As filed with the U.S. Securities and Exchange Commission on February 21, 2023.

Registration Statement No. 333-268015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

Form F-1

(Amendment No. 3)

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________________________

Decca Investment Limited

(Exact name of Registrant as specified in its charter)

__________________________________________

Not Applicable

(Translation of Registrant’s name into English)

__________________________________________

British Virgin Islands | | 2590 | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

2/F, Decca Industrial Centre

21 Cheung Lee Street

Chai Wan, Hong Kong

(852) 2896 2699

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

__________________________________________

c/o Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(212) 947-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

__________________________________________

Copies of all communications, including communications sent to agent for service, should be sent to:

Lawrence S. Venick, Esq.

Loeb & Loeb LLP

2206-19 Jardine House

1 Connaught Place, Central

Hong Kong SAR

Telephone: +852-3923-1111 | | Ying Li, Esq.

Guillaume de Sampigny, Esq.

Hunter Taubman Fischer & Li LLC

950 Third Avenue, 19th Floor

New York, NY 10022

Telephone: +1 (212) 530-2210 |

__________________________________________

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act: Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION, DATED FEBRUARY 21, 2023 |

Ordinary Shares

Decca Investment Limited

We are offering 6,000,000 ordinary shares, par value $0.0001 per share (“Ordinary Shares”). This is the initial public offering of Ordinary Shares of Decca Investment Limited (our “Company”). The offering price of our Ordinary Shares in this offering is expected to be between $4.00 and $6.00 per share. Prior to this offering, there has been no public market for our Ordinary Shares. We will apply to have our Ordinary Shares listed on the Nasdaq Capital Market (or Nasdaq) under the symbol “DCCA”. We cannot guarantee that we will be successful in listing our Ordinary Shares on Nasdaq; however, this offering is contingent upon on the final approval from Nasdaq and we will not complete this offering unless we are so listed.

Our Company is a holding company incorporated in the British Virgin Islands (“BVI”). As a holding company with no material operations of our own, we conduct our operations in Asia, primarily in Hong Kong and China, Europe and the U.S. through our operating subsidiaries. This is an offering of the Ordinary Shares of our Company, the holding company in the BVI, instead of shares of our operating entities. You may never directly hold any equity interest in our operating entities. We are offering 6,000,000 Ordinary Shares of our Company, representing 13.0% of the Ordinary Shares following completion of the offering of our Company. Following the offering, 13.0% of the Ordinary Shares will be held by public shareholders, assuming the underwriters do not exercise their over-allotment option.

Following the completion of this offering, we will be a “controlled company” within the meaning of the NASDAQ Stock Market Rules and may rely on exemptions from certain corporate governance requirements. As at the date of this prospectus, 100% of the issued share capital of the Company is owned by Pioneer East Investment Development Limited, which in turn is owned 70% by Mr. Wong Man Hin, Max, our Director. Mr. Wong Man Hin, Max therefore beneficially owns 70% of our total voting power as at the date of this prospectus. Following completion of this offering, 87.0% of the issued share capital of the Company will be owned by Pioneer East Investment Development Limited and Mr. Wong Man Hin, Max will in turn beneficially own 60.9% of our total voting power. See “Management — Controlled Company Exception”.

As our Company is a holding company incorporated in the BVI and not a Chinese operating company, our operations in Hong Kong and China are conducted by our subsidiaries based in Hong Kong and China. The Ordinary Shares offered in this offering are shares of Decca Investment Limited, the BVI holding company, instead of shares of the operating subsidiaries. Investors in this offering are purchasing interests in the BVI holding company and will not directly hold equity interests in the operating subsidiaries. This structure involves unique risks to investors. See “Risk Factors” beginning on page 16 of this prospectus for a discussion of risks facing the Company and the offering as a result of this structure. We may be subject to unique risks due to uncertainty of the interpretation and the application of the PRC laws and regulations, including but not limited to the cybersecurity review and regulatory review of oversea listing of our Ordinary Shares through an offshore holding company. We are also subject to the risks of uncertainty about any future actions of the Chinese government or authorities in Hong Kong in this regard.

Should the Chinese government choose to exercise significant oversight and discretion over the conduct of our business, they may intervene in or influence our operations. Such governmental actions:

• could result in a material change in our operations;

• could significantly limit or completely hinder our ability to continue our operations;

• could hinder our ability to continue to offer securities to investors; and

• may cause the value of our Ordinary Shares to significantly decline or be worthless.

Additionally, although we have direct ownership of our operating entities in Hong Kong and China and currently do not have or intend to have any contractual arrangement to establish a variable interest entity (“VIE”) structure with any entity in the China, we are still subject to certain legal and operational risks associated with our operating subsidiaries in Hong Kong and China.

Trading in our Ordinary Shares on U.S. markets, including the OTC market, may be prohibited under the Holding Foreign Companies Accountable Act (the “HFCA Act”) if the PCAOB determines that it is unable to inspect or investigate completely our auditor for two consecutive years. On December 16, 2021, the Public Company Accounting Oversight Board (the “PCAOB”) issued the HFCA Act Determination Report to notify the SEC of its determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong (the “2021 Determinations”). As of the date of this report, our auditor is not included in the HFCA Act Determination Report. On December 15, 2022, the PCAOB announced that it was able to conduct inspections and investigations completely of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong in 2022. The PCAOB vacated its previous 2021 Determinations accordingly. As a result, we do not expect to be identified as a “Commission-Identified Issuer” under the HFCA Act for the current period after we file our F-1 report. However, whether the PCAOB will continue to conduct inspections and investigations completely to its satisfaction of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control, including positions taken by authorities of the PRC. The PCAOB is expected to continue to demand complete access to inspections and investigations against accounting firms headquartered in mainland China and Hong Kong in the future and states that it has already made plans to resume regular inspections in early 2023 and beyond. The PCAOB is required under the HFCA Act to make its determination on an annual basis with regards to its ability to inspect and investigate completely accounting firms based in the mainland China and Hong Kong. The possibility of being a “Commission-Identified Issuer” and risk of delisting could continue to adversely affect the trading price of our securities. Should the PCAOB again encounter impediments to inspections and investigations in mainland China or Hong Kong as a result of positions taken by any authority in either jurisdiction, the PCAOB will make determinations under the HFCA Act as and when appropriate. For details, see “Risk Factors—Risks Relating to Doing Business in China- Recent developments with respect to audits of China-based companies may still also create uncertainty about the ability of our current auditor to fully cooperate with the PCAOB’s inspection requests without the approval of the relevant PRC authorities.

During the years ended March 31, 2022 and 2021 and the six months ended September 30, 2022, the transfer of cash among our Company and our subsidiaries were in the form of dividends. For the year ended March 31, 2021 and the six months ended September 30, 2022, we did not declare any dividend. For the year ended March 31, 2022, we declared dividends of HKD 400,304,030 (USD 51,086,587) in relation to our retained profit, which were funds transferred through payment of dividends from our subsidiaries. As of September 30, 2022, dividend payables balance amounted to HKD 156.1 million ($19.9 million). Our Company expects to pay out the remaining balance of the dividend payables to the shareholders by March 31, 2023 with the cash flow generated from our operating activities. We do not have any current intentions to distribute further earnings. If we determine to pay dividends on any of our Ordinary Shares in the future, as a holding company, we will be dependent on receipt of funds from our subsidiaries by way of dividend payments. See “Dividend Policy”, Summary Consolidated Financial Data and Consolidated Statements of Change in Shareholders’ Equity in the Report of Independent Registered Public Accounting Firm for further details.

We are aware that recently the PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon the legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any. It is also highly uncertain what the potential impact such modified or new laws and regulations will have on our daily business operation in Hong Kong or the PRC, our ability to accept foreign investments and the listing of our Ordinary Shares on a U.S. or other foreign exchanges.

Investing in our Ordinary Shares is highly speculative and involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our Ordinary Shares in “Risk Factors” beginning on page 16 of this prospectus.

We are an “emerging growth company” as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company and a Foreign Private Issuer” for additional information.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | PER SHARE | | TOTAL |

Initial public offering price | | $ | | | $ | |

Underwriting discounts(1) | | $ | | | $ | |

Proceeds, before expenses, to us | | $ | | | $ | |

We expect our total cash expenses for this offering (including cash expenses payable to our underwriters for their out-of-pocket expenses) to be approximately $ , exclusive of the above discounts. In addition, we will pay additional items of value in connection with this offering that are viewed by the Financial Industry Regulatory Authority, or FINRA, as underwriting compensation. These payments will further reduce proceeds available to us before expenses. See “Underwriting.”

This offering is being conducted on a firm commitment basis. The underwriters are obligated to take and pay for all of the shares if any such shares are taken. We have granted the underwriters an option for a period of forty-five (45) days after the closing of this offering to purchase up to 15% of the total number of our Ordinary Shares to be offered by us pursuant to this offering (excluding shares subject to this option), solely for the purpose of covering over-allotments, at the initial public offering price less the underwriting discounts. If the underwriters exercise the option in full, the total underwriting discounts payable will be $ based on an assumed initial public offering price of $ per ordinary share (the midpoint of the price range set forth on the cover page of this prospectus), and the total gross proceeds to us, before underwriting discounts and expenses, will be $ . If we complete this offering, net proceeds will be delivered to us on the closing date. We will not be able to use such proceeds in China, however, until we complete capital contribution procedures which require prior approval from each of the respective local counterparts of China’s Ministry of Commerce, the State Administration for Market Regulation, and the State Administration of Foreign Exchange. See remittance procedures in the section titled “Use of Proceeds” beginning on page 42.

The underwriters expect to deliver the Ordinary Shares against payment as set forth under “Underwriting”, on or about , 2023.

The date of this prospectus is , 2023.

Table of Contents

TABLE OF CONTENTS

We are responsible for the information contained in this prospectus and any free writing prospectus we prepare or authorize. We have not, and the underwriters have not, authorized anyone to provide you with different information, and we and the underwriters take no responsibility for any other information others may give you. We are not, and the underwriters are not, making an offer to sell our Ordinary Shares in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or the sale of any Ordinary Shares.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Ordinary Shares and the distribution of this prospectus outside the United States.

Our Company is incorporated under the laws of the British Virgin Islands and a majority of our outstanding securities are owned by non-U.S. residents. Under the rules of the U.S. Securities and Exchange Commission, or the SEC, we currently qualify for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial statements with the Securities and Exchange Commission, or the SEC, as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Until and including , 2022 (twenty-five (25) days after the date of this prospectus), all dealers that buy, sell or trade our Ordinary Shares, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

Table of Contents

CONVENTIONS THAT APPLY TO THIS PROSPECTUS

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to:

• “BVI” are to the British Virgin Islands;

• “Hong Kong” are to the Hong Kong Special Administrative Region in China;

• “HKD” or “HK$” are to the legal currency of Hong Kong;

• “Ordinary Shares” are the ordinary shares of our Company, par value of $0.0001 per share;

• “our Company” are to Decca Investment Limited, the holding company incorporated in the BVI that will issue the Ordinary Shares being offered in this offering;

• “our Group”, “we”, “us” and “our” are to our Company and its subsidiaries, as the context requires;

• “Hong Kong Operating Subsidiaries” are to the subsidiaries incorporated and operating in Hong Kong, including Decca (Mgt) Limited, Decca Furniture Limited, Decca (China) Limited, Vielie Flooring Limited, CLI Design Limited, CLI Design (HK) Limited and Decca Contract Furniture (HK) Limited;

• “PRC Operating Subsidiaries” are to the subsidiaries established and operating in China, including Dongguan Yi Xin Furniture and Decoration Co. Ltd, Dongguan Decca Furniture Co. Ltd, Dongguan Kong Chai Trading Co. Ltd and Guangzhou Yi Xin Decoration Co. Ltd;

• “U.S. Operating Subsidiaries” are to the subsidiaries incorporated and operating in the U.S., including Decca Furniture (USA) Inc., Bolier & Company LLC, Decca Hospitality Furnishing, LLC, Decca Contract Furniture, LLC and Decca Home, LLC;

• “our Director(s)” are to the director(s) of our Company;

• “PRC” or “China” are to the People’s Republic of China;

• “RMB” or “Renminbi” are to the legal currency of China;

• “$”, “USD”, “US$” or “U.S. dollars” are to the legal currency of the United States;

• “SGD” are to the legal currency of Singapore;

• “THB” are to the legal currency of Thailand;

• “EUR” are to the legal currency of the European Union; and

• “MOP” are to the legal currency of Macau.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

Unless the context indicates otherwise, all information in this prospectus assumes no exercise by the underwriters of their over-allotment option.

The functional currency of our entities located in the U.S. is U.S. dollar, the functional currency of our entities located in Hong Kong is HKD, the functional currency of our entities located in the PRC is RMB, the functional currency of our entities located in Singapore is SGD, the functional currency of our entities located in Thailand is THB, the functional currency of our entities located in the European Union is EUR, and the functional currency of our entities located in Macau is MOP. Our consolidated financial statements are presented in HKD. We use HKD as reporting currency in our consolidated financial statements and in this prospectus. Assets and liabilities are translated at the exchange rates on the balance sheet date, equity amounts are translated at historical exchange rates, and revenues, expenses, gains and losses are translated using the average rate for the period. Gains or losses resulting from foreign currency transactions are included in the accompanying consolidated statement of income and other comprehensive income.

Translations of balances in the consolidated balance sheets, consolidated statements of income and consolidated statements of cash flows from HKD into USD as of and for the year ended March 31, 2022 and the six months ended September 30, 2022 are solely for the convenience of the reader and were calculated at the rate of HKD 1.00 to USD 0.1274, representing closing rate set by the United States federal reserve on September 30, 2022 which is the Company’s most recent practicable date. No representation is made that the HKD amounts represent or could have been, or could be, converted, realized or settled into USD at that rate, or at any other rate.

ii

Table of Contents

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our Ordinary Shares. You should read the entire prospectus carefully, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related notes thereto, in each case included in this prospectus. You should carefully consider, among other things, the matters discussed in the section of this prospectus titled “Business” before making an investment decision.

Overview

Our Group is a specialized architectural woodworking company based in Hong Kong which manufactures high quality custom made wooden furniture and architectural fixtures and fittings. We are also a specialist contractor for interior works. We manufacture and sell a range of furniture serving residential, office, hotel and retail markets in Asia, primarily in Hong Kong and China, as well as in the U.S. and Europe.

Founded by Mr. Tsang Chi Hung, our Group’s then chairman and managing director, in 1973, our Group has grown from a small subcontractor of interior works to a major specialized manufacturer of custom made furniture and architectural woodwork worldwide as well as a sizable contractor of interior works in Hong Kong and China.

The principal operations of our Group comprise:

• the manufacture of custom made wooden furniture for residential buildings, offices, hotels and other uses;

• the manufacture of architectural fixtures and fittings, such as wall panelling, floors, built-in cabinets, molding, doors and door frames and architectural features at its factory in Dongguan, China. Generally, architectural fixtures and fittings manufactured by our Group are manufactured as part of its interior building works contracts or installed by others where our Group acts as a sub-contractor;

• interior building works which involve the fitting out or refurbishing of the interiors of newly constructed and existing buildings on a contract basis;

• design and build contracts whereby our Group’s own interior design team offers a comprehensive interior design and installation service; and

• furniture showroom sales across Asia, U.S. and Europe which involve the manufacture and distribution of ranges of high quality furniture and fixtures.

Industry Background

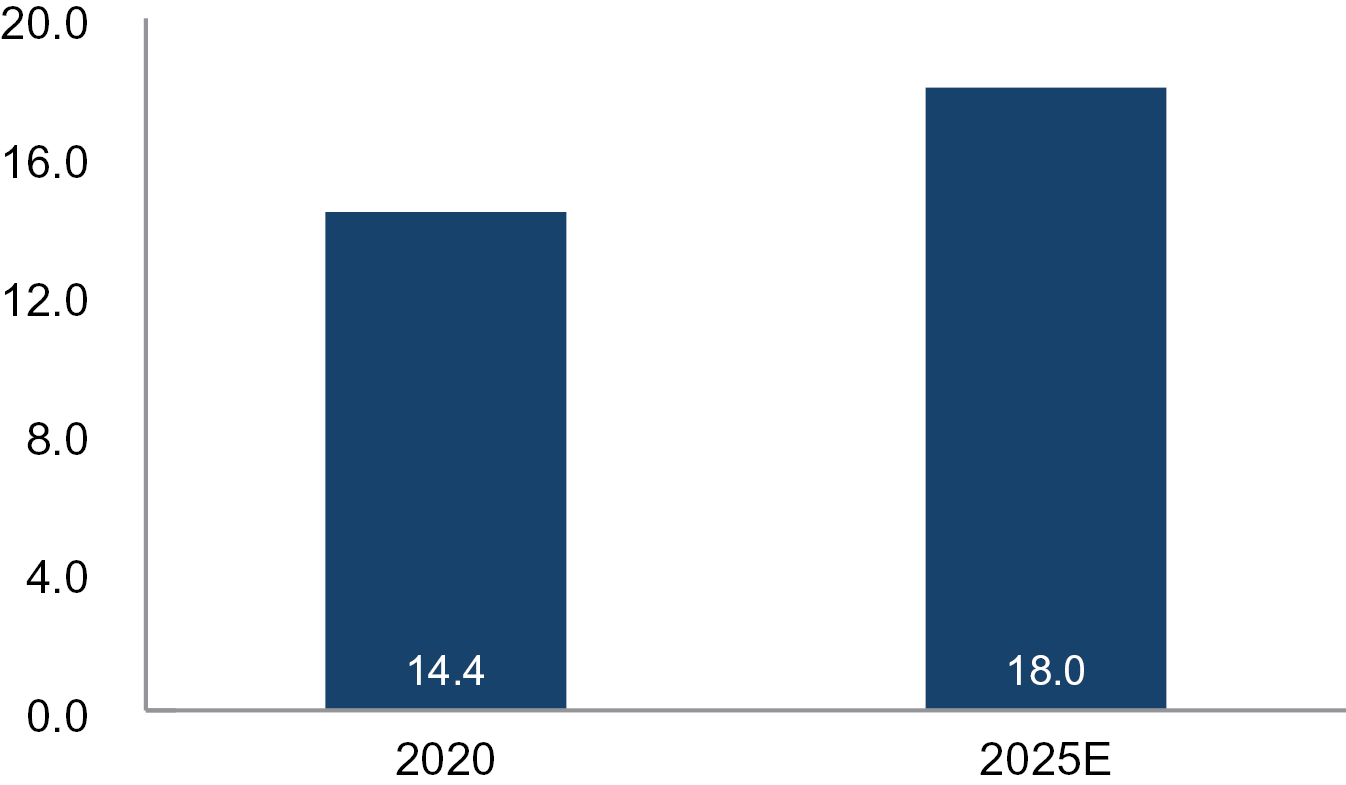

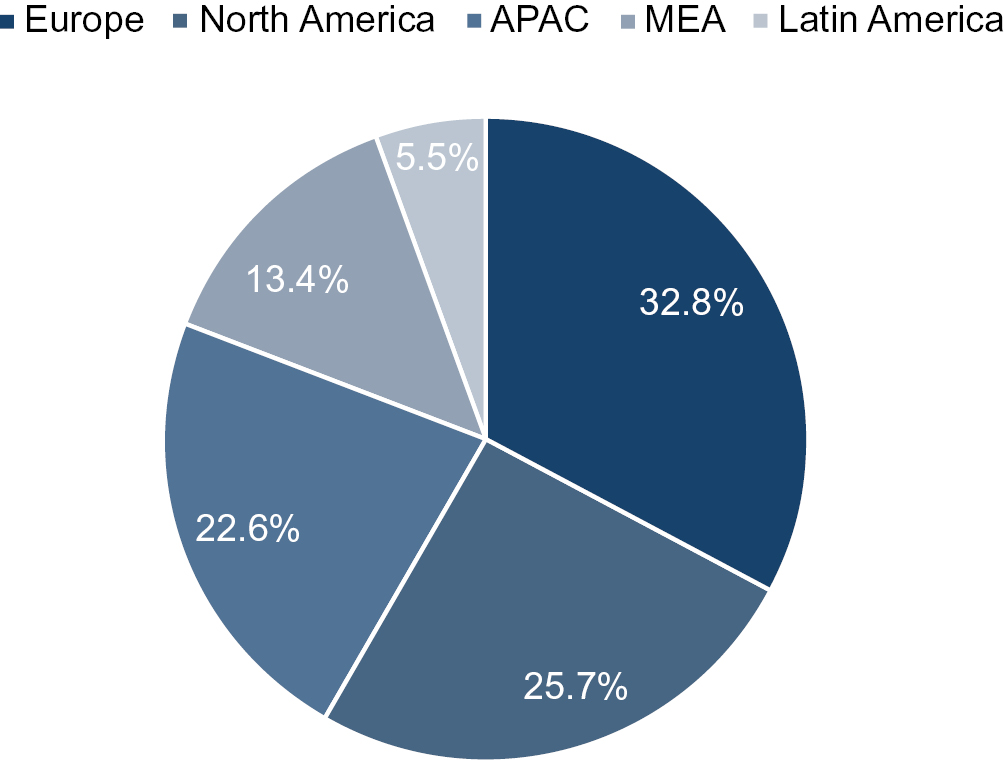

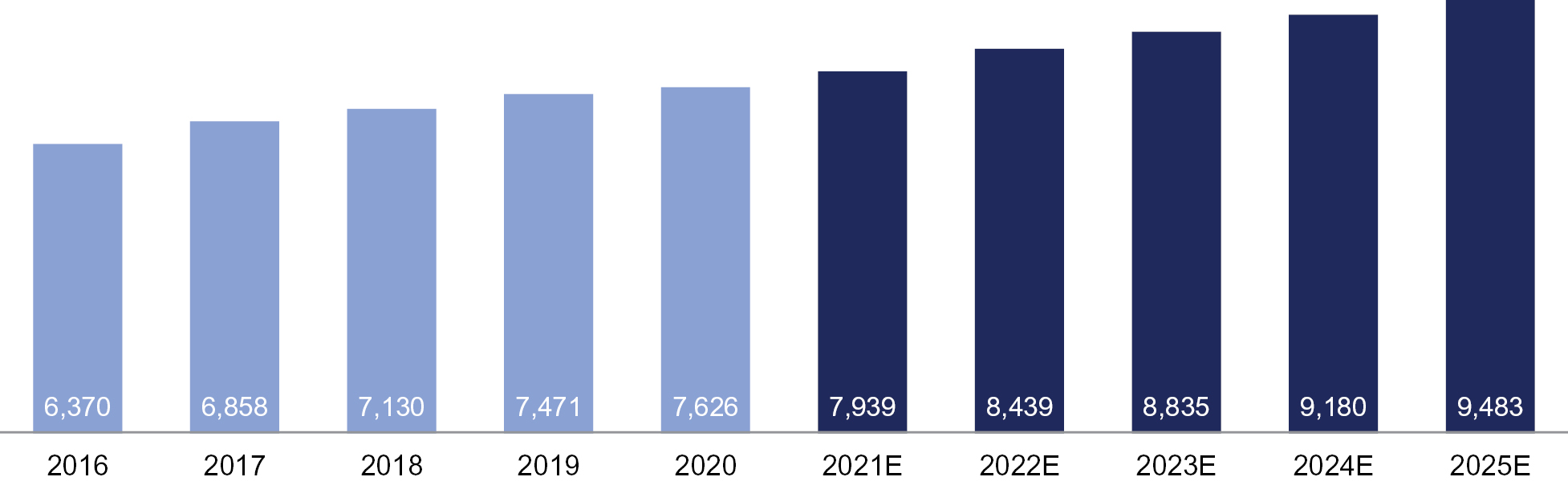

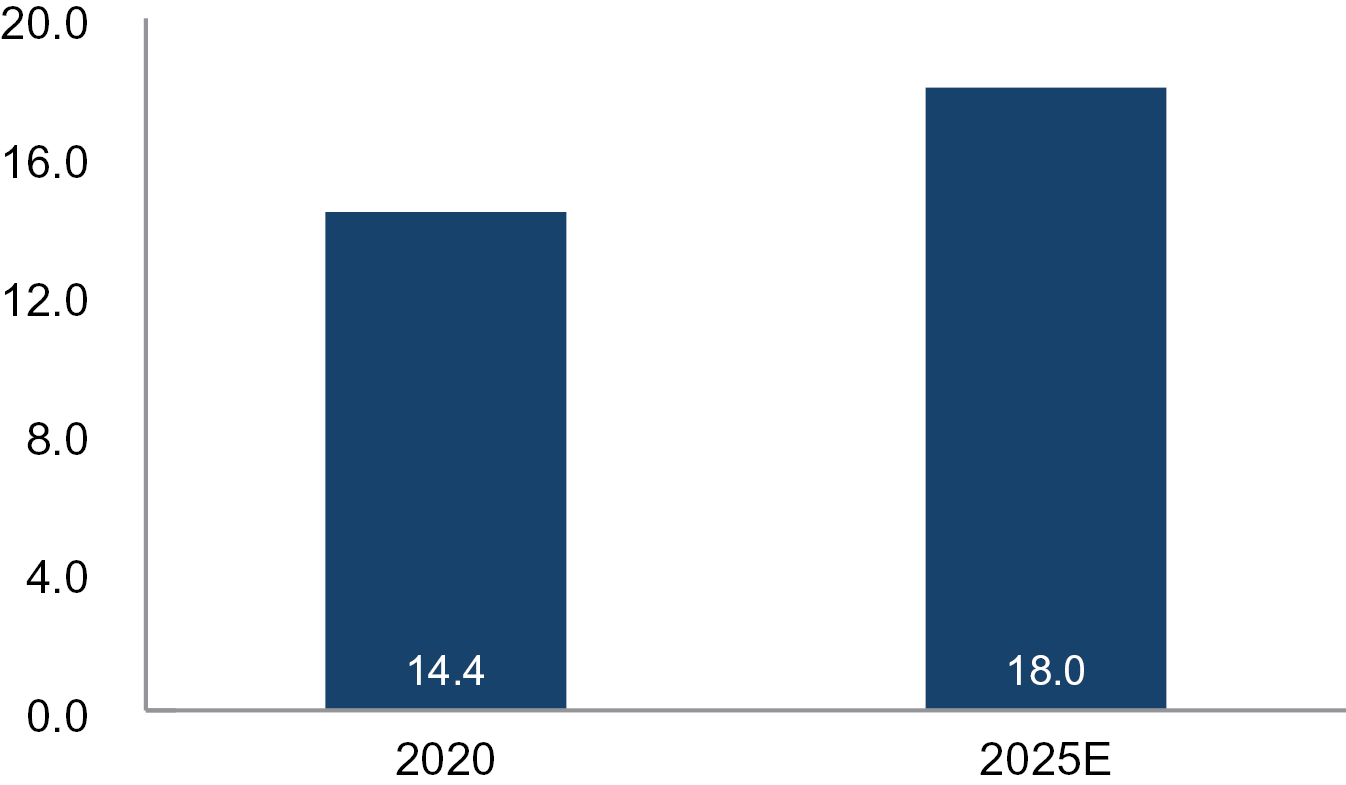

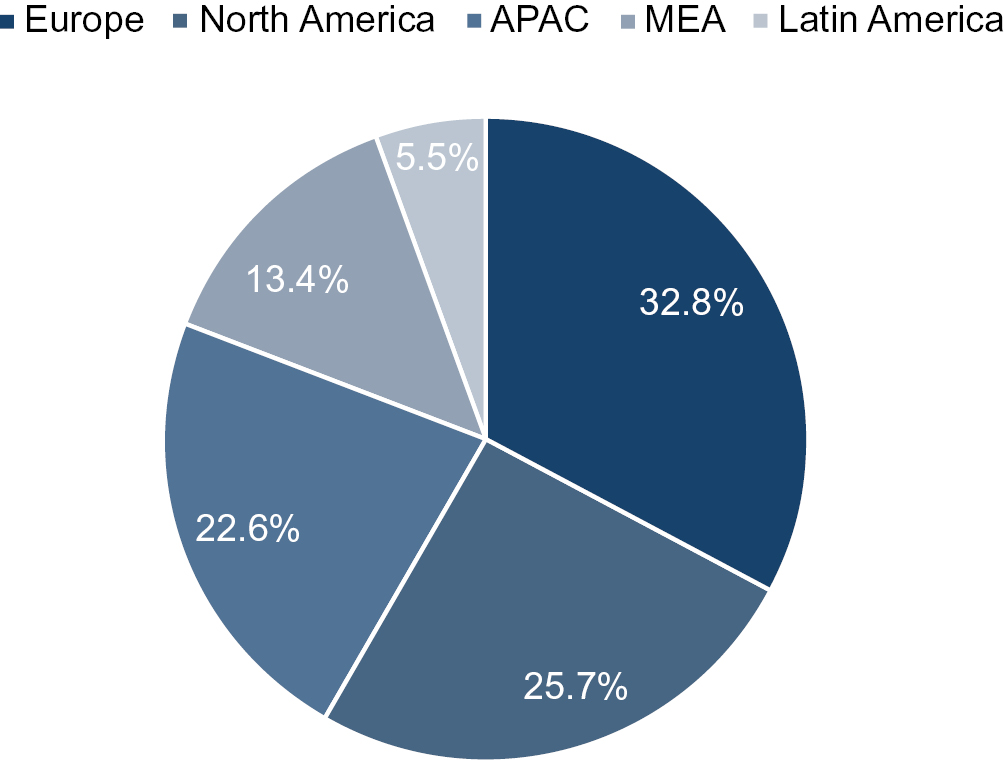

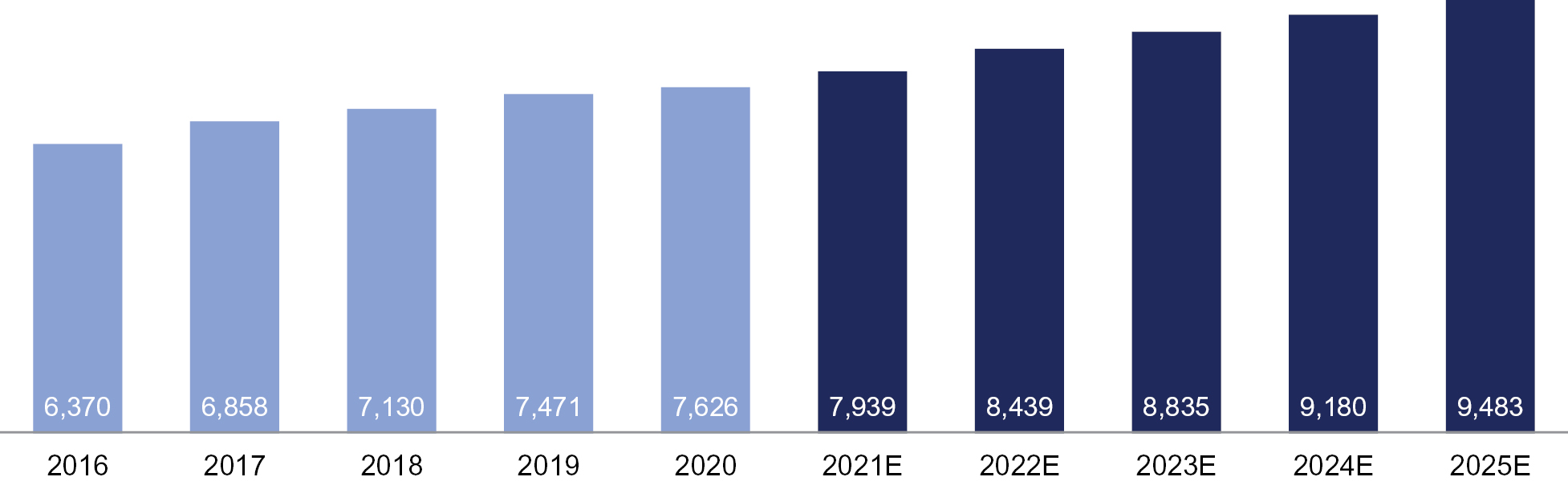

We operate in the global luxury furniture industry where:

• the market size is estimated to increase steadily due to strong demand;

• Europe, North America and Asia-Pacific (APAC) together dominate the market;

• China as one of the largest markets in APAC, is expected to further increase with demands by a growing number of luxury hotels, luxury retail stores, etc.;

• Market in China is fragmented and dominated by a few unlisted participants;

• Strict and significant market entry barriers including branding, product engineering and product crafting are hindering new entrants to participate in this market;

• Development trend of China’s luxury furniture market is positive, with growing demand from high-income groups, luxury hotels, high-end apartments, luxury villas, while the market concentration is expected to increase.

1

Table of Contents

Competitive Strengths

We believe the following competitive strengths differentiate us from our competitors:

• Commitment in product design and development and innovation;

• Comprehensive and high standard product range; and

• Broad client base.

Our Strategy

We intend to pursue the following strategies to further expand our business:

• Increase worldwide brand awareness;

• Enhance our IT system; and

• Expand our production facilities.

Our Corporate History

Our Group’s operations commenced in 1973 when Mr. Tsang Chi Hung, our Group’s then chairman and managing director until August 2021, established Decca (Mgt) Limited (formerly known as Decca Limited), our first principal operating subsidiary in Hong Kong. The original operation of Decca (Mgt) Limited was the supply and installation of furniture and architectural woodwork as a subcontractor for a local interior works contracting company.

Since 1976, our Group has ceased to operate as a subcontractor and established its own furniture manufacturing and woodworking department.

During the 1980s, our Group expanded its manufacturing facilities enabling us to centralize operations and manufacture all wood components for architectural woodwork and furniture. In the late 1980s, due to spatial constraints and the lack of skilled labor in Hong Kong, our Group acquired a 40,000 sq. ft. land in Dongguan, China and established a major manufacturing facility.

In 1993, our Group decided to consolidate all our manufacturing in China, moving operations to facilities that comprise 100,000 sq. ft., in order to gain better control of quality, costs and delivery.

In the mid-1990s, we saw an increase in work outside of China and Hong Kong and our business began to expand to Europe and the US. In 1996 and 1997, we opened our first showroom in Hong Kong and Singapore, respectively. In 1998, we entered into a licensing arrangement with Hickory Business Furniture (“HBF”), a division of The Lane Company which is headquartered in Alta Vista, Virginia, the U.S., to manufacture on its behalf its office furniture range. The decision to enter the office furniture market was prompted principally by the desire to utilize our Group’s manufacturing facility more effectively and to mitigate the cyclical nature of sales of custom made hotel furniture.

In 2000, Decca Holdings Limited, as the then listing entity of our Group, was listed on the Main Board of The Stock Exchange of Hong Kong Limited following a financial restructuring to support expansion of the business and the growth of sales of our Group.

In the early 2000s, our Group established the brands “Decca Hospitality”, “Decca Contract” and “Bolier” to strengthen our market presence in the U.S. We also established our business in Europe with an office opened in Copenhagen and registered branch offices set up in London and Paris.

In 2007, our Group acquired a factory in Thailand as our second manufacturing facility.

In 2008, our Group qualified to manufacture FSC®-certified products and also achieved Greenguard® certification for low-emitting furniture products and materials.

In the early 2010s, our Group opened several new showrooms in Shanghai, Bangkok and New York to support our business growth.

In 2012, our Group was restructured and privatized, which created greater flexibility and management control for the development of our Group.

2

Table of Contents

In 2015, we established the brand “Decca Home”.

In August 2021, Pioneer East Investment Development Limited, which is owned 70% by Mr. Wong Man Hin, and 30% by Ms. Tsang Yee Ling, both our Directors, acquired 100% of the issued share capital of Decca Investment Limited from Chosen Investments Limited, the former sole shareholder, which is beneficially owned by Mr. Tsang Chi Hung, Mr. Liu Hoo Kuen and Ms. Kwan Yau Choi, the former directors and beneficial owners of the Company.

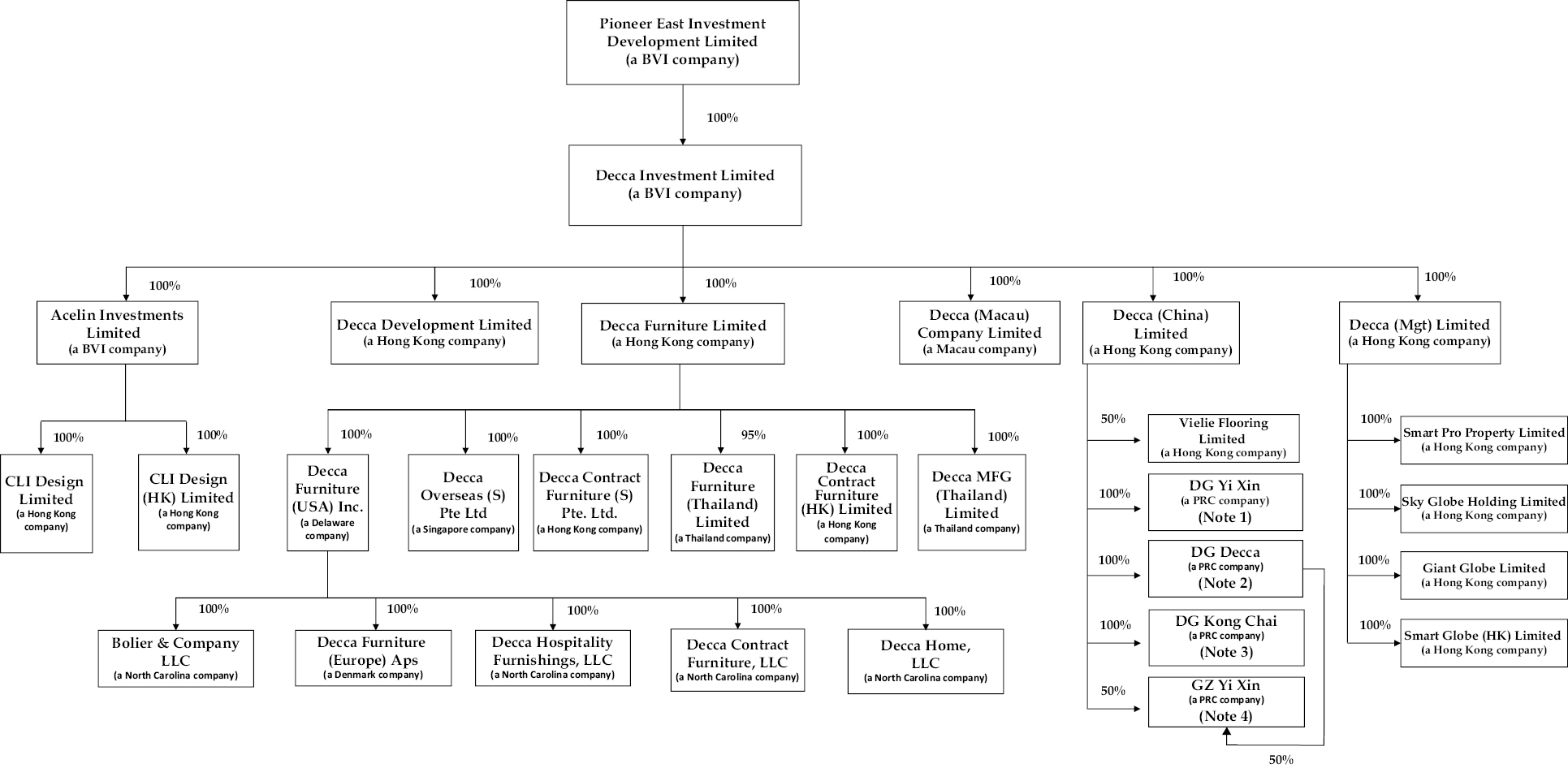

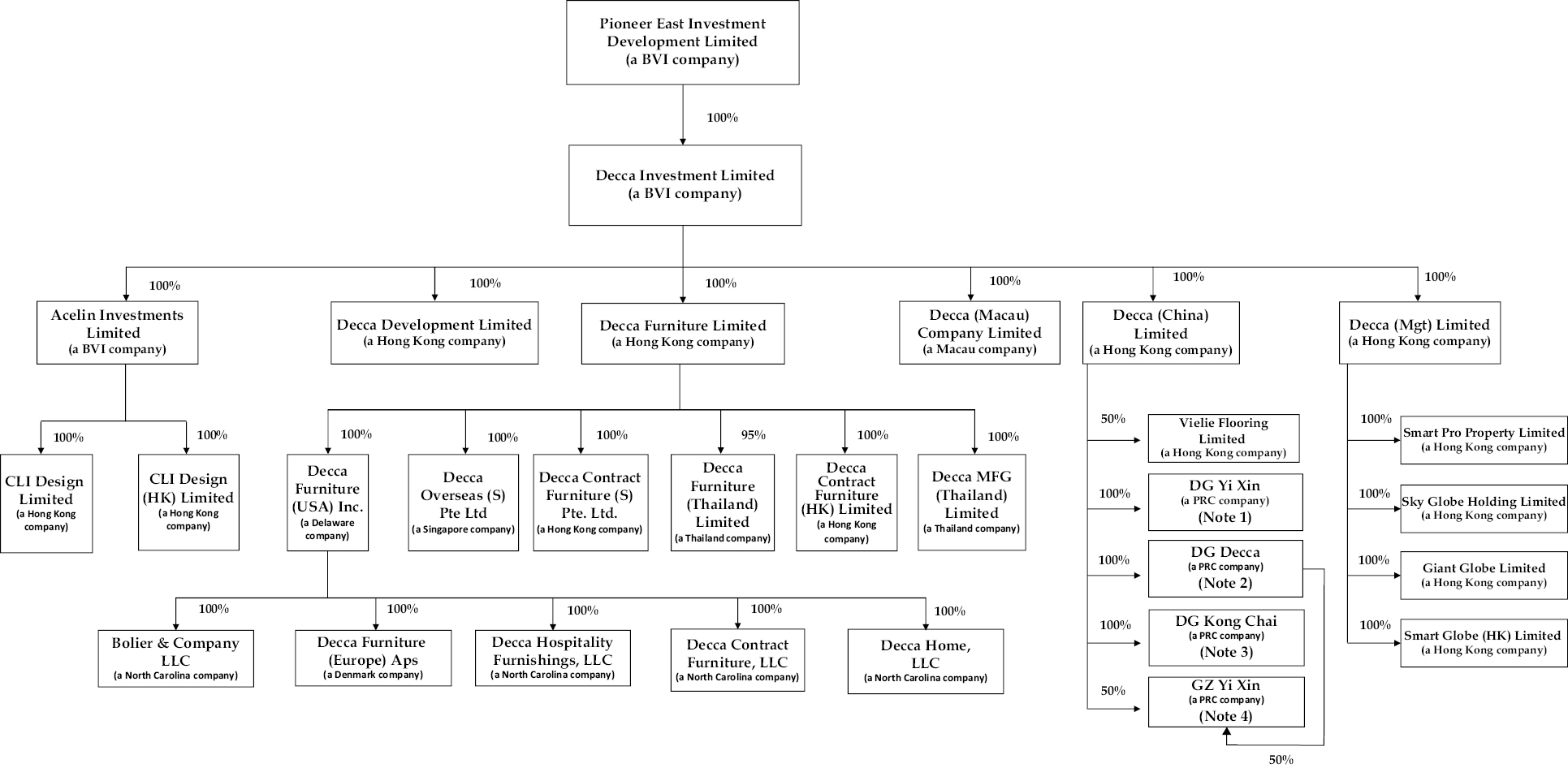

Our Corporate Structure

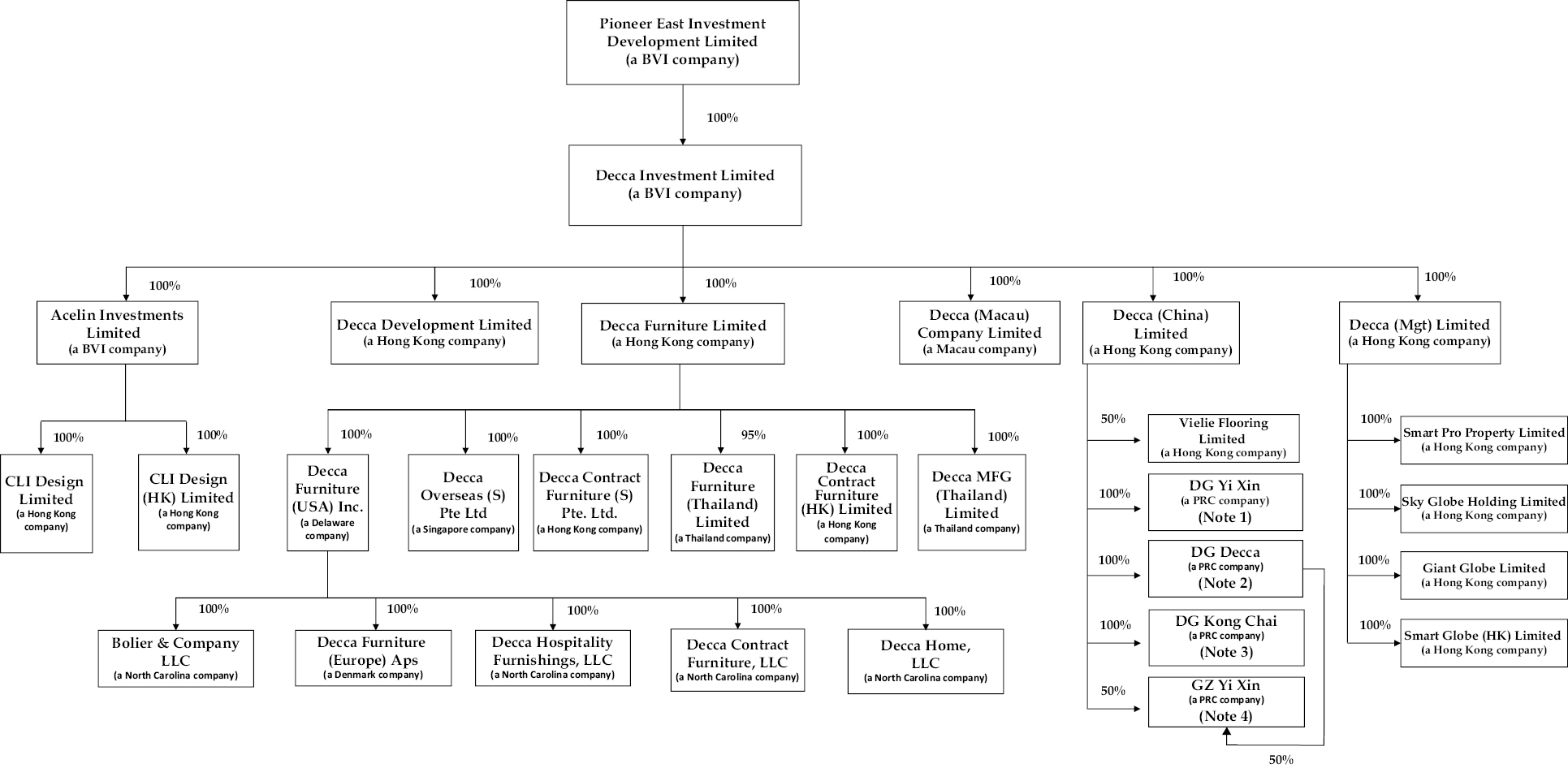

The following diagram illustrates our corporate structure as of the date of this prospectus.

All of the entities held by our Group below are direct or indirect subsidiaries of our Company and that none are of contractual arrangements with our Group using variable interest entity agreements.

Transfers of Cash to and From Our Subsidiaries

Our Company is permitted under the laws of BVI to provide funding to our subsidiaries through loans or capital contributions without restrictions on the amount of the funds. Our non-PRC subsidiaries are permitted under the laws of their respective jurisdictions to provide funding to our Company through dividend distribution without restrictions on the amount of the funds.

The PRC has currency and capital transfer regulations that require us to comply with certain requirements for the movement of capital. To utilize the expected proceeds from this offering, we may make additional capital contributions to our PRC subsidiaries, establish new PRC subsidiaries and make capital contributions to these new PRC subsidiaries, or make loans to our PRC subsidiaries. Our Company’s subsidiaries within China can transfer funds to each other when necessary through the way of current lending. Our PRC subsidiaries have not transferred any earnings or cash to our Company to date. As a result of PRC laws and regulations (noted below) that require annual appropriations of 10% of after-tax income to be set aside in a general reserve fund prior to payment of dividends, our PRC subsidiaries are restricted in that respect, as well as in other respects noted below, in their ability to transfer a portion of their net assets to our Company as a dividend.

3

Table of Contents

We control our PRC Operating Subsidiaries by a direct holding structure, that is, the overseas entity to be listed in the U.S., our Company directly controls our PRC Operating Subsidiaries through one of our Hong Kong Operating Subsidiaries, Decca (China) Limited. With respect to transferring cash from our Company to our PRC subsidiaries, increasing our Company’s registered capital in a PRC Operating Subsidiary requires the filing with the State Administration for Market Regulation or its local bureau, while a shareholder loan requires a filing with the State Administration of Foreign Exchange or its local bureau. Foreign direct investment and loans must be approved by and/or registered in accordance with the Foreign Exchange Administration Regulations (1996), as amended in 2008. The total amount of loans we can make to our PRC subsidiaries cannot exceed statutory limit which is the difference between the amount of total investment as approved by the Ministry of Commerce or its local counterpart and the amount of registered capital or 2.5 times of its net worth of our PRC subsidiaries.

With respect to the payment of dividends, we note the following:

1. PRC regulations currently permit the payment of dividends only out of accumulated profits, as determined in accordance with PRC accounting standards and PRC regulations (an in-depth description of the PRC regulations is set forth below);

2. Our PRC Operating Subsidiaries are required to set aside, at a minimum, 10% of their net income after taxes, based on PRC accounting standards, each year as statutory surplus reserves until the cumulative amount of such reserves reaches 50% of their registered capital;

3. Such reserves may not be distributed as cash dividends;

4. Our PRC Operating Subsidiaries may also allocate a portion of their after-tax profits to fund their staff welfare and bonus funds; except in the event of a liquidation, these funds may also not be distributed to shareholders; and

5. The incurrence of debt, specifically the instruments governing such debt, may restrict a subsidiary’s ability to pay stockholder dividends or make other cash distributions.

If, for the reasons noted above, our PRC Operating Subsidiaries are unable to pay shareholder dividends and/or make other cash payments to our Company when needed, our Company’s ability to conduct operations, make investments, engage in acquisitions, or undertake other activities requiring working capital may be materially and adversely affected. However, our operations and business, including investment and/or acquisitions by our PRC Operating Subsidiaries, will not be affected as long as the capital is not transferred in or out of the PRC.

We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments.

Subject to the BVI Act and our post-offering memorandum and articles of association, our board of directors may authorize and declare a dividend to shareholders at such time and of such an amount as they think fit if they are satisfied, on reasonable grounds, that immediately following the dividend the value of our assets will exceed our liabilities and we will be able to pay our debts as they become due. There is no further BVI statutory restriction on the amount of funds which may be distributed by us by dividend.

For our Company and our subsidiaries located outside China, there is no restrictions on foreign exchange for such entities and they are able to transfer cash among these entities, across borders and to U.S. investors without any restriction. Also, there is no restrictions and limitations on the abilities of non-PRC subsidiaries to distribute earnings from their businesses, including from subsidiaries to the parent company or from the holding company to the U.S. investors as well as the abilities to settle amounts owed.

Regarding cash transfer to and from our PRC Operating Subsidiaries, we are able to have such transfer through banks in China under current account items, such as profit distributions and trade and service-related foreign exchange transactions, which can be made in foreign currencies without prior approval from the State Administration of Foreign Exchange (the “SAFE”) by complying with certain procedural requirements with the banks. However, approval from or registration with appropriate government authorities is required where RMB is to be converted into foreign currency

4

Table of Contents

and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. PRC laws and regulations allow an offshore holding company to provide funding to our PRC Operating Subsidiaries only through loans or capital contributions, subject to the filing or approval of government authorities and limits on the amount of capital contributions and loans. Subject to satisfaction of applicable government registration and approval requirements, we may extend inter-company loans to our PRC Operating Subsidiaries or make additional capital contributions to fund their capital expenditures or working capital. For increase of registered capital, our PRC Operating Subsidiaries need to file such change of registered capital with the State Administration for Market Regulation (the “SAMR”) or its local counterparts through the enterprise registration system and the national enterprise credit information publicity system, and the SAMR or its local counterparts will then push such information to the China’s Ministry of Commerce or its local counterparts. If the holding company provide funding to our PRC Operating Subsidiaries through loans, (a) in the event that the foreign debt management mechanism as provided in the Measures for Foreign Debts Registration and Administration and other relevant rules applies, the balance of such loans cannot exceed the difference between the total investment and the registered capital of the subsidiaries and we will need to register such loans with the SAFE or its local branches, or (b) in the event that the mechanism as provided in the Notice of the People’s Bank of China on Matters concerning the Macro-Prudential Management of Full-Covered Cross-Border Financing, or PBOC Notice No. 9, applies, the balance of such loans will be subject to the risk-weighted approach and the net asset limits and we will need to file the loans with the SAFE in its information system pursuant to applicable requirements and guidelines issued by the SAFE or its local branches. Under PRC law, our PRC Operating Subsidiaries are also required to set aside at least 10% of its after-tax profits each year, if any, to fund certain statutory reserve funds until such reserve funds reach 50% of its registered capital.

During the years ended March 31, 2022 and 2021 and the six months ended September 30, 2022, the transfers of cash among our Company and our subsidiaries were in the form of dividends. For the year ended March 31, 2021 and the six months ended September 30, 2022, we did not declare any dividend. For the year ended March 31, 2022, we declared dividend of HKD 400,340,030 (USD 51,086,587) in relation to our retained profit, which were funds transferred through payment of dividends from our subsidiaries. If we determine to pay dividends on any of our Ordinary Shares in the future, as a holding company, we will be dependent on receipt of funds from our subsidiaries by way of dividend payments.

See “Dividend Policy”, “Risk Factors — We rely on dividends and other distributions on equity paid by our subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our subsidiaries to make payments to us could have a material adverse effect on our ability to conduct our business.”, Summary Consolidated Financial Data and Consolidated Statements of Change in Shareholders’ Equity in the Report of Independent Registered Public Accounting Firm for more information.

Risks Related to Our Business and Industry (beginning on page 16 of this prospectus)

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may materially and adversely affect our business, financial condition, results of operations, cash flows and prospects that you should consider before making a decision to invest in our Ordinary Shares. These risks are discussed more fully in “Risk Factors” set out in page 16 to page 36. These risks include, but are not limited to, the following:

• We rely on a principal product category of custom made wooden furniture.

• We rely significantly on our major projects.

• Our operation is subject to the state of the property market and, in particular, the hotel sector.

• We are subject to renewal of qualification permits, licenses and land use rights from time to time.

• Our business is subject to environmental risks.

• We face competition in the industry and may lose our competitive edge to our competitors.

• We may incur operating losses in the future, and may not achieve or maintain profitability in the future.

• We depend on our management’s and other team members’ experience and knowledge of our industry.

• The supply and cost of lumber and veneer may affect our business.

5

Table of Contents

• Our business and operating results may be harmed if we are unable to timely and effectively deliver merchandise to our clients and manage our supply chain.

• Our financial performance is affected by the revenue recognition on service contracts.

• Our business relies on successful tendering for contracts.

• Our continued success is substantially dependent on our positive brand identity.

• Our ability to attract clients to our showrooms depends heavily on successfully locating our showrooms in suitable locations.

• Legal, political, and economic uncertainty surrounding the exit of the United Kingdom from the EU may be a source of instability to international markets, create significant currency fluctuations, create logistic and other customs-related complexities, adversely affect our operations in the United Kingdom and pose additional risks to our business, financial condition, and results of operations.

• Our business has been and may continue to be affected by the significant and widespread risks posed by the COVID-19 pandemic or a similar outbreak of an infectious disease.

Risks Related to Our Corporate Structure (beginning on page 20 of this prospectus)

• We rely on dividends and other distributions on equity paid by our subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our subsidiaries to make payments to us could have a material adverse effect on our ability to conduct our business.

• Our lack of effective internal controls over financial reporting may affect our ability to accurately report our financial results or prevent fraud which may affect the market for and price of our Ordinary Share.

Risks Related to Doing Business in China (beginning on page 22 of this prospectus)

• Due to the long arm provisions under the current PRC laws and regulations, the Chinese government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of our Ordinary Shares. Changes in the policies, regulations, rules, and the enforcement of laws of the Chinese government may also be quick with little advance notice and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system cannot be certain.

• If the Chinese government chooses to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China based issuers, such action may significantly limit or completely hinder our ability to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless.

• PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds of this offering to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business.

• Recent developments with respect to audits of China-based companies may still also create uncertainty about the ability of our current auditor to fully cooperate with the PCAOB’s inspection requests without the approval of the relevant PRC authorities.

• We may become subject to a variety of laws and other obligations regarding data protection, and any failure to comply with applicable laws and obligations could have a material and adverse effect on our business, financial condition and results of operations.

• If we fail to comply with work safety or environmental regulations, we could be exposed to penalties, fines, suspensions or action in other forms.

6

Table of Contents

• Increases in labor costs and enforcement of stricter labor laws and regulations in China and our additional payments of statutory employee benefits may adversely affect our business and profitability.

• The enactment of Law of the PRC on Safeguarding National Security in the Hong Kong Special Administrative Region (the “Hong Kong National Security Law”) could impact our Hong Kong subsidiaries.

• A downturn in the Hong Kong, China or global economy, and economic and political policies of China could materially and adversely affect our business and financial condition.

• The Hong Kong legal system embodies uncertainties which could limit the legal protections available to our Company.

• Changes in international trade policies, trade disputes, barriers to trade, or the emergence of a trade war may dampen growth in China and other markets where the majority of our clients reside.

• Fluctuations in exchange rates could have a material and adverse effect on our results of operations and the value of your investment.

Risks Related to our Ordinary Shares (beginning on page 29 of this prospectus)

• There has been no public market for our Ordinary Shares prior to this offering, and you may not be able to resell our Shares at or above the price you pay for them, or at all.

• We will incur increased costs as a result of being a public company, particularly after we cease to qualify as an “emerging growth company.”

• Recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the public accounting firms headquartered in mainland China and Hong Kong who are not inspected by the PCAOB. These developments could add uncertainties to our offering.

• If we fail to meet applicable listing requirements, Nasdaq may delist our Ordinary Shares from trading, in which case the liquidity and market price of our Ordinary Shares could decline.

• The stock price and trading volume for some companies have recently been extremely volatile and our Ordinary Shares price may be volatile in the future for reasons unrelated to our operating performance and, as a result, investors in our Ordinary Shares could incur substantial losses.

• Volatility in our Ordinary Shares price may subject us to securities litigation.

• Our pre-IPO shareholders will be able to sell their shares after completion of this offering subject to restrictions under the Rule 144.

• Resales of our Ordinary Shares in the public market during this Offering by the Selling Shareholders or investors in this Offering may cause the market price of our Ordinary Shares to decline.

• If you purchase our Ordinary Shares in this offering, you will incur immediate and substantial dilution in the book value of your shares.

• We will be a “controlled company” within the meaning of Nasdaq rules and we will qualify for and may rely on exemptions from certain corporate governance requirements.

• Our management has broad discretion to determine how to use the funds raised in the offering and may use them in ways that may not enhance our results of operations or the price of our Ordinary Shares.

• Our disclosure controls and procedures may not prevent or detect all errors or acts of fraud.

• We do not intend to pay dividends for the foreseeable future.

7

Table of Contents

• Securities analysts may not publish favorable research or reports about our business or may publish no information at all, which could cause our share price or trading volume to decline.

• Investors may have difficulty enforcing judgments against us, our Directors and management.

• You may have more difficulty protecting your interests than you would as a shareholder of a U.S. corporation.

• The laws of BVI may provide less protections for minority shareholders than those under U.S. law, so minority shareholders will not have the same options as to recourse in comparison to the United States if the shareholders are dissatisfied with the conduct of our affairs.

• We qualify as a foreign private issuer and, as a result, we will not be subject to U.S. proxy rules and will be subject to Exchange Act reporting obligations that permit less detailed and less frequent reporting than that of a U.S. domestic public company.

• As a foreign private issuer, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from Nasdaq corporate governance listing standards. These practices may afford less protection to shareholders than they would enjoy if we complied fully with corporate governance listing standards.

• There can be no assurance that we will not be a passive foreign investment company, or PFIC, for U.S. federal income tax purposes for any taxable year, which could result in adverse U.S. federal income tax consequences to U.S. holders of our Ordinary Shares.

• We may not be able to pay any dividends on our Ordinary Shares in the future due to BVI law.

• We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses.

• We are an emerging growth company within the meaning of the Securities Act and may take advantage of certain reduced reporting requirements.

Regulatory Permission

We are currently not required to obtain approval from PRC authorities to list on U.S. exchanges, however, if our subsidiaries or the holding company were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on a U.S. exchange, which would materially affect the interest of the investors. It is uncertain when and whether our Company will be required to obtain permission from the PRC government to list on U.S. exchanges in the future, and when such permission is obtained, whether it will be rescinded. Although our Company is currently not required to obtain permission from any of the PRC state or local government to list on U.S. exchanges and has not received any denial to list on a U.S. exchange, our operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to its business or industry. If we are subsequently advised by any Chinese authorities that permission for this offering and/or listing on the Nasdaq Stock Market was required, we may not be able to obtain such permission in a timely manner, if at all. If this risk occurs, our ability to offer securities to investors could be significantly limited or completely hindered and the securities currently being offered may substantially decline in value or become worthless.

We are an offshore holding company with some of our operations conducted in China. In using the proceeds of this offering, we may make loans to our PRC subsidiaries, or we may make additional capital contributions to our PRC subsidiaries, or we may establish new PRC subsidiaries and make capital contributions to these new PRC subsidiaries, or we may acquire offshore entities with business operations in China in an offshore transaction. Most of these ways are subject to PRC regulations and approvals or registration. For example, loans by us to our wholly owned PRC subsidiary to finance its activities cannot exceed statutory limits and must be registered with the local counterpart of SAFE. If we decide to finance our wholly owned PRC subsidiary by means of capital contributions, these capital contributions are subject to registration with the State Administration for Market Regulation or its local branch, reporting of foreign investment information with the Ministry of Commerce, or registration with other governmental authorities in China. In light of the various requirements imposed by PRC regulations on loans to and direct investment in PRC entities by offshore holding companies, we cannot assure you that we will be able to complete the necessary

8

Table of Contents

government registrations or obtain the necessary government approvals on a timely basis, or at all, with respect to future loans to our PRC subsidiaries or future capital contributions by us to our PRC subsidiaries. For more details, see “Risk Factors — Risks Relating to Doing Business in China — PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds of this offering to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business.”

Recently, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Strictly Cracking Down on Illegal Securities Activities, which were made available to the public on July 6, 2021. The Opinions on Strictly Cracking Down on Illegal Securities Activities emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over overseas listings by Chinese companies. Pursuant to the Opinions, Chinese regulators are required to accelerate rulemaking related to the overseas issuance and listing of securities, and update the existing laws and regulations related to data security, cross-border data flow, and management of confidential information. Numerous regulations, guidelines and other measures are expected to be adopted under the umbrella of or in addition to the Cybersecurity Law and Data Security Law. As of the date of this prospectus, no official guidance or related implementation rules have been issued. As a result, the Opinions on Strictly Cracking Down on Illegal Securities Activities remain unclear on how they will be interpreted, amended and implemented by the relevant PRC governmental authorities.

On February 17, 2023, the CSRC issued the Trial Measures for the Administration of Overseas Issuance and Listing of Securities by Domestic Enterprises and five supporting guidelines, which will become effective on March 31, 2023 (“Overseas Listing Regulations”). The Overseas Listing Regulations requires that a PRC domestic enterprise seeking to issue and list its shares overseas shall complete the filing procedures of and submit the relevant information to CSRC, failing which we may be fined between RMB 1 million and RMB 10 million. According to the Notice on the Management Arrangements for Overseas Issuance and Listing of Domestic Enterprises issued by CSRC on the same day, if we can obtain the SEC’s Notice of Effectiveness before March 31 and complete the issuance and listing before September 30, 2023, we will no longer need to submit the relevant information to CSRC for the filing procedures, otherwise we still need to complete the filing procedures with CSRC before our listing on U.S. exchanges. The Overseas Listing Regulations may subject us to additional compliance requirement in the future, and we cannot assure you that we will be able to get the clearance of filing procedures as required on a timely basis, or at all. Any failure of us to fully comply with new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our ordinary shares, cause significant disruption to our business operations, and severely damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause our ordinary shares to significantly decline in value or become worthless.

On December 28, 2021, the Cyberspace Administration of China (the “CAC”) jointly with the relevant authorities formally published Measures for Cybersecurity Review (2021) which took effect on February 15, 2022 and replace the former Measures for Cybersecurity Review (2020). Measures for Cybersecurity Review (2021) stipulates that operators of critical information infrastructure purchasing network products and services, and online platform operator (together with the operators of critical information infrastructure, the “Operators”) carrying out data processing activities that affect or may affect national security, shall conduct a cybersecurity review, any online platform operator who controls more than one million users’ personal information must go through a cybersecurity review by the cybersecurity review office if it seeks to be listed in a foreign country. Given that: (i) we do not possess personal information on more than one million users in our business operations; and (ii) data processed in our business does not have a bearing on national security and thus may not be classified as core or important data by the authorities, we would not be required to apply for a cybersecurity review under the Measures for Cybersecurity Review (2021).

However, if the CSRC, CAC or other regulatory agencies later promulgate new rules or explanations requiring that we obtain their approvals for this offering and any follow-on offering, we may be unable to obtain such approvals and we may face sanctions by the CSRC, CAC or other PRC regulatory agencies for failure to seek their approval which could significantly limit or completely hinder our ability to offer or continue to offer securities to our investors and the securities currently being offered may substantially decline in value and be worthless. For more details, see “Risk Factors — Risks Related to Doing Business in China — If the Chinese government chooses to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China based issuers, such action may significantly limit or completely hinder our ability to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless.”

9

Table of Contents

PCAOB Developments

Trading in our Ordinary Shares on U.S. markets, including the OTC market, may be prohibited under the HFCA Act if the PCAOB determines that it is unable to inspect or investigate completely our auditor for two consecutive years. On December 16, 2021, the PCAOB issued the HFCA Act Determination Report to notify the SEC of its determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong (the “2021 Determinations”). As of the date of this report, our auditor is not included in the HFCA Act Determination Report. On December 15, 2022, the PCAOB announced that it was able to conduct inspections and investigations completely of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong in 2022. The PCAOB vacated its previous 2021 Determinations accordingly. As a result, we do not expect to be identified as a “Commission-Identified Issuer” under the HFCA Act for the current period after we file our F-1 report. However, whether the PCAOB will continue to conduct inspections and investigations completely to its satisfaction of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control, including positions taken by authorities of the PRC. The PCAOB is expected to continue to demand complete access to inspections and investigations against accounting firms headquartered in mainland China and Hong Kong in the future and states that it has already made plans to resume regular inspections in early 2023 and beyond. The PCAOB is required under the HFCA Act to make its determination on an annual basis with regards to its ability to inspect and investigate completely accounting firms based in the mainland China and Hong Kong. The possibility of being a “Commission-Identified Issuer” and risk of delisting could continue to adversely affect the trading price of our securities. Should the PCAOB again encounter impediments to inspections and investigations in mainland China or Hong Kong as a result of positions taken by any authority in either jurisdiction, the PCAOB will make determinations under the HFCA Act as and when appropriate.

For more detailed information, see “Risk Factors — Risks Related to Doing Business in China — Recent developments with respect to audits of China-based companies may still also create uncertainty about the ability of our current auditor to fully cooperate with the PCAOB’s inspection requests without the approval of the relevant PRC authorities.

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

As a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012, and may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

• being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in our filings with the SEC;

• not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting;

• reduced disclosure obligations regarding executive compensation in periodic reports, proxy statements and registration statements; and

• exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our Ordinary Shares pursuant to this offering. However, if certain events occur before the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.235 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company before the end of such five-year period.

10

Table of Contents

In addition, Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. We have elected to take advantage of the extended transition period for complying with new or revised accounting standards and acknowledge such election is irrevocable pursuant to Section 107 of the JOBS Act.

We are a “foreign private issuer,” as defined by the SEC. As a result, in accordance with the rules and regulations of The Nasdaq Stock Market LLC, or Nasdaq, we may comply with home country governance requirements and certain exemptions thereunder rather than complying with Nasdaq corporate governance standards. We may choose to take advantage of the following exemptions afforded to foreign private issuers:

• Exemption from filing quarterly reports on Form 10-Q or provide current reports on Form 8-K disclosing significant events within four (4) days of their occurrence.

• Exemption from Section 16 rules regarding sales of Ordinary Shares by insiders, which will provide less data in this regard than shareholders of U.S. companies that are subject to the Exchange Act.

• Exemption from the Nasdaq rules applicable to domestic issuers requiring disclosure within four (4) business days of any determination to grant a waiver of the code of business conduct and ethics to directors and officers. Although we will require board approval of any such waiver, we may choose not to disclose the waiver in the manner set forth in the Nasdaq rules, as permitted by the foreign private issuer exemption.

• Exemption from the requirement that our board of directors have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities.

• Exemption from the requirements that director nominees are selected, or recommended for selection by our board of directors, either by (i) independent directors constituting a majority of our board of directors’ independent directors in a vote in which only independent directors participate, or (ii) a committee comprised solely of independent directors, and that a formal written charter or board resolution, as applicable, addressing the nominations process is adopted.

Furthermore, Nasdaq Rule 5615(a)(3) provides that a foreign private issuer, such as us, may rely on our home country corporate governance practices in lieu of certain of the rules in the Nasdaq Rule 5600 Series and Rule 5250(d), provided that we nevertheless comply with Nasdaq’s Notification of Noncompliance requirement (Rule 5625), the Voting Rights requirement (Rule 5640) and that we have an audit committee that satisfies Rule 5605(c)(3), consisting of committee members that meet the independence requirements of Rule 5605(c)(2)(A)(ii). If we rely on our home country corporate governance practices in lieu of certain of the rules of Nasdaq, our shareholders may not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of Nasdaq. If we choose to do so, we may utilize these exemptions for as long as we continue to qualify as a foreign private issuer.

Although we are permitted to follow certain corporate governance rules that conform to the BVI requirements in lieu of many of the Nasdaq corporate governance rules, we intend to comply with the Nasdaq corporate governance rules applicable to foreign private issuers.

Implication of Being a Controlled Company

We are and will continue, following this offering, to be a “controlled company” within the meaning of the Nasdaq Stock Market Rules and, as a result, may rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies.

We are, and will remain, a “controlled company” as defined under the Nasdaq Stock Market Rules. As at the date of this prospectus, 100% of the issued share capital of the Company is owned by Pioneer East Investment Development Limited, which in turn is owned 70% by Mr. Wong Man Hin, Max, our Director. Mr. Wong Man Hin, Max therefore beneficially owns 70% of our total voting power as at the date of this prospectus. Following completion of this offering, 87.0% of the issued share capital of the Company will be owned by Pioneer East Investment Development

11

Table of Contents

Limited and Mr. Wong Man Hin, Max will in turn beneficially own 60.9% of our total voting power. For so long as we are a controlled company, we are permitted to elect not to comply with certain stock exchange rules regarding corporate governance, including the following requirements:

– that a majority of its board of directors consist of independent directors;

– that its director nominees be selected or recommended for the board’s selection by a majority of the board’s independent directors in a vote in which only independent directors participate or by a nominating committee comprised solely of independent directors, in either case, with a formal written charter or board resolutions, as applicable, addressing the nominations process and such related matters as may be required under the federal securities laws; and

– that its compensation committee be composed solely of independent directors with a written charter addressing the committee’s purpose and responsibilities.

As a result, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements.

Although we do not intend to rely on the “controlled company” exemption under the Nasdaq listing rules, we could elect to rely on this exemption after we complete this offering. If we elected to rely on the “controlled company” exemption, a majority of the members of our board of directors might not be independent directors and our nominating and corporate governance and compensation committees might not consist entirely of independent directors after we complete this offering. (See “Risk Factors — Risks Related to Our Ordinary Shares — We will be a “controlled company” within the meaning of Nasdaq rules and we will qualify for and may rely on exemptions from certain corporate governance requirements.”)

Impact of COVID-19

The ongoing outbreak of a novel strain of coronavirus (“COVID-19”) has resulted in quarantines, travel restrictions, and the temporary closure of stores and business facilities globally for the past years. In March 2020, the World Health Organization declared COVID-19 as a pandemic. A recent outbreak of the Omicron variant of COVID-19 worldwide also forced new orders on temporary lockdown or social distancing in some countries or regions, in particular the tightened social distancing and quarantine orders in Hong Kong and the lockdown orders in several cities in China in which our customers and suppliers operate. Given the rapidly expanding nature of the COVID-19 pandemic, and because a substantial proportion of our business operations and our workforce are concentrated in Hong Kong and China, we believe there is a risk that our business, results of operations, and financial condition will be adversely affected. Potential impact to our results of operations will also depend on future developments and new information that may emerge regarding the duration and severity of COVID-19 and the actions taken by government authorities and other entities to contain COVID-19 or mitigate its impact, almost all of which are beyond our control.

The impact of COVID-19 on our business, financial conditions, and operating results includes, but is not limited to the following:

– As at the date of this prospectus, our companies resumed work. However, due to the quarantine policy in different region, some workers of our operating subsidiaries were unable to return to the working sites on time.

– We delayed deliveries of the products in some countries or regions including the U.S., Europe, China and Hong Kong.

Because of the uncertainty surrounding the COVID-19 outbreak, business disruption and its financial impact related to the outbreak of and response to COVID-19 cannot be reasonably estimated at this time. We believe that our current cash and cash equivalents and our anticipated cash flows from operations will be sufficient to meet our anticipated working capital requirements and capital expenditures for the next 12 months. We may, however, need additional capital in the future to fund our continuing operations. The issuance and sale of additional equity would result in further dilution to our shareholders. The incurrence of indebtedness would result in increased fixed obligations and could result in operating covenants that would restrict our operations. In addition, the COVID-19 outbreak was

12

Table of Contents

declared to be a pandemic by the World Health Organization on March 10, 2020. Actions taken around the world to help mitigate the spread of COVID-19 include restrictions on travel, and quarantines in certain areas, and forced closures for certain types of public places and businesses. During the years ended March 31, 2022 and 2021, COVID-19 has had a limited impact on the Company’s operations. However, it could impact economies and financial markets, resulting in an economic downturn that could impact our ability to raise capital or slow down potential business opportunities. There are still uncertainties of COVID-19’s future impact, and the extent of the impact will depend on a number of factors, including the duration and severity of the pandemic; and the macroeconomic impact of government measures to contain the spread of COVID-19 and related government stimulus measures. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all.

Corporate Information

Our principal executive office is located at 2/F, Decca Industrial Centre, 21 Cheung Lee Street, Chai Wan, Hong Kong. Our telephone number is (+852) 2896 2699. Our registered office in the BVI is located at Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands.

Our agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor New York, NY 10168. Our website is located at www.decca.com.hk. Information contained on, or that can be accessed through, our website is not a part of, and shall not be incorporated by reference into, this prospectus.

13

Table of Contents

The Offering(1)

Securities being offered: | | 6,000,000 Ordinary Shares on a firm commitment basis. |

Initial public offering price: | | We estimate the initial public offering price will be between $4.00 and $6.00 per ordinary share. |

Number of Ordinary Shares outstanding before this offering: | |

40,000,000 Ordinary Shares.

|

Number of Ordinary Shares outstanding after this offering: | |

46,000,000 Ordinary Shares, assuming no exercise of the underwriters’ over-allotment option.

|

Over-allotment option: | | We have granted to the underwriters a 45-day option to purchase up to an aggregate of additional 900,000 Ordinary Shares (equal to 15% of the number of Ordinary Shares sold in the offering), at the offering price per Ordinary Shares less underwriting discounts. The underwriters may exercise this option for 45 days from the date of closing of this offering solely to cover over-allotments. |

Use of proceeds: | | Based upon an initial public offering price of $[ ] per Share, we estimate that we will receive net proceeds from this offering, after deducting the estimated underwriting discounts and the estimated offering expenses payable by us, of approximately $[ ] if the underwriters do not exercise their over-allotment option, and $[ ] if the underwriters exercise their over-allotment option in full, , after deducting the underwriting discounts, non-accountable expense allowance and estimated offering expenses payable by us. We plan to use the net proceeds of this offering as follows: • Approximately 20% for developing more sales channels for individual customers globally; • Approximately 20% for expanding more showrooms and distributors to increase the market share in North America and Europe; • Approximately 20% for developing more brands and designs on products; • Approximately 20% for spending on potential mergers and acquisitions, which would expand our manufacturing facilities; and • The balance to fund working capital and for other general corporate purposes. For more information on the use of proceeds, see “Use of Proceeds” on page 42. |

14

Table of Contents

Lock-up: | | All of our Directors, officers and principal shareholders (defined as owners of 5% or more of our Ordinary Shares) have agreed with the underwriters, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of our Ordinary Shares or securities convertible into or exercisable or exchangeable for our Ordinary Shares for a period of 180 days from the date of this prospectus. See “Shares Eligible for Future Sale” and “Underwriting” for more information. |

Listing: | | We intend to apply to list our Ordinary Shares on the Nasdaq Capital Market. At this time, Nasdaq has not yet approved our application to list our Ordinary Shares. The closing of this offering is conditioned upon Nasdaq’s final approval of our listing application, and there is no guarantee or assurance that our Ordinary Shares will be approved for listing on Nasdaq. |

Proposed Nasdaq symbol: | | “DCCA”. |

Risk factors: | | Investing in our Ordinary Shares is highly speculative and involves a high degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 16. |