As filed with the Securities and Exchange Commission on March 3, 2022 | Registration No. 333-261070 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form S-1/A

(Amendment No. 1)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

RUBBER LEAF INC

(Exact name of registrant as specified in its charter)

| Nevada | | 3714 | | 32-0655276 |

(State or other jurisdiction of incorporation or organization) | | (Primary standard industrial classification code number) | | (IRS employer identification number) |

Qixing Road, Weng’ao Industrial Zone,

Chunhu Subdistrict, Fenghua District

Ningbo, Zhejiang, China

+86 - 0574 - 88733850

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

ParaCorp Incorporated

318 N. Carson Street, Ste. 208

Carson City, Nevada 89701

(916)-576-7000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

William B. Barnett, Esq.

Barnett & Linn

60 Kavenish Drive

Rancho Mirage, California 92270

(442)-599-1299

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | | Emerging Growth Company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | | Amount to be Registered (1) | | | Proposed Maximum Offering Price Per Share (2) | | | Proposed Maximum Aggregate Offering Price | | | Amount of Registration Fee (3) | |

| | | | | | | | | | | | | |

Common Stock, $0.001 par value | | | 10,916,458 | | | $ | 2.50 | | | $ | 27,291,145 | | | $ | 2,530.00 | |

(1) Includes 916,458 shares to be resold by certain Selling Stockholders.

(2) The offering price has been arbitrarily determined by the Company and bears no relationship to assets, earnings, or any other valuation criteria.

(3) Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY OUR EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION, DATED ON March 3, 2022

RUBBER LEAF INC

10,000,000 Shares of Common Stock by the Company

916,458 Shares of Common Stock by the Selling Shareholders

Rubber Leaf Inc (“Rubber Leaf” or the “Company”) is offering a maximum of 10,000,000 shares of our common stock at $2.50 per share (the “Shares”), in a best effort, direct public offering, by our officers and directors for the Company and the Company’s management. There is no minimum proceeds threshold for the offering. We are also registering 916,458 shares of Common Stock for certain selling shareholders (collectively, the “Selling Shareholders”). The Selling Shareholders acquired the shares of Common Stock in accordance with the Regulation S of the Securities Act of 1933, as amended. The offering will terminate within 365 days from the date of this prospectus unless earlier fully subscribed or terminated by the Company. The Company will not retain any of the proceeds received from the shares sold on their accounts in this offering. The Company will retain the proceeds for the shares sold by the Company. The Company has not made any arrangements to place the proceeds in an escrow or trust account. Any proceeds received in this offering may be immediately used by the Company in its sole discretion. There are no minimum purchase requirements for each investor. There is no guarantee that we will sell any of the securities being offered in this offering. Additionally, there is no guarantee that this offering will successfully raise enough funds to institute our Company’s business plan. Additionally, there is no guarantee that a public market will ever develop and you may be unable to sell your shares.

Prior to this offering, there has been no public market for the Company’s common stock. No assurances can be given that a public market will develop following completion of this offering or that, if a market does develop, it will be sustained. The offering price for the Shares has been arbitrarily determined by the Company and does not necessarily bear any direct relationship to the assets, operations, book or other established criteria of value of the Company. The Shares will become tradable on the effective date of the registration statement of which this prospectus is a part. Upon completion of this Offering, we will attempt to have the shares quoted on the OTCQB operated by OTC Markets Group, Inc. There is no assurance that the Shares will ever be quoted on the OTCQB. To be quoted on the OTCQB, a market maker must apply to make a market in our common stock. As of the date of this Prospectus, we have not made any arrangement with any market makers to quote our shares.

Neither the Company nor any selling shareholders has any current arrangements nor entered into any agreements with any underwriters, broker-dealers or selling agents for the sale of the Shares. If the Company or selling shareholders can locate and enter into any such arrangement(s), the Shares will be sold through such licensed underwriter(s), broker-dealer(s) and/or selling agent(s).

Investors are cautioned that you are not buying shares of a China-based operating company but instead are buying shares of a holding company issuer that fully controls an operating subsidiary conducting business in China. Because all of our operations are conducted in China through our wholly-owned subsidiary, the Chinese government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of our common stocks.

Recent statements by the Chinese government have indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investments in China based issuers. Any future action by the Chinese government expanding the categories of industries and companies whose foreign securities offerings are subject to government review could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause the value of such securities to significantly decline or be worthless.

Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. We do not believe that we are directly subject to these regulatory actions or statements, as we do not have a variable interest entity structure (“VIE”) and our business does not involve the collection of user data, implicate cybersecurity, or involve any other type of restricted industry. Because these statements and regulatory actions are new, however, it is highly uncertain how soon legislative or administrative regulation making bodies in China will respond to them, or what existing or new laws or regulations will be modified or promulgated, if any, or the potential impact such modified or new laws and regulations will have on our daily business operations or our ability to accept foreign investments and list on an U.S. exchange.

Pursuant to the Holding Foreign Companies Accountable Act (“HFCAA”), the Public Company Accounting Oversight Board (the “PCAOB”) issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. Our registered public accounting firm, Simon & Edward, LLP, is not headquartered in mainland China or Hong Kong and was not identified in this report as a firm subject to the PCAOB’s determination. Notwithstanding the foregoing, if the PCAOB is not able to fully conduct inspections of our auditor’s work papers in China, you may be deprived of the benefits of such inspection which could result in limitation or restriction to our access to the U.S. capital markets and trading of our securities may be prohibited under the HFCAA. See Risk Factor “The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering. In the event it is later determined that the PCAOB is unable to inspect or investigate completely the Company’s auditor, then such lack of inspection could cause trading in the Company’s securities to be prohibited under the HFCAA, and ultimately result in a determination by a securities exchange to delist the Company’s securities.”

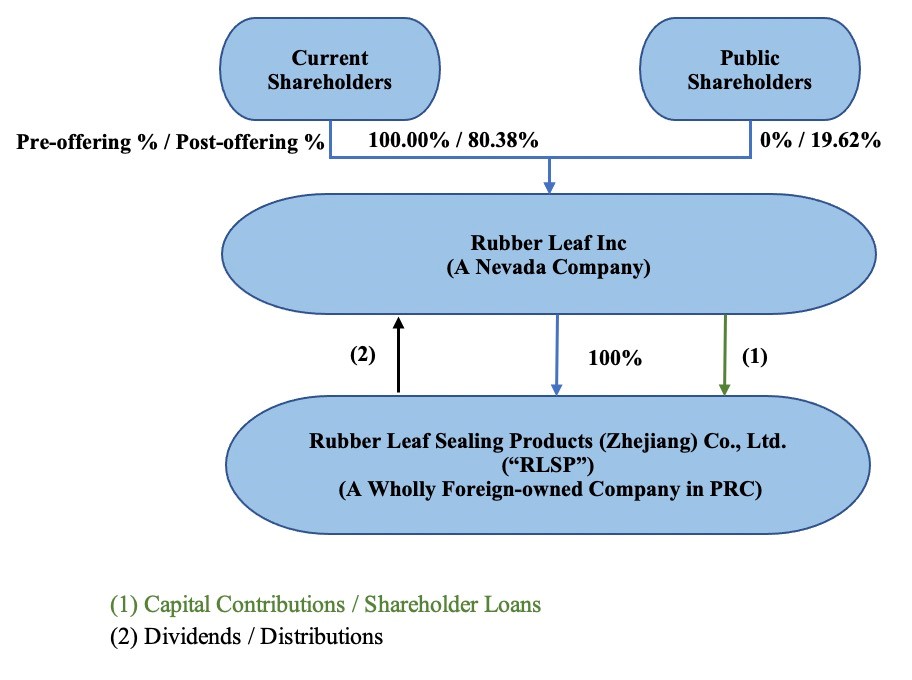

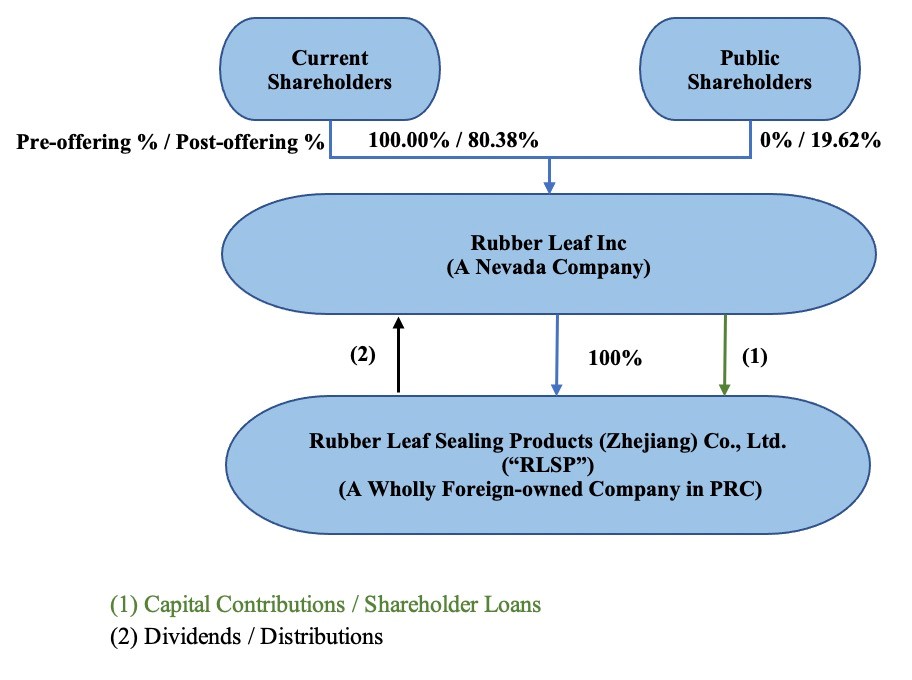

The structure of cash flows within our organization, and as summary of the applicable regulations, is as follows:

1. Our equity structure is a direct holding structure, that is, Rubber Leaf Inc (the “Company” or “RLI”), directly controls Rubber Leaf Sealing Products (Zhejiang) Co., Ltd. (“RLSP”), a foreign-owned company established in People’s Republic of China. See “Corporate History and Structure” under “THE BUSINESS AND BUSINESS PLAN” for additional details.

2. Within our direct holding structure, the cross-border transfer of funds within our corporate group is legal and compliant with the laws and regulations of the PRC. After foreign investors’ funds enter the Company at the close of this offering, the funds can be directly transferred to RLSP.

If the Company intends to distribute dividends, the Company will transfer the dividends from RLSP to RLI in accordance with the laws and regulations of the PRC, and then the dividends will be distributed from RLI to all shareholders respectively in proportion to the shares they hold, regardless of whether the shareholders are U.S. investors or investors in other countries or regions.

3. In the reporting periods presented in this Prospectus, no cash and other asset transfers have occurred among the Company and its subsidiary; and no dividends or distributions of a subsidiary has been made to the Company. For the foreseeable future, the Company intends to use the earnings for research and development, to develop new products and to expand its production capacity. As a result, we do not expect to pay any cash dividends.

4. Our PRC subsidiary’s ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC subsidiary to transfer profits to RLI only out of its after-tax accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, our subsidiary in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each of such entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation.

The following diagram shows the nature of the flow of funds within our organization.

| | ● | Rubber Leaf Inc, a Nevada company, was incorporated on May 18, 2021. |

| | ● | Rubber Leaf Sealing Products (Zhejiang) Co., Ltd. (“RLSP” or the “WOFE”), a wholly foreign-owned enterprise established in the PRC in July 2019, and now is wholly owned by Rubber Leaf Inc. |

| | ● | Post-offering percentage assumes the 10,000,000 proposed shares are fully subscribed by the public shareholders. |

To address persistent capital outflows and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China and the State Administration of Foreign Exchange, or SAFE, have implemented a series of capital control measures in the subsequent months, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments and shareholder loan repayments. The PRC government may continue to strengthen its capital controls and our PRC subsidiary’s dividends and other distributions may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if our subsidiary in the PRC incur debt on its own in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments.

Investing in our common shares involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus for a discussion of information that should be considered in connection with an investment in our common shares.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 5.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Rubber Leaf Inc

Ningbo City

Zhejiang Provence, China

Prospectus dated __________________, 2021

The following table of contents has been designed to help you find important information contained in this prospectus. We encourage you to read the entire prospectus.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. We have not authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

PROSPECTUS SUMMARY

This Prospectus, and any supplement to this Prospectus include “forward-looking statements”. To the extent that the information presented in this Prospectus discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section in this Prospectus.

This summary only highlights selected information contained in greater detail elsewhere in this Prospectus. This summary may not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire Prospectus, including “Risk Factors” beginning on Page 5, and the financial statements, before making an investment decision.

Commonly Used Defined Terms

Except as otherwise indicated by the context and for the purposes of this prospectus only, references in this prospectus to:

| | ● | “we,” “us,” “Rubber Leaf”, “RLI”, “Company” or “our,” are referred to Rubber Leaf Inc, a company incorporated in the State of Nevada, United States; |

| | | |

| | ● | “WOFE” stands for Wholly Foreign-Owned Enterprise, which is referred to our wholly owned subsidiary Rubber Leaf Sealing Products (Zhejiang) Co., Ltd.; |

| | | |

| | ● | “RLSP” is also referred to our wholly owned subsidiary Rubber Leaf Sealing Products (Zhejiang) Co., Ltd., a foreign-owned company established in the PRC; |

| | | |

| | ● | “PRC” and “China” are to the People’s Republic of China, excluding, for the purpose of this prospectus, Taiwan and the special administrative regions of Hong Kong and Macau; |

| | | |

| | ● | “Renminbi” and “RMB” are to the legal currency of China; and |

| | | |

| | ● | “U.S. dollars,” “dollars,” “US$” and “$” are to the legal currency of the United States. |

The Company

Rubber Leaf Inc (“the Company”) was incorporated under the laws of the State of Nevada on May 18, 2021. It acquired Rubber Leaf Sealing Products (Zhejiang) Co., Ltd. (“RLSP”) on May 27, 2021, through a Share Exchange Agreement between the Company and Xingxiu Hua, the President of the Company and who owned all of the issued and outstanding shares of RLSP. After the acquisition, RLSP became a 100% directly controlled subsidiary of the Company. Currently, all of the Company’s business is conducted through RLSP, our WOFE in China. RLSP was established in Fenghua, Ningo, China and commenced operations in July 2019. RLSP was the wholly owned subsidiary of Rubber Leaf LLC, a Delaware company organized on June 1, 2018, and Ms. Xingxiu Hua was the sole member of Rubber Leaf LLC. RLSP’s main business areas include production and sales of synthetic rubber, rubber compound, car window seals, auto parts and etc. We are a well-known auto parts enterprise, and we are also the first-tier supplier of well-known auto brands such as Dongfeng Motor and French Renault.

The Company’s principal business address is Qixing Road, Weng’ao Industrial Zone, Chunhu Subdistrict, Fenghua District Ningbo, Zhejiang, China.

Our Offering

We have authorized capital stock consisting of 100,000,000 shares of common stock, $0.001 par value per share (“Common Stock”) and 40,000,000 shares of preferred stock, $0.001 par value per share (“Preferred Stock”). We have 40,976,458 shares of Common Stock issued outstanding and no shares of Preferred Stock issued and outstanding. Through this offering we will register a total of 10,916,458 shares. These shares represent 10,000,000 additional shares of common stock to be issued by the Company and 916,458 shares of common stock by our Selling Stockholders. The price at which the Company will offer these shares is at a fixed price of $2.50 per share for the duration of the offering. The Selling Stockholders will also sell shares at a fixed price of $2.50 for the duration of the offering. There is no arrangement to address the possible effect of the offering on the price of the stock. We will receive all proceeds from the sale of our common stock but we will not receive any proceeds from the Selling Stockholders.

| Securities being offered by the Company | | 10,000,000 shares of common stock, at a fixed price of $2.50 offered by us in a direct offering. Our offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering. |

| Securities being offered by the Selling Stockholders | | 916,458 shares of common stock, at a fixed price of $2.50 offered by selling stockholders in a resale offering. The 2.50 fixed price applies at all times for the duration of the offering. The offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus, unless extended by our Board of Directors for an additional 90 days. The Company may however, at any time and for any reason terminate the offering. |

| | | |

| Offering price per share | | The Company and the selling shareholders will sell the shares at a fixed price per share of $2.50 for the duration of this Offering. |

| | | |

| Number of shares of common stock outstanding prior to this offering | | 40,976,458 common shares are currently issued and outstanding. |

| | | |

| Number of shares of common stock outstanding after this offering | | 50,976,458 common shares will be issued and outstanding assuming the sale of all of the Company’s shares being offered herein |

| | | |

| The minimum number of shares to be sold in this offering | | None. |

| | | |

| Market for the common shares | | There is no public market for the common shares. The price per share is $2.50 We may not be able to meet the requirement for a public listing or quotation of our common stock. Furthermore, even if our common stock is quoted or granted listing, a market for the common shares may not develop. The offering price for the shares will remain at $2.50 per share for the duration of the offering |

| | | . |

| Use of Proceeds | | We intend to use the gross proceeds to us for furthering our business operations as detailed in the section titled, “use of proceeds” on page 34. |

| | | |

| Termination of the Offering | | This offering will terminate upon the earlier to occur of (i) 365 days after this registration statement becomes effective with the Securities and Exchange Commission, or (ii) the date on which all 10,916,458 shares registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 90 days. At any time and for any reason we may also terminate the offering. |

| | | |

| Terms of the Offering | | The Company’s officers and directors will sell the 10,000,000 shares of common stock on behalf of the Company on a BEST EFFORTS basis. |

| | | |

| Subscriptions: | | All subscriptions once accepted by us are irrevocable. |

| | | |

| Registration Costs | | We estimate our total offering registration costs to be approximately $300,000. |

| | | |

| Risk Factors: | | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

Regulatory Permissions

Recently, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Strictly Cracking Down on Illegal Securities Activities, which were made available to the public on July 6, 2021. The Opinions on Strictly Cracking Down on Illegal Securities Activities emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over overseas listings by Chinese companies. Effective measures, such as promoting the construction of relevant regulatory systems will be taken to deal with the risks and incidents of China-based overseas listed companies, and cybersecurity and data privacy protection requirements and similar matters. It is still uncertain how PRC governmental authorities will regulate overseas listing in general and whether we will be required to obtain any specific regulatory approvals. Furthermore, if the CSRC or other regulatory agencies later promulgate new rules or explanations requiring that we obtain their approvals for this offering and any follow-on offering, we may be unable to obtain such approvals which could significantly limit or completely hinder our ability to offer or continue to offer securities to our investors.

We believe that neither we nor our subsidiary are currently required to obtain approval from any PRC governmental authorities, including the CSRC, or Cybersecurity Administration Committee, or CAC, to list on U.S exchanges or issue securities to foreign investors. We have been closely monitoring regulatory developments in China regarding any necessary approvals from the CSRC, CAC or other PRC governmental authorities required for overseas listings, including this offering. As of the date of this prospectus, we have not received any inquiry, notice, warning, sanctions or regulatory objection to this offering from the CSRC or other PRC governmental authorities. However, there remains significant uncertainty as to the enactment, interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities. If it is determined in the future that the approval of the CSRC, The Cyberspace Administration of China (CAC) or any other regulatory authority is required for this offering, we may face sanctions by the CSRC, the CAC or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on our operations in China, limit our ability to pay dividends outside of China, limit our operations in China, delay or restrict the repatriation of the proceeds from this offering into China or take other actions that could have a material adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of our securities. The CSRC, the CAC or other PRC regulatory agencies also may take actions requiring us, or making it advisable for us, to halt this offering before settlement and delivery of our common stock. Consequently, if you engage in market trading or other activities in anticipation of and prior to settlement and delivery, you do so at the risk that settlement and delivery may not occur. In addition, if the CSRC, the CAC or other regulatory PRC agencies later promulgate new rules requiring that we obtain their approvals for this offering, we may be unable to obtain a waiver of such approval requirements, if and when procedures are established to obtain such a waiver. Any uncertainties and/or negative publicity regarding such an approval requirement could have a material adverse effect on the trading price of our securities.

All limited liability companies incorporated and operating in the PRC are governed by the Company Law of the People’s Republic of China, or the Company Law, which was amended and promulgated by the Standing Committee of the National People’s Congress on October 26, 2018. However, on December 24, 2021, the Standing Committee of the National People’s Congress issued the Company Law of the People’s Republic of China (Draft for Comments) (the “Revised Company Law”), which is now open for public comments. The Revised Company Law further stipulates the establishment and withdrawal of the company, the organizational structure and the capital system of the company, and strengthens the responsibilities of shareholders and management personnel and Corporate Social Responsibility. Foreign invested projects must also comply with the Company Law, with exceptions as specified in foreign investment laws.

With respect to the establishment and operation of wholly foreign-owned projects, or WFOE, the MOFCOM and NDRC, promulgated the Special Administrative Measures for the Access of Foreign Investment (Negative List) (2021 Version) (the “2021 Negative List”) on December 27, 2021, which became effective on January 1, 2022. The 2021 Negative List will replace the Special Administrative Measures for the Access of Foreign Investment (2020 Version) (the “2020 Negative List”) and serve as the main basis for management and guidance for the MOFCOM to manage and supervise foreign investments. Those industries not set out on the 2021 Negative List shall be classified as industries permitted for foreign investment. None of our businesses are on the 2021 Negative List, nor on the 2020 Negative List. Therefore, the Company is able to conduct its business through its wholly owned PRC subsidiary without being subject to restrictions imposed by the foreign investment laws and regulations of the PRC.

The Foreign Investment Law of the People’s Republic of China (the “Foreign Investment Law”) was adopted by the second meeting of the 13th National People’s Congress on March 15, 2019, which became effective on January 1, 2020. On December 26, 2019, the State Council promulgated Regulation for Implementing the Foreign Investment Law of the People’s Republic of China (the “Regulation”), which became effective on January 1, 2020.

The Foreign Investment Law and the Regulation apply the administrative system of pre-establishment national treatment plus negative list to foreign investment and clarify the state shall develop a catalogue of industries for encouraging foreign investment to specify the industries, fields, and regions where foreign investors are encouraged and directed to invest, which refers to the Catalogue of Industries for Guiding Foreign Investment Industries (amended in 2020) (the “Catalogue”). Specifically, the special administrative measures to be implemented are the restricted and prohibited industry categories as well as encouraged industry categories having shareholding and executive management requirements prescribed in the Catalogue (the Special Administrative Measures for the Access of Foreign Investment specified in the Catalogue was replaced by the 2020 Negative List, and the Catalogue of Industries for Encouraged Foreign Investment specified in the Catalogue was replaced by the Catalogue of Industries for Encouraged Foreign Investment (2020 Version).

The abovementioned Company Law of the People’s Republic of China provides that companies established in the PRC may take the form of company of limited liability or company limited by shares. Each company has the status of a legal person and owns its assets itself. Assets of a company may be used in full for the company’s liability. The Company Law applies to foreign-invested companies unless relevant laws provide otherwise.

The Foreign Investment Law replaced Law of the People’s Republic of China on Wholly Foreign-owned Enterprises. It stipulates that the PRC implements a system of pre-establishment national treatment plus negative list for the administration of foreign investment. Foreign investors are not allowed to invest in fields or sectors prohibited in the market access negative list for foreign investment. Foreign investors that intend to invest in the fields subject to access restrictions stipulated in market access negative list for foreign investment shall satisfy the conditions stipulated in such negative list. The PRC policies supporting enterprise development are equally applicable to foreign-invested enterprises. The PRC does not impose expropriation on foreign investment. Under special circumstances, if it requires imposing expropriation on foreign investment due to the need of public interest, expropriation shall be imposed according to legal procedures, and the foreign-invested enterprises concerned shall receive fair and reasonable compensation. Foreign-invested enterprises can raise funds through public issuance of stocks, corporate bonds and other securities in accordance with the law. Overall, The Foreign Investment Law establishes the clear principle of applying national treatment to FIEs except those engaged in industries on the 2020 Negative List. Since our current and planned business is not on the 2020 Negative List, to the best of our knowledge, it will not create any material adverse effect to our Company’s business.

SUMMARY FINANCIAL INFORMATION

The following tables set forth a summary of our historical financial data as of, and for the period ended on, the dates indicated. We have derived the statements of operations data for the nine months ended September 30, 2021 and December 31, 2020 from our audited financial statements included in this prospectus. Historical results for any prior period are not necessarily indicative of results to be expected in any future period. You should read the following summary financial data together with our financial statements and the related notes appearing at the end of this prospectus and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this prospectus.

| | | Nine Months Ended September 30, 2021 | | | December 31, 2020 | |

| STATEMENT OF OPERATIONS DATA | | | | | | | | |

| Revenue | | $ | 11,529,890 | | | $ | 16,664,671 | |

| Operating & administration expenses | | $ | 997.264 | | | $ | 596,526 | |

| (Loss) income from operations | | $ | (1,856,744 | ) | | $ | 682,859 | |

| Other expense, net | | $ | (182,254 | ) | | $ | (29,641 | ) |

| Net (loss) income before income taxes | | $ | (2,038,998 | ) | | $ | 653,218 | |

| Basic and diluted loss per share | | $ | (0.05 | ) | | $ | - | |

| Weighted average common shares outstanding | | | 40,139,267 | | | | - | |

| | | As of | |

| | | September 30, 2021 (Unaudited) | |

| BALANCE SHEET DATA | | | | |

| Total current assets | | $ | 6,878,092 | |

| Total assets | | $ | 14,006,443 | |

| Total current liabilities | | $ | 12,869,995 | |

| Total liabilities | | $ | 12,869,995 | |

| Total stockholders’ equity | | | 1,136,448 | |

RISK FACTORS

Please consider the following risk factors and other information in this prospectus relating to our business before deciding to invest in our common stock.

This offering and any investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed.

We consider the following to be the material risks for an investor regarding this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount.

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

Risks Related to Doing Business in the People’s Republic of China (“PRC”)

PRC regulations relating to investments in foreign companies by PRC residents may subject our PRC-resident beneficial owners or our PRC subsidiary to liability or penalties, limit our ability to inject capital into our PRC subsidiary or limit our PRC subsidiary’ ability to increase their registered capital or distribute profits.

As an U.S. holding company of our PRC subsidiary, we may make loans to our PRC subsidiary or may make additional capital contributions to our PRC subsidiary, subject to satisfaction of applicable governmental registration and approval requirements.

Any loans we extend to our PRC subsidiary, which are treated as foreign-invested enterprises under PRC law, cannot exceed the statutory limit and must be registered with the local counterpart of the State Administration of Foreign Exchange (“SAFE”).

In July 2014, SAFE promulgated the Circular on Relevant Issues Concerning Foreign Exchange Control on Domestic Residents’ Offshore Investment and Financing and Roundtrip Investment through Special Purpose Vehicles, or SAFE Circular 37, which replaces the previous SAFE Circular 75. SAFE Circular 37 requires PRC residents, including PRC individuals and PRC corporate entities, to register with SAFE or its local branches in connection with their direct or indirect offshore investment activities. SAFE Circular 37 is applicable to our shareholders who are PRC residents and may be applicable to any offshore acquisitions that we may make in the future.

Under SAFE Circular 37, PRC residents who make, or have prior to the implementation of SAFE Circular 37 made, direct or indirect investments in offshore special purpose vehicles, or SPVs, are required to register such investments with SAFE or its local branches. In addition, any PRC resident who is a direct or indirect shareholder of an SPV, is required to update its registration with the local branch of SAFE with respect to that SPV, to reflect any material change. Moreover, any subsidiary of such SPV in China is required to urge the PRC resident shareholders to update their registration with the local branch of SAFE to reflect any material change. If any PRC resident shareholder of such SPV fails to make the required registration or to update the registration, the subsidiary of such SPV in China may be prohibited from distributing its profits or the proceeds from any capital reduction, share transfer or liquidation to the SPV, and the SPV may also be prohibited from making additional capital contributions into its subsidiaries in China. In February, 2015, SAFE promulgated a Notice on Further Simplifying and Improving Foreign Exchange Administration Policy on Direct Investment, or SAFE Notice 13. Under SAFE Notice 13, applications for foreign exchange registration of inbound foreign direct investments and outbound direct investments, including those required under SAFE Circular 37, must be filed with qualified banks instead of SAFE. Qualified banks should examine the applications and accept registrations under the supervision of SAFE. We have used our best efforts to notify PRC residents or entities who directly or indirectly hold shares in our U.S. holding company and who are known to us as being PRC residents to complete the foreign exchange registrations. However, we may not be informed of the identities of all the PRC residents or entities holding direct or indirect interest in our company, nor can we compel our beneficial owners to comply with SAFE registration requirements. We cannot assure you that all other shareholders or beneficial owners of ours who are PRC residents or entities have complied with, and will in the future make, obtain or update any applicable registrations or approvals required by, SAFE regulations. Failure by such shareholders or beneficial owners to comply with SAFE regulations, or failure by us to amend the foreign exchange registrations of our PRC subsidiary, could subject us to fines or legal sanctions, restrict our overseas or cross-border investment activities, and limit our PRC subsidiary’s ability to make distributions or pay dividends to us or affect our ownership structure, which could adversely affect our business and prospects.

Furthermore, as these foreign exchange and outbound investment related regulations are relatively new and their interpretation and implementation has been constantly evolving, it is unclear how these regulations, and any future regulation concerning offshore or cross-border investments and transactions, will be interpreted, amended and implemented by the relevant government authorities. For example, we may be subject to a more stringent review and approval process with respect to our foreign exchange activities, such as remittance of dividends and foreign-currency-denominated borrowings, which may adversely affect our financial condition and results of operations. We cannot assure you that we have complied or will be able to comply with all applicable foreign exchange and outbound investment related regulations. In addition, if we decide to acquire a PRC domestic company, we cannot assure you that we or the owners of such company, as the case may be, will be able to obtain the necessary approvals or complete the necessary filings and registrations required by the foreign exchange regulations. This may restrict our ability to implement our acquisition strategy and could adversely affect our business and prospects.

In light of the various requirements imposed by PRC regulations on loans to, and direct investment in, PRC entities by offshore holding companies, we cannot assure you that we will be able to complete the necessary government registrations or obtain the necessary government approvals on a timely basis, if at all, with respect to future loans to our PRC subsidiary or future capital contributions by us to our PRC subsidiary. If we fail to complete such registrations or obtain such approvals, our ability to use the proceeds we expect to receive from this offering and to fund our PRC operations may be negatively affected, which could materially and adversely affect our liquidity and our ability to fund and expand our business.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S exchanges, however, if our subsidiary or the holding company was required to obtain approval in the future and was denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange and the value of our ordinary shares may significantly decline or become worthless, which would materially affect the interest of the investors.

The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property and other matters. The central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

For example, the Chinese cybersecurity regulator announced on July 2, 2021 that it had begun an investigation of Didi Global Inc. (NYSE: DIDI) and two days later ordered that the company’s app be removed from smartphone app stores.

As such, the business segments of the Company’s subsidiary, RLSP may be subject to various government and regulatory interference in the provinces in which it operates. RLSP could be subject to regulation by various political and regulatory entities, including various local and municipal agencies and government sub-divisions. RLSP may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply. The Chinese government may intervene or influence our operations at any time with little advance notice, which could result in a material change in our operations and in the value of our ordinary shares. Any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or become worthless.

Furthermore, it is uncertain when and whether the Company or our subsidiary in the PRC will be required to obtain permission from the PRC government to list on U.S. exchanges in the future, and even when such permission is obtained, whether it will be denied or rescinded. Although the Company and our subsidiary in the PRC are currently not required to obtain any permission from any of the PRC federal or local government and has not received any denial to list on the U.S. exchange, our operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to its business or industry. As a result, our common stocks may decline in value dramatically or even become worthless should we or our subsidiary in the PRC become subject to new requirement to obtain permission from the PRC government to list on U.S. stock market in the future.

Recently, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Severe and Lawful Crackdown on Illegal Securities Activities, which was available to the public on July 6, 2021. These opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies. These opinions proposed to take effective measures, such as promoting the construction of relevant regulatory systems, to deal with the risks and incidents facing China-based overseas-listed companies and the demand for cybersecurity and data privacy protection. Moreover, the State Internet Information Office issued the Measures of Cybersecurity Review (Revised Draft for Comments, not yet effective) on July 10, 2021, which requires operators with personal information of more than 1 million users who want to list abroad to file a cybersecurity review with the Office of Cybersecurity Review. The aforementioned policies and any related implementation rules to be enacted may subject us to additional compliance requirement in the future. While we believe that our operations are not affected by this, as these opinions were recently issued, official guidance and interpretation of the opinions remain unclear in several respects at this time. Therefore, we cannot assure you that we will remain fully compliant with all new regulatory requirements of these opinions or any future implementation rules on a timely basis, or at all.

Changes in the policies of the PRC government could have a significant impact upon our ability to operate profitably in the PRC.

We conduct all of our operations and all of our revenue is generated in the PRC. Accordingly, economic, political and legal developments in the PRC will significantly affect our business, financial condition, results of operations and prospects. Policies of the PRC government can have significant effects on economic conditions in the PRC and the ability of businesses to operate profitably. Our ability to operate profitably in the PRC may be adversely affected by changes in policies by the PRC government, including changes in laws, regulations or their interpretations.

PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Uncertainties with respect to the PRC legal system, including those regarding the enforcement of laws, and sudden or unexpected changes, with little advance notice, in laws and regulations in China could adversely affect us and limit the legal protections available to you and us.

There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations including, but not limited to, the laws and regulations governing our business and the enforcement and performance of our arrangements with customers in certain circumstances. The laws and regulations are sometimes vague and may be subject to future changes, and their official interpretation and enforcement could be unpredictable, with little advance notice. The effectiveness and interpretation of newly enacted laws or regulations, including amendments to existing laws and regulations, may be delayed, and our business may be affected if we rely on laws and regulations which are subsequently adopted or interpreted in a manner different from our understanding of these laws and regulations. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our business.

Our subsidiary, RLSP is formed under and governed by the laws of the PRC. The PRC legal system is a civil law system based on written statutes. Unlike the common law system, prior court decisions under the civil law system may be cited for reference, but have limited precedential value. Since these laws and regulations are relatively new and the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and the enforcement of these laws, regulations and rules involves uncertainties.

In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general, such as foreign investment, corporate organization and governance, commerce, taxation and trade. The overall effect of legislation over the past three decades has significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to evolve rapidly, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involves uncertainties and sudden changes, sometimes with little advance notice. As a significant part of our business is conducted in China, our operations are principally governed by PRC laws and regulations, which may limit legal protections available to us. Uncertainties due to evolving laws and regulations could also impede the ability of a China-based company, such as our company, to obtain or maintain permits or licenses required to conduct business in China. In the absence of required permits or licenses, governmental authorities could impose material sanctions or penalties on us. In addition, some regulatory requirements issued by certain PRC government authorities may not be consistently applied by other PRC government authorities (including local government authorities), thus making strict compliance with all regulatory requirements impractical, or in some circumstances impossible. For example, we may have to resort to administrative and court proceedings to enforce the legal protection that we enjoy either by law or contract. However, since PRC administrative and court authorities have discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to predict the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more developed legal systems. Furthermore, the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all and may have retroactive effect. As a result, we may not be aware of our violation of any of these policies and rules until sometime after the violation. In addition, any administrative and court proceedings in China may be protracted, resulting in substantial costs and diversion of resources and management attention.

The PRC government has significant oversight and discretion over the conduct of our business and may intervene or influence our operations as the government deems appropriate to further regulatory, political and societal goals. The PRC government has recently published new policies that significantly affected certain industries such as the education and internet industries, and we cannot rule out the possibility that it will in the future release regulations or policies regarding our industry that could adversely affect our business, financial condition and results of operations. Furthermore, the PRC government has recently indicated an intent to exert more oversight and control over securities offerings and other capital markets activities that are conducted overseas and foreign investment in China-based companies like us. Any such action, once taken by the PRC government, could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or in extreme cases, become worthless.

Furthermore, if China adopts more stringent standards with respect to certain areas such as environmental protection or corporate social responsibilities, we may incur increased compliance costs or become subject to additional restrictions in our operations. Certain areas of the law, including intellectual property rights and confidentiality protections in China may also not be as effective as in the United States or other countries. In addition, we cannot predict the effects of future developments in the PRC legal system on our business operations, including the promulgation of new laws, or changes to existing laws or the interpretation or enforcement thereof. These uncertainties could limit the legal protections available to us and our investors, including you.

We may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. We may be liable for improper use or appropriation of personal information provided by our customers.

We may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. These laws and regulations are continuously evolving and developing. The scope and interpretation of the laws that are or may be applicable to us are often uncertain and may be conflicting, particularly with respect to foreign laws. In particular, there are numerous laws and regulations regarding privacy and the collection, sharing, use, processing, disclosure, and protection of personal information and other user data. Such laws and regulations often vary in scope, may be subject to differing interpretations, and may be inconsistent among different jurisdictions.

We expect to obtain information about various aspects of our operations as well as regarding our employees and third parties. We also maintain information about various aspects of our operations as well as regarding our employees. The integrity and protection of our customer, employee and company data is critical to our business. Our customers and employees expect that we will adequately protect their personal information. We are required by applicable laws to keep strictly confidential the personal information that we collect, and to take adequate security measures to safeguard such information.

The PRC Criminal Law, as amended by its Amendment 7 (effective on February 28, 2009) and Amendment 9 (effective on November 1, 2015), prohibits institutions, companies and their employees from selling or otherwise illegally disclosing a citizen’s personal information obtained during the course of performing duties or providing services or obtaining such information through theft or other illegal ways. On November 7, 2016, the Standing Committee of the National People’s Congress of China (SCNPC) issued the Cyber Security Law of the PRC, or Cyber Security Law, which became effective on June 1, 2017.

Pursuant to the Cyber Security Law, network operators must not, without users’ consent, collect their personal information, and may only collect users’ personal information necessary to provide their services. Providers are also obliged to provide security maintenance for their products and services and shall comply with provisions regarding the protection of personal information as stipulated under the relevant laws and regulations.

The Civil Code of the PRC (issued by the PRC National People’s Congress on May 28, 2020 and effective from January 1, 2021) provides main legal basis for privacy and personal information infringement claims under the Chinese civil laws. PRC regulators, including the Cyberspace Administration of China, MIIT, and the Ministry of Public Security have been increasingly focused on regulation in the areas of data security and data protection.

The PRC regulatory requirements regarding cybersecurity are constantly evolving. For instance, various regulatory bodies in China, including the Cyberspace Administration of China, the Ministry of Public Security and the SAMR, have enforced data privacy and protection laws and regulations with varying and evolving standards and interpretations. In April 2020, the Chinese government promulgated Cybersecurity Review Measures, which came into effect on June 1, 2020. According to the Cybersecurity Review Measures, operators of critical information infrastructure must pass a cybersecurity review when purchasing network products and services which do or may affect national security.

In November 2016, the SCNPC passed China’s first Cybersecurity Law (“CSL”), which became effective in June 2017. The CSL is the first PRC law that systematically lays out the regulatory requirements on cybersecurity and data protection, subjecting many previously under-regulated or unregulated activities in cyberspace to government scrutiny. The legal consequences of violation of the CSL include penalties of warning, confiscation of illegal income, suspension of related business, winding up for rectification, shutting down the websites, and revocation of business license or relevant permits. In April 2020, the Cyberspace Administration of China and certain other PRC regulatory authorities promulgated the Cybersecurity Review Measures, which became effective in June 2020. Pursuant to the Cybersecurity Review Measures, operators of critical information infrastructure must pass a cybersecurity review when purchasing network products and services which do or may affect national security. On July 10, 2021, the Cyberspace Administration of China issued a revised draft of the Measures for Cybersecurity Review for public comments (“Draft Measures”), which required that, in addition to “operator of critical information infrastructure,” any “data processor” carrying out data processing activities that affect or may affect national security should also be subject to cybersecurity review, and further elaborated the factors to be considered when assessing the national security risks of the relevant activities, including, among others, (i) the risk of core data, important data or a large amount of personal information being stolen, leaked, destroyed, and illegally used or exited the country; and (ii) the risk of critical information infrastructure, core data, important data or a large amount of personal information being affected, controlled, or maliciously used by foreign governments after listing abroad. The Cyberspace Administration of China has said that under the proposed rules companies holding data on more than 1,000,000 users must now apply for cybersecurity approval when seeking listings in other nations because of the risk that such data and personal information could be “affected, controlled, and maliciously exploited by foreign governments,” The cybersecurity review will also investigate the potential national security risks from overseas IPOs. On June 10, 2021, the SCNPC promulgated the PRC Data Security Law, which took effect on September 1, 2021. The Data Security Law also sets forth the data security protection obligations for entities and individuals handling personal data, including that no entity or individual may acquire such data by stealing or other illegal means, and the collection and use of such data should not exceed the necessary limits The costs of compliance with, and other burdens imposed by, CSL and any other cybersecurity and related laws may limit the use and adoption of our products and services and could have an adverse impact on our business. Further, if the enacted version of the Measures for Cybersecurity Review mandates clearance of cybersecurity review and other specific actions to be completed by companies like us, we face uncertainties as to whether such clearance can be timely obtained, or at all.

On August 20, 2021, the SCNPC promulgated the PRC Personal Information Protection Law, which will take effect in November 2021. The Personal Information Protection Law provides that any entity involving processing of personal information (“Personal Information Processer”)shall take various measures to prevent the disclosure, modification or losing of the personal information processed by such entity, including, but not limited to, formulating a related internal management system and standard of operation, conducting classified management of personal information, taking safety technology measures to encrypt and de-identify the processed personal information, providing regular safety training and education for staff and formulating a personal information safety emergency accident plan. The Personal Information Protection Law further provides that a Personal Information Processer shall conduct a prior evaluation of the impact of personal information protection before the occurrence of various situations, including, but not limited to, processing of sensitive personal information (personal information that, once leaked or illegally used, may lead to discrimination against an individual or serious harm to an individual’s personal or property safety, including information on an individual’s ethnicity, religious beliefs, personal biological characteristics, medical health, financial accounts, personal whereabouts), using personal information to make automated decisions and providing personal information to any overseas entity.

Under the new PRC Data Security Law enacted in September 2021, we are not subject to the cybersecurity review by the CAC for this offering, given that: (i) our products are offered not directly to individual users but through our company customers; (ii) we do not possess a large amount of personal information in our business operations; and (iii) data processed in our business does not have a bearing on national security and thus may not be classified as core or important data by the authorities. However, there remains uncertainty as to how the Draft Measures will be interpreted or implemented and whether the PRC regulatory agencies, including the CAC, may adopt new laws, regulations, rules, or detailed implementation and interpretation related to the Draft Measures. If any such new laws, regulations, rules, or implementation and interpretation comes into effect, we will take all reasonable measures and actions to comply and to minimize the adverse effect of such laws on us.

We cannot assure you that PRC regulatory agencies, including the CAC, would take the same view as we do, and there is no assurance that we can fully or timely comply with such laws. In the event that we are subject to any mandatory cybersecurity review and other specific actions required by the CAC, we face uncertainty as to whether any clearance or other required actions can be timely completed, or at all. Given such uncertainty, we may be further required to suspend our relevant business, shut down our website, or face other penalties, which could materially and adversely affect our business, financial condition, and results of operations.

We believe that we have been in compliance with the data privacy and personal information requirements of the CAC. Neither the CAC nor any other PRC regulatory agency or administration has contacted the Company in connection with the Company’s operations. The Company is currently not required to obtain regulatory approval from the CAC nor any other PRC authorities for our subsidiary’s operations.

We are a holding company, and will rely on dividends paid by our subsidiary for our cash needs. Any limitation on the ability of our subsidiary to make dividend payments to us, or any tax implications of making dividend payments to us, could limit our ability to pay our parent company expenses or pay dividends to holders of our common stocks.

We are a holding company and conduct substantially all of our business through our PRC subsidiary, which is a limited liability company established in China. We may rely on dividends to be paid by our PRC subsidiary to fund our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses. If our PRC subsidiary incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us.

Under PRC laws and regulations, our PRC subsidiary, which is a wholly foreign-owned enterprise in China, may pay dividends only out of its accumulated profits as determined in accordance with PRC accounting standards and regulations. In addition, a wholly foreign-owned enterprise is required to set aside at least 10% of its accumulated after-tax profits each year, if any, to fund a certain statutory reserve fund, until the aggregate amount of such fund reaches 50% of its registered capital.

Our PRC subsidiary generates primarily all of its revenue in Renminbi, which is not freely convertible into other currencies. As a result, any restriction on currency exchange may limit the ability of our PRC subsidiary to use its Renminbi revenues to pay dividends to us. The PRC government may continue to strengthen its capital controls, and more restrictions and substantial vetting process may be put forward by SAFE for cross-border transactions falling under both the current account and the capital account. Any limitation on the ability of our PRC subsidiary to pay dividends or make other kinds of payments to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends, or otherwise fund and conduct our business.

In addition, the Enterprise Income Tax Law, or EIT, and its implementation rules provide that a withholding tax rate of up to 10% will be applicable to dividends payable by Chinese companies to non-PRC-resident enterprises unless otherwise exempted or reduced according to treaties or arrangements between the PRC central government and governments of other countries or regions where the non-PRC resident enterprises are incorporated. Any limitation on the ability of our PRC subsidiary to pay dividends or make other distributions to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends, or otherwise fund and conduct our business.

Because our business is conducted in RMB and the price of our common stock is quoted in United States dollars, changes in currency conversion rates may affect the value of your investments.

Our business is conducted in the PRC, our books and records are maintained in RMB, which is the currently of the PRC, and the financial statements that we file with the SEC and provide to our shareholders are presented in United States dollars. Changes in the exchange rate between the RMB and dollar affect the value of our assets and the results of our operations in United States dollars. The value of the RMB against the United States dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC’s political and economic conditions and perceived changes in the economy of the PRC and the United States. Any significant revaluation of the RMB may materially and adversely affect our cash flows, revenue and financial condition. Further, our ordinary shares offered by this prospectus are offered in United States dollars, we will need to convert the net proceeds we receive into RMB in order to use the funds for our business. Changes in the conversion rate between the United States dollar and the RMB will affect that amount of proceeds we will have available for our business.

The value of the Renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions in China and by China’s foreign exchange policies. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the Renminbi to the U.S. dollar, and the Renminbi appreciated more than 20% against the U.S. dollar over the following three years. Between July 2008 and June 2010, this appreciation halted and the exchange rate between the Renminbi and the U.S. dollar remained within a narrow band. Since June 2010, the Renminbi has fluctuated against the U.S. dollar, at times significantly and unpredictably. On November 30, 2015, the Executive Board of the International Monetary Fund (IMF) completed the regular five-year review of the basket of currencies that make up the Special Drawing Right, or the SDR, and decided that with effect from October 1, 2016, Renminbi is determined to be a freely usable currency and will be included in the SDR basket as a fifth currency, along with the U.S. dollar, the Euro, the Japanese yen and the British pound. In the fourth quarter of 2016, the Renminbi depreciated significantly in the backdrop of a surging U.S. dollar and persistent capital outflows of China.

This depreciation halted in 2017, and the RMB appreciated approximately 7% against the U.S. dollar during this one-year period. The Renminbi in 2018 depreciated approximately by 5% against the U.S. dollar. Starting from the beginning of 2019, the Renminbi has depreciated significantly against the U.S. dollar again. In early August 2019, the PBOC set the Renminbi’s daily reference rate at RMB7.0039 to US$1.00, the first time that the exchange rate of Renminbi to U.S. dollar exceeded 7.0 since 2008. With the development of the foreign exchange market and progress towards interest rate liberalization and Renminbi internationalization, the PRC government may in the future announce further changes to the exchange rate system, and we cannot assure you that the Renminbi will not appreciate or depreciate significantly in value against the U.S. dollar in the future. It is difficult to predict how market forces or PRC or U.S. government policy may impact the exchange rate between the Renminbi and the U.S. dollar in the future.

There remains significant international pressure on the Chinese government to adopt a flexible currency policy to allow the Renminbi to appreciate against the U.S. dollar. Significant revaluation of the Renminbi may have a material and adverse effect on your investment. Substantially all of our revenues and costs are denominated in Renminbi. Any significant revaluation of Renminbi may materially and adversely affect our revenues, earnings and financial position, and the value of, and any dividends payable on, our ordinary shares in U.S. dollars.

To the extent that we need to convert U.S. dollars we receive from this offering into Renminbi for capital expenditures and working capital and other business purposes, appreciation of the Renminbi against the U.S. dollar would have an adverse effect on the Renminbi amount we would receive from the conversion. Conversely, a significant depreciation of the Renminbi against the U.S. dollar may significantly reduce the U.S. dollar equivalent of our earnings, which in turn could adversely affect the price of our ordinary shares, and if we decide to convert Renminbi into U.S. dollars for the purpose of making dividend payments on our ordinary shares, strategic acquisitions or investments or other business purposes, appreciation of the U.S. dollar against the Renminbi would have a negative effect on the U.S. dollar amount available to us.

Very limited hedging options are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions in an effort to reduce our exposure to foreign currency exchange risk. While we may decide to enter into hedging transactions in the future, the availability and effectiveness of these hedges may be limited and we may not be able to adequately hedge our exposure or at all. In addition, our currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert Renminbi into foreign currency. As a result, fluctuations in exchange rates may have a material adverse effect on your investment.

Governmental control of currency conversion may limit our ability to utilize our net revenues effectively and affect the value of your investment.

The PRC government imposes controls on the convertibility of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. We receive substantially all of our net revenues in RMB. Under our current corporate structure, our Company in the United States relies on dividend payments from our PRC subsidiary to fund any cash and financing requirements we may have. Under existing PRC foreign exchange regulations, payments of current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval from SAFE by complying with certain procedural requirements. Therefore, our PRC subsidiary is able to pay dividends in foreign currencies to us without prior approval from SAFE, subject to the condition that the remittance of such dividends outside of the PRC complies with certain procedures under PRC foreign exchange regulation, such as the overseas investment registrations by the beneficial owners of our Company who are PRC residents. But approval from or registration with appropriate government authorities is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies.

In light of the flood of capital outflows of China in 2016 due to the weakening RMB, the PRC government has imposed more restrictive foreign exchange policies and stepped up scrutiny of major outbound capital movement. More restrictions and substantial vetting process are put in place by SAFE to regulate cross-border transactions falling under the capital account. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign currencies to our shareholders.

Under the PRC Enterprise Income Tax Law, or the EIT Law, we may be classified as a “resident enterprise” of China, which could result in unfavorable tax consequences to us and our non-PRC shareholders.