Bio** | | Joint Venture | | USD 1,524,540 | | USD 259,172 | | N/A |

| * | Linjia Medical is 51% held by Jiuzhou Pharmacy, 34% held by Linjia Medical Investment Management (Shanghai) Co., Ltd., whose shareholders are not affiliated to the Company, and 15% held by a non-affiliated individual. |

| ** | Kahamadi Bio is 49% held by Shouantang Bio and 51% held by Qintianbasike Biotech Co., Ltd, whose shareholders are not affiliated to the Company. |

Set forth below is selected consolidating statements of income and cash flows for the years ended March 31, 2022, 2021 and 2020 and selected balance sheet information as of March 31, 2022, 2021 and 2020 showing financial information for CJJD (excluding the VIEs), the VIEs, eliminating entries and consolidated information.

Consolidating Statements of Income Information

| | | Year Ended March 31, 2022 |

| | | PARENT | | | SUBSIDIARIES | | | VIE | | | Eliminations | | | Consolidated | |

| Revenue | | $ | - | | | $ | 181,179 | | | $ | 244,933,524 | | | $ | (80,722,148 | ) | | $ | 164,392,555 | |

| Cost of revenue | | | - | | | | 182,732 | | | | 208,169,174 | | | | (80,478,391 | ) | | | 127,873,515 | |

| Gross profit | | | - | | | | (1,553 | ) | | | 36,764,350 | | | | (243,757 | ) | | | 36,519,040 | |

| Operating Expenses | | | 43,042 | | | | 1,479,243 | | | | 37,583,788 | | | | 106,857 | | | | 39,212,930 | |

| Loss from operations | | | (43,042 | ) | | | (1,480,796 | ) | | | (819,438) | | | | (350,614) | | | | (2,693,890 | ) |

| Other income, net | | | (258 | ) | | | (21,931 | ) | | | 617,439 | | | | - | | | | 595,250 | |

| Provision for income tax | | | - | | | | 247 | | | | 1,099,479 | | | | - | | | | 1,099,726 | |

| Net loss | | $ | (43,300 | ) | | | (1,502,974 | ) | | | (1,301,478 | ) | | | (350,614 | ) | | | (3,198,366 | ) |

| | | Year Ended March 31, 2021 | |

| | | PARENT | | | SUBSIDIARIES | | | VIE | | | Eliminations | | | Consolidated | |

| Revenue | | $ | - | | | $ | 1,693,950 | | | $ | 206,173,492 | | | $ | (74,732,809 | ) | | $ | 133,134,633 | |

| Cost of revenue | | | - | | | | 1,250,742 | | | | 177,441,192 | | | | (74,801,110 | ) | | | 103,890,824 | |

| Gross profit | | | - | | | | 443,208 | | | | 28,732,300 | | | | 68,301 | | | | 29,243,809 | |

| Operating Expenses | | | 3,941,600 | | | | 2,724,339 | | | | 31,569,482 | | | | (154,372 | ) | | | 38,081,049 | |

| Loss from operations | | | (3,941,600 | ) | | | (2,281,131 | ) | | | (2,837,182 | ) | | | 222,673 | | | | (8,837,240 | ) |

| Other income, net | | | 64,090 | | | | (646,415 | ) | | | 467,923 | | | | 607,702 | | | | 493,300 | |

| Provision for income tax | | | - | | | | - | | | | 31,638 | | | | - | | | | 31,638 | |

| Net loss | | $ | (3,877,510 | ) | | $ | (2,927,546 | ) | | | (2,400,897 | ) | | $ | 830,375 | | | $ | (8,375,578 | ) |

| | | Year Ended March 31, 2020 | |

| | | PARENT | | | SUBSIDIARIES | | | VIE | | | Elimination | | | Consolidated | |

| Revenue | | $ | | | | $ | 2,059,685 | | | $ | 175,378,838 | | | $ | (60,110,834 | ) | | $ | 117,327,689 | |

| Cost of revenue | | | - | | | | 1,504,696 | | | | 150,319,467 | | | | (60,022,904 | ) | | | 91,801,259 | |

| Gross profit | | | - | | | | 554,989 | | | | 25,059,371 | | | | (87,930 | ) | | | 25,526,430 | |

| Operating Expenses | | | 34,560 | | | | 1,351,229 | | | | 31,734,804 | | | | (590,421 | ) | | | 32,530,172 | |

| Loss from operations | | | (34,560 | ) | | | (796,240 | ) | | | (6,675,433 | ) | | | 502,491 | | | | (7,003,742 | ) |

| Other income, net | | | 401,158 | | | | (164,693 | ) | | | 916,278 | | | | (590,420 | ) | | | 562,323 | |

| Provision for income tax | | | - | | | | 1 | | | | 16,257 | | | | - | | | | 16,258 | |

| Net loss | | $ | 366,598 | | | $ | (960,934 | ) | | $ | (5,775,412 | ) | | $ | (87,929 | ) | | $ | (6,457,677 | ) |

Consolidating Balance Sheets Information

| | | Year Ended March 31, 2022 |

| | | PARENT | | | SUBSIDIARIES | | | VIE | | | Elimination | | | Consolidated | |

| Total assets | | $ | 46,700 | | | $ | 55,796,336 | | | $ | 90,528,406 | | | $ | (39,987,233 | ) | | $ | 106,384,209 | |

| Total liabilities | | | (48,578,210 | ) | | | 17,576,098 | | | | 107,864,555 | | | | 6,782,980 | | | | 83,645,423 | |

| Current assets | | | 46,700 | | | | 12,676,793 | | | | 71,423,189 | | | | (8,694,788 | ) | | | 75,451,894 | |

| Current liabilities | | | (48,578,210 | ) | | | 17,576,098 | | | | 107,864,555 | | | | (2,414,047 | ) | | | 74,448,396 | |

| Working capital | | | 48,624,910 | | | | (4,899,305 | ) | | | (36,441,366 | ) | | | (6,280,741 | ) | | | 1,003,498 | |

| Accumulated deficit | | | (17,136,455 | ) | | | (5,669,391 | ) | | | (24,496,890 | ) | | | (831,757 | ) | | | (48,134,493 | ) |

| Total equity | | | 48,624,910 | | | | 38,220,238 | | | | (17,336,149 | ) | | | (46,770,213 | ) | | | 22,738,786 | |

| | | Year Ended March 31, 2021 | |

| | | PARENT | | | SUBSIDIARIES | | | VIE | | | Elimination | | | Consolidated | |

| Total assets | | $ | - | | | $ | 57,976,479 | | | $ | 82,863,681 | | | $ | (34,529,529 | ) | | $ | 106,310,631 | |

| Total liabilities | | | (48,668,211 | ) | | | 19,712,130 | | | | 98,304,131 | | | | 12,560,236 | | | | 81,908,286 | |

| Current assets | | | - | | | | 14,880,358 | | | | 61,824,239 | | | | (4,470,354 | ) | | | 72,234,243 | |

| Current liabilities | | | (48,668,211 | ) | | | 19,712,130 | | | | 96,411,862 | | | | (2,557,847 | ) | | | 64,897,934 | |

| Working capital | | | 48,668,211 | | | | (4,831,772 | ) | | | (34,587,623 | ) | | | (1,912,507 | ) | | | 7,336,309 | |

| Accumulated deficit | | | (17,093,153 | ) | | | (4,525,944 | ) | | | (21,987,871 | ) | | | (1,335,406 | ) | | | (44,942,374 | ) |

| Total equity | | | 48,668,211 | | | | 38,264,349 | | | | (15,440,450 | ) | | | (47,089,765 | ) | | | 24,402,345 | |

| | | Year Ended March 31, 2020 | |

| | | PARENT | | | SUBSIDIARIES | | | VIE | | | Elimination | | | Consolidated | |

| Total assets | | $ | - | | | $ | 46,018,763 | | | $ | 72,390,246 | | | $ | (18,892,776 | ) | | $ | 99,516,233 | |

| Total liabilities | | | (39,239,520 | ) | | | 17,605,106 | | | | 84,235,162 | | | | 18,137,356 | | | | 80,738,104 | |

| Current assets | | | - | | | | 11,704,443 | | | | 52,758,690 | | | | (3,475,921 | ) | | | 60,987,212 | |

| Current liabilities | | | (39,303,610 | ) | | | 19,892,848 | | | | 77,831,462 | | | | (982,726 | ) | | | 57,437,974 | |

| Working capital | | | 39,303,610 | | | | (8,188,405 | ) | | | (25,072,772 | ) | | | (2,493,195 | ) | | | 3,549,238 | |

| Accumulated deficit | | | (13,215,642 | ) | | | (2,600,637 | ) | | | (17,900,981 | ) | | | (2,683,577 | ) | | | (36,400,837 | ) |

| Total equity | | | 39,239,520 | | | | 28,413,657 | | | | (11,844,916 | ) | | | (37,030,132 | ) | | | 18,778,129 | |

Consolidating Cash Flows Information

| | | Year Ended March 31, 2022 | |

| | | PARENT | | | SUBSIDIARIES | | | VIE | | | Elimination | | | Consolidated | |

| Net cash (used in)/provided by operating activities | | $ | (43,300 | ) | | $ | 3,283,202 | | | $ | (10,638,849 | ) | | $ | 2,012,974 | | | $ | (5,385,973 | ) |

| Net cash used in investing activities | | | - | | | | (63,291 | ) | | | (242,847 | ) | | | - | | | | (306,138 | ) |

| Net cash (used in)/provided by financing activities | | | 90,000 | | | | (6,256,428 | ) | | | 12,810,723 | | | | (1,807,397 | ) | | | 4,836,898 | |

| Effect of exchange rate on cash and cash equivalents | | | - | | | | 1,499,349 | | | | 228,373 | | | | (205,577 | ) | | | 1,522,146 | |

| Net increase in cash and cash equivalents | | | 46,700 | | | | (1,537,168 | ) | | | 2,157,401 | | | | - | | | | 666,933 | |

| | | Year Ended March 31, 2021 | |

| | | PARENT | | | SUBSIDIARIES | | | VIE | | | Elimination | | | Consolidated | |

| Net cash (used in)/provided by operating activities | | $ | (9,364,000 | ) | | $ | 2,197,717 | | | $ | 6,164,131 | | | $ | 939,860 | | | $ | (62,292 | ) |

| Net cash used in investing activities | | $ | - | | | $ | (297,265 | ) | | $ | (2,355,805 | ) | | $ | 654,745 | | | $ | (1,998,325 | ) |

| Net cash (used in)/provided by financing activities | | $ | 9,364,600 | | | $ | (346,960 | ) | | $ | (3,241,948 | ) | | $ | (2,695,839 | ) | | $ | 3,079,853 | |

| Net increase in cash and cash equivalents | | $ | - | | | $ | 3,151,646 | | | $ | 538,392 | | | $ | - | | | $ | 3,690,038 | |

| | | Year Ended March 31, 2020 | |

| | | PARENT | | | SUBSIDIARIES | | | VIE | | | Elimination | | | Consolidated | |

| Net cash (used in)/provided by operating activities | | $ | (9,273,077 | ) | | $ | 6,492,750 | | | $ | (3,689,278 | ) | | $ | (438,340 | ) | | $ | (6,907,945 | ) |

| Net cash used in investing activities | | $ | - | | | $ | (304,645 | ) | | $ | (3,058,771 | ) | | $ | (1,473,197 | ) | | $ | (4,836,613 | ) |

| Net cash (used in)/provided by financing activities | | $ | 9,273,077 | | | $ | (285,123 | ) | | $ | 8,448,290 | | | $ | 1,577,462 | | | $ | 19,013,706 | |

| Net increase in cash and cash equivalents | | $ | - | | | $ | 5,822,263 | | | $ | 415,141 | | | $ | - | | | $ | 6,237,404 | |

Cash Transfer and Dividend Payment

Our holding company, subsidiaries and the consolidated VIEs usually operate independently and transfer funds upon capital raising. We raised capital of $17.5 million in our IPO in April 2010. In addition, we raised capital for a total amount of $33.648 million from 2015 to 2020 through various financings. Renovation Investment (HK) Co., Ltd. (“Renovation”), our Hong Kong intermediate holding subsidiary, received funds from our investors in these financings. After receiving the proceeds, Renovation typically invested these funds into Jiuxin Management, a WFOE, which then exchanged the currency of the proceeds from U.S. dollar into Chinese Yuan (“RMB”) upon the approval from local banks. Additionally, Renovation lent funds to Jiuxin Management. As of the date of this prospectus, the total amount invested in and lent to Jiuxin Management is approximately $23.5 million and $8.7 million, respectively. Jiuxin Management then distributed the RMB as loans to the operating entities including Jiuzhou Pharmacy, Jiuxin Medicine, Jiuzhou Service and Jiuzhou Clinic, which are the consolidated VIEs. As of the date of this prospectus, Jiuxin Management has distributed a loan of approximately $21.9 million to Jiuzhou Pharmacy, a loan of approximately $1.4 million to Jiuzhou Service, a loan of approximately $0.04 million to Jiuzhou Clinic, a loan of approximately $0.31 million to Linjia Medical, a loan of approximately $0.16 to Shouantang Bio.

Additionally, Jiuxin Medicine is the major supplier to Jiuzhou Pharmacy and Jiuzhou Pharmacy transfers funds to pay off the debts owed to Jiuxin Medicine as a result of merchandise purchases. In the last three fiscal years, the annual amount of purchases by Jiuxin Medicine from Jiuzhou Pharmacy ranges from approximately $60 million to $80 million.

All the sales and purchases between Jiuxin Medicine and Jiuzhou Pharmacy are eliminated as internal transactions. Furthermore, the ending balances owed to/from the VIEs are eliminated in the balance sheets. Below are the sales and purchases between Jiuxin Medicine and Jiuzhou Pharmacy in last three fiscal years:

| Years | | Amount |

| Fiscal 2020 | | $ | 58,575,861 | |

| Fiscal 2021 | | $ | 73,239,387 | |

| Fiscal 2022 | | $ | 80,712,044 | |

Additional transfers between other VIEs and subsidiaries are as below:

| | | | | Amount | |

| Transfer from | | Transfer to | | 2020 | | | 2021 | | | 2022 | |

| Renovation | | Jiuxin Management | | $ | 8,705,000 | | | $ | 9,000,000 | | | $ | - | |

| Jiuxin Management | | Jiuzhou Pharmacy | | | 574,248 | | | | 1,860,573 | | | | 582,736 | |

| Jiuxin Management | | Jiuxin Medicine | | | - | | | | 2,622,495 | | | | 779,059 | |

| Jiuxin Management | | Qianhong Agriculture | | | 37,083 | | | | 31,433 | | | | 30,496 | |

| Jiuzhou Pharmacy | | Jiuzhou Service | | | 420,810 | | | | 425,345 | | | | 342,822 | |

The PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of currency out of China. The majority of the VIEs’ and their subsidiaries’ income is received in RMB and shortages in foreign currencies may restrict our ability to pay dividends or other payments, or otherwise satisfy our foreign currency denominated obligations, if any. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from The State Administration of the Foreign Exchange (“SAFE”) in the PRC as long as certain procedural requirements are met. Approval from appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be able to pay dividends in foreign currencies to our shareholders. To the extent cash or assets in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds or assets may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of you, your subsidiaries, or the consolidated VIEs by the PRC government to transfer cash or assets.

Cash dividends, if any, on our ordinary shares will be paid in U.S. dollars. Our ability to pay dividends depend on the distribution from the operating entities to the Company. As of the date of this prospectus, none of the subsidiaries or consolidated VIEs has made any distribution to the Company. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax. As of the date of this prospectus, the Company did not have any distributions to our investors through either our holding company, subsidiaries or the consolidated VIEs, and does not intend to distribute any dividends in any forms in the near future. Please refer to “condensed consolidating schedule” and “consolidated financial statements” in Company’s annual report on Form 20-F filed with SEC on July 28, 2022, which is incorporated by reference to this registration statement.

Relevant PRC laws and regulations permit the PRC companies to pay dividends only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Additionally, the Company’s PRC subsidiary and the VIE can only distribute dividends upon approval of the shareholders after they have met the PRC requirements for appropriation to the statutory reserves. As a result of these and other restrictions under the PRC laws and regulations, our PRC subsidiaries and the VIEs are restricted to transfer a portion of their net assets to the Company either in the form of dividends, loans or advances. Even though the Company currently does not require any such dividends, loans or advances from the PRC subsidiaries and the VIEs for working capital and other funding purposes, the Company may in the future require additional cash resources from its PRC subsidiaries and the VIEs due to changes in business conditions, to fund future acquisitions and developments, or merely declare and pay dividends to or distributions to the Company’s shareholders.

We have maintained cash management policies which dictates the purpose, amount and procedure of cash transfers among CJJD, the VIEs and non-VIE subsidiaries. Cash transfers of less than RMB50,000 (approximately $7,182) must be reported to and approved by both the financial departments of the entities and the heads of subsidiaries or VIEs. Cash transfers in excess of RMB50,000 (approximately $7,182) other than regular payments to suppliers need the approval from the CEO of the Company in addition to the procedure mentioned above.

Other than those disclosed above, the Company and its subsidiaries, the VIEs and its subsidiaries do not have any applicable regulatory or contractual cash management policies.

Licenses and Permits

As a wholesale distributor and retailer of pharmaceutical products, we are subject to regulation and oversight by different levels of the food and drug administration in China, in particular, National Medical Products Administration (the “NMPA”) . The Drug Administration Law of the PRC, as amended, provides the basic legal framework for the administration of the production and sale of pharmaceutical products in China and governs the manufacturing, distributing, packaging, pricing, and advertising of pharmaceutical products in China. The corresponding implementation regulations set out detailed rules with respect to the administration of pharmaceuticals in China. The VIEs are also subject to other PRC laws and regulations that are applicable to business operators, retailers, and foreign-invested companies.

A distributor of pharmaceutical products must obtain a distribution permit from the relevant provincial or designated municipal-level NMPA. The grant of such permit is subject to an inspection of the distributor’s facilities, warehouses, hygienic environment, quality control systems, personnel, and equipment. The distribution permit is valid for five (5) years, and the holder must apply for renewal of the permit within six (6) months prior to its expiration. After inspection, NMPA must decide whether to grant a new distribution permit prior to the expiration of the old permit. If a distributor does not meet the NMPA requirements, a three months grace period will be granted for further remediation. If the distributor still misses the NMPA requirements, the permit will be canceled and the distributor will no longer be allowed to distribute pharmaceutical products. In addition, a pharmaceutical product distributor needs to obtain a business license from the relevant administration for industry and commerce prior to commencing its business. Based on the management belief, all of the VIEs that engage in the retail pharmaceutical business have obtained necessary pharmaceutical distribution permits, and we do not expect to face any difficulties in renewing these permits and/or certifications.

Our wholly owned subsidiaries and the VIEs and their subsidiaries are required to have, and each has, a business license issued by the PRC State Administration for Market Regulation and its local counterparts. In addition, major PRC regulations applicable to our products and services and the Internet security industry include Internet Security Protection Technology Measures Provision (Ministry of Public Security Order No. 82) (“Order 82”).

Order 82 specifies certain security measures Internet service providers shall take to ensure Internet security among operations. Providers of ISP connecting service and Internet-based data processing service are within the scope of Order 82. During the operations, any violations to take certain security measures, such as failure to establish a security protection management system, failure to take security technology protection measures, among others, shall be punished by the public security bureaus. The penalty includes but is not limited to rectification, confiscation of illegal income or fine. If the circumstances are serious, Internet service providers may even be given a cessation of networking for no more than six months. The Company has implemented appropriate measures such as utilizing a separate server, and allowing only authorized access to data to keep customer information safe and secure to comply with Order 82.

On December 24, 2021, the CSRC released the Administrative Provisions of the State Council Regarding the Overseas Issuance and Listing of Securities by Domestic Enterprises (Draft for Comments) (the “Draft Administrative Provisions”) and the Measures for the Overseas Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing Measures”, collectively with the Draft Administrative Provisions, the “Draft Rules Regarding Overseas Listing”), both of which have a comment period that expires on January 23, 2022. The Draft Rules Regarding Overseas Listing lay out the filing regulation arrangement for both direct and indirect overseas listing, and clarify the determination criteria for indirect overseas listing in overseas markets.

As of the date of this prospectus, the comment period has ended, but the Draft Rules Regarding overseas listing have not been promulgated, and we are not required to obtain any permissions from the government of China for any offering pursuant to this prospectus. The final version of the Draft Rules Regarding overseas listing is expected to be adopted in later 2022, and as advised by our PRC counsel, our subsidiaries and/or the VIEs will then be required to comply with the filing requirements or procedures set forth in the Draft Rules Regarding overseas listing assuming the final rules contain no changes comparing to the Draft Rules Regarding Overseas Listing.

As of the date of this prospectus, based on the management’s belief, we, including the VIEs and their subsidiaries, have obtained all the requisite licenses and approvals to operate business in China. However, it is uncertain whether the current laws will be modified or the new laws will be enacted to require any additional licenses or approvals that we currently are not required to. If the Company or its subsidiaries do not receive or maintain such permissions or approvals, or mistakenly conclude that such permissions or approvals are not required, our business may be adversely affected. In such case, the Company would either exit from such field of business, or collaborate with parties that can obtain such permissions or the Company may have to switch the participating industry, which may trigger material negative impact on the Company’s business such as posing significant costs in receiving such permissions or approvals, halting our operation of business and consequently reduce the value of our securities.

Contractual Arrangement with VIE Entities and the Key Personnel

Our relationships with VIE Entities and the Key Personnel namely, Lei Liu and Li Qi, are governed by a series of contractual arrangements that they have entered into with Jiuxin Management. These contractual arrangements, as amended and in effect, include the following:

Consulting Services Agreements. Pursuant to certain exclusive consulting services agreements (the “Consulting Services Agreements”), Jiuxin Management has the exclusive right to provide Jiuzhou Pharmacy, Jiuzhou Service and Jiuzhou Clinic with general business operation services, including advisory and strategic planning services, as well as consulting services related to their current and future operations (the “Services”). Additionally, Jiuxin Management owns the intellectual property rights developed or discovered through research and development, in the course of providing the Services, or derived from the provision of the Services. Jiuzhou Pharmacy, Jiuzhou Service and Jiuzhou Clinic must each pay a quarterly consulting services fee in RMB to Jiuxin Management that is equal to its profits for such quarter. This agreement is in effect until and unless terminated by written notice of a party to the agreement in the event that: (a) a party becomes bankrupt, insolvent, is the subject of proceedings or arrangements for liquidation or dissolution, ceases to carry on business, or becomes unable to pay its debts as they become due; (b) Jiuxin Management terminates its operations; or (c) circumstances arise which would materially and adversely affect the performance or the objectives of the agreement. Jiuxin Management may also terminate the agreement with any of Jiuzhou Pharmacy, Jiuzhou Service or Jiuzhou Clinic if one of them breaches the terms of the agreement, or without cause.

Operating Agreements. Pursuant to certain operating agreements (the “Operating Agreements”), Jiuxin Management agrees to guarantee the contractual performance by Jiuzhou Pharmacy, Jiuzhou Service and Jiuzhou Clinic of their agreements with any third party. In return, the Key Personnel must appoint designees of Jiuxin Management to the boards of directors and senior management of Jiuzhou Pharmacy, Jiuzhou Service and Jiuzhou Clinic. In addition, each of Jiuzhou Pharmacy, Jiuzhou Service and Jiuzhou Clinic agrees to pledge its accounts receivable and all of its assets to Jiuxin Management. Moreover, without the prior consent of Jiuxin Management, Jiuzhou Pharmacy, Jiuzhou Service and Jiuzhou Clinic cannot engage in any transactions that could materially affect their respective assets, liabilities, rights or operations, including, without limitation, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of their assets or intellectual property rights in favor of a third party, or transfer of any agreements relating to their business operations to any third party. They must also abide by corporate policies set by Jiuxin Management with respect to their daily operations, financial management and employment issues. The term of this agreement is from August 1, 2009 until the maximum period of time permitted by law. Jiuzhou Pharmacy, Jiuzhou Service and Jiuzhou Clinic cannot terminate this agreement.

Equity Pledge Agreements. Pursuant to certain equity pledge agreements (the “Equity Pledge Agreement”), the Key Personnel have pledged all of their equity interests in Jiuzhou Pharmacy, Jiuzhou Service and Jiuzhou Clinic to Jiuxin Management in order to guarantee these companies’ performance of their respective obligations under the Consulting Services Agreement. If these companies or the Key Personnel breach their respective contractual obligations, Jiuxin Management, as pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. The Key Personnel have also agreed that upon occurrence of any event of default, Jiuxin Management shall be granted an exclusive, irrevocable power of attorney to take actions in the place and stead of the Key Personnel to carry out the security provisions of this agreement, and to take any action and execute any instrument that Jiuxin Management may deem necessary or advisable to accomplish the purposes of this agreement. The Key Personnel agree not to dispose of the pledged equity interests or take any actions that would prejudice Jiuxin Management’s interests. This agreement will expire two (2) years after the obligations of Jiuzhou Pharmacy, Jiuzhou Service and Jiuzhou Clinic under the Consulting Services Agreement have been fulfilled.

Option Agreements. Pursuant to the option agreements, the Key Personnel irrevocably grant Jiuxin Management or its designee an exclusive option to purchase, to the extent permitted under PRC law, all or part of their equity interests in Jiuzhou Pharmacy, Jiuzhou Service and Jiuzhou Clinic for the cost of the initial contributions to the registered capital or the minimum amount of consideration permitted by applicable PRC law. Jiuxin Management or its designee has sole discretion to decide when to exercise the option, whether in part or in full. The term of this agreement commenced from August 1, 2009 and continues for the maximum period of time permitted by law.

Voting Rights Proxy Agreements. Pursuant to the voting rights proxy agreements, the Key Personnel irrevocably grant a designee of Jiuxin Management the right to exercise the voting and other ownership rights of the Key Personnel in Jiuzhou Pharmacy, Jiuzhou Service and Jiuzhou Clinic, including the rights to (i) attend any meeting of the Key Personnel (or participate by written consent in lieu of such meeting) in accordance with applicable laws and each company’s incorporating documents, (ii) sell or transfer all or any of the equity interests of the Key Personnel in these companies, and (iii) appoint and vote for the companies’ directors. The proxy agreement may be terminated by mutual consent of the parties or upon thirty (30) days’ written notice from Jiuxin Management.

Other than as pursuant to the foregoing contractual arrangements, Jiuzhou Pharmacy, Jiuzhou Service and Jiuzhou Clinic cannot transfer any funds generated from their respective operations. The contractual arrangements were originally entered into on August 1, 2009, and amended on October 27, 2009.

Corporate Information

Our principal executive office is located at 6th Floor, Hai Wai Hai Tongxin Mansion, Gong Shu District, Hangzhou City, Zhejiang Province, and China. Our main telephone number is +86-571-88219579, and fax number is +86-571-8821-9579. Our agent for service of process in the United States is Pryor Cashman LLP, located at 7 Times Square, New York, New York 10036.

We own and operate the following websites: www.dada360.com (for online sales) and www.jiuzhou360.com (our English-language corporate website). Information contained on, or that can be accessed through, our websites is not a part of, and shall not be incorporated by reference into, this prospectus.

The Securities We May Offer

We may use this prospectus to offer up to $200,000,000.00 of:

| | ● | units, which may consist of any combination of the above securities. |

We may also offer securities of the types listed above that are convertible or exchangeable into one or more of the securities listed above.

Summary of Risk Factors related to China