| PROSPECTUS | Filed pursuant to Rule 424(b)(3) |

| | Registration No. 333 - 284051 |

5,280,000 Ordinary Shares

Up to 3,520,000 Warrants to Purchase up to 3,520,000 Ordinary Shares

Up to 1,656,271 Pre-Funded Warrants to Purchase up to 1,656,271 Ordinary Shares

This prospectus relates to the resale, from time to time, by the selling shareholder identified in this prospectus under the section “Selling Shareholder,” (the “selling shareholder”) of NeuroSense Therapeutics Ltd. (“NeuroSense,” “we,” “us” or the “Company”) of (i) 103,729 of our ordinary shares, no par value per share (the “Shares”) issued to the selling shareholder under a securities purchase agreement, dated December 2, 2024 (the “Purchase Agreement”), by and between us and the purchasers named therein, (ii) up to 3,520,000 ordinary shares issuable to the selling shareholder upon exercise of warrants to purchase ordinary shares at an exercise price of $1.25 per ordinary share (the “Ordinary Warrants”), (iii) 3,520,000 Ordinary Warrants issued to the selling shareholder, (iv) up to 1,656,271 ordinary shares, issuable to the selling shareholder upon exercise of pre-funded warrants to purchase Ordinary Shares at an exercise price of $0.0001 per ordinary share (the “Pre-Funded Warrants” and together with the Ordinary Warrants, the “Warrants”), (v) 1,656,271 Pre-Funded Warrants. The Shares, the Prefunded Warrants, the ordinary shares underlying Prefunded Warrants (the “PFW Shares”), the Warrants and the ordinary shares underlying the Warrants (the “Ordinary Warrant Shares” and together with the “PFW Shares”, the “Warrant Shares”)) were offered pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act of 1933, as amended (the “Securities Act”), and Regulation D promulgated thereunder.

The selling shareholder will receive all of the proceeds from any sales of the resale of Shares, Warrants and Warrant Shares offered hereby. We will not receive any of the proceeds, but we will incur expenses in connection with such offering. To the extent the Warrants are exercised for cash, if at all, we will receive the exercise price of the Warrants.

The selling shareholder may sell the Shares, the Warrants, and the Warrant Shares covered by this prospectus through public or private transactions at market prices prevailing at the time of sale, at negotiated prices or such other prices as such selling shareholder may determine. The timing and amount of any sale are within the sole discretion of such selling shareholder. Our registration of the Shares, the Warrants, and the Warrant Shares for resale covered by this prospectus does not mean that the selling shareholder will offer or sell any of the Shares, the Warrants, and the Warrant Shares,. For further information regarding the possible methods by which the Shares, the Warrants and the Warrant Shares may be distributed, see “Plan of Distribution.”

We are an “emerging growth company” and a “foreign private issuer”, each as defined under federal securities laws, and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company” and “Prospectus Summary — Implications of Being a Foreign Private Issuer” for additional information.

Our ordinary shares and warrants to purchase our ordinary shares are listed on The Nasdaq Capital Market (“Nasdaq”) under the symbols “NRSN” and “NRSNW.” On December 24, 2024, the closing price for our ordinary shares of was $1.28 and the closing price for the warrants to purchase our ordinary shares was $0.46.

Investing in our securities is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 8 to read about factors you should consider before buying the Shares or the Warrants.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of the disclosures in this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is January 16, 2025

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of the registration statement on Form F-3 that we filed with the Securities and Exchange Commission (the “SEC”) for the offering of the Shares, the Warrants and the Warrant Shares by the selling shareholder.

You should not assume that the information contained in, or incorporated by reference into, this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus, even though this prospectus is delivered or the Shares, the Warrants, the Warrant Shares, the Pre-Funded Warrants and PFW Shares covered by this prospectus are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in, or incorporated by reference into, this prospectus in making your investment decision. You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find Additional Information” in this prospectus.

Neither we nor the selling shareholder have authorized anyone to provide any information or to make any representation other than those contained in, or incorporated by reference into, this prospectus. You must not rely upon any information or representation not contained in, or incorporated by reference into, this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any of our securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

This prospectus, including the information incorporated by reference herein, contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

TRADEMARKS, SERVICE MARKS AND TRADENAMES

The NeuroSense Therapeutics logo and other trademarks and service marks of NeuroSense Therapeutics Ltd. appearing in this prospectus or the information incorporated by reference herein are the property of the Company. Solely for convenience, some of the trademarks, service marks, logos and trade names referred to in this prospectus are presented without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, service marks and trade names. This prospectus, including the information incorporated by reference herein, contains additional trademarks, service marks and trade names of others. All trademarks, service marks and trade names appearing in this prospectus or the information incorporated by reference herein are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

MARKET AND INDUSTRY DATA

This prospectus, including the information incorporated by reference herein, contains industry, market and competitive position data that are based on industry publications and studies conducted by third parties as well as our own internal estimates and research. These industry publications and third-party studies generally state that the information that they contain has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that each of these publications and third-party studies is reliable, we have not independently verified the market and industry data obtained from these third-party sources. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements included in, or incorporated by reference into, this prospectus. While we believe our internal research is reliable and the definition of our market and industry are appropriate, neither such research nor these definitions have been verified by any independent source.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and certain information incorporated by reference herein contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and other securities laws. Many of the forward-looking statements contained in, or incorporated by reference into, this prospectus can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “should,” “target,” “would” and other similar expressions that are predictions of or indicate future events and future trends, although not all forward-looking statements contain these identifying words.

Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to substantial risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to a variety of factors, including, but not limited to, those identified under the section titled “Risk Factors” in this prospectus or the documents incorporated herein. These risks and uncertainties include factors relating to:

| | ● | our ability to maintain the listing of our ordinary shares on Nasdaq; |

| | | |

| | ● | the going concern reference in our financial statements and our need for substantial additional financing to achieve our goals; |

| | | |

| | ● | our limited operating history and history of incurring significant losses and negative cash flows since our inception, which we anticipate will continue for the foreseeable future; |

| | ● | our dependence on the success of our lead product candidate, PrimeC, including our obtaining of regulatory approval to market PrimeC in the United States (“U.S.”); |

| | ● | our limited experience in conducting clinical trials and reliance on clinical research organizations and others to conduct them; |

| | ● | our ability to advance our preclinical product candidates into clinical development and through regulatory approval; |

| | ● | the results of our clinical trials, which may fail to adequately demonstrate the safety and efficacy of our product candidates; |

| | ● | our ability to achieve the broad degree of physician adoption and use and market acceptance necessary for commercial success; |

| | ● | our reliance on third parties in marketing, producing or distributing products and research materials for certain raw materials, compounds and components necessary to produce PrimeC for clinical trials and to support commercial scale production of PrimeC, if approved; |

| | ● | our receipt of regulatory clarity and approvals for our therapeutic candidates and the timing of other regulatory filings and approvals; |

| | ● | estimates of our expenses, revenues, capital requirements and our needs for additional financing; |

| | ● | our efforts to obtain, protect or enforce our patents and other intellectual property rights related to our product candidates and technologies; |

| | ● | the impact of the public health, political and security situation in Israel, the U.S. and other countries in which we may obtain approvals for our products or our business; |

| | ● | the impacts on our ongoing and planned trials and manufacturing as a result of the war in Israel; and |

| | ● | those factors referred to in our most recent Annual Report on Form 20-F incorporated by reference herein in “Item 3. Key Information — D. Risk Factors,” “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects,” as well as in our most recent Annual Report on Form 20-F generally, which is incorporated by reference into this prospectus. |

The preceding list is not intended to be an exhaustive list of all of our risks and uncertainties. As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus or the documents incorporated herein or therein will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus or any document incorporated herein or therein, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information.

Unless otherwise required by law, we do not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

You should read this prospectus, the documents incorporated herein and therein, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in or incorporated by reference into this prospectus that we consider important. This summary does not contain all of the information you should consider before investing in our securities. Before you decide to invest in our securities, you should read the entire prospectus carefully, including the “Risk Factors” section and the financial statements and related notes incorporated by reference into this prospectus and the other documents incorporated by reference into this prospectus, which are described under “Incorporation by Reference” before making an investment in our securities.

Company Overview

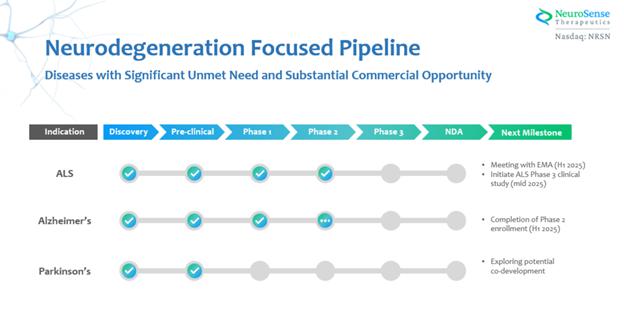

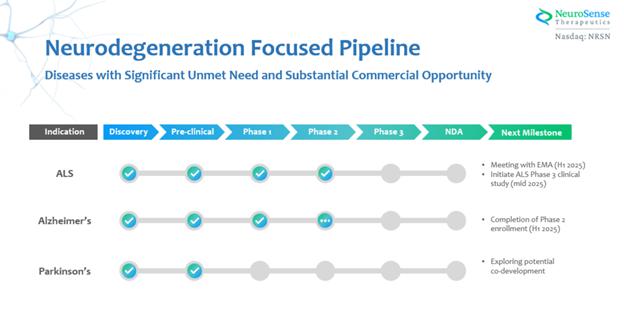

We are a clinical-stage biotechnology company focused on discovering and developing treatments for people living with neurodegenerative diseases, including amyotrophic lateral sclerosis (ALS), Alzheimer’s disease (AD) and Parkinson’s disease (PD). We believe these diseases represent some of the most significant unmet medical needs of our time, with limited effective therapeutic options available. The burden of these diseases on both patients and society is substantial. For example, the average annual cost of ALS alone is $180,000 per patient, and its estimated annual burden on the U.S. healthcare system is greater than $1 billion. Due to the complexity of neurodegenerative diseases, our strategy is utilizing a combined therapeutic approach to target multiple disease-related pathways.

Our lead therapeutic candidate, PrimeC, is a novel extended-release oral formulation, fixed-dose combination of two FDA-approved drugs, ciprofloxacin and celecoxib. PrimeC is designed to treat ALS by modulating microRNA synthesis, iron accumulation, and neuroinflammation, all of which are hallmarks of ALS pathology. The U.S. Food and Drug Administration, or the FDA and the European Medicines Agency, or the EMA have granted PrimeC orphan drug designation for the treatment of ALS. In addition, the EMA has granted PrimeC the Small and Medium-Sized Enterprise, or SME, status, which offers significant potential benefits leading up to and following drug regulatory approval. We believe PrimeC’s multifunctional mechanism of action has the potential to significantly prolong lifespan and improve ALS patients’ quality of life, thereby reducing the burden of this debilitating disease on both patients and healthcare systems.

PrimeC was evaluated in PARADIGM, a Phase IIb randomized, multi-center, multinational, prospective, double-blind, placebo-controlled study, to evaluate safety, tolerability, and efficacy of PrimeC in 68 people living with ALS. Participants were being administered PrimeC or placebo at a 2:1 ratio, respectively, for the six-month double-blind part. Study participants were allowed to continue standard of care treatment of approved products. The primary endpoints of the study are an evaluation of ALS-biomarkers as well as safety and tolerability assessment. Secondary and exploratory endpoints are the evaluation of clinical efficacy (ALS Functional Rating Scale — Revised, or ALSFRS-R, and slow vital capacity), survival, and improvement in quality of life. All subjects who completed the six-month double-blind, placebo-controlled dosing period had the opportunity to be transferred to the PrimeC active arm for a 12-month open label extension. The study completed enrollment in May 2023, enrolling 69 participants, in which 68 are living with ALS and one participant who was misdiagnosed for ALS and was excluded from the evaluations. Four ALS clinical centers participated in the study in 3 territories: Israel, Italy, and Canada. In December 2023, we reported that we met the primary safety and tolerability endpoints and achieved secondary clinical efficacy endpoints in the top-line results of our 6-month double-blind phase of PARADIGM. In May 2024, we announced new positive data analysis from PARADIGM clinical trial demonstrating statistically significant slowing of disease progression in high-risk ALS patients. In July 2024, we announced results from the 12-month analysis of the PARADIGM clinical trial which showed a significant improvement in the rate of decline of ALS Functional Rating Scale-Revised (ALSFRS-R) scores and survival rates for subjects who received PrimeC from the start of the trial compared to those who started on placebo. In August 2024, we announced positive 12-month biomarker data from the PARADIGM clinical trial, which showed a significant decrease in ferritin levels and a corresponding increase in transferrin levels, both indicating alleviation of the pathology. In October 2024, we completed the full 18-month dosing in PARADIGM and in December 2024 we announced results from the 18-month analysis of the PARADIGM clinical trial which showed statistically significant positive results from the 18-month data analysis of the PARADIGM study, evaluating the efficacy of PrimeC in the treatment of ALS.

Following the FDA’s recommendation for additional non-clinical data to support long term use of Ciprofloxacin (as PrimeC is intended for long-term administration in treating ALS) a long-term tox study was initiated. In September 2024, we announced the successful completion of the in-life phase of the study, as we move towards the initiation of a Phase 3 study in the US. We had a Type C meeting with the FDA in November 2024 and plan to meet with the EMA in the first quarter of 2025 and to subsequently commence a pivotal Phase III clinical trial for PrimeC in ALS treatment in the first half of 2025. Additionally, in November 2023, we concluded a successful Type D meeting with the FDA regarding CMC development plans for the expected Phase 3 pivotal study and subsequent marketing approval. The FDA endorsed our proposed CMC development plan.

In December 2024, we announced the outcome of the Type C meeting held with the FDA in November 2024. The purpose of the meeting was to discuss the design of a proposed Phase 3 clinical study and the plan for submission of an eventual 505(b)(2) marketing application. We had a productive discussion with the FDA regarding the design of the planned Phase 3 pivotal study with PrimeC, including efficacy and safety measurements. In light of the FDA’s positive feedback, we plan to submit a final protocol to the FDA during the first half of 2025 with the aim of commencing enrollment of the pivotal Phase 3 study in mid-2025, which would include approximately 300 patients divided by a ratio of 2:1, PrimeC to placebo. The Phase 3 study is expected to be a randomized, multi-center, multinational, prospective, double-blind, placebo-controlled study, with an open label extension (OLE), to evaluate the efficacy and safety of PrimeC in people living with ALS. Following 12 months of treatment, it is expected that all participants will transition to PrimeC for a 12-month OLE.

PrimeC was previously evaluated in a Phase IIa clinical trial, or NST002, in 15 people living with ALS, conducted at the Tel Aviv Sourasky Medical Center, Israel. The primary endpoint of the NST002 trial, which was safety and tolerability, was met. In this trial, the safety profile observed was consistent with known safety profiles of ciprofloxacin and celecoxib. Side effects were mild and transient in nature. There were no new or unexpected safety signals detected during the trial.

Additionally, we observed positive clinical signals in comparison to virtual controls, and a serum biomarker analysis showed significant changes following treatment, indicating biological activity of the drug in comparison to untreated matched ALS patients. All 12 patients who completed the NST002 trial elected to continue into an extension study with PrimeC, that was conducted as an Investigator Initiated Study. To date, we are still supporting the drug supply for a few of the participants in this study, which is over than 40 months since NST002 was initiated.

We completed three additional studies in 2022 as part of our drug development program to further support our future regulatory submissions. In April 2022, we initiated a pharmacokinetic, or PK, study, or NCT05232461, of PrimeC. The PK open-label, randomized, single-dose, three-treatment, three-period crossover study evaluated the effect of food on the bioavailability of PrimeC as compared to the bioavailability of co-administered ciprofloxacin tablets and celecoxib capsules in adult subjects in the U.S. under an FDA cleared IND protocol.

In August 2022, we completed enrollment and dosing of all subjects in a multi-dose PK study, or NCT05436678. On September 28, 2022, we released the results of the NCT05436678 study. Based on results, we believe the PK profile of PrimeC supports the formulation’s extended-release properties, as the concentrations of the active components have been synchronized, aiming to potentially maximize the synergism between the two compounds. In June 2022, we reported the successful completion of the “in-life” phase of its 90-day GLP toxicology study. In this study, the components of PrimeC, celecoxib and ciprofloxacin, were administered to rodents at doses 4x the maximal clinical dose. All animals appeared normal, with no significant findings observed. We intend to present the data from these studies to the FDA as part of PrimeC’s drug development plan.

We believe we have a strong patent estate, including patents on method of use, combination, and formulation. We have secured U.S. Patent 10,980,780 relating to methods for treatment of ALS using ciprofloxacin and celecoxib, the components of PrimeC, which expires in 2038. Equivalent patents also have been issued in the European Patent Office, Canada, Australia, Israel and Japan. The patent estate also includes US Patent Application 18/047,289, which relates to Prime C formulations. This application was allowed by the United States Patent and Trademark Office in June 2024, and once granted, will expire in October 2042. Equivalent applications are pending in many jurisdictions worldwide. We also expect to take advantage of orphan drug exclusivity for PrimeC, if approved, for seven years in the United States and ten years in the European Union. In addition, U.S. patent application 16/623,467, which relates to methods of treatment of neurodegenerative disease using combinations of ciprofloxacin and celecoxib, is currently pending. This patent application is expected to expire on June 20, 2038.

Our organization is built around a management team with extensive experience in the pharmaceutical industry, with a particular focus on ALS research and clinical trials. We believe that our leadership team is well-positioned to lead us through clinical development, regulatory approval and commercialization of our product candidates. Furthermore, we maintain steadfast and extensive communication and collaboration with patient advocacy groups and associations, underscoring the importance of patient perspectives in advancing therapeutic strategies.

In addition to PrimeC, we extended our pipeline and conducted research and development efforts for AD and PD, with a similar strategy of combined products. The following chart represents our current product development pipeline:

Recent Developments

April 2024 Registered Direct Offering

On April 10, 2024, we entered into a securities purchase agreement pursuant to which we issued and sold to an institutional purchaser in a registered direct offering, (i) an aggregate of 1,732,000 ordinary shares, at an offering price of $1.50 per share; and (ii) an aggregate of 1,248,000 pre-funded warrants, each representing the right to acquire one ordinary share at an offering price of $1.4999 per pre-funded warrant, for gross proceeds of approximately $4.47 million before deducting the placement agent fee and related offering expenses, which included in part the placement agent shares. Each pre-funded warrant represented the right to purchase one ordinary share at an exercise price of $0.0001 per share and were exercised in full. In a concurrent private placement, pursuant to the purchase agreement, we issued and sold to such purchaser warrants to purchase up to an aggregate of 2,980,000 ordinary shares, which are exercisable immediately upon issuance at an exercise price of $1.50 per ordinary share and will expire on the fifth anniversary of the original issuance date.

August 2024 Private Placement

On August 6, 2024, we entered into a securities purchase agreement with certain investors, which include members of our senior management and existing investors, pursuant to which we issued and sold in a private placement offering an aggregate of 800,000 ordinary shares and warrants to purchase an aggregate of 800,000 ordinary shares at a combined purchase price of $0.75 per share and warrant. Each warrant is exercisable immediately upon issuance at an exercise price of $0.75 per ordinary share and will expire on the fifth anniversary of the original issuance date.

August 2024 ATM

On August 16, 2024, we entered into a Capital on Demand™ Sales Agreement (the “Sales Agreement”) with JonesTrading Institutional Services LLC, as sales agent (the “Sales Agent”), pursuant to which we may offer and sell, from time to time, to or through the Sales Agent, ordinary shares having an aggregate offering price of up to gross sale proceeds of up to $2,524,437.

Standby Equity Purchase Agreement with YA

On October 31, 2024, we entered into the Standby Equity Purchase Agreement (“Standby Equity Purchase Agreement”) with YA II PN, LTD., a Cayman Islands exempt limited partnership (“YA”). Pursuant to the Standby Equity Purchase Agreement, the Company has the right, but not the obligation, to sell to YA from time to time (each such occurrence, an “Advance”) up to $30.0 million (the “Commitment Amount”) of our ordinary shares during the 36 months following the execution of the Purchase Agreement, subject to the restrictions and satisfaction of the conditions in the Standby Equity Purchase Agreement. At our option, the ordinary shares would be purchased by YA from time to time at a price equal to 97% of the lowest of the three daily VWAPs during a three consecutive trading day period commencing on the date that we, subject to certain limitations, deliver a notice to YA that the Company is committing Yorkville to purchase such ordinary shares (the “Advance Shares”). We may also specify a certain minimum acceptable price per share in each Advance. “VWAP” means, for any trading day, the daily volume weighted average price of our ordinary shares for such trading day on the Nasdaq Stock Market during regular trading hours as reported by Bloomberg L.P. As consideration for YA’s irrevocable commitment to purchase our ordinary shares up to the Commitment Amount, we issued 224,697 ordinary shares (the “Commitment Shares”) to YA and also paid a $25,000 structuring fee to YA.

Pursuant to the Standby Equity Purchase Agreement, YA shall not be obligated to purchase or acquire any ordinary shares under the Standby Equity Purchase Agreement which, when aggregated with all other ordinary shares beneficially owned by YA and its affiliates, would result in the beneficial ownership of YA and its affiliates (on an aggregated basis) to exceed 4.99% of the then outstanding voting power or number of our ordinary shares.

December 2024 Private Placement

On December 2, 2024, we entered into the Purchase Agreement with the selling shareholder and Alon Ben-Noon, the Company’s Chief Executive Officer pursuant to which we agreed to issue and sell, in a private placement (the “Offering”) by us directly to the purchasers (i) 2,343,729 Shares; (ii) Warrants exercisable for an aggregate of 8,000,000 ordinary shares at an exercise price of $1.25 per share; and (iii) Pre-Funded Warrants exercisable for an aggregate of 1,656,271 ordinary shares at an exercise price of $0.0001 per share. The purchase price of each Share and accompanying two Warrants was $1.25, and the purchase price of each Pre-Funded Warrant and accompanying two Warrants was $1.2499. The gross proceeds to us from the offering were $5.0 million, before deducting offering expenses payable by us.

The Warrants are exercisable immediately upon issuance at an exercise price of $1.25 per share and expire five years from the date of issuance. The Pre-Funded Warrants are exercisable immediately upon issuance at an exercise price of $0.0001 per share and may be exercised at any time until the pre-funded warrants are exercised in full. A holder of pre-funded warrants or Warrants (together with its affiliates) may not exercise any portion of such warrants to the extent that the holder would own more than 9.99% of our outstanding ordinary shares immediately after exercise.

Pursuant to the terms of the Purchase Agreement, on December 5, 2024 we issued to the purchasers the subscribed for Shares and Warrants, as applicable against payment for $2.8 million. On December 17, 2024, we received the remaining proceeds of $2.2 million.

Pursuant to the terms of the Purchase Agreement, we registered for resale on the registration statement on Form F-3 filed with the Securities Exchange Commission on December 6, 2024 (File No. 333-283656) (i) 2,200,000 Shares issued to the selling shareholder, (ii) up to 4,400,000 ordinary shares issuable to the selling shareholder upon exercise of the Warrants, and (iii) 4,400,000 Warrants issued to the selling shareholder, which are the securities attributable to the payment made by the selling shareholder to us on December 5, 2024.

Pursuant to the terms of the Purchase Agreement, we are registering for resale on this registration statement on Form F-3 (i) 103,729 Shares issued to the selling shareholder, (ii) up to 3,520,000 ordinary shares issuable to the selling shareholder upon exercise of the Ordinary Warrants (iii) 3,520,000 Ordinary Warrants issued to the selling shareholder, (iv) up to 1,656,271 ordinary shares, issuable to the selling shareholder upon exercise of the Pre-Funded Warrants and (v) 1,656,271 Pre-Funded Warrants issuable to the selling shareholder, which are the securities attributable to the payment made by the selling shareholder to us on December 17, 2024.

Nasdaq Non-Compliance

To continue to be listed on Nasdaq, we need to satisfy a number of conditions, including a minimum closing bid price per share of $1.00 for 30 consecutive business days and shareholders’ equity of at least $2.5 million. On June 21, 2024, we received a notification letter from Nasdaq that we had not regained compliance with Nasdaq’s Listing Rule 5550(b) (the “Minimum Equity Rule”) due to our stockholders’ equity falling below the required minimum of $2,500,000. We promptly requested a hearing before the Nasdaq Hearings Panel (the “Panel”), which was held on August 1, 2024, where we presented a comprehensive plan to regain compliance. On August 25, 2024, we received a written notice from Nasdaq that the Panel granted our request for an exception to continue its listing on Nasdaq until October 31, 2024. On November 11, 2024, we received a written notice from Nasdaq stating that the Panel had granted our request for continued listing on Nasdaq, subject to our filing a public disclosure on or before December 18, 2024, describing the transactions we had undertaken to achieve compliance and demonstrate long-term compliance with Minimum Equity Rule and providing an indication of our equity following those transactions and the provision of income projections to Nasdaq. This extension allowed us additional time to demonstrate compliance with the Minimum Equity Rule and meet the required conditions. On December 17, 2024, we filed a Current Report on Form 6-K where we stated that we as of such date, we believe we have shareholders’ equity of $3 million, which is above the $2.5 million required by the Minimum Equity Rule. We are currently awaiting Nasdaq’s confirmation that we have evidenced compliance with the Minimum Equity Rule and that the matter has been closed.

Separately, on August 26, 2024, we received a notification letter from Nasdaq notifying us that we are not in compliance with the minimum bid price requirement set forth in Nasdaq Listing Rules for continued listing on Nasdaq, since the closing bid price for the Company’s ordinary shares listed on Nasdaq was below $1.00 for 30 consecutive trading days. Nasdaq Listing Rule 5550(a)(2) requires listed securities to maintain a minimum bid price of $1.00 per share for 30 consecutive business days (the “Minimum Bid Price Rule”), and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days. In accordance with Listing Rule 5810(c)(3)(A), we had a period of 180 calendar days from the date of notification, or until February 24, 2025, to regain compliance with the Minimum Bid Price Rule. On September 23, 2024, Nasdaq notified us that we had regained compliance with the Minimum Bid Price Rule.

No assurance can be given that we will be able to regain compliance with either the Minimum Equity Rule or comply with the other standards that we are required to meet in order to maintain a listing on such exchange, and no assurance can be given that even if we regain compliance with the Minimum Equity Rule we will maintain sufficient shareholders’ equity, or alternatively that the price of the ordinary shares will not again be in violation of Nasdaq’s Minimum Bid Price Rule in the future. Our failure to meet these requirements may result in our securities being delisted from Nasdaq.

Corporate Information

Our legal and commercial name is NeuroSense Therapeutics Ltd. We were incorporated on February 13, 2017 and were registered as a private company limited by shares under the laws of the State of Israel. We completed our initial public offering on the Nasdaq in December 2021. Our ordinary shares and warrants to purchase our ordinary shares are traded on the Nasdaq under the symbol “NRSN” and “NRSNW,” respectively.

Our principal executive offices are located at 11 HaMenofim Street, Building B, Herzliya, 4672562 Israel, and our telephone number is +972-9-7996183. Our website address is www.neurosense-tx.com. The information on our website does not constitute a part of this prospectus. Our agent for service of process in the United States is Cogency Global Inc., 122 East 42nd Street, 18th Floor, New York, NY 10168.

Implications of Being an Emerging Growth Company

As a company with less than $1.235 billion in revenue during our last fiscal year, we are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we may take advantage of certain exemptions from various reporting requirements that are applicable to other publicly traded entities that are not emerging growth companies. These exemptions include:

| | ● | not being required to have our registered independent public accounting firm attest to management’s assessment of our internal control over financial reporting; |

| | ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (“PCAOB”), regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| | ● | not being required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency” and “say-on-golden parachutes”; |

| | ● | the audit reports of our independent registered public accounting firm do not require communication of critical audit matters; and |

| | ● | not being required to disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

As a result, the information contained in this prospectus and the documents incorporated by reference herein may be different from the information you receive from other public companies in which you hold shares. We may take advantage of these provisions for up until we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earliest to occur of: (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.235 billion; (ii) the date on which we have issued more than $1 billion in non-convertible debt securities during the previous three years; (iii) the date on which we are deemed to be a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act; or (iv) the last day of the fiscal year following the fifth anniversary of our initial public offering.

Implications of Being a Foreign Private Issuer

We are also a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| | ● | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| | ● | the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| | ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial statements and other specified information, and current reports on Form 8-K upon the occurrence of specified significant events. |

Notwithstanding these exemptions, we will file with the SEC, within four months after the end of each fiscal year, or such applicable time as required by the SEC, an Annual Report on Form 20-F containing financial statements audited by an independent registered public accounting firm.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents; (ii) more than 50% of our assets are located in the U.S.; or (iii) our business is administered principally in the U.S.

Both foreign private issuers and emerging growth companies also are exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer.

THE OFFERING

| Securities offered by the selling shareholder for resale | | (i) 103,729 Shares, (ii) 3,520,000 ordinary shares issuable upon exercise of Ordinary Warrants, (iii) 3,520,000 Ordinary Warrants, (iv) 1,656,271 ordinary shares, issuable upon exercise of Pre-Funded Warrants, (v) 1,656,271 Pre-Funded Warrants. |

| | | |

| Ordinary shares as of December 25, 2024 | | 23,228,941 ordinary shares. |

| | | |

| Use of proceeds | | All of the Shares, the Warrants, and the Warrant Shares offered by the selling shareholder for resale pursuant to this prospectus will be sold by the selling shareholder. We will not receive any proceeds from such sales. See the section titled “Use of Proceeds” in this prospectus for more information. However, to the extent the Warrants are exercised for cash, if at all, we will receive the exercise price of the Warrants. The exercise price of the Warrants may exceed the trading price of our ordinary shares. If the price of our ordinary shares is below $1.25, we believe that the holder of the Ordinary Warrants will be unlikely to exercise their Ordinary Warrants, resulting in little to no cash proceeds to us. If all the Warrants were exercised, we would receive gross proceeds of approximately $4.4 million. See the section titled “Use of Proceeds” in this prospectus for more information. |

| | | |

| Offering price | | The exercise price of the Ordinary Warrants is $1.25 per ordinary share and the exercise price of the Pre-Funded Warrants is $0.0001 per ordinary share. The Shares, the Warrants and the Warrant Shares offered by the selling shareholder under this prospectus may be offered and sold at prevailing market prices, negotiated prices or such other prices as the selling shareholder may determine. See the section titled “Plan of Distribution” in this prospectus for more information. |

| | | |

| Risk factors | | See the section titled “Risk Factors” beginning on page 8 and the other information included in this prospectus for a discussion of factors you should consider before deciding to invest in the Shares, the Warrants, the Warrant Shares, the Pre-Funded Warrants and PFW Shares. |

| | | |

| Listing | | Our ordinary shares and warrants to purchase ordinary shares are listed on The Nasdaq Capital Market under the symbols “NRSN” and “NRSNW, respectively.” |

Unless otherwise stated, all information in this prospectus, is based on 23,228,941 ordinary shares outstanding as of December 25, 2024, and does not include the following as of that date:

| | ● | 1,069,128 ordinary shares issuable upon the exercise of options outstanding, at a weighted average exercise price of $2.31 per share under our 2018 Employee Share Option Plan; |

| | ● | 200,000 ordinary shares issuable upon the vesting of restricted share units outstanding under our 2018 Share Incentive Plan; |

| | ● | 848,705 ordinary shares reserved for issuance and available for future grant under our 2018 Share Incentive Plan; |

| | ● | 8,535,000 ordinary shares underlying warrants with a weighted average exercise price of $2.37 per share; |

| | ● | 1,656,271 ordinary shares underlying Pre-Funded Warrants issued in the Offering; and |

| | ● | 8,000,000 ordinary shares underlying Warrants issued in the Offering. |

Except as otherwise indicated, all information in this prospectus assumes no exercise of any Pre-Funded Warrants or Warrants.

RISK FACTORS

You should carefully consider the risks described below and the risks described in our 2023 Annual Report, which are incorporated by reference herein, as well as the financial or other information included in this prospectus or incorporated by reference in this prospectus, including our consolidated financial statements and the related notes, before you decide to buy our securities. The risks and uncertainties described below are not the only risks facing us. We may face additional risks and uncertainties not currently known to us or that we currently deem to be immaterial. Any of the risks described below, and any such additional risks, could materially adversely affect our business, financial condition or results of operations. In such case, you may lose all or part of your original investment. The discussion of risks includes or refers to forward-looking statements; you should read the explanation of the qualifications and limitations on such forward-looking statements discussed elsewhere in this prospectus supplement under the caption “Cautionary Statement Regarding Forward-Looking Statements” above.

Risks Related to this Offering

If we fail to maintain compliance with NASDAQ’s continued listing requirements, our shares may be delisted from the NASDAQ Capital Market.

To continue to be listed on Nasdaq, we need to satisfy a number of conditions, including the Minimum Bid Price Rule and the Minimum Equity Rule. On June 21, 2024, we received a notification letter from Nasdaq that we had not regained compliance with the Minimum Equity Rule due to our stockholders’ equity falling below the required minimum of $2,500,000. We promptly requested a hearing before the Panel, which was held on August 1, 2024, where we presented a comprehensive plan to regain compliance. On August 25, 2024, we received a written notice from Nasdaq that the Panel granted our request for an exception to continue its listing on Nasdaq until October 31, 2024. On November 11, 2024, we received a written notice from Nasdaq, stating that the Panel had granted our request for continued listing on Nasdaq, subject to our filing a public disclosure on or before December 18, 2024, describing the transactions we had undertaken to achieve compliance and demonstrate long-term compliance with Minimum Equity Rule and providing an indication of our equity following those transactions and the provision of income projections to Nasdaq. This extension allowed us additional time to demonstrate compliance with the Minimum Equity Rule and meet the required conditions. On December 17, 2024, we filed a Current Report on Form 6-K where we stated that we as of such date, we believe we have shareholders’ equity of $3 million, which is above the $2.5 million required by the Minimum Equity Rule. We are currently awaiting Nasdaq’s confirmation that we have evidenced compliance with the Minimum Equity Rule and that the matter has been closed.

No assurance can be given that we will be able to regain compliance with the Minimum Equity Rule or comply with the other standards that we are required to meet in order to maintain a listing on such exchange, such as the Minimum Bid Price Rule, and no assurance can be given that even if we regain compliance with the Minimum Equity Rule we will maintain sufficient shareholders’ equity or the price of the ordinary shares will not again be in violation of Nasdaq’s Minimum Bid Price Rule in the future. Our failure to meet these requirements may result in our securities being delisted from Nasdaq.

If the ordinary shares are delisted from Nasdaq, we may seek to list them on other markets or exchanges or the ordinary shares may trade on the pink sheets. In the event of such delisting, our shareholders’ ability to trade, or obtain quotations of the market value of, our ordinary shares would be severely limited because of lower trading volumes and transaction delays. These factors could contribute to lower prices and larger spreads in the bid and ask prices for our securities. In addition, the substantially decreased trading in the ordinary shares and decreased market liquidity of the ordinary shares as a result of the loss of market efficiencies associated with Nasdaq and the loss of federal preemption of state securities laws, which could materially adversely affect our ability to obtain financing on acceptable terms, if at all, and may result in the potential loss of confidence by investors, suppliers, customers and employees and fewer business development opportunities. Additionally, the market price of the ordinary shares may decline further and shareholders may lose some or all of their investment. There can be no assurance that the ordinary shares, if delisted from Nasdaq in the future, would be listed on another national or international securities exchange or on a national quotation service, the Over-The-Counter Markets or the pink sheets.

The sale of a substantial amount of our ordinary shares or ordinary shares, including resale of the shares held by the selling shareholder in the public market could adversely affect the prevailing market price of our ordinary shares.

Sales of substantial amounts of shares of our ordinary shares or ordinary shares in the public market, or the perception that such sales might occur, could adversely affect the market price of our ordinary shares, and the market value of our other securities. We cannot predict if and when the selling shareholder may sell such shares in the public markets. Furthermore, in the future, we may issue additional ordinary shares or ordinary shares or other equity or debt securities convertible into ordinary shares or ordinary shares. Any such issuance could result in substantial dilution to our existing shareholders and could cause our share price to decline.

The price of our ordinary shares may be volatile.

The market price of our ordinary shares has fluctuated in the past. Consequently, the current market price of our ordinary shares may not be indicative of future market prices, and we may be unable to sustain or increase the value of your investment in our ordinary shares.

There is no guarantee that the Ordinary Warrants will be in the money, and they may expire worthless.

The exercise price of the Ordinary Warrants is $1.25 per ordinary share, subject to adjustment. The exercise price of the Ordinary Warrants has at times exceeded the market price of our ordinary shares. To the extent the price of our ordinary shares remains below $1.25, we believe that holders of the Ordinary Warrants will be unlikely to exercise their warrants, resulting in little to no cash proceeds to us. There is no guarantee the exercise price of the Ordinary Warrants will ever exceed the market price of our ordinary shares in the future and, as such, the Ordinary Warrants may expire worthless.

We do not intend to apply for any listing of the Warrants on any exchange or nationally recognized trading system, and we do not expect a market to develop for the Warrants.

We do not intend to apply for any listing of the Warrants on Nasdaq or any other securities exchange or nationally recognized trading system, and we do not expect a market to develop for the Warrants. Without an active market, the liquidity of the Warrants will be limited. Further, the existence of the Warrants may act to reduce both the trading volume and the trading price of our ordinary shares.

Holders of Warrants will have no rights as shareholders of ordinary shares until such holders exercise their Warrants and acquire ordinary shares.

The Warrants do not confer any rights of ordinary share ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire ordinary shares at a fixed price. A holder of (i) a Pre-Funded Warrant may exercise the right to acquire an ordinary share and pay an exercise price of $0.0001 at any time; and (ii) an Ordinary Warrant may exercise the right to acquire an ordinary share and pay an exercise price of $1.25 at any time. Upon exercise of any of the Warrants, the holders thereof will be entitled to exercise the rights of a holder of our ordinary shares only as to matters for which the record date occurs after the exercise date.

We conduct some of our operations in Israel. Conditions in Israel, including the recent attack by Hamas and other terrorist organizations from the Gaza Strip and Israel’s war against them, may affect our operations.

Our corporate headquarters is located in Herzliya, Israel. Because we are incorporated under the laws of the State of Israel, and most of our officers and fourteen out of sixteen of our employees are residents of Israel, our business and operations are directly affected by economic, political, geopolitical and military conditions in Israel. Since the establishment of the State of Israel in 1948, a number of armed conflicts have occurred between Israel and its neighboring countries and terrorist organizations active in the region. These conflicts have involved missile strikes, hostile infiltrations and terrorism against civilian targets in various parts of Israel, which have negatively affected business conditions in Israel.

In October 2023, Hamas terrorists infiltrated Israel’s southern border from the Gaza Strip and conducted a series of attacks on civilian and military targets. Hamas also launched extensive rocket attacks on Israeli population and industrial centers located along Israel’s border with the Gaza Strip and in other areas within the State of Israel. These attacks resulted in thousands of deaths and injuries, and Hamas additionally kidnapped many Israeli civilians and soldiers. Following the attack, Israel’s security cabinet declared war against Hamas and a military campaign against these terrorist organizations commenced in parallel to their continued rocket and terror attacks. In parallel, border clashes between Israel and the Hezbollah terrorist group on Israel’s northern border with Lebanon intensified and may escalate into a greater regional conflict.

In addition, since the commencement of these events, there have been continued hostilities along Israel’s northern border with Lebanon (with the Hezbollah terror organization) and on other fronts from various extremist groups in region, such as the Houthis in Yemen and various rebel militia groups in Syria and Iraq. In addition, in April 2024 and October 2024, Iran (in concert with other regional actors) launched direct attacks on Israel involving hundreds of drones and missiles and has threatened to continue to attack Israel and is widely believed to be developing nuclear weapons. Such attacks may continue due to continuing tensions in the region. Iran is also believed to have a strong influence among extremist groups in the region, such as Hamas in Gaza, Hezbollah in Lebanon, the Houthi movement in Yemen and various rebel militia groups in Syria and Iraq. These situations may potentially escalate in the future to more violent events which may affect Israel and us. Additionally, Yemeni rebel group, the Houthis, launched series of attacks on global shipping routes in the Red Sea, causing disruptions of supply chain. These geopolitical developments may adversely affect our ability to continue carrying out various administrative, research, operational and commercial functions and activities both in Israel and globally.

Any hostilities, armed conflicts, terrorist activities involving Israel or the interruption or curtailment of trade between Israel and its trading partners, or any political instability in the region could directly or indirectly adversely affect business conditions and our results of operations and could make it more difficult for us to raise capital and could adversely affect the market price of our ordinary share. An escalation of tensions or violence might result in a significant downturn in the economic or financial condition of Israel, which could have a material adverse effect on our operations in Israel and our business. Parties with whom we do business have sometimes declined to travel to Israel during periods of heightened unrest or tension, forcing us to make alternative arrangements when necessary in order to meet our business partners face to face. In addition, the political and security situation in Israel may result in parties with whom we have agreements involving performance in Israel claiming that they are not obligated to perform their commitments under those agreements pursuant to force majeure provisions in such agreements.

The Israel Defense Force, or IDF, the national military of Israel, is a conscripted military service, subject to certain exceptions. Since October 7, 2023, the IDF has called up several hundred thousand of its reserve forces to serve. Fourteen out of our current 16 employees are resident in Israel. Three of our five executive officers and the 11 other non-management employees of the Company reside in Israel. Currently none of our executive officers nor non-management employees have been called up to perform reserve military service; however, some employees may be called for service in the current or future wars or other armed conflicts with Hamas, Hezbollah or other regional threat actors, and such persons may be absent for an extended period of time. As a result, our operations in Israel may be disrupted by such absences, which disruption may materially and adversely affect our business, prospects, financial condition and results of operations.

Since the war broke out on October 7, 2023, our operations have not been adversely affected by this situation, and we have not experienced disruptions to our clinical studies. As such, our clinical and business development activities remain on track. However, the intensity and duration of Israel’s current war against Hamas and Hezbollah is difficult to predict at this stage, as are such war’s economic implications on our business and operations and on Israel’s economy in general. If the war extends for a long period of time or expands to other fronts, such as Iran, Lebanon, Syria and the West Bank, our operations may be adversely affected.

All of our clinical and pre-clinical research and development is currently being conducted outside of Israel, other than our 12-month open label-extension, or OLE, study of the PARADIGM trial, partially conducted in Tel Aviv, and a planned Phase 2 trial with PrimeC for AD that we plan to conduct in Haifa, Israel. The OLE has not been affected by the war, although the quality of the study may be adversely affected if as a result of the war patients are unable to visit the study center or the study coordinator is not able to conduct home visits and monitor the patients. In addition, in the event of a significant escalation of hostilities in northern Israel, there may be a delay in the planned AD trial. We do not believe the planned AD trial will be materially affected by the war and do not anticipate that any such delay as a result of the war would have a material impact on us. We may also elect to set up a site in Israel for a Phase 3 pivotal ALS trial of PrimeC, but this would be in addition to numerous other sites in Europe and the United States, and as a result we do not expect the timeline or quality of this trial to be adversely affected by the war. Our manufacturing is conducted in India. We do not currently anticipate any disruption to the supply chain relevant to our ongoing clinical trials and believe there are alternative sources of supply from whom we could obtain the necessary finished drug product to conduct our clinical trials. In addition, we believe we have sufficient finished product in inventory to continue our ongoing clinical trials for at least the next few months.

Our commercial insurance does not cover losses that may occur as a result of an event associated with the security situation in the Middle East. Although the Israeli government is currently committed to covering the reinstatement value of direct damages that are caused by terrorist attacks or acts of war, there can be no assurance that this government coverage will be maintained, or if maintained, will be sufficient to compensate us fully for damages incurred. Any losses or damages incurred by us could have a material adverse effect on our business, financial condition and results of operations.

Finally, political conditions within Israel may affect our operations. Israel has held five general elections between 2019 and 2022, and prior to October 2023, the Israeli government pursued extensive changes to Israel’s judicial system, which sparked extensive political debate and unrest. To date, these initiatives have been substantially put on hold. Actual or perceived political instability in Israel or any negative changes in the political environment, may individually or in the aggregate adversely affect the Israeli economy and, in turn, our business, financial condition, results of operations and growth prospects.

THE PRIVATE PLACEMENT

On December 2, 2024, we entered into the Purchase Agreement with the selling shareholder and Alon Ben-Noon, the Company’s Chief Executive Officer pursuant to which we agreed to issue and sell, in a private placement by us directly to the purchasers (i) 2,343,729 Shares; (ii) Warrants exercisable for an aggregate of 8,000,000 ordinary shares at an exercise price of $1.25 per share; and (iii) Pre-Funded Warrants exercisable for an aggregate of 1,656,271 ordinary shares at an exercise price of $0.0001 per share. The purchase price of each Share and accompanying two Warrants was $1.25, and the purchase price of each Pre-Funded Warrant and accompanying two Warrants was $1.2499. The gross proceeds to us from the offering are expected were $5.0 million, before deducting offering expenses payable by us.

The Warrants are exercisable immediately upon issuance at an exercise price of $1.25 per share and expire five years from the date of issuance. The Pre-Funded Warrants are exercisable immediately upon issuance at an exercise price of $0.0001 per share and may be exercised at any time until the pre-funded warrants are exercised in full. A holder of pre-funded warrants or Warrants (together with its affiliates) may not exercise any portion of such warrants to the extent that the holder would own more than 9.99% of our outstanding ordinary shares immediately after exercise.

Pursuant to the terms of the Purchase Agreement, on December 5, 2024 we issued to the purchasers the subscribed for Shares and Warrants, as applicable against payment for $2.8 million. On December 17, 2024, we received the remaining proceeds of $2.2 million.

Pursuant to the terms of the Purchase Agreement, we registered for resale on the registration statement on Form F-3 filed with the Securities Exchange Commission on December 6, 2024 (File No. 333-283656) (i) 2,200,000 Shares issued to the selling shareholder, (ii) up to 4,400,000 ordinary shares issuable to the selling shareholder upon exercise of the Warrants, and (iii) 4,400,000 Warrants issued to the selling shareholder, which are the securities attributable to the payment made by the selling shareholder to us on December 5, 2024.

Pursuant to the terms of the Purchase Agreement, we are registering for resale on this registration statement on Form F-3 (i) 103,729 Shares issued to the selling shareholder, (ii) up to 3,520,000 ordinary shares issuable to the selling shareholder upon exercise of the Warrants (iii) 3,520,000 Warrants issued to the selling shareholder, (iv) up to 1,656,271 ordinary shares, issuable to the selling shareholder upon exercise of the Pre-Funded Warrants and (v) 1,656,271 Pre-Funded Warrants issuable to the selling shareholder, which are the securities attributable to the payment made by the selling shareholder to us on December 17, 2024.

USE OF PROCEEDS

All of the Shares, the Warrants, and the Warrant Shares offered by the selling shareholder for resale pursuant to this prospectus will be sold by the selling shareholder. We will not receive any of the proceeds from such sales. The selling shareholder will receive all of the proceeds from any sales of the Shares, the Warrants, and the Warrant Shares offered hereby. However, we will incur expenses in connection with the registration of the Shares, the Warrants, and the Warrant Shares offered hereby.

We will receive the exercise price upon any exercise of the Warrants, to the extent exercised on a cash basis. If all of the Warrants were exercised, we would receive gross proceeds of approximately $4.4 million. However, the holders of the Warrants are not obligated to exercise the Warrants, and we cannot predict whether or when, if ever, the holders of the Warrants will choose to exercise the Warrants, in whole or in part. The exercise price of the Ordinary Warrants may exceed the trading price of our ordinary shares. If the price of our ordinary shares is below $1.25, we believe that holder of the Ordinary Warrants will be unlikely to exercise its warrants, resulting in little to no cash proceeds to us. Accordingly, we currently intend to use the proceeds received upon such exercise, if any, to advance the clinical development of our lead product candidate, PrimeC for ALS, for the clinical development and preclinical and clinical research and development in support of potential investigational new drug applications for Alzheimer’s disease, for Parkinson’s disease and for other indications, for future research and development of new product candidates and for working capital and general corporate purposes.

MARKET FOR ORDINARY SHARES AND DIVIDEND POLICY

Our ordinary shares are traded on the Nasdaq Capital Market under the symbol “NRSN.” The last reported sale price of our ordinary shares on December 24, 2024 on the Nasdaq Capital Market was $1.28 per share. We do not plan on applying to list the Warrants on any exchange or nationally recognized trading system.

We have never declared or paid any cash dividends on our ordinary shares, and we anticipate that, for the foreseeable future, we will retain any future earnings to support operations and to finance the growth and development of our business. Therefore, we do not expect to pay cash dividends for at least the next several years.

The distribution of dividends may also be limited by the Israeli Companies Law, 5759-1999 (the “Companies Law”), which permits the distribution of dividends only out of retained earnings or earnings derived over the two most recent fiscal years, whichever is higher, provided that there is no reasonable concern that payment of a dividend will prevent a company from satisfying its existing and foreseeable obligations as they become due. As of December 31, 2023, we did not have distributable earnings pursuant to the Companies Law. Dividend distributions may be determined by our board of directors, as our amended and restated articles of association do not provide that such distributions require shareholder approval.

CAPITALIZATION

The table below sets forth our total capitalization:

| | ● | on an actual basis as of September 30, 2024; and |

| | ● | on a pro forma basis, giving effect to (i) the issuance of 66,000 ordinary shares as a result of vested RSUs; (ii) the issuance of 224,697 ordinary shares as Commitment Shares to YA pursuant to the Standby Equity Purchase Agreement; (iii) the sale of an aggregate of 785,606 ordinary shares at an average price of $1.21 per ordinary share, for aggregate gross proceeds of $949,327 (net proceeds of approximately $921,821 thousand, after deducting sales agent fees); (iv) the issuance and sale of (A) 2,343,729 ordinary shares, (B) 8,000,000 Warrants and (C) 1,656,271 Pre-Funded Warrants at a combined purchase price of $1.25 per ordinary share and accompanying Warrants and $1.2499 per Pre-Funded Warrant and accompanying Warrants for aggregate net proceeds of $4,936,000, after deducting estimated offering expenses payable by us, and (v) the irrevocable waiver of our officers of their right to future payment of certain and potential annual bonuses, as if such events had occurred on September 30, 2024. |

“The amounts shown below are unaudited, represent management’s estimate, and their accounting treatment has not been completed.”

The following table should be read in conjunction with “Use of Proceeds,” our financial statements and related notes that are incorporated by reference into this prospectus and the other financial information included or incorporated by reference into this prospectus. Our historical results do not necessarily indicate our expected results for any future periods.

| As of September 30, 2024 |

| (unaudited) | | Actual

(in thousands) | | | Pro Forma

(in thousands) | |

| Cash | | $ | 344 | | | $ | 6,201 | |

| Long term liabilities | | | 19 | | | | 19 | |

| Shareholders’ equity: | | | | | | | | |

| Ordinary shares, no par value per share | | | — | | | | — | |

| Share premium and capital reserve | | | 31,712 | | | | 37,569 | |

| Accumulated deficit | | | (34,530 | ) | | | (33,232 | ) |

| Total shareholders’ equity | | | (2,818 | ) | | | 4,337 | |

| | | | | | | | | |

| Total capitalization | | $ | (2,799 | ) | | $ | 4,356 | |

The table above is based on 19,808,909 ordinary shares issued and outstanding as of September 30, 2024. This number excludes:

| | ● | 1,069,128 ordinary shares issuable upon the exercise of options outstanding, at a weighted average exercise price of $2.31 per share under our 2018 Employee Share Option Plan; |

| | ● | 266,000 ordinary shares issuable upon the vesting of restricted share units outstanding, some of which are under our 2018 Share Incentive Plan; |

| | ● | 848,705 ordinary shares reserved for issuance and available for future grant under our 2018 Share Incentive Plan; |

| | ● | 8,535,000 ordinary shares underlying warrants with a weighted average exercise price of $2.38 per share; |

| | ● | 1,010,303 ordinary shares issued pursuant to the Sales Agreement and Standby Equity Purchase Agreement; |

| | ● | 2,343,729 ordinary shares issued in the Offering; |

| | ● | 1,656,271 ordinary shares underlying Pre-Funded Warrants issued in the Offering; and |

| | ● | 8,000,000 ordinary shares underlying Warrants issued in the Offering. |

Except as otherwise indicated, all information in this prospectus assumes no exercise of any Pre-Funded Warrants or Warrants.

SELLING SHAREHOLDER

The ordinary shares being offered by the selling shareholder pursuant to this prospectus are those issuable to such selling shareholder, including without limitation upon exercise of the Warrants. For additional information regarding the issuance of the Warrants, see “The Private Placement” above. We are registering the Shares, the Warrants, and the Warrant Shares in order to permit the selling shareholder to offer the Shares, the Warrants, and the Warrant Shares for resale from time to time. To our knowledge, the selling shareholder has not had any material relationship with us or our affiliates within the past three years. Our knowledge is based on information provided by the selling shareholder in connection with the filing of this prospectus.

The table below lists the selling shareholder and other information regarding the beneficial ownership of the Shares, the Warrants, and the Warrant Shares, by the selling shareholder. The second column lists the number of our ordinary shares beneficially owned by the selling shareholder, based on its ownership of our ordinary shares, as of December 25, 2024, and assuming exercise of all of the Warrants held by the selling shareholder on that date, without regard to any limitations on exercises. The third column lists the maximum number of our ordinary shares that may be sold or otherwise disposed of by the selling shareholder pursuant to the registration statement of which this prospectus forms a part. The selling shareholder may sell or otherwise dispose of some, all or none of their Shares, the Warrants, and the Warrant Shares in this offering. Pursuant to the rules of the SEC, beneficial ownership includes any of the ordinary shares as to which a shareholder has sole or shared voting power or investment power, as well as any ordinary shares that a selling shareholder has the right to acquire within 60 days of December 25, 2024. The percentage of beneficial ownership for the selling shareholder is based on 23,228,941 ordinary shares outstanding as of December 25, 2024 and the number of ordinary shares issuable upon exercise or conversion of convertible securities that are currently exercisable or convertible or are exercisable or convertible within 60 days of December 25, 2024 beneficially owned by the applicable selling shareholder. The fourth and eighth columns assumes the sale of all of the Shares, the Warrants, and the Warrant Shares, offered by the selling shareholder pursuant to this prospectus.

| Name of Selling Shareholder | | Ordinary

Shares

Beneficially

Owned Prior

to the

Offering(1) | | | Percentage of

Outstanding

Ordinary

Shares(1) | | | Maximum Number of Ordinary Shares To Be Sold Pursuant to this Prospectus | | | Number of Ordinary Shares Beneficially Owned

After the

Offering(2) | | | Percentage of

Outstanding

Ordinary

Shares after the

Offering(2) | | | Warrants

Beneficially

Owned

Prior to the

Offering | | | Percentage of

Outstanding

Warrants | | | Maximum

Number of

Warrants To Be Sold

Pursuant

to this Prospectus | | | Number of Warrants Beneficially Owned

After the

Offering | | | Percentage of

Outstanding

Warrants after the

Offering | |

| Rimon Gold Assets, Ltd.(3) | | | 11,880,000 | (4) | | | 36.21 | % | | | 5,280,000 | (5) | | | 6,660,000 | (6) | | | 20.12 | % | | | 9,576,271 | (7) | | | 100 | % | | | 5,176,271 | (8) | | | 4,400,000 | (9) | | | 45.9 | % |

| (1) | Assumes that (i) all of the Warrants covered by the registration statement of which this prospectus is a part are exercised in this offering, and (ii) the selling shareholder does not acquire additional warrants. |

| (2) | Assumes that (i) all of the Shares covered by the registration statement of which this prospectus is a part are sold in this offering and (ii) the selling shareholder does not acquire additional ordinary shares after the date of this prospectus and prior to completion of this offering. The number and percentage of ordinary shares listed do not take into account any limitations on exercise of warrants preventing the selling shareholder from exercising any portion of such warrants if such exercise would result in the selling shareholder owning greater than 9.99% of the outstanding ordinary shares following such exercise. |

| (3) | The securities are directly held by Rimon Gold Assets, Ltd., an Israeli private company (“Rimon Gold”) wholly owned by the Goldfinger Trust (the “Trust”), whose trustee is Abir Raveh (the “Trustee”) and whose beneficiary is Yair Goldfinger. The Trust directs the management of Rimon Gold, its investment and voting decisions and the Trustee directs the management of the Trust, its investment and voting decisions. The address of Rimon Gold is Raveh Ravid & Co. 32A Habarzel Street, Tel Aviv, Israel. The pre-funded warrants and Warrants are subject to a beneficial ownership limitation of 9.99%, which such limitation restricts the selling shareholder from exercising that portion of the pre-funded warrants and warrants that would result in the selling stockholder and its affiliates owning, after exercise, a number of ordinary shares in excess of the beneficial ownership limitation. The number of ordinary shares set forth in the above table does not reflect the application of this limitation. |

| | |

| (4) | Consists of (i) 2,303,729 ordinary shares, (ii) 1,656,271 ordinary shares issuable upon exercise of Pre-Funded warrants, and (iii) 7,920,000 ordinary shares issuable upon exercise of Ordinary Warrants. |

| | |

| (5) | Consists of (i) 103,729 ordinary shares, (ii) 1,656,271 ordinary shares issuable upon exercise of Pre-Funded Warrants, and (iii) 3,520,000 ordinary shares issuable upon exercise of Ordinary Warrants. |

| | |

| (6) | Consists of (i) 2,200,000 ordinary shares, and (ii) 4,400,000 ordinary shares issuable upon exercise of Ordinary Warrants. |

| | |

| (7) | Consists of (i) 1,656,271 ordinary shares issuable upon exercise of Pre-Funded Warrants, and (ii) 7,920,000 ordinary shares issuable upon exercise of Ordinary Warrants. |

| | |

| (8) | Consists of (i) 1,656,271 ordinary shares issuable upon exercise of Pre-Funded Warrants, and (ii) 3,520,000 ordinary shares issuable upon exercise of Ordinary Warrants. |

| | |

| (9) | Consists of 4,400,000 ordinary shares issuable upon exercise of Ordinary Warrants. |

PLAN OF DISTRIBUTION

The selling shareholder and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on the Nasdaq Capital Market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A selling shareholder may use any one or more of the following methods when selling securities:

| | ● | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| | ● | block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| | ● | purchases by a broker-dealer as principal and the subsequent resale by the broker-dealer for its account; |

| | ● | an exchange distribution in accordance with the rules of the applicable exchange; |

| | ● | an over-the-counter distribution in accordance with the rules of Nasdaq; |