Filed pursuant to Rule 424(b)(4)

Registration No. 333-265756

1,000,000 American Depositary Shares

Intchains Group Limited

Representing 2,000,000 Class A Ordinary Shares

This is the initial public offering of American depositary shares, or ADSs, of Intchains Group Limited. We are offering 1,000,000 ADSs. Each ADS represents two Class A ordinary shares, par value US$0.000001 per share.

Prior to this offering, there has been no public market for the ADSs or our Class A ordinary shares.

Upon the completion of this offering, our outstanding share capital will consist of Class A ordinary shares and Class B ordinary shares, and we will be a “controlled company” as defined under the Nasdaq Stock Market Rules because our co-founders, namely, Mr. Qiang Ding and Mr. Chaohua Sheng, will beneficially own all of our issued Class B ordinary shares and will be able to exercise approximately 92.3% of the total voting power of our issued and outstanding share capital immediately following the completion of this offering, assuming that the underwriters do not exercise their over-allotment option to purchase additional ADSs. As a “controlled company”, we are permitted to elect not to comply with certain corporate governance requirements. If we rely on these exemptions, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements. Holders of Class A ordinary shares and Class B ordinary shares have the same rights except for voting and conversion rights. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to ten votes, subject to certain conditions, and is convertible into one Class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances.

We have been approved for listing the ADSs on the Nasdaq Capital Market, or Nasdaq, under the symbol “ICG”.

We are an “emerging growth company” as defined in the Jumpstart Our Business Act of 2012, as amended, and are eligible for reduced public company reporting requirements.

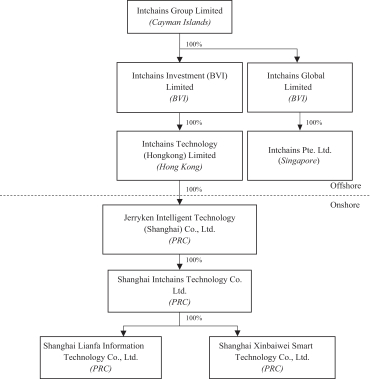

Investing in the ADSs involves risks. See “Risk Factors” beginning on page 16 of this prospectus. We are not a Chinese operating company but a Cayman Islands holding company with operations conducted by our subsidiaries based in China. The “Company” and “our Company” refer to Intchains Group Limited, a Cayman Islands company. “We,” “us,” and “our” refer to Intchains Group Limited and its subsidiaries. We currently conduct our business through Jerryken Intelligent Technology (Shanghai) Co., Ltd., or Jerryken Shanghai, and Shanghai Intchains Technology Co., Ltd., or Shanghai Intchains, each an indirect wholly owned subsidiary of the Company, and two operating subsidiaries wholly owned by Shanghai Intchains. All of these four operating subsidiaries are established under the laws of the PRC. This operating structure may involve unique risks to investors. Under relevant PRC laws and regulations, foreign investors are permitted to own 100% of the equity interests in a PRC-incorporated company engaged in the business of IC design. However, the PRC government may implement changes to the existing laws and regulations in the future, which may result in the prohibition or restriction of foreign investors from owning equity interests in our PRC operating subsidiaries. See “Risk Factors—Risks Relating to Doing Business in the PRC—The Chinese government may intervene in or influence our operations at any time, which could result in a material change in our operations and significantly and adversely impact the value of our ADSs” for a detailed discussion. There are significant legal and operational risks associated with being based in or having the majority of operations in China, including that changes in the legal, political and economic policies of the Chinese government, the relations between China and the United States, or Chinese or U.S. regulations may materially and adversely affect our business, financial condition and results of operations. Any such changes could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors, and could cause the value of our securities to significantly decline or become worthless. Recent statements made and regulatory actions undertaken by Chinese government, such as the Opinions on Strictly Cracking Down on Illegal Securities Activities issued on July 6, 2021 by the Chinese government, and any other future laws and regulations could significantly limit or completely hinder our ability to conduct our business, accept foreign investments, or list on an U.S. or other foreign exchange. Our auditor, which is based in New York, is currently subject to inspection by the PCAOB at least every three years. However, our auditor’s China affiliate is located in, and organized under the laws of, the PRC. On December 16, 2021, the PCAOB issued a report on its determinations that it is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong because of positions taken by PRC authorities in those jurisdictions. On August 26, 2022, the PCAOB entered into a Statement of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the PRC and, as summarized in the “Statement on Agreement Governing Inspections and Investigations of Audit Firms Based in China and Hong Kong” published on the U.S. Securities and Exchange Commission’s official website, the parties agreed to the following: (i) in accordance with the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation; (ii) the PCAOB shall have direct access to interview or take testimony from all personnel of the audit firms whose issuer engagements are being inspected or investigated; (iii) the PCAOB shall have the unfettered ability to transfer information to the SEC, in accordance with the Sarbanes-Oxley Act; and (iv) the PCAOB inspectors shall have access to complete audit work papers without any redactions, with view-only procedures for certain targeted pieces of information such as personally identifiable information. The PCAOB is required to reassess its determinations as to whether it is able to carry out inspection and investigation completely and without obstruction by the end of 2022. We cannot assure you that we will not be identified by the SEC under the Holding Foreign Companies Accountable Act, or the HFCA Act, as an issuer that has retained an auditor that has a branch or office located in a foreign jurisdiction that the PCAOB determines it is unable to inspect or investigate completely because of a position taken by an authority in that foreign jurisdiction. In addition, there can be no assurance that, if we have a “non-inspection” year, we will be able to take any remedial measures. If any such event were to occur, trading in our securities could in the future be prohibited under the HFCA Act and, as a result, we cannot assure you that we will be able to maintain the listing of the ADRs on Nasdaq or that you will be allowed to trade the ADRs in the United States on the “over-the-counter” markets or otherwise. Should the ADRs become not listed or tradeable in the United States, the value of the ADRs could be materially affected. See “Risk Factors—Risks Relating to Doing Business in the PRC” for a detailed discussion.

Intchains Group Limited holds all of the equity interests in its PRC subsidiaries through subsidiaries incorporated in the British Virgin Islands, or BVI, and Hong Kong. As we have a direct equity ownership structure, we do not have any agreement or contract between our Company and any of its subsidiaries that are typically seen in a variable interest entity structure. Within our direct equity ownership structure, funds from foreign investors can be directly transferred to our PRC subsidiaries by way of capital injection or in the form of a shareholder loan from Intchains Group Limited following this offering. If the Company plans to distribute dividends to its shareholders, our PRC operating subsidiaries will transfer the funds to the Company through our subsidiaries incorporated in the BVI and Hong Kong, and the Company will then distribute dividends to all shareholders in proportion to the shares they hold, regardless of the citizenship or domicile of the shareholders. For the three years ended December 31, 2019, 2020 and 2021 and the nine months ended September 30, 2021 and 2022, except for unsecured and interest-free inter-company funding of RMB11,040,000 transferred between our PRC subsidiaries in connection with our purchase of a 17.51% of equity interest in Shanghai Intchains Technology Co., Ltd and inter-company transactions that occurred in the ordinary course of business, no cash or other asset transfers occurred among Intchains Group Limited and its subsidiaries, and no dividends or distributions from a subsidiary were made to Intchains Group Limited or other investors. See “Corporate History and Structure” for additional details.

Neither the United States Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | |

| | | Per ADS | | Total |

Initial public offering price | | US$8.00 | | US$8,000,000 |

Underwriting discount and commissions(1) | | US$0.56 | | US$560,000 |

Proceeds, before expenses, to us | | US$7.44 | | US$7,440,000 |

| (1) | In addition to the underwriting discounts listed above, we have agreed to issue, upon closing of this offering, warrants to Maxim Group LLC (or its permitted assignees) to purchase a number of our ADSs equal to an aggregate of three percent (3.0%) of the total number of ADSs sold in this offering, or the Underwriter’s Warrants. The Underwriter’s Warrants will have an exercise price equal to 125% of the offering price of the ADSs sold in this offering and may be exercised on a cashless basis. The registration statement of which this prospectus is a part also covers the Underwriter’s Warrants and the ADSs representing our Class A ordinary shares issuable upon the exercise thereof. See “Underwriting” for additional information regarding total underwriter compensation. |

The underwriters have an option to purchase up to an aggregate of 150,000 additional ADSs from us at the initial public offering price, less underwriting discounts and commissions.

The underwriters expect to deliver the ADSs against payment in U.S. dollars on March 20, 2023.

Maxim Group LLC

Prospectus dated March 15, 2023