ARHAUS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2020 and 2019

deems advisable. Total expenses recorded in selling, general and administrative expenses on the consolidated statements of comprehensive income related to the plan were $0.5 million and $1.1 million for 2020 and 2019, respectively.

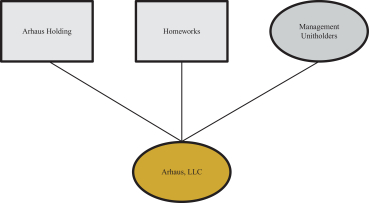

8. Members’ Deficit

At December 31, 2013, Arhaus had 20,938,265 Class A member units and 7,488,248 Class B member units authorized, issued and outstanding. Per the limited liability company operating agreement in existence at December 31, 2013, all Company decisions and actions were to be decided by Holdings in its sole discretion.

In connection with Holdings’ sale of all Class B units to a private equity investor in January 2014, the members of Arhaus amended and restated the LLC operating agreement. The restated LLC operating agreement (the “2014 Operating Agreement”) authorized a total of 32,213,730 units for issuance, consisting of 20,938,265 Class A units, 7,488,248 Class B units, 3,197,909 Class C units, 481,590 Class D units and 107,718 Class E units. In May 2015, the Company approved the increase of Class D units authorized for issuance to 1,500,000.

In September 2016, the members of the Company amended and restated the 2014 Operating Agreement. The amended and restated agreement (the “2016 Operating Agreement”), among others things, eliminated Class E units, and added Class 1 and Class 2 Percentage Units.

The Class C, D, E, and Percentage Units were incentive units to be issued to employees, directors, and others pursuant to the terms of the Arhaus, LLC 2014 Equity Plan, and have no voting rights and do not participate in profits or losses.

In connection with the issuance of the Prior Credit Facilities discussed in Note 5, the Class A and Class B unit equity holders made an aggregate $25.0 million capital contribution to the Company in exchange for 1,250,000 Class A Preferred units and 1,250,000 Class B Preferred Units, respectively (collectively, the “Preferred Units”). The Preferred Units were issued pursuant to the Third Amended and Restated Limited Liability Company Agreement of the Company dated June 26, 2017 (the “2017 LLC Agreement”), and accrue a 16% per annum (compounded annually) preferred return. The Preferred Units have no voting rights and do not participate in profits or losses. Preferred Unit holders are entitled to receive distributions in excess of tax distributions to Class A and B members in proportion to the accrued and unpaid preferred return and unreturned capital contributions. Further, preferred unit holders are entitled to receive proceeds upon a capital transaction before other unit holders in proportion to the accrued and unpaid preferred return and unreturned capital contributions. The Company can redeem the Preferred Units at our discretion, however, because the Preferred Unit holders control the Board and could force the Company to redeem the Preferred Units they are recorded as mezzanine equity.

The accumulated 16% preferred return was $11.4 million at December 31, 2019. On December 29, 2020, the Preferred Units were repaid in full, with the preferred return dividend payments of $17.1 million.

Among other things, the 2017 LLC Agreement authorized the Company to issue up to 20,938,265 Class A Units, 7,488,248 Class B Units, 3,185,435 Class C Units, 285,387 Class D Units, 3,158,501 Class F Units, 3,158,501 Class F-1 Units, 1,250,000 Class A Preferred Units, 1,250,000 Class B Preferred Units, one Class 1 Percentage Unit, and one Class 2 Percentage Unit. Only the Class A and Class B Units have voting rights. Distributions are payable to the various unit classes only upon the occurrence of certain capital events, based upon participation thresholds and waterfalls as defined within the 2017 LLC Agreement.

F-24