Our most liquid assets are cash and cash equivalents. The levels of these assets depend on our operating, financing, lending and investing activities during any given period. At September 30, 2021, liquid assets (defined as cash and due from banks and interest bearing deposits), consisting of cash and due from banks, totaled $68.1 million. We believe that our liquid assets combined with the available lines of credit provide adequate liquidity to meet our current financial obligations for at least the next 12 months.

Capital Resources

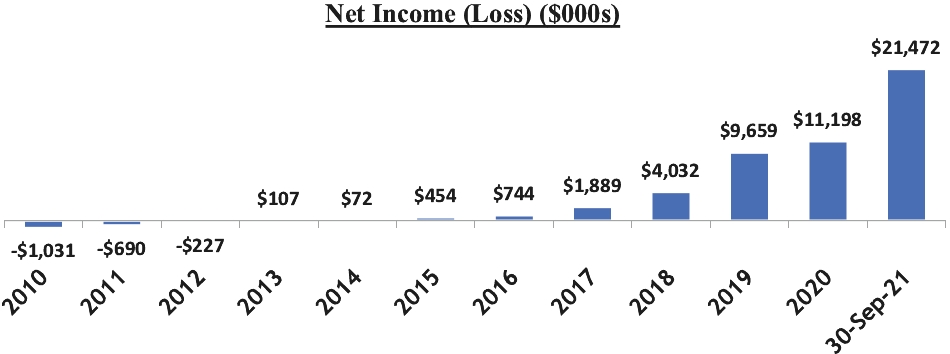

Shareholders’ equity increased $23.2 million to $69.1 million at September 30, 2021 compared to $45.9 million at December 31, 2020. The increase in shareholders’ equity was due primarily to net income for the nine months ended September 30, 2021, which amounted to $21.5 million and an increase in additional paid-in capital of $1.8 million. Stock options exercised, and stock-based compensation increased additional paid-in capital aggregately by approximately $1.8 million.

Shareholders’ equity increased $12.8 million to $45.9 million at December 31, 2020 compared to $33.1 million at December 31, 2019. The increase in shareholders’ equity was due primarily to net income for the year ended December 31, 2020, which amounted to $11.2 million and an increase in additional paid-in capital of $1.6 million. Stock options exercised, warrants issued to BFG, and stock-based compensation increased additional paid-in capital aggregately by approximately $1.9 million. This increase was partially offset by $0.3 million, or 84,198 shares, repurchased and retired during the year ended December 31, 2020.

Shareholders’ equity increased $13.9 million to $33.1 million at December 31, 2019 compared to $19.2 million at December 31, 2018. The increase in shareholders’ equity was due primarily to net income for the year ended December 31, 2019, which amounted to $9.7 million and an increase in additional paid-in capital of $ 4.2 million. The acquisition of our interest in BFG, stock options exercised, shares issued as compensation, shares issued in lieu of cash bonus, and stock-based compensation increased additional paid-in capital aggregately by approximately $5.6 million. This increase was partially offset by $1.4 million, or 395,232 shares, repurchased and retired during the year ended December 31, 2019.

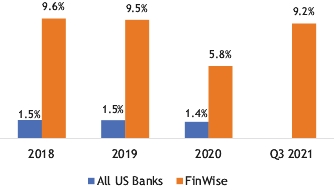

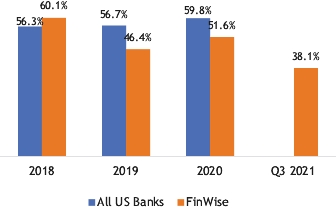

We use several indicators of capital strength. The most commonly used measure is average common equity to average assets, which was 17.5%, 16.0%, 17.8% and 16.7% at September 30, 2021, December 31, 2020, 2019 and 2018, respectively.

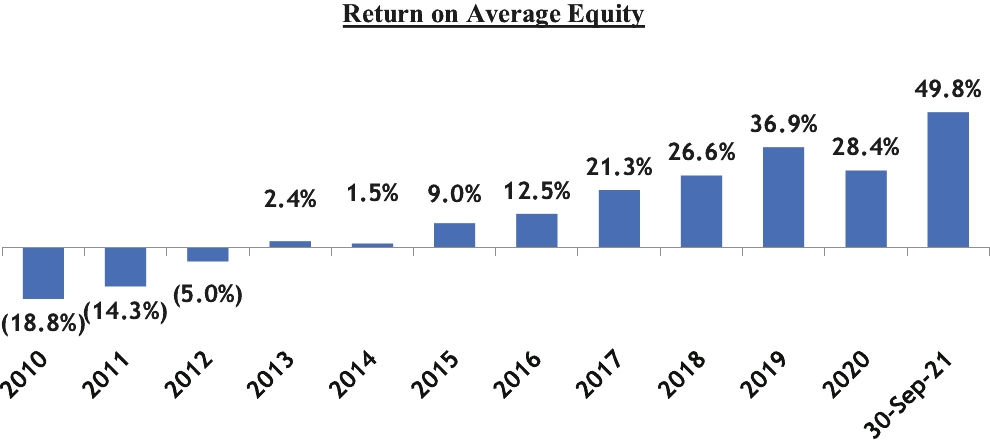

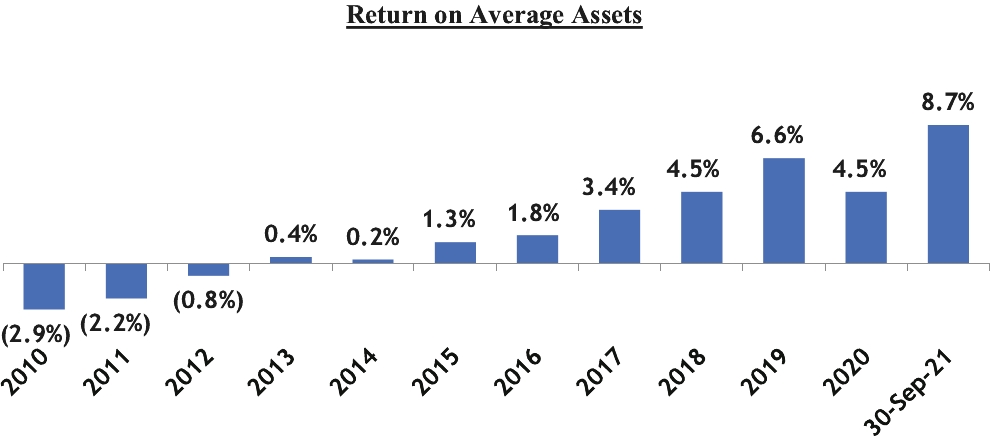

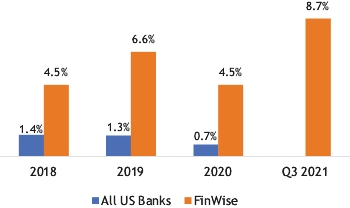

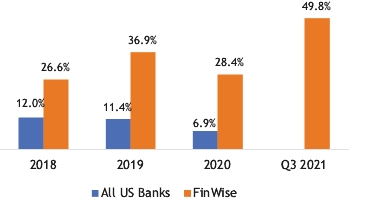

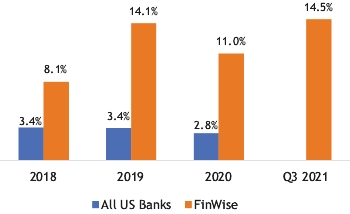

Our return on average equity was 49.8%, 28.4%, 36.9% and 26.6% for the nine months ended September 30, 2021 and years ended December 31, 2020, 2019 and 2018, respectively. Our return on average assets was 8.7%, 4.5%, 6.6% and 4.5% for the nine months ended September 30, 2021, and years ended December 31, 2020, 2019 and 2018, respectively.

We seek to maintain adequate capital to support anticipated asset growth, operating needs and unexpected risks, and to ensure that we are in compliance with all current and anticipated regulatory capital guidelines. Our primary sources of new capital include retained earnings and proceeds from the sale and issuance of capital stock or other securities. To date, we have primarily employed a self-funding capital model, but have also raised private common equity capital at various times since inception. Expected future use or activities for which capital may be set aside include balance sheet growth and associated relative increases in market or credit exposure, investment activity, potential product and business expansions, acquisitions and strategic or infrastructure investments.

The Bank is subject to various regulatory capital requirements administered by the federal banking agencies. Failure to meet minimum capital requirements can initiate certain mandatory and possibly additional discretionary actions by regulators that, if undertaken, could have a material effect on the Company’s financial statements. Under capital adequacy guidelines and the regulatory framework for prompt corrective action, the Bank must meet specific capital guidelines that involve quantitative measures of its assets, liabilities, and certain off-balance sheet items as calculated under regulatory accounting practices. The capital amounts and classifications are also subject to qualitative judgments by the regulators about components, risk weightings, and other factors.

Under the prompt corrective action rules, an institution is deemed “well capitalized” if its Tier 1 leverage ratio, Common Equity Tier 1 ratio, Tier 1 Capital ratio, and Total Capital ratio meet or exceed 5%, 6.5%, 8%, and 10%, respectively. On September 17, 2019, the federal banking agencies jointly finalized a rule intending to simplify the regulatory capital requirements described above for qualifying community banking organizations that opt into the Community Bank Leverage Ratio framework, as required by Section 201 of the Regulatory Relief Act. The Bank has elected to opt into the Community Bank Leverage Ratio framework starting in 2020. Under these new capital