Our restated certificate of incorporation and amended and restated bylaws will provide that, to the fullest extent authorized or permitted by the DGCL, as now in effect or as amended, we will indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding by reason of the fact that such person, or a person of whom he or she is the legal representative, is or was our director or officer, or by reason of the fact that our director or officer is or was serving, at our request, as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust or other enterprise, including service with respect to employee benefit plans. We will indemnify such persons against expenses, liabilities, and loss (including attorneys’ fees), judgments, fines, excise taxes or penalties under the Employee Retirement Income Security Act of 1974, penalties and amounts paid in settlement actually and reasonably incurred in connection with such action.

We have obtained policies that insure our directors and officers and those of our subsidiaries against certain liabilities they may incur in their capacity as directors and officers. Under these policies, the insurer, on our behalf, may also pay amounts for which we have granted indemnification to the directors or officers.

Item 15. Recent Sales of Unregistered Securities.

Set forth below is information regarding securities we have issued within the past three years that were not registered under the Securities Act. Amounts below do not give effect to the Reorganization.

(a) Issuances of Capital Stock

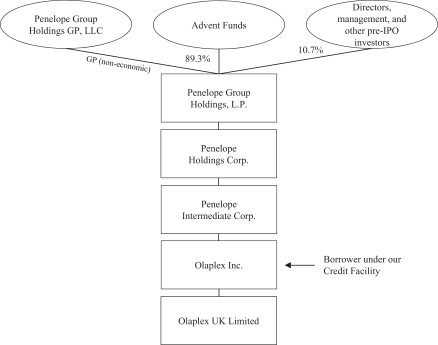

During the year ended December 31, 2020, Penelope Group Holdings issued and sold an aggregate of 857,046.68636 Class A Voting Common Units to the Advent Funds for an aggregate of $857.0 million, at a price of $1,000 per unit, and an aggregate of 102,821.25 Class A Non-Voting Common Units to other investors, certain of our officers and certain members of the Board of Managers of Penelope Group GP for an aggregate of $102.8 million, at a price of $1,000 per unit.

Since January 1, 2021, Penelope Group Holdings has issued and sold an aggregate of 316.7362 Class A Non-Voting Common Units to certain of our officers and certain members of the Board of Managers of Penelope Group GP for an aggregate of $0.6 million, at a price of $2,000 per unit.

No underwriters were involved in the foregoing sales of securities. The sales of securities described above were exempt from registration pursuant to Section 4(a)(2) of the Securities Act. Prior to the completion of this offering, these equity interests will, as part of the Reorganization, be exchanged for shares of our common stock.

(b) Grants and Exercises of Stock Options

During the year ended December 31, 2020, Penelope Holdings Corp. granted options to purchase an aggregate of 66,266 shares of its common stock, with a weighted average option exercise price of $563.85 per share, to employees and members of the Board of Managers of Penelope Group GP pursuant to the 2020 Plan.

Since January 1, 2021, Penelope Holdings Corp. has granted options to purchase an aggregate of 6,750 shares of its common stock, with a weighted average option exercise price of $2,148.15 per share, to employees and members of the Board of Managers of Penelope Group GP pursuant to the 2020 Plan.

Prior to the completion of this offering, these options will, as part of the Reorganization, be exchanged for options to purchase shares of our common stock.

The issuances of the securities described above were exempt from registration pursuant to Section 4(a)(2) of the Securities Act or Rule 701 promulgated under the Securities Act as transactions pursuant to compensatory benefit plans.

II-2

OLAPLEX INSPIRED BY SALONS. PROVEN BY SCIENCE.REPAIR STRENGTHEN PROTECT

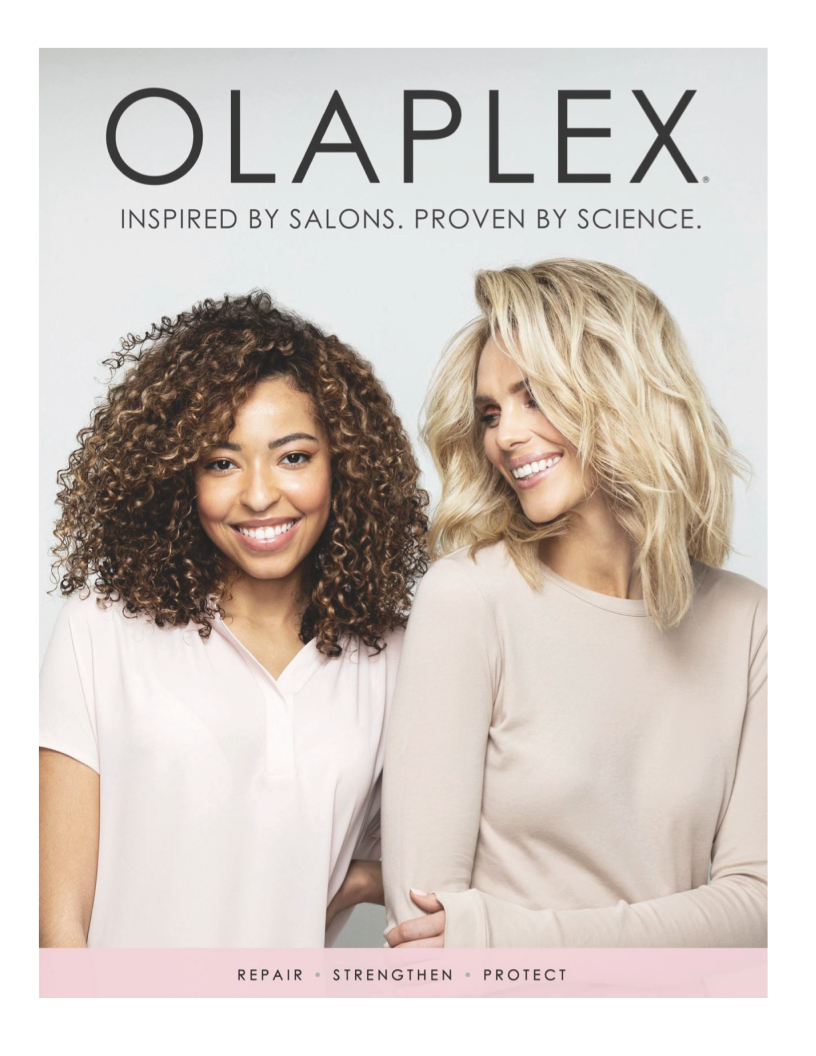

OLAPLEX INSPIRED BY SALONS. PROVEN BY SCIENCE.REPAIR STRENGTHEN PROTECT OLAPLEX THE COMPLETE HAIR REPAIR SYSTEM REPAIR STRENGTHEN PROTECT

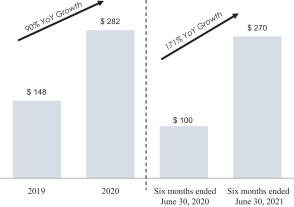

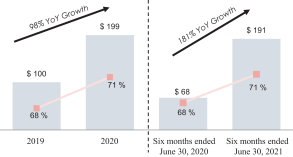

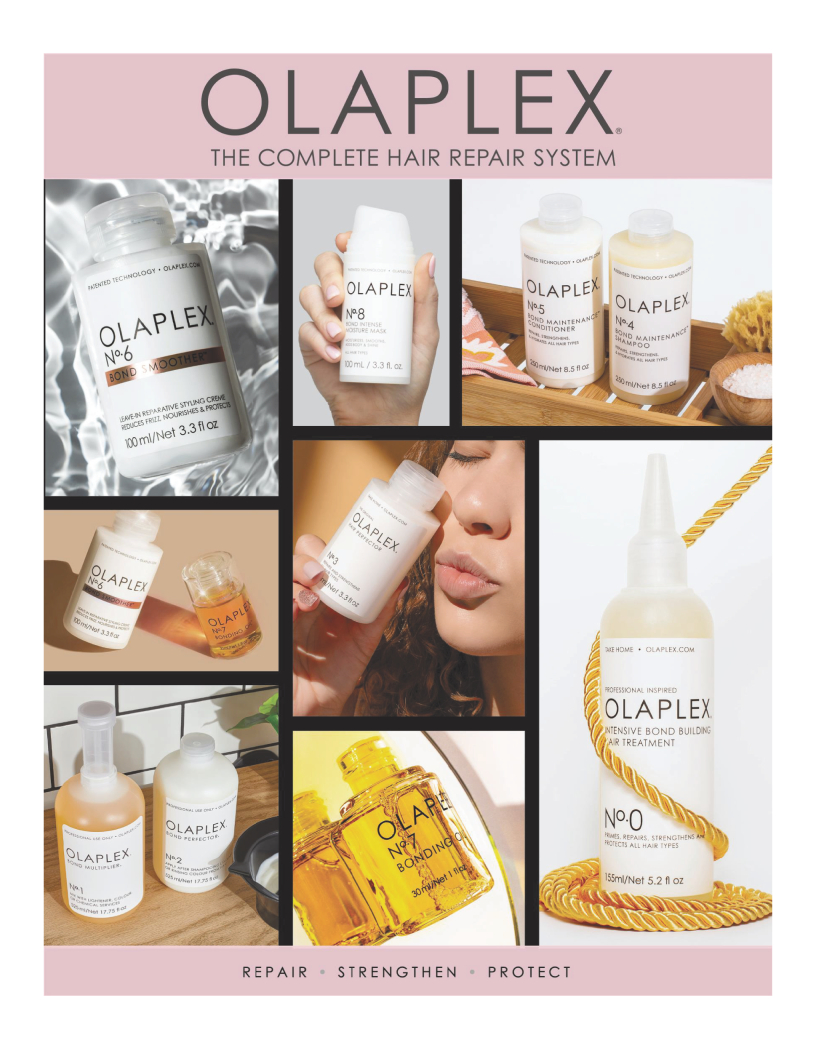

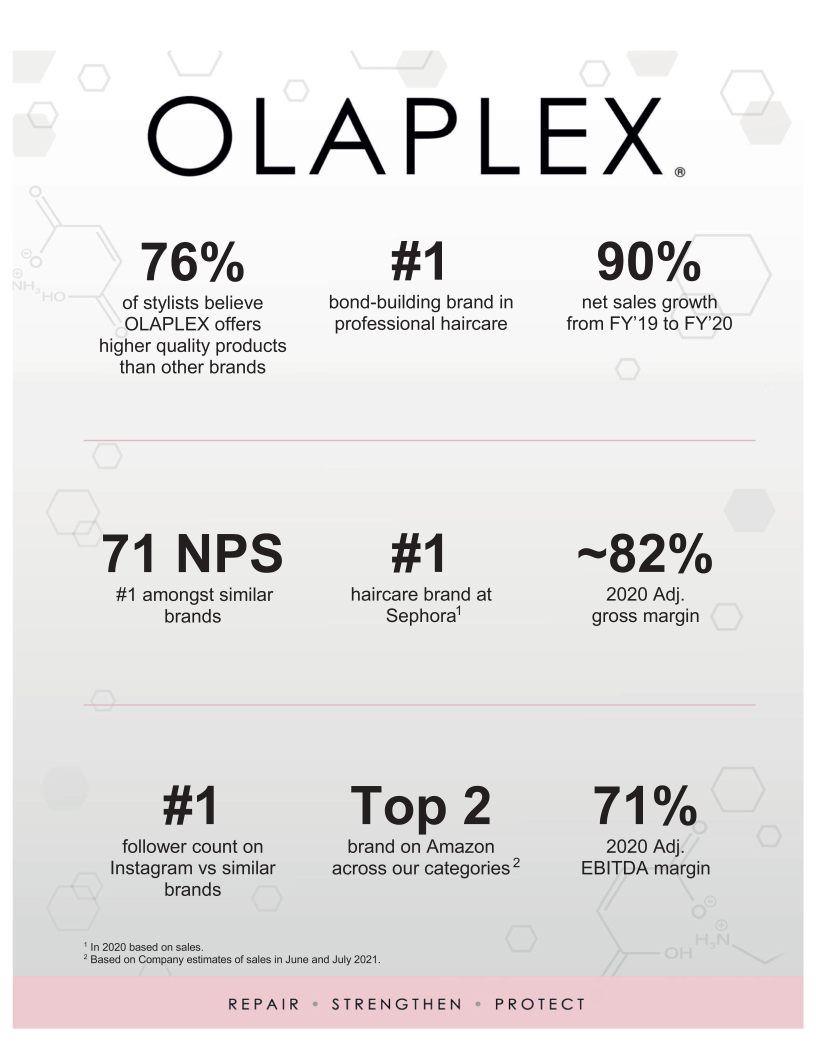

OLAPLEX THE COMPLETE HAIR REPAIR SYSTEM REPAIR STRENGTHEN PROTECT OLAPLEX 76% of stylists believe OLAPLEX offers higher quality products than other brands #1 brand in professional haircare 90% growth from FY19 to FY21 71 NPS #1 amongst similar brands #1 brand at Sephora 80%+ gross margins #1 follower count across haircare brands on Instagram Top2 brand on Amazon across our categories 65%+ Adj. EBITDA margin REPAIR STRENGTHEN PROTECT

OLAPLEX 76% of stylists believe OLAPLEX offers higher quality products than other brands #1 brand in professional haircare 90% growth from FY19 to FY21 71 NPS #1 amongst similar brands #1 brand at Sephora 80%+ gross margins #1 follower count across haircare brands on Instagram Top2 brand on Amazon across our categories 65%+ Adj. EBITDA margin REPAIR STRENGTHEN PROTECT