ATLAS SAND COMPANY, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

outstanding. There were no outstanding borrowings under the 2018 ABL Credit Facility as of December 31, 2022. The Company recognized $0.2 million, $0.2 million, and $0.3 million of interest expense, unutilized commitment fees and other fees under the 2018 ABL Credit Facility, classified as interest expense, for the years ended December 31, 2022, 2021 and 2020, respectively.

The 2018 ABL Credit Facility requires that if the excess availability, as defined, is less than the greater of (i) 12.50% of the maximum credit and (ii) $5.0 million, the Company shall comply with a minimum fixed charge coverage ratio of at least 1.00 to 1.00, for covenant trigger periods beginning after March 14, 2019. In addition, the 2018 ABL Credit Facility contains negative covenants that restrict the Company from, among other things, incurring additional debt, granting liens, entering into guarantees, entering into certain mergers, making certain loans and investments, entering into swap agreements, disposing of assets, prepaying certain debt, declaring dividends, accounting changes, transactions with affiliates, modifying certain material agreements or organizational documents relating to, or changing the business it conducts.

The 2018 ABL Credit Facility contains certain customary representations and warranties, affirmative covenants, and events of default, including, among other things, payment defaults, breach of representations and warranties, covenant defaults, cross-defaults and cross-acceleration to certain indebtedness, certain events of bankruptcy, certain events of abandonment, certain events under the Employee Retirement Income Security Act of 1974 as amended from time to time, material judgments, actual or asserted failure of any guaranty or security document supporting the 2018 ABL Credit Facility to be in full force and effect and change of control. If such an event of default occurs, the lenders under the 2018 ABL Credit Facility would be entitled to take various actions, including the acceleration of amounts due under the 2018 ABL Credit Facility and all actions permitted to be taken by a secured creditor. As of December 31, 2022, the Company was in compliance with the covenants of the 2018 ABL Credit Facility.

Limited Waiver and First Amendment to the 2018 ABL Credit Facility

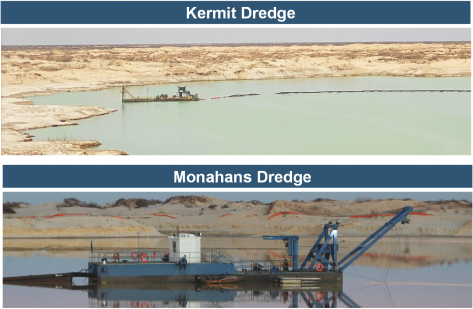

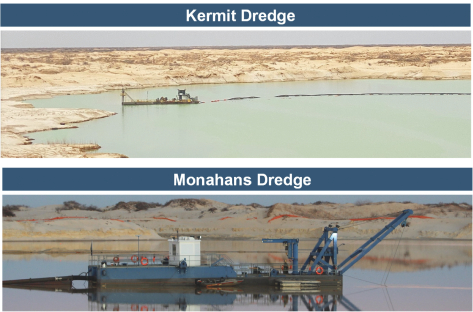

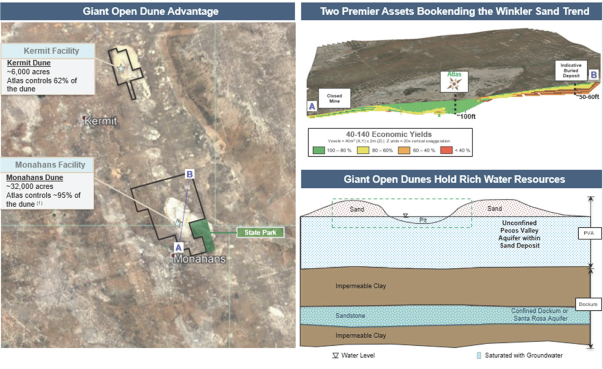

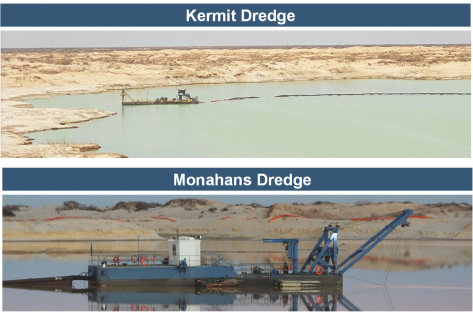

On June 4, 2019, the Company and the lenders agreed to amended certain terms of the 2018 ABL Credit Facility to extend the due date for taking certain actions with regard to two wholly owned subsidiaries of the Company, OLC Kermit, LLC and OLC Monahans, LLC, and to allow the making of limited investments into those subsidiaries. In addition, the lender agreed to waive any defaults or events of default that may have resulted from the Company’s acquisition of the two subsidiaries. The Limited Waiver and First Amendment was extended on August 31, 2019, on December 31, 2019, and on June 30, 2020.

Second Amendment to the 2018 ABL Credit Facility

On October 22, 2019, the Company and the lenders agreed to amend certain terms of the 2018 ABL Credit Facility to allow the Company to enter into insurance premium financing arrangements in the ordinary course of business.

Third Amendment to the 2018 ABL Credit Facility

On April 13, 2020, the Company and the lenders agreed to amend certain terms of the 2018 ABL Credit Facility that, in the event the Qualified SBA Loan is not forgiven, or fails to qualify for forgiveness, in accordance with the terms of the CARES ACT, allows the Company to establish reserves up to the amount of the Qualified Small Business Administration Loan that is not forgiven or fails to qualify for forgiveness.

F-26