The information in this proxy statement/prospectus is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commissions, of which this proxy statement/prospectus is a part, is declared effective. This proxy statement/prospectus does not constitute an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 15, 2021

PRELIMINARY PROXY STATEMENT/PROSPECTUS

Bullish

PROXY STATEMENT OF

FAR PEAK ACQUISITION CORPORATION

PROSPECTUS FOR UP TO 137,457,929 CLASS A ORDINARY SHARES, 27,000,000 WARRANTS AND 27,000,000 CLASS A ORDINARY SHARES ISSUABLE UPON EXERCISE OF WARRANTS OF BULLISH

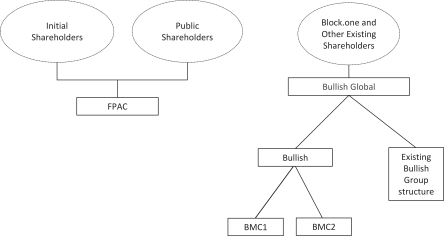

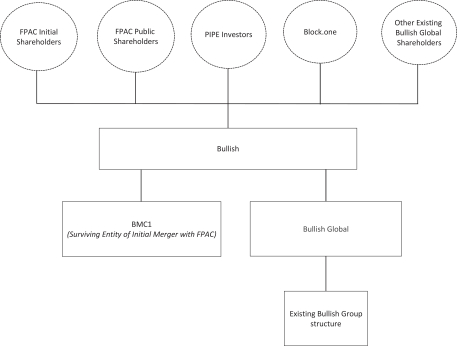

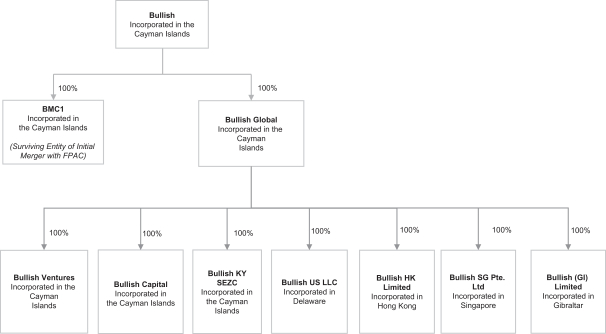

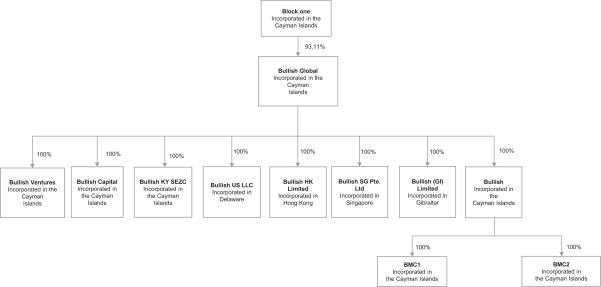

The board of directors of Far Peak Acquisition Corporation, a Cayman Islands exempted company (“FPAC”) has unanimously approved the Business Combination Agreement, dated as of July 8, 2021 (the “Business Combination Agreement”), by and among FPAC, Bullish, a Cayman Islands exempted company (“Bullish”), BMC1, a Cayman Islands exempted company and a direct wholly owned subsidiary of Bullish (“Merger Sub 1”), BMC2, a Cayman Islands exempted company and a direct wholly owned subsidiary of Bullish (“Merger Sub 2”, and together with Merger Sub 1 the “Merger Subs”), and Bullish Global, a Cayman Islands exempted company (“Bullish Global”), which, among other things, provides for the merger of FPAC with Merger Sub 1, with Merger Sub 1 as the surviving entity in the merger, and, after giving effect to such merger, continuing as a wholly owned subsidiary of Bullish (the “Initial Merger”) and, following the Initial Merger, the merger of Bullish Global and Merger Sub 2, with Bullish Global as the surviving entity in the merger, and, after giving effect to such merger, continuing as a wholly owned subsidiary of Bullish (the “Acquisition Merger” and, together with the Initial Merger and the other transactions contemplated by the Business Combination Agreement, the “Business Combination” or the “Transactions”). As a result of and upon consummation of the Business Combination, each of FPAC and Bullish Global will become a wholly-owned subsidiary of Bullish, as described in this proxy statement/prospectus and Bullish will become a new public company owned by the prior FPAC Shareholders, the prior Bullish Global shareholders, and the PIPE Investors describe below. Certain terms are defined in the section of this proxy statement/prospectus captioned “Frequently Used Terms.”

Pursuant to the Business Combination Agreement, upon the consummation of the Business Combination (i) each outstanding Class A and Class B Ordinary Share of FPAC will be converted into one Class A ordinary share (the “Class A Ordinary Shares”) of Bullish, which will have one vote per share, and (ii) each outstanding warrant of FPAC (“FPAC Warrant”) will be converted into one warrant of Bullish (“Bullish Warrant”) that entitles the holder thereof to purchase one Class A Ordinary Share of Bullish in lieu of one Class A ordinary share of FPAC and otherwise upon substantially the same terms and conditions. Accordingly, this proxy statement/prospectus covers the issuance by Bullish of an aggregate of up to 69,750,000 Class A Ordinary Shares to FPAC Shareholders, 27,000,000 Warrants, 27,000,000 Class A Ordinary Shares issuable upon exercise of warrants.

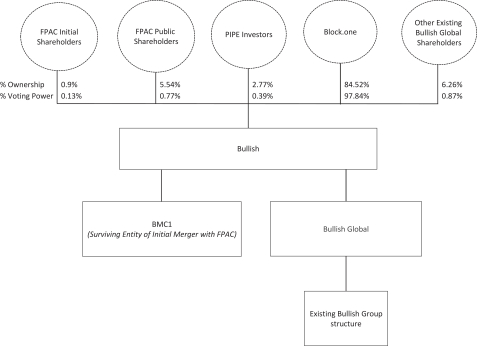

In addition, as part of the Business Combination, certain Bullish Global shareholders currently owning approximately 93.11% of the issued and outstanding ordinary shares of Bullish Global will receive Class B ordinary shares of Bullish (“Class B Ordinary Shares”) entitling them to ten votes per share and the remaining issued and outstanding ordinary shares of Bullish Global will be exchanged into Class A Ordinary Shares of Bullish. This proxy statement/prospectus covers up to 67,707,929 Class A Ordinary Shares to be issued in exchange for outstanding Class C common shares of Bullish Global held by non-affiliates of Bullish Global. The number of Class A and Class B Ordinary Shares to be issued to the shareholders of Bullish Global will be determined pursuant to the “Exchange Ratio” as defined in Business Combination Agreement and will depend in part on the Digital Asset Market Value (as defined in the Business Combination Agreement) to be held by Bullish Global at the closing of the Business Combination. Based on the 20-day average price of digital asset market values as of August 31, 2021 (the date used in the pro forma financial information in respect of the Business Combination is provided in this proxy statement/prospectus), the shareholders of Bullish Global would have received 240,895,554 Class A Ordinary Shares and 741,440,478 Class B Ordinary Shares. Such shares (assuming that no FPAC Shareholders elect to redeem their ordinary shares underlying the units sold in FPAC’s initial public offering (“Public Shares”) for cash in connection therewith as permitted by FPAC’s memorandum and articles of association and excluding the warrants), would collectively represent approximately 90.78% of Bullish’s issued and outstanding Class A and Class B Ordinary Shares and 98.71% of the combined voting power of Bullish’s Class A and Class B Ordinary Shares. Class B Ordinary Shares shall automatically convert into Class A Ordinary Shares on a one-for-one basis (a) at any time and from time to time at the option of the holders thereof; and (b) immediately prior to the consummation of a transfer of such Class B Ordinary Shares to any third party (other than to specified transferees). Based on an estimate of the high and low prices of the digital assets that may be held by Bullish Global at closing over the 52-week period ended August 31, 2021, the percentage of Bullish equity to be received by the shareholders of Bullish Global, assuming no redemptions, would range from 91.92% to 83.54%.

Certain investors (the “PIPE Investors”) will subscribe for an aggregate of 30,000,000 Class A Ordinary Shares of Bullish at $10.00 per share for gross proceeds of $300,000,000 concurrently with the effective time of the Business Combination (the “PIPE Investment”).

In addition, it is anticipated that, upon completion of the Business Combination, based on the above assumptions: (1) Public Shareholders will own 60,000,000 Class A Ordinary Shares or approximately 5.54% of Bullish’s outstanding Ordinary Shares or 0.77 % of the voting power; (2) the PIPE Investors will own 30,000,000 Class A Ordinary Shares or approximately 2.77% of Bullish’s outstanding Ordinary Shares or 0.39% of the voting power; (3) FPAC’s Sponsor and the Initial Investors will own 7,800,000 Class A Ordinary Shares or approximately 0.72% of Bullish’s outstanding Ordinary Shares or 0.13% of the voting power (in addition, the BR Investors (as defined herein) will hold 1,950,000 Class A Ordinary Shares as transferred by the FPAC Sponsor).

In addition, after the Business Combination, Public Shareholders will hold 20,000,000 formerly Public Warrants and there will be 6,500,000 formerly Private Placement Warrants held between FPAC’s Sponsor, the BR Investors, and the Anchor Subscriber (as defined herein).

Proposals to approve the Business Combination Agreement and the other matters discussed in this proxy statement/prospectus will be presented at the special meeting of FPAC Shareholders scheduled to be held virtually on , 2021.

FPAC’s Units, Class A ordinary shares and warrants are currently listed on The New York Stock Exchange (“NYSE”), under the symbols “FPACU,” “FPAC,” and “FPACW,” respectively. Bullish will apply for listing, to be effective at the time of the Business Combination, of its Class A Ordinary Shares and warrants on the NYSE under the symbols, “BULL” and “BULLW,” respectively. Bullish will not have units traded following consummation of the Business Combination. Bullish will be a “controlled company” pursuant to NYSE listing rules.

Each of FPAC and Bullish is an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and has elected to comply with certain reduced public company reporting requirements.

This proxy statement/prospectus provides you with detailed information about the Business Combination and other matters to be considered at the extraordinary general meeting of FPAC Shareholders. The FPAC Board encourages you to carefully read this entire document and the documents incorporated by reference. You should also carefully consider the risk factors described in “Risk Factors.”

These securities have not been approved or disapproved by the Securities and Exchange Commission (the “SEC”) or any state securities commission nor has the SEC or any state securities commission passed upon the accuracy or adequacy of this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated , 2021, and is first being mailed to FPAC securityholders on or about , 2021.