We will face certain challenges in implementing our business strategy including, among others, the fact that earlier development of THIO was not commercially pursued. Even if THIO successfully advances through clinical studies and towards approval for use, we may face early competition from generic alternatives after expiration of any applicable regulatory exclusivities. The FDA’s accelerated approval pathway, even if initially granted, does not guarantee an accelerated review or marketing approval by the FDA.

Our Intellectual Property

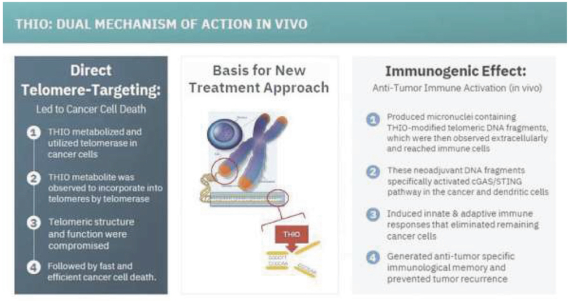

Our global patent and patent-pending estate covers several areas. Telomerase mediated telomere altering compounds and treatment of therapy-resistant cancers are part of our portfolio. Further, THIO’s immunogenic treatment strategy, which focuses on sequential combination with checkpoint inhibitors has been filed. We maintain five (5) issued patents and have twenty-nine (29) pending applications.

Recent Developments

November 2023 Offering of Common Stock and Warrants

On November 17, 2023, we sold to three institutional investors, in a registered direct offering priced at-the-market under the rules of NYSE American (the “Registered Offering”), 2,424,243 shares (the “Shares”) of our common stock, at a price per Share of $1.65, for gross proceeds of approximately $4 million, before deducting placement agent fees and related offering expenses. The Shares were offered and sold pursuant to the Company’s effective registration statement on Form S-3 (Form No. 333-273984), which was declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on August 23, 2023, and the base prospectus and prospectus supplement included therein. H.C. Wainwright & Co., LLC (“Wainwright”) served as placement agent for the Registered Offering.

In a concurrent private placement, pursuant to the terms of the Purchase Agreement, the Company also agreed to issue and sell unregistered warrants (the “Warrants”) to purchase up to 2,424,243 shares of Common Stock, at an offering price of $1.65 per Warrant to purchase one share of Common Stock (the “Private Placement” and, together with the Registered Offering, the “Offering”) (which offering price is included in the purchase price per Share). The Warrants have an exercise price of $1.86 per share (subject to customary adjustments as set forth in the Warrants), are exercisable six months following issuance and will have a term of five years from the initial exercise date. The Warrants contain customary anti-dilution adjustments to the exercise price, including for share splits, share dividends, rights offerings and pro rata distributions.

Concurrently with the closing of the Offering we also issued to Wainwright (or its designees) warrants to purchase up to 169,697 shares of Common Stock (the “Wainwright Warrants”). The Wainwright Warrants have substantially the same terms as the Warrants, except that the Wainwright Warrants will expire five years from the commencement of the sales of the Offering and have an exercise price of $2.0625 per share (subject to customary adjustment as set forth in the Wainwright Warrants), representing 125% of the purchase price per Share in the Registered Offering.

Termination of ATM Sales Agreement

On November 15, 2023, the Company suspended sales of Common Stock pursuant to that certain Sales Agreement, dated as of September 1, 2023 (the “Sales Agreement”), between the Company and ThinkEquity LLC (the “ThinkEquity”), the Company’s sales agent thereunder, and provided notice to ThinkEquity that it is terminating the Sales Agreement, which termination became effective 10 days after November 15, 2023, or on November 25, 2023, in accordance with the terms of the Sales Agreement. In accordance with the terms of the Sales Agreement, the Company was initially authorized to offer and sell shares of Common Stock having an aggregate offering price of up to up to $7,000,000 from time to time through the ThinkEquity, in an “at the market” equity offering