UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

December 31, 2023

Or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from - to –

Commission File No. 001-40718

_______________________

SYLVAMO CORPORATION

(Exact Name of Registrant as Specified in its Charter)

_______________________

| | | | | |

| Delaware | 86-2596371 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| | | | | |

6077 Primacy Parkway Memphis, Tennessee | 38119 |

| (Address of Principal Executive Offices) | (Zip Code) |

901-519-8000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $1.00 per share | | SLVM | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large Accelerated Filer | ☒ | Accelerated filer | ☐ |

| | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. x

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

As of June 30, 2023, the aggregate market value of the registrant’s common stock held by non-affiliates was $1,683,429,048 based on the closing price of a share of the common stock on the New York Stock Exchange on such date.

The number of shares outstanding of the registrant’s common stock, par value $1.00 per share, as of February 16, 2024 was 41,220,910.

Documents incorporated by reference:

Portions of the registrant’s proxy statement filed within 120 days of the close of the registrant’s fiscal year in connection with the registrant’s 2023 annual meeting of shareholders are incorporated by reference into Part III of this Form 10-K.

SYLVAMO CORPORATION

INDEX TO ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2023

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| ITEM 1C. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| ITEM 7. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| ITEM 7A. | | |

| ITEM 8. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | | | | | | |

| | |

| ITEM 9. | | |

| ITEM 9A. | | |

| ITEM 9B. | | |

| ITEM 9C. | | |

| PART III. | | |

| ITEM 10. | | |

| ITEM 11. | | |

| ITEM 12. | | |

| ITEM 13. | | |

| ITEM 14. | | |

| PART IV. | | |

| ITEM 15. | | |

| ITEM 16. | | |

| | |

| APPENDIX I | | |

| APPENDIX II | | |

PART I.

ITEM 1. BUSINESS

OUR COMPANY

Sylvamo Corporation (the “Company” or “Sylvamo”, which may also be referred to as “we” or “us”) is a global uncoated papers company with a broad portfolio of top-tier brands and low-cost, large-scale paper mills located in and serving the most attractive geographies, including Europe, Latin America and North America, which are our business segments. We produce uncoated freesheet (“UFS”) for paper products such as cutsize and offset paper, as well as market pulp. With roots going back to 1898, we have a long history of offering premium quality papers to meet the needs of our customers and end-users. Our mills predominantly rank in the lowest quartile on global and regional UFS cost curves, and we believe our low-cost operations enable us to serve our customers with the highest quality products at attractive margins. Our industry-leading brands, known for their long-standing reputation in their respective markets for product quality and performance, allow us to maintain our long-term relationships with top-tier customers throughout economic cycles. Our international reach and strong positioning across retail, merchant and e-commerce channels optimally positions us to meet the paper needs of our end-users around the world. This also provides geographical diversification of our revenue and profits. From 2021 to 2023, on average, we generated 44% of our revenues and 46% of our Business Segment Operating Profit in Europe and Latin America. Each region in which we operate exhibits different supply and demand characteristics. Both Latin America and North America have strong profitability for the uncoated paper industry relative to other geographies. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Business Segment Results - Results of Operations for a definition of Business Segment Operating Profit.

During the second quarter of 2022, we committed to a plan to sell our Russian operations (which were sold on October 2, 2022). Our operations in Russia, which included a paper mill in Svetogorsk, Russia and long-term harvesting rights on 860,000 acres of government-owned forestland, represented approximately 15% of our total net sales and 10% of our long-lived assets for the year ended December 31, 2021. As this divestiture was a strategic shift away from the Russian markets, we have presented the historical operating results of the Russian operations as “discontinued operations” in all periods presented, as applicable (see Note 8 Divestiture and Impairment of Business to the Consolidated and Combined Financial Statements for additional discontinued operations information). As a result, the narrative discussion in this Item 1 relates only to our continuing operations, and all other financial results, disclosures and discussions of the Company’s continuing operations appearing elsewhere in this Annual Report on Form 10-K exclude our Russian operations, unless otherwise noted.

In January 2023, the Company completed the previously announced acquisition of Stora Enso’s uncoated freesheet paper mill in Nymölla, Sweden, for €157 million (approximately $167 million), subject to customary purchase price adjustments. The integrated mill has the capacity to produce approximately 500,000 short tons of uncoated freesheet on two paper machines. The Nymölla mill’s results of operations are included in Sylvamo’s consolidated financial statements from the date of acquisition.

COMPETITION

The markets in which we operate are highly competitive with well-established domestic and foreign manufacturers. For instance, in North America, the four largest manufacturers of UFS, including Sylvamo, represent approximately 78% of the total annual production capacity. As the use of electronic mediums and alternative products increases, and because paper production does not generally rely on proprietary processes, except for highly specialized papers or products, the areas into which Sylvamo sells its principal products are increasingly competitive. Furthermore, the level of competitive pressure Sylvamo may face is dependent, in part, upon exchange rates, particularly the rate between the U.S. dollar and the Euro and the U.S. dollar and the Brazilian real. Some of our competitors have converted mills or paper machines at their mills to linerboard, pulp and boxboard capacity, which reduced the supply of UFS and other printing papers.

MARKETING AND DISTRIBUTION

Sylvamo sells products directly to end users and converters, as well as through agents, resellers and paper distributors.

DESCRIPTION OF PRINCIPAL PRODUCTS

RAW MATERIALS

HUMAN CAPITAL

In this Human Capital section and elsewhere in this Annual Report on Form 10-K, we refer in various contexts to our website and to reports, policies and other information published by us and on our website. The information on our website and in the referenced reports, policies and other information, and that is otherwise connected to our website, is not incorporated by reference into this Annual Report on Form 10-K, and should not be considered part of this or any other report that we file with or furnish to the SEC.

Employees

Sylvamo’s capabilities and potential are delivered through our dedicated, talented and diverse workforce, which we believe is among the best in the industry. We employ over 6,500 people globally, with 25%, 47% and 28% of our workforce located primarily in 14 countries in Europe, Latin America and North America, respectively. A portion of our workforce is represented by unions in Brazil, France, Sweden and, in the United States, at our mill in Ticonderoga, New York. We believe that our relationships with our unions are constructive.

We strive to be the employer of choice. To attract, retain and develop talented and diverse employees that reflect our diverse communities and customers, we work to foster a safe and inclusive workplace where all employees feel safe, welcomed, valued, engaged, fairly compensated and have opportunities for professional development.

Health and Safety

The health and safety of our employees, contractors and visitors to our facilities are paramount. We strive to design and operate injury-free workplaces for our employees and everyone who enters our facilities. As responsible stewards of people and their communities, we have emphasized safety at our Company and strictly complied with national regulations such as, in the United States, the Occupational Safety and Health Administration’s regulations. Based on our safety record and our comparison of it against publicly available industry safety information, we are an industry-leading company in employee safety.

We track our safety record and report it annually in our Environmental, Social and Governance Report (“ESG Report”). This information is available at sylvamo.com.

We take precautions to protect the health and safety of our employees and comply with applicable government requirements and safety guidance in the three regions where we operate. Our “People Before Paper” program, introduced in 2022, includes ongoing communications, training and leadership emphasis throughout the organization on putting people’s safety before operations, always. As part of such program, we developed a Safety Leadership Training Program rolled out in 2023 to train our leaders in how and why people may act in unsafe ways and how to be a leader in reducing this risk. Our program also promotes increasing safety, especially in the manufacturing setting, by emphasizing focus on one safe task a time. It further emphasizes mental health and overall well-being as important to increasing safety. We frequently communicate and emphasize to employees the importance of, and have provided opportunities for them to enhance, their physical and mental health and well-being.

Attraction and Retention of Employees and Labor Supply

Our talent strategy focuses on attracting and retaining the best employee talent from the diverse backgrounds of the communities where we operate. To that end, we aim to foster for employees an inclusive and diverse work culture, provide competitive compensation and benefits, reward performance, provide professional development opportunities, promote employee health and well-being, and encourage engagement by showing our employees that we value their engagement with us and in their communities.

To provide our employees globally competitive and fair compensation and benefits, we periodically review, adjust and align our compensation practices with best practices around the material elements of our compensation structure.

Our employee recruiting includes developing and recruiting new talent from diverse backgrounds through college recruiting efforts. For example, in the United States and Brazil, we have programs that include internships and trainee programs to attract college hires, with a special focus on preparing early career engineers and safety professionals to be future leaders at our Company.

We have launched Employee Assistance Programs globally, because our employees’ health and well-being is a top priority.

We support, encourage and provide our employees with opportunities to be engaged at Sylvamo and in the communities where they work and live. We communicate to our employees the value we place on employee engagement.

We develop the capabilities of our employees through our continuous learning, development and performance management programs. We invest in their growth and development by providing a multi-dimensional approach to learning. This approach includes various learning journeys to help employees grow personally and professionally and advance within our organization, including for specific positions, for specific development targets, and for development of competencies and our Company culture. These learning resources are intended to provide employees with the skills they need to achieve their career goals, build management skills and be leaders within our Company.

Our hiring and retention efforts are challenged by a competitive labor market, particularly for labor with the high level of the various skills needed in our industry, particularly at our mills, which makes our cost of labor high compared to industries that require less skilled labor. We have not experienced any material shortage of labor, but if the labor supply were to further contract substantially in any of the regions where we operate, including if a public health crisis resulted in restrictions on in-person interactions imposed by governmental authorities or were to lead to more people exiting the labor market – similar to what happened in connection with the COVID-19 pandemic – it could impede our ability to attract and retain employee talent and further increase our cost of labor. For more information regarding our risks relating to challenges in the labor market or a public health crisis, see Item 1A. Risk Factors, particularly – “Our business and business prospects could be materially adversely affected if we fail to attract and retain senior management and other key employees.”

In 2023, we implemented “Project Horizon” to streamline our organization and reduce costs. We streamlined our organization based upon an evaluation of needs at all levels of the organization, eliminating a number of salaried positions and reorganizing job responsibilities. This will result in a leaner, stronger organization and cost savings. We do not believe that there are any material risks arising from the changes to our workforce made as part of Project Horizon.

Inclusion and Diversity

As part of our effort to attract and retain exceptional employee talent, we show our employees that we value having an inclusive workforce of diverse backgrounds, reflecting the communities where we are located. We believe that a workforce where diverse backgrounds are represented, engaged and empowered to inspire innovative ideas and decisions, and where all employees feel welcome and valued, facilitates achieving organizational results, differentiates us in the competition for talent and drives innovation. As we compete for talent, our commitment to a diverse and inclusive workplace supports our employer of choice objective, as prospective employees and candidates may consider a company’s commitment to diversity and inclusion in deciding whether to apply for and accept jobs. Similarly, an employee’s choice to stay with an organization may be influenced by the organization’s commitment to those same attributes.

We want to give every employee equal opportunity and celebrate the different perspectives and talents that each of us brings to Sylvamo. Our Code of Conduct sets forth the actions and behaviors that we expect of our employees and reflects our core values, including conduct that promotes inclusion and diversity. Among other things, our Code of Conduct provides that our

employee leaders will form inclusive teams reflecting our diverse global communities, build and sustain a work environment that embraces individuality and collaboration, respect differences and treat everyone fairly, demonstrate that all viewpoints matter, and provide equal opportunity for employee professional development and growth. We believe that embedding these values in our Code of Conduct stresses their importance at Sylvamo.

Our senior management team is internationally diverse with global experience, hailing from all of the geographies in which we operate — Europe, Latin America and North America. We have in place the following 2030 goals as we continue to hire top talent with diverse backgrounds and experience that reflect the communities in which we live and work:

• 30% overall women representation

• 35% women in leadership positions

• 25% minority representation in North America and other regional representation targets.

These percentages are directional goals to which we aspire to better reflect the communities in which we live and work and to be the employer of choice for our employees and potential employees. We report 2022 progress on our 2030 goals in our 2022 ESG Report at Sylvamo.com, and will report on 2023 progress in our 2023 ESG Report. We believe that we can achieve these goals by operating inclusively, embracing diversity, seeking large pools of candidates for positions, providing equal opportunity to all talent, and reducing barriers, but we cannot guarantee that we will achieve them. Our ability to achieve them is subject to risks and uncertainties both known and unknown, including many of the risks noted in Item 1A. Risk Factors.

We have an active Sylvamo team headed by our Manager of Organizational Development, Inclusion and Diversity, that, with the support of our senior leadership, refines our Company’s inclusion and diversity (“I&D”) strategy and governance model. Additionally, a broad-based team of employees, our Global I&D Council, further develops our I&D strategy and helps identify and implement means for our strategy to succeed. The Global I&D Council’s members include a range of employees at various levels of leadership, including our Senior Vice President – Operational Excellence and several Company vice presidents, who are from the regions where we operate and are of diverse races, genders and cultural backgrounds. In 2023, the efforts of the I&D team and Global I&D Council resulted in initiatives that included training and communications intended to help broaden employee perspectives and reduce biases, fostering employee mentoring and networking, and facilitating for employees the means to identify and leverage opportunities for growth and advancement. We also continued the meetings and activities of our employee inclusion networks that we started in 2022, “Women in Operations” and “Women in Leadership”. The networks provide opportunities for participating employees to share perspectives, provide and receive support and mentoring, and enhance inclusivity. All initiatives and employee inclusion networks are voluntary and open to all employees.

We expect that our Global I&D Council, regional I&D councils, employee inclusion networks and other I&D initiatives will create strong, diverse leaders who will serve as role models for other employees. Our senior leadership and board of directors strongly support our I&D initiatives, progress against which they are kept aware by periodic reports from management. The Management Development and Compensation Committee is the committee of our board of directors responsible for oversight of I&D matters.

ENVIRONMENTAL AND OTHER REGULATIONS

Sylvamo is subject to a wide range of general and industry-specific laws and regulations that are complex and changing in the regions, countries, states and other jurisdictions where we operate. They include, but are not limited to, laws pertaining to: environmental, health and safety; climate change; tax; privacy and data security; antitrust; product liability; intellectual property ownership and infringement; labor and employment; anti-corruption; import, export and trade; and foreign exchange controls and foreign ownership and investment. In addition, new laws or regulations affecting our facilities are routinely passed or proposed.

Environmental and Climate Change Regulation

Current or proposed environmental laws (by “laws,” we also mean regulations and other governmental rules) include those governing wood harvesting, air emissions, climate change, waste water discharges, storage, management and disposal of hazardous substances and wastes, contaminated sites, landfill operation and closure obligations, and health and safety matters. Compliance with these laws in all jurisdictions where we operate, therefore, is a significant factor in the operation of our business and may result in capital expenditures as well as additional operating costs. For example, our United States mills are in compliance with the U.S. Environmental Protection Agency’s (“EPA”) maximum achievable control technology (“MACT”)

standards that require owners of specified pulp and paper process equipment and boilers to meet air emissions standards for certain substances. However, as required by the Clean Air Act, the EPA will conduct a Risk and Technology Review (“RTR”) after the application of the MACT standards to determine if the standard was protective enough for human health. It is possible that such review could result in future MACT and RTR regulations that necessitate our making future capital project expenditures to comply with such regulations.

Many environmental and health and safety laws provide for substantial fines or penalties and other civil and criminal sanctions for failure to comply. Certain environmental laws provide for strict liability and, under certain circumstances, joint and several liability for investigation and remediation of the release of hazardous substances into the environment. We are committed to controlling emissions and discharges from our facilities to avoid adverse impacts on the environment, both as an environmental steward and to maintain our compliance with applicable laws. However, we may encounter situations in which our operations failed to maintain full compliance with applicable requirements, or we may learn that previous owners of our property released substances in violation of environmental laws, possibly leading to civil or criminal fines, fees, penalties or enforcement actions against us. These could include governmental or judicial orders that stop or interrupt our operations or that require us to take corrective measures at substantial costs, such as installation of additional pollution control equipment or environmental remediation. See Item 1A. Risk Factors – “We are subject to extensive environmental laws and regulations and could incur substantial costs as a result of compliance with, violations of or liabilities under these laws and regulations.” We remain committed to compliance with all applicable environmental laws and to protecting the environment.

Also, laws addressing climate change may have a material impact on us. The Paris Agreement, an international treaty on climate change, went into effect in November 2016 and continues international efforts and voluntary commitments toward reducing greenhouse gas (“GHG”) emissions. Consistent with this objective, participating countries aim to balance GHG emissions generation and sequestration in the second half of this century or, in effect, achieve net zero global GHG emissions. To assist member countries in meeting GHG reduction obligations, the EU operates an Emissions Trading System ("EU ETS"). Our Saillat mill is directly subject to regulation under Phase III, and our Nymölla mill is subject to regulation under Phase IV, of the EU ETS. The EU ETS may in the future have a material impact on us depending on, among other factors, how the Paris Agreement's non-binding commitments or allocation of and market prices for GHG credits under existing rules evolve over the coming years.

In the United States, the EPA manages regulations to: (i) control GHG emissions from mobile sources by adopting transportation fuel efficiency standards; (ii) control GHG emissions from new Electric Generating Units ("EGUs"); (iii) control emissions from new oil and gas processing operations; and (iv) require reporting of GHG emissions from sources of GHG emissions greater than 25,000 tons per year. Several U.S. states have enacted or are considering legal measures to require the reduction of GHG emissions by companies and public utilities. These federal and state regulations have not had a material impact on us. We monitor proposed programs, but it is unclear what impacts, if any, future GHG rules would have on our operations. Although not required by current regulations, we aim to reduce our Scope 1, 2 and 3 GHG emissions by 35% and define a pathway to net zero emissions by 2030 against a 2019 baseline, although we cannot provide assurance that we will be successful in these efforts.

Furthermore, governments may enact additional laws to protect the environment and address climate change, which could expose us to the costs of additional compliance and the risks of potential noncompliance. Environmental and climate change regulation continues to evolve in the various countries and U.S. states where we do business. For example, some U.S. states in which we have manufacturing operations, including New York, are taking measures to reduce GHG emissions, such as by developing a cap-and-trade program. While it is likely that governmental action and legislation regarding environmental protection and climate change (including GHG emissions) will continue or increase in the future, it is not possible to predict what additional laws relating to environmental protection and climate change may be implemented, which countries, U.S. states or other jurisdictions may adopt such laws, or the extent to which such laws may impact our business; nor is it possible to predict how existing or future laws will be administered or interpreted. In addition to possible direct impacts, such as our costs of compliance and risk of penalties and corrective measures in the event of violations, future laws could impact us indirectly, such as causing us higher prices for transportation, energy and other inputs, as well as generating more protracted air permitting processes, and causing delays and higher costs to implement capital projects.

As regulators and investors have been increasingly focused on climate change and other sustainability issues, we have been, or may, become subject to new disclosure frameworks and regulations. For example, the European Parliament adopted the Corporate Sustainability Reporting Directive (“CSRD”), and EU sustainability reporting standards are being developed by the European Financial Reporting Advisory Group, with such standards to be tailored to EU policies building on and contributing to international standardization initiatives. Such reporting will apply not only to local operations in the EU, but under certain circumstances, to entire global companies that have EU operations. The CSRD will not apply to us in calendar year 2024, but

we will need to comply with it in the future and are assessing our obligations under the CSRD. Also, the SEC has proposed, and the State of California has adopted, new climate change disclosure rules. The SEC announced proposed rules in March 2021 that are not yet final or in effect. Reporting in compliance with the CSRD, the California rules and, if adopted, the SEC rules, may require significant resources, time and attention from our management.

We have procedures in place to stay informed about developments concerning possible new legislation and laws in the countries where we operate. We regularly assess whether such legislation or laws may have a material effect on us, our operations and financial condition.

In 2023, we spent approximately $1.9 million on capital projects in the aggregate for our mills in the three regions where we operate to control environmental releases into the air and water and to assure environmentally sound management and disposal of waste. We expect to spend approximately $4.8 million in 2024 and $9.5 million in 2025 on regulatory projects.

Other Regulation

Regional, national, state and local regulations apply to us in Europe, Latin America and North America that regulate the licensing and inspection of our facilities, including, in the United States, compliance with the Occupational Safety and Health Act that sets health and safety standards to protect our employees from accidents, and Department of Labor regulations that set employment practice standards for workers.

We are subject to highly complex tax laws in various countries in Europe, Latin America and North America, most notably in the countries where we have significant operations – Brazil, France, Sweden and the United States – that if violated, could result in significant fines, interest charges and costs associated with litigation. In Brazil, our business is subject to various tax proceedings, including those discussed in Note 13 Commitments and Contingent Liabilities and Note 12 Income Taxes to the Consolidated and Combined Financial Statements included in Item 8 of this Annual Report on Form 10-K.

Our operations around the world are subject to anti-corruption laws and regulations, such as the U.S. Foreign Corrupt Practices Act and the U.K. Bribery Act of 2010.

SUSTAINABILITY MATTERS

Sylvamo remains committed to operating responsibly and sustainably, and incorporates this into our strategies and everyday processes as we seek to seize opportunities, address risks and create long-term value for our shareholders. Our commitment to sustainability spans our value chain, from the safety of our employees, to the responsible sourcing of raw materials, to using renewable energy and ensuring the recyclability of our products. Our commitment is part of our Code of Conduct and it requires us to operate as responsible stewards for our communities and the environment. We believe that operating in this manner creates healthy communities, enhances our competitive position with our customers, increases our desirability as an investment and helps engender employee pride in the Company, helping us achieve our vision to be the world’s paper company: the employer, supplier and investment of choice.

To show how we pursue our responsibility to sustain safety at our facilities, protect the environment, promote I&D and employee well-being, and invest in the communities where we live and work, in July 2023 we issued our first ESG Report since

becoming a standalone public company in late 2021. We also launched a new sustainability hub on our website, sylvamo.com, to share sustainability news, certifications, in-depth data and more.

Our 2022 ESG Report (available at sylvamo.com/us/en/sustainability) illustrates our 2022 contributions to the circular, low-carbon economy, while improving people’s lives where we do business through our I&D efforts and actions supporting our communities. It reflects our intent to operate as a sustainable company that generates profits for our shareholders, protects the environment and improves people’s lives. In the 2022 ESG Report, we report our sustainability initiatives and progress made on those initiatives. We plan to report on sustainability initiatives and our progress for 2023 in our 2023 ESG Report to be published in 2024. We cannot guarantee that we will achieve the goals described in the ESG Report and in this Annual Report on Form 10-K, including our 2030 goals, and our ability to achieve them is subject to risks and uncertainties both known and unknown, including various risks noted in Item 1A. Risk Factors and elsewhere herein.

Sustainable Sourcing and Forest Management

Sylvamo recognizes the environmental, social and economic values of forested landscapes. We seek to play an active role in preventing deforestation and forest degradation, promoting and increasing the use of responsibly managed forests, and meeting market demand for sustainably certified products, through our efforts described below.

In addition to our Code of Conduct, our Environmental, Health, Safety and Sustainability Policy sets forth the principles we follow to ensure the health and safety of all employees, contractors and visitors, improve our environmental impact and our stewardship of natural resources. Our Global Fiber Procurement Policy sets forth requirements for the wood we accept, including requirements intended to protect the environment and rights of indigenous peoples and local communities. Our Third Party Code of Conduct requires the parties with which we do business to comply with all laws and encourages them to reduce their impact on the environment. We make these policies available on our website and provide more information about them in our 2022 ESG Report.

Our operations strive to incorporate responsible forest stewardship to ensure healthy and productive forest ecosystems for generations to come. For example, we promote healthy and productive forest ecosystems by committing to source 100% of our fiber from sustainably managed forests and aiming to conserve, enhance or restore 250,000 acres of ecologically significant forestland globally by 2030. Towards this goal, in 2023 we continued to invest in reforestation in the Atlantic Forest region of Brazil through joint efforts with international and local organizations.

We maintain longstanding partnerships with several of the world’s largest and most respected environmental and conservation organizations to restore and protect forests and advance the understanding of the role of forests as natural climate solutions, including the Arbor Day Foundation, the Nature Conservancy, the World Wildlife Fund and various local environmental organizations in the communities where we live and work. We also help our suppliers with their efforts to develop actions that improve forest management and fiber procurement practices. We believe that these strategic informal partnerships are essential to achieve the scale necessary for positive long-term impact and to develop sustainable solutions that address critical regional and global forestry issues.

We support and use third-party certification of sustainable forest management through forest certification and chain-of-custody systems, and work to continue to meet our customer’s demand for certified-fiber products. Sylvamo follows these credible certification systems: Forest Stewardship Council® (FSC®), the Sustainable Forestry Initiative® (SFI®), and the Programme for the Endorsement of Forest Certification (PEFC). Based on the latest figures available, we source more than half of our wood from forests certified under these programs.

Reduction of Water Usage

Sylvamo is working to reduce our water usage by an incremental 25% compared to a 2019 baseline. Our efforts to accomplish this goal in 2023 included an intensive water engineering study at one of our mills to identify water saving projects. We intend to update our progress reducing water usage at least annually on our Company website or in our ESG Reports.

Climate Change and Reduction of GHG Emissions

Sylvamo recognizes that the climate is changing. Because carbon dioxide and methane trap higher amounts of heat in the atmosphere than many other atmospheric gasses and remain in the atmosphere for years, we believe that it is prudent to reduce those emissions. Sylvamo seeks to reduce its GHG emissions, by working to reduce our Scope 1, 2 and 3 emissions as noted

above, and advancing a lower-carbon economy by designing 100% reusable, recyclable or compostable papers that people depend on for education, communication and entertainment.

Consistent with the Paris Agreement, we are working to define a pathway to net zero GHG emissions and seek to achieve an incremental 35% reduction in our mills’ Scope 1, 2 and 3 GHG emissions by 2030, as compared against a 2019 baseline. We submitted our greenhouse gas emissions reduction targets to Science Based Targets Initiative (SBTi) for validation, which we received in April 2023. Our progress reducing Scope 1, 2 and 3 GHG emissions is updated at least annually on our Company website or our ESG Report.

In 2022, the most recent year for which we have data, Sylvamo’s mills generated more than 80% of the energy used in the mills from carbon-neutral biomass residuals, which minimizes the use of fossil fuels that our company would otherwise use in its operations. An example of our leadership in the use of renewable energy is our mill in Saillat, France, which was the first French mill to obtain EU Ecolabel certification for copy and graphic papers, and has been PEFC certified and FSC chain of custody certified for approximately 20 years and 14 years, respectively. Saillat implements rigorous sustainable practices. All of its wood comes from controlled sources, and it is 85% energy self-sufficient. Saillat and its partner, Dalkia, a French energy company, were selected by the French Ministry of Ecological Transition to promote renewable energy and reduce GHG emissions. Under this program, Saillat and Dalkia will implement an additional bark boiler and a new turbine generator to produce 25 mega-watts of green electricity for a 20-year fixed price, reducing Saillat’s energy costs and consumption of fossil fuels. In 2023, we acquired a mill in Nymölla, Sweden, which has EU Ecolabel and Nordic Swan Ecolabel certification.

Sylvamo participates in the Carbon Disclosure Project (“CDP”) questionnaires concerning climate change, forests and water, to quantify and provide transparency on our environmental practices and progress. Additionally, we align our sustainability reporting in our ESG Report with the Global Reporting Initiative and the Task Force On Climate Related Financial Disclosures (“TCFD”) frameworks.

The long-term effects of climate change on the global economy, our industry and us are unclear, especially in view of the political significance and uncertainty around regulatory actions proposed or being taken to address climate change. Changes in climate where we, our customers and our suppliers operate could have an adverse impact on our business, results of operations, and financial condition, as could regulatory actions to address climate change. More information about risks related to climate change and climate change regulation is available in Item 1A. Risk Factors – “We are subject to physical, financial and reputational risks associated with climate change, including global, regional and local weather conditions, as well as the potential impact of increasing regulatory and investor focus on climate change.”

Management and Board Oversight

Sylvamo has a dedicated sustainability team of employees led by our Chief Sustainability Officer (“CSO”). The team develops strategy and initiatives intended to protect the environment and improve the lives of those we interact with while creating profit for shareholders. We also have an Environmental, Social and Governance (“ESG”) Steering Team, a cross functional group of senior employee leaders that works with our CSO. The ESG Steering Team is responsible for advising, setting and supporting the implementation of our sustainability strategy. Our CSO regularly reports to the Nominating and Corporate Governance Committee of our board of directors, which is responsible for oversight of sustainability matters, including oversight of climate-related matters.

AVAILABLE INFORMATION

Sylvamo’s internet address is www.sylavamo.com. We make available, free of charge, on or through our internet website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, as soon as reasonable practicable after we electronically file such material with, or furnish it to, the SEC.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains information that includes or is based upon forward-looking statements. Forward-looking statements forecast or state expectations concerning future events. These statements often can be identified by the fact that they do not relate strictly to historical or current facts. They typically use words such as “anticipate,” “assume,” “could,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “should,” “will” and other words and terms of similar meaning, or they are tied to future periods in connection with discussions of the Company’s performance. Some examples of forward-looking statements include those relating to our business and operating outlook, future obligations and anticipated expenditures.

Forward-looking statements are not guarantees of future performance. Any or all forward-looking statements may turn out to be incorrect, and actual results could differ materially from those expressed or implied in forward-looking statements. Forward-looking statements are based on current expectations and the current economic environment. They can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and other factors that are difficult to predict. Although it is not possible to identify all of these risks, uncertainties and other factors, the impact of the following factors, among others, on us or on our suppliers or customers, could cause our actual results to differ from those in the forward-looking statements: deterioration of global and regional economic and political conditions, including the impact of wars and other conflicts in Ukraine and the Middle East; physical, financial and reputational risks associated with climate change; public health crises that could have impacts similar to those experienced as a result of the COVID-19 pandemic; increased costs or reduced availability of the raw materials, energy, transportation (truck, rail and ocean) and labor needed to manufacture and deliver our products; reduced demand for our products due to industry-wide declines in demand for paper, the cyclical nature of the paper industry or competition from other businesses; a material disruption at any of our manufacturing facilities; information technology risks including potential cybersecurity breaches; extensive environmental laws and regulations, as well as tax and other laws, in the United States, Brazil and other jurisdictions to which we are subject, including our compliance costs and risk of violations and liability; our reliance on a small number of customers; a failure by us to attract and retain senior management and other key and skilled employees; loss of our commercial agreements with International Paper; our indebtedness having a material adverse effect on our financial condition, or our inability to generate sufficient cash to service our indebtedness; and the factors disclosed in Item 1A. Risk Factors, as such disclosures may be amended, supplemented or superseded from time to time by other reports we file with the U.S. Securities and Exchange Commission (the “SEC”), including subsequent annual reports on Form 10-K and quarterly reports on Form 10-Q.

We assume no obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect subsequent events or circumstances or actual outcomes.

Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, along with all other reports and any amendments thereto filed with or furnished to the SEC, are publicly available free of charge on the Investors section of our website at www.sylvamo.com as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information contained on or connected to our website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this or any other report that we filed with or furnished to the SEC.

ITEM 1A. RISK FACTORS

Sylvamo faces risks in the normal course of business and through global, regional and local events. In addition to the risks and uncertainties discussed elsewhere in this Annual Report on Form 10-K, including in Item 1. Business, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and Item 1C. Cybersecurity, the following are some important risk factors that we face. The occurrence of any of the following risk factors, or of additional risks and uncertainties not presently known to us or that we currently believe to be immaterial, could cause a material adverse effect on our business, financial condition, results of operations and cash flows. In any such case, the trading price of our common stock could decline. In addition, many of these risks are interrelated and could occur under similar business and economic conditions, and the occurrence of certain of them could in turn cause the emergence or exacerbate the effect of others.

This Annual Report on Form 10-K also contains forward-looking statements and estimates that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific factors, including the factors described below. See Item 1. Business - Forward-Looking Statements.

SUMMARY RISK FACTORS

Our business is subject to numerous risks and uncertainties, including those described in “Risk Factors” below. The principal risks and uncertainties affecting our business include the following:

•global and regional economic and political conditions;

•physical, financial and reputational risks associated with climate change;

•public health crises that could have impacts similar to those experienced as a result of the COVID-19 pandemic;

•increases in the cost or availability of raw materials and energy needed to manufacture our products;

•reduced truck, rail and ocean freight availability;

•industry-wide decline in demand for paper and related products;

•the cyclical nature of the paper industry, resulting in fluctuations in paper product prices and demand;

•competition from other businesses and consolidation within the paper industry;

•material disruptions at one or more of our manufacturing facilities;

•information technology risks, including risk of cybersecurity breaches;

•extensive laws, regulations and government requirements, including those related to the environment and climate change, including costs of compliance and any liabilities under such laws;

•our reliance on a small number of significant customers;

•our failure to attract and retain senior management and other key employees;

•a significant write-down of our goodwill or other intangible assets;

•failure to achieve expected investment returns on pension plan assets or other factors affecting the plans’ funded level;

•labor disputes;

•inability to achieve expected benefits from strategic corporate actions;

•inability to protect our intellectual property and other proprietary rights;

•the loss of commercial agreements with International Paper;

•our short history as a standalone public company;

•the failure of the transactions in connection with our spin-off from International Paper to qualify for non-recognition treatment for U.S. federal income tax purposes;

•the satisfaction of indemnification obligations between us and International Paper;

•federal and state fraudulent transfer laws and New York and Delaware corporate law which may permit a court to void the transactions that separated us from International Paper;

•our indebtedness having a material adverse effect on our financial condition, or our inability to generate sufficient cash to service our indebtedness;

•future offerings of debt or equity securities senior to our common stock, depressing its price;

•if we do not continue to declare dividends, repurchase shares of our common stock or otherwise return capital to shareholders, shareholders must rely on appreciation in our stock’s value for investment returns;

•future issuances of equity, diluting our outstanding common stock;

•a shareholder’s sale of a substantial number of shares of our common stock, causing its price to decline;

•actions of activist shareholders that cause us to incur costs and adversely affect our stock price; and

•provisions in our certificate of incorporation and bylaws that could hinder a change in control of our company, cause a reduction in the price of our stock and limit the forum for actions against, and the liability of, our directors and officers.

RISKS RELATING TO OUR BUSINESS

Risks Relating to Economic Conditions and Other External Factors

Our operations and performance depend significantly on global and regional economic and political conditions, and adverse economic or political conditions can materially adversely affect our business, financial condition, results of operations and cash flows.

We operate in three primary regions, each of which contributes significantly to our financial performance: Europe, Latin America and North America. Five of the seven mills that we own are located outside the United States: three in Brazil, one in France and one in Sweden (acquired in January 2023). We sold our Russian operations in 2022. Deterioration of business conditions, economic conditions or geopolitical events in any one of the regions where we operate could have a material adverse effect on our business, financial condition and results of operations. Examples of conditions that could adversely affect us are deterioration of trade relations affecting one or more of the regions where we operate, general economic instability, or civil unrest, political conflict or military conflict; for example, spread of the war in Ukraine to other countries in Europe, spread of the Israel – Hamas war further in the Middle East, and increased disruption to transportation networks due to attacks by the Houthis in and near the Red Sea. The impact on us of these wars and conflicts has been limited and not material, but their potential to spread and, if they spread, the unpredictability of their impacts are risks for our business.

Other events in the three regions where we operate, such as strikes, high unemployment levels, lack of availability and cost of credit, and fluctuations in the value of local currency versus the U.S. dollar, may adversely affect our cost and ability to manufacture and deliver our products to customers, as well as generally affect industrial non-durable goods production, consumer spending, commercial printing and advertising activity, white-collar employment levels and consumer confidence, all of which may impact demand for our products.

In addition, volatility in the capital and credit markets, which impacts interest rates, currency exchange rates and the availability of credit, may have a material adverse effect on our business, financial condition and results of operations.

Trade protection measures in favor of local producers of competing products, including governmental subsidies, tax benefits and other measures giving local producers a competitive advantage over our company, could also have a material adverse effect on our results of operations and business prospects in the regions where we operate. For example, our mills in Brazil have historically benefited from policies favoring domestic producers. We cannot guarantee that any such policies will continue or that we will continue to benefit from existing or future policies, nor can we guarantee that we will not be harmed by future policies. Likewise, disruption in existing trade agreements or increased trade friction between countries, which can result in tariffs, anti-dumping and countervailing duties, could have a material adverse effect on our business and results of operations by restricting the free flow of goods and services across borders.

Additionally, our international operations are subject to regulation under laws related to operations in foreign jurisdictions, including in the United States, the Foreign Corrupt Practices Act and the policies of the U.S. Department of Treasury’s Office of Foreign Asset Control. Failure to comply with applicable laws could result in various adverse consequences, including the imposition of civil or criminal sanctions and the prosecution of executives overseeing our international operations.

We are subject to physical, financial and reputational risks associated with climate change, including the impact of global, regional and local weather conditions, the availability of wood fiber, water and fuel, and the impact of increasing regulatory and investor focus on climate change.

Climate change has the potential to cause disruptions to our business, financial condition and results of operations. Increases in global average temperatures caused by increased concentrations of carbon dioxide and other GHGs in the atmosphere could cause significant changes in weather patterns, including changes to precipitation patterns and growing seasons. An increase in global temperature could also lead to an increase in the frequency and severity of extreme weather events and other natural disasters, such as hurricanes, tornados, hailstorms, fire, floods, snow and ice storms. Our operations and the operations of our suppliers are subject to changes in global, regional and local weather patterns. These types of events could have multiple adverse impacts on our business, including, without limitation:

•Severe weather events or other natural disasters, which may be caused by climate change, occurring at any of our locations could cause heavy damage to or destruction of one or more of our valuable assets; for example, one of our mills or our Brazilian forestland.

•The productivity of forests, the frequency and severity of wildfires, heavy rain or drought, the distribution and abundance of species, and the spread of disease or insect epidemics, may adversely affect timber production and harvesting, including on the forestlands that we own or manage in Brazil which have been producing yields of mature virgin fiber that are not optimal (see “ – Changes in the cost or availability of raw materials and energy used to manufacture our products could have a material adverse effect on our business, financial condition and results of operations,”) thus reducing the availability to us of, or reducing the density and quality of, the virgin fiber upon which we rely to manufacture our products. This could significantly increase our costs of manufacturing our products and delay or interrupt our manufacturing operations.

•A steady supply of significant volumes of water are necessary to the manufacturing operations at our mills, and weather events interrupting such supply may slow or interrupt our mill operations.

•Our manufacturing operations rely significantly on a steady supply of energy, and fuel is critical to the transport to us of inputs and the distribution by us of our products. The transition to a lower-carbon economy could increase the price of energy needed to manufacture our products, the transportation components of our input costs and costs of delivering products.

•Unpredictable weather patterns or extended periods of severe weather also may result in supply chain disruptions, increased material costs and delays or stoppage of operations.

•Our ability to mitigate the adverse physical impacts of climate change depends in part upon our disaster preparedness and response and business continuity planning, but we cannot guarantee that our disaster preparedness and business continuity planning would adequately mitigate such impacts.

•The introduction of a carbon tax or government mandates to reduce GHG emissions, and more stringent or complex environmental and other permitting requirements, could result in costs to meet such requirements and other additional costs of compliance.

•There is no assurance that we can recover, through increased prices, any increased costs to us of fiber, energy, other materials, manufacturing stoppages or delays, regulatory compliance, or any other factor related to climate change, and if we were to pass these costs on to customers, it may reduce demand for our products.

•There has been an increased focus, including from investors, customers, regulators and other stakeholders regarding climate change, which have resulted or may result in more prescriptive reporting requirements with respect to climate change-related topics, including, recently, reporting requirements adopted in California and the European Union and reporting requirements proposed by the SEC, as well as increased expectation and pressure to voluntarily disclose such topics, all of which increase compliance costs.

•We have established and publicly disclosed targets related to certain sustainability matters, including our 2030 goal to reduce Scope 1, 2 and 3 GHG emissions. Our sustainability targets are subject to assumptions, risks and uncertainties, many of which are outside our control. If we cannot meet these targets by 2030, or if they are perceived negatively, including the perception that they are not sufficiently robust or, conversely, are too costly, our reputation could be harmed.

We are assessing our climate-related risks and determining the best strategies to address any identified risks.

As a result of any or all of these climate-related risks, climate change could, directly or indirectly, have a material adverse effect on our business, financial condition and results of operations.

A public health crisis could have a material adverse effect on our business, financial condition and results of operations.

If a public health crisis were to result in the imposition of governmental restrictions on the general public or on business activities to prevent viral spread, or were to cause widespread illness among our or our customers’ or suppliers’ employees – such as occurred during the COVID-19 pandemic – it could, in turn, have a material adverse effect on our business, financial condition and results of operations. For example, a global resurgence of severe COVID infection or another public health crisis could reduce demand for our paper as a result of school and business closures and increased remote work among the general public, disrupt operations at our mills due to employee attrition, illness, quarantines, government actions or other restrictions, and cause labor shortages, supply chain disruptions and inflation that constrain our operations and increase our costs to operate. The extent of any future impact of any public health crisis is mostly outside of our control and will depend on various factors, including the severity of outbreaks and viral strains, the availability and effectiveness of treatments and vaccines, the extent and duration of its adverse effect on economic conditions, consumer confidence, discretionary spending and preferences, labor and healthcare costs and unemployment rates.

Risks Relating to Our Industry, the Products We Offer and Product Distribution

Changes in the cost or availability of raw materials and energy used to manufacture our products could have a material adverse effect on our business, financial condition and results of operations.

We rely heavily on the use of certain raw materials (principally virgin wood fiber, caustic soda, starch and water) and energy sources (principally biomass, natural gas, electricity and fuel oil) to manufacture our products. Our profitability has been, and will continue to be, affected by changes in the cost and availability of the raw materials and energy sources we use. In 2023, global volatility in the costs of raw materials and energy, and labor as well, directly and indirectly caused unpredictability in our costs of materials (including raw materials such as wood fiber and other materials such as chemicals) and energy. Any future inflation in the costs of raw materials and energy is not within our

control and could increase our costs of production. Any future shortages are also not within our control and could increase our costs and slow or stop our production.

The market price of virgin wood fiber varies based upon demand, availability, source, and the costs of labor and the fuels used in harvesting and transporting the fiber. The cost and availability of wood fiber can also be affected by weather, climate variations, natural disasters, general logging conditions, geography, human activity and regulatory activity. For example, our mills in Brazil and Sweden experienced increases in the cost of virgin wood fiber in 2023. In Brazil, the increase was due to weather-related and other circumstances, including that the number of healthy trees reaching maturity on Brazilian forestlands that we own or manage were, and continue to be, insufficient for us to optimize the use of fiber from them in our Brazilian operations. We thus increased the amount of virgin wood fiber that we procured from more expensive third party sources. At our Nymölla, Sweden mill, the increased wood fiber costs were primarily due to a shortage of wood fiber in the region and exchange rate fluctuations.

Regulatory activity has the potential to decrease the supply of wood fiber available to our operations. For example, carbon sequestration regulations limiting the availability of forestlands for harvest could increase our cost of wood fiber and potentially create shortages having an impact on our operations.

In Europe, there is a heightened level of sensitivity in the pricing and availability of raw materials and energy from the geopolitical conflicts in Europe, the Middle East and Red Sea. We cannot predict whether these geopolitical conflicts will cause future increases in the costs of raw materials and energy for our mills, particularly our mills in Sweden and France.

Due to the commodity nature of our products, the supply and demand for our products determines our ability to increase prices, and we could be unable to pass on increases in our operating costs to our customers. Any sustained increase in the prices of raw materials and energy required for our manufacturing operations without any corresponding increase in product pricing would reduce our operating margins and could have a material adverse effect on our business, financial condition and results of operations.

Reduced truck, rail and ocean freight availability could lead to higher costs or poor service, resulting in lower earnings, and could affect our ability to deliver the products we manufacture in a timely manner.

We rely on third parties to transport materials to us used in our operations and to deliver our products to our customers, including transport by third party rail, trucks and ships. If any of these providers fail to deliver materials to us in a timely manner, we may experience delays in our ability to manufacture our products and be unable to meet customer demand. If any of our transportation providers fail to deliver our products to customers in a timely manner, it may result in additional costs to us in order to remedy the untimely delivery. Further, reduced availability of transportation causes inflationary pressure on the prices charged by our transportation providers, increasing our costs of production and delivery to customers. If any of our transportation providers were to cease operations or cease doing business with us, we may be unable to replace them at a reasonable cost. Any of the circumstances described in this paragraph may result in lost sales, increased supply chain costs and damage to our reputation, and have a material adverse effect on our business, financial condition and results of operations.

In 2023, we did not experience significant supply chain disruptions, and freight rates normalized. However, by the end of 2023, the attacks by the Houthis on and near the Red Sea brought instability to the region, which if continued in 2024 could cause instability in ocean freight costs, as well as an imbalance in the distribution of ships and containers across regions of the world. We cannot predict whether these events would occur or if they would cause us to experience disruptions in our supply chain, increases in our transportation costs or difficulty supplying our customers.

The industry-wide decline in demand for paper and related products could have a material adverse effect on our business, financial condition and results of operations.

We rely heavily on the sale of paper products, an industry that has experienced, and is expected to continue experiencing, a decline in demand, which could put pressure on our future revenue, profit margin and growth opportunities. The global demand for uncoated freesheet (“UFS”) decreased at 2.5% CAGR from 2017 to 2023 (which includes the COVID-19 pandemic’s atypical impact in 2020 of a 10.2% decline year-over-year), based on third party RISI industry data reporting as of December 2023. This secular decline in demand is due in large part to competing technologies and materials, including the increased use of e-mail and other electronic forms of communication, increased and permanent product substitution, including less print advertising, more electronic billing, more e-

commerce, fewer catalogs and a reduced volume of mail. The secular decline in demand historically has had a material adverse effect on our business, financial condition and results of operations. As the use of these alternatives continue to grow, demand for paper products is likely to decline further, which could have a further material adverse effect on our business, financial condition and results of operations.

The paper industry is cyclical. Fluctuations in the prices of, and the demand for, our paper products could result in lower sales volumes and smaller profit margins.

The paper industry is cyclical. Historically, economic and market shifts, fluctuations in capacity and changes in foreign currency exchange rates have created cyclical changes in prices, sales volume and margins for our paper products. The length and magnitude of industry cycles have varied over time and by product, but generally reflect changes in macroeconomic conditions and levels of industry capacity. Most of our paper products are commodities that are available from other producers. While brand recognition impacts the demand for products, because commodity products have few other distinguishing qualities from producer to producer, competition for these products is significantly based on price, which is determined by supply relative to demand.

The overall levels of demand for the paper products that we manufacture, and consequently our sales and profitability, reflect fluctuations in levels of end-user demand, which depend in part on general macroeconomic conditions, competition, including from electronic substitution, and other factors described above in “—The industry-wide decline in demand for paper and related products could have a material adverse effect on our business, financial condition and results of operations.”

Industry supply of paper products is also subject to fluctuation, as changing industry conditions have and will continue to influence producers to idle or permanently close individual machines or entire mills or convert them to different products to offset a decline in demand. Any such closures by us would result in significant cash and non-cash charges. In addition, to avoid substantial cash costs in connection with idling or closing a mill, some producers will choose to continue to operate at a loss, sometimes even a cash loss, which could prolong weak pricing environments due to oversupply. As a result, prices for our paper products are driven by many factors outside of our control, and we have little influence over the timing and extent of price changes, which are often volatile. Our profitability with respect to our products depends on managing our cost structure, particularly wood fiber, chemicals, transportation and energy costs, which represent the largest components of our operating costs and can fluctuate based upon factors beyond our control. If the prices or demand for our paper products decline, or if wood fiber, chemicals, transportation or energy costs increase, or both, our business, financial condition and results of operations could be materially adversely affected. See “—Changes in the cost or availability of raw materials and energy used to manufacture our products could have a material adverse effect on our business, financial condition and results of operations.”

Competition from other businesses and consolidation within the paper industry could have a material adverse effect on our competitive position, financial condition and results of operations.

We operate in a competitive environment in Europe, Latin America and North America. Product innovations, manufacturing and operating efficiencies, and marketing, distribution and pricing strategies pursued or achieved by competitors could have a material adverse effect on our business, financial condition and results of operations.

In addition, there has been a trend toward consolidation in the paper industry. Consolidation could result in the emergence of competitors with greater resources and scale than ours, which could adversely impact our competitive position, financial conditions and results of operations. Further, actual or speculated consolidation among competitors, or the acquisition by, or of, our third party service providers and business partners by competitors could increase the competitive pressures faced by us as customers could delay spending decisions or not purchase our products at all.

Risks Relating to Our Operations

Material disruptions at one of our manufacturing facilities could have a material adverse effect on our business, financial condition and results of operations.

A material disruption at our corporate headquarters or one of our manufacturing facilities, or involving any of our machines within such facilities, could prevent us from meeting customer demand and reduce our sales, which could have a material adverse effect on our business, financial condition and results of operations. Any of our manufacturing

facilities, or any of our machines within an otherwise operational facility, could cease operations unexpectedly due to a number of events, including:

• fires, floods, earthquakes, hurricanes or other catastrophes;

• the effect of a drought, reduced rainfall or a flood on its water supply;

• the effect of severe weather conditions on equipment and facilities;

• disruption in the supply of raw materials, including wood fiber, or other manufacturing inputs;

• information system disruptions or failures due to any number of causes, including cyber-attacks;

• domestic and international laws and regulations applicable to our business and our business partners around the world;

• unscheduled maintenance outages;

• prolonged power failures;

• an equipment failure or damage to any of our paper-making equipment;

• a chemical spill or release of pollutants or hazardous substances;

• explosion of or damage to a boiler or other equipment;

• damage or disruptions caused by third parties operating on or adjacent to one of our manufacturing facilities;

• disruptions in the transportation infrastructure, including roads, bridges, railroad tracks and tunnels;

• a widespread outbreak of an illness or any other communicable disease, such as the COVID-19 pandemic or any other public health crisis;

• failure of our third-party service providers and business partners to satisfactorily fulfill their commitments and responsibilities in a timely manner and in accordance with agreed upon terms;

• labor difficulties; and

• other operational problems.

Our operations require substantial capital, and any significant capital investments could increase fixed costs, which could negatively affect our profitability.

We frequently make capital investments to improve our operations. These capital expenditures could result in increased fixed costs or large one-time capital expenditures, which could negatively affect our profitability. Capital expenditures for expansion or replacement of existing facilities or equipment or to comply with future changes in environmental laws and regulations may be substantial. Our expected capital expenditures are discussed in Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources - Capital Expenditures. We cannot guarantee that key pieces of equipment in our various manufacturing facilities will not need to be repaired or replaced or that we will not incur significant additional costs associated with environmental compliance. The costs of repairing or replacing such equipment and the associated downtime of the affected production line could have a material adverse effect on our business, financial condition and results of operations. If for any reason we are unable to provide for our operating needs, capital expenditures, and other cash requirements on economically favorable terms, we could experience a material adverse effect on our business, financial condition and results of operations.

We are subject to information technology risks, including risks related to breaches of security pertaining to sensitive company, customer, employee and vendor information as well as breaches in the technology used to manage operations and other business processes.

Our business operations rely upon secure information technology systems for data capture, processing, storage and reporting. Despite careful security and controls design, implementation, updating and independent third-party verification, our information technology systems could become subject to employee error or malfeasance, cyber-attacks, geopolitical events, natural disasters, failures or impairments of telecommunications networks or other catastrophic events.

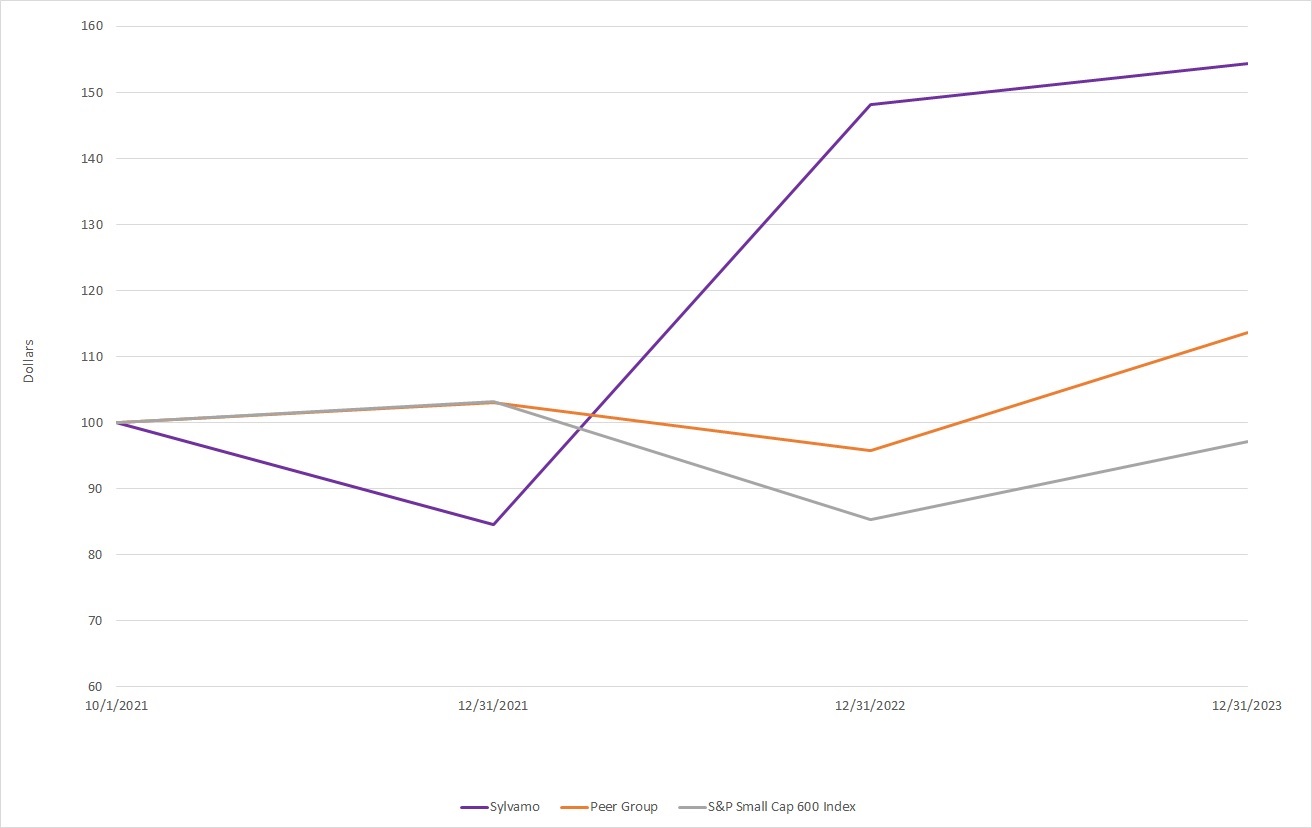

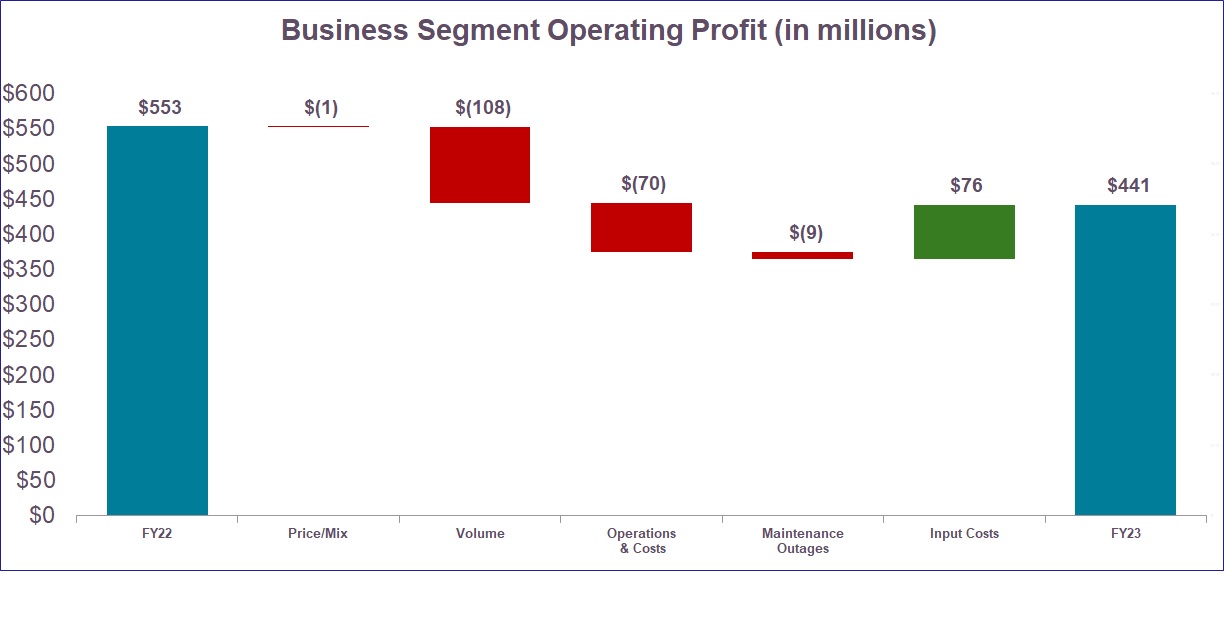

Also, third parties with which we do business are potential sources of cybersecurity risks. For example, we outsource certain information technology functions that allow access to our information technology systems, which could lead to a compromise of our systems or the introduction of vulnerable or malicious code, resulting in security breaches adversely affecting us or our customers. While many of our agreements with third parties include indemnification provisions, we may not be able to recover sufficiently, or at all, under these provisions to adequately offset any losses we may incur from third-party cyber incidents.