“SilverBox Shares” means, collectively, the SilverBox Class A Shares and the SilverBox Class B Shares.

“SilverBox Warrants” means each warrant to purchase one SilverBox Class A Share at an exercise price of $11.50 per share, subject to adjustment in accordance with the Warrant Agreement (including, for the avoidance of doubt, each such warrant held by the Sponsor).

“SilverBox Working Capital Loan” means any loan made to SilverBox by any of the Sponsor, an Affiliate of the Sponsor or any of SilverBox’s officers or directors, and evidenced by a promissory note or other Contract, for the purpose of financing expenses incurred in connection with a business combination.

“Software” shall mean any and all (a) computer programs, including any and all software implementations of algorithms, models and methodologies, whether in source code or object code; (b) databases and compilations, including any and all data and collections of data, whether machine readable or otherwise; (c) descriptions, flowcharts and other work product used to design, plan, organize and develop any of the foregoing, screens, user interfaces, report formats, firmware, development tools, templates, menus, buttons and icons; and (d) all documentation, including user manuals and other training documentation, related to any of the foregoing.

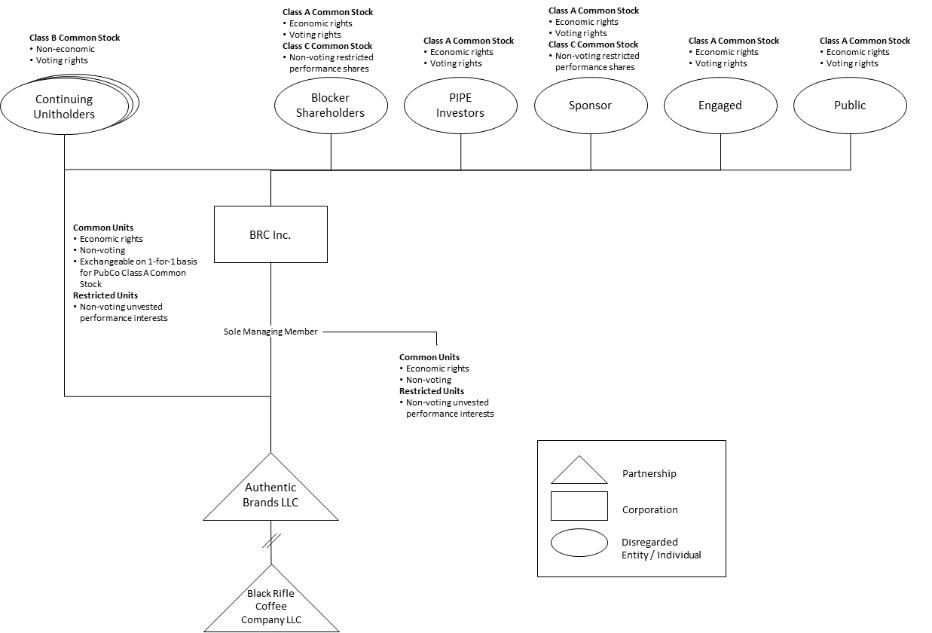

“Sponsor” has the meaning set forth in the recitals to this Agreement.

“Sponsor Letter Agreement” has the meaning set forth in the recitals to this Agreement.

“Straddle Period” means any taxable period that begins on or before (but does not end on) the Closing Date.

“Subscription Agreement” has the meaning set forth in the recitals to this Agreement.

“Subsidiary” means, with respect to any Person, any corporation, limited liability company, partnership or other legal entity of which (a) if a corporation, a majority of the total voting power of shares of stock entitled (without regard to the occurrence of any contingency) to vote in the election of directors, managers or trustees thereof is at the time owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of such Person or a combination thereof, or (b) if a limited liability company, partnership, association or other business entity (other than a corporation), a majority of the partnership or other similar ownership interests thereof is at the time owned or controlled, directly or indirectly, by such Person or one or more Subsidiaries of such Person or a combination thereof and for this purpose, a Person or Persons own a majority ownership interest in such a business entity (other than a corporation) if such Person or Persons shall be allocated a majority of such business entity’s gains or losses or shall be a, or control any, managing director or general partner of such business entity (other than a corporation). The term “Subsidiary” shall include all Subsidiaries of such Subsidiary.

“Tax” or “Taxes” means all net, adjusted, or gross income, gross proceeds, payroll, employment, excise, severance, stamp, occupation, windfall or excess profits, profits, customs, capital stock, withholding, social security, unemployment, disability, real property, personal property (tangible and intangible), sales, use, transfer, value added, alternative or add-on minimum, capital gains, user, leasing, lease, natural resources, ad valorem, franchise, capital, estimated, goods and services, fuel, registration, recording, premium, turnover, environmental or other taxes, assessments, duties or similar charges, in each case, in the nature of a tax, imposed by a Governmental Entity, including all interest, penalties and additions imposed with respect to (or in lieu of) the foregoing by any Governmental Entity, and, in each case, whether disputed or not.

“Tax Authority” means any Governmental Entity responsible for the collection or administration of Taxes or Tax Returns.

“Tax Receivable Agreement” has the meaning set forth in the recitals to this Agreement.

“Tax Return” means returns, declarations, reports, claims for refund, information returns, elections, disclosures, statements, or other documents (including any related or supporting schedules, attachments, statements or information, and including any amendments thereof) filed or required to be filed with a Governmental Entity in connection with, or relating to, Taxes.

“Termination Date” has the meaning set forth in Section 8.1(d).