Investor Presentation Issuer Free Writing Prospectus dated, February 28 , 2023 Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended Relating to Preliminary Prospectus dated February 17 , 2023 Registration Statement No. 333 - 267367 Shengfeng Development Limited

2 This free writing prospectus relates to the proposed public offering of Class A Ordinary Shares (“Class A Ordinary Shares”) of Shengfeng Development Limited (“we”, “us”, or “our”) and should be read together with the Registration Statement we filed with the U . S . Securities and Exchange Commission (the “SEC”) for the offering to which this presentation relates and may be accessed through the following web link : https : //www . sec . gov/Archives/edgar/data/ 1863218 / 000121390023012822 /ea 173873 - f 1 a 4 _shengfeng . htm The Registration Statement has not yet become effective . Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have with the SEC in their entirety for more complete information about us and the offering . You may get these documents for free by visiting EDGAR on the U . S . Securities and Exchange Commission(the “SEC”) website at http : //www . sec . gov . Alternatively, we or our underwriter will arrange to send you the prospectus if you contact Univest Securities, LLC, 75 Rockefeller Plaza, Suite 1838 , New York, NY 10019 , or via email : info@univest . us , or contact Shengfeng Development Limited via email : ir@sfwl . com . cn . Free Writing Prospectus Statement

This presentation contains forward - looking statements that reflect our current expectations and views of future events . You can identify some of these forward - looking statements by words or phrases such as "may," "will," "should," "expect," "anticipate," "aim," "estimate," "intend," "plan," "believe," "is/are likely to," "approximately," "potential," "continue," or other similar expressions . We have based these forward - looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs . These forward - looking statements involve various risks and uncertainties . Although we believe that our expectations expressed in these forward - looking statements are reasonable, our expectations may later be found to be incorrect . The forward - looking statements made in this presentation relate only to events or information as of the date on which the statements are made in this presentation . Except as required by law, we undertake no obligation to update or revise publicly any forward - looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events . You should thoroughly read this presentation and the documents that we refer to herein with the understanding that our actual future results may be materially different from and worse than what we expect . We qualify all of our forward - looking statements by these cautionary statements . This presentation contains certain data and information that we obtained from various government and private publications . Statistical data in these publications also include projections based on a number of assumptions . Failure of this industry to grow at the projected rate may have a material and adverse effect on our business and the market price of our ordinary shares . If any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions . You should not place undue reliance on these forward - looking statements . You should read carefully the factors described in the “Risk Factors” section of the prospectus contained in the Registration Statement to better understand the risks and uncertainties inherent in our business and any forward - looking statements . All references to dollar amounts in the offering summary or to use of proceeds are subject to change pending a final prospectus . 3 Forward - Looking Statement

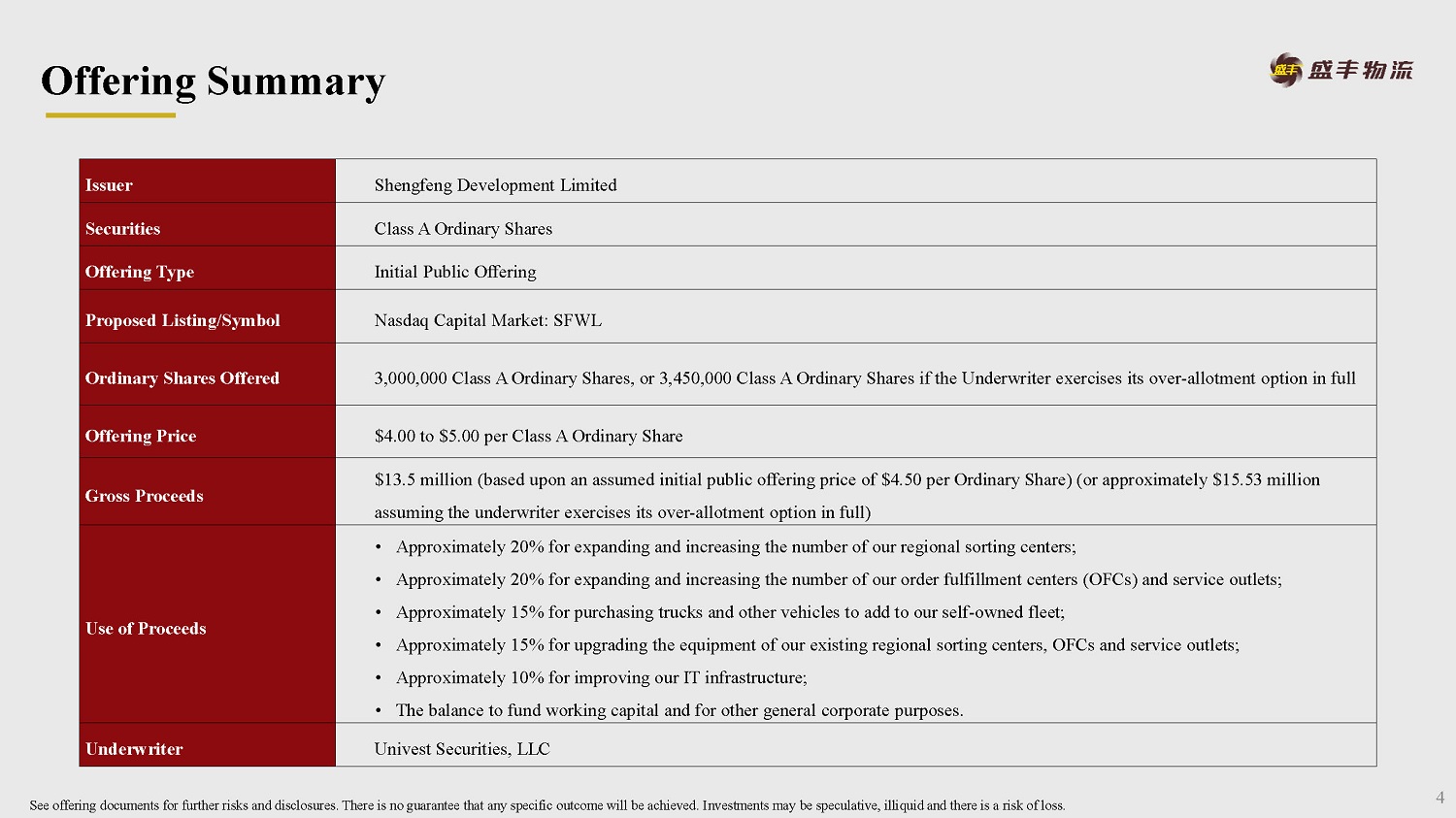

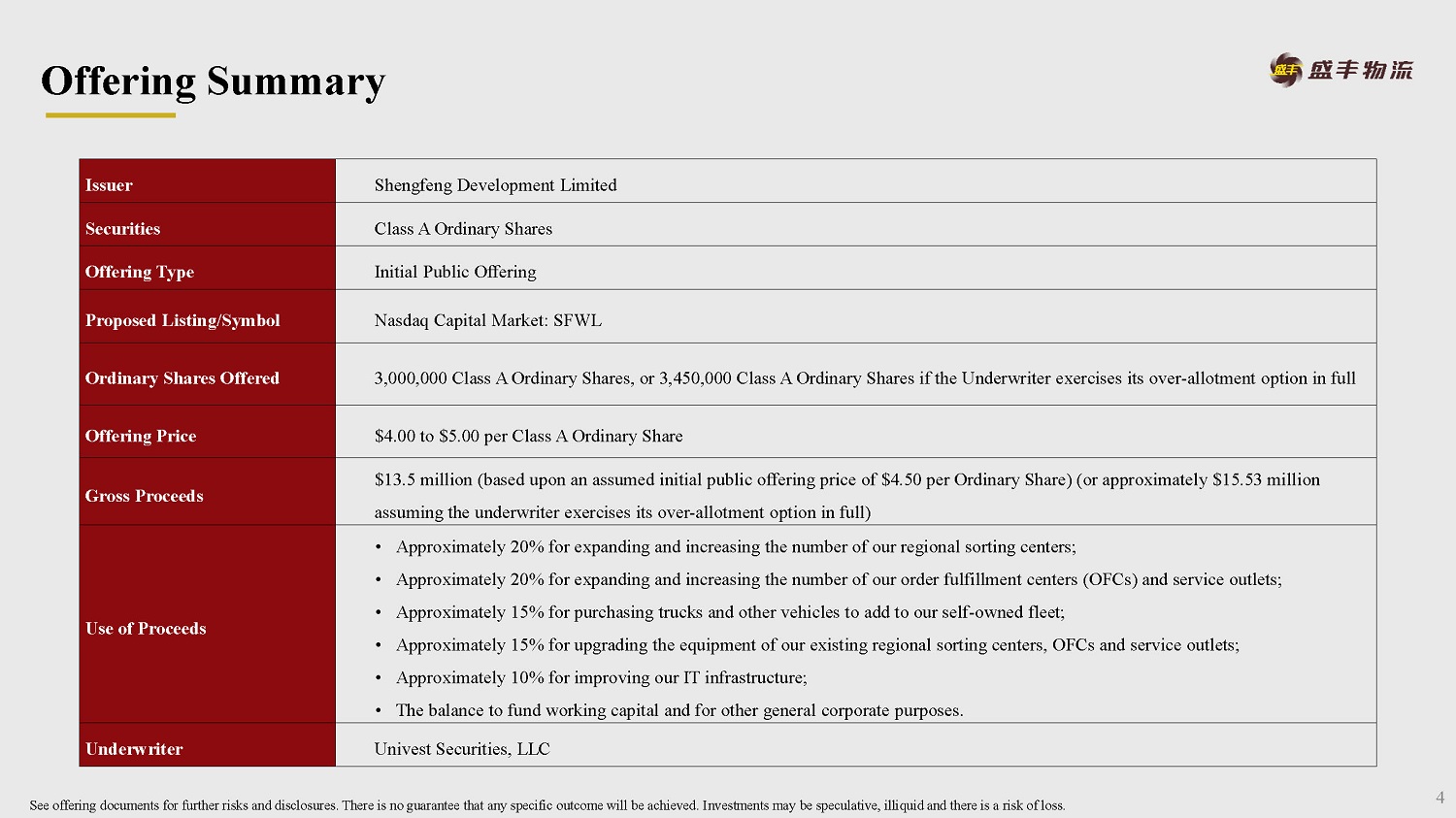

Issuer Shengfeng Development Limited Securities Class A Ordinary Shares Offering Type Initial Public Offering Proposed Listing/Symbol Nasdaq Capital Market: SFWL Ordinary Shares Offered 3,000,000 Class A Ordinary Shares, or 3,450,000 Class A Ordinary Shares if the Underwriter exercises its over - allotment option i n full Offering Price $4.00 to $5.00 per Class A Ordinary Share Gross Proceeds $13.5 million (based upon an assumed initial public offering price of $4.50 per Ordinary Share) (or approximately $15.53 mill ion assuming the underwriter exercises its over - allotment option in full) Use of Proceeds • Approximately 20% for expanding and increasing the number of our regional sorting centers; • Approximately 20% for expanding and increasing the number of our order fulfillment centers (OFCs) and service outlets; • Approximately 15% for purchasing trucks and other vehicles to add to our self - owned fleet; • Approximately 15% for upgrading the equipment of our existing regional sorting centers, OFCs and service outlets; • Approximately 10% for improving our IT infrastructure; • The balance to fund working capital and for other general corporate purposes. Underwriter Univest Securities, LLC 4 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Offering Summary

Corporate Structure See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 5 Shengfeng International Limited BVI, 2020 Other Minority Shareholders Public Shareholders Shengfeng Development Limited “Shengfeng Cayman” Cayman Islands, 2020 Shengfeng Holdings Limited “Shengfeng HK” Hong Kong, 2020 Fujian Tianyu Shengfeng Logistics Co., Ltd. “Tianyu” PRC, 2020 Shengfeng Logistics Group Co., Ltd. “Shengfeng Logistics” PRC, 2001 31 Significant Subsidiaries of Shengfeng Logistics PRC Pre - IPO%/Post - IPO% 91.66%/91.06% 8.34%/8.29% 0%/0.65% Outside the PRC Inside the PRC VIE - Agreement 100% 100% Note: As a holding company with no material operations of Shengfeng Development Limited’s own, its operations have been condu cte d in China by its subsidiaries and through contractual arrangements, which are also known as the “VIE Agreements”, with a VIE, Shengfeng Logistics Group Co., Ltd., and the VIE’s subsidiaries.

Began operations in 2001, we are a contract logistics company in China providing our customers with integrated logistics solutions. Company Overview See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Note: * As of June 30, 2022 As a holding company with no material operations of Shengfeng Development Limited’s own, its operations have been conducted i n C hina by its subsidiaries and through contractual arrangements, which are also known as the “VIE Agreements”, with a VIE, Shengfeng Logistics Group Co., Ltd., and the VIE’s subsidiaries. 6 We have developed extensive and reliable transportation networks in China, covering 341 cities in over 31 provinces*. B2B Freight Transportation Services Cloud Storage Services Value - added Services

Operation Scale 7 35 Regional Sorting Centers* 22 Cloud Order Fulfillment Centers* 600+ Self - owned Trucks and Vehicles 42 Service Outlets* 40,000+ Transportation Providers* 1500+ Employees* 2,444,000 sq. ft. Storage Space* See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Note: * As of June 30, 2022

164,292 166,538 287,464 346,699 1H2021 Unaudited 1H2022 Unaudited FY2020 FY2021 Revenue (in USD thousands) 18,818 18,242 35,975 41,345 1H2021 Unaudited 1H2022 Unaudited FY2020 FY2021 Gross Profit (in USD thousands) 1,671 2,455 6,043 6,644 1H2021 Unaudited 1H2022 Unaudited FY2020 FY2021 Net Income (in USD thousands) Financial Highlights See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 8 Note: Fiscal Year ended December 31. Six months ended June 30.

627.1 677.3 754.1 881.5 1005.8 1154.9 1112.6 1253.4 1401.8 1550.8 1709.9 2014 2015 2016 2017 2018 2019 2020E 2021E 2022E 2023E 2024E Market Size of Contract Logistics, China, 2014 - 2024E (In RMB Billion) CAGR:13.0% CAGR:8.2% 499.4 529.2 578.1 661.9 740.6 832.6 784.2 867.6 952.8 1036.2 1123.0 2014 2015 2016 2017 2018 2019 2020E 2021E 2022E 2023E 2024E Market Size of Independent B2B Contract Logistics, China, 2014 - 2024E (In RMB Billion) CAGR:10.8% CAGR:6.2% Fast - Growing Market See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 9 Source: Frost & Sullivan

Contract Logistics Service Provider with Established Operating History in China Operational Efficiency Driven by Detailed Operational Guidelines Scalable Integrated Network Model Extensive and Growing Ecosystem Superior Service Quality Experienced Management Team with a Proven Track Record Competitive Strengths See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 10 Competitive Strengths

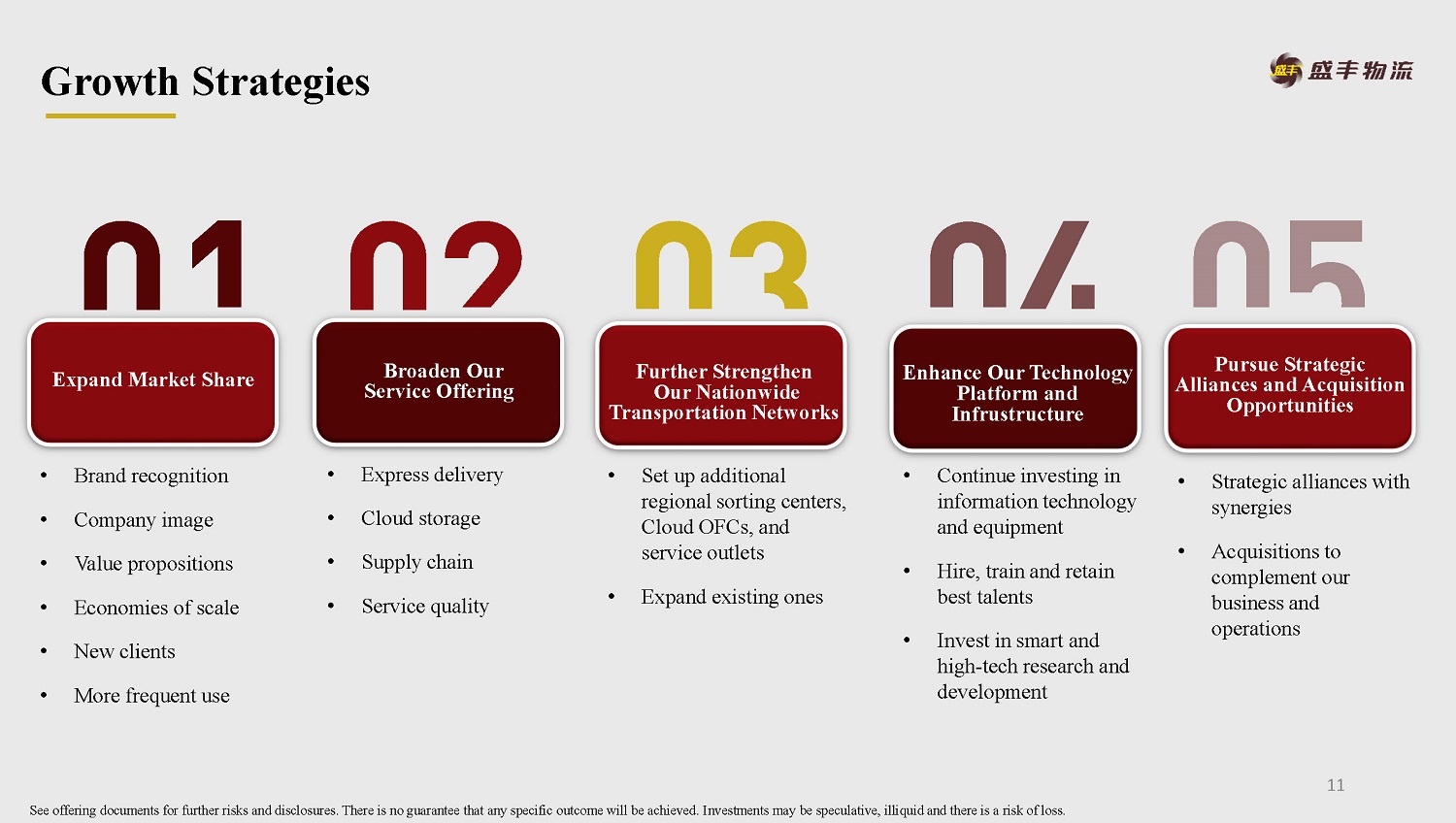

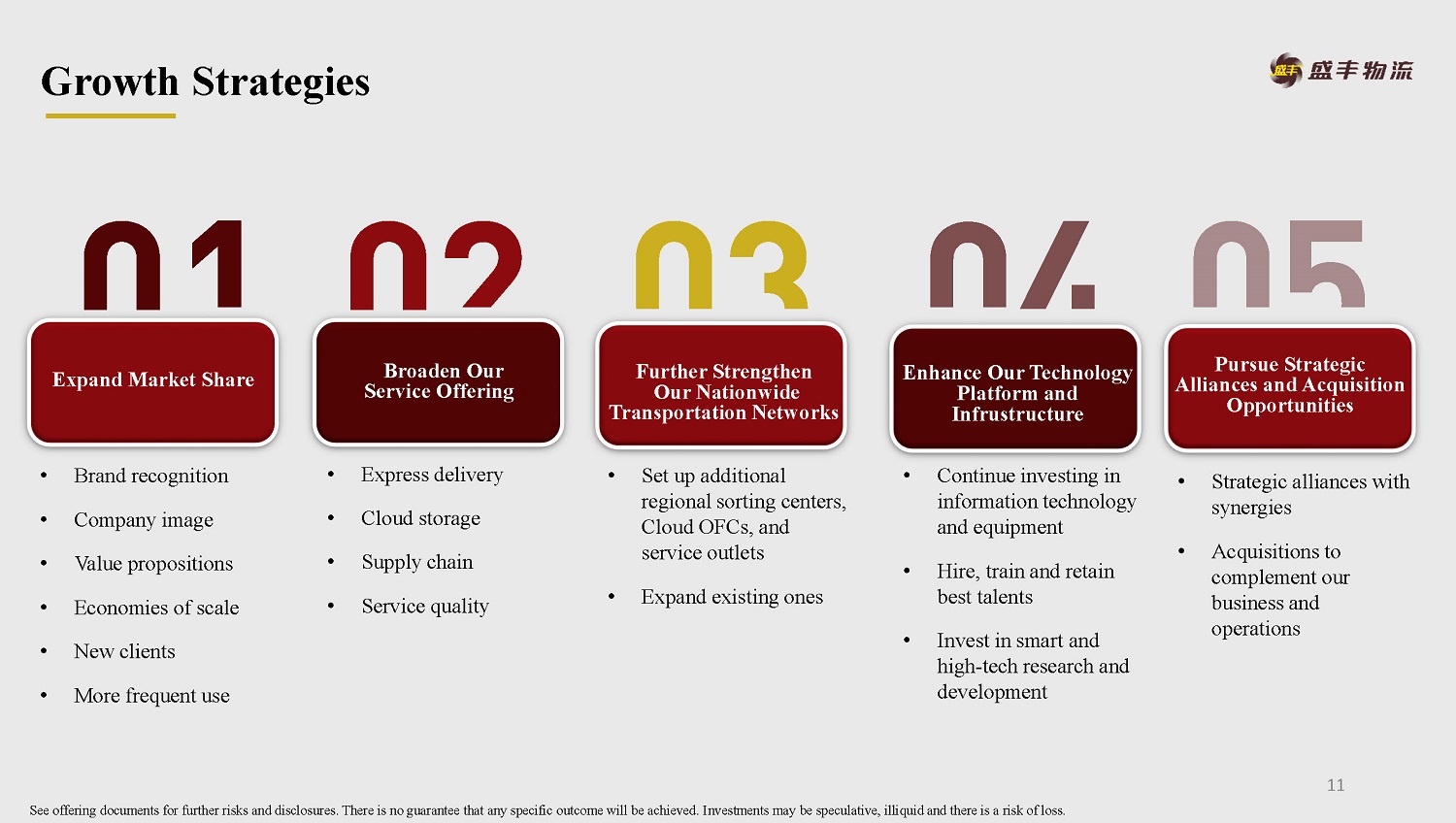

Broaden Our Service Offering s Further Strengthen Our Nationwide Transportation Networks Enhance Our Technology Platform and Infrustructure Pursue Strategic Alliances and Acquisition Opportunities • Brand recognition • Company image • Value propositions • Economies of scale • New clients • More frequent use • Express delivery • Cloud storage • Supply chain • Service quality • Set up additional regional sorting centers, Cloud OFCs, and service outlets • Expand existing ones • Continue investing in information technology and equipment • Hire, train and retain best talents • Invest in smart and high - tech research and development • Strategic alliances with synergies • Acquisitions to complement our business and operations Growth Strategies Expand Market Share See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 11

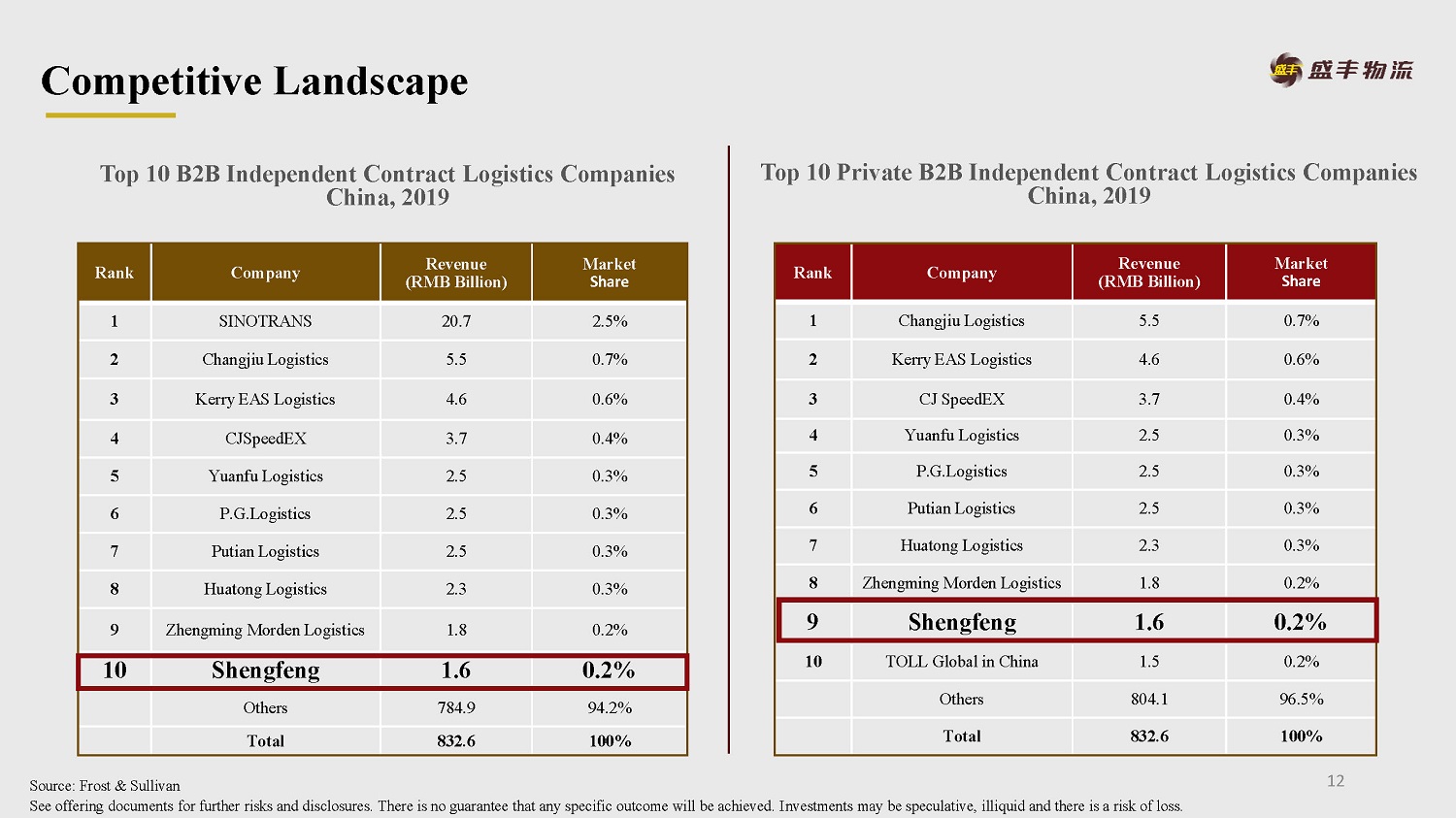

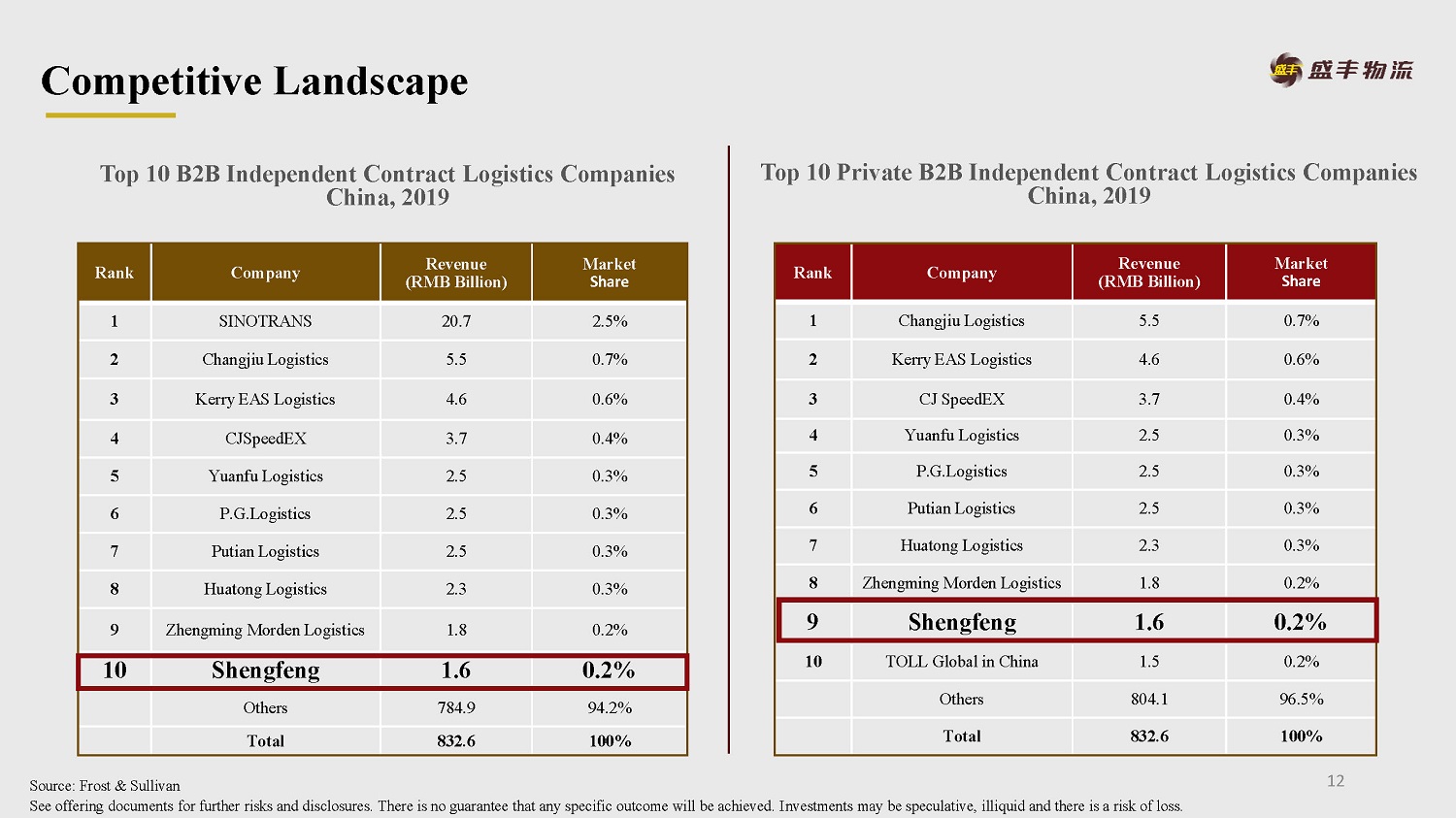

Top 10 B2B Independent Contract Logistics Companies China, 2019 Rank Company Revenue (RMB Billion) Market Share 1 SINOTRANS 20.7 2.5% 2 Changjiu Logistics 5.5 0.7% 3 Kerry EAS Logistics 4.6 0.6% 4 CJSpeedEX 3.7 0.4% 5 Yuanfu Logistics 2.5 0.3% 6 P.G.Logistics 2.5 0.3% 7 Putian Logistics 2.5 0.3% 8 Huatong Logistics 2.3 0.3% 9 Zhengming Morden Logistics 1.8 0.2% 10 Shengfeng 1.6 0.2% Others 784.9 94.2% Total 832.6 100% Top 10 Private B2B Independent Contract Logistics Companies China, 2019 Competitive Landscape See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Rank Company Revenue (RMB Billion) Market Share 1 Changjiu Logistics 5.5 0.7% 2 Kerry EAS Logistics 4.6 0.6% 3 CJ SpeedEX 3.7 0.4% 4 Yuanfu Logistics 2.5 0.3% 5 P.G.Logistics 2.5 0.3% 6 Putian Logistics 2.5 0.3% 7 Huatong Logistics 2.3 0.3% 8 Zhengming Morden Logistics 1.8 0.2% 9 Shengfeng 1.6 0.2% 10 TOLL Global in China 1.5 0.2% Others 804.1 96.5% Total 832.6 100% 12 Source: Frost & Sullivan

Cloud Storage Services Value - added Services Freight Transportation Services • FTL Freight Transportation • LTL Freight Transportation • Warehouse Management • In - warehouse Processing • Order Fulfillment • Collection on Delivery • Customs Declaration • Delivery Upstairs • Packaging • Pay - at - arrival • Return Proof of Delivery • Shipment Protection 92.84% of Total Revenue* Our Services See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Note: * For the six months ended June 30, 2022 13

LTL FTL Senders Warehouse Factories Shops Service outlets Regional sorting centers Destination regional sorting centers Service outlets Recipients Pickup Sorting and Transportation Delivery Shengfeng/Transportation Providers Shengfeng/Transportation Providers Shengfeng/Transportation Providers Clients’ Warehouses Regional sorting centers Destination regional sorting centers Designated Destination Pickup Sorting and Transportation Delivery Shengfeng/Transportation Providers Shengfeng/Transportation Providers Shengfeng/Transportation Providers Less Than Truckload Freight Transportation Full Truckload Freight Transportation Freight Transportation Services 14 Shipment Flow Shipment Flow See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss.

• Differ from traditional warehouses x Direct order fulfillment and dispatch operations x Storage • 22 Cloud Order Fulfillment Centers across China* • 2,444,000 square feet storage area* • Connect to our information systems • Constantly monitor the service quality Services Provided with Cloud OFCs Cloud Order Fulfillment Centers(OFCs) Cloud Storage Services • Storage • Pick and Pack • Kitting and Assembly • Fulfillment • Delivery Process Management • Other Value - added Services • Inventory Optimization Management See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 15 Note: * As of June 30, 2022

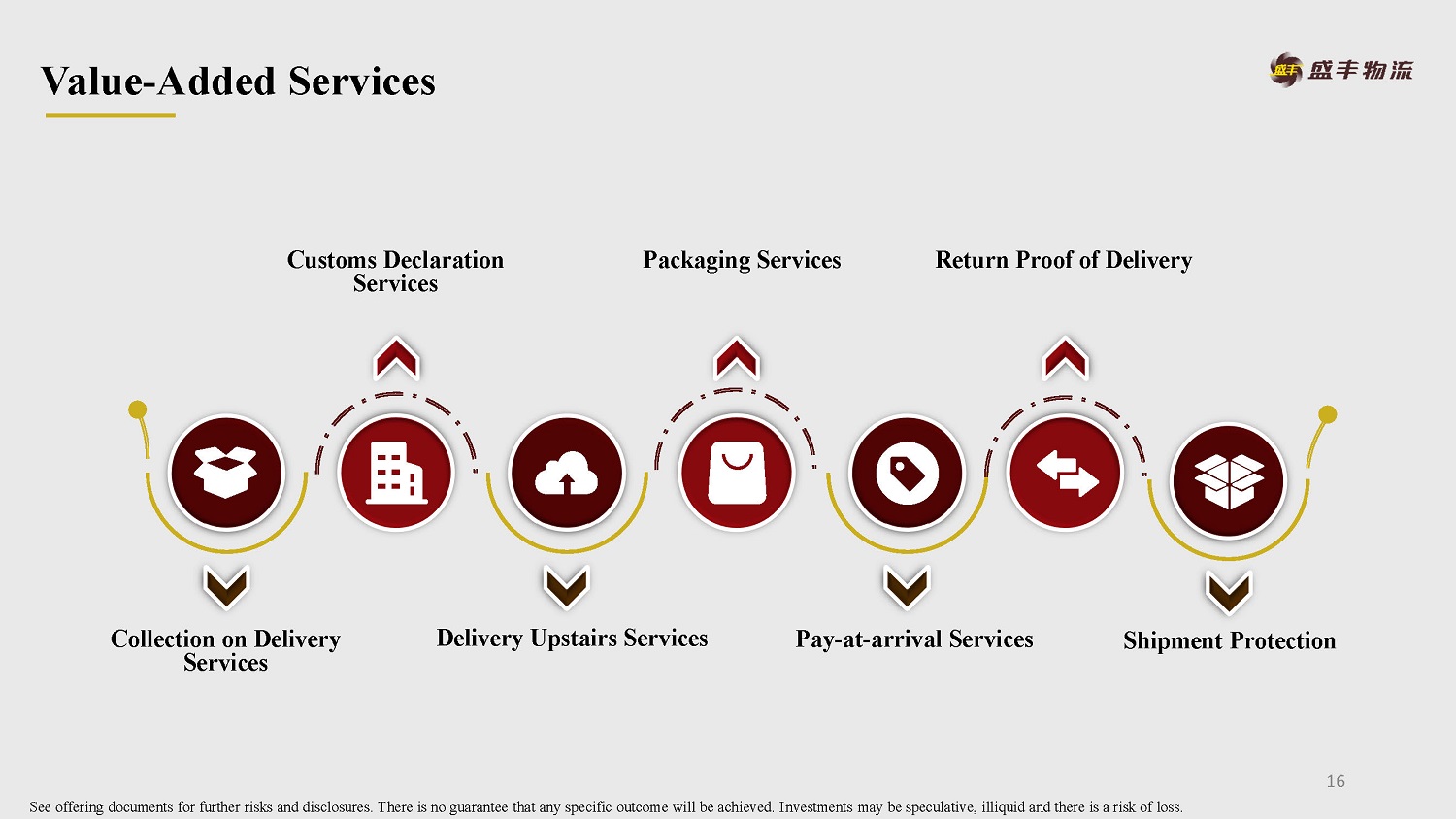

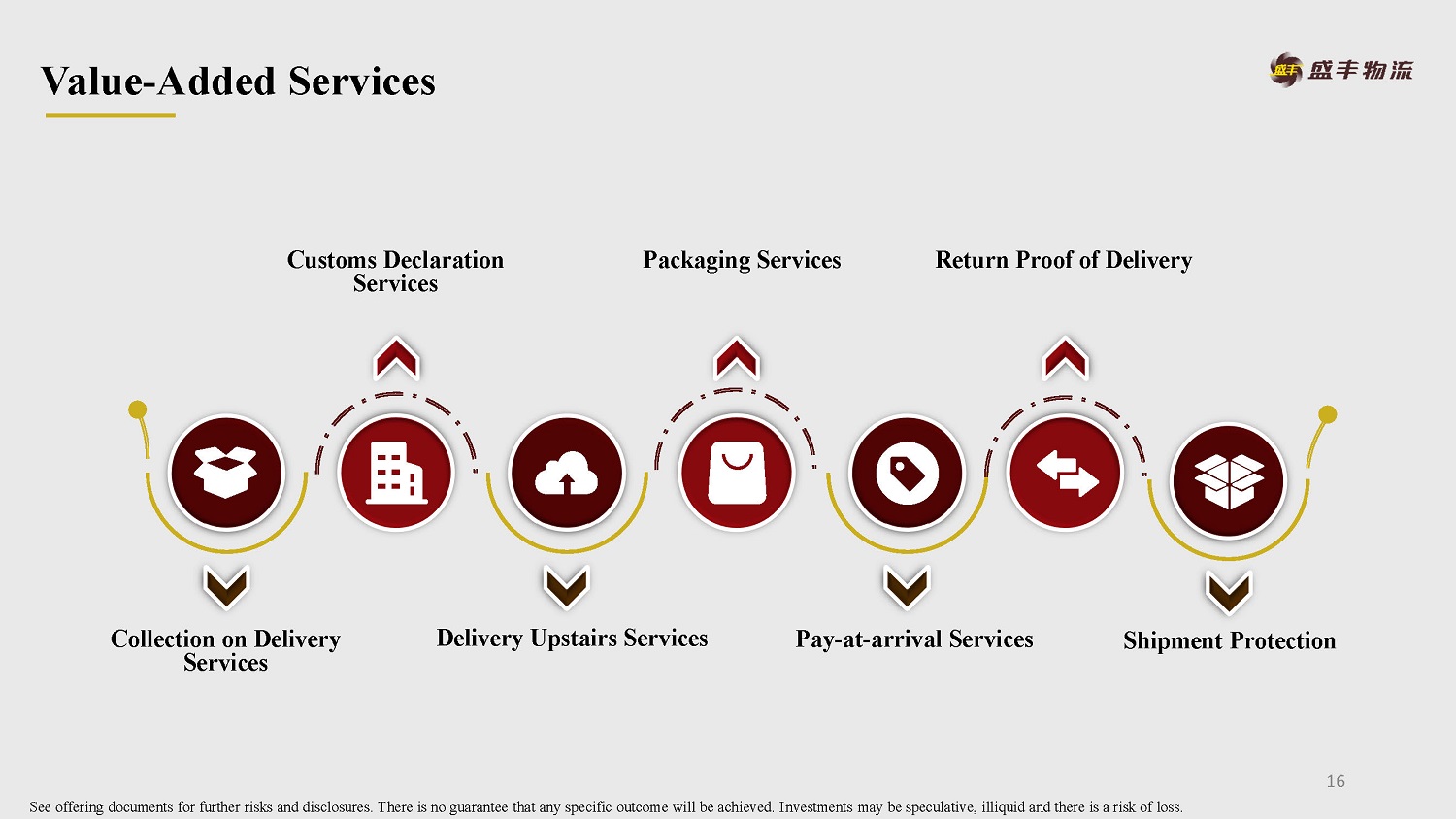

Collection on Delivery Services Customs Declaration Services Delivery Upstairs Services Packaging Services Pay - at - arrival Services Return Proof of Delivery Shipment Protection Value - Added Services See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 16

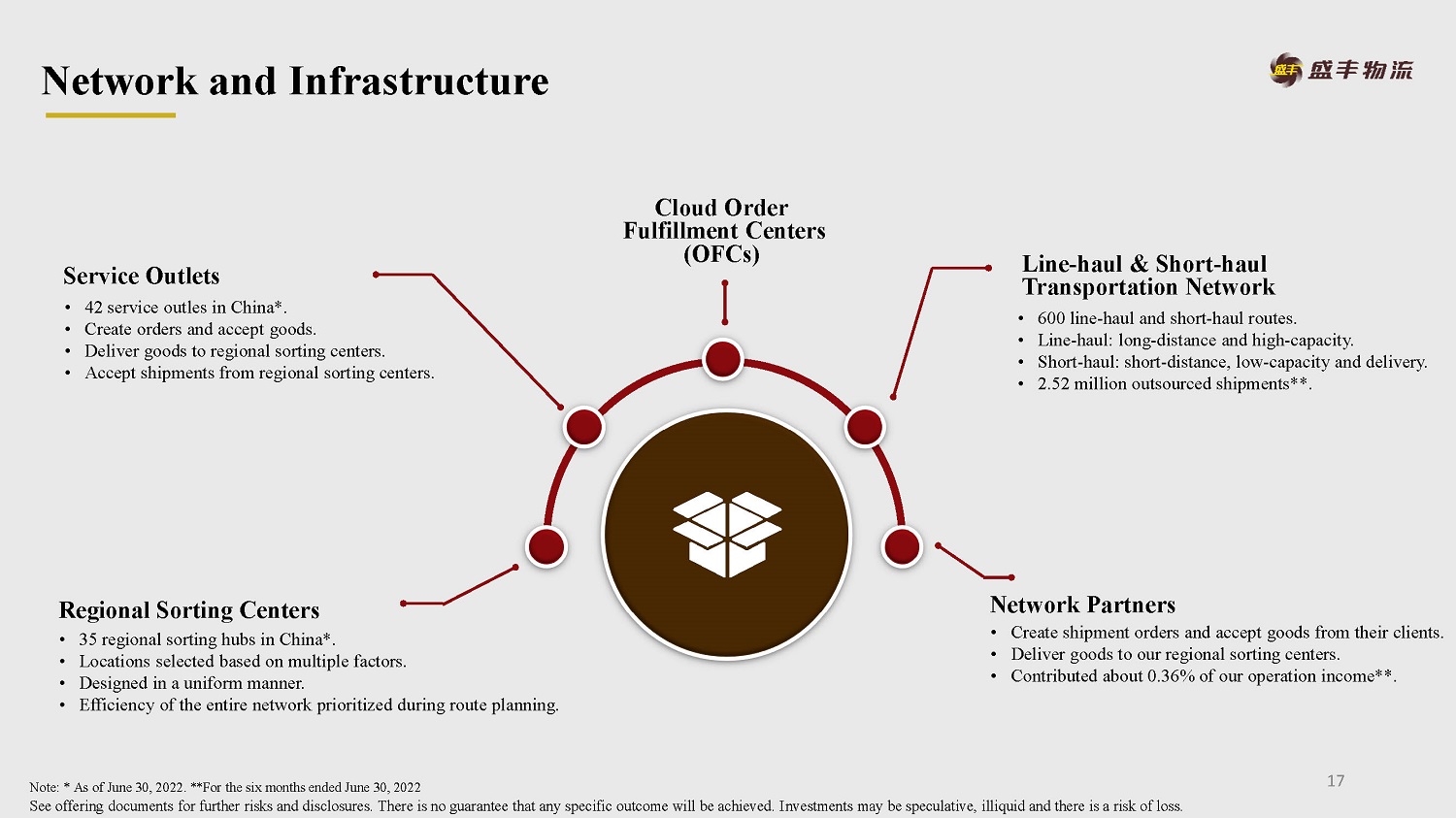

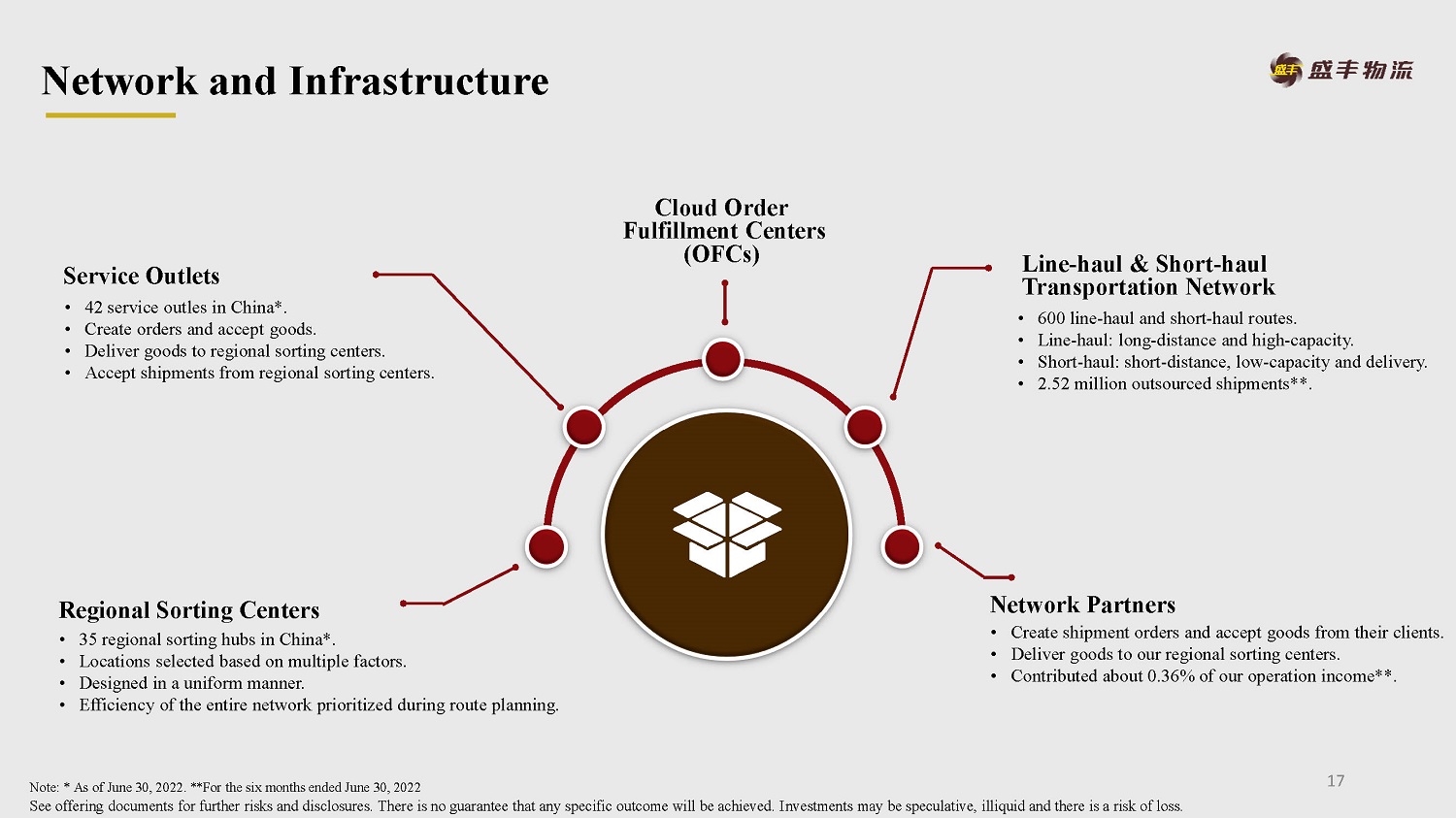

Regional Sorting Centers • 35 regional sorting hubs in China*. • Locations selected based on multiple factors. • Designed in a uniform manner. • Efficiency of the entire network prioritized during route planning. Line - haul & Short - haul Transportation Network • 600 line - haul and short - haul routes. • Line - haul: long - distance and high - capacity. • Short - haul: short - distance, low - capacity and delivery. • 2.52 million outsourced shipments**. Cloud Order Fulfillment Centers (OFCs) Service Outlets • 42 service outles in China*. • Create orders and accept goods. • Deliver goods to regional sorting centers. • Accept shipments from regional sorting centers. Network Partners • Create shipment orders and accept goods from their clients. • Deliver goods to our regional sorting centers. • Contributed about 0.36% of our operation income**. Network and Infrastructure 17 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. Note: * As of June 30, 2022. **For the six months ended June 30, 2022

Industry Percentage Manufacturing 16.20% Fast Moving Customer Goods 16.04% Publishing 6.39% TOTAL 38.63% Six Months Ended June 30 Fiscal Years Ended December 31 2022 2021 2021 2020 Owner - operators of a single truck (#) 21,164 18,155 35,224 38,992 Private fleets (#) 25 44 54 91 Large trucking companies (#) 1,222 1,153 1,458 1,278 Our Main Clients* Our Transportation Providers Our Ecosystem Transportation Providers Clients Shengfeng More Services More Participants More Usage See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 18 Note: * As of June 30, 2022.

• Individual profile for each service provider required • Store all corporate records and material information • Monitor real - time status and location • Track shipments by third - party transportation providers • Automatic routing calculation • GPS trackers synchronized with Shengfeng TMS • Integrated with BeiDou Navigation Satellite System, WeChat and manual recording • Tracks each client’s order • View and issue bills to clients and truck client payments • Online client portal • View order histories, track real - time shipment status, make direct service requests • Provide better and more effective services to clients Shengfeng Transportation Management System (TMS) Technology Infrastructure Shipment Transportation and Tracking Management Payment Calculation Portals for Third - party Transportation Providers Client Portal and Service Support See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 19

Shengfeng Warehouse Management System ( WMS ) Storage Location Management Order Management “First - In, First - Out” Management Bar Code Management and Tracking Order and Operation Review Storage Management Effectively monitor the capacity of our warehouses on a real - time basis and track each and every movement of a good from its entry into our warehouse to its delivery at its destination. Technology Infrastructure See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 20

Customer Acquirements Constantly Improving Marketing Strategies Recognitions AAAAA Information Updates Brand Awareness • Outstanding logistics company by CCTA • Top 10 AAAAA class logistic company CFLP in 2018 • Top 100 logistics company by CCTA in 2016 and 2018 • 32/50 privately - owned logistics company by CFLP as of June 30, 2022 • Various programs and marketing activities • Social network mobile applications • Convenient features: shipment tracking, service outlet locator, shipment booking, etc. • Conferences and exhibitions in different industries • Promotion activities • Market bidding activities • Upstream and downstream researches • Logos on vehicles and uniforms • Maintain existing client relationships • Establish new client relationships • Enhance our service quality and efficiency • Manage our marketing system and expertise Branding and Marketing See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 21 Note: “CCTA” stands for China Communications and Transportation Association; “CFLP” stands for China Federation of Logistics & Purchasing .

Management Team Yongxu Liu Chief Executive Officer, Director, President and Chairman • Mr . Li u has been our Chief Executive Officer , President, and C hairman since May 20 , 2021 and D irector since July 16 , 2020 . • Mr . Liu is the founder of Shengfeng Logistics and has served as its C hairman and C hief E xecutive O fficer since December 2001 . • Mr . Liu served as the vice chairman of Fujian Province Logistics Association in 2006 and the v ice c hairman of Fuzhou City Logistics Association in 2007 . • Mr . Liu also served as the deputy to Fuzhou Municipal People’s Congress in 2011 . • Mr . Liu was the manager of Department of Vehicle Management of Shenghui Logistics Group Co . , Ltd . from 1997 to 2001 . Before the formal formation of Shenghui Logistics Group Co . , Ltd . , Mr . Liu worked for such entity from 1992 to 1997 as a self - employed individual of logistics transportation . • Mr . Liu received his M aster’s degree in Executive Master of Business Administration from Tsinghua University in 2016 . Guoping Zheng Chief Financial Officer and Vice President • Mr . Zheng has been our Chief Financial Officer and Vice President since May 20 , 2021 . • Mr . Zheng has served as Vice President and Chief Financial Officer of Shengfeng Logistics, Principal of its Strategy Department and its Finance Department since 2016 . • Mr . Zheng served as the senior director of the Financial Management Department of East China and North China in Deppon Logistics Co . , Ltd . from 2008 to 2016 . • Mr . Zheng received his Bachelor’s degree in Financial Management from Xiamen University in 2008 . See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 22

Board of Directors See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. I nve stments may be speculative, illiquid and there is a risk of loss. 23 Dan Liu Independent Director Appointee* Wen Li Independent Director Appointee* • Ms . Li has served as a financial director of Fujian Qunsheng Property Limited Company in China since 2013 and an independent director of Shenzhen Coship Electronics Co . , Ltd . since March 2021 . • Ms . Li served as an independent director of Fufa Group Co . , Ltd . in Fujian Province from 2006 to 2012 . • Ms . Li also served as the financial director of Fuzhou TV Station from 2008 to 2013 and the financial director of Fujian Zhongcheng Group from 2006 to 2008 . • Ms . Li was the general manager of Department of Finance of Fujian Huafu Securities Company from 1997 to 2005 and the general manager of Department of Finance of Fujian Huafu Real Estate Company from 1989 to 1997 . • Ms . Li received her B achelor’s degree in Economics from Fuzhou University in 1989 . Ms . Li also completed a Master course in Finance conducted by Xiamen University in 1999 . Ms . Li has been certified as a Senior Accountant in China since 2001 , obtained Securities Practitioner qualification in China since 2002 and Independent Director qualification in Shenzhen Stock Exchange since 2007 . John F. Levy Independent Director Apointee * • Ms. Liu has been a professor in the School of Economics and Management of Fuzhou University since 2017. Ms. Liu served as an ass ociate professor in the same school of Fuzhou University from 2006 to 2017. • Ms. Liu served as an associate professor in Fuzhou Polytechnic f rom 2001 to 2006. • Ms. Liu was a senior lecturer of the Department of Vocational Education of Fujian Economics and Management Cadre Institute from 2000 to 2001, after being a lecturer in the same department from 1994 to 2000. Ms. Liu served as a teaching assistant under the same department from 1987 to 1994. • Ms. Liu received her B achelor ’ s degree in Material Management Engineering from Huazhong University of Science & Technology in 1987, her M aster ’ s degree in Business Management from Fuzhou University in 2005 and her Ph.D. in Logistics Management from Fuzhou University in 2012 . • Mr. Levy currently serves as Chief Executive Officer and Principal Consultant for Board Advisory (the “Levy Company”). Mr. Le vy has held this role since May 2005. • Mr. Levy has also served as Chief Executive Officer of Sticky Fingers Restaurants, LLC from 2019 to 2020. • Mr. Levy is a recognized corporate governance and financial reporting expert with over 30 years of progressive financial, acc oun ting and business experience. • Mr. Levy currently serves on the board of directors of three other public companies: Applied Minerals, Inc. (since January 20 08) , Washington Prime Group, Inc. (since June 2016), and Happiness Biotech Group Ltd. (since October 2019). • Mr. Levy is a Certified Public Accountant. Mr. Levy is a graduate of the Wharton School of Business at the University of Penn syl vania and received his MBA from St. Joseph’s University in Philadelphia, Pennsylvania. Zhiping Yang Director • Mr . Yang has been our D irector since April 7 , 2021 . Mr . Yang joined Shengfeng Logistics in 2001 . • Mr . Yang has served as the vice president of Shengfeng Logistics since 2020 and the general manager of the Operation Center in Shengfeng Logistics since 2014 . • Mr . Yang has served as the director of Shengfeng Logistics from December 2018 to April 2021 . • Mr . Yang received his Bachelor’s degree in Applied Psychology from Xi’an Institute of Political Science of the People’s Liberation Army in 2015 . Mr . Yang completed a Human Resources Advanced Training Class conducted by Tsinghua University in 2014 .

Issuer Shengfeng Development Limited Email: ir@sfwl.com.cn Tel: +86 - 591 - 83619860 Address: S hengfeng Building, No. 478 Fuxin East Road Jin’an District, Fuzhou City , Fujian Province, China, 350001 Underwriter Univest Securities, LLC Edric Guo CEO Email: info@univest.us Tel: + 1 212 - 343 - 8888 Address: 75 Rockefeller Plaza, Suite 1838, New York, NY 10019 Contact