UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________

FORM 10-Q

________________

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended June 30, 2022

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to

______________________________

Commission File Number 001-40718

________________

SYLVAMO CORPORATION

(Exact Name of Registrant as Specified in its Charter)

________________

| | | | | |

| Delaware | 86-2596371 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| | | | | |

6400 Poplar Avenue Memphis, Tennessee | 38197 |

| (Address of Principal Executive Offices) | (Zip Code) |

901-519-8000

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former name, former address and and former fiscal year if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class to be so registered | Trading Symbol(s) | Name of each exchange on which each class is to be registered |

| Common Stock, par value $1.00 per share | SLVM | New York Stock Exchange |

| Preferred Stock Purchase Rights | SLVM | New York Stock Exchange |

________________Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (paragraph 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange

Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the registrant’s common stock, par value $1.00 per share, as of August 5, 2022 was 44,126,955.

INDEX

ITEM 1. FINANCIAL STATEMENTS

SYLVAMO CORPORATION

CONDENSED CONSOLIDATED AND COMBINED STATEMENTS OF OPERATIONS

(Unaudited)

(In millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| NET SALES | | $ | 912 | | | $ | 695 | | | $ | 1,733 | | | $ | 1,319 | |

| COSTS AND EXPENSES | | | | | | | | |

| Cost of products sold (exclusive of depreciation, amortization and cost of timber harvested shown separately below) | | 562 | | | 408 | | | 1,108 | | | 828 | |

| Selling and administrative expenses | | 81 | | | 57 | | | 147 | | | 96 | |

| Depreciation, amortization and cost of timber harvested | | 32 | | | 31 | | | 63 | | | 62 | |

| Distribution expenses | | 97 | | | 82 | | | 171 | | | 156 | |

| Taxes other than payroll and income taxes | | 6 | | | 6 | | | 12 | | | 13 | |

| Interest (income) expense, net | | 17 | | | (29) | | | 34 | | | (29) | |

| INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES | | 117 | | | 140 | | | 198 | | | 193 | |

| Income tax provision | | 33 | | | 39 | | | 59 | | | 54 | |

| NET INCOME FROM CONTINUING OPERATIONS | | 84 | | | 101 | | | 139 | | | 139 | |

| Discontinued operations, net of taxes | | (143) | | | 14 | | | (172) | | | 38 | |

| NET INCOME (LOSS) | | $ | (59) | | | $ | 115 | | | $ | (33) | | | $ | 177 | |

| BASIC EARNINGS (LOSS) PER SHARE | | | | | | | | |

| Earnings from continuing operations | | $ | 1.90 | | | $ | 2.30 | | | $ | 3.15 | | | $ | 3.16 | |

| Discontinued operations, net of taxes | | (3.24) | | | 0.31 | | | (3.90) | | | 0.87 | |

| Net earnings (loss) | | $ | (1.34) | | | $ | 2.61 | | | $ | (0.75) | | | $ | 4.03 | |

| DILUTED EARNINGS (LOSS) PER SHARE | | | | | | | | |

| Earnings from continuing operations | | $ | 1.89 | | | $ | 2.30 | | | $ | 3.13 | | | $ | 3.16 | |

| Discontinued operations, net of taxes | | (3.22) | | | 0.31 | | | (3.87) | | | 0.87 | |

| Net earnings (loss) | | $ | (1.33) | | | $ | 2.61 | | | $ | (0.74) | | | $ | 4.03 | |

The accompanying notes are an integral part of these condensed consolidated and combined financial statements.

SYLVAMO CORPORATION

CONDENSED CONSOLIDATED AND COMBINED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| NET INCOME (LOSS) | | $ | (59) | | | $ | 115 | | | $ | (33) | | | $ | 177 | |

| OTHER COMPREHENSIVE INCOME (LOSS), NET OF TAXES | | | | | | | | |

| Defined Benefit Pension and Postretirement Adjustments: | | | | | | | | |

| Amortization of pension and postretirement loss (less taxes of $0, $0, $0 and $0) | | — | | | — | | | (1) | | | — | |

| Change in cumulative foreign currency translation adjustment | | (21) | | | 140 | | | 78 | | | (15) | |

| Net gains/losses on cash flow hedging derivatives: | | | | | | | | |

| Net gains (losses) arising during the period (less taxes of ($(1), $(4), ($13) and ($2)) | | 4 | | | 6 | | | 33 | | | 4 | |

| Reclassification adjustment for (gains) losses included in net earnings (less taxes of $2, $2, $5 and $1) | | (4) | | | (2) | | | (10) | | | (2) | |

| TOTAL OTHER COMPREHENSIVE INCOME (LOSS), NET OF TAXES | | (21) | | | 144 | | | 100 | | | (13) | |

| COMPREHENSIVE INCOME (LOSS) | | $ | (80) | | | $ | 259 | | | $ | 67 | | | $ | 164 | |

The accompanying notes are an integral part of these condensed consolidated and combined financial statements.

SYLVAMO CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions)

| | | | | | | | | | | |

| June 30, 2022 | | December 31, 2021 |

| (unaudited) | | |

| ASSETS | | | |

| Current Assets | | | |

| Cash and temporary investments | $ | 157 | | | $ | 159 | |

| Accounts and notes receivable, net | 469 | | | 402 | |

| Contract assets | 27 | | | 26 | |

| Inventories | 304 | | | 279 | |

| Assets held for sale | 357 | | | 179 | |

| Other current assets | 31 | | | 63 | |

| Total Current Assets | 1,345 | | | 1,108 | |

| Plants, Properties and Equipment, net | 755 | | | 764 | |

| Forestlands | 299 | | | 278 | |

| Goodwill | 128 | | | 122 | |

| Right of Use Assets | 40 | | | 40 | |

| Long-Term Assets Held for Sale | — | | | 141 | |

| Deferred Charges and Other Assets | 174 | | | 144 | |

| TOTAL ASSETS | $ | 2,741 | | | $ | 2,597 | |

| LIABILITIES AND EQUITY | | | |

| Current Liabilities | | | |

| Accounts payable | $ | 360 | | | $ | 387 | |

| Notes payable and current maturities of long-term debt | 25 | | | 41 | |

| Accrued payroll and benefits | 53 | | | 48 | |

| Liabilities held for sale | 288 | | | 91 | |

| Other current liabilities | 158 | | | 191 | |

| Total Current Liabilities | 884 | | | 758 | |

| Long-Term Debt | 1,290 | | | 1,357 | |

| Deferred Income Taxes | 185 | | | 169 | |

| Long-Term Liabilities Held for Sale | — | | | 13 | |

| Other Liabilities | 130 | | | 118 | |

| Commitments and Contingent Liabilities (Note 12) | 0 | | 0 |

| Equity | | | |

| Common stock $1 par value, 200.0 shares authorized, 44.1 shares and 43.9 shares issued and outstanding at June 30, 2022 and December 31, 2021, respectively | 44 | | | 44 | |

| Paid-in capital | 14 | | | 4 | |

| Retained earnings | 1,897 | | | 1,935 | |

| Accumulated other comprehensive loss | (1,701) | | | (1,801) | |

| 254 | | | 182 | |

| Less: Common stock held in treasury, at cost, 0.1 shares and 0.0 shares at June 30, 2022 and December 31, 2021, respectively | (2) | | | — | |

| Total Equity | 252 | | | 182 | |

| TOTAL LIABILITIES AND EQUITY | $ | 2,741 | | | $ | 2,597 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

SYLVAMO CORPORATION

CONDENSED CONSOLIDATED AND COMBINED STATEMENTS OF CASH FLOWS

(Unaudited)

(In millions)

| | | | | | | | | | | | | | |

| | Six Months Ended

June 30, |

| | 2022 | | 2021 |

| OPERATING ACTIVITIES | | | | |

| Net income from continuing operations | | $ | 139 | | | $ | 139 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation, amortization, and cost of timber harvested | | 63 | | | 62 | |

| Deferred income tax provision (benefit), net | | 2 | | | (2) | |

| Stock-based compensation | | 11 | | | 7 | |

| Changes in operating assets and liabilities and other | | | | |

| Accounts and notes receivable | | (58) | | | (26) | |

| Inventories | | (33) | | | 5 | |

| Accounts payable and accrued liabilities | | (31) | | | 33 | |

| Other | | 37 | | | (63) | |

| CASH PROVIDED BY OPERATING ACTIVITIES FROM CONTINUING OPERATIONS | | 130 | | | 155 | |

| CASH PROVIDED BY OPERATING ACTIVITIES FROM DISCONTINUED OPERATIONS, NET | | 45 | | | 67 | |

| CASH PROVIDED BY OPERATING ACTIVITIES | | 175 | | | 222 | |

| INVESTMENT ACTIVITIES | | | | |

| Invested in capital projects | | (59) | | | (27) | |

| Cash pool arrangements with Parent | | — | | | (15) | |

| Other | | — | | | (3) | |

| CASH PROVIDED BY (USED FOR) INVESTMENT ACTIVITIES FROM CONTINUING OPERATIONS | | (59) | | | (45) | |

| CASH PROVIDED BY (USED FOR) INVESTMENT ACTIVITIES FROM DISCONTINUED OPERATIONS, NET | | (5) | | | 7 | |

| CASH PROVIDED BY (USED FOR) INVESTMENT ACTIVITIES | | (64) | | | (38) | |

| FINANCING ACTIVITIES | | | | |

| Net transfers from Parent | | — | | | 1 | |

| Reduction of debt | | (86) | | | (4) | |

| Other | | (6) | | | — | |

| CASH PROVIDED BY (USED FOR) FINANCING ACTIVITIES FROM CONTINUING OPERATIONS | | (92) | | | (3) | |

| CASH PROVIDED BY (USED FOR) FINANCING ACTIVITIES FROM DISCONTINUED OPERATIONS, NET | | — | | | — | |

| CASH PROVIDED BY (USED FOR) FINANCING ACTIVITIES | | (92) | | | (3) | |

| Effect of Exchange Rate Changes on Cash | | 42 | | | (50) | |

| Change in Cash Included in Assets Held for Sale | | 63 | | | 13 | |

| Change in Cash and Temporary Investments | | (2) | | | 118 | |

| Cash and Temporary Investments | | | | |

| Beginning of the period | | 159 | | | 70 | |

| End of the period | | $ | 157 | | | $ | 188 | |

The accompanying notes are an integral part of these condensed consolidated and combined financial statements.

SYLVAMO CORPORATION

NOTES TO CONDENSED CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS

NOTE 1 BASIS OF PRESENTATION

On December 3, 2020, International Paper Company (“International Paper” or “Parent”) announced that its Board of Directors had approved a plan to spin-off its Printing Papers segment along with certain mixed-use coated paperboard and pulp businesses in Europe, Latin America, and North America (collectively referred to herein as the “Company,” “we,” “us,” or “our”), and separate into two distinct publicly-traded companies. On October 1, 2021, we settled the net parent investment and the spin-off was completed by a pro rata distribution to International Paper’s stockholders of approximately 80.1% of our common stock, with International Paper retaining a 19.9% ownership interest. As a result of the spin-off, Sylvamo Corporation is now an independent public company trading on the New York Stock Exchange under the symbol “SLVM.”

Prior to the spin-off, we historically operated as part of International Paper and not as a standalone company. These condensed consolidated and combined financial statements reflect the combined historical results of operations and cash flows of the Company as historically managed within International Paper for the periods prior to the completion of the spin-off and reflect our consolidated financial position, results of operations and cash flows for the period after the completion of the spin-off. The condensed consolidated and combined financial statements have been prepared in United States (“U.S.”) dollars and in conformity with accounting principles generally accepted in the United States (‘‘U.S. GAAP’’). We recommend that the accompanying condensed consolidated and combined financial statements be read in conjunction with the audited consolidated combined financial statements and the notes thereto included in our 2021 Form 10-K. The accompanying condensed consolidated and combined financial statements reflect all normal and recurring adjustments that are, in the opinion of management, necessary for the fair presentation of the financial position, results of operations and cash flows for the interim periods presented. The results of operations for any interim period are not indicative of the results that might be achieved for a full year.

For the periods prior to the spin-off, the condensed combined statements of operations also include expense allocations for certain functions provided by International Paper, including, but not limited to general corporate expenses related to finance, legal, information technology, human resources, communications, insurance and stock-based compensation. These expenses have been allocated to the Company on the basis of direct usage when identifiable, with the remainder principally allocated on the basis of percent of capital employed, headcount or other measures. During the three months and six months ended June 30, 2021, the Company was allocated $47 million and $85 million, respectively, of such general corporate expenses related to continuing operations, which were included within “Cost of products sold” and “Selling and administrative expenses.” Management considers the basis on which the expenses have been allocated to reasonably reflect the utilization of services provided to or the benefit received by the Company during the periods presented. The allocations may not, however, reflect the expenses the Company would have incurred if the Company had been an independent company for all periods presented. Actual costs that may have been incurred if the Company had been an independent company during these periods would depend on several factors, including the organizational structure, whether functions were outsourced or performed by employees, and strategic decisions made in areas such as information technology and infrastructure. The Company is unable to determine what such costs would have been had the Company been independent during the periods prior to completion of the spin-off.

All intracompany transactions have been eliminated. Related party transactions between the Company and International Paper relating to general operating activities have been included in these condensed consolidated and combined financial statements. These related party transactions historically settled in cash between the Company and International Paper have been reflected in the condensed consolidated and combined statements of cash flows as either “Accounts and notes receivable” or “Accounts payable and accrued liabilities” within operating activities.

The aggregate net effect of transactions with International Paper not settled in cash, including corporate allocations, has been reflected in the condensed consolidated and combined statements of cash flows as “Net transfers from Parent” within financing activities.

In addition, certain of the Company’s Europe locations participated in International Paper’s centralized cash pooling arrangement. Amounts due from the cash pool were generally settled on a daily basis with the aggregate net activity between the Company and International Paper reflected in the condensed consolidated and combined statements of cash flows as “Cash pool arrangements with Parent” within investing activities. Our participation in International Paper’s centralized cash pooling arrangements was terminated prior to September 30, 2021.

International Paper utilized a centralized approach to cash management and financing its operations. This arrangement was not reflective of the manner in which the Company would have been able to finance its operations had it been independent from International Paper for the periods prior to the completion of the spin-off. The cash and temporary investments held by International Paper at the corporate level were not specifically identifiable to the Company and therefore were not reflected in the Company’s condensed combined statements of cash flows. Cash and temporary investments in the condensed combined statements of cash flows for the periods prior to the completion of the spin-off represent only cash and temporary investments held locally by the Company.

The condensed combined financial statements for the periods prior to the completion of the spin-off included certain assets and liabilities that were historically held at the International Paper corporate level but were specifically identifiable or otherwise attributable to the Company. International Paper’s third-party debt and the related interest expense have not been allocated to the Company for any of the periods presented as the Company was not the legal obligor of such debt. During the third quarter of 2021, we entered into a series of financing transactions under which we incurred $1.5 billion of debt in conjunction with our spin-off from International Paper, consisting of 2 term loan facilities, the 7% senior notes due 2029 (the “2029 Senior Notes”) and borrowings from our cash flow-based revolving credit facility. The proceeds of the debt were used primarily to fund a $1.5 billion special payment to International Paper on September 29, 2021 and pay related fees and expenses.

The Company operates on a calendar year-end.

Divestiture of Russian Operations

During the second quarter of 2022, management committed to a plan to sell the Company’s Russian operations, which were previously part of the Europe business segment. As a result, all current and historical operating results of the Russian operations are presented as “Discontinued operations, net of taxes” in the condensed consolidated and combined statement of operations and the notes to the condensed consolidated and combined statement of operations. All historical assets and liabilities of the Russian operations are classified as current and long-term assets and liabilities of discontinued operations in the accompanying condensed consolidated balance sheet. We recorded a pre-tax charge of $68 million ($57 million after taxes) for the impairment of the Russian fixed assets during the first quarter of 2022 and a pre-tax charge of $156 million ($156 million after taxes) during the second quarter of 2022 to reserve for the elimination of the cumulative foreign currency translation loss related to our Russian business. See Note 7 Divestiture and Impairment of Business for further details.

Our operations in Russia include a paper mill in Svetogorsk, Russia, and long-term harvesting rights on 860,000 acres of government-owned forestland, and represented approximately 15% of our net sales and 10% of our long-lived assets for the year ended December 31, 2021.

NOTE 2 SIGNIFICANT ACCOUNTING POLICIES

Our significant accounting policies are described in Note 2 to the audited consolidated and combined financial statements included in our 2021 10-K. There have been no material changes to the significant accounting policies for the six months ended June 30, 2022.

Recently Issued Accounting Pronouncements Not Yet Adopted

Reference Rate Reform

In March 2020, the FASB issued ASU 2020-04, “Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting.” This guidance provides companies with optional guidance to ease the potential accounting burden associated with transitioning away from reference rates that are expected to be discontinued. This guidance is effective upon issuance and generally can be applied through December 31, 2022. We will apply the amendments in this update to account for contract modifications due to changes in reference rates once those occur. We do not expect these amendments to have a material impact on our condensed consolidated and combined financial statements.

NOTE 3 REVENUE RECOGNITION

External Net Sales by Product

External net sales by major products were as follows by business segment:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| In millions | | 2022 | | 2021 | | 2022 | | 2021 |

| Europe | | | | | | | | |

| Uncoated Papers | | $ | 112 | | | $ | 52 | | | $ | 202 | | | $ | 122 | |

| Market Pulp | | 23 | | | 23 | | | 50 | | | 43 | |

| Europe | | 135 | | | 75 | | | 252 | | | 165 | |

| Latin America | | | | | | | | |

| Uncoated Papers | | 228 | | | 190 | | | 424 | | | 333 | |

| Market Pulp | | — | | | 11 | | | — | | | 24 | |

| Latin America | | 228 | | | 201 | | | 424 | | | 357 | |

| North America | | | | | | | | |

| Uncoated Papers | | 528 | | | 402 | | | 1,013 | | | 764 | |

| Market Pulp | | 21 | | | 17 | | | 44 | | | 33 | |

| North America | | 549 | | | 419 | | | 1,057 | | | 797 | |

| Total | | $ | 912 | | | $ | 695 | | | $ | 1,733 | | | $ | 1,319 | |

Revenue Contract Balances

A contract asset is created when the Company recognizes revenue on its customized products for which we have an enforceable right to payment.

A contract liability is created when customers prepay for goods prior to the Company transferring those goods to the customer. The contract liability is reduced when control of the goods is transferred to the customer, satisfying our performance obligation. The majority of our customer prepayments are received during the fourth quarter each year for goods that will be transferred to customers over the following twelve months. Contract liabilities of $1 million and $1 million are included in “Other current liabilities” as of June 30, 2022 and December 31, 2021, respectively.

The difference between the opening and closing balances of the Company’s contract assets and contract liabilities primarily results from the difference between the price and quantity at comparable points in time for goods which we have an unconditional right to payment or receive pre-payment from the customer, respectively.

NOTE 4 EQUITY

A summary of changes in equity for the three months and six months ended June 30, 2022 and 2021 is provided below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2022 |

| In millions | | Shares | | Common Stock | | Paid-In Capital | | Retained Earnings | | Accumulated Other Comprehensive

Loss | | Common Stock Held In Treasury, At Cost | | Total Equity |

| Balance, March 31, 2022 | | 44 | | | $ | 44 | | | $ | 8 | | | $ | 1,961 | | | $ | (1,680) | | | $ | (2) | | | $ | 331 | |

| Stock-based employee compensation | | — | | | — | | | 6 | | | — | | | — | | | — | | | 6 | |

| Dividends ($0.1125 per share) | | — | | | — | | | — | | | (5) | | | — | | | — | | | (5) | |

| Comprehensive income (loss) | | — | | | — | | | — | | | (59) | | | (21) | | | — | | | (80) | |

| Balance, June 30, 2022 | | 44 | | | $ | 44 | | | $ | 14 | | | $ | 1,897 | | | $ | (1,701) | | | $ | (2) | | | $ | 252 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2022 |

| In millions | | Shares | | Common Stock | | Paid-In Capital | | Retained Earnings | | Accumulated Other Comprehensive

Loss | | Common Stock Held In Treasury, At Cost | | Total Equity |

| Balance, December 31, 2021 | | 44 | | | $ | 44 | | | $ | 4 | | | $ | 1,935 | | | $ | (1,801) | | | $ | — | | | $ | 182 | |

| Stock-based employee compensation | | — | | | — | | | 10 | | | — | | | — | | | (2) | | | 8 | |

| Dividends ($0.1125 per share) | | — | | | — | | | — | | | (5) | | | — | | | — | | | (5) | |

| Comprehensive income (loss) | | — | | | — | | | — | | | (33) | | | 100 | | | — | | | 67 | |

| Balance, June 30, 2022 | | 44 | | | $ | 44 | | | $ | 14 | | | $ | 1,897 | | | $ | (1,701) | | | $ | (2) | | | $ | 252 | |

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2021 |

| In millions | | Parent Company

Investment | | Accumulated Other Comprehensive

Loss | | Total Equity |

| Balance, March 31, 2021 | | 3,736 | | | (1,637) | | | 2,099 | |

| Net transfers from Parent | | (74) | | | — | | | (74) | |

| Comprehensive income (loss) | | 115 | | | 144 | | | 259 | |

| Balance, June 30, 2021 | | $ | 3,777 | | | $ | (1,493) | | | $ | 2,284 | |

| | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2021 |

| In millions | | Parent Company

Investment | | Accumulated Other Comprehensive

Loss | | Total Equity |

| Balance, December 31, 2020 | | 3,592 | | | (1,480) | | | 2,112 | |

| Net transfers from Parent | | 8 | | | — | | | 8 | |

| Comprehensive income (loss) | | 177 | | | (13) | | | 164 | |

| Balance, June 30, 2021 | | $ | 3,777 | | | $ | (1,493) | | | $ | 2,284 | |

Rights Agreement

On April 22, 2022, the board of directors of the Company (the “Board”) adopted a Rights Agreement (the “Rights Agreement”) and declared a dividend of 1 preferred share purchase right (a “Right”), payable on May 2, 2022, for each share of common stock, par value $1.00 per share, of the Company (the “Common Shares”) outstanding on May 2, 2022 (the “Record Date”) to the registered holders of Common Shares on that date. Each Right entitles the registered holder to purchase from the Company one one-thousandth of a share of Series A Preferred Stock, par value $1.00 per share, of the Company (the “Preferred Shares”) at a price of $190.00 per one one-thousandth of a Preferred Share represented by a Right (the “Purchase Price”), subject to adjustment. The Rights will initially trade with the Common Shares and will generally become exercisable only if any person (or any persons acting as a group) acquires 10% (or 20% in the case of certain passive investors) or more of the Company’s outstanding Common Shares. Existing 10% or greater holders of Common Shares are grandfathered to the extent of their April 22, 2022 ownership levels.

In the event the Rights are triggered, the Rights will become exercisable for Common Shares having a value equal to 2 times the exercise price of the Right. If, at any time after the Rights are triggered, the Company engages in a merger or sale of 50% or more of the Company’s consolidated assets or earning power, then each holder of a Right, upon the exercise thereof, will receive the number of shares of common stock of the acquiring company which at the time of such transaction will have a market value of 2 times the exercise price of the Right.

The Rights will expire on the close of business on April 21, 2023, unless earlier redeemed or terminated by the Company, as provided in the Rights Agreement. Until a Right is exercised, the holder thereof will have no voting or dividend privileges with respect to the rights.

NOTE 5 OTHER COMPREHENSIVE INCOME

The following table presents the changes in Accumulated Other Comprehensive Income (Loss) (“AOCI”), net of taxes, reported in the condensed consolidated and combined financial statements:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| In millions | | 2022 | | 2021 | | 2022 | | 2021 |

| Defined Benefit Pension and Postretirement Adjustments | | | | | | | | |

| Balance at beginning of period | | $ | (81) | | | $ | (48) | | | $ | (80) | | | $ | (48) | |

| Amounts reclassified from accumulated other comprehensive income | | — | | | — | | | (1) | | | — | |

| Balance at end of period | | (81) | | | (48) | | | (81) | | | (48) | |

| Change in Cumulative Foreign Currency Translation Adjustments | | | | | | | | |

| Balance at beginning of period | | (1,620) | | | (1,588) | | | (1,719) | | | (1,433) | |

| Other comprehensive income (loss) before reclassifications | | (21) | | | 140 | | | 78 | | | (15) | |

| Balance at end of period | | (1,641) | | | (1,448) | | | (1,641) | | | (1,448) | |

| Net Gains and Losses on Cash Flow Hedging Derivatives | | | | | | | | |

| Balance at beginning of period | | 21 | | | (1) | | | (2) | | | 1 | |

| Other comprehensive income (loss) before reclassifications | | 4 | | | 6 | | | 33 | | | 4 | |

| Amounts reclassified from accumulated other comprehensive income | | (4) | | | (2) | | | (10) | | | (2) | |

| Balance at end of period | | 21 | | | 3 | | | 21 | | | 3 | |

| Total Accumulated Other Comprehensive Income (Loss) at End of Period | | $ | (1,701) | | | $ | (1,493) | | | $ | (1,701) | | | $ | (1,493) | |

NOTE 6 EARNINGS PER SHARE

Basic earnings per share from continuing operations is computed by dividing net income from continuing operations by the weighted average number of shares of common stock outstanding during the period. Diluted earnings per share from continuing operations is computed by dividing net income from continuing operations by the weighted-average number of shares of common stock outstanding during the period, increased to include the number of shares of common stock that would have been outstanding had potentially dilutive shares of common stock been issued. The dilutive effect of restricted stock units is reflected in diluted earnings per share by applying the treasury stock method. Basic and dilutive earnings per share from discontinued operations are computed under the same approach utilizing the same weighted-average number of shares of common stock outstanding during the period and dilutive shares.

There are no adjustments required to be made to net income from continuing operations for purposes of computing basic and diluted earnings per share from continuing operations.

These financial statements are prepared on the basis that, at the date of distribution of Sylvamo common stock by International Paper to its shareholders on October 1, 2021, Sylvamo had 43,949,277 total shares of common stock outstanding. The calculation of earnings per share from continuing operations utilizes the number of shares of common stock outstanding at the date of distribution as the basis for the calculation of the weighted average number of shares of common stock outstanding for

periods presented prior to the spinoff because, at that time, Sylvamo did not operate as a separate, stand-alone entity, and no shares or equity-based awards were outstanding prior to the date of distribution.

Basic and diluted earnings per share from continuing operations are calculated as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| In millions, except per share amounts | | 2022 | | 2021 | | 2022 | | 2021 |

| Net income from continuing operations | | $ | 84 | | | $ | 101 | | | $ | 139 | | | $ | 139 | |

| Weighted average common shares outstanding | | 44.1 | | | 43.9 | | | 44.1 | | | 43.9 | |

| Effect of dilutive securities | | 0.4 | | | — | | | 0.2 | | | — | |

| Weighted average common shares outstanding - assuming dilution | | 44.5 | | | 43.9 | | | 44.3 | | | 43.9 | |

| Earnings per share from continuing operations - basic | | $ | 1.90 | | | $ | 2.30 | | | $ | 3.15 | | | $ | 3.16 | |

| Earnings per share from continuing operations - diluted | | $ | 1.89 | | | $ | 2.30 | | | $ | 3.13 | | | $ | 3.16 | |

NOTE 7 DIVESTITURE AND IMPAIRMENT OF BUSINESS

RUSSIAN OPERATIONS

2022: During the second quarter of 2022, management committed to a plan to sell the Company’s Russian operations. As a result, all current and historical operating results of the Russian operations are presented as “Discontinued operations, net of taxes” in the condensed consolidated and combined statement of operations. All historical assets and liabilities of the Russian operations are classified as current and long-term assets and liabilities held for sale in the accompanying condensed consolidated balance sheet. The Russian operations were previously part of the Europe business segment. The following summarizes the major classes of line items comprising Income (Loss) Before Income Taxes reconciled to Discontinued Operations, net of taxes, related to the Russian operations for all periods presented in the condensed consolidated and combined statement of operations.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| In millions | 2022 | | 2021 | | 2022 | | 2021 |

| NET SALES | $ | 157 | | | $ | 149 | | | $ | 313 | | | $ | 303 | |

| COSTS AND EXPENSES | | | | | | | |

| Cost of products sold (exclusive of depreciation, amortization and cost of timber harvested shown separately below) | 139 | | | 117 | | | 242 | | | 223 | |

| Selling and administrative expenses | 3 | | | 1 | | | 4 | | | 3 | |

| Depreciation, amortization and cost of timber harvested | — | | | 4 | | | 4 | | | 8 | |

| Distribution expenses | 7 | | | 11 | | | 17 | | | 21 | |

| Taxes other than payroll and income taxes | 1 | | | — | | | 1 | | | 1 | |

| Impairment of business | 156 | | | — | | | 224 | | | — | |

| Interest (income) expense, net | (2) | | | — | | | (3) | | | — | |

| INCOME (LOSS) BEFORE INCOME TAXES | (147) | | | 16 | | | (176) | | | 47 | |

| Income tax provision (benefit) | (4) | | | 2 | | | (4) | | | 9 | |

| DISCONTINUED OPERATIONS, NET OF TAXES | $ | (143) | | | $ | 14 | | | $ | (172) | | | $ | 38 | |

The following summarizes the major classes of assets and liabilities of the Russian operations reconciled to current assets and long-term assets and liabilities held for sale and current and long-term liabilities held for sale in the accompanying condensed consolidated balance sheet:

| | | | | | | | | | | |

| In millions | June 30, 2022 | | December 31, 2021 |

| Cash and temporary investments | $ | 84 | | | $ | 21 | |

| Accounts and notes receivable | 90 | | | 88 | |

| Contract assets | 2 | | | 3 | |

| Inventories | 98 | | | 63 | |

| Other current assets | 2 | | | 4 | |

| Current Assets Held for Sale | $ | 276 | | | $ | 179 | |

| Plants, Properties and Equipment | 38 | | | 121 | |

| Goodwill | 14 | | | 10 | |

| Right of Use Assets | 2 | | | 1 | |

| Deferred Charges and Other Assets | 27 | | | 9 | |

Long-Term Assets Held for Sale (a) | $ | 81 | | | $ | 141 | |

| Notes payable and current maturities of long-term debt | $ | 2 | | | $ | 1 | |

| Accounts payable | 81 | | | 58 | |

| Accrued payroll and benefits | 6 | | | 3 | |

| Other current liabilities | 177 | | | 29 | |

| Current Liabilities Held for Sale | $ | 266 | | | $ | 91 | |

| Long-Term Debt | 0 | | | 1 | |

| Deferred Income Taxes | — | | | — | |

| Other Liabilities | 22 | | | 12 | |

Long-Term Liabilities Held for Sale (a) | $ | 22 | | | $ | 13 | |

(a) Amounts included in current “Assets held for sale” and current “Liabilities held for sale” in the accompanying consolidated balance sheet as of June 30, 2022.

The following summarizes the total cash provided by operating activities from discontinued operations, net and total cash provided by (used for) investing activities from discontinued operations, net and included in the condensed consolidated and combined statement of cash flows:

| | | | | | | | | | | |

| In millions for the six months ended June 30 | 2022 | | 2021 |

| Cash Provided by Operating Activities | $ | 45 | | | $ | 67 | |

Cash Provided by (Used for) Investment Activities (a) | $ | (5) | | | $ | 7 | |

(a) Includes cash invested in capital projects of $5 million and $5 million for the six months ended June 30, 2022 and 2021, respectively.

During the first quarter of 2022, as a result of the significant changes in the business climate impacting our Russian operations, a determination was made that the current carrying value of our Russian operations exceeded the estimated fair value. The fair value of the Russian operations was estimated based on a probability-weighted average approach of the potential cash flows from various paths the Company was evaluating to exit the business. As a result, a pre-tax charge of $68 million ($57 million, net of taxes) was recorded for the impairment and allocated to the Russian fixed assets. During the second quarter of 2022, a pre-tax charge of $156 million ($156 million after taxes) was recorded to reserve for the elimination of the cumulative foreign currency translation losses related to our Russian operations. These charges are included in “Impairment of business” within the summarized income statement for our Russian operations included in this footnote and is included in “Discontinued operations, net of taxes” in the condensed consolidated and combined statement of operations.

NOTE 8 SUPPLEMENTARY FINANCIAL STATEMENT INFORMATION

Temporary Investments

Temporary investments with an original maturity of three months or less and money market funds with greater than three-month maturities but with the right to redeem without notice are treated as cash equivalents and are stated at cost. Temporary investments totaled $64 million at both June 30, 2022 and December 31, 2021, respectively.

Accounts and Notes Receivable

Accounts and notes receivable, net, by classification were:

| | | | | | | | | | | | | | |

| In millions | | June 30, 2022 | | December 31, 2021 |

| Accounts and notes receivable: | | | | |

| Trade | | $ | 447 | | | $ | 391 | |

| Notes and other | | 22 | | | 11 | |

| Total | | $ | 469 | | | $ | 402 | |

The allowance for expected credit losses was $22 million and $19 million at June 30, 2022 and December 31, 2021, respectively. Based on the Company’s accounting estimates and the facts and circumstances available as of the reporting date, we believe our allowance for expected credit losses is adequate.

Inventories

| | | | | | | | | | | |

| In millions | June 30, 2022 | | December 31, 2021 |

| Raw materials | $ | 35 | | | $ | 37 | |

| Finished paper and pulp products | 191 | | | 164 | |

| Operating supplies | 72 | | | 69 | |

| Other | 6 | | | 9 | |

| Total | $ | 304 | | | $ | 279 | |

Plants, Properties and Equipment, Net

Accumulated depreciation was $3.6 billion and $3.5 billion at June 30, 2022 and December 31, 2021, respectively. Depreciation expense was $32 million and $31 million for the three months and $62 million and $62 million for the six months ended June 30, 2022 and 2021, respectively.

Non-cash additions to plants, property and equipment included within accounts payable were $6 million each at June 30, 2022 and December 31, 2021.

Interest

Interest payments of $34 million and $1 million were made during the six months ended June 30, 2022 and June 30, 2021, respectively.

Amounts related to interest were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| In millions | | 2022 | | 2021 | | 2022 | | 2021 |

| Interest expense | | $ | 20 | | | $ | 1 | | | $ | 39 | | | $ | 1 | |

| Interest income | | (2) | | | (30) | | | (4) | | | (30) | |

| Capitalized interest cost | | (1) | | | — | | | (1) | | | — | |

| Total | | $ | 17 | | | $ | (29) | | | $ | 34 | | | $ | (29) | |

ASSET RETIREMENT OBLIGATIONS

At both June 30, 2022 and December 31, 2021, we had recorded liabilities of $26 million related to asset retirement obligations. These amounts are included in “Other liabilities.”

NOTE 9 LEASES

The Company leases various real estate, including certain operating facilities, warehouses, office space and land. The Company also leases material handling equipment, vehicles and certain other equipment. The Company’s leases have a remaining lease term of up to 15 years. Total lease cost was $15 million and $8 million for the three months and $30 million and $17 million for the six months ended June 30, 2022 and 2021, respectively.

Supplemental Balance Sheet Information Related to Leases

| | | | | | | | | | | | | | | | | |

| In millions | Classification | | June 30, 2022 | | December 31, 2021 |

| Assets | | | | | |

| Operating lease assets | Right of use assets | | $ | 40 | | | $ | 40 | |

| Finance lease assets | Plants, properties, and equipment, net (a) | | 25 | | | 27 | |

| Total leased assets | | | $ | 65 | | | $ | 67 | |

| Liabilities | | | | | |

| Current | | | | | |

| Operating | Other current liabilities | | $ | 14 | | | $ | 15 | |

| Finance | Notes payable and current maturities of long-term debt | | 3 | | | 3 | |

| Noncurrent | | | | | |

| Operating | Other Liabilities | | 31 | | | 25 | |

| Finance | Long-term debt | | 16 | | | 17 | |

| Total lease liabilities | | | $ | 64 | | | $ | 60 | |

(a)Finance leases are recorded net of accumulated amortization of $12 million and $9 million as of June 30, 2022 and December 31, 2021, respectively.

NOTE 10 GOODWILL AND OTHER INTANGIBLES

Goodwill

The following table presents changes in the goodwill balance as allocated to each business segment for the six months ended June 30, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| In millions | | Europe | | Latin America | | North America | | Total |

| Balance as of December 31, 2021 | | | | | | | | |

| Goodwill | | $ | 11 | | | $ | 112 | | | $ | — | | | $ | 123 | |

| Accumulated impairment losses | | (1) | | | — | | | — | | | (1) | |

| | $ | 10 | | | $ | 112 | | | $ | — | | | $ | 122 | |

Currency translation and other (a) | | (1) | | | 7 | | | — | | | 6 | |

| Balance as of June 30, 2022 | | | | | | | | |

| Goodwill | | 10 | | | 119 | | | — | | | 129 | |

| Accumulated impairment losses | | (1) | | | — | | | — | | | (1) | |

| Total | | $ | 9 | | | $ | 119 | | | $ | — | | | $ | 128 | |

(a)Represents the effects of foreign currency translations and reclassifications.

Other Intangibles

Identifiable intangible assets comprised the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2022 | | December 31, 2021 |

| In millions | | Gross Carrying Amount | | Accumulated Amortization | | Net Intangible Assets | | Gross Carrying Amount | | Accumulated Amortization | | Net Intangible Assets |

| Customer relationships and lists | | $ | 59 | | | $ | (51) | | | $ | 8 | | | $ | 56 | | | $ | (48) | | | $ | 8 | |

| Software | | 3 | | | (3) | | | — | | | 3 | | | (2) | | | 1 | |

| Other | | 4 | | | (4) | | | — | | | 4 | | | (4) | | | — | |

| Total | | $ | 66 | | | $ | (58) | | | $ | 8 | | | $ | 63 | | | $ | (54) | | | $ | 9 | |

Amortization expense related to intangibles was immaterial for each of the three months and six months ended June 30, 2022 and 2021, respectively.

NOTE 11 INCOME TAXES

An income tax provision of $33 million and $59 million was recorded for the three and six months ended June 30, 2022 and the reported effective income tax rate was 28% and 30%, respectively. An income tax provision of $39 million and $54 million was recorded for the three and six months ended June 30, 2021, and the reported effective income tax rate was 27% and 28%, respectively.

The Brazilian Federal Revenue Service has challenged the deductibility of goodwill amortization generated in a 2007 acquisition by International Paper do Brasil Ltda., now named Sylvamo do Brasil Ltda. (“Sylvamo Brasil”). a wholly-owned subsidiary of the Company (the “Brazil Tax Dispute”). Sylvamo Brasil received assessments for the tax years 2007-2015 totaling approximately $114 million in tax, and $355 million in interest, penalties and fees as of June 30, 2022 (adjusted for variation in currency exchange rates). International Paper challenged and is managing the litigation of this matter pursuant to the tax matters agreement between us and International Paper. After a previous favorable ruling challenging the basis for these assessments, there were subsequent unfavorable decisions from the Brazilian Administrative Council of Tax Appeals. On behalf of Sylvamo Brasil, International Paper has appealed and at present, has advised us that it intends to further appeal these and any future unfavorable administrative judgments to the Brazilian federal courts; however, this tax litigation matter may take

many years to resolve. The Company believes that the transaction underlying these assessments was appropriately evaluated, and that the Company’s tax position would be sustained, based on Brazilian tax law.

Pursuant to the terms of the tax matters agreement entered into between International Paper and Sylvamo, International Paper will pay 60%, and Sylvamo will pay 40% on up to $300 million of any assessment related to this matter, and International Paper will pay all amounts of the assessment over $300 million. Also in connection with this agreement, all decisions concerning the conduct of the litigation related to this matter, including strategy settlement, pursuit and abandonment, will continue to be made by International Paper, which is vigorously defending Sylvamo Brasil’s historic tax position against the current assessments and any similar assessments that may be issued for tax years subsequent to 2015.

NOTE 12 COMMITMENTS AND CONTINGENT LIABILITIES

Environmental and Legal Proceedings

The Company is subject to environmental remediation laws and regulations in the countries in which we operate. Remediation costs are recorded in the condensed consolidated and combined financial statements when they become probable and reasonably estimable. The Company has estimated the probable liability associated with these environmental remediation matters to be approximately $23 million in the aggregate as of June 30, 2022. The $23 million estimated probable liability pertains to matters on property owned by the Company’s Russian operations, and as a result, is included in “Current liabilities held for sale” in the accompanying condensed consolidated balance sheet. The increase from the estimated probable liability of $15 million reported for these matters as of March 31, 2022 is due to increased strength of the Russian ruble.

In 2018, the Company discovered and voluntarily disclosed to the Russian environmental agency, Rosprirodnadzor (“RPN”) the presence of mercury contamination in sediment in a river tributary that traverses the Company’s mill property in Svetogorsk, Russia, and the authorities initiated an investigation. The mercury contamination resulted from the operations of a former chlor-alkali manufacturing plant on the mill site. Remediation of the river tributary was completed in 2020. The Company continues to remediate the soil and groundwater contamination associated with the chlor-alkali plant. Of the $23 million estimated probable liability for environmental remediation matters as of June 30, 2022, $17 million is associated with this matter.

In February 2022, the Company received from RPN a damage claim in the amount of approximately $9 million relating to alleged discharges of mercury, aluminum and lignin into the river in 2019 from the contaminated sediment at the Svetogorsk mill site. The Company has estimated the probable liability for this matter at approximately $2 million as of June 30, 2022, which estimate reflects the results of expert sampling and testing conducted by the Company for the presence of the pollutants claimed to be released in 2019.

The Company is involved in various other inquiries, administrative proceedings and litigation relating to environmental and safety matters, taxes (including VAT), personal injury, product liability, labor and employment, contracts, sales of property, intellectual property, tax, and other matters, some of which allege substantial monetary damages. See Taxes Other Than Payroll Taxes below for details regarding certain tax matters. Assessments of lawsuits and claims can involve a series of complex judgments about future events, can rely heavily on estimates and assumptions, and are otherwise subject to significant uncertainties. As a result, there can be no certainty that the Company will not ultimately incur charges in excess of presently recorded liabilities. The Company believes that loss contingencies arising from pending matters including the matters described herein, will not have a material effect on the consolidated financial position or liquidity of the Company. However, in light of the inherent uncertainties involved in pending or threatened legal matters, some of which are beyond the Company's control, and the large or indeterminate damages sought in some of these matters, a future adverse ruling, settlement, unfavorable development, or increase in accruals with respect to these matters could result in future charges that could be material to the Company's results of operations or cash flows in any particular reporting period.

Taxes Other Than Payroll Taxes

In 2017, the Brazilian Federal Supreme Court decided that the state value-added tax (“VAT”) should not be included in the basis of federal VAT calculation, and in 2021, such court ruled on the definition of VAT. The rulings are final with no further rulings or action in this matter expected. We recognized a receivable as a result of such rulings. As of June 30, 2022, the receivable is $7 million after giving effect to the portion of the receivable that has been consumed by offsetting various taxes payable.

We have other open tax matters awaiting resolution in Brazil, which are at various stages of review in various administrative and judicial proceedings. We routinely assess these tax matters for materiality and probability of loss or gain, and appropriate amounts have been recorded in our financial statements for any open items where the risk of loss is deemed probable. We currently do not consider any of these other tax matters to be material individually. However, it is reasonably possible that settlement of any of these matters concurrently could result in a material loss or that over time a matter could become material, for example, if interest were accruing on the amount at issue for a significant period of time. Also, future exchange rate fluctuations could be unfavorable to the U.S. dollar and significant enough to cause an open matter to become material. The expected timing for resolution of these open matters ranges from one year to ten years.

NOTE 13 LONG-TERM DEBT

In anticipation of our separation from International Paper, on August 16, 2021, we entered into a series of financing transactions in which we incurred long-term debt consisting of 2 term loans (“Term Loan F” and “Term Loan B”) and the 2029 Senior Notes. The proceeds of the debt were directly attributed to the Company and as such are reflected as long-term debt.

In addition to the debt noted above, the Company has the ability to access a five-year cash flow-based revolving credit facility with a total borrowing capacity of $450 million (“Revolving Credit Facility”). As of June 30, 2022, the Company had no outstanding borrowings on the Revolving Credit Facility. As of December 31, 2021, the Company had $20 million outstanding borrowings on the Revolving Credit Facility. The outstanding balance on the Revolving Credit Facility is recorded within “Notes payable and current maturities of long-term debt.”

Long-term debt is summarized in the following table:

| | | | | | | | | | | | | | |

| In millions | | June 30, 2022 | | December 31, 2021 |

Term Loan F - due 2027 (a) | | $ | 506 | | | $ | 512 | |

Term Loan B - due 2028 (b) | | 348 | | | 401 | |

7.00% Senior Notes - due 2029 (c) | | 443 | | | 443 | |

| Other | | 18 | | | 20 | |

| Less: current portion | | (25) | | | (19) | |

| Total | | $ | 1,290 | | | $ | 1,357 | |

(a) As of June 30, 2022 and December 31, 2021, presented net of $4 million and $5 million in unamortized debt issuance costs, respectively.

(b) As of June 30, 2022 and December 31, 2021, presented net of $4 million and $5 million in unamortized debt issuance costs, respectively. As of June 30, 2022 and December 31, 2021, presented net of $3 million and $4 million in unamortized original issue discount paid, respectively.

(c) As of June 30, 2022 and December 31, 2021, presented net of $7 million and $7 million in unamortized debt issuance costs, respectively.

The 2029 Senior Notes are unsecured bonds with a 7.00% fixed interest rate, payable semi-annually. The obligations under the Term Loan F, Term Loan B and Revolving Credit Facility are secured by substantially all the tangible and intangible assets of Sylvamo and its subsidiaries, subject to certain exceptions, and along with the 2029 Senior Notes facility are guaranteed by Sylvamo and certain subsidiaries. The interest rates applicable to the Term Loan F, Term Loan B and revolving credit facility are based on a fluctuating rate of interest measured by reference to LIBOR plus a fixed percentage of 1.75%, 4.50% and 1.50%, respectively, payable monthly, with a LIBOR floor of 0.00% for the Term Loan F and Revolving Credit Facility and 0.50% floor for the Term Loan B.

We are receiving interest patronage credits under the Term Loan F. Patronage credits are distributions of profits from banks in the Farm Credit system, which as cooperatives are required to distribute a portion of profits to their members. Patronage distributions, which are made primarily in cash but also in equity in the lenders, are generally received in the first quarter of the year following that in which they were earned. Expected patronage credits are accrued in accounts and notes receivable as a reduction to interest expense in the period earned. After giving effect to expected patronage distributions of 90 basis points, of which 70 basis points is expected as a cash rebate, the effective net interest rate on the Term Loan F was approximately 2.52% and 1.05% as of June 30, 2022 and December 31, 2021, respectively.

In the fourth quarter of 2021 in connection with the Term Loan F, the Company entered into interest rate swaps with various counterparties with a notional amount of $400 million and maturities ranging from 2024 to 2026. These interest rate swaps allow for the Company to exchange the difference in the variable rates on Term Loan F determined in reference to LIBOR and the fixed interest rate per notional amount ranging from 1.05% to 1.40%. As of June 30, 2022, the fair value of these interest rate swaps was an asset of $26 million. As of December 31, 2021, the fair value of these interest rate swaps was immaterial. Fair values of interest rate swap assets are reflected in “Deferred charges and other assets.”

The Company is subject to certain covenants limiting, among other things, the ability of most of its subsidiaries to incur additional indebtedness or issue certain preferred shares; pay dividends on or make distributions in respect of the Company’s or its subsidiaries’ capital stock or make investments or other restricted payments; create restrictions on the ability of the Company’s restricted subsidiaries to pay dividends to the Company or make certain other intercompany transfers; sell certain assets; create liens; consolidate, merge, sell or otherwise dispose of all or substantially all of the Company’s assets; and enter into certain transactions with its affiliates.

With respect to the Revolving Credit Facility and Term Loan F Facility, the Company is required to comply with a minimum consolidated interest charge coverage ratio of 3.00 to 1.00 and a maximum consolidated total leverage ratio of 4.25 to 1.00, stepping down to 4.00 to 1.00 following the third quarter of 2022, and with a further step down to 3.50 to 1.00 on and after September 13, 2023, if and so long as certain conditions remain unsatisfied that relate to the Company’s potential liability in connection with the Brazil Tax Dispute. In addition, until certain conditions related to the Company’s potential liability in connection with the Brazil Tax Dispute have been satisfied, the Company’s ability to make certain restricted payments will be capped at an annual amount equal to $25 million, which amount shall be increased to $50 million in any calendar year if the Company’s pro forma consolidated total leverage ratio is below 2.50 to 1.00 and $75 million in any calendar year if the Company’s pro forma consolidated total leverage ratio is below 2.00 to 1.00.

NOTE 14 PENSION AND POSTRETIREMENT BENEFIT PLANS

Defined Benefit Plans

Certain of the Company’s employees participated in defined benefit pension plans sponsored by International Paper through August 31, 2021, which included participants of other International Paper operations, that were accounted for by International Paper in accordance with accounting guidance for defined benefit pension plans. Accordingly, net periodic pension expense for Company employees was allocated to the Company based upon a percent of salaries and reported in the condensed consolidated and combined statements of operations, and the Company did not record an asset or liability to recognize the funded or unfunded status of the Plans. The service and non-service cost components of net periodic pension expense for these employees is recorded within “Cost of products sold” and “Selling and administrative expenses.”

As part of our separation from International Paper, the Company established and sponsored pension plans for the benefit of the Company’s employees. Pension assets and obligations relating to the employees of the Company that participated in plans sponsored by International Paper were transferred into pension plans sponsored by the Company. The Company is accounting for these plans as direct to the Company beginning on September 1, 2021. The assets and liabilities were remeasured on September 1, 2021 and all balances related to plans sponsored by the Company are reflected in “Deferred charges and other assets” and “Other liabilities.”

In addition, the Company has sponsored and maintained certain defined benefit pension plans for participating employees in the United Kingdom and Brazil. The Company’s participation in these plans have been accounted for using the single-employer method in all periods presented. All balances related to these plans are reflected in “Deferred charges and other assets” and “Other liabilities.”

The components of net periodic pension expense are included in “Cost of products sold” and “Selling and administrative expenses.” Net periodic pension expense (benefit) for all pension plans sponsored by the Company for the six months ended June 30, 2022 and for the plans accounted for as single-employer plans for the six months ended June 30, 2022 was immaterial.

The Company’s funding policy for the pension plans is to contribute amounts sufficient to meet legal funding requirements, plus any additional amounts that the Company may determine to be appropriate considering the funded status of the plans, tax deductibility, cash flow generated by the Company, and other factors. The Company continually reassesses the amount and timing of any discretionary contributions. Generally, the non-U.S. pension plans are funded using the projected benefit as a target, except in certain countries where funding of benefit plans is not required.

NOTE 15 INCENTIVE PLANS

International Paper had an Incentive Compensation Plan (“ICP”) prior to the spin-off. The ICP authorizes grants of restricted stock, restricted or deferred stock units, performance awards payable in cash or stock upon the attainment of specified performance goals, dividend equivalents, stock options, stock appreciation rights, other stock-based awards and cash-based awards at the discretion of the Management Development and Compensation Committee of the Board of Directors of International Paper (the “Committee”) that administers the ICP. Stock-based compensation expense until the spin-off on October 1, 2021, includes expense attributable to us based on the awards and terms previously granted to our employees and an allocation of International Paper’s corporate and shared functional expenses.

Subsequent to the spin-off, Sylvamo adopted the Sylvamo 2021 Incentive Compensation Plan, which includes shares available under its long-term incentive plan (“LTIP”) that grants certain employees or non-employee directors of the Company different forms of awards including time-based and performance-based restricted stock units. As of June 30, 2022, 3,212,359 shares remain available for future grants.

Total stock-based compensation cost recognized by the Company was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| In millions | | 2022 | | 2021 | | 2022 | | 2021 |

| Total stock-based compensation expense (included in selling and administrative expense) | | $ | 7 | | | $ | 4 | | | $ | 11 | | | $ | 7 | |

As of June 30, 2022, $25 million of compensation cost, net of estimated forfeitures, related to all stock-based compensation arrangements for Company employees had not yet been recognized. This amount will be recognized in expense over a weighted-average period of 1.6 years.

NOTE 16 FINANCIAL INFORMATION BY BUSINESS SEGMENT AND GEOGRAPHIC AREA

The Company’s business segments, Europe, Latin America and North America, are consistent with the internal structure used to manage these businesses. All segments are differentiated on a common product, common customer basis, consistent with the business segmentation generally used in the Forest Products industry.

Business segment operating profit is used by the Company’s management to measure the earnings performance of its businesses. Management believes that this measure provides investors and analysts useful insights into our operating performance. Business segment operating profit is defined as income from continuing operations before income taxes, excluding interest (income) expense, net, and net special items.

External sales are defined as those that are made to parties outside the Company’s combined group, whereas sales by segment in the Net Sales table are determined using a management approach and include intersegment sales.

Information By Business Segment

Net Sales

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| In millions | | 2022 | | 2021 | | 2022 | | 2021 |

| Europe | | $ | 135 | | | $ | 94 | | | $ | 252 | | | $ | 178 | |

| Latin America | | 249 | | | 189 | | | 464 | | | 357 | |

| North America | | 549 | | | 426 | | | 1,057 | | | 808 | |

| Intersegment Sales | | (21) | | | (14) | | | (40) | | | (24) | |

| Net Sales | | $ | 912 | | | $ | 695 | | | $ | 1,733 | | | $ | 1,319 | |

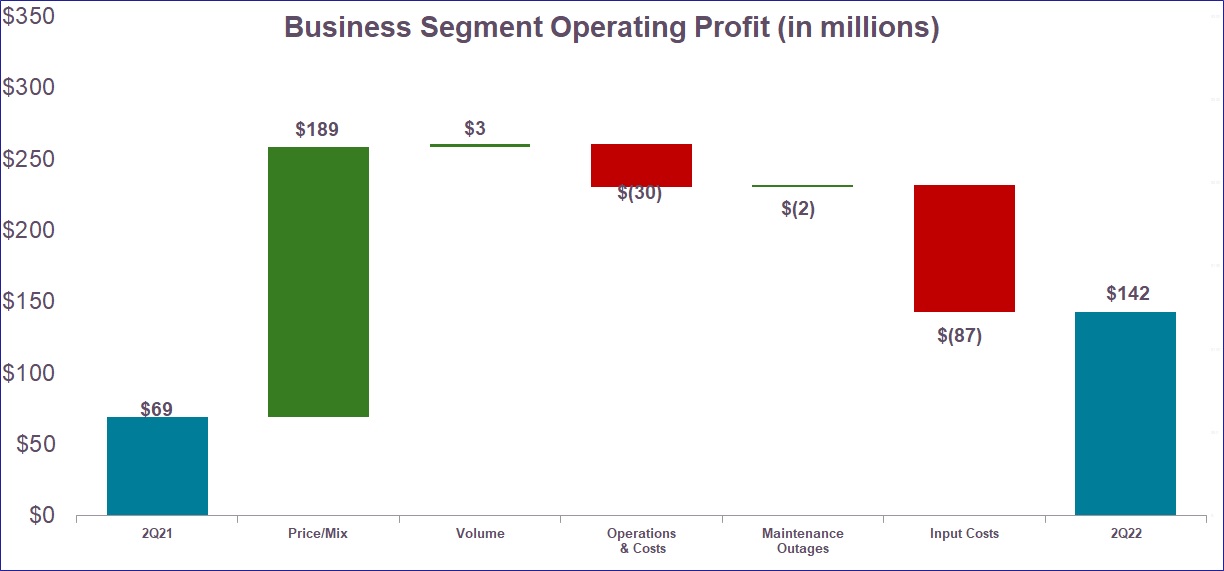

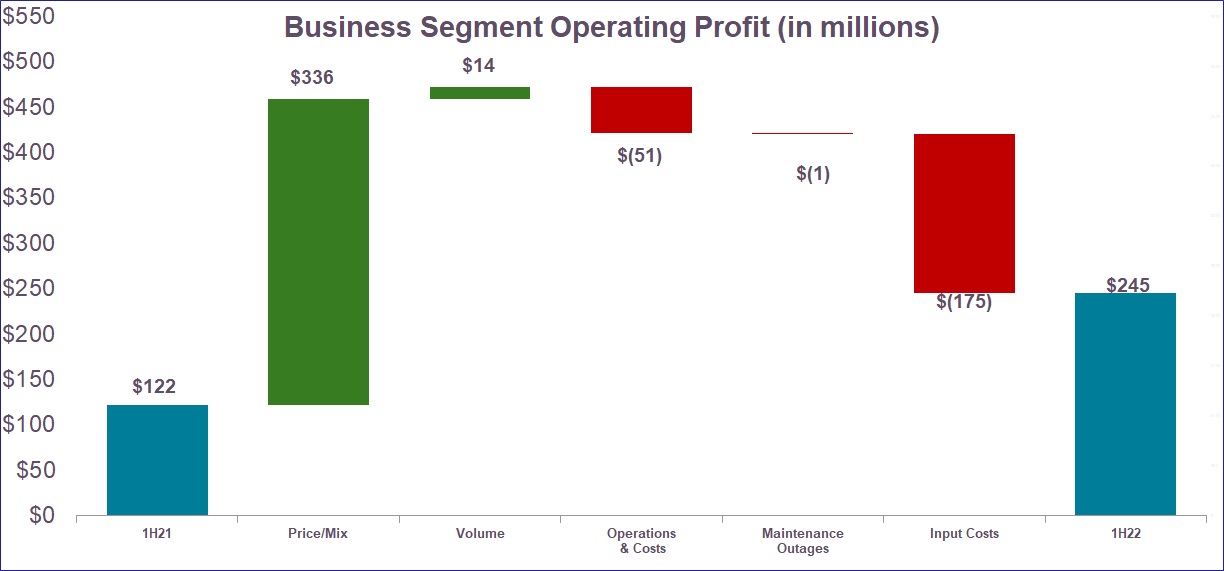

Business Segment Operating Profit

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| In millions | | 2022 | | 2021 | | 2022 | | 2021 |

| Europe | | $ | 17 | | | $ | 4 | | | $ | 19 | | | $ | (3) | |

| Latin America | | 59 | | | 44 | | | 98 | | | 86 | |

| North America | | 66 | | | 21 | | | 128 | | | 39 | |

| Business Segment Operating Profit | | $ | 142 | | | $ | 69 | | | $ | 245 | | | $ | 122 | |

| Income from continuing operations before income taxes | | $ | 117 | | | $ | 140 | | | $ | 198 | | | $ | 193 | |

| Interest (income) expense, net | | 17 | | | (29) | | | 34 | | | (29) | |

| Net special items expense (income) | | 8 | | | (42) | | | 13 | | | (42) | |

| | $ | 142 | | | $ | 69 | | | $ | 245 | | | $ | 122 | |

NOTE 17 RELATED PARTY TRANSACTIONS

Prior to the spin-off on October 1, 2021, we historically operated as part of International Paper and not as a standalone company. As a result of the spin-off on October 1, 2021, Sylvamo became an independent public company. The following discussion summarizes activity between the Company and International Paper both prior and subsequent to the spin-off.

Allocation of General Corporate Expenses

The condensed consolidated and combined statements of operations include expenses for certain centralized functions and other programs provided and administered by International Paper that were charged directly to the Company. In addition, for purposes of preparing these condensed consolidated and combined financial statements for periods prior to the spin-off on a carve-out basis, we have been allocated a portion of International Paper’s total corporate expense. See Note 1 Basis of Presentation for a discussion of the methodology used to allocate corporate-related costs for purposes of preparing these financial statements on a carve-out basis.

Net transfers from Parent are included within the summary of changes in equity included in Note 4 Equity. The components of the net transfers from International Paper are as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| In millions | | 2022 | | 2021 | | 2022 | | 2021 |

| General financing activities | | $ | — | | | $ | (120) | | | $ | — | | | $ | (79) | |

| Corporate allocations | | — | | | 42 | | | — | | | 80 | |

| Stock-based compensation | | — | | | 4 | | | — | | | 7 | |

| Total net transfers from Parent | | $ | — | | | $ | (74) | | | $ | — | | | $ | 8 | |

Related Party Sales and Purchases

The Company purchases certain of its products from International Paper which are produced in facilities that remained with International Paper. The Company continues to purchase uncoated freesheet and bristols pursuant to an offtake agreement between the Company and International Paper. The Company purchased inventory associated with the offtake agreements of $147 million for the six months ended June 30, 2022.

The Company purchases fiber pursuant to a fiber purchase agreement between the Company and International Paper. The Company purchased inventory associated with the fiber supply agreements of $47 million for the six months ended June 30, 2022.

Transition Services Agreement

Pursuant to the Transition Services Agreement, International Paper and Sylvamo will provide certain services to one another on an interim, transitional basis. The services to be provided include certain information technology services, finance and accounting services and human resources and employee benefits services. The agreed-upon charges for such services are generally intended to allow the providing company to recover all costs and expenses for providing such services. The total amount of expenses incurred by Sylvamo under the Transition Services Agreement for the six months ended June 30, 2022 was $16 million.

Related Party Receivable

The Company had related party receivables of $1 million and $3 million as of June 30, 2022 and December 31, 2021, respectively, related to product sales to International Paper and other items. Related party receivables are included in “Accounts and notes receivable.”

Related Party Payable

The Company had related party payables of $84 million and $110 million as of June 30, 2022 and December 31, 2021, respectively, related to inventory purchases from International Paper. Related party payables are included in “Accounts payable” and “Other current liabilities.”

Included in our December 31, 2021 inventory purchases payable is a $77 million related party payable, pursuant to the terms of the supply and offtake agreements between the Company and International Paper, which was repaid throughout the first six months of 2022.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our condensed consolidated and combined financial statements and related notes included in “Financial Information” of this Quarterly Report on Form 10-Q (this “Form 10-Q”) and the Company’s 10-K for the three years ended December 31, 2021, 2020 and 2019. In addition to historical consolidated combined financial information, the following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs that involve significant risks and uncertainties. Our actual results could differ materially from those stated and implied in any forward-looking statements. Factors that could cause or contribute to those differences include those discussed below and elsewhere in this Form 10-Q and in our 2021 10-K, particularly under the headings “Risk Factors” and “Forward-Looking Statements.”

THE SPIN-OFF

Prior to the spin-off on October 1, 2021, we historically operated as part of International Paper and not as a standalone company. These condensed consolidated and combined financial statements reflect the combined historical results of operations and cash flows of the Company as historically managed within International Paper for the periods prior to the completion of the spin-off and reflect our consolidated financial position, results of operations and cash flows for the period after the completion of the spin-off. The condensed consolidated and combined financial statements have been prepared in U.S. dollars and in conformity with U.S. GAAP. We recommend that the accompanying condensed consolidated and combined financial statements be read in conjunction with the audited consolidated combined financial statements and the notes thereto included in our 2021 10-K. The accompanying condensed consolidated and combined financial statements reflect all normal and recurring adjustments that are, in the opinion of management, necessary for the fair presentation of the financial position, results of operations and cash flows for the interim periods presented. The results of operations for any interim period are not indicative of the results that might be achieved for a full year.

EXECUTIVE SUMMARY

In the second quarter of 2022, we increased earnings and generated strong cash from continuing operations. In May, we announced the decision to sell our Russian operations and the business is now classified as discontinued operations. Second quarter net income from continuing operations was $84 million ($1.89 per diluted share), compared with $55 million ($1.25 per diluted share) for the first quarter. Operating cash from continuing operations was $76 million in the second quarter compared to $54 million in the prior quarter. Adjusted EBITDA was $189 million in the second quarter, which represents a 30% increase of $43 million from first quarter adjusted EBITDA of $146 million. Additionally, our second quarter adjusted EBITDA margin of 20.7% represents a 290 basis point improvement from our adjusted EBITDA margin of 17.8% in the prior quarter. Free cash flow improved in the second quarter to $39 million compared to $32 million in the first quarter.

Comparing our performance in the second quarter to the first quarter, we benefited from gains in pricing, and commercial and operational execution, all of which combined allowed us to outpace inflation and expand our margins. The improvement in price and mix reflected better price realization in Europe and North America that exceeded our forecasts. Demand for uncoated freesheet continued to strengthen in Latin America and North America as schools and offices reopened. Volumes remained strong and our production facilities ran full in all three regions. In addition, we initiated a dividend program during the quarter, which was paid in July, we paid down $48 million in long-term debt, and our Board of Directors authorized a share repurchase program of up to $150 million.

Looking ahead to the third quarter of 2022, we remain committed to generating strong earnings and cash flow despite continuing cost inflation and supply chain and geo-political challenges. Global uncoated freesheet demand is expected to remain strong. Selling prices remain favorable and we expect to realize the benefits of price increases already communicated to our customers in all regions, which we expect will allow us to continue outpacing input and transportation cost inflation. Lastly, we will continue to pursue the sale of our Russian operations.

Divestiture of Russian Operations

During the second quarter of 2022, management committed to a plan to sell the Company’s Russian operations, which were previously part of the Europe business segment. As a result, all current and historical operating results of the Russian operations are presented as “Discontinued operations, net of taxes.” All historical assets and liabilities of the Russian operations are classified as current and long-term assets and liabilities of discontinued operations. We recorded a pre-tax charge of $68 million ($57 million after taxes) for the impairment of the Russian fixed assets during the first quarter of 2022 and a pre-tax charge of

$156 million ($156 million after taxes) during the second quarter of 2022 to reserve for the elimination of the cumulative foreign currency translation loss related to our Russian business. See Note 7 Divestiture and Impairment of Business for further details. Unless otherwise indicated, all financial information refers to continuing operations.

Our operations in Russia include a paper mill in Svetogorsk, Russia, and long-term harvesting rights on 860,000 acres of government-owned forestland, and represented approximately 15% of our net sales and 10% of our long-lived assets for the year ended December 31, 2021.

RESULTS OF OPERATIONS

The following summarizes our results of operations for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| In millions | 2022 | | 2021 | | 2022 | | 2021 |

| NET SALES | $ | 912 | | | $ | 695 | | | $ | 1,733 | | | $ | 1,319 | |

| COSTS AND EXPENSES | | | | | | | |

| Cost of products sold (exclusive of depreciation, amortization and cost of timber harvested shown separately below) | 562 | | | 408 | | | 1,108 | | | 828 | |

| Selling and administrative expenses | 81 | | | 57 | | | 147 | | | 96 | |

| Depreciation, amortization and cost of timber harvested | 32 | | | 31 | | | 63 | | | 62 | |

| Distribution expenses | 97 | | | 82 | | | 171 | | | 156 | |

| Taxes other than payroll and income taxes | 6 | | | 6 | | | 12 | | | 13 | |

| Interest (income) expense, net | 17 | | | (29) | | | 34 | | | (29) | |

| INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES | 117 | | | 140 | | | 198 | | | 193 | |

| Income tax provision | 33 | | | 39 | | | 59 | | | 54 | |

| NET INCOME FROM CONTINUING OPERATIONS | 84 | | | 101 | | | 139 | | | 139 | |

| Discontinued operations, net of taxes | (143) | | | 14 | | | (172) | | | 38 | |

| NET INCOME (LOSS) | $ | (59) | | | $ | 115 | | | $ | (33) | | | $ | 177 | |

Three Months Ended June 30, 2022 Compared to the Three Months Ended June 30, 2021

Net Sales

For the three months ended June 30, 2022, the Company reported net sales of $912 million, compared with $695 million for the three months ended June 30, 2021. The net sales increase was primarily driven by an increase in average sales prices of our products, reflecting our success in obtaining price increases from our customers in order to offset higher input costs. International net sales (based on the location of the seller and including U.S. exports) totaled $363 million, or 40% of total sales for the three months ended June 30, 2022. This compares with international net sales of $276 million, or 40% of total sales for the three months ended June 30, 2021. Additional details on net sales are provided in the section titled “Business Segment Operating Results.”

Cost of Products Sold

Cost of products sold increased by $154 million, primarily due to higher input and operating costs compared to the prior period.

Selling and Administrative Expenses

The $24 million increase in selling and administrative expenses was the result of the increase in net sales activity and $8 million and $9 million of expense recognized in the three months ended June 30, 2022 related to the transition service agreement and one-time costs associated with the spin-off, respectively. Additional details regarding the one-time costs associated with the spin-off are provided in “Non-GAAP Financial Measures.”

Interest (Income) Expense, net