The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling securityholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated October 13, 2022

PRELIMINARY PROSPECTUS

118,118,018 Ordinary Shares

241,147 Warrants

9,268,131 Ordinary Shares Issuable Upon Exercise of Warrants

Tritium DCFC Limited

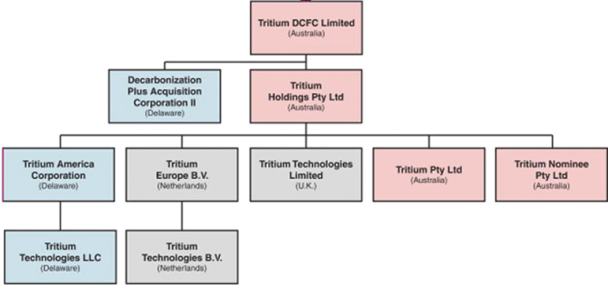

This prospectus relates to the offer and sale by the selling securityholders or their permitted transferees (collectively, the “Selling Securityholders”) of (A) up to 118,118,018 ordinary shares, no par value (“Ordinary Shares”), of Tritium DCFC Limited, a public limited company organized under the laws of Australia (the “Company”), consisting of up to (i) 99,675,382 Ordinary Shares issued to certain affiliated securityholders of the Company (excluding DCRN Sponsor (as defined below)) in connection with the acquisition by the Company of all of the issued equity interests in Tritium Holdings Pty Ltd and merger of Decarbonization Plus Acquisition Corporation II, a Delaware corporation (“DCRN”) with and into Hulk Merger Sub, Inc. (“Merger Sub”), in each case, on the terms and subject to the conditions set forth in the Business Combination Agreement, dated May 25, 2021 by and among Decarbonization Plus Acquisition Corporation II, Tritium Holdings Pty Ltd, Tritium DCFC Limited and Hulk Merger Sub, Inc. (such agreement referred to as the “Business Combination Agreement” and such transaction referred to as the “Business Combination”), including shares issued pursuant to the Option Agreements (as defined below) or as stock-based compensation to certain of our executive officers, (ii) 2,500,000 Ordinary Shares the Company issued to Palantir Technologies Inc. (“Palantir”) in connection with the A&R Subscription Agreement (as defined below); (iii) 13,395,833 Ordinary Shares held by Decarbonization Plus Acquisition Sponsor II LLC, a Delaware limited liability company (“DCRN Sponsor”) and certain previous independent directors of DCRN that were (x) issued to DCRN Sponsor in connection with the Option Agreements or (y) previously held as Class B common stock of DCRN, which was converted into Class A common stock of DCRN in accordance with DCRN’s amended and restated certificate of incorporation at the effective time of the merger in connection with the Business Combination and subsequently exchanged for Ordinary Shares; and (iv) 2,546,803 Ordinary Shares issued by the Company in private placements to DCRN Sponsor and certain previous independent directors of DCRN upon the “cashless” exercise of warrants that were originally issued to such holders in connection with private placements by DCRN to such holders, including 1,000,000 warrants that were issued to DCRN Sponsor as warrants for Ordinary Shares of the Company at the closing of the business combination in connection with working capital loans made by DCRN Sponsor to DCRN (the “Private Placement Warrants”), and (B) up to 241,147 Private Placement Warrants. The number of Ordinary Shares registered for resale by each holder is based on holdings information known to the Company as of August 30, 2022.

We are registering the offer and sale of the securities held by the Selling Securityholders, in some cases, to satisfy certain registration rights we have granted, and in other cases, to provide for resale by affiliates of the Company under the Securities Act. Subject to existing lockup or other restrictions on transfer, the Selling Securityholders may offer all or part of the securities for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. These securities are being registered to permit the Selling Securityholders to sell securities from time to time, in amounts, at prices and on terms determined at the time of offering. The Selling Securityholders may sell these securities through ordinary brokerage transactions, directly to market makers of our shares or through any other means described in the section entitled “Plan of Distribution” herein. In connection with any sales of ordinary shares offered hereunder, the Selling Securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, or the “Securities Act.”

We are registering these securities for resale by the Selling Securityholders named in this prospectus, or their transferees, pledgees, donees or assignees or other successors-in-interest (that receive any of the shares as a gift, distribution, or other non-sale related transfer).

This prospectus also relates to the issuance by us of up to an aggregate of 9,268,131 Ordinary Shares, which consists of (i) up to 241,147 Ordinary Shares that are issuable upon the exercise of 241,147 Private Placement Warrants and (ii) up to 9,026,984 Ordinary Shares that are issuable upon the exercise of 9,026,984 Warrants, originally issued as warrants of DCRN sold to the public in DCRN’s initial public offering (“Public Warrants” and, together with the Private Placement Warrants (but excluding the Financing Warrants (as defined below)), the “Warrants”), based on the number of Public Warrants outstanding on October 12, 2022. This prospectus also relates to the resale by certain previous independent directors of DCRN of the 241,147 Ordinary Shares issuable upon the exercise of the Private Placement Warrants. We will receive the proceeds from any exercise of any warrants for cash.

We will not receive any proceeds from the sale of the securities by the Selling Securityholders, except with respect to amounts received by the Company upon exercise of the Warrants to the extent such Warrants are exercised for cash.

This prospectus also covers any additional securities that may become issuable by reason of share splits, share dividends or other similar transactions.