experienced restaurant professionals who are equally passionate about Fogo, including Tony Laday, our CFO, Rick Lenderman, our COO, Selma Oliveira, our Chief Culture Officer, Janet Geiselman, our CMO, Andrew Feldmann, President of International Franchise Development and Blake Bernet, our General Counsel.

Our Growth Strategies

We plan to expand our restaurant footprint and platforms to drive revenue growth, improve operating contribution, restaurant contribution and Adjusted EBITDA margins, enhance our competitive positioning and continue to delight our diverse customer base by executing on the following strategies:

Grow Our Restaurant Base in the U.S. and Abroad

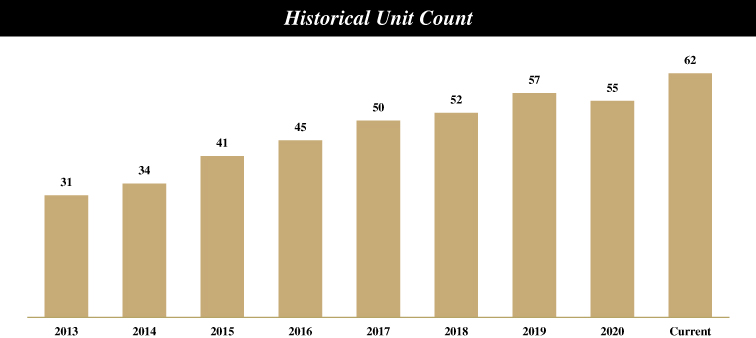

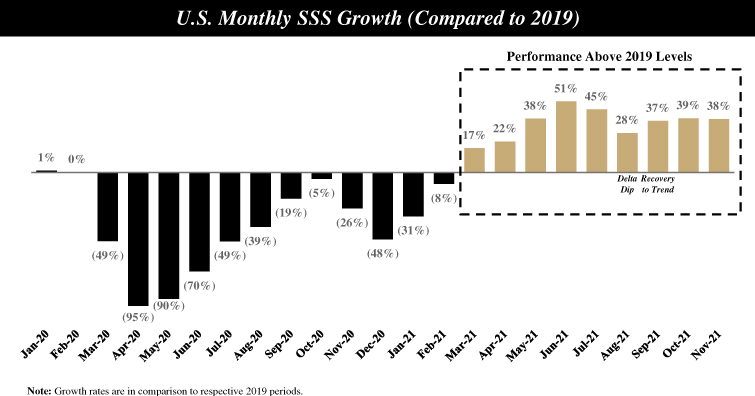

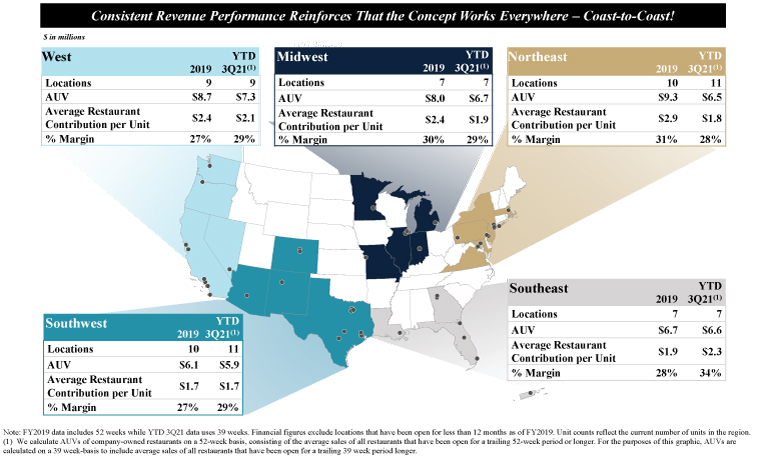

We are in the early stages of our growth with our 62 current restaurants, 48 of which are company-owned restaurants in the United States (across 21 states, the District of Columbia and Puerto Rico). We believe our concept has proven portability, with consistently strong AUVs across a diverse range of geographic regions and real estate settings. In 2022, we anticipate opening 8-10 new restaurants in the U.S., and 1-2 international franchises. Based on internal analysis and an in-depth study prepared by eSite, we believe there exists long-term potential for over 300 total sites in the United States, which represent a substantial 20-year growth opportunity. We also believe, based on an internal review of other American restaurant group store counts throughout the world as well as insights from our international franchise advisors, that there is potential for 250 franchise restaurants internationally over the next 20 years. Through the broad appeal of our differentiated concept, improved unit economic model and enhanced real estate strategy lowering overall investment costs, we believe we can meet the same return hurdles in smaller trade demand areas than in the past and do so more predictably, which has expanded our overall whitespace of new restaurants which meet our high return hurdle. While we are targeting a substantial whitespace opportunity in growing our restaurant base, we continue to evaluate the impact of the COVID-19 pandemic, which disrupted and may again disrupt our business and ability to expand our restaurant base.

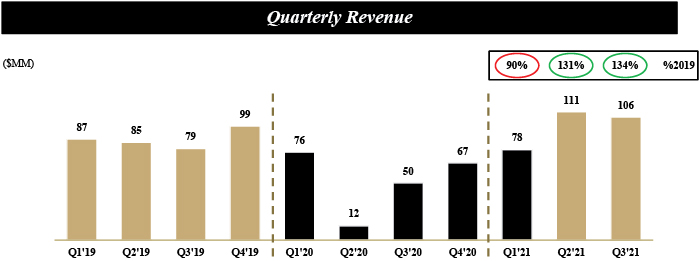

Our current restaurant investment model targets an average cash investment of $3.5 million per restaurant, net of tenant allowances and pre-opening costs, assuming an average restaurant size of approximately 8,500 square feet, an AUV of $6.6 million or $776 of sales per square foot and targeted cash-on-cash returns of approximately 40%, which we calculate by dividing our restaurant contribution in the third year of operation by our initial investment costs (net of tenant allowances and excluding pre-opening expenses). As of the date of this prospectus, six of our restaurants opened since 2019 are performing in excess of our expectations. Albuquerque, NM, Bethesda, MD, Burlington, MA, Long Island, NY, Irvine, CA, and White Plains, NY For example, our three new U.S. restaurants opened since 2019 (located in Bethesda, MD, Long Island, NY, Irvine, CA) that were open during the 39 weeks ended October 3, 2021 had average weekly sales of $169,000 in that period, compared to average weekly sales of restaurants opened previously of $169,000, $85,000 and $148,000 generated in the 39 weeks ended October 3, 2021, Fiscal 2020 and Fiscal 2019. The $169,000 average weekly sales for the three new U.S. restaurants referenced above exceeds the average weekly sales implied by our target year 3 U.S. AUV of $6.6 million by 33%. Additionally, these three new restaurants are approximately 14% smaller on average (9,100 square feet on average as opposed to 10,600 square feet on average), hence demonstrating the potential that our smaller sized units can generate comparable sales levels. Furthermore, three of our newer units opened during 2021 (White Plains, NY, Albuquerque, NM, and Burlington, MA) are performing above our expectations.

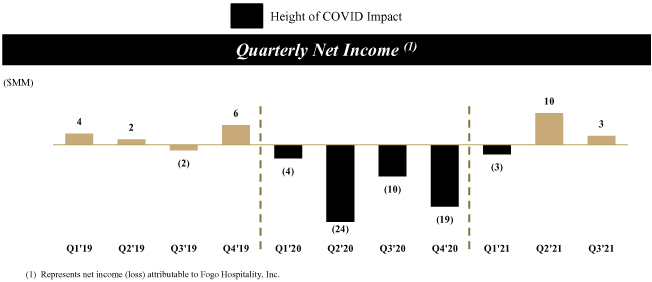

Based on strong average weekly sales of our new development model restaurants during the thirty-nine weeks of Fiscal 2021 and our reduced targeted average cash investment of $3.5 million per new restaurant, we have confidence that we will achieve our targeted 40% cash-on-cash returns with our new restaurant development strategy, which is generally in line with our 43% U.S. cash-on-cash returns and 43% Brazil cash-on-cash returns in Fiscal 2019, before the COVID-19 pandemic, and higher than our 11% U.S. cash-on-cash returns and (1%) Brazil cash-on-cash returns in Fiscal 2020, which reflect the impact of the COVID-19 pandemic.

-129-