UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | | | | | | | | | | | |

Commission

File Number | | Name of Registrant; State or Other Jurisdiction of Incorporation; Address of Principal Executive Offices; and Telephone Number | | IRS Employer Identification Number |

| | | | |

| 001-41137 | | CONSTELLATION ENERGY CORPORATION | | 87-1210716 |

| | (a Pennsylvania corporation) 1310 Point Street Baltimore, Maryland 21231-3380 (833) 883-0162 | | |

| | | | |

| 333-85496 | | CONSTELLATION ENERGY GENERATION, LLC | | 23-3064219 |

| | (a Pennsylvania limited liability company) 200 Energy Way Kennett Square, Pennsylvania 19348-2473 (833) 883-0162 | | |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| CONSTELLATION ENERGY CORPORATION: | | | | |

| Common Stock, without par value | | CEG | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| | | | | | | | | | | | | | | | | |

| Constellation Energy Corporation | Yes | x | | No | ☐ |

| Constellation Energy Generation, LLC | Yes | ☐ | | No | x |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| | | | | | | | | | | | | | | | | |

| Constellation Energy Corporation | Yes | ☐ | | No | x |

| Constellation Energy Generation, LLC | Yes | ☐ | | No | x |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| | | | | | | | | | | | | | | | | |

| Constellation Energy Corporation | Yes | x | | No | ☐ |

| Constellation Energy Generation, LLC | Yes | x | | No | ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Constellation Energy Corporation | Large Accelerated Filer | x | Accelerated Filer | ☐ | Non-accelerated Filer | ☐ | Smaller Reporting Company | ☐ | Emerging Growth Company | ☐ |

| Constellation Energy Generation, LLC | Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | Non-accelerated Filer | x | Smaller Reporting Company | ☐ | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

The estimated aggregate market value of the voting and non-voting common equity held by nonaffiliates of each registrant as of June 30, 2024 was as follows:

| | | | | |

| Constellation Energy Corporation | $62,564,709,888 |

| Constellation Energy Generation, LLC | Not applicable |

The number of shares outstanding of each registrant’s common stock as of January 31, 2025 was as follows:

| | | | | |

| Constellation Energy Corporation Common Stock, without par value | 312,847,257 | |

| Constellation Energy Generation, LLC | Not applicable |

Documents Incorporated by Reference

Portions of the Registrants’ Definitive Proxy Statement relating to the 2025 Annual Meeting of Shareholders are incorporated by reference into Part III of this report. The Registrants expect to file the Definitive Proxy Statement with the Securities and Exchange Commission within 120 days after December 31, 2024.

TABLE OF CONTENTS

| | | | | | | | |

| GLOSSARY OF TERMS AND ABBREVIATIONS |

| Constellation Energy Corporation and Related Entities |

| CEG Parent | | Constellation Energy Corporation |

| Constellation | | Constellation Energy Generation, LLC (formerly Exelon Generation Company, LLC) |

| Registrants | | CEG Parent and Constellation, collectively |

| Antelope Valley | | Antelope Valley Solar Ranch One |

| Continental Wind | | Continental Wind LLC |

| CENG | | Constellation Energy Nuclear Group, LLC |

| CR | | Constellation Renewables, LLC |

| Crane | | Crane Clean Energy Center (formerly known as Three Mile Island Unit 1) |

| CRP | | Constellation Renewables Partners, LLC |

| FitzPatrick | | James A. FitzPatrick nuclear generating station |

| Ginna | | R. E. Ginna nuclear generating station |

| NER | | NewEnergy Receivables LLC |

| NMP | | Nine Mile Point nuclear generating station |

| RPG | | Renewable Power Generation, LLC |

| | |

| STP | | South Texas Project nuclear generating station |

| | |

| West Medway II | | West Medway Generating Station II |

| | | | | | | | |

| Former Related Entities |

| Exelon | | Exelon Corporation |

| ComEd | | Commonwealth Edison Company |

| PECO | | PECO Energy Company |

| BGE | | Baltimore Gas and Electric Company |

| PHI | | Pepco Holdings LLC |

| Pepco | | Potomac Electric Power Company |

| DPL | | Delmarva Power & Light Company |

| | |

| ACE | | Atlantic City Electric Company |

| BSC | | Exelon Business Services Company, LLC |

| | | | | | | | |

| GLOSSARY OF TERMS AND ABBREVIATIONS |

| Other Terms and Abbreviations | | |

| ABO | | Accumulated Benefit Obligation |

| AEC | | Alternative Energy Credit that is issued for each megawatt hour of generation from a qualified alternative energy source |

| AEP Texas | | American Electric Power Texas, Inc. |

| AESO | | Alberta Electric Systems Operator |

| | |

| AOCI | | Accumulated Other Comprehensive Income (Loss) |

| APBO | | Accumulated Post-Retirement Benefit Obligation |

| ARC | | Asset Retirement Cost |

| ARO | | Asset Retirement Obligation |

| | |

| | |

| | |

| ASR | | Accelerated Share Repurchase |

| Atomic Energy Act | | Atomic Energy Act of 1954, as amended |

| | |

| Bcf | | Billion cubic feet |

| | |

| C&I | | Commercial and Industrial |

| CAISO | | California ISO |

| CBAs | | Collective Bargaining Agreements |

| | |

| | |

| CenterPoint | | CenterPoint Energy Houston Electric, LLC |

| CERCLA | | Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended |

| | |

| Clean Air Act | | Clean Air Act of 1963, as amended |

| Clean Energy Law | | Illinois Public Act 102-0062 signed into law on September 15, 2021 |

| Clean Water Act | | Federal Water Pollution Control Amendments of 1972, as amended |

| CMC | | Carbon Mitigation Credit |

| CO2 | | Carbon Dioxide |

| CODM | | Chief Operating Decision Maker |

| CORe | | Constellation Offsite Renewables |

| | |

| | |

| DCPSC | | District of Columbia Public Service Commission |

| DEPSC | | Delaware Public Service Commission |

| DOE | | United States Department of Energy |

| | |

| DOJ | | United States Department of Justice |

| DPP | | Deferred Purchase Price |

| | |

| | |

| | |

| EFEC | | Emissions-Free Energy Certificate |

| | |

| EMT | | Everett Marine Terminal |

| EPA | | United States Environmental Protection Agency |

| | |

| ERCOT | | Electric Reliability Council of Texas |

| ERISA | | Employee Retirement Income Security Act of 1974, as amended |

| EROA | | Expected Rate of Return on Assets |

| ERP | | Enterprise Resource Program |

| | |

| | |

| | |

| EV | | Electric Vehicle |

| Exchange Act | | Securities Exchange Act of 1934. as amended |

| | |

| Federal Power Act | | Federal Power Act of 1920, as amended |

| FERC | | Federal Energy Regulatory Commission |

| | |

| Former ComEd Units | | Braidwood, Byron, Dresden, LaSalle and Quad Cities nuclear generating units |

| Former PECO Units | | Limerick, Peach Bottom, and Salem nuclear generating units |

| FRCC | | Florida Reliability Coordinating Council |

| | |

| GAAP | | Generally Accepted Accounting Principles in the United States |

| GDP | | Gross Domestic Product |

| | | | | | | | |

| GHG | | Greenhouse Gas |

| GW | | Gigawatt |

| GWh | | Gigawatt hour |

| HSR Act | | Hart-Scott-Rodino Antitrust Improvements Act |

| ICC | | Illinois Commerce Commission |

| ICE | | Intercontinental Exchange |

| IPA | | Illinois Power Agency |

| IRA | | Inflation Reduction Act of 2022 |

| | |

| IRS | | Internal Revenue Service |

| ISO | | Independent System Operator |

| ISO-NE | | ISO New England Inc. |

| ITC | | Investment Tax Credit |

| kWh | | Kilowatt-hour |

| LIBOR | | London Interbank Offered Rate |

| LLRW | | Low-Level Radioactive Waste |

| | |

| | |

| LTIP | | Long-Term Incentive Plan |

| | |

| MDE | | Maryland Department of the Environment |

| MDPSC | | Maryland Public Service Commission |

| MISO | | Midcontinent Independent System Operator, Inc. |

| | |

| | |

| MRV | | Market-Related Value |

| MW | | Megawatt |

| MWh | | Megawatt-hour |

| Mystic COS | | Mystic Cost of Service Agreement |

| N/A | | Not applicable |

| NASDAQ | | Nasdaq Stock Market, LLC |

| NAV | | Net Asset Value |

| NDT | | Nuclear Decommissioning Trust |

| NEIL | | Nuclear Electric Insurance Limited |

| | |

| NERC | | North American Electric Reliability Corporation |

| NGX | | Natural Gas Exchange, Inc. |

| | |

| NJDEP | | New Jersey Department of Environmental Protection |

| Non-Regulatory Agreement Units | | Nuclear generating units or portions thereof whose decommissioning-related activities are not subject to contractual elimination under regulatory accounting |

| | |

| NPDES | | National Pollutant Discharge Elimination System |

| NPNS | | Normal Purchase Normal Sale scope exception |

| NRC | | Nuclear Regulatory Commission |

| | |

| NYISO | | New York ISO |

| NYMEX | | New York Mercantile Exchange |

| NYPSC | | New York Public Service Commission |

| OCI | | Other Comprehensive Income (Loss) |

| OIESO | | Ontario Independent Electricity System Operator |

| OPEB | | Other Postretirement Employee Benefits |

| | |

| PAPUC | | Pennsylvania Public Utility Commission |

| PBO | | Projected Benefit Obligation |

| | |

| Pension Protection Act (the Act) | | Pension Protection Act of 2006 |

| PG&E | | Pacific Gas and Electric Company |

| PJM | | PJM Interconnection, LLC |

| PP&E | | Property, Plant, and Equipment |

| | | | | | | | |

| PPA | | Power Purchase Agreement |

| Price-Anderson Act | | Price-Anderson Nuclear Industries Indemnity Act of 1957 |

| PRP | | Potentially Responsible Parties |

| | |

| PSEG | | Public Service Enterprise Group Incorporated |

| PTC | | Production Tax Credit |

| PUCT | | Public Utility Commission of Texas |

| PV | | Photovoltaic |

| | |

| RCRA | | Resource Conservation and Recovery Act of 1976, as amended |

| REC | | Renewable Energy Certificate (Credit), which is the environmental attribute associated with each megawatt hour of production from a qualified renewable energy source |

| Regulatory Agreement Units | | Nuclear generating units or portions thereof whose decommissioning-related activities are subject to contractual elimination under regulatory accounting (includes the Former ComEd units, the Former PECO units, and STP) |

| RFP | | Request for Proposal |

| | |

| | |

| | |

| RMP | | Risk Management Policy |

| RNF | | Operating Revenues Net of Purchased Power and Fuel Expense |

| RNG | | Renewable Natural Gas |

| | |

| ROU | | Right-of-use |

| | |

| RPS | | Renewable Energy Portfolio Standards |

| | |

| | |

| | |

| RTO | | Regional Transmission Organization |

| S&P | | Standard & Poor’s Ratings Services |

| | |

| SEC | | United States Securities and Exchange Commission |

| SERC | | SERC Reliability Corporation (formerly Southeast Electric Reliability Council) |

| | |

| SNF | | Spent Nuclear Fuel |

| SOA | | Society of Actuaries |

| SOFR | | Secured Overnight Financing Rate |

| SOS | | Standard Offer Service |

| SPDES | | State Pollutant Discharge Elimination System |

| SPP | | Southwest Power Pool |

| | |

| STPNOC | | STP Nuclear Operating Company |

| | |

| TMA | | Tax Matters Agreement |

| | |

| TSA | | Transition Services Agreement |

| | |

| TWh | | Terawatt-hour |

| U.S. Court of Appeals for the D.C. Circuit | | United States Court of Appeals for the District of Columbia Circuit |

| U.S. Treasury | | U.S. Department of the Treasury |

| | |

| VEBA | | Voluntary Employees' Beneficiary Associations |

| VIE | | Variable Interest Entity |

| WECC | | Western Electric Coordinating Council |

| ZEC | | Zero Emission Credit |

| | |

FILING FORMAT

This combined Annual Report on Form 10-K is being filed separately by Constellation Energy Corporation and Constellation Energy Generation, LLC, (the Registrants). Information contained herein relating to any individual Registrant is filed by the Registrant on its own behalf. Neither Registrant makes any representation as to information relating to the other Registrant.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

This Report contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. Words such as “could,” “may,” “expects,” “anticipates,” “will,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “predicts,” and variations on such words, and similar expressions that reflect our current views with respect to future events and operational, economic and financial performance, are intended to identify such forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding the proposed transaction between Constellation and Calpine Corporation, the expected closing of the proposed transaction and the timing thereof, the financing of the proposed transaction and the pro forma combined company and its operations, strategies and plans, enhancements to investment-grade credit profile, synergies, opportunities and anticipated future performance and capital structure, and expected accretion to earnings per share and free cash flow. Information adjusted for the proposed transaction should not be considered a forecast of future results.

Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected. The factors that could cause actual results to differ materially from the forward-looking statements made by us include those factors discussed herein, including those factors discussed in (a) Part I, ITEM 1A. Risk Factors, (b) Part II, ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, (c) Part II, ITEM 8. Financial Statements and Supplementary Data: Note 18 — Commitments and Contingencies, and (d) other factors discussed in filings with the SEC by the Registrants.

Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this report. Neither Registrant undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this Report.

AVAILABLE INFORMATION

The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements, and other information that we file electronically with the SEC. We file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports with the SEC. In addition, as soon as reasonably practicable after such materials are furnished to the SEC, we make copies of these documents available to the public free of charge through our website at www.ConstellationEnergy.com. Information contained on our website shall not be deemed incorporated into, or to be a part of, this Report.

PART I

General

On February 21, 2021, the Board of Directors of Exelon Corporation (“Exelon”) authorized management to pursue a plan to separate its competitive generation and customer-facing energy businesses, conducted through Constellation Energy Generation, LLC (“Constellation”, formerly Exelon Generation Company, LLC) and its subsidiaries, into an independent, publicly traded company. Constellation Energy Corporation (“CEG Parent” or the “Company”), a Pennsylvania corporation and a direct, wholly owned subsidiary of Exelon, was newly formed for the purpose of separation and had not engaged in any activities except in preparation for the distribution. On February 1, 2022, Exelon completed the separation by distributing all the outstanding shares of the Company’s common stock, on a pro rata basis to the holders of Exelon’s common stock, with the Company holding all the interests in Constellation previously held by Exelon (the "Separation"). As of 2002, Constellation has been an individual registrant since the registration of their public debt securities under the Securities Act. As an individual registrant, Constellation has historically filed consolidated financial statements to reflect their financial position and operating results as a stand-alone, wholly owned subsidiary of Exelon.

Unless otherwise indicated or the context otherwise requires, references herein to the terms "we," "our," "us" and "the Company" refer collectively to CEG Parent and Constellation. See Glossary for defined terms.

Our Business

We are the nation’s largest producer of reliable, emissions-free energy and a leading energy supplier to businesses, homes and public sector customers nationwide, including three-fourths of Fortune 100 companies. Our nuclear, hydro, wind, and solar generation facilities have the generating capacity to power the equivalent of 16 million homes, providing about 10 percent of the nation's clean energy in the United States. Our fleet is helping to accelerate the nation’s transition to a carbon-free future with more than 31,676 megawatts of capacity and an annual output that is nearly 90 percent carbon-free. We are committed to investing in innovative technologies to drive the transition to a reliable, sustainable and secure energy future. Our customer-facing business is one of the nation's largest competitive energy suppliers, offering innovative solutions to meet our customers' needs. We employ approximately 14,264 people, and do business in 48 states, the District of Columbia, Canada, and the United Kingdom.

Our Operations

We operate the largest carbon-free generation fleet in the nation and are one of the largest competitive electric generation companies in the nation, as measured by owned and contracted MWs. Collectively, the combined fleet is the cleanest large generation portfolio in the country (nearly 90% carbon-free based on generation output of electricity) according to the 2024 Ceres Benchmarking Air Emissions of the 100 Largest Electric Power Producers in the United States.

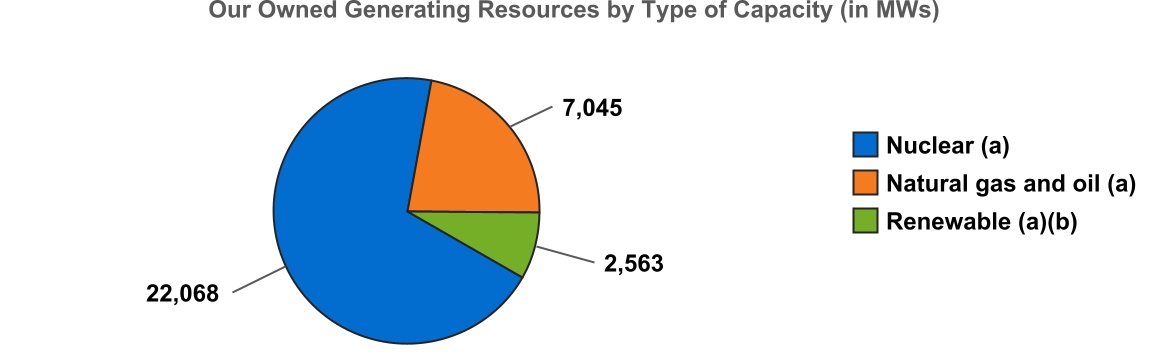

At December 31, 2024, our owned generating resources total capacity of 31,676 MWs consisted of the following:

__________

(a)Net generation capacity is stated at proportionate ownership share. See ITEM 2. PROPERTIES for additional information.

(b)Includes wind, hydroelectric, and solar generating assets.

In addition to the owned generating resources above, at December 31, 2024 we have contracted generation with a total capacity of 4,774 MWs, which represents electric supply procured under unit-specific agreements.

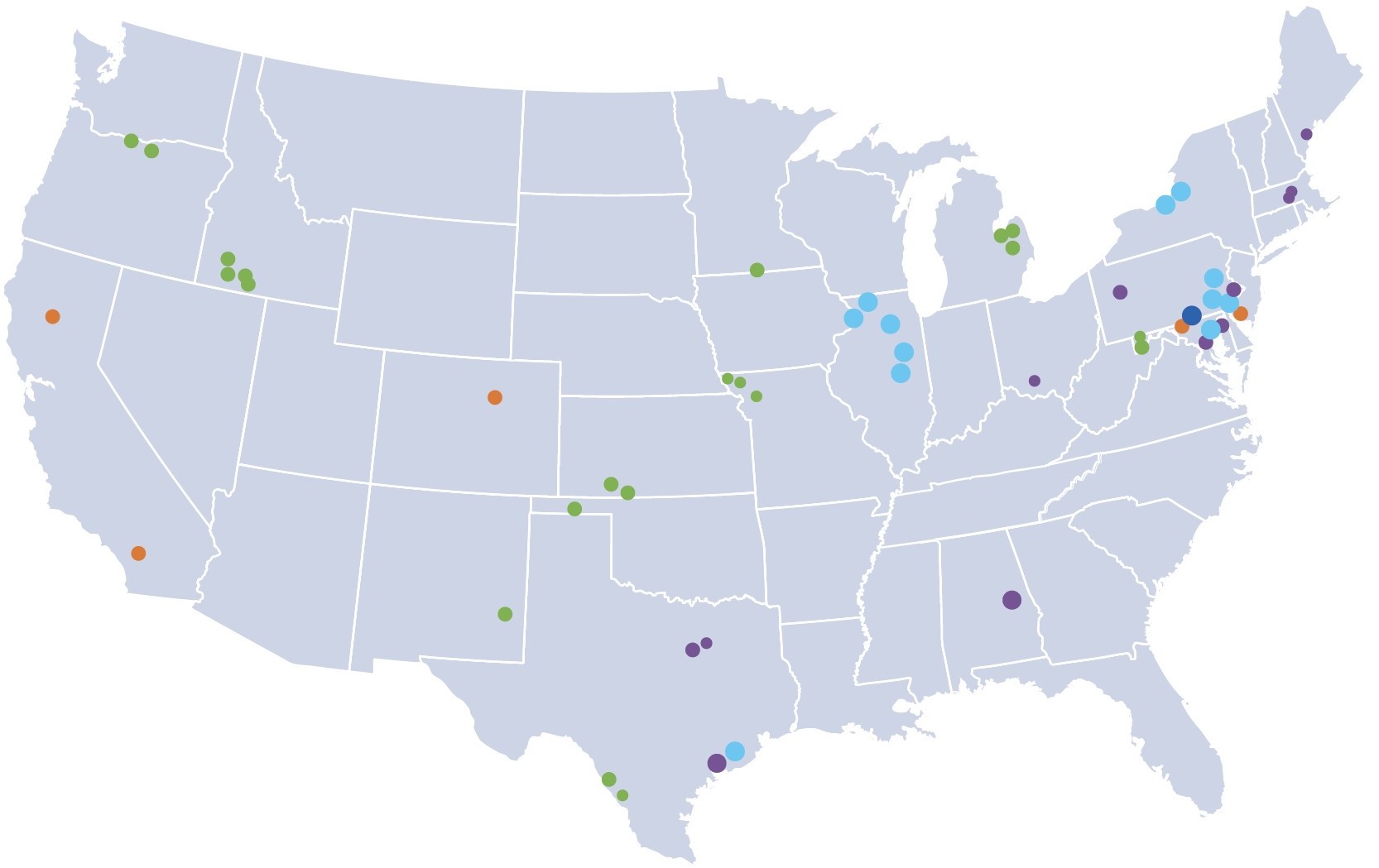

The following map illustrates the locations of our owned generation facilities as of December 31, 2024:

Our Owned Generation Fleet Map(a)(b)

Owned Assets

__________

(a)One symbol is included per location. Some locations may have multiple generating units. Locations in tight geographic proximity may appear as one symbol. Units that are not currently operational are not captured.

(b)Does not reflect Grand Prairie Generating Station (Gas/Other), located in Alberta, Canada.

We have five reportable segments, as described in the table below, representing the different geographic regions in which our owned generating resources are located and our customer-facing activities are conducted.

| | | | | | | | | | | | | | | | | | | | |

Segment(a) | | Net Generation Capacity (MWs)(b) | | % of Net Generation Capacity | | Geographic Regions |

| Mid-Atlantic | | 10,387 | | | 33 | % | | Eastern half of PJM, which includes New Jersey, Maryland, Virginia, West Virginia, Delaware, the District of Columbia, and parts of Pennsylvania and North Carolina |

| Midwest | | 11,608 | | | 37 | % | | Western half of PJM and the United States footprint of MISO, excluding MISO’s Southern Region |

| New York | | 3,093 | | | 10 | % | | NYISO |

| ERCOT | | 4,740 | | | 15 | % | | Electric Reliability Council of Texas |

| Other Power Regions | | 1,848 | | | 5 | % | | New England, South, West, and Canada |

| Total | | 31,676 | | | 100 | % | | |

__________(a)See Note 5 — Segment Information of the Combined Notes to Consolidated Financial Statements for additional information on reportable segments.

(b)Net generation capacity is stated at proportionate ownership share as of December 31, 2024. See ITEM 2. PROPERTIES for additional information.

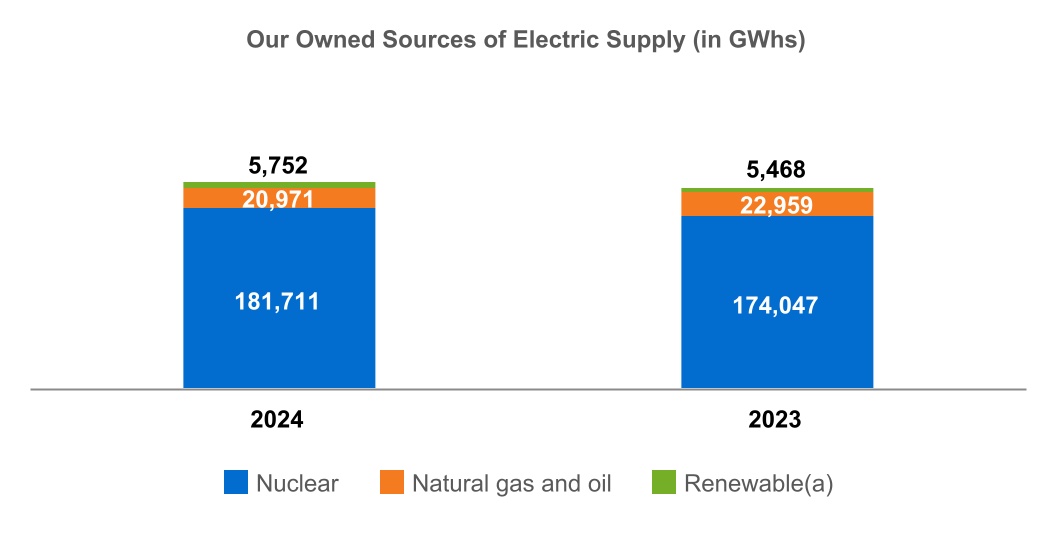

The following table shows our total owned sources of electric supply of 208,434 GWhs and 202,474 GWhs for 2024 and 2023, respectively, which includes the proportionate share of output where we have an undivided ownership interest in jointly-owned generating plants.

_________

(a)Includes wind, hydroelectric, and solar generating assets.

In addition to the owned generation above, we also had purchased power from the spot energy markets that are administered by the RTOs/ISOs and bilateral transactions of 60,983 GWhs and 67,215 GWhs for the years ended December 31, 2024 and 2023, respectively. See ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS for additional information on electric supply sources.

Nuclear Facilities

Our nuclear fleet is the nation’s largest, with current generating capacity of approximately 22 GWs, producing 182 TWhs of zero-emissions electricity during 2024 – enough to power 16 million homes and avoid more than 122 million metric tons of carbon emissions according to the EPA GHG Equivalencies Calculator. We have ownership interests in 14 nuclear generating stations currently in service, consisting of 25 units. As of December 31, 2024, we wholly own all our nuclear generating stations, except for undivided ownership interests in five jointly-owned nuclear stations: Quad Cities (75% ownership), Peach Bottom (50% ownership), Salem (42.59% ownership), NMP Unit 2 (82% ownership), and STP (44% ownership), that are reflected in our consolidated financial statements relative to our proportionate ownership interest in each unit. See ITEM 2. PROPERTIES for additional information on our nuclear facilities.

In September 2024, we executed a 20-year PPA with Microsoft that will support the restart of Three Mile Island Unit 1, renamed as the Crane Clean Energy Center, which was retired in 2019 for economic reasons. Under the agreement, Microsoft will purchase the output generated from the renewed plant which includes energy, capacity and carbon-free attributes as part of its goal to help power its data centers in PJM with clean energy. The site, which is expected to be online in 2028, will have approximately 835 MWs of carbon-free capacity. The restart is subject to certain regulatory approvals, permitting, and obtaining a renewed operating license.

In November 2023, we acquired NRG South Texas LP, which owns a 44% undivided ownership interest in the jointly-owned STP. Other owners include City Public Service Board of San Antonio (CPS, 40%) and the City of Austin, Texas (Austin Energy, 16%). In May 2024, we executed a settlement agreement with CPS/City of San Antonio, Austin, and NRG Energy, Inc., the terms of which require we sell a 2% ownership interest in STP to CPS. See Note 2 — Mergers, Acquisitions, and Dispositions of the Combined Notes to Consolidated Financial Statements for additional information regarding the acquisition of STP.

We operate all of our nuclear generating stations, except for the units at Salem and STP, which are operated by PSEG Nuclear, LLC (an indirect, wholly owned subsidiary of PSEG) and STPNOC, respectively. We have consistently operated our nuclear plants at best-in-class levels. During 2024, 2023, and 2022, our nuclear generating facilities achieved capacity factors(a) of 94.6%, 94.4%, and 94.8%, respectively, at ownership percentage. The nuclear capacity factor has been approximately four percentage points better than the industry average annually since 2013.

Capacity factors, which are significantly affected by the number and duration of refueling and non-refueling outages, can have a material impact on our results of operations. In 2024, we achieved an average refueling outage duration of 19 days for units we operate. We achieved an average refueling outage duration of 21 days in both 2023 and 2022, respectively, against industry averages of 38 and 40 days, respectively.

We manage our scheduled refueling outages to minimize their duration and to maintain high nuclear generating capacity factors, resulting in a stable supply position for our wholesale and retail power marketing activities. In 2024, 2023, and 2022, electric supply (in GWhs) generated from our nuclear generating facilities was 67%, 65%, and 64%, respectively, of our total electric supply.

During scheduled refueling outages, we perform maintenance and equipment upgrades in order to maintain safe, reliable operations and to minimize the occurrence of unplanned outages. In addition to the maintenance and equipment upgrades performed by us during scheduled refueling outages, we have extensive operating and security procedures in place to ensure the safe operation of our nuclear units. We also have extensive safety systems in place to protect the plant, personnel, and surrounding area in the unlikely event of an accident or other incident.

__________

(a)Capacity factor is defined as the ratio of the actual output of a unit (or combination of units) over a period of time to its output if the unit had operated at net monthly mean capacity for that time period. See ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — Financial Results of Operations for additional information.

We have original 40-year operating licenses from the NRC for each of our nuclear units and have received 20-year operating license renewals from the NRC for all our nuclear units except Clinton. PSEG and STPNOC have also received 20-year operating license renewals for the Salem and STP units, respectively. Peach Bottom has previously received a second 20-year license renewal from the NRC for Units 2 and 3, for a total 80-year term. See Note 3 — Regulatory Matters of the Combined Notes to Consolidated Financial Statements for additional information on the status of Peach Bottom's license renewal.

The following table summarizes the current license expiration dates for our nuclear facilities currently in service:

| | | | | | | | | | | | | | | | | | | | |

| Station | | Unit | | In-Service Date(a) | | Current License

Expiration |

| Braidwood | | 1 | | | 1988 | | 2046 |

| | 2 | | | 1988 | | 2047 |

| Byron | | 1 | | | 1985 | | 2044 |

| | 2 | | | 1987 | | 2046 |

| Calvert Cliffs | | 1 | | | 1975 | | 2034 |

| | 2 | | | 1977 | | 2036 |

Clinton(b) | | 1 | | | 1987 | | 2027 |

Dresden(b) | | 2 | | | 1970 | | 2029 |

| | 3 | | | 1971 | | 2031 |

| FitzPatrick | | 1 | | | 1975 | | 2034 |

| LaSalle | | 1 | | | 1984 | | 2042 |

| | 2 | | | 1984 | | 2043 |

| Limerick | | 1 | | | 1986 | | 2044 |

| | 2 | | | 1990 | | 2049 |

| NMP | | 1 | | | 1969 | | 2029 |

| | 2 | | | 1988 | | 2046 |

Peach Bottom(c) | | 2 | | | 1974 | | 2033 |

| | 3 | | | 1974 | | 2034 |

| Quad Cities | | 1 | | | 1973 | | 2032 |

| | 2 | | | 1973 | | 2032 |

| Ginna | | 1 | | | 1970 | | 2029 |

| Salem | | 1 | | | 1977 | | 2036 |

| | 2 | | | 1981 | | 2040 |

| STP | | 1 | | | 1988 | | 2047 |

| | 2 | | | 1989 | | 2048 |

__________

(a)Denotes year in which nuclear unit began commercial operations.

(b)We are currently seeking license renewals for Clinton and Dresden Units 2 and 3 to extend the operating licenses by an additional 20 years.

(c)In February 2022, the NRC issued an order related to its review of our subsequent license renewal application for Peach Bottom and the NRC directed its staff to change the expiration dates for the licenses back to 2033 and 2034. We expect that the license expiration dates will be restored to 2053 and 2054, respectively. See Note 3 — Regulatory Matters of the Combined Notes to Consolidated Financial Statements for additional information.

The operating license renewal process takes approximately four years from commencement, which includes approximately two years for us to develop the application and approximately two additional years for the NRC to review the application. Depreciation provisions are based on the estimated useful lives of the stations, which generally include expectations for an additional 20-year term beyond current license expiration, except for Calvert Cliffs, FitzPatrick, Limerick, NMP Unit 2, Salem, and STP, where depreciation provisions correspond with the expiration of the current NRC operating license denoted in the table above. See Note 3 — Regulatory

Matters and Note 8 — Property, Plant, and Equipment of the Combined Notes to Consolidated Financial Statements for additional information.

Natural Gas, Oil and Renewable Facilities (including Hydroelectric)

We operate approximately 10 GWs of natural gas, oil, hydroelectric, wind, and solar generation assets, which provide a mix of baseload, intermediate, and peak power generation. We wholly own all our natural gas, oil, and renewable generating stations, except for: (1) Wyman 4; (2) certain wind project entities; and (3) CRP. We operate all of these facilities, except for Wyman 4, which is operated by the principal owner, NextEra Energy Resources LLC, a subsidiary of NextEra Energy, Inc. See ITEM 2. PROPERTIES for additional information regarding these generating facilities and Note 21 — Variable Interest Entities of the Combined Notes to Consolidated Financial Statements for additional information regarding CRP, which is a VIE.

In 2024, 2023, and 2022, electric supply (in GWhs) generated from our owned natural gas, oil, and renewable generating facilities was 10%, 11%, and 10%, respectively, of our total electric supply. Our natural gas, oil and renewable fleet has similarly demonstrated a track record of strong performance with a Dispatch Match(a) of 97.4%, 98.5%, and 98.2% and Renewables Energy Capture(b) of 96.1%, 96.4%, and 96.5% in 2024, 2023, and 2022, respectively.

Natural gas, oil, wind and solar generation plants are generally not licensed, and therefore, the decision on when to retire plants is, fundamentally, a commercial one. FERC has the exclusive authority to license most non-federal hydropower projects located on navigable waterways or federal lands, or connected to the interstate electric grid, which include our Conowingo Hydroelectric Project (Conowingo) and Muddy Run Pumped Storage Facility Project (Muddy Run). Muddy Run's license expires on December 1, 2055 and is currently being depreciated over an estimated useful life that corresponds with the available license term. In March 2021, FERC issued a new 50-year license for Conowingo, which was subsequently vacated in December 2022; however, depreciation provisions continue to assume an estimated useful life through 2071 in anticipation of the license expiration date being restored. See Note 3 — Regulatory Matters of the Combined Notes to Consolidated Financial Statements for additional information on the status of Conowingo's license.

__________

(a)Dispatch Match is used to measure the responsiveness of a unit to the market, expressed as the total actual energy revenue net of fuel cost relative to the total desired energy revenue net of fuel cost. Factors having an adverse effect on Dispatch Match include forced outages, derates, and failure to operate to the desired generation signal. Beginning in 2023, Dispatch Match reflects a change to remove the Conowingo run-of-river hydroelectric operational performance. Dispatch Match for 2022 was previously reported as 98.4%.

(b)Renewable Energy Capture is an indicator of how efficiently the installed assets capture the natural energy available from the wind, the sun, and water. Renewable Energy Capture represents an energy-based fraction, the numerator of which is the energy produced by the sum of the wind turbines, solar panels, and run-of-river hydroelectric operations in the year, and the denominator of which is the total expected energy to be produced during the year, with adjustments made for certain events that are considered non-controllable, such as force majeure events, serial design-manufacturing equipment failures, and transmission curtailments. Renewable Energy Capture for the combined wind, solar, and run-of-river hydroelectric fleet is weighted by the relative site projected pre-tax variable revenue. Beginning in 2023, Renewable Energy Capture reflects a change to include the Conowingo run-of-river hydroelectric operational performance. Renewable Energy Capture for 2022 was previously reported as 95.8%.

Contracted Generation

In addition to energy produced by owned generation assets, we source electricity from generators we do not own under long-term contracts. The following tables summarize our long-term contracts to purchase unit-specific physical power with an original term in excess of one year in duration, by region, in effect as of December 31, 2024:

| | | | | | | | | | | | | | | | | | | | |

| Region | | Number of

Agreements | | Expiration

Dates | | Capacity (MWs) |

Mid-Atlantic | | 17 | | | 2025 - 2039 | | 446 | |

| Midwest | | 7 | | | 2026 - 2044 | | 805 | |

| | | | | | |

| ERCOT | | 8 | | | 2025 - 2035 | | 1,121 | |

| Other Power Regions | | 16 | | | 2025 - 2037 | | 2,402 | |

| Total | | 48 | | | | | 4,774 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2025 | | 2026 | | 2027 | | 2028 | | 2029 | | 2030 and thereafter | | Total |

| Capacity Expiring (MWs) | | 501 | | | 398 | | | 5 | | | 75 | | | 98 | | | 3,697 | | | 4,774 | |

Customer-Facing Business

We are one of the nation’s largest energy suppliers. Through our integrated business operations, we sell electricity, natural gas, and other energy-related products and sustainable solutions to various types of customers, including distribution utilities, municipalities, cooperatives, and commercial, industrial, public sector, and residential customers in markets across multiple geographic regions. We serve approximately 1.5 million total customers, including three-fourths of Fortune 100 companies, and approximately 1.2 million residential customers.

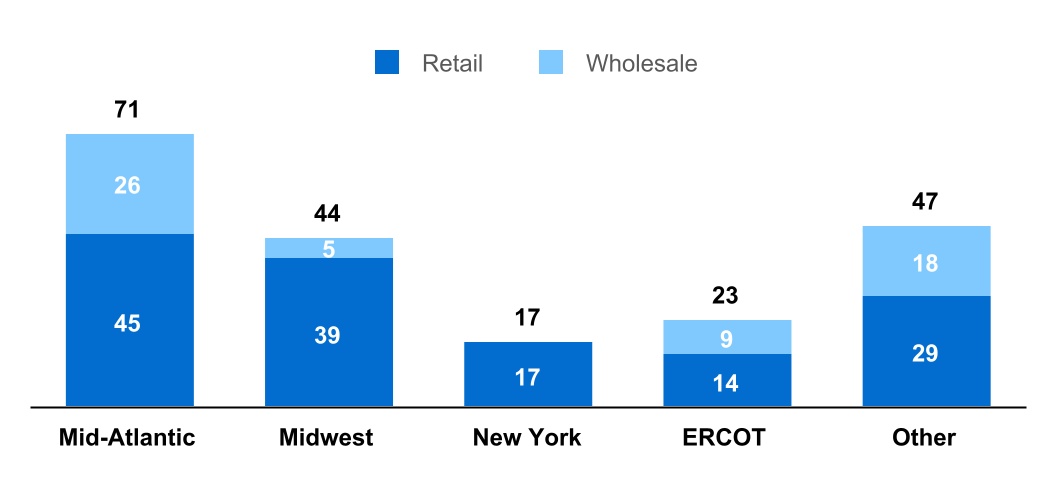

We are a leader in electric power supply, serving approximately 202 TWhs in 2024 through sales to retail customers and wholesale load auctions to a geographically diverse customer base. The following table illustrates these volumes across our five reportable segments:

2024 Electric Power Supply (TWhs) Served(a)

__________

(a)Includes retail load and wholesale load auction volumes only. Electric generation in excess of our total retail and wholesale load would be sold in the respective RTO or ISO in which our facility is located. Other includes New England, South, and West.

We are active in all domestic wholesale power and gas markets that span the entire lower 48 states and have complementary retail activity across many of those states. We typically obtain power supply from the market to meet our wholesale and retail obligations; our market risk is mitigated by our owned and contracted generation located in multiple geographic regions. The commodity risks associated with the output from owned and contracted generation are managed using various commodity transactions including sales to retail customers, trades on commodity exchanges, bilateral contracts, and sales to wholesale counterparties in accordance with our hedging program. See further discussion of the hedging program in the Price and Supply Risk Management section below. The main objective is to obtain low-cost energy supply to meet physical delivery obligations to both our wholesale and retail customers.

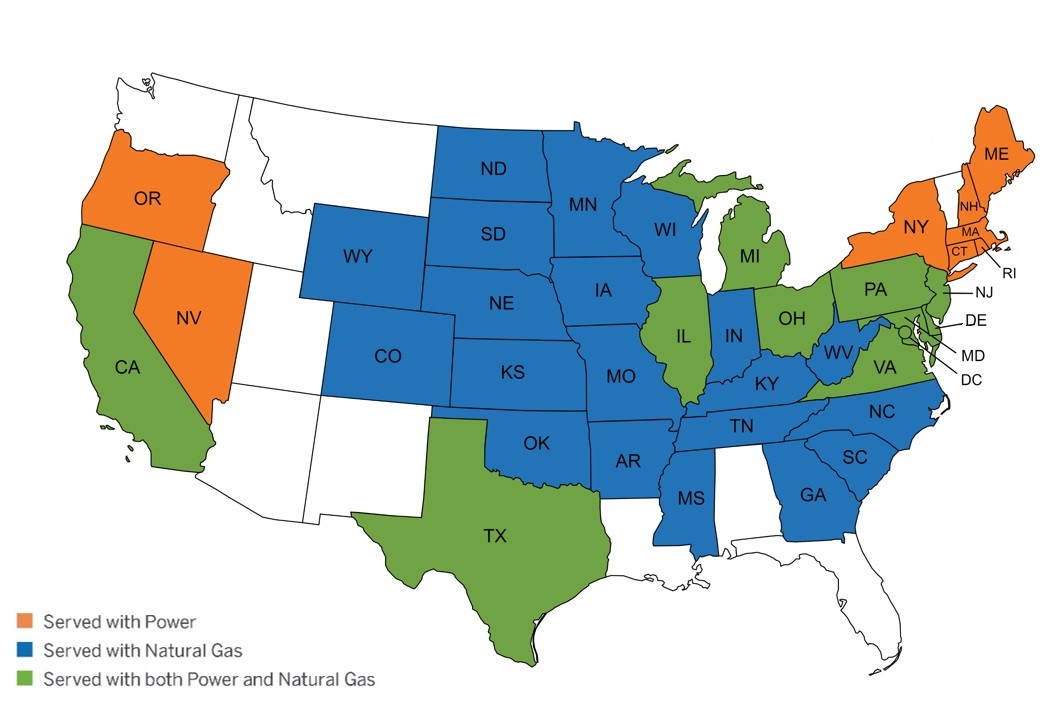

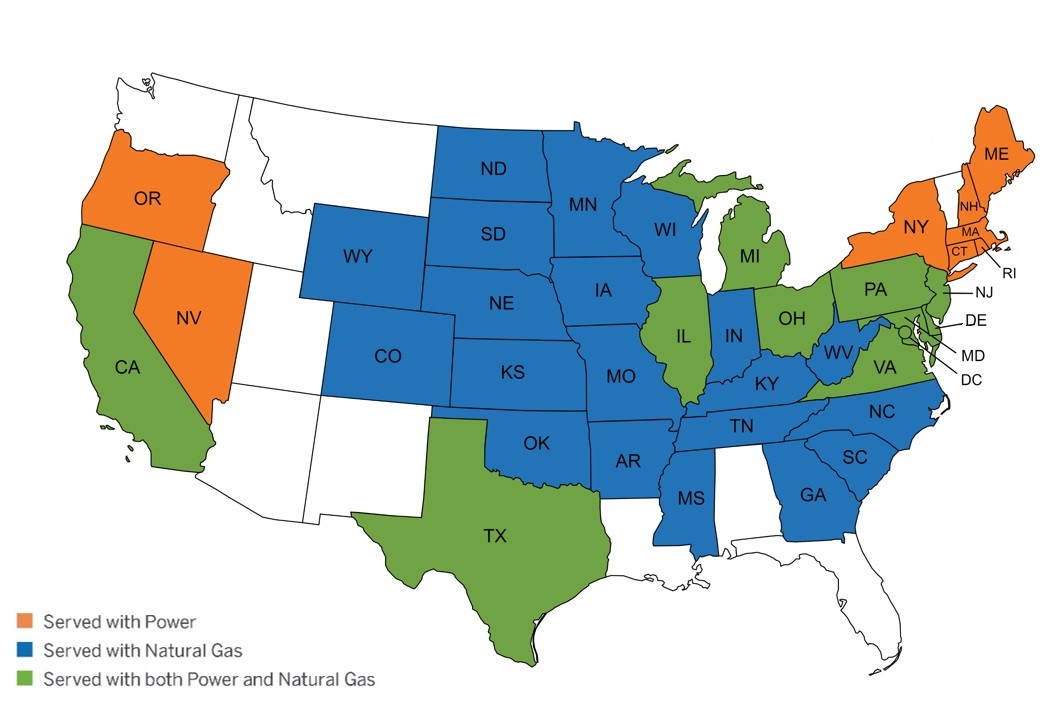

Retail Market

Retail competition in states across the U.S. range from full competition of energy suppliers for all retail customers (commercial, industrial, public sector, and residential) to partial retail competition available up to a capped amount for C&I customers only. We are a leader in retail markets, serving approximately 144 TWhs of electric power retail load and approximately 800 Bcf of gas in 2024, primarily to C&I customers across multiple geographic regions in the U.S.

Diverse Geographic Footprint in Retail Market

Strong customer relationships are a key part of our customer-facing business strategy, as demonstrated by our high renewal rates. Retail customer renewal rates have been strong over the last nine years across C&I power customer groups with average contract terms of approximately two years and customer duration of approximately five years, with many customers well beyond these metrics. Specifically, we enjoyed renewal rates of 78% for C&I power customers and 88% for C&I gas customers in 2024, owing to both our competitive pricing as well as our strong customer relationships. Our consistently high renewal rates are driven by our ability to provide customized solutions and deliver focused attention to our customers’ needs, resulting in an industry-leading C&I customer-service business ranking in the DNV 2024 Energy Blueprint: Sales Strategies report. We are also successful at acquiring new customers by offering innovative services and products that meet their needs. In addition to our high customer renewal rates, we have produced consistently high new win rates within C&I power

as well, acquiring nearly one out of every three new customers who have chosen to shop with us over the past six years.

High customer satisfaction levels, market expertise, stability, and scale driven growth have resulted in a historically proven business with consistent margins. While providing customers with a competitive price is a key focus, we leverage our broad suite of electric and gas product structures, oftentimes customized, to provide customers with the commodity solution and information that best fits their needs. It is this attention to the customer that creates the durable and repeatable value highlighted in these statistics.

Consumer purchasing strategies have trended from direct supply relationships to third-party relationships with a number of customers looking to third-party consultants and brokers to find suppliers like us to reduce costs and evaluate the increasing number of options available for expanding energy solutions beyond the commodity. In response, we have expanded our third-party capabilities, created scale through a comprehensive support structure, and enhanced digital applications providing tools, tracking, and measurement, as well as the ability to extend the reach of our sustainability solutions to drive additional market share. While this trend of customers using third parties to find suppliers has slowed in recent years, we have remained the market leader in direct C&I sales with over 32% of the C&I market share of direct customer business driven by our highly experienced and long-tenor direct sales team.

Wholesale Market

Our wholesale channel-to-market involves the sale of electricity among electric utilities and electricity marketers before it is eventually sold to end-use consumers. In 2024, we served approximately 58 TWhs of power load across competitive utility load procurement and bilateral sales to municipalities, co-ops, and other wholesale entities. Complementary to our national customer portfolio, we have several decades of relationships with wholesale counterparties across all domestic power markets as a means of both monetizing our own generation, as well as sourcing contracted generation to meet customer and portfolio needs. With increased customer demand for sustainability, our ability to source contracted generation has provided a capital-light way for us to provide customers with long-term sustainable solutions they are demanding to support a cleaner energy ecosystem. This creates durable customer relationships and repeatable business through the ability to respond to customer and marketplace trends. Similarly, this contracting acumen provides the ability to supplement our native generation with other non-renewable assets to meet changing portfolio needs in a financially efficient manner. In our wholesale gas business, we participate across all parts of the gas value chain, including trading, transport and storage, and physical supply.

Energy Solutions

As one of the largest customer-facing platforms in the U.S., we benefit from significant economies of scale, that allow us to provide our customers with competitively priced energy and to structure highly tailored solutions targeted to a customer’s unique power needs and clean energy goals. Our CORe+ product serves C&I customers' sustainability needs by matching contracted, third-party new-build renewable generation with customer desire to add additional carbon-free generation to the grid with a preference to be located within the same region as their load. In 2024, we continued to see growing demand for our Hourly Carbon-Free Energy (CFE) product and platform, as we have closed a number of additional Hourly CFE transactions with a strong pipeline of interested prospects. Achieving 100% carbon-free power is a key sustainability goal for many organizations. As customers make the transition to 100% hourly carbon-free power, many are looking to bridge the gap between their real-time electricity demand and available sources of carbon-free power. Our Hourly CFE platform and associated products match carbon-free generation every hour with a customer’s load, along with appropriate tracking and retirement of hourly attributes in the applicable registry. Many existing CORe+ customers are converting to 100% Hourly CFE with existing nuclear filling in the gaps of the hours renewable generation is not producing. In addition to larger-scale CORe+ offerings and Hourly CFE, we offer a range of sustainability solutions to customers (e.g., RECs, CORe+, EFECs, RINs, RNG, carbon offsets, etc.) as well as offers for carbon-free generation attributes to support their needs during the transition to a carbon-free energy ecosystem.

We also partner with our customers to provide energy efficiency options to meet their carbon-free energy goals. Our energy efficiency products provide the ability to optimize performance and maximize efficiency across customer facilities and operations through contract structures that include implementation of energy efficiency upgrades and behind-the-meter solutions with no upfront capital requirements. Additionally, these service

offerings provide scalable solutions to meet sustainability goals through investment across the life of the facility or operations and allow for greater budget certainty. The ongoing ability to optimize energy consumption for customers allows us to support customer demands with the right combination of technology and efficiency program options.

In addition to sustainability solutions, data and analytics have also become increasingly important for our customers. We recently launched Constellation Navigator, which delivers customized paths and sustainable solutions for customers to set and meet their environmental and operational goals. Driven by advanced technology platforms and experienced advisors, it provides strategies to help organizations understand their baseline emissions and reduce their carbon footprints. Constellation Navigator helps businesses solve challenges across the energy lifecycle including utility bill management, carbon accounting, rebate administration and sustainability advisory services. These platforms and services provide new avenues for incremental growth by coupling the opportunities for customer usage optimization with accompanying products and sustainable solutions that we can provide to customers. These types of data and analytical services allow us to grow our customer base in previously inaccessible regulated markets by offering non-commodity energy-related products and services.

We continue to look for new and innovative products and solutions to bring to our customers. Constellation Technology Ventures (CTV) is our venture investing business, focused on driving innovation and scaling breakthrough technologies. CTV invests in a broad range of hardware and software solutions that accelerate the transition to a sustainable, low-carbon economy. Our portfolio spans diverse areas, including, generation technologies, sustainability monitoring tools, distributed energy resources, financing solutions, and more. By collaborating closely with our portfolio companies, we help commercialize their products and technologies across our expansive customer base, creating value for both our partners and us.

Price and Supply Risk Management

We leverage a combination of wholesale and retail customer load sales, federal and state programs, as well as non-derivative and derivative contracts, all with credit-approved counterparties, to hedge the commodity price risk of our generation portfolio.

Beginning in 2024, our existing nuclear fleet is eligible for the nuclear PTC provided by the IRA, an important tool in managing commodity price risk for each nuclear unit not already receiving state support. The nuclear PTC provides increasing levels of support as unit revenues decline below levels established in the IRA and is further adjusted for inflation after 2024 through the duration of the program based on the GDP price deflator for the preceding calendar year. See Note 3 — Regulatory Matters and Note 6 — Government Assistance of the Combined Notes to Consolidated Financial Statements for additional information on the nuclear PTC.

In locations and periods where our load serving activities do not naturally offset existing generation portfolio risk, remaining commodity price exposure is managed through portfolio hedging activities. Portfolio hedging activities are generally concentrated in the prompt three years, when customer demand and market liquidity enable effective price risk mitigation. During this prompt three-year period, we seek to mitigate price risk associated with our load serving contracts, non-nuclear generation, and any residual price risk for our nuclear generation that the nuclear PTC and state programs may not fully mitigate. We also enter transactions that further optimize the economic benefits of our overall portfolio.

A portion of our hedging strategy may be implemented using fuel products based on assumed correlations between power and fuel prices. Our risk management group monitors the financial risks of the wholesale and retail power marketing activities. We also use financial and commodity contracts for proprietary trading purposes, but this activity accounts for only a small portion of our efforts and is not material to our results. The proprietary trading portfolio is subject to a risk management policy that includes stringent risk management limits. See ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK for additional information.

The cycle of production and utilization of nuclear fuel includes the mining and milling of uranium ore into uranium concentrates, the conversion of uranium concentrates to uranium hexafluoride, the enrichment of the uranium hexafluoride, and the fabrication of fuel assemblies. Nuclear fuel is obtained predominantly through long-term contracts for uranium concentrates, conversion services, enrichment services, (or a combination thereof) and fabrication services, including contracts sourced from Russia. We have inventory in various forms and engage a diverse set of domestic and international suppliers to secure the nuclear fuel needed to continue to operate our

nuclear fleet. We manage various risks around our nuclear fuel requirements in accordance with our fuel procurement policy limiting our transactions with each supplier to mitigate concentration of risk. The size of our inventory holdings and forward contractual coverage considers our refueling needs across multiple years to protect against supply disruptions and near-term price volatility, while allowing for capital flexibility. Our fuel procurement activities comply with all U.S. and international trade laws and we continue to take advantage of all available avenues to ensure continuity in our nuclear fuel supply, including working with the U.S. Government and our diverse set of suppliers to secure the nuclear fuel needed to continue to operate our nuclear fleet long-term. See ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK for additional information.

Natural gas is procured through long-term and short-term contracts, as well as spot-market purchases. Fuel oil inventories are managed so that in the winter months sufficient volumes of fuel are available in the event of extreme weather conditions and during the remaining months to take advantage of favorable market pricing.

See ITEM 1A. RISK FACTORS, ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS, Critical Accounting Policies and Estimates and Note 15 — Derivative Financial Instruments of the Combined Notes to Consolidated Financial Statements for additional information regarding derivative financial instruments.

Seasonality

Our operations are affected by weather, which affects demand for electricity and natural gas. The market price for electricity is also affected by changes in the demand for electricity and the available supply of electricity. With respect to the electric business, very warm weather in summer months and, with respect to the electric and natural gas businesses, very cold weather in winter months is generally referred to as “favorable weather conditions” because those weather conditions result in increased deliveries of electricity and natural gas. Conversely, mild weather reduces demand. As a result, our operating results in the future may fluctuate substantially on a seasonal basis, especially when more severe weather conditions such as heat waves or extreme winter weather make such fluctuations more pronounced. The pattern of this fluctuation may change depending on the type and location of the facilities owned, the wholesale and retail load served and the terms of contracts to purchase or sell electricity. See ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK for additional information.

Weather can also impact our operating conditions. See ITEM 1A RISK FACTORS for additional information regarding risks related to operational factors. To mitigate the potential for weather to impact our operations, we conduct seasonal readiness reviews at our power plants to ensure availability of fuel supplies and equipment performance before entering the summer and winter seasons. We also consider and review national climate assessments to inform our longer-term planning. Our nuclear fleet is resilient to weather extremes and is capable of generating emissions-free electricity 24 hours a day, even during unexpectedly cold winter events and hot summer events.

Insurance

We are subject to liability, property damage, and other risks associated with major incidents at our generating stations. We have reduced our financial exposure to these risks through insurance, both property damage and liability, and other industry risk-sharing provisions. We also maintain business interruption insurance for certain of our renewable assets, but not for our other generating stations unless required by contract or financing agreements. We are self-insured to the extent that any losses may exceed the amount of insurance maintained or are within the policy deductible for our insured losses.

See Note 18 — Commitments and Contingencies of the Combined Notes to Consolidated Financial Statements for insurance specific to our nuclear facilities.

Regulation

CEG Parent's subsidiaries include public utilities as defined under the Federal Power Act that are subject to FERC’s exclusive ratemaking jurisdiction over wholesale sales of electricity and the transmission of electricity in interstate commerce. Under the Federal Power Act, FERC has the authority to grant or deny market-based rates for sales of energy, capacity, and ancillary services to ensure that such sales are just and reasonable. FERC’s

jurisdiction over ratemaking includes the authority to suspend the market-based rates of utilities and set cost-based rates should FERC find that its previous grant of market-based rates authority is no longer just and reasonable. Other matters subject to FERC jurisdiction include, but are not limited to, certain third-party financings; review of certain mergers involving public utilities; certain dispositions of jurisdictional facilities and acquisitions of securities of another public utility or an existing operational generating facility; certain affiliate transactions; certain intercompany financings and cash management arrangements; certain internal corporate reorganizations; and certain holding company acquisitions of public utility and holding company securities.

RTOs and ISOs are FERC-regulated entities that exist in several regions to provide transmission service across multiple transmission systems. FERC has approved PJM, MISO, ISO-NE, and SPP as RTOs and CAISO and NYISO as ISOs. These entities are responsible for regional planning, managing transmission congestion, developing wholesale markets for energy and capacity, maintaining reliability, market monitoring, and the scheduling of physical power transactions in the region. ERCOT is not subject to regulation by FERC but performs a similar function in Texas to that performed by RTOs and ISOs in markets regulated by FERC.

We are subject to the jurisdiction of the NRC with respect to the operation of our nuclear generating facilities, including the licensing for operation of each unit. The NRC subjects nuclear generating stations to continuing review and regulation covering, among other things, operations, maintenance, emergency planning, security, and environmental and radiological aspects of those stations. As part of its Reactor Oversight Process, the NRC continuously assesses unit performance indicators and inspection results and communicates its assessment on a semi-annual basis. The NRC may modify, suspend, or revoke operating licenses and impose violations and/or civil penalties for failure to comply with the Atomic Energy Act, NRC regulations, or the terms of the operating licenses or orders. Changes in requirements by the NRC may require a substantial increase in capital expenditures and/or operating costs for our nuclear generating facilities. NRC regulations also require that licensees of nuclear generating facilities demonstrate reasonable assurance that funds will be available in specified minimum amounts at the end of the life of the facility to decommission the facility. We meet the ultimate decommissioning funding obligation through the use of dedicated NDT funds. See ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — Liquidity and Capital Resources; Critical Accounting Policies and Estimates — Nuclear Decommissioning Asset Retirement Obligations; and Note 10 — Asset Retirement Obligations and Note 17 — Fair Value of Financial Assets and Liabilities of the Combined Notes to Consolidated Financial statements for additional information regarding our NDT funds and decommissioning obligations.

Our operations are also subject to the jurisdiction of various other federal, state, regional, and local agencies, and federal and state environmental protection agencies. Additionally, we are subject to NERC mandatory reliability standards, which protect the nation’s bulk power system against potential disruptions from cyber and physical security breaches.

Constellation's Strategy and Outlook

Strategy

We believe shareholder value is built on a foundation of operational excellence and the pairing of our majority carbon-free energy fleet with our customer-facing platform. We are committed to maintaining investment grade credit ratings. We focus on optimizing cash returns through a disciplined approach to safe and efficient operations and cost management, underpinned by stable and durable margins from our customer-facing business and coupled with distinct payments to our generation plants for the clean energy attributes. We may pursue future growth opportunities that provide additional value building on our core businesses, or expanding our competitive advantages. We are committed to maintaining a strong balance sheet, returning value to our shareholders, and investing in energy and sustainable solutions to meet customer needs.

The demand for reliable, carbon-free energy and sustainability solutions continues to grow across the country. We are committed to a clean energy future and aim to meet the growing energy needs of all our customers. We continue to serve as a partner to businesses and public entities that are setting ambitious sustainability goals and seeking long-term solutions to ensure reliability and maintain affordability.

The principles of our business strategy demonstrate our commitment to a carbon-free future while maintaining a strong balance sheet, advancing our sustainability and community initiatives, and investing in clean energy solutions:

•Power America's Clean Energy Future

•Expand America's Largest Fleet of Clean Energy Centers

•Uplift and Strengthen our Communities

•Provide Energy and Sustainability Solutions for Customers

We are committed to maintaining sufficient financial liquidity and an appropriate capital structure to support safe, secure and reliable operations, even in volatile market conditions. We believe our investment grade credit rating is a competitive advantage and we intend to maintain our credit position and best-in-class balance sheet. In line with that commitment, available cash flow will first be used to meet investment grade credit targets, with incremental capital allocated towards disciplined growth and shareholder return. We will build upon a strong compliance and risk management foundation and recognize the critical role this serves in maximizing operational results. We will continue to manage cash flow volatility through prudent risk management strategies across our business.

Growth Opportunities. We continually evaluate growth opportunities aligned with our businesses, assets, and markets leveraging our expertise in those areas and offering durable returns. We may pursue growth opportunities that optimize our core business or expand upon our strengths, including, but not limited to the following:

•Opportunistic energy acquisitions with a focus on reliability,

•Create new value from the existing fleet through nuclear uprates and license extensions, repowering of renewables, co-location of data centers, production of clean hydrogen, and other opportunities,

•Grow sustainability solutions for our customers focused on clean energy, efficiency, storage and electrification; help our C&I customers develop and meet sustainability targets,

•Engagement with the technology and innovation ecosystem through continued partnerships with national labs, universities, startups, and research institutions, and

•Continue to monitor opportunities to participate in advanced nuclear to maintain our leadership position as stewards of a carbon-free energy future.

We will employ a disciplined approach to acquisitions that grow future cash flow and support strategic initiatives. In further pursuit of our strategy, on January 10, 2025 we announced an agreement to acquire Calpine Corporation (Calpine), a combination that would couple the largest producer of clean, carbon-free energy with the reliable, dispatchable natural gas assets of Calpine, and also create the nation’s leading competitive retail electric supplier, providing increased scale, diversification and complementary capabilities that will enable us to meet growing demand with a broader array of energy and sustainability products. See Note 2 — Mergers, Acquisitions, and Dispositions of the Combined Notes to Consolidated Financial Statements for additional information on the proposed transaction.

Various market, financial, regulatory, legislative and operational factors could affect our success in pursuing these strategies. We continue to assess infrastructure, operational, policy, and legal solutions to these issues. See ITEM 1A. RISK FACTORS for additional information.

Outlook

The U.S. energy sector is experiencing unprecedented changes that we believe will increase the demand for reliable, clean power generation and benefit our business. We believe our generation fleet, including our nuclear assets, is well-positioned to deliver reliable and carbon-free power and benefit from growing demand for such electricity. Key drivers of increased demand include:

•Governmental and corporate policies designed to accelerate the decarbonization of the economy,

•Policy support for nuclear energy sources that also enable energy security, reliability and diversification,

•New technologies requiring reliable energy, and

•Evolving customer preferences favoring clean energy, choice and digitization.

Policy Support for Decarbonization and Emerging Carbon-Free Technologies. Many governments, corporations, and investors have been advocating for the reduction of GHG emissions across all sectors of the economy, with reduction of GHG emissions by the energy sector being a key focus. These include state mandates requiring increasingly stringent policies that require the reduction of GHG emissions over time. For example, many large corporations have adopted targets to reduce the carbon emissions in their business operations, spurred in part by demand from investors and customers for sustainable, environment-friendly business practices. These governmental and corporate policies support the retention and expansion of carbon-free generation and developments in emerging technologies like advanced nuclear power, carbon capture and sequestration, energy storage, advanced geothermal and hydrogen. We are focused on a clean energy future and we believe our business is well-positioned to benefit from policy support for decarbonization as our generation fleet is essential to helping meet sustainability goals.

Policy Support for Nuclear Energy. We expect our generation fleet will continue to play a critical role in meeting baseload power needs. Nuclear energy is currently the largest source of zero-emissions electricity in the U.S., accounting for over 50% of the nation’s carbon-free power and our nuclear plants are meaningful contributors to the clean energy mix in the states in which they operate. Through enactment of the nuclear PTC in the IRA, federal policymakers have recognized the need to ensure the continued operation of the nation’s nuclear power plants. Actions taken by states recognize that existing nuclear generation facilities are essential to meeting their policy objectives to reduce GHG emissions, with three states currently considering bills to add nuclear energy to clean energy targets and four states, including Connecticut, Michigan, North Carolina and Tennessee, finalizing such legislation since 2023. In addition, nuclear energy generation supports jobs and regional economies, and helps to ensure reliability and security of the electrical grid. As such, we plan to file applications to extend the licenses of our nuclear fleet to 80 years for our units that receive continued policy support for their long-term operation.

New Technologies Requiring Reliable Energy. Many news reports indicate the rapid expansion of data centers and the need for increased energy supply to meet future demand. Significant planned investments from hyperscalers such as Microsoft, Google, and Amazon in artificial intelligence (AI) technology and infrastructure are further contributing to unprecedented demand for reliable, around-the-clock energy in the U.S and abroad. According to the DOE, data centers are one of the most energy-intensive building types, consuming 10 to 50 times the energy per floor space of a typical commercial office building. Efforts to reduce GHG emissions could lead to further electrification of the U.S. economy, including electrification of transportation, industrial operations, heating and cooling, and appliances, which could materially increase demand for electricity. For companies like us whose core competency is safely generating and serving electricity and related products to our customers, the increasing demand provides natural growth opportunities.

Evolving Customer Preferences. Consumers are increasingly purpose-driven and knowledgeable of services that drive decarbonization, leading them to value the ability to be connected to and trace the source of their clean energy choices. Growing awareness of climate change and green energy helps drive customer interest in value-add services and products around their energy usage, such as solar, behind-the-meter storage, EV charging, and the ability to choose 100 percent clean power 24 hours a day, 365 days a year in competitive retail energy markets. Continuing innovation in the digitization of the broader economy will facilitate greater control and opportunities for customers and businesses to more frequently engage with their energy providers and become more knowledgeable of their energy choices, including the products and solutions we provide.

Environmental Matters and Regulation

We are subject to comprehensive and complex environmental legislation and regulation at the federal, state, and local levels, including requirements relating to climate change, air and water quality, solid and hazardous waste, and impacts on species and habitats.

Our Board of Directors is responsible for overseeing the management of environmental matters. We have a management team to address environmental compliance and strategy, including the CEO, and other members of senior management. Performance of those individuals directly involved in environmental compliance and strategy is reviewed and affects compensation as part of the annual individual performance review process. Our Board of Directors has delegated to its Nuclear Oversight Committee and the Corporate Governance Committee the authority to oversee our compliance with health, environmental, and safety laws and regulations and its

strategies and efforts to protect and improve the quality of the environment, including our internal climate change and sustainability policies and programs, as discussed in further detail below.

Climate

Many governments, corporations, and investors have advocated for the reduction of GHG emissions across all sectors of the economy, with reduction of GHG emissions by the energy sector being a key focus. These include state mandates requiring increasingly stringent policies that require the reduction of GHG emissions over time. For example, many large corporations have adopted targets to reduce the carbon emissions in their business operations, spurred in part by demand from investors and customers for sustainable, environment-friendly business practices. Emerging technologies like battery storage, carbon capture and sequestration, and clean hydrogen production are also helping to advance decarbonization.

We believe our business is well-positioned to benefit from policy for decarbonization. However, we also face climate mitigation and transition risks as well as adaptation risks. Mitigation and transition risks include changes to the energy systems as a result of new technologies, changing customer expectations, and/or voluntary GHG reduction goals, as well as local, state, or federal regulatory requirements intended to reduce GHG emissions. Adaptation risk refers to risks to our facilities or operations that may result from changes in the physical climate, such as changes to temperatures, weather patterns, and sea level rise. See ITEM 1A. RISK FACTORS for additional information.

GHG Mitigation and Transition

We currently are subject to, and may become subject to additional, federal and/or state legislation and/or regulations addressing GHG emissions. We are deliberately positioned as a low-carbon generation company. We have minimized GHG emitting assets in our portfolio and maximized carbon-free electric production. Our Scope 1 and 2 market-based GHG emissions in 2023 were 10 million metric tons carbon dioxide equivalent, of which 9.3 million metric tons were from our natural gas and oil-fueled generation fleet, significantly less than our peers with similar volume of power generation. Even with our proposed acquisition of Calpine, we would continue to have the lowest carbon intensity of any large generator in the U.S.

We produce electricity predominantly from low and carbon-free generating facilities (such as nuclear, hydroelectric, natural gas, wind, and solar) and neither own nor operate any coal-fueled generating assets. Our natural gas and oil generating plants produce some GHG emissions, most notably CO2. We have made investments in developing carbon capture technologies to reduce GHG emissions from carbon emitting generating plants. In addition, we sell natural gas through our customer-facing business; and consumers’ use of such natural gas produces GHG emissions. However, our owned-asset emission intensity, or rate of carbon dioxide equivalent (CO2e) emitted per unit of electricity generated, is among the lowest in the industry. In 2024, we achieved a 94.6% percent capacity factor across our nuclear fleet and our ownership of 22 GWs of carbon-free generation capacity at 25 nuclear units produced 182 TWhs of electricity in 2024.

The electric sector plays a key role in lowering GHG emissions across the rest of the economy. Electrification of other sectors such as transportation and buildings coupled with simultaneous decarbonization of electric generation is a key lever for emissions reductions. To support this transition, we are advocating for public policy supportive of vehicle electrification, investing in enabling infrastructure and technology, and supporting customer education and adoption. We also continue to explore other decarbonization opportunities, supporting pilots of emerging energy technologies and development of clean fuels.

International Climate Agreements. At the international level, the United States is a party to the United Nations Framework Convention on Climate Change (UNFCCC). The Parties to the UNFCCC adopted the Paris Agreement at the 21st session of the UNFCCC Conference of the Parties (COP 21) in December 2015. Under the Agreement, which became effective in November 2016, the parties committed to limit the global average temperature increase and to develop national GHG reduction commitments. The United States has set an economy-wide target of reducing its net GHG emissions by 50-52% below 2005 levels by 2030. UNFCC Conference of Parties (COP) sessions occur annually and we monitor developments in these international meetings for their impact on the U.S. energy policy. In January 2025, President Trump issued an executive order to withdraw the United States from the Paris Agreement.

Federal Climate Policy. The reelection of President Donald Trump has altered the landscape of federal climate policy. In the short time since his inauguration, President Trump has taken several actions that pare back climate and sustainability initiatives from prior administrations and called for the repeal of several Biden-era energy tax-support and related initiatives. It is not yet clear what impact, if any, these actions may have on us. President Trump has also emphasized the importance of reliable, affordable electricity to grow the economy and protect national security, and has specifically cited nuclear energy as an important technology.

Regulation of GHGs from Power Plants under the Clean Air Act. In April 2024, EPA issued a final rule that regulates greenhouse gases from existing coal, new natural gas-fired power plants, and existing oil/gas steam generators under Clean Air Act section 111. The applicable standards are subcategorized by retirement date for existing coal and capacity factor for existing gas. We are evaluating market impacts of this rule, which will be affected by upcoming state implementation and ongoing litigation. EPA has solicited comment on approaches for regulating GHGs from existing gas plants in a docket that closed in May 2024. In October 2024, the U.S. Supreme Court rejected a request to temporarily block implementation of EPA's GHG standards for existing coal, new gas, and existing oil/gas steam generators. The rule is currently being litigated in the DC Circuit. Under the Unleashing American Energy Executive Order, issued on January 20, 2025, agencies are directed to revisit regulations that “impose an undue burden” on the use of domestic energy resources, including coal, natural gas, and oil. In February 2025, EPA filed a motion to hold the D.C. Circuit litigation in abeyance.

State Climate Legislation and Regulation. Many states in which we operate have state and regional programs to reduce GHG emissions and renewable and other portfolio standards, which impact the power sector and other sectors as well. 25 states and the District of Columbia have 100% clean energy targets, deep GHG reductions, or both, encompassing 55% of U.S. residential electricity customers. See discussion below for additional information on renewable and other portfolio standards. As the nation’s largest generator of carbon-free electricity, our fleet supports these efforts to produce safe, reliable electricity with minimal GHGs.

In 2019, New York enacted the Climate Leadership and Community Protection Act, which commits the state to achieving net-zero emissions by 2050, with interim emission reduction and renewable energy requirements in 2030 and 2040. New Jersey’s Energy Master Plan provides a comprehensive roadmap for achieving the state’s goal of a 100% clean energy economy by 2050. The state's Global Warming Response Act stated GHG emissions reductions of 80% below 2006 levels by 2050 which was subsequently accelerated by Executive Order 315 targeting 100% clean energy by 2035. In September 2021, Illinois Public Act 102-0662 was signed into law by the Governor of Illinois. The Clean Energy Law is designed to achieve 100% carbon-free power by 2045 to enable the state’s transition to a clean energy economy. The Clean Energy Law establishes decarbonization requirements for Illinois as well as programs to support the retention and development of emissions-free sources of electricity.