The information in this preliminary proxy statement/prospectus is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY - SUBJECT TO COMPLETION, DATED DECEMBER 7, 2021

PROXY STATEMENT FOR EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS OF

Bridgetown 2 Holdings Limited

and

PROSPECTUS FOR UP TO 57,147,453 ORDINARY SHARES

OF

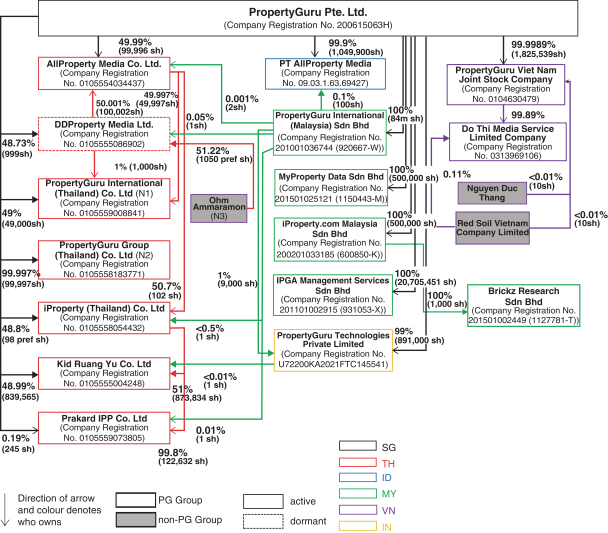

The board of directors of Bridgetown 2 Holdings Limited, an exempted company limited by shares incorporated under the laws of the Cayman Islands (“Bridgetown 2”), has unanimously approved the Business Combination Agreement, dated July 23, 2021 (as may be amended, supplemented, or otherwise modified from time to time, the “Business Combination Agreement”), by and among PropertyGuru Group Limited, an exempted company limited by shares incorporated under the laws of the Cayman Islands (“PubCo”), Bridgetown 2, B2 PubCo Amalgamation Sub Pte. Ltd., a Singapore private limited company and a direct wholly-owned subsidiary of PubCo (“Amalgamation Sub”) and PropertyGuru Pte. Ltd., a Singapore private company limited by shares (“PropertyGuru”), pursuant to which Bridgetown 2 is proposing to enter into a business combination with PropertyGuru involving a merger and an amalgamation, upon the consummation of which, PropertyGuru would become a wholly-owned subsidiary of PubCo, and the shareholders of Bridgetown 2 and PropertyGuru would receive shares, par value $0.0001 per share, of PubCo (“PubCo Ordinary Shares”) as consideration.

Pursuant to the Business Combination Agreement, upon the consummation of the Business Combination (as defined herein): (i) each Bridgetown 2 Class A ordinary share, par value $0.0001 per share (“Bridgetown 2 Class A Ordinary Share”) issued and outstanding immediately prior to the effective time of the Merger (as defined herein) shall be canceled in exchange for the right to receive one PubCo Ordinary Share, (ii) each Bridgetown 2 Class B ordinary share, par value $0.0001 per share (“Bridgetown 2 Class B Ordinary Shares” and collectively with the Bridgetown 2 Class A Ordinary Shares, the “Bridgetown 2 Shares”) issued and outstanding immediately prior to the effective time of the Merger shall be canceled in exchange for the right to receive one PubCo Ordinary Share and (iii) each Bridgetown 2 warrant (“Bridgetown 2 Warrant”) outstanding immediately prior to the effective time of the Merger shall cease to be a warrant with respect to Bridgetown 2 Shares and be assumed by PubCo and converted into a warrant of PubCo to purchase one PubCo Ordinary Share, subject to substantially the same terms and conditions prior to the effective time of the Merger.

In addition, pursuant to the Business Combination Agreement, upon the consummation of the Business Combination (i) each of the outstanding shares of PropertyGuru (“ PropertyGuru Shares”) shall be canceled in exchange for the right to receive such fraction of a newly issued PubCo Ordinary Share that is equal to the quotient obtained by dividing $361.01890 (the “Price per Share”) by $10.00 (the “Exchange Ratio”), (ii) each outstanding PropertyGuru Restricted Stock Unit Award (as defined below) shall be assumed by PubCo and converted into the right to receive restricted stock units of PubCo in respect of such number of newly issued PubCo Ordinary Shares equal to (x) the number of PropertyGuru Shares subject to the PropertyGuru Restricted Stock award immediately before the Amalgamation Effective Time (as defined herein) multiplied by (y) the Exchange Ratio (such product rounded down to the nearest whole number), (iii) each outstanding PropertyGuru Option (as defined below) shall be assumed by PubCo and converted into an option of PubCo in respect of such number of newly issued PubCo Ordinary Shares equal to (x) the number of PropertyGuru Shares subject to such PropertyGuru Option immediately prior to the Amalgamation Effective Time multiplied by (y) the Exchange Ratio (such product rounded down to the nearest whole number), (iv) each PropertyGuru Warrant (as defined below) shall be assumed by PubCo and converted into a PubCo Warrant exercisable for that number of PubCo Ordinary Shares equal to (x) the number of PropertyGuru Shares subject to such PropertyGuru Warrant immediately prior to the Amalgamation Effective Time multiplied by (y) the Exchange Ratio (such product rounded down to the nearest whole number) at an exercise price equal to (a) the exercise price of such PropertyGuru Warrant divided by (b) the Exchange Ratio and multiplied by (c) the exchange rate of S$1.3675 to US$1.00 on July 21, 2021.

For details on the transactions involved in the Business Combination, see “Questions and Answers about the Proposals—What is expected to happen in the Business Combination?”

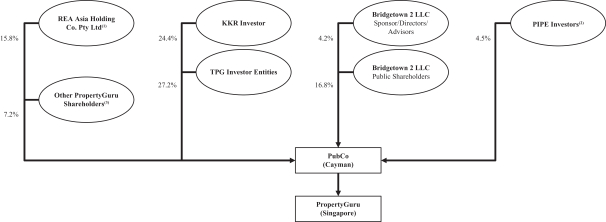

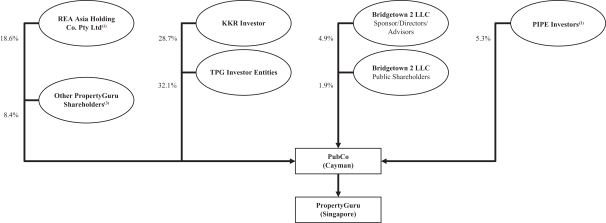

Bridgetown 2 shareholders are being asked to consider a vote upon the Business Combination and certain proposals related thereto as described in this proxy statement/prospectus. As a result of, and upon consummation of, the Business Combination, PropertyGuru shall become a wholly-owned subsidiary of PubCo, and PubCo shall become a new public company owned by the prior holders of Bridgetown 2 Shares, the prior holders of Bridgetown 2 Warrants, the prior holders of the PropertyGuru Shares, the prior holders of options to purchase PropertyGuru Shares under a PropertyGuru incentive plan (“PropertyGuru Options”), the prior holders of an award of restricted stock units based on PropertyGuru Shares (whether to be settled in cash or shares), granted under a PropertyGuru incentive plan (“PropertyGuru Restricted Stock Unit Awards”), the 112,000 warrants to purchase PropertyGuru Shares issued to Epsilon Asia Holdings II Pte. Ltd. (the “KKR Investor”) in accordance with the PropertyGuru Warrant Instrument (as defined below) (“PropertyGuru Warrants”) and certain third-party investors (the “PIPE Investors”). PubCo has applied for listing, to be effective upon the consummation of the Business Combination, of its ordinary shares, par value $0.0001 per share (“PubCo Ordinary Shares”) on the New York Stock Exchange (“NYSE”) under the symbol “PGRU”.

Substantially concurrently with the execution and delivery of the Business Combination Agreement, (i) PubCo, Bridgetown 2 and the PIPE Investors entered into share subscription agreements (“PIPE Subscription Agreements”) pursuant to which the PIPE Investors committed to subscribe for and purchase, in the aggregate, 13,193,068 PubCo Ordinary Shares for $10 per share for an aggregate purchase price equal to $131,930,680, which includes REA’s $20.0 million subscription in the PIPE Investment and an additional $31.9 million equity investment in PubCo by REA relating to REA’s existing call option to acquire additional shares in PropertyGuru.

The Business Combination Agreement is attached to this proxy statement/prospectus as Annex A. Upon the consummation of the Business Combination, PubCo shall adopt the amended and restated memorandum and articles of association (the “Amended PubCo Articles”) in the form attached to this proxy statement/prospectus as Annex B.

Proposals to approve the Business Combination Agreement and the other matters discussed in this proxy statement/prospectus shall be presented at the Extraordinary General Meeting of shareholders of Bridgetown 2 scheduled to be held on , 2021.

This proxy statement/prospectus provides you with detailed information about the Business Combination and other matters to be considered at the Extraordinary General Meeting of Bridgetown 2 shareholders. We encourage you to carefully read this entire document. You should, in particular, carefully consider the risk factors described in “Risk Factors” beginning on page 51 of this proxy statement/prospectus.

The board of directors of Bridgetown 2 has unanimously approved and adopted the Business Combination Agreement and unanimously recommends that the Bridgetown 2 shareholders vote FOR all of the proposals presented to the shareholders. When you consider the board of directors’ recommendation of these proposals, you should keep in mind that certain of Bridgetown 2’s directors and officers have interests in the Business Combination. See the section entitled “The Business Combination Proposal—Interests of Bridgetown 2’s Directors and Officers in the Business Combination.”

This proxy statement/prospectus is dated , 2021 and is first being mailed to Bridgetown 2 shareholders on or about , 2021.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS OR ANY OF THE SECURITIES TO BE ISSUED IN THE BUSINESS COMBINATION, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

ADDITIONAL INFORMATION

No person is authorized to give any information or to make any representation with respect to the matters that this proxy statement/prospectus describes other than those contained in this proxy statement/ prospectus, and, if given or made, the information or representation must not be relied upon as having been authorized by PubCo, Bridgetown 2 or PropertyGuru. This proxy statement/prospectus does not constitute an offer to sell or a solicitation of an offer to buy securities or a solicitation of a proxy in any jurisdiction where, or to any person to whom, it is unlawful to make such an offer or a solicitation. Neither the delivery of this proxy statement/prospectus nor any distribution of securities made under this proxy statement/prospectus will, under any circumstances, create an implication that there has been no change in the affairs of PubCo, Bridgetown 2 or PropertyGuru since the date of this proxy statement/prospectus or that any information contained herein is correct as of any time subsequent to such date.

ordinary shares

ordinary shares

Amount

Amount

No. of ordinary shares under option

No. of ordinary shares under option