The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the United States Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated , 2022

PRELIMINARY PROSPECTUS

GigaCloud Technology Inc

Class A Ordinary Shares

This is an initial public offering of Class A ordinary shares, par value $0.0001 per share, by GigaCloud Technology Inc. We anticipate the initial public offering price of our Class A ordinary shares to be between $ and $ per Class A ordinary share.

Prior to this offering, there has been no public market for our shares. We have applied to list our Class A ordinary shares on the New York Stock Exchange, or NYSE under the symbol “GCT.”

In this prospectus, “we,” “us,” “our company,” “our,” “our group,” “GigaCloud,” or “GigaCloud Technology” refer to GigaCloud Technology Inc, our Cayman Islands holding company, its predecessor entity, its subsidiaries and, in the context of describing our operations and consolidated financial statements, its consolidated VIEs and any subsidiaries of its consolidated VIEs.

We are an “emerging growth company” as defined under applicable U.S. securities laws and are eligible for reduced public company reporting requirements.

See “Risk Factors” beginning on page 23 to read about factors you should consider before buying our Class A ordinary shares.

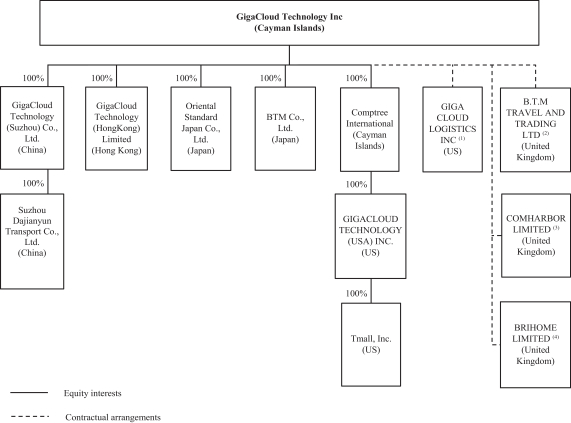

GigaCloud Technology is a holding company incorporated in the Cayman Islands. As a holding company with no material operations of our own, we conduct our operations through our principal subsidiaries incorporated in Hong Kong, the PRC, Japan and the United States and our principal consolidated variable interest entities, or VIEs, incorporated in the United States and the United Kingdom. Our corporate structure involves unique risks to investors as they are purchasing equity securities in a Cayman Islands holding company. The Class A ordinary shares offered in this offering are shares of our Cayman Islands holding company instead of the shares of our subsidiaries or consolidated VIEs. Investors will not and may never directly hold equity interests in our subsidiaries or VIEs, including the equity interests in our principal subsidiaries based in Hong Kong, the PRC, Japan and the United States and our principal consolidated VIEs based in the United States and the United Kingdom. We do not own any equity interest in the VIEs. We control and receive the economic benefits of our consolidated VIEs and their business operations through certain contractual arrangements. Uncertainties exist as to our ability to enforce the VIE agreements, and the enforceability of the VIE agreements have not been tested in a court of law. For a description of our corporate structure and our contractual arrangements with our consolidated VIEs and the risks related to our corporate structure, see “Corporate History and Structure—Contractual Arrangements with Our Consolidated VIEs and their Shareholders” and “Risk Factors—Risks Related to Our Corporate Structure—We rely on contractual arrangements with our consolidated VIEs and their shareholders for a portion of our business operations. These arrangements may not be as effective as direct ownership in providing operational control.”

The PRC government has recently indicated an intent to exert more oversight and control over overseas securities offerings and other capital markets activities by, and foreign investment in, companies with operations in the PRC, including enhancing supervision over companies with operations in the PRC that are listed overseas using VIE structure, and that the PRC regulatory authorities could disallow the use of such VIE holding structure. We do not believe that we are directly subject to these regulatory actions or statements, as we do not currently have any VIE in the PRC. However, the rules and regulations and the enforcement thereof in China can change quickly. The PRC government may intervene with or influence our operations in the PRC as the government deems appropriate to further regulatory, political and societal goals. Any such action, once taken by the PRC government, could result in a material change in our operations, significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of the securities we are registering for sale to significantly decline or in extreme cases, become worthless. See “Risk Factors—Risks Related to Doing Business in China—The PRC government may exercise significant oversight and discretion over a company’s ability to conduct business in the PRC and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of the securities we are registering for sale.”

Although we have operations in many locations globally, we face various legal and operational risks and uncertainties as a result of being based in and having major operations in mainland PRC and Hong Kong. We launched our GigaCloud Marketplace under our Hong Kong subsidiary, GigaCloud Technology (HongKong) Limited (formerly known as Giga Cloud Logistics (Hong Kong) Limited), in 2019. Our PRC subsidiaries perform cost functions and internal operational functions, but our PRC subsidiaries do not generate revenue in the PRC. Accordingly, the laws and regulations of the PRC have an impact on the operational and procurement aspects of our business. Furthermore, the PRC government has authority to exert political and economic influence on the ability of a company with operations in mainland PRC to conduct business, accept foreign investment or list on a U.S. or other foreign exchange. For example, we may face risks associated with regulatory approvals of offshore offerings, anti-monopoly regulatory actions, oversight on cybersecurity and data privacy, the lack of inspection of the Public Company Accounting Oversight Board, or the PCAOB, of our auditors, as well as regulatory risks relating to companies in Hong Kong. We believe we are currently not required to file with the CAC for a cybersecurity review as of the date hereof, because (i) our B2B ecommerce platform, GigaCloud Marketplace, is operated in Hong Kong under our Hong Kong subsidiary with under one million users, (ii) any data we collected on our sellers and buyers are limited, and (iii) our PRC subsidiaries only perform cost functions and internal operational functions and do not collect any data on users in the PRC. See “Risk Factors—Risks Related to Doing Business in China—The approval or other administration requirements of the China Securities Regulatory Commission, or the CSRC, or other PRC governmental authorities, may be required in connection with this offering under a PRC regulation or any new laws, rules or regulations to be enacted, and if required, we cannot assure you that we will be able to obtain such approval. The regulation also establishes more complex procedures for acquisitions conducted by foreign investors that could make it more difficult for us to grow through acquisitions.” There is also risk that the PRC government may intervene or influence our operations in Hong Kong and that our Hong Kong subsidiary may be subject to such direct intervention or influence in the future due to changes in laws or other unforeseeable reasons. Such risks could result in a material change in our operations and/or the value of our Class A ordinary shares or could significantly limit or completely hinder our ability to offer or continue to offer Class A ordinary shares and/or other securities to investors and cause the value of the securities we are registering for sale to significantly decline or be worthless. See “Risk Factors—Risks Related to Doing Business in China—The PRC government may exercise significant oversight and discretion over a company’s ability to conduct business in the PRC and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of the securities we are registering for sale,” and “Risk Factors—Risks Related to Doing Business in China—We operate our GigaCloud Marketplace through our Hong Kong subsidiary. If the PRC government were to extend its oversight into companies in Hong Kong, our Hong Kong subsidiary may be subject to additional regulations which could have a material effect on our business operations.”

Pursuant to the Holding Foreign Companies Accountable Act, or the HFCA Act, on December 16, 2021, the PCAOB issued a report on its determinations that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in the PRC and Hong Kong, because of positions taken by PRC authorities in these jurisdictions. The PCAOB included in its report a list of registered public accounting firms headquartered in the PRC and Hong Kong that the PCAOB is unable to inspect or investigate completely, including our auditor, KPMG Huazhen LLP. Our Class A ordinary shares may be delisted under the HFCA Act if the PCAOB is unable to inspect auditors who are located in China and if we fail to implement measures to enable PCAOB’ inspection of our auditor. See “Risk Factors—Related to Our Class A Ordinary Shares and this Offering—Our Class A ordinary shares may be delisted under the HFCA Act if the PCAOB is unable to inspect auditors who are located in China and if we fail to implement measures to enable PCAOB’s inspection of our auditor. The delisting of our Class A ordinary shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct inspections deprives our investors of the benefits of such inspections.”

We have operations in many locations globally through our principal subsidiaries incorporated in Hong Kong, the PRC, Japan and the United States and our principal consolidated VIEs incorporated in the United States and the United Kingdom. If needed, cash can be transferred between our holding company and subsidiaries through intercompany fund advances. In 2020 and 2021, our Cayman holding company has received a total of $12.3 million and $6.7 million, respectively, in cash from our subsidiaries and VIEs, as applicable, in Hong Kong, Germany and the United States. In 2020 and 2021, our Cayman holding company has transferred a total of $1.8 million and $18.6 million, respectively, in cash to our subsidiary in Hong Kong and a total of $0.4 million and nil, respectively, in cash to our VIEs in the United States and Germany. In 2020 and 2021, our subsidiaries in the PRC have received a total of $5.0 million and $16.6 million, respectively, in cash from our Hong Kong subsidiary. In 2020 and 2021, our subsidiaries in the PRC have transferred a total of nil and $0.5 million, respectively, in cash to our VIEs in the United States and Japan. Our subsidiaries and VIEs have never made any dividends or distributions to our Cayman Islands holding company. Similarly, our Cayman Islands holding company has not declared or made any dividend or other distribution to its shareholders, including U.S. investors, in the past.

Neither the United States Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per Class A

ordinary share | | | Total | |

Initial public offering price | | $ | | | | $ | | |

Underwriting discounts and commissions (1) | | $ | | | | $ | | |

Proceeds, before expenses, to us | | $ | | | | $ | | |

| | (1) | For additional information on underwriting compensation, see “Underwriting.” |

To the extent that the underwriters sell more than Class A ordinary shares in this offering, the underwriters have a 30-day option to purchase up to an aggregate of additional Class A ordinary shares from us at the initial public offering price less the underwriting discounts and commissions.

Immediately prior to the completion of this offering, our outstanding share capital will consist of Class A ordinary shares and Class B ordinary shares. will beneficially own all of our issued Class B ordinary shares and will be able to exercise approximately % of the total voting power of our issued and outstanding share capital immediately following the completion of this offering. Holders of Class A ordinary shares and Class B ordinary shares will have the same rights except for voting and conversion rights. Each Class A ordinary share will be entitled to vote[s], and each Class B ordinary share will be entitled to votes. Our Class A ordinary shares and Class B ordinary shares vote together as a single class on all matters submitted to a vote of our shareholders, except as may otherwise be required by law. Each Class B ordinary share will be convertible into Class A ordinary share. Class A ordinary shares will not be convertible into Class B ordinary shares under any circumstances.

Upon the completion of this offering, we will be a “controlled company” as defined under the NYSE Listed Company Manual because will hold more than 50% of our voting power for the election of directors. In addition, our directors, officers and certain affiliated shareholders will own a substantial majority of our shares and will be able to exercise a substantial majority of the total voting power of our total issued and outstanding ordinary shares immediately upon the completion of this offering, assuming the underwriters do not exercise their option to purchase additional Class A ordinary shares. See “Principal Shareholders” for details.

The underwriters expect to deliver the Class A ordinary shares against payment in U.S. dollars in New York, New York on or about , 2022

| | |

| BofA Securities | | Wells Fargo Securities |

PROSPECTUS DATED , 2022