- HWH Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1/A Filing

HWH International (HWH) S-1/AIPO registration (amended)

Filed: 5 Jun 24, 4:16pm

As filed with the Securities and Exchange Commission on June 5, 2024

Registration No. 333-278560

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1/A

Amendment No. 3

UNDER

THE SECURITIES ACT OF 1933

| HWH International Inc. |

| (Exact Name of Registrant as Specified in its Charter) |

| Delaware | 5122 | 87-3296100 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

4800 Montgomery Lane, Suite 210

Bethesda, MD

1-301-971-3955

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John Thatch

Chief Executive Officer

HWH International Inc.

4800 Montgomery Lane, Suite 210

Bethesda, MD 20814

1-301-971-3955

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Darrin Ocasio, Esq.

Sichenzia Ross Ference Carmel LLP

1185 Avenue of the Americas, 31st Floor

New York, NY 10036

Telephone: (212) 930-9700

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended (the “Securities Act”), or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. The selling stockholder named in this prospectus may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated June 5, 2024

PROSPECTUS

HWH International Inc.

149,443 Shares of Common Stock

This prospectus relates to the resale by the selling stockholders of HWH International Inc. (the “Company”) named in this prospectus from time to time of up to 149,443 shares of common stock, par value $0.0001 per share, issued pursuant to a Satisfaction and Discharge of Indebtedness Agreement (the “Satisfaction Agreement”) between the Company and EF Hutton LLC (“EF Hutton”), dated as of December 18, 2023. The consideration received for 149,443 shares of common stock consisted of deferred underwriting commission, equivalent to $1,509,375 in deferred underwriting commission equitized at $10.10 per share.

We will not receive any proceeds from the sale of shares of common stock by the selling stockholders.

Our registration of the shares of common stock covered by this prospectus does not mean that the selling stockholders will offer or sell any of such shares of common stock. The selling stockholders named in this prospectus, or their donees, pledgees, transferees or other successors-in-interest, may resell the shares of common stock covered by this prospectus through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. For additional information on the possible methods of sale that may be used by the selling stockholders, you should refer to the section of this prospectus entitled “Plan of Distribution.”

No underwriter or other person has been engaged to facilitate the sale of the common stock in this offering. We will bear all costs, expenses and fees in connection with the registration of the common stock. The selling stockholders will bear all commissions and discounts, if any, attributable to their sales of our common stock.

Our common stock commenced trading on the Nasdaq Global Market LLC (“Nasdaq”) under the ticker symbol “HWH” on January 9, 2024, and the Company’s warrants are expected to commence trading under the symbol “HWHW” at a later date. On June 3, 2024, the closing price of our common stock on Nasdaq was $1.09 per share.

Investment in our common stock involves a high degree of risk. See “Risk Factors” contained in this prospectus on page 5, in our periodic reports filed from time to time with the Securities and Exchange Commission (the “SEC”), and in any applicable prospectus supplement. You should carefully read this prospectus before you invest in our common stock.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or the accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May , 2024.

TABLE OF CONTENTS

| i |

ABOUT THIS PROSPECTUS

This prospectus is part of the registration statement that we filed with the SEC pursuant to which the selling stockholders named herein may, from time to time, offer and sell or otherwise dispose of the shares of our common stock covered by this prospectus. As permitted by the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained in this prospectus.

This prospectus includes important information about us, the securities being offered and other information you should know before investing in our securities. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus, even though this prospectus is delivered or shares of common stock are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus in making your investment decision. You should also read and consider the information in the documents to which we have referred you under “Where You Can Find More Information” in this prospectus.

You should rely only on this prospectus. We have not, and the selling stockholders have not, authorized anyone to give any information or to make any representation to you other than those contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

Unless otherwise indicated, information contained in this prospectus concerning our industry, including our general expectations and market opportunity, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily uncertain due to a variety of factors, including those described in “Risk Factors” beginning on page 5 of this prospectus. These and other factors could cause our future performance to differ materially from our assumptions and estimates.

This prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer to sell these securities in any state or jurisdiction where the offer or sale is not permitted.

| 1 |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire prospectus carefully, including the “Risk Factors” section in this prospectus. In this prospectus, unless otherwise stated or the context otherwise requires, references to “HWH International,” “Company,” “we,” “us,” “our” or similar references mean HWH International Inc. and/or our subsidiaries on a consolidated basis.

Company Overview

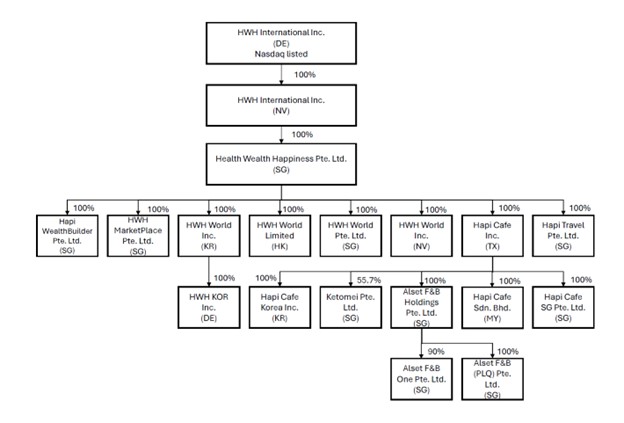

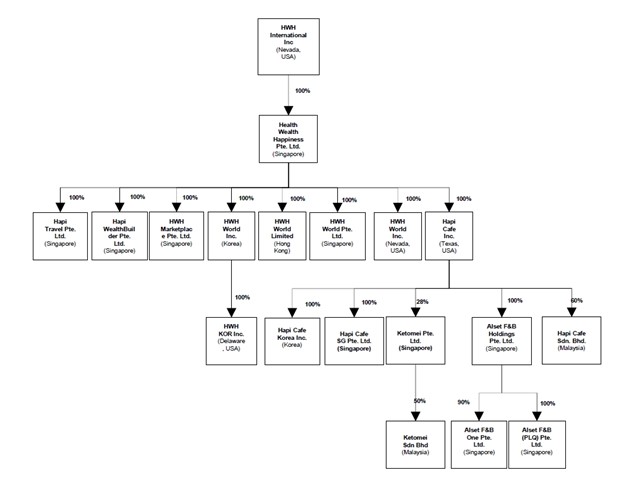

The business we acquired in January of 2024 started in South Korea with a single-level membership marketing model with limited products for sale. We registered the business on April 1, 2019, and we started selling founders packages on July 1, 2019. While we had been profitable and growing, the COVID-19 pandemic had a material adverse effect on such growth and profits. Due to the decline in membership and revenue starting in 2020, we reorganized our internal staff by adding a broader team in each of the United States, Hong Kong and Singapore with direct selling and business development experience to head up and expand our operations across various geographies and revised our business plan to a multi-level membership tier model in 2022, with more products and services to be made available to our members. We created a new corporate structure, with subsidiaries in the United States, Hong Kong and Singapore, that would allow for quick geographical expansion and turning our focus to the Hapi Café development.

We have 9,811 individuals with founding member status. This is a privileged class that will be able to enjoy continuous membership benefits given that they have trusted the Company and joined at an early stage. Such benefits include the ability to purchase new memberships, in the model described below, at a favorable rate to be determined by the Company. They will also continue to be able to earn affiliate commissions as they sell our products in the marketplace and enjoy discounted rates when visiting Hapi Cafés until further notice. The total number of founding members was capped at 10,000. The Company is in the midst of implementing a new membership model that operates on a yearly subscription basis. While we are not currently selling memberships, we intend to resume membership sales under this new model.

Members will get exclusive discounts on HWH Marketplace products, priority invites to product launch events and other parties, and can earn passive income when a member’s referral signs up for membership or makes an initial purchase of HWH Marketplace products through them.

Our operations include:

HWH Marketplace, which offers certain products manufactured by our affiliate companies, at a discounted price to our members. It is in the development stage, as we have been in discussions regarding the import and export of these products internationally. The various aspects of the HWH Marketplace will be launched in phases across various regions, each with their own timeline, depending on the completion of the establishment of the logistical aspects for implementation (i.e., payment gateway systems, business licenses, banking set up, import licenses, managerial resources, etc.). This will be an on-going process as we expand our product and service offering range. There are, however, certain limited products currently for sale at our Hapi Cafés, including spaghetti, a gig-economy business book and certain skincare products.

Hapi Cafés, which are, and will be, in-person, location-based social experiences, which offer members the opportunity to build a sense of community with like-minded customers who share a potential interest in our products. The cafes expose our members to and educate them about the products and services of our affiliates, providing us with the chance to significantly increase our membership base as well as increase the amounts spent by our members on our affiliates’ products and services. Each of our cafés is a “Hapi Café.” We opened proof-of-concept Hapi Café locations in Seoul, South Korea and Singapore in May 2022, July 2022 and April 2024, and plan to open additional Hapi Cafés as we beta test and further improve our business concept. We intend to grow our memberships as we grow the number of Hapi Cafés around the world. Hapi Cafe is positioned to be an integral part of HWH’s business model.

Our travel business is in the planning stage as we are working with our affiliates to determine the market-by-market services. Through our travel business, we plan to offer exclusive access to unpublished rates and discounts on air travel, cruises, car rentals, hotels, and resorts for members.

Hapi Wealth Builder is in the planning stage as we are exploring the options of providing services to our members through financial educational materials aimed at various types of investing opportunities. The team has been diligently producing digital content for Hapi Wealth Builder and working to collaborate with the right partners to launch the program and make it available to members. We have been establishing Hapi Cafés as venues and destinations that help build the credibility and reputation of the Company and its Hapi Wealth Builder business, which we intend to launch later in 2024.

| 2 |

Market Opportunity

Following the COVID-19 pandemic, we believe people are looking for in-person community. By offering a social and business centric atmosphere at our Hapi Cafés, we plan to leverage this deeply-rooted desire and build a membership organization, increase their familiarity with and educate them about the products and services of our affiliates and how those products and services can help them in their own individual pursuits of health, wealth and happiness.

Growth Strategy

Our strategy is to continuously grow our membership base, while displaying to our members the added benefits of the higher tiers of membership. We will look to accomplish this by providing a comfortable in person setting of a Hapi Café for our customers in many more locations. We also plan to continually expand our product offerings and the services our affiliate companies can provide in the belief that this can serve to grow our membership base and have our members increasingly opt to avail themselves of membership options that offer them larger discounts and other benefits on the products and services of our affiliates.

Nasdaq Deficiency

On March 7, 2024, we received notice from Nasdaq indicating that, because the market value of our common stock had been below $50,000,000 for the prior 37 consecutive business days, we no longer complied with the minimum market value of listed securities (the “MVLS”) requirement for continued listing on the Nasdaq Global Market under Rule 5450(b)(2)(A) of Nasdaq Listing Rules.

Nasdaq’s notice has no immediate effect on the listing of our common stock on the Nasdaq Global Market. Pursuant to Nasdaq Marketplace Rule 5810(c)(3)(C), we have been provided an initial compliance period of 180 calendar days, or until September 3, 2024, to regain compliance with the MVLS requirement. To regain compliance, the Company’s MVLS must close at $50,000,000 or more for a minimum of ten consecutive business days prior to September 3, 2024. In the event we do not regain compliance with the MVLS requirement prior to the expiration of the compliance period, we will receive written notification that our securities are subject to delisting. We may be able to continue our listing by transferring the listing of our securities from the Nasdaq Global Market to the Nasdaq Capital Market, which has a lower MVLS requirement of $35,000,000.

Credit Facility

On April 24, 2024, we entered into a Credit Facility Agreement (the “Credit Agreement”) with Alset Inc., a Texas corporation and the Company’s indirect, majority stockholder (“Alset Inc.”), pursuant to which Alset Inc. has provided the Company a line of credit facility (the “Credit Facility”) which provides a maximum, aggregate credit line of up to $1,000,000.

Pursuant to the Credit Agreement, the Company may request an advance (each, an “Advance”) on the Credit Facility. Each advance shall bear a simple interest rate of three percent (3%) per annum. Each Advance and all accrued but unpaid interest shall be due and payable at the first (1st) anniversary of the effective date of the Credit Agreement. HWH may at any time during the term of the Credit Agreement prepay a portion or all amounts of its indebtedness without penalty. Each advance shall not be secured by a lien or other encumbrance on any HWH assets, but shall be solely a general unsecured debt obligation of HWH.

Corporate Information

Our mailing address is 4800 Montgomery Lane, Suite 210, Bethesda, MD, 20814. We were incorporated in Delaware on October 20, 2021 under the name Alset Capital Acquisition Corp. The Company was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. The Company consummated a business combination on January 9, 2024 and changed its name from “Alset Capital Acquisition Corp.” to “HWH International Inc.” The Company is an early stage and emerging growth company and, as such, the Company is subject to all of the risks associated with early stage and emerging growth companies. The Company maintains a website at https://www.hwhintl.com.

| 3 |

THE OFFERING

Common Stock to be Offered by the Selling Stockholders | Up to 149,443 shares of our common stock. | |

| Use of Proceeds | All shares of our common stock offered by this prospectus are being registered for the account of the selling stockholders and we will not receive any proceeds from the sale of these shares. See “Use of Proceeds” beginning on page 23 of this prospectus for additional information. | |

| Plan of Distribution | The selling stockholders named in this prospectus, or their pledgees, donees, transferees, distributees, beneficiaries or other successors-in-interest, may offer or sell the shares of common stock from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The selling stockholders may also resell the shares of common stock to or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions.

See “Plan of Distribution” beginning on page 48 of this prospectus for additional information on the methods of sale that may be used by the selling stockholders. | |

| Nasdaq Global Market Symbol | Our common stock is listed on the Nasdaq Global Market LLC under the ticker symbol “HWH”. | |

| Risk Factors | Investing in our common stock involves significant risks. See “Risk Factors” beginning on page 5 of this prospectus. |

| 4 |

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information about these risks contained in this prospectus, as well as the other information contained in this prospectus generally, before deciding to buy our securities. Any of the risks we describe below could adversely affect our business, financial condition, operating results or prospects. The market prices for our securities could decline if one or more of these risks and uncertainties develop into actual events and you could lose all or part of your investment. Additional risks and uncertainties that we do not yet know of, or that we currently think are immaterial, may also impair our business operations. You should also refer to the other information contained in this prospectus, including our financial statements and the related notes.

If any of the events described in these risk factors actually occurs, or if additional risks and uncertainties that are not presently known to us or that we currently deem immaterial later materialize, then our business, prospects, results of operations and financial condition could be materially adversely affected. In that event, the trading price of our securities could decline, and you may lose all or part of your investment in our securities. The risks discussed include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

Risks Affecting HWH’s Business and Operations

Our stock price may incur negative pressure from sales pursuant to this registration statement.

The potential sale of shares of common stock pursuant to this registration statement may exert downward pressure on the public trading price of our shares of common stock. As of June 5, 2024, the shares registered herein represent approximately 0.92% of the total number of shares outstanding. Although the current trading price may be significantly below our SPAC IPO price of $10.00 per unit, selling stockholders could still have an incentive to sell. Such sales could result in increased market supply, leading to a decrease in the stock price. This downward pressure on the stock price could negatively impact investor sentiment, market perception, and the Company’s ability to raise capital or pursue strategic initiatives. Investors should consider the potential impact of these sales on the trading price of our common stock carefully before making investment decisions.

Our future growth may be limited.

The Company’s ability to achieve its expansion objectives into each of its intended four operational activities and to manage the growth of each and all effectively depends upon a variety of factors, including the Company’s ability to properly customize the products and services in each country of operations, to attract and retain members’ interest in each, any, or all four operational activities, to successfully position and market its products and services in each, any, or all four operational activities, and to capitalize on potential opportunities in a multitude of countries. The Company may never be able to successfully offer products and services in each, any, or all four operational activities which may cause it to cease operations.

Our business plan and operational structure may change.

As an emerging company, we continually analyze our business plan and operations in each of our four operational activities in light of current trends within certain countries. As a result of our ongoing analyses, we may decide to make substantial changes in one or all of our operational activities and the operations therein. In the future, as we continue our internal analyses and as market conditions and our available capital change, we may decide to make organizational changes and/or alter some or all of our operational activities, including ceasing operations in one or more of our planned operational activities. Currently, the Company has no intention of changing its business model or operational structure.

| 5 |

Our continued operations depend on the public’s acceptance of our product lines and services in the applicable country.

The ability to customize and develop our products and services that the applicable market finds desirable and willing to purchase membership is critically important to our success. We cannot be certain that the products and services we offer our members will be appealing to the applicable market and as a result there may not be any demand and our membership sales could be limited. In addition, there are no assurances that if we alter, customize, or develop new products or services in the future that the applicable markets demand for these will develop and this could adversely affect our business and any possible revenues.

The loss of key management personnel could adversely affect HWH’s business, financial condition, results of operations or independent associate relations.

Although HWH’s executive officers and senior management team do not work full-time for HWH and are instead employed by affiliates of HWH, HWH nevertheless depends on the continued services of its executive officers and senior management team as they work closely with independent associate leaders and are responsible for HWH’s day-to-day operations. HWH’s success depends in part on its ability to retain its executive officers and to continue to attract additional qualified individuals to HWH’s management team. Although HWH has not entered into employment agreements with any of its senior executive officers or members of its management team, all of those individuals have entered into employment agreements with affiliates of HWH, and HWH does not believe that any of them are planning to leave or retire in the near term, no assurances can be made that HWH’s senior executive officers or members of HWH’s senior management team will remain with it. The loss or limitation of the services of any of HWH’s executive officers or members of its senior management team, including its regional and country managers, or the inability to attract additional qualified management personnel could have a material adverse effect on HWH’s business, financial condition, results of operations, or independent associate relations.

The inability to attract, train and retain highly qualified employees could adversely impact HWH’s business, financial condition and results of operations.

HWH’s success depends on the contributions of its employees, the members of its senior management and other key operations, and administrative personnel. Excluding its senior executives and members of the senior management team, none of whom work full-time for HWH or under an employment contract, HWH has three employees at HWH World (Korea), three employees at Hapi Café Korea, Inc., and four employees at Hapi Café SG Pte Ltd. HWH must attract, train and retain a large and growing number of qualified employees, while controlling related labor costs. HWH’s ability to control labor and benefit costs is subject to numerous internal and external factors, including the continuing impacts of the pandemic, regulatory changes, prevailing wage rates, and healthcare and other insurance costs. HWH competes with other retail and non-retail businesses for these employees and invests significant resources in training and motivating them. There is no assurance that HWH will be able to attract or retain highly qualified employees in the future, which could have a material adverse effect on HWH’s business, financial condition and results of operations.

Although HWH relies on its affiliates to provide it with a number of key services necessary for its day-to-day operations, it does not have written contracts in place with those affiliates that contractually obligate them to provide such services, and if such affiliate providers do not perform adequately or perform at all, HWH’s costs may increase and HWH’s business, financial condition and results of operations could be adversely affected.

HWH relies heavily on HWH’s relationships with its affiliates to provide services for it. For example, and as discussed above, HWH relies on its affiliates to provide it with its executive officers and senior members of the management team. As another example, HWH relies on its affiliates to handle nearly all of its back-office functions, and it does not have written contracts or other written arrangements in place that govern how costs should be allocated between HWH and its affiliates in respect of such services or as to how the responsibilities should be allocated among HWH and its affiliates in respect of such services. For example, HWH relies on the internet technology services of NHN Godomall (“NHN”) to manage all aspects of its information technology infrastructure including for its online connectivity, infrastructure hosting, technical infrastructure, network management, content delivery, load balancing and protection against hacking and distributed denial-of-service attacks. Because NHN is not contractually obligated to provide these services to HWH, no assurances can be made that NHN will continue to provide such services to HWH, or that NHN will be available to assist HWH in the event that problems arise that need to be addressed. While HWH is seeking to transition to another service provider in the near future, there can be no assurance that there will be a contractual relationship and whether the terms will be favorable. Any of these risks stemming from HWH’s reliance on third-parties to provide support absent a written contract or favorable terms between them could increase HWH’s costs and adversely affect HWH’s business, financial condition and results of operations.

| 6 |

HWH relies on its affiliates, in particular its U.S.-based affiliate Sharing Services Global Corp. (“Sharing Services”), to provide it with all of the products which HWH currently sells to its customers and members, and as of the present time, no written contract is in place to govern the pricing and other terms of any sales from Sharing Services to HWH.

HWH currently purchases 100% percent of the products which it sells to consumers from Sharing Services. Although affiliated companies typically enter into written contracts between one another to set pricing terms and govern their economic relationships generally, HWH makes such purchases in the absence of a written contract that governs such sales and allocates the risks of such sales between Sharing Services and HWH. As a publicly-traded company, however, Sharing Services is required to act in the best interests of its own stockholders, and in the event Sharing Services faces a lack of sufficient inventory of its products, no assurances can be made that Sharing Services would allocate products to HWH instead of its own unaffiliated customers which potentially offer more favorable profit margins. In the event HWH is unable to obtain sufficient inventory of products to sell from Sharing Service and its other affiliates, HWH might have to alternatively source similar products from third-party vendors. If HWH needed to do this, no assurances can be made that this would not increase HWH’s costs and adversely affect HWH’s business, financial condition and results of operations.

HWH currently depends on a single supplier for the products it sells and there is potential for material disruptions in its supply chain or potential increases in the prices of the products HWH purchases beyond what HWH can pass along to its customers and members.

HWH depends on its affiliate supplier for all of the products which it currently sells. Any disruption or substantial decrease in the supply of products by this supplier, as a result of a shortage of raw materials, organized labor disputes, natural disasters, acts of cyberterrorism, or otherwise, could disrupt or substantially decrease HWH’s ability to fulfill customer orders. If this occurred, particularly for an extended period, HWH may not be able to continue to offer these or similar products and its future sales may decline. In such event, HWH may not be able to offset the decline in sales through substitution of products, price increases, or otherwise. In addition, if HWH’s supplier implemented unilateral price increases in response to the decrease in the supply of their products, HWH might not be able to pass along such price increases to HWH’s customers and its profitability may be reduced or eliminated as a result. The occurrence of any of these conditions could have a material adverse effect on HWH’s business, financial condition and results of operations.

HWH’s failure to appropriately respond to changing consumer preferences in any of its operational activities and demand for new products or product enhancements or new services or service compliments could significantly harm its relationship with its members, its product sales, as well as its financial condition and operating results.

HWH’s business, and the business of each of its operational activities, is subject to changing consumer trends and preferences, including rapid and frequent changes in demand for products, new product introductions and enhancements, and new services and compliments thereto. HWH’s failure to accurately predict these trends could negatively impact members’ opinion of the products sold by HWH, which in turn could harm its member relationships and cause the loss of sales. The success of HWH’s new product and service offerings and enhancements depends upon a number of factors, including HWH’s ability to:

● procure such products and services from its affiliates and other third-party suppliers;

● accurately anticipate consumer needs;

| 7 |

● negotiate favorable pricing for products and services from its affiliates and other third-party suppliers;

● successfully commercialize new products or product enhancements, or new services, in a timely manner;

● price its products and services competitively; and

● differentiate its product and services offerings from those of its competitors.

If HWH does not introduce new products or services or make enhancements or improvements to meet the changing needs of its customers and members in a timely manner, some of its products or services could be rendered obsolete, which could negatively impact its revenues, financial condition, and operating results.

HWH faces strong competition from other retailers, membership clubs, and service agencies, which could adversely affect its business, financial condition and results of operations.

The retail and services business and membership driven business is highly competitive. HWH competes for members, employees, sites, products and services and in other important respects with a number of local, regional and national wholesalers, retailers, and membership programs in the United States and Asia, including other business or social clubs with third party benefits, supermarkets, supercenters, internet retailers, department and specialty stores and operators selling a single category or narrow range of merchandise. Such retailers, service providers, and membership business operators compete in a variety of ways, including products, pricing, selection and availability, services, location, convenience, and the attractiveness and ease of use of websites and mobile applications. The evolution of online and mobile channels has improved the ability of customers to comparison shop, which has enhanced competition. Some competitors have greater financial resources and technology capabilities, better access to merchandise or services, and greater market penetration than HWH does. HWH’s inability to respond effectively to competitive pressures, changes in the retail or service markets or customer expectations could result in lost market share and negatively affect HWH’s financial results.

HWH’s failure to drive membership growth, loyalty and brand recognition could adversely affect its results of operations.

Membership loyalty and growth are essential to HWH’s business. The extent to which HWH achieves growth in its membership base, increases the penetration of the higher levels of membership, and sustains high renewal rates materially influences its profitability. Damage to HWH’s brands or reputation may negatively impact comparable sales, diminish member trust, and reduce renewal rates and, accordingly, net sales and membership fee revenue, negatively impacting its results of operations.

HWH sells, or plans to sell, many products and services under the brands of its affiliates. Maintaining consistent product and service quality, competitive pricing, and availability of these products and services is essential to developing and maintaining member loyalty. If HWH’s affiliate brands experience a loss of member acceptance or confidence, HWH’s membership sales and gross margin results could be adversely affected.

The partial dependence of HWH’s direct selling business model to sell its affiliates’ products and services to its members, and the highly competitive and dynamic nature of the direct selling industry could adversely affect its results of operations.

HWH, through the offerings of the products and services of its affiliate companies, operates in the direct selling industry market and distributes products and services to its members. The distribution of such products and services depends upon the continued efforts of HWH employees, and to a lesser extent, HWH members, to recruit new members. The success of their efforts to recruit and retain members may be affected by the competitive environment among membership-based companies, the conditions of the general labor market, including levels of employment, the occurrence of demographic and cultural changes in the workforce, and the extent to which their brand is recognized in the geographies in which they operate. There can be no assurance that HWH will be successful in recruiting, retaining, and upleveling enough members to grow its business worldwide.

| 8 |

The direct selling part of HWH’s business is highly competitive and dynamic, and generally there are few barriers to entering the industry. In particular, the sale of health and wellness products by direct selling industry participants, online resellers, and others is highly competitive. There are several companies, including many with more resources than HWH’s affiliate companies, that offer competing health and wellness products. The primary competitive factors for health and wellness products are (a) price; (b) the quality, perceived value, brand recognition and package appeal of the product; (c) the skills and effectiveness of the independent distributor and customer service staff interacting with the customer or potential customer; and (d) the continuous availability of enough product to fulfill orders promptly. There can be no assurance that HWH’s affiliates will remain competitive or that competition in the industry will not intensify.

If HWH does not remain competitive and promptly and effectively respond to increased competition, including competition for members, and to marketplace changes in the future, future sales of HWH memberships, and HWH’s affiliate products and services could decline. This could have a material adverse effect on HWH’s consolidated financial condition, results of operations and cash flows.

HWH’s ability to attract and retain members, and the potential adverse impact of the loss of a significant number of members may be for causes out of HWH’s control.

HWH’s operations in the direct selling industry depend on its ability to promote its membership, as well as the products and services HWH members have discounted access to and to market its membership and distribute HWH’s affiliate products and services. HWH’s success in recruiting and retaining members may be affected by the competitive environment among membership and direct-to-consumer companies, the conditions of the general labor market, including levels of employment, the occurrence of demographic and cultural changes in the workforce, and the extent to which HWH’s affiliates’ brands are recognized in the geographies in which HWH operates. HWH’s inability to attract and retain members in the future, the failure of a member to uplevel, the ineffectiveness of a member as a source of referrals, or the loss of a significant number of members for causes out of their control may adversely affect future sales of HWH’s products and services. This could have a material adverse effect on HWH’s consolidated financial condition, results of operations and cash flows.

Changes to HWH’s membership benefits could be negatively perceived by members, could fail to achieve the desired long-term goals, and could adversely impact future membership sales.

HWH may modify or add aspects of the membership benefits from time to time in efforts to keep its membership benefits competitive and attractive to its existing and future members, to address changing market conditions, to provide incentives that HWH believes will help grow its business, and to ensure conformance with evolving government regulations, among other reasons. In addition, the Company may be required to modify membership benefits from time to time to comply with existing or new regulations in the future, including in response to potential governmental enforcement action. Changes to its membership, including changes perceived to reduce the benefits and discounts available, could be negatively received by HWH members, could fail to achieve the desired long-term goals, and could adversely impact future sales. This, in turn, could adversely affect HWH’s business, financial condition, results of operations and cash flows.

If HWH’s is unable to maintain a positive image and brand acceptance in the dynamic, highly competitive, and sometimes unpredictable marketplace, including the impact of social media, its results of operations could be adversely impacted.

In recent years, there has been a significant increase in the use by businesses of social media platforms, including informal blogs, social media websites, and other forms of internet-based communications. Social media can enable a business to reach a wide selection of consumers and other targeted audiences, generally in a more cost-effective way than more traditional forms of marketing and advertising. However, negative, inaccurate, or false information about a company or the products or services it sells may be circulated through social media quickly and may damage a company’s reputation and business. In addition, negative, inaccurate, or false information about a company or the products or services it sells may be circulated through more traditional communication means. Many members and would be members value readily available information and often act on such information without further investigation. The harm caused by the circulation of negative, inaccurate, or false information about a company or its products or services may be immediate, and opportunities to redress and correct the information may be slow and costly. If HWH was the victim of allegations, or the dissemination of negative, inaccurate, or false information, circulated through social media or otherwise, this could adversely impact HWH’s reputation and business and could result in the loss of members and in a decline in HWH’s future sales.

| 9 |

HWH may also use social media platforms to communicate with existing and prospective members, and to otherwise promote its products and services. Laws and regulations intended to govern the use of the Internet and social media platforms are complex and evolving. If HWH, or other third parties acting on HWH’s behalf, were found to be in violation of any of these laws and regulations, this could result in fines and enforcement actions and adversely impact HWH’s reputation and business.

The occurrence of any of these conditions could have a material adverse effect on HWH’s business, financial condition, results of operations and cash flows.

Adverse or negative publicity could cause HWH’s business to suffer.

HWH’s business depends, in part, on the public’s perception of its integrity and the safety and quality of the products and services it sells. Any adverse publicity could negatively affect the public’s perception about HWH’s industry, HWH’s products and services, or HWH’s reputation and could result in a significant decline in its operations. Specifically, HWH is susceptible to adverse or negative publicity regarding:

● the nutritional supplements industry;

● skeptical consumers;

● competitors;

● the safety and quality of the products and services it sells;

● regulatory investigations of the products and services it sells or the products or services sold by its competitors; and

●scandals or regulatory investigations regarding the business practices or products or HWH’s competitors, specifically those competitors within the direct selling channel.

The success of HWH’s growth initiatives, including its efforts to attract new members, build brand awareness, and expand into additional international areas, is imperative.

HWH’s long-term success is dependent on its ability to achieve sustained growth. HWH is a developing company and has no significant sales history. In efforts to initiate growth and expansion into each of its four operational activities, HWH plans to launch a multipronged growth strategy intended to accelerate sales growth, including by: (a) expanding its service offerings, (b) increasing the number of Hapi Cafés, and (c) initiating operations in new countries in North America and Asia, among others. There can be no assurance that these strategic initiatives will result in the sales growth we anticipate, or any sales growth at all, the lack of which could have a material adverse effect on HWH’s business, financial condition, results of operations and cash flows.

A downturn in the economy could affect consumer purchases of discretionary items such as the health and wellness products that we offer, or the travel services we plan to offer, which could have an adverse effect on HWH’s business, financial condition, profitability, and cash flows.

HWH offers, or plans to offer, a broad selection of health and wellness products and travel services. A downturn in the economy could adversely impact consumer purchases of discretionary items such as health and wellness products or travel. The United States and global economies may slow dramatically as a result of a variety of problems, including turmoil in the credit and financial markets, concerns regarding the stability and viability of major financial institutions, the state of the housing markets, and volatility in worldwide stock markets. In the event of such economic downturn, the U.S. and global economies could become significantly challenged in a recessionary state for an indeterminate period of time. These economic conditions could cause many of HWH’s existing and potential members to delay or reduce purchases of the products and services sold by HWH for some time, which in turn could harm HWH’s business by adversely affecting its revenues, results of operations, cash flows and financial condition. HWH cannot predict these economic conditions or the impact they would have on HWH’s consumers or business.

| 10 |

HWH is subject to payment-related risks.

HWH accepts payments using a variety of methods, including select credit and debit cards, cash and checks, and member discounts. As HWH offers new payment options to its members, HWH may be subject to additional rules, regulations, compliance requirements, and higher fraud losses. For certain payment methods, HWH pays interchange and other related acceptance fees, along with additional transaction processing fees. HWH relies on third parties to provide payment transaction processing services for credit and debit cards and HWH’s shop card. It could disrupt HWH’s business if these processing service providers become unwilling or unable to provide these services to HWH. HWH is also subject to evolving payment card association and network operating rules, including data security rules, certification requirements and rules governing electronic funds transfers. If HWH’s internal systems are breached or compromised, HWH may be liable for card re-issuance costs, subject to fines and higher transaction fees and lose its ability to accept card payments from HWH members, and HWH’s business and operating results could be adversely affected.

HWH might sell products that cause illness or injury to its members, harm to its reputation, and expose HWH to litigation.

If HWH’s merchandise, including its food products prepared for human consumption, wellness products, skincare products, household products and durable goods, among others, do not meet or are perceived not to meet applicable safety or labeling standards or HWH’s members’ expectations, HWH could experience lost sales, increased costs, litigation or reputational harm. The sale of these items involves the risk of illness or injury to HWH’s members. Such illnesses or injuries could result from tampering by unauthorized third parties, product contamination or spoilage, including the presence of foreign objects, substances, chemicals, other agents, or residues introduced during the growing, manufacturing, storage, handling and transportation phases, or faulty design. HWH’s affiliate suppliers are generally contractually required to comply with product safety laws, and HWH is dependent on them to ensure that the products HWH buys comply with safety and other standards. While HWH is subject to governmental inspection and regulations and works to comply in all material respects with applicable laws and regulations, HWH cannot be sure that consumption or use of the products sold by HWH will not cause illness or injury or that HWH will not be subject to claims, lawsuits, or government investigations relating to such matters, resulting in costly product recalls and other liabilities that could adversely affect HWH’s business and results of operations. Even if a product liability claim is unsuccessful or is not fully pursued, negative publicity could adversely affect HWH’s reputation with existing and potential members and its corporate and brand image, and these effects could have a long-term adverse impact.

Furthermore, because HWH does not have a written agreement in place that sets forth the terms of sale between HWH and its affiliate suppliers, it is not clear that HWH would have recourse against its affiliate suppliers or any indemnification rights against such suppliers, given the absence of any written contract in place to govern the sale of such products by the affiliate supplier to HWH.

Nutritional supplements are often supported only by limited available clinical studies.

Nutritional supplements, such as many of the health and wellness products available through the HWH Marketplace, have a long history of human consumption. Some of these products may contain innovative ingredients or contain combinations of ingredients. Although HWH believes that all the products are safe when taken as directed, there is only limited data available about human consumption of certain of these product ingredients or combinations of ingredients in concentrated form. HWH’s affiliate suppliers conduct research and test the formulation and production of the products. However, there are only limited, if any, conclusive clinical studies available about the products and similar product in the marketplace. Furthermore, because HWH is highly dependent on members’ perception of the efficacy, safety, and quality of the products, HWH could be adversely affected in the event that the products, or similar products in the marketplace, are proven or asserted to be ineffective or harmful to consumers or in the event of publicity associated with any adverse effects resulting from the use or misuse of such products, or similar products in the marketplace. Any of these conditions could have a material adverse effect on HWH’s business, financial condition, results of operations and cash flows.

| 11 |

If the implementation of an information technology systems is not executed efficiently and effectively, HWH’s business, financial position, and operating results could be adversely affected.

Like many companies, HWH’s business is heavily dependent upon its information technology infrastructure to effectively manage and operate many of its key business functions, including:

● order processing;

● supply chain management;

● customer service;

● services provision;

● product distribution;

● cash receipts and payments; and

● financial reporting.

These systems and operations are vulnerable to damage and interruption from fires, earthquakes, telecommunications failures, and other events. They are also subject to break-ins, sabotage, intentional acts of vandalism and similar misconduct.

Occasionally information technology systems must be upgraded or replaced and if this system implementation is not executed efficiently and effectively, the implementation may cause interruptions in HWH’s primary management information systems, which may make HWH’s website or services unavailable thereby preventing us from processing transactions, which would adversely affect HWH’s financial position or operating results.

With increased frequency in recent years, cyber-attacks against companies have resulted in breaches of data security. HWH’s business requires the storage and transmission of suppliers’ data and our independent associates’ and customers’ personal, credit card, and other confidential information. HWH’s information technology systems are susceptible to a growing and evolving threat of cybersecurity risk. Any substantial compromise of HWH’s data security, whether externally or internally, or misuse of associate, customer, or employee data, could cause considerable damage to its reputation, cause the public disclosure of confidential information, and result in lost sales, significant costs, and litigation, which would negatively affect its financial position and results of operations.

Risks Related to HWH’s International Operations

HWH is highly dependent on the financial performance of its South Korea (“Korea”) and Singapore operations.

HWH’s financial and operational performance is currently highly dependent on its Korea and Singapore operations. Declines in financial performance of these operations could arise from, among other things: slow growth or declines in membership growth, comparable product sales (comparable sales); negative trends in operating expenses, including increased labor, healthcare and energy costs; failing to meet targets for Hapi Café openings changes or uncertainties in economic conditions in HWH’s markets, including higher levels of unemployment and depressed home values; and failing to consistently provide high quality and innovative new products and services.

HWH may not be able to successfully execute its international expansion strategy.

As a key part of its business strategy, HWH is looking to expand its operations in markets outside Korea and Singapore, including through the opening of additional overseas cafés and subsidiaries, particularly in South and Southeast Asia and in North America. In the coming years, HWH is looking to organize subsidiaries and rapidly expand its operations in numerous other countries, with a particular focus on the United States and Canada in North America and on Hong Kong, Malaysia, Singapore, Thailand, and Taiwan.

| 12 |

Notwithstanding the foregoing, the expansion of HWH’s operations abroad may be difficult due to the presence of established competitors in the relevant local markets. In addition, overseas expansion and the management of international operations may require significant financial expenditures as well as management attention and customization, and will subject HWH to the challenges of operating in an unfamiliar business environment with different regulatory, legal and taxation systems and political, economic and social risks.

HWH’s growth is also dependent, in part, on its ability to acquire property and build or lease new Hapi Cafés. HWH competes with other retailers and businesses for suitable locations. Local land use and other regulations restricting the construction and operation of Hapi Cafés, as well as local community actions opposed to the location of Hapi Cafés at specific sites and the adoption of local laws restricting HWH’s operations and environmental regulations, may impact HWH’s ability to find suitable locations and increase the cost of sites and of constructing, leasing and operating them. HWH may also have difficulty negotiating leases or purchase agreements on acceptable terms.

HWH intends to open additional Hapi Cafés in new markets. Associated risks include difficulties in attracting members due to a lack of familiarity with HWH, attracting members of other health, wealth and happiness-based club operators, HWH’s may be less familiarity with local member preferences, and seasonal differences in the markets. Entry into new markets may bring HWH into competition with new competitors or with existing competitors with a large, established market presence.

More generally, HWH’s international operations and future expansion plans are subject to political, economic, and social uncertainties, including:

● inflation;

● the renegotiation or modification of various agreements;

● increases in custom duties and tariffs;

● complex U.S. and foreign laws, treaties and regulations, including without limitation, tax laws, the U.S. Foreign Corrupt Practices Act, and similar anti-bribery and corruption acts and regulations in many of the markets in which we operate;

● trademark availability and registration issues;

● changes in exchange rates;

● changes in taxation;

● wars, civil unrest, acts of terrorism and other hostilities;

● political, economic, and social conditions;

● the effects of COVID-19;

● changes to trade practice laws or regulations governing direct selling and marketing;

● increased government scrutiny surrounding direct selling and network marketing; and

● changes in the perception of network marketing.

| 13 |

The risks outlined above could adversely affect HWH’s ability to sell products or services, obtain international customers, or to operate its international businesses, or business operational activities, profitably, which would have a negative impact on HWH’s overall business and results of operations. Furthermore, any negative changes in HWH’s distribution channels may force it to invest significant time and money related to HWH’s distribution and sales to first grow and then maintain its position in certain international markets. Accordingly, there is no guarantee that HWH will be successful in executing its overseas expansion strategy. The failure of its international expansion strategy could have an adverse impact on our business, results of operations and financial condition.

Fluctuations in foreign currency exchange rates will affect HWH’s financial results, which we report in U.S. Dollars.

HWH currently operates in multiple jurisdictions, which exposes it to the effects of fluctuations in currency exchange rates. HWH earns revenue denominated in Korean Won, Singapore Dollars, and U.S. Dollars. Fluctuations in the exchange rates between the various currencies that HWH uses could result in expenses being higher and revenue being lower than would be the case if exchange rates were stable. HWH cannot assure you that movements in foreign currency exchange rates will not have a material adverse effect on HWH’s results of operations in future periods. HWH has not previously entered into hedging contracts to limit its exposure to fluctuations in the value of the currencies that its businesses use, though it may do so at some point in the future, should it deem it expedient to do so. HWH cannot assure you that central banks of the jurisdictions in which it operates will, or would be able to, intervene in the foreign exchange market in the future to achieve stabilization or other objectives, or that such intervention would be effective in achieving the intended objectives.

Restrictions on currency exchange in certain countries may limit HWH’s ability to receive and use its revenue effectively.

A large majority of its revenue and expenses are currently denominated in Korean Won and Singapore Dollars. If revenue denominated in Korean Won or Singapore Dollars increase or expenses denominated in such currencies decrease in the future, HWH may need to convert a portion of its revenue into other currencies to meet its foreign currency obligations, including, among others, payment of dividends declared, if any, in respect of its shares. Especially as HWH expands into additional markets, HWH cannot guarantee that it will be able to convert the currencies of the countries in which it operates into U.S. Dollars or other foreign currencies to pay dividends or for other purposes on a timely basis or at all.

HWH has no business insurance coverage or certain other types of insurance.

Insurance products currently available in Asia are not as extensive as those offered in more developed regions. Consistent with customary industry practice in Asia, HWH does not currently carry business insurance. HWH has determined that the costs of insuring for related risks and the difficulties associated with acquiring such insurance on commercially reasonable terms makes it impractical for HWH to have such insurance. Any uninsured damage to HWH facilities or disruption of HWH’s business operations could require it to incur substantial costs and divert its resources, which could have an adverse effect on our business, financial condition and results of operations.

While HWH does carry insurance to cover claims for employee health care benefits and workers’ compensation as are required under applicable laws, general liability, property damage, directors’ and officers’ liability, and other exposures would be funded wholly by HWH. Significant claims or events, regulatory changes, a substantial rise in costs of health care or costs to maintain HWH’s insurance or the failure to maintain adequate insurance coverage could have an adverse impact on HWH’s financial condition and results of operations.

HWH’s revenue and net income may be materially and adversely affected by any economic slowdown in any regions of Asia as well as globally.

While HWH plans to expand its operations into North American, HWH currently derives 4% of its revenue from Korea and 96% from Singapore in the three months ended March 31, 2024, respectively, and 3% and 87% in the three months ended March 31, 2023, in Korea and Singapore, respectively, and is exposed to general economic conditions that affect consumer confidence, consumer spending, consumer discretionary income or changes in consumer purchasing habits. As a result, HWH’s revenue and net income could be impacted to a significant extent by economic conditions in Asia and globally. The Asia and global economy and markets are influenced by many factors beyond HWH’s control, including consumer perception of current and future economic conditions, political uncertainty, employment levels, inflation or deflation, real disposable income, interest rates, taxation and currency exchange rates.

| 14 |

Economic growth in Asia has experienced a mild moderation in recent years, partially due to the slowdown of the Chinese economy since 2012, as well as the global COVID-19 pandemic, global volatility of energy and consumer prices, U.S. monetary policies and other markets, and other factors. Asia will have to cope with potential external and domestic risks to sustain its economic growth. An economic downturn, whether actual or perceived, a further decrease in economic growth rates or an otherwise uncertain economic outlook in Asia or any other market in which HWH may operate could have a material adverse effect on HWH’s business, financial condition and results of operations.

Risks Related to HWH’s Operations in Korea

Unfavorable financial and economic developments in Korea may have an adverse effect on us.

At the present time, a material portion of HWH’s operations and assets are located in Korea. HWH is subject to political, economic, legal and regulatory risks specific to Korea, and HWH’s performance and successful fulfillment of its operational strategies are dependent in large part on the overall Korean economy. The economic indicators in Korea in recent years have shown mixed signs of growth and uncertainty, and starting in 2020, the overall Korean economy and the economies of Korea’s major trading partners have shown signs of deterioration due to the debilitating effects of the COVID-19 pandemic. Any possible recurrence of COVID-19 or other types of widespread infectious diseases in Korea may adversely affect HWH’s business, financial condition and results of operations.

The future growth of the Korean economy is subject to many factors beyond our control, including developments in the global economy. In recent years, adverse conditions and volatility in the worldwide financial markets, fluctuations in oil and commodity prices, supply chain disruptions and the increasing weakness of the global economy, in particular due to the COVID-19 pandemic and more recently Russia’s invasion of Ukraine and ensuing sanctions against Russia, have contributed to the uncertainty of global economic prospects in general and have adversely affected, and may continue to adversely affect, the Korean economy. The value of the Won, Korea’s national currency, relative to major foreign currencies has fluctuated significantly and, as a result of uncertain global and Korean economic conditions, there has been significant volatility in the stock prices of Korean companies recently. Any future deterioration of the Korean or global economy could adversely affect HWH’s business, financial condition and results of operations.

Developments that could have an adverse impact on Korea’s economy include:

| ● | the occurrence of severe health epidemics in Korea and other parts of the world (such as the ongoing global COVID-19 pandemic); | |

| ● | a continuing rise in the level of household debt and increasing delinquencies and credit defaults by retail or small- and medium-sized enterprise borrowers in Korea; | |

| ● | a deterioration in economic or diplomatic relations between Korea and its trading partners or allies, including deterioration resulting from territorial or trade disputes or disagreements in foreign policy; | |

| ● | increased sovereign default risks in select countries and the resulting adverse effects on the global financial markets; | |

| ● | a deterioration in the financial condition or performance of small- and medium-sized enterprises and other companies in Korea due to the government’s policies to increase minimum wages and limit working hours of employees; | |

| ● | investigations of large Korean conglomerates and their senior management for possible misconduct; | |

| ● | social and labor unrest; | |

| ● | substantial changes in the market prices of Korean real estate; |

| 15 |

| ● | a substantial decrease in tax revenues and a substantial increase in the Korean government’s expenditures for fiscal stimulus measures, unemployment compensation and other economic and social programs, in particular in light of the Korean government’s ongoing efforts to provide emergency relief payments to households and emergency loans to corporations in need of funding in light of the ongoing COVID-19 pandemic, which together would likely lead to a national budget deficit as well as an increase in the Korean government’s debt; | |

| ● | loss of investor confidence arising from corporate accounting irregularities and corporate governance issues concerning certain Korean conglomerates; | |

| ● | increases in social expenditures to support an aging population in Korea or decreases in economic productivity due to the declining population size in Korea; | |

| ● | geopolitical uncertainty and the risk of further attacks by terrorist groups around the world; | |

| ● | political uncertainty or increasing strife among or within political parties in Korea; | |

| ● | hostilities, political or social tensions involving Russia (including the invasion of Ukraine by Russia and ensuing actions that the United States and other countries may take) and the resulting adverse effects on the global supply of oil and other natural resources and the global financial markets; | |

| ● | hostilities or political or social tensions involving oil producing countries in the Middle East (including a potential escalation of hostilities between the United States and Iran) and North Africa and any material disruption in the global supply of oil or sudden increase in the price of oil; | |

| ● | natural or man-made disasters that have a significant adverse economic or other impact on Korea or its major trading partners; and | |

| ● | an increase in the level of tensions or an outbreak of hostilities between North Korea and Korea or the United States. |

Escalations in tensions with North Korea could have an adverse effect on HWH.

Relations between Korea and North Korea have been tense throughout Korea’s modern history. The level of tension between the two Koreas has fluctuated and may increase abruptly as a result of current and future events. In particular, there have been heightened security concerns in recent years stemming from North Korea’s nuclear weapon and ballistic missile programs as well as its hostile military actions against Korea.

North Korea’s economy also faces severe challenges, which may further aggravate social and political pressures within North Korea. Although bilateral summit meetings between the two Koreas were held in April 2018, May 2018 and September 2018 and between the United States and North Korea in June 2018, February 2019 and June 2019, there can be no assurance that the level of tensions affecting the Korean peninsula will not escalate in the future. Any further increase in tensions, which may occur, for example, if North Korea experiences a leadership crisis, high-level contacts between Korea and North Korea break down or military hostilities occur, could have a material adverse effect on the Korean economy and on HWH’s Korea- based members and customers, thereby having a material adverse effect on HWH’s business, financial condition and results of operations.

Strengthening of Korea’s consumer protection laws could adversely affect our Korean operations.

As a direct-to-consumer seller of consumer products in Korea, HWH is potentially subject to a variety of regulations in Korea that are designed to protect consumers. In recent years, in light of heightened public concern regarding privacy issues, the Korean government has placed greater emphasis on protection of personal information by companies in direct-to-consumer businesses and has implemented a number of measures to enhance consumer protection. Under the Personal Information Protection Act, companies designated as personal information managers may not collect, store, maintain, utilize or provide resident registration numbers of their customers, unless other laws or regulations specifically require or permit the management of resident registration numbers. In addition, under the Use and Protection of Credit Information Act, a company owes a higher duty to protect all information that it collects from its customers and is required to treat such information as credit information. A company’s ability to transfer or provide the information to its affiliates or holding company is considerably restricted, and significant damages may be imposed on a company for leakage of such information. Furthermore, under the Electronic Financial Transaction Act, a company may be primarily responsible for compensating its customers harmed by a cyber security breach affecting the company even if the breach is not directly attributable to the company.

| 16 |

Labor unrest in Korea may adversely affect HWH’s operations.

Economic difficulties in Korea or increases in corporate reorganizations and bankruptcies could result in layoffs and higher unemployment. Such developments could lead to social unrest and substantially increase government expenditures for unemployment compensation and other costs for social programs. According to statistics from the Korea National Statistical Office, the unemployment rate increased from 3.8% in 2018 and 2019 to 4.5% in 2020 and 3.7% in 2021. Further increases in unemployment and any resulting labor unrest in the future could adversely affect HWH’s operations, and the ability of many of HWH’s customers to purchase memberships and products from HWH. These developments in Korea may have an adverse effect on HWH’s financial condition and results of operations.

Risks Related to Regulation

HWH’s business may be adversely affected by legal claims and regulatory actions against it.

HWH is subject to the risk of legal claims and regulatory actions, which may expose it to monetary damages and legal costs, injunctive relief, criminal and civil penalties, sanctions against our management and employees and regulatory restrictions on our operations, as well as reputational harm.

HWH is unable to predict the outcome of many of the legal claims and regulatory actions in which it is involved, and the scope of the claims or actions or the total amount in dispute in such matters may increase.

Furthermore, adverse decisions, findings or resolutions in such matters could encourage other parties, including governmental authorities in other jurisdictions, to bring similar claims and actions against HWH. Accordingly, the outcome of current and future legal claims and regulatory actions, particularly those for which it is difficult to assess the maximum potential exposure or the ultimate adverse impact with any degree of certainty, may materially and adversely impact HWH’s business, reputation, results of operations and financial condition.

Civil or governmental challenges to HWH’s membership driven model or its related direct selling system or the distribution and service policies of HWH’s affiliates could harm HWH’s business.

The membership-based industry and the direct-to-consumer industry are subject to governmental scrutiny, including as a result of various national, state, and local laws and regulations. For example, in the U.S., the FTC has actively warned several direct selling companies, and the industry as a whole, about certain business practices associated with direct selling and has entered into settlements with several direct selling companies that required those companies to modify their compensation plans and business models.

In the countries where HWH operates, the direct selling industry and the service provision industry rely on the implementation of distributor or service provider rules and policies designed to protect consumers, prevent inappropriate sales activities and marketing practices, and prevent unregistered broker-dealer activity. HWH’s affiliates who engage in direct sales have adopted formal rules and policies that HWH’s affiliates believe are consistent with best domestic and global industry standards, as applicable. However, there can be no assurance that elements of HWH’s affiliates’ systems, or elements of their policies will not be challenged in civil or governmental actions, or that the application and interpretation of laws or regulations governing such industry operations in the future would not be harmful to HWH’s business. The occurrence of any of these conditions could have a material adverse effect on HWH’s business, financial condition, results of operations and cash flows.

| 17 |

HWH may fail to obtain, maintain or renew requisite licenses and approvals.

HWH may not be able to obtain all the licenses and approvals that may be deemed necessary to provide the products and services it plans to offer. Because the industries in which HWH operates may be relatively new in certain markets, the relevant laws and regulations, as well as their interpretations, are often unclear and evolving. This can make it difficult to know which licenses and approvals are necessary, or the processes for obtaining them. For these same reasons, HWH also cannot be certain that it will be able to maintain the licenses and approvals that it has previously obtained, or that once they expire HWH will be able to renew them. HWH also believes that some of its business operations fall outside the scope of licensing requirements, or benefit from certain exemptions, making it not necessary to obtain certain licenses or approvals. HWH cannot be sure that its interpretations of the rules and their exemptions have always been or will be consistent with those of the local regulators.