advisor, to discuss, among other things, an overview of the expected process for an initial business combination with Cohn Robbins. A subsequent meeting of the parties was held via teleconference on August 17, 2021 to discuss the same.

On August 5, 2021, a meeting was held via teleconference between Mr. Robbins, Mr. Marcy and Mr. Mena, on behalf of Cohn Robbins, and Ms. Natalie Alderson, on behalf of KKCG, along with a representative from PJT Partners UK, on behalf of SAZKA Entertainment as SAZKA Entertainment’s financial advisor, to discuss the timing of a potential business combination, the mutual interest of Cohn Robbins and SAZKA Entertainment in a potential business combination and continue the dialogue around the key terms of a proposed business combination. On August 12, 2021, a subsequent meeting was held via teleconference between the same parties to discuss SAZKA Entertainment’s annual audit, a virtual data room being opened for Cohn Robbins to begin diligence and Cohn Robbins’ intent to send SAZKA Entertainment a draft a term sheet.

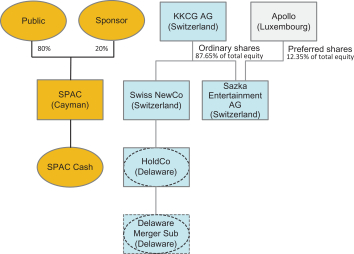

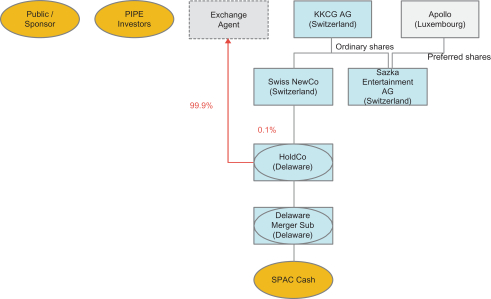

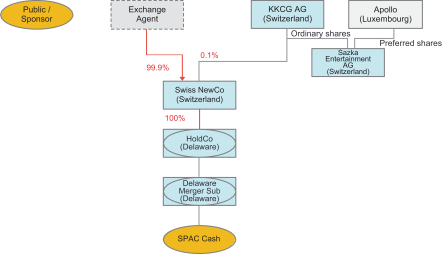

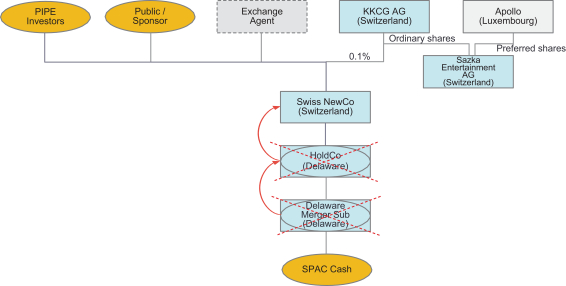

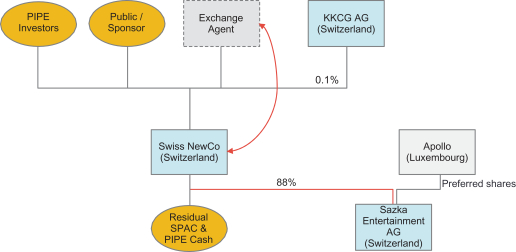

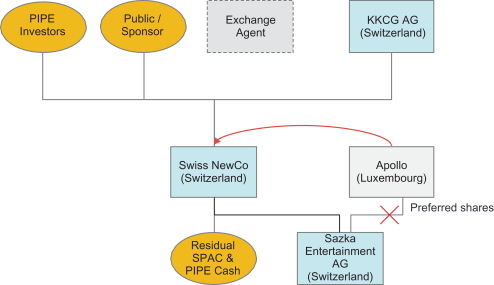

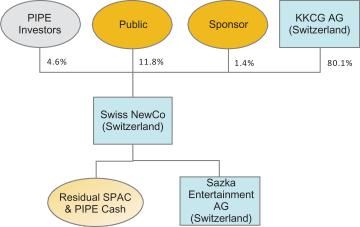

In addition, from August 19, 2021, through the execution of the Term Sheet on October 1, 2021, drafts were exchanged between SAZKA Entertainment, on the one hand, and Cohn Robbins and their legal advisors, on the other hand, on the provisions of the Term Sheet and the final Term Sheet was prepared. The principal issues discussed included the determination of the enterprise value and use of proceeds, the length of post-Closing lock-up and exclusivity period, the PIPE Financing, conditions to Closing and the structure of the combined company (including the structure and size of the board of directors and the dual-class share structure).

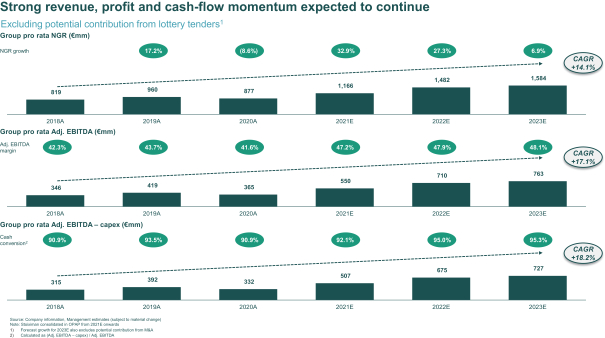

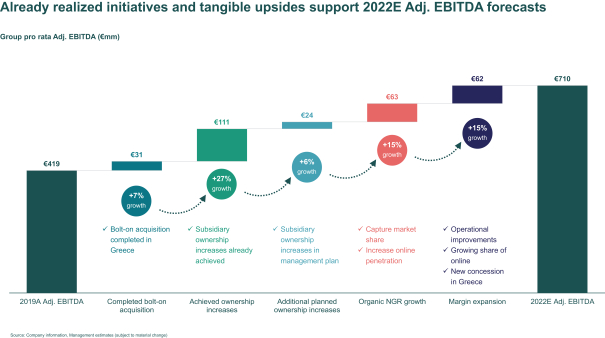

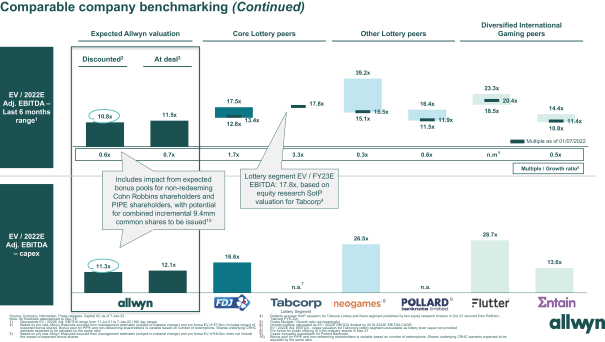

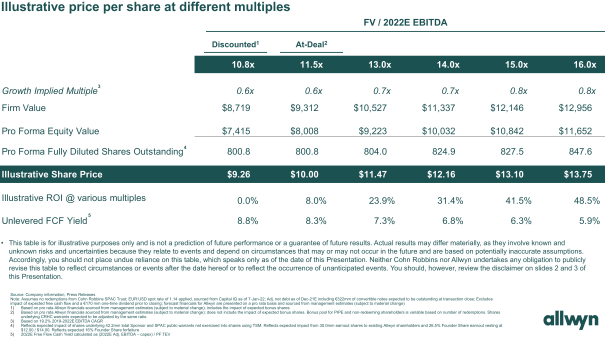

On August 24, 2021, an initial draft of a term sheet and updated proposal letter was sent by Cohn Robbins to KKCG and SAZKA Entertainment, which reflected an enterprise value of $11.6 billion (€9.9 billion), based on comparable public company multiples and the projected information of SAZKA Entertainment described below.

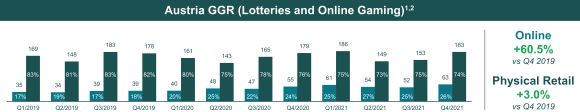

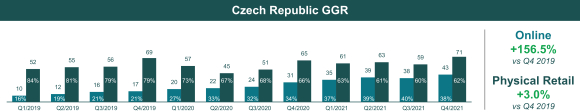

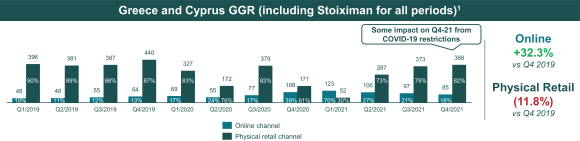

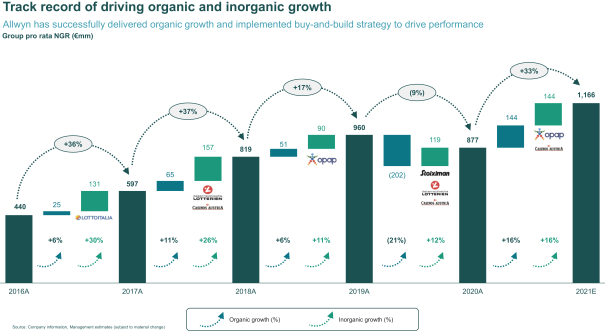

On August 27, 2021, a meeting was held via teleconference between Mr. Marcy and Mr. Mena, on behalf of Cohn Robbins, and Mr. Morton and Mr. Hruby, on behalf of SAZKA Entertainment, to discuss SAZKA Entertainment’s financial statements, including an overview of summary financial information by country, historical dividends and distributions by SAZKA Entertainment and the Group, historical mergers and acquisitions and the reasons therefore and tax differences by each of SAZKA Entertainment’s material segments. Further meetings via teleconference were held amongst the parties to discuss the same matters on September 21, 2021, September 25, 2021 and October 25, 2021.

On August 31, 2021, an introductory meeting was held via teleconference between Mr. Robbins, Mr. Cohn, Mr. Marcy and Mr. Mena, on behalf of Cohn Robbins, Michele Raba and Rajesh Jegadeesh, on behalf of Primrose, to discuss, among other things, Cohn Robbins and the benefits of an initial business combination with a U.S.-listed company.

On September 6, 2021, a meeting was held via teleconference between Mr. Marcy, on behalf of Cohn Robbins, and a representative from PJT Partners UK, on behalf of SAZKA Entertainment as SAZKA Entertainment’s financial advisor, to discuss the key terms of the August 24, 2021 draft of a term sheet.

On September 17, 2021, Cohn Robbins sent KKCG and SAZKA Entertainment an updated draft of a term sheet which reflected the addition of the Non-Redeemer Pool (as defined below), lengthening the mutual lock-up clause and reflecting a dual-class of shares for the combined company.

From September 9, 2021, through September 10, 2021, in-person meetings were held with representatives from Cohn Robbins, Mr. Robbins, Mr. Marcy and Mr. Mena, KKCG and SAZKA Entertainment in Prague, Czech Republic that included separate meetings with the CEO, CFO, CIO and CTO, in each case, of SAZKA Entertainment.

On September 18, 2021, KKCG’s principal, Mr. Komarek, KKCG representatives Mr. Saroch, Ms. Kohlmayer and Ms. Alderson and SAZKA Entertainment representative, Mr. Dlouhy, met with Cohn Robbins representatives Mr. Cohn, Mr. Robbins and Mr. Marcy, along with representatives from Citi and PJT Partners

392