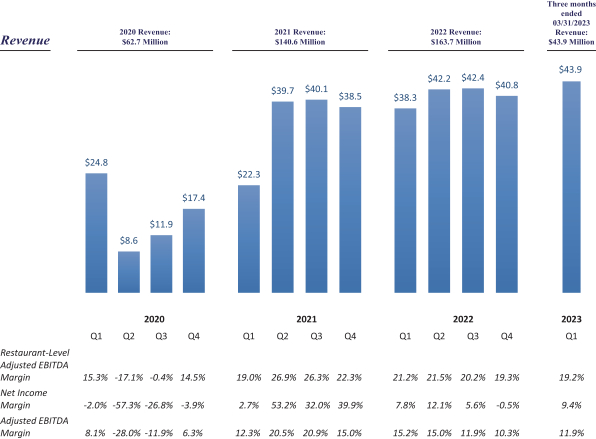

restaurants. Within one week, we modified operations at 15 locations to add take-out only service. As restrictions were lifted over the next few months, we were able to gradually reopen more restaurants at reduced indoor dining capacities and we also started offering outdoor dining at certain locations.

To support our employees during this challenging time, we continued paying normal payrolls to all employees through April 5, 2020 and to all kitchen employees through May 9, 2020. After those dates, we furloughed most employees but continued to pay store managers and key kitchen staff throughout the periods when their respective restaurants were temporarily closed. We also continued to pay the employee portion of all furloughed employees’ health insurance through July 31, 2020. As our restaurants reopened with expanding capacities during late spring and summer of 2020, we were able to invite back many of our furloughed employees.

In response to the ongoing pandemic, we prioritized actions to protect the health and safety of our employees and customers. We increased cleaning and sanitizing protocols in our restaurants and implemented additional training and operational manuals for our restaurant employees, as well as increased handwashing procedures. We provided each restaurant employee with face masks and gloves, and required each employee to pass a health screening process, which included a temperature check, before the start of each shift.

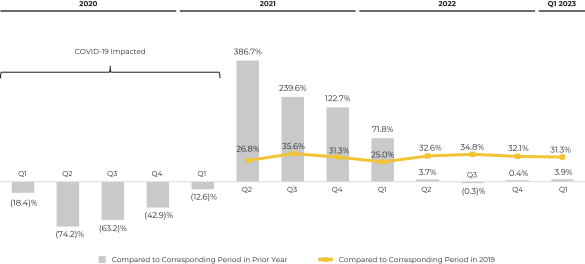

The temporary restaurant closures and the reduced capacities at the reopened restaurants caused a substantial decline in our sales. In light of the challenges posed by the pandemic, we focused on maximizing our restaurant dining capacity by adding temporary outdoor dining at certain locations. Beyond prioritizing actions to help assure a safe environment for our employees and customers, we worked hard to maintain our operational efficiencies as much as possible to preserve our liquidity.

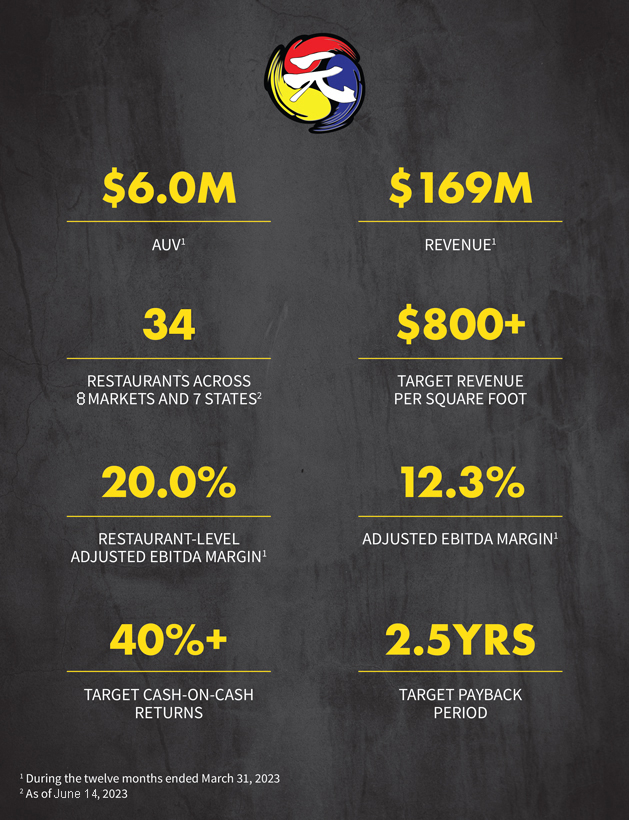

Although we temporarily paused our new restaurant opening plans during the pandemic, our long-term growth strategy is to continue to open new restaurants in locations that we believe will achieve profitability levels consistent with our pre-pandemic experience. During 2022, we opened three new restaurants and we have ten new restaurant locations with leases that have been signed, three of which we opened in 2023. These locations are in Kapolei, Hawaii, Westheimer (Houston), Texas, Seattle, Washington, Jacksonville, Florida, Dallas, Texas, Arlington, Texas, Maui, Hawaii, Cerritos, California (opened on April 4, 2023), Chandler, Arizona (opened on June 1, 2023) and Fort Lauderdale, Florida (opened on June 10, 2023). We currently expect to open four or five additional locations during the rest of 2023. Future sales and profitability levels of our restaurants and our ability to successfully implement our growth strategy in the near term, however, remain uncertain, as the full impact and duration of the pandemic continues to evolve as of the date of this prospectus.

Recent Events Concerning Our Financial Position

During 2020, we entered into various agreements with Pacific City Bank, which provided for loans in the amount of $9.5 million, or the 2020 PPP Loans, and $0.9 million in Economic Injury Disaster Loans, or the EIDL Loans, pursuant to the Paycheck Protection Program under the CARES Act, signed into law on March 27, 2020. By the end of 2021, we had received loan forgiveness on the 2020 PPP Loans in the amount of $9.2 million, and recorded the amount of the forgiven balances in “Gain on extinguishment of debt” in 2021.

During 2021, we also entered into several additional Paycheck Protection Program, or PPP, agreements, which provided for an additional aggregate loan in the amount of $13.5 million, or the 2021 PPP Loans, and together with the 2020 PPP Loans, the PPP Loans, as of October 6, 2021. During the month of December 2021, we received notices of loan forgiveness related to the 2021 PPP Loans that totaled $13.1 million. In addition, we have received approximately $16.8 million in Restaurant Revitalization Fund grants. These grants were recognized as income as the money was spent, with $13.0 million recorded as income as of December 31, 2021, and $3.8 million was deferred as of December 31, 2022 and March 31, 2023. During 2022, we received notices of forgiveness of $0.4 million related to the 2021 PPP Loans and recorded it as a “Gain on extinguishment of debt” in 2022. The remaining unforgiven PPP Loan balance of $0.3 million was repaid in 2022. During the twelve months ended December 31, 2021 and 2022, we received $1.4 million and $2.6 million, respectively, in additional EIDL loans. There are no additional EIDL loans expected. The EIDL loans mature in 2050 and 2051, and carry an interest rate of 3.75%. The range of monthly payments under the EIDL loans are from $700 to $9,770.

75