Year ended December 31, 2021 compared to year ended December 31, 2020

Revenues

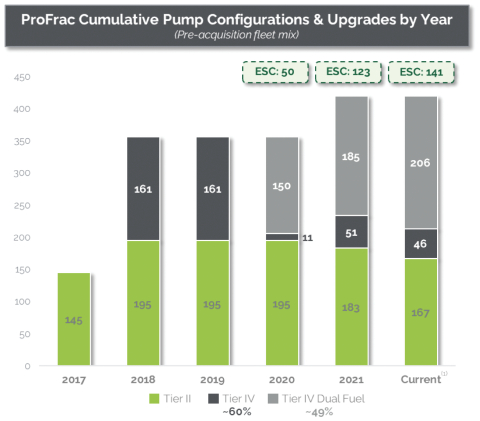

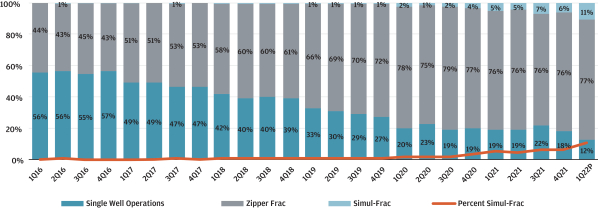

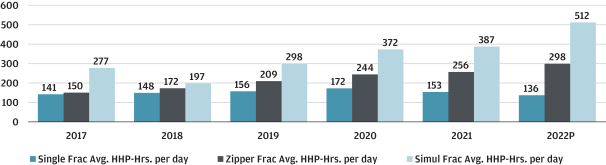

Revenues—Stimulation services. Stimulation services revenues increased 38%, or $207.1 million, to $745.4 million for the year ended December 31, 2021, from $538.3 million for the year ended December 31, 2020. The increase was primarily attributable to strong recovery from the COVID-19 pandemic resulting in an increase in customer activity for our stimulation services. We increased pumping hours 31% for the year ended December 31, 2021, versus the year ended December 31, 2020. Our average marketed active fleet count increased 27% to 14 for the year ended December 31, 2021, from 11 in the year ended December 31, 2020. We define a marketed fleet as 50,000 hydraulic horsepower, three blenders, high pressure iron, one hydration unit, one data van, suction hoses, a manifold system and other ancillary equipment as needed.

Revenues—Manufacturing. Manufacturing revenues increased 65%, or $30.1 million, to $76.4 million for the year ended December 31, 2021, from $46.2 million for the year ended December 31, 2020. The increase was primarily attributable to an increase in demand for our products due to an increase in commodity prices, demand for manufactured components utilized in the oilfield service industry, and the acquisition of a majority stake in EKU. For the years ended December 31, 2021 and 2020, intersegment revenues accounted for 92% and 97% of manufacturing revenues, respectively.

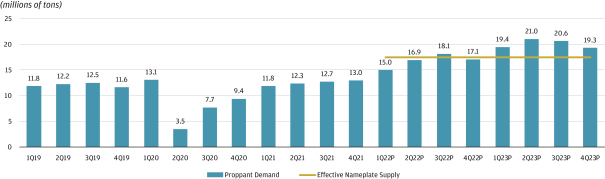

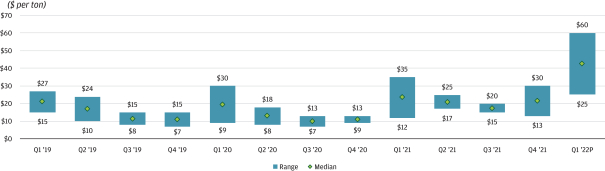

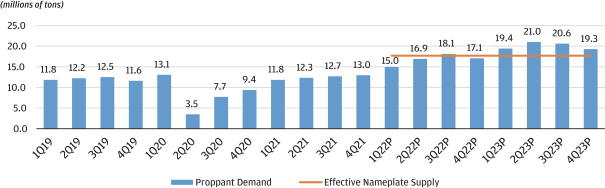

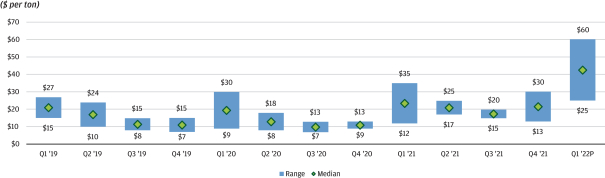

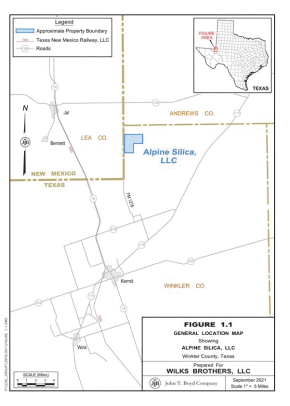

Revenues—Proppant production. Proppant production revenues increased 167%, or $17.0 million, to $27.2 million for the year ended December 31, 2021, from $10.2 million for the year ended December 31, 2020. The increase was primarily attributable to a 123% increase in proppant production and a 19% increase in proppant pricing resulting from increases in commodity prices and proppant demand in the Permian basin. The plant operated all 12 months of 2021 as a result of the COVID-19 pandemic recovery compared to 9 months of the same period for 2020. For the years ended December 31, 2021 and 2020, intersegment revenues accounted for 40% and 21% of proppant production revenues, respectively.

Total revenues. Total revenues increased 40%, or $220.7 million, to $768.4 million for the year ended December 31, 2021, from $547.7 million for the year ended December 31, 2020. The increase was primarily attributable to recovery from the COVID-19 pandemic resulting in increased demand for oilfield services. Average oil and natural gas prices have increased 73% and 92%, respectively, from the year ended December 31, 2021, to the comparative period in 2020. The Baker Hughes U.S. onshore rig count also increased 16% when comparing the same periods.

Operating costs and expenses

Cost of revenues, exclusive of depreciation, depletion, and amortization—Stimulation services. Cost of revenues, exclusive of depreciation, depletion, and amortization—Stimulation services increased 32%, or $137.7 million, to $570.8 million for the year ended December 31, 2021, from $433.1 million for the year ended December 31, 2020. The increase was primarily due to an increase in fuel, personnel, expendable and other variable costs due to higher activity levels and an increase in our average marketed fleet count from 11 in the year ended December 31, 2020, to 14 in the year ended December 31, 2021. As a percentage of revenues, Cost of revenues, exclusive of depreciation and depletion—Stimulation services was 77% for the year ended December 31, 2021, as compared to 80% for the year ended December 31, 2020.

Cost of revenues, exclusive of depreciation, depletion, and amortization—Manufacturing. Cost of revenues, exclusive of depreciation, depletion, and amortization—Manufacturing increased 63%, or $25.4 million, to $65.8 million for the year ended December 31, 2021, from $40.4 million for the year ended December 31, 2020. The increase was due to higher activity levels, coupled with higher personnel headcount and our acquisition of

89