recent efforts have concentrated on specific regions, such as Utah and the Midwest where we have executed PPAs representing 675 MW and 2,223 MW, respectively, as of September 30, 2021.

We work to optimize the capital structure for individual projects with project non-recourse debt, tax equity, subordinated non-recourse financing, and the sale of minority interests to significantly reduce our cost of capital and need for holding company equity contributions. We believe that our financing expertise, longstanding industry relationships, and strong financial position, including our fixed revenue contracts, have enabled us, and will continue to enable us, to source tax equity financing and low-cost, long-duration, non-recourse project finance debt to fund the construction and operation of our projects. We value fostering strong relationships with creditworthy, financing counterparties, as evidenced by the 33 different lenders and 14 different tax equity investors utilized in our current portfolio for our project debt and tax equity financings, respectively through September 30, 2021.

During 2019, we secured tax equity funding commitments and project non-recourse financing commitments of approximately $409.2 million and $1.0 billion, respectively. Despite the economic uncertainties associated with COVID-19, during 2020, we secured tax equity funding commitments and project non-recourse financing commitments of approximately $345.8 million and $885.0 million, respectively. Through the nine months ended September 30, 2021, we secured tax equity funding commitments and project non-recourse financing commitments of approximately $428.3 million and $1.6 billion, respectively. With a continual emphasis on procuring project non-recourse financing with highly attractive terms, ensuring a low cost of capital, we averaged approximately LIBOR + 130 bps for new project financings during 2019, 2020, and the nine months ended September 30, 2021. Such favorable terms were achieved as a result of our extensive financing expertise, strong development efforts, and industry knowledge, and were based on sound, high-quality projected project performance, which is further substantiated through verification by third-party, independent engineers and consultants. We closed financing for 614 MW, 527 MW, and 1.2 GW of our projects during 2019, 2020, and the nine months ended September 30, 2021, respectively.

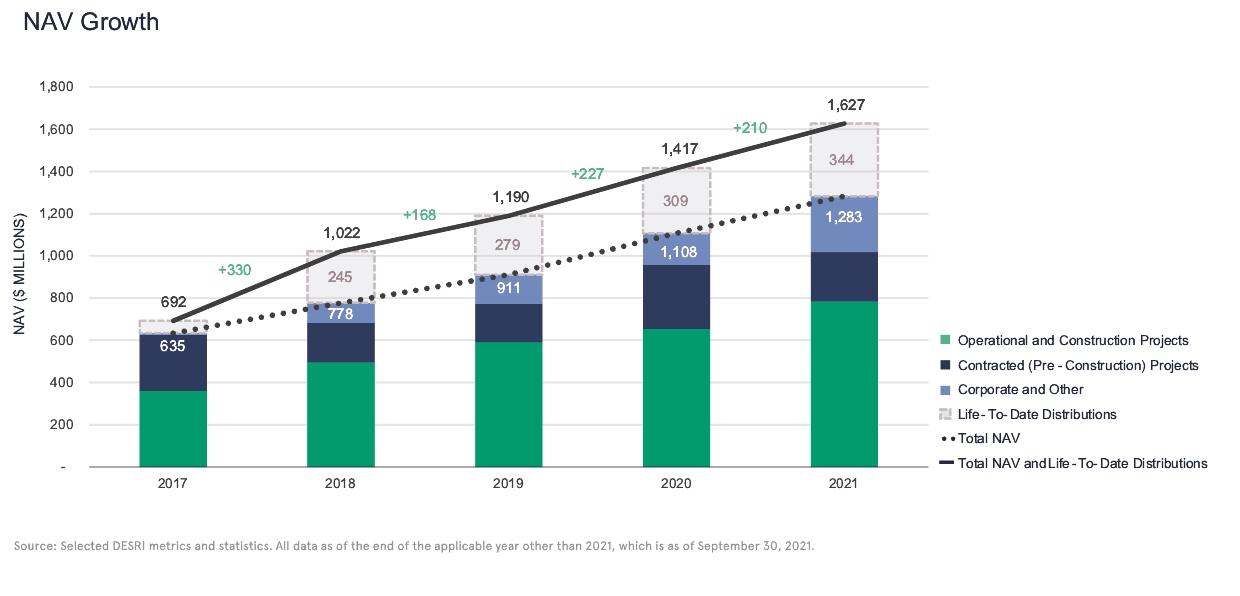

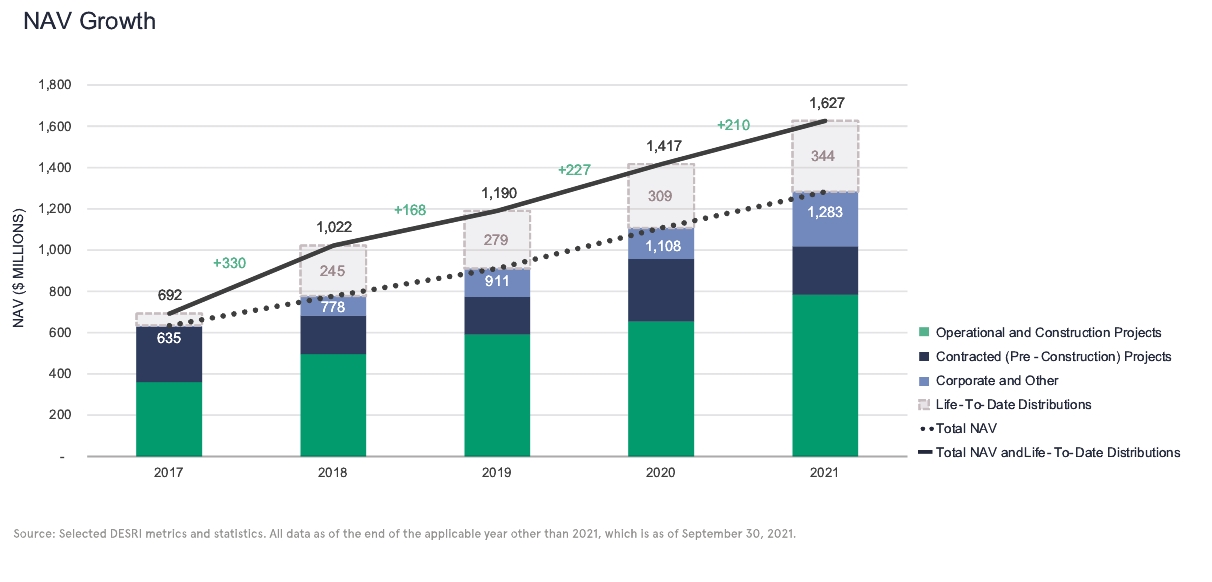

Convert non-operational contracted projects into operational assets at a high success rate and substantially increase the value of our existing portfolio by optimizing a project throughout its lifecycle.

Through our project optimization, improvement, and advancement efforts, we have established a track record of converting non-operational projects into high-quality operational assets at a high success rate. We continually pursue opportunities to improve project value, including optimizing the development, construction, financing, and operations of our projects. For example, through relationships with industry-leading equipment vendors, we are able to efficiently and cost-effectively source high-quality modules and other key equipment that are covered under the terms of long-term warranties. During 2019, 2020, and the nine months ended September 30, 2021, we acquired 775 MW, 1.1 GW, and 1.6 GW, respectively, of modules from Tier 1 vendors, such as First Solar, Jinko, and Longi. Our in-house design and procurement team collaborates with our development and financing team to optimize design and improve the value of each project.

On the operational front, we continuously look for opportunities to improve project performance and NAV. In 2019, we implemented annual infrared solar panel inspections across the operational portfolio to (i) ensure standard degradation rates do not exceed .03 to .07 in accordance with equipment warranties and (ii) monitor project performance to allow for timely identification of possible performance issues. Finally, in the last five years, we successfully re-negotiated certain terms for 17 of our long-term operating and maintenance contracts, which resulted in economically favorable revisions to the annual, contracted operations and maintenance costs for such projects.

In 2019 and 2020, we completed our “safe harbor” initiative, which involved the purchase of approximately $130 million in solar modules and tracking equipment and 45 transformers. This allowed us to preserve approximately $2 billion in future investment tax credit benefit on more than 5.5 GW of projects, providing us a competitive advantage in future origination and further solidifying a future pipeline of accretive projects.

Efficiently redeploy capital into new renewable energy investments.

We monetize our operational asset value growth through the sale of minority interests and refinancings, to generate cash and we recycle capital from our operational projects to invest in new project opportunities and improved growth of our portfolio. For the years ended December 31, 2019 and 2020, and for the nine months ended September 30, 2021, we received cash proceeds from the sale of minority interests of $34.2 million, $32.0 million, and $129.4 million, respectively. Since 2016, we have completed 20 refinancings of project debt on operational assets, allowing us to accrete substantial value to our equity and generating more than $235 million of distributions