CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO 17 C.F.R. § 200.83

As confidentially submitted to the Securities and Exchange Commission on August 6, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information herein remains strictly confidential.

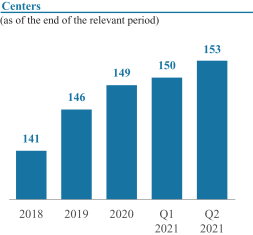

On May 8, 2020, we re-opened our first center in Oklahoma City, Oklahoma. With a focus on providing a healthy and clean environment for our members and team members, we continued to re-open our centers as governmental authorities permitted. As of June 30, 2020, September 30, 2020, December 31, 2020, and March 31, 2021, we had 105, 148, 141 and 151 of our centers opened, respectively. However, many of our centers remained closed or were required to be closed again after re-opening for some period of time during each of these quarters as a result of the COVID-19 pandemic and related restrictions. For instance, during the three months ended June 30, 2020, September 30, 2020 and December 31, 2020, 149, 43 and 31 of our centers, respectively, were closed for some period of time. The performance of our centers after we were able to re-open them has varied depending on various factors, including how early we were able to re-open them in 2020, whether we were required to close them again, their geographic location and applicable governmental restrictions. We have experienced a slightly faster recovery in our membership dues revenue compared to our in-center revenue as our centers have re-opened. We expect membership dues revenue to remain a higher percentage of our total revenue in the near term and return to more historical levels over time. While we are encouraged by the trends of increased vaccination rates, reduced COVID-19 infections and hospitalizations and reduced operating restrictions in many of the regions where our centers operate, the full extent of the impact of COVID-19, including the Delta variant, remains uncertain and is dependent on future developments that cannot be accurately predicted at this time. Considering this uncertainty, the extent of the impact of COVID-19 on our financial position, results of operations, liquidity and cash flows is uncertain at this time.

Operations

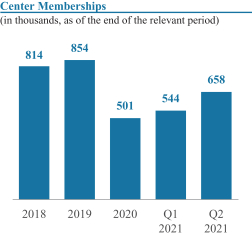

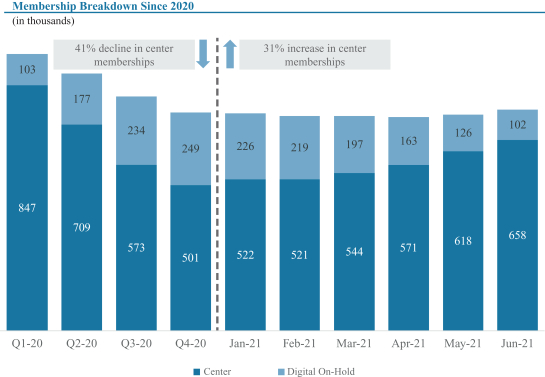

As of June 30, 2021, all but three of our 153 centers were open. Our three closed centers opened in July 2021. As of June 30, 2021, total memberships were 759,720, a decrease of 20.0% compared to 950,183 at March 31, 2020. Center memberships were 657,737, a decrease of 22.4% compared to 847,161 at March 31, 2020. Digital On-hold memberships were 101,983, a decrease of 1.0% compared to 103,022 at March 31, 2020.

We continue to monitor governmental orders regarding the operations of our centers, as well as our center operating processes and protocols. We expect we may need to continue to adjust such processes and protocols as facts and circumstances change, including as a result of variants of the COVID-19 virus, such as the Delta variant.

We also expect our centers and in-center businesses will continue to be impacted differently based upon considerations such as their geographic location, vaccination rates, impacts of variants, applicable government restrictions and guidance, and team member and member sentiment with respect to our center operating processes and protocols and working in and/or using our centers. For example, we are seeing an increase in Center memberships and center utilization in various regions where government restrictions have been lifted.

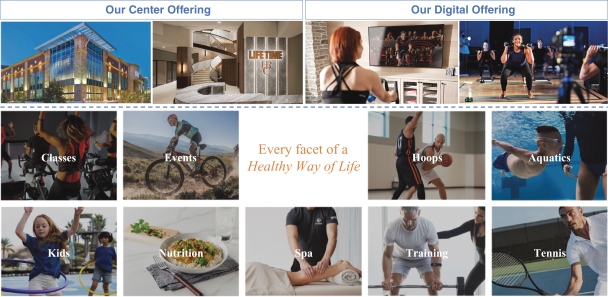

Given increasing demand for online engagement with consumers, we have increased our focus on delivering a digitized in-center experience through our omni-channel ecosystem. In December 2020, we expanded our Digital membership offering, bringing our “Healthy Way of Life” programs, services and content to consumers virtually. This omni-channel experience is designed to deliver health, fitness and wellness where, when and how members want it by offering online reservations registrations, virtual training, live streaming and on-demand classes, virtual events and more.

Cash Flows and Liquidity

In response to the impact of COVID-19 on our business, we took swift cash management actions to reduce our operating costs and preserve liquidity. These actions included: initially furloughing over 95% of our employees; undertaking two corporate restructuring events to right size overhead relative to the current business; initially suspending virtually all construction capital spending; negotiating rent reductions and deferrals with many of our landlords; evaluating the CARES Act and receiving the employee retention credit, the deferment of the employer’s portion of social security tax payments and the various income tax-related benefits; and completing sale-leaseback transactions associated with six properties.