As filed with the Securities and Exchange Commission on August 3, 2023

Registration No. 333-269833

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 6

to

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Healthy Green Group Holding Limited

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of Registrants name into English)

| Cayman Islands | 2000 | Not Applicable | ||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

Flat 2-3, 4/F

Join-In Hang Sing Centre

2-16 Kwai Fung Crescent

Kwai Chung, New Territories

Hong Kong

(+852) 3181 4488

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, New York 10168

800-221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Henry F. Schlueter, Esq. Celia Velletri, Esq. Schlueter & Associates, P.C. 5655 South Yosemite St., Suite 350 Greenwood Village, CO 80111 Telephone: (303) 292-3883 | Mitchell S. Nussbaum, Esq. David J. Levine, Esq. Loeb & Loeb LLP 345 Park Avenue New York, NY 10154 Telephone: (212) 407-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The term new or revised financial accounting standard refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed or supplemented. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission of which this prospectus is a part is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated August 3, 2023

PRELIMINARY PROSPECTUS

Healthy Green Group Holding Limited

2,000,000 Ordinary Shares

This is an initial public offering of ordinary shares, US$0.001 par value per share (“Ordinary Shares”) of Healthy Green Group Holding Limited (“Healthy Green,” the “Company,” “we,” “our” or “us”). We are offering 2,000,000 Ordinary Shares. We anticipate that the initial public offering price of the Ordinary Shares will be between US$6.00 and US$7.00 per Ordinary Share.

Prior to this offering, there has been no public market for our Ordinary Shares. We have applied to list our Ordinary Shares on the NYSE American under the symbol “GDD”. This offering is contingent upon the listing of our Ordinary Shares on the NYSE American or another national securities exchange. There can be no assurance that we will be successful in listing our Ordinary Shares on the NYSE American or another national securities exchange and, if this listing is not successful, this offering may not be completed.

Investing in our Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See Risk Factors beginning on page 19 to read about factors you should consider before buying our Ordinary Shares.

We are an “Emerging Growth Company” and a “Foreign Private Issuer” under applicable U.S. federal securities laws and, as such, are eligible for reduced public company reporting requirements. Please see “Implications of Our Being an Emerging Growth Company” and “Implications of Our Being a Foreign Private Issuer” beginning on page 15 of this prospectus for more information.

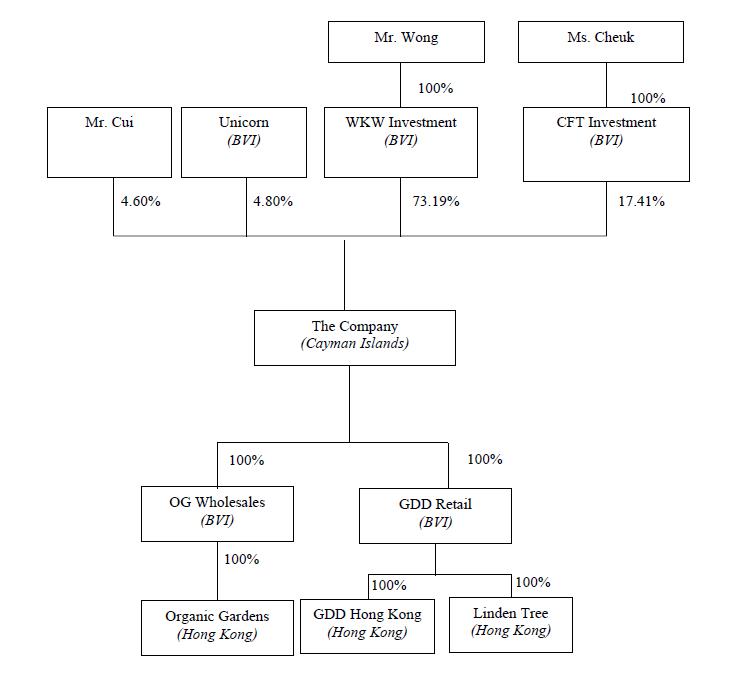

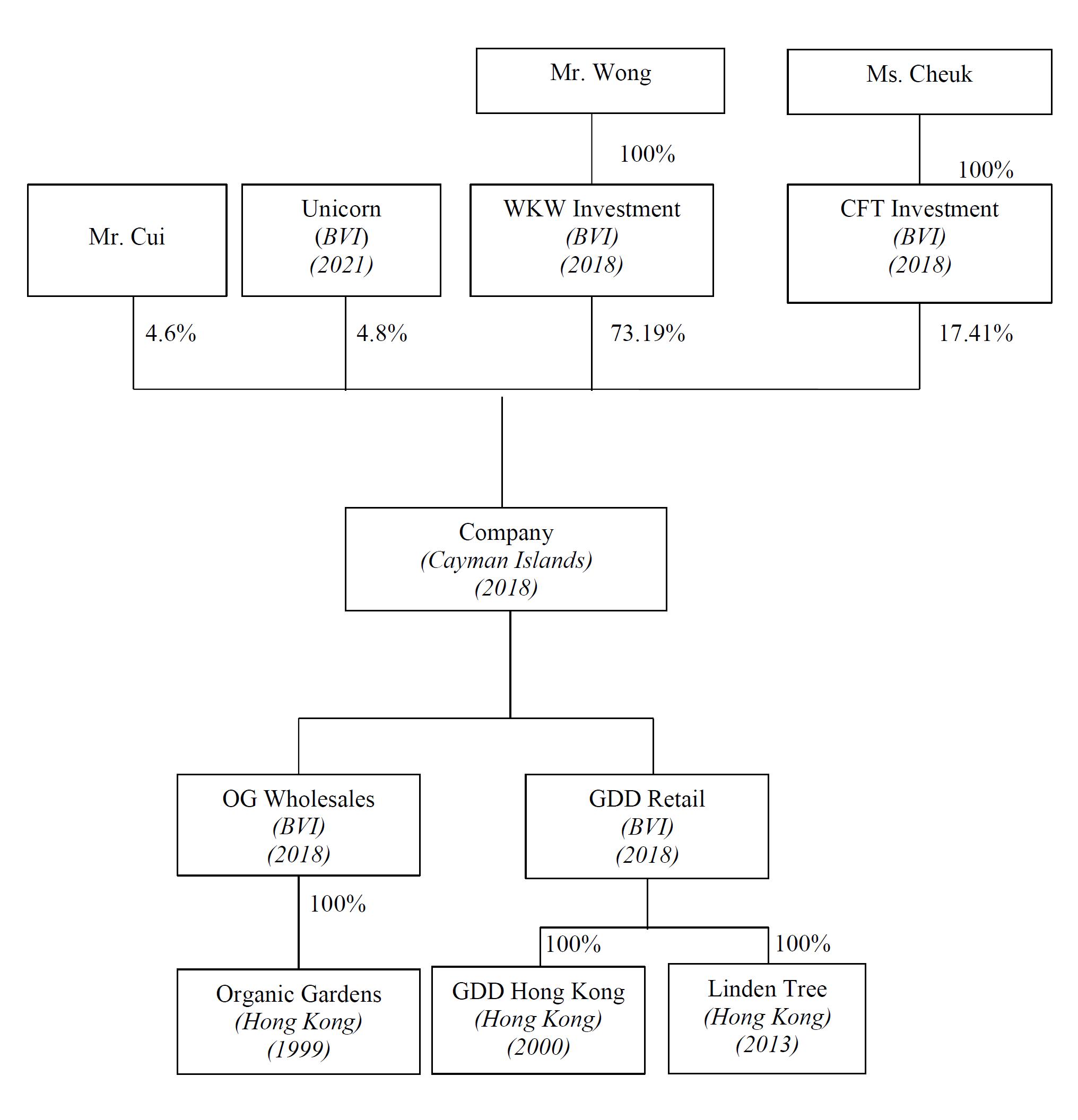

We are not a Chinese operating company but a holding company incorporated in the Cayman Islands. As a holding company with no material operations of our own, we conduct our operations solely through Organic Gardens International Limited (“Organic Gardens”), Greendotdot.com Limited (“GDD Hong Kong”) and Linden Tree Consultancy Limited (“Linden Tree”) (collectively, our “Operating Subsidiaries”). Each of these three operating subsidiaries is established under the laws of Hong Kong. The Ordinary Shares offered in this offering are shares of the Cayman Islands holding company. Investors of our Ordinary Shares are not purchasing and may never directly hold equity interests in our Operating Subsidiaries.

Our Operating Subsidiaries conduct their business in Hong Kong, a Special Administrative Region of the PRC, and some of the suppliers of the Operating Subsidiaries are PRC companies that may have shareholders or directors that are PRC individuals. Also, some customers of our retail outlets may be PRC individuals. Conducting business in Hong Kong involves risks of uncertainty about any actions the Chinese government or authorities in Hong Kong may take. See “Prospectus Summary - Recent Regulatory Development in the PRC” beginning on page 13 and “Risk Factors – Risks Relating to Doing Business in the Jurisdictions in which our Operating Subsidiaries Operate” beginning on page 25.

There are significant legal and operational risks associated with being based in or having the majority of operations in Hong Kong, including that changes in the legal, political and economic policies of the Chinese government, the relations between China and the United States, or Chinese or U.S. regulations may materially and adversely affect our business, financial condition and results of operations. Further, the Chinese government may disallow our current corporate structure. Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. No effective laws or regulations in the PRC explicitly require the Company to seek approval from the China Securities Regulatory Commission (the “CSRC”) or any other PRC governmental authorities for the Company’s overseas listing plan, nor has the Company or any of the Operating Subsidiaries received any inquiry, notice, warning or sanctions regarding the planned overseas listing from the CSRC or any other PRC governmental authorities. However, since these statements and regulatory actions by the PRC government are newly published, and official guidance and related implementation rules have not been issued, it is highly uncertain what the potential impact such modified or new laws and regulations will have on the Company’s daily business operation, the ability to accept foreign investments and list on a U.S. exchange. Any such changes could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors and could cause the value of our securities to significantly decline or become worthless.

On February 17, 2023, with the approval of the State Council, the CSRC promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the Trial Measures, and five supporting guidelines, which will come into effect on March 31, 2023. Pursuant to the Trial Measures, (i) domestic companies that seek to offer or list securities overseas, both directly and indirectly, shall complete filing procedures with the CSRC pursuant to the requirements of the Trial Measures within three working days following their submission of initial public offerings or listing applications. If a domestic company fails to complete the required filing procedures or conceals any material fact or falsifies any major content in its filing documents, such domestic company may be subject to administrative penalties, such as an order to rectify, warnings and fines, and its controlling shareholders, actual controllers, the person directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines; (ii) if the issuer meets both of the following criteria, the overseas offering and listing conducted by such issuer shall be deemed an indirect overseas offering and listing by a PRC domestic company: (A) 50% or more of any of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent fiscal year were derived from PRC domestic companies; and (B) the majority of the issuer’s business activities are carried out in mainland China, or its main place(s) of business are located in mainland China, or the majority of its senior management team in charge of its business operations and management are PRC citizens or have their usual place(s) of residence located in mainland China; and (C) where a PRC domestic company is seeking an indirect overseas offering and listing in an overseas market, the issuer shall designate a major domestic operating entity responsible for all filing procedures with the CSRC, and where an issuer makes an application for an initial public offering or listing in an overseas market, the issuer shall submit filings with the CSRC within three business days after such application is submitted.

Based on the above mentioned, given that the operating income, total profit, total assets or net assets of the Company were not derived from PRC domestic companies, the majority of the Company’s business activities are not carried out in mainland China, its main place of business is located in Hong Kong and the majority of its senior management team in charge of its business operations and management are PRC citizens or have their usual place(s) of residence located in mainland China, this offering shall not be deemed as a domestic enterprise that indirectly offer or list securities on an overseas stock exchange, nor does it requires filing or approvals from the CSRC. Further, as of the date of this prospectus, in the opinion of our Hong Kong legal counsel, Robertsons, we: (i) are not required to obtain permission from any PRC authorities (including those in Hong Kong) to issue our Ordinary Shares to investors; and (ii) are not subject to permission requirements from the CSRC, the CAC or any other entity that is required to approve of our Operating Subsidiaries’ operations. However, there can be no assurance that the relevant PRC governmental authorities, including the CSRC, would reach the same conclusion as us, or that the CSRC or any other PRC governmental authorities would not promulgate new rules or new interpretation of current rules (with retrospective effect) to require us to obtain CSRC or other PRC governmental approvals for this offering. If we or our Operating Subsidiaries inadvertently conclude that such approvals are not required, our ability to offer or continue to offer our Ordinary Shares to investors could be significantly limited or completed hindered, which could cause the value of our Ordinary Shares to significantly decline or become worthless. Our Group may also face sanctions by the CSRC, the CAC or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on our operations in China, limit our ability to pay dividends outside of China, limit our operations in China, delay or restrict the repatriation of the proceeds from this offering into China or take other actions that could have a material adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of our securities.

The Holding Foreign Companies Accountable Act, or HFCA Act, was enacted on December 18, 2020. The HFCA Act states that if the SEC determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the Public Company Accounting Oversight Board of the United States (the “ PCAOB”) for three consecutive years beginning in 2021, the SEC shall prohibit the company’s shares from being traded on a national securities exchange or in the over-the-counter trading market in the United States. Our auditor, JP Centurion & Partners PLT, the independent registered public accounting firm that issues the audit report included in this prospectus, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess JP Centurion & Partners PLT’s compliance with applicable professional standards. JP Centurion & Partners PLT is headquartered in Malaysia and has been inspected by the PCAOB on a regular basis, with the last inspection in 2020. Therefore, we believe that, as of the date of this prospectus, our auditor is not subject to the PCAOB determinations. See “Risk Factors — Risks Related to Our Securities and this Offering — Our Ordinary Shares may be prohibited from being traded on a national exchange under the HFCA Act if the PCAOB is unable to inspect our auditors for three consecutive years beginning in 2021” on page 28. On August 26, 2022, the PCAOB signed a Statement of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the People’s Republic of China, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong completely, consistent with U.S law. It includes three provisions that, if abided by, would grant the PCAOB complete access for the first time: (i) the PCAOB has sole discretion to select the firms, audit engagements and potential violations it inspects and investigates – without consultation with, nor input from, Chinese authorities; (ii) procedures are in place for PCAOB inspectors and investigators to view complete audit work papers with all information included and for the PCAOB to retain information as needed; and (iii) the PCAOB has direct access to interview and take testimony from all personnel associated with the audits the PCAOB inspects or investigates. On December 15, 2022, the PCAOB announced that it has completed a test inspection of two selected auditing firms in mainland China and Hong Kong and has voted to vacate its previous Determination Report, which concluded in December 2021 that the PCAOB could not inspect or investigate completely registered public accounting firms based in mainland China or Hong Kong. On December 23, 2022 the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”) was enacted, which amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three and such act was signed into law on December 29, 2022. However, if in the future the PCAOB is prohibited from conducting complete inspections and investigations of PCAOB-registered public accounting firms in mainland China and Hong Kong, then the companies audited by those registered public accounting firms could be subject to a trading prohibition on U.S. markets pursuant to the Holding Foreign Companies Accountable Act. There can be no assurance that China will abide by the Statement of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the People’s Republic of China, and that on-site inspections and investigations of firms headquartered in mainland China and Hong Kong will occur and allow for full and timely access to information.

The Company holds all of the equity interests in its Hong Kong subsidiaries through subsidiaries incorporated in the British Virgin Islands, or BVI. As we have a direct equity ownership structure, we do not have any agreement or contract between our Company and any of its subsidiaries that are typically seen in a variable interest entity structure. Within our direct equity ownership structure, funds from foreign investors can be directly transferred to our Hong Kong subsidiaries by way of capital injection or in the form of a shareholder loan from the Company following this offering. As a holding company, we may rely on dividends and other distributions on equity paid by our Operating Subsidiaries for our cash and financing requirements. We are permitted under the laws of the Cayman Islands and our memorandum and articles of association (as amended from time to time) to provide funding to our Operating Subsidiaries incorporated in Hong Kong through loans and/or capital contributions. Our Operating Subsidiaries are permitted under the laws of Hong Kong to issue cash dividends to us without limitation on the size of such dividends. However, if any of our Operating Subsidiaries incurs debt on its own behalf, the instruments governing such debt may restrict its ability to pay dividends. As of the date of this prospectus, our Operating Subsidiaries have not encountered difficulties or limitations with respect to their respective abilities to transfer cash between each other. They do not maintain formal cash management policies or procedures with respect to the size or means of such transfers. There can be no assurance that the PRC government will not restrict or prohibit the flow of cash in or out of Hong Kong. Until recently, we previously had not declared or paid any dividends or made any transfers of assets among our Operating Subsidiaries or us. On June 27, 2022, however, we approved, declared and distributed a special dividend of HK$22 million (approximately US$2.8 million) to our shareholders. This special dividend distributed retained profits accumulated from prior years and was paid to offset the amount due from related parties. Please refer to the financial statements of Healthy Green Group Holding Limited including “Note 17 – Dividend” on page F-19 for further details. Apart from this special dividend distribution, we intend to retain all available funds and future earnings, if any, for operation and business development and do not anticipate declaring or paying any dividends in the foreseeable future. For additional information, see “Dividends and Dividend Policy,” “Summary Financial Data” and “Consolidated Statements of Changes in Shareholders’ Equity” in the audited financial statements as of and for the year ended December 31, 2022 contained in this prospectus.

Upon completion of this offering, our issued and outstanding shares will consist of 11,375,000 Ordinary Shares, assuming the underwriters do not exercise their over-allotment option to purchase additional Ordinary Shares, or 11,675,000 Ordinary Shares, assuming the over-allotment option is exercised in full. Upon completion of this offering, WKW Investment and CFT Investment (the “Controlling Shareholders”), will be the beneficial owners of an aggregate of 6,861,563 Ordinary Shares and 1,632,187 Ordinary Shares, respectively, which will represent 60.32% and 14.35%, respectively, of the then total issued and outstanding Ordinary Shares assuming that the underwriters do not exercise their over-allotment option, 58.77% and 13.98%, respectively, of the total voting power, assuming that the over-allotment option is exercised in full. As a result, we will be a “controlled company” under NYSE American Company Guide Section 801(a) and, therefore, eligible for certain exemptions from the corporate governance requirements of the NYSE American listing rules. If we cease to be a foreign private issuer, we intend to rely on these exemptions. Furthermore, the Controlling Shareholders will be able to exert significant control over our management and affairs, including approval of significant corporate transactions. For additional information, see “Risk Factors — Risks Related to Our Securities and this Offering — Our Controlling Shareholders have substantial influence over the Company.”

| Per Share | Total(3)(4) | ||||||

| Offering price(1) | US$ | 6.50 | US$ | 13,000,000 | |||

| Underwriting discounts(2) | US$ | 0.49 | US$ | 975,000 | |||

| Proceeds to the Company before expenses(3) | US$ | 6.01 | US$ | 12,025,000 | |||

(1) Assumes the initial public offering price of US$6.50 per share (the midpoint of the price range set forth on the cover page of this prospectus).

(2) We have agreed to pay the underwriters a discount/commission equal to 7.5% of the initial offering price. For a description of the other compensation to be received by the underwriters, see “Underwriting” beginning on page 95.

(3) Excludes fees and expenses payable to the underwriters. See “Underwriting – Discounts, Commission and Expenses” on page 95.

(4) Assumes that the underwriters do not exercise any portion of their over-allotment option.

We have granted the underwriters an option, exercisable from time to time, in whole or in part, to purchase up to 300,000 additional Ordinary Shares from us at the initial public offering price, less underwriting discounts and commissions, within 45 days from the date of this prospectus to cover over-allotments, if any. If the underwriters exercise the option in full, the total underwriting discounts payable will be US$1,121,250, and the total proceeds to us, before expenses, will be US$13,828,750.

This offering is being conducted on a firm commitment basis. If we complete this offering, net proceeds will be delivered to us on the closing date. The underwriters expect to deliver the Ordinary Shares to the purchasers against payment therefor on or about [●], 2023.

Neither the United States Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

You should not assume that the information contained in the registration statement of which this prospectus is a part is accurate as of any date other than the date hereof, regardless of the time of delivery of this prospectus or of any sale of the Ordinary Shares being registered in the registration statement of which this prospectus forms a part.

No dealer, salesperson or any other person is authorized to give any information or make any representations in connection with this offering other than those contained in this prospectus, and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any jurisdiction in which the offer or solicitation is not authorized or is unlawful.

EF HUTTON

division of Benchmark Investments, LLC

The date of this prospectus is [●], 2023

TABLE OF CONTENTS

Until , 2023 (the 25th day after the date of this prospectus), all dealers that effect transactions in these Ordinary Shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

| 2 |

Neither we nor any of the underwriters have authorized anyone to provide you with any information or to make any representations other than as contained in this prospectus or in any related free writing prospectus. Neither we nor the underwriters take responsibility for, nor provide any assurance about the reliability of, any information that others may give you. This prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Ordinary Shares and the distribution of this prospectus outside the United States.

We obtained statistical data, market data and other industry data and forecasts used in this prospectus from market research, publicly available information and industry publications. While we believe that the statistical data, industry data, forecasts and market research are reliable, we have not independently verified the data.

PRESENTATION OF FINANCIAL INFORMATION

Basis of Presentation

Unless otherwise indicated, all financial information contained in this prospectus is prepared and presented in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP” or “GAAP”).

Certain amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, amounts, percentages and other figures shown as totals in certain tables or charts may not be the arithmetic aggregation of those that precede them, and amounts and figures expressed as percentages in the text may not total 100% or, when aggregated, may not be the arithmetic aggregation of the percentages that precede them.

Financial Information in U.S. Dollars

Our reporting currency is the Hong Kong dollar. This prospectus also contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations of Hong Kong dollars into U.S. dollars were made at HK$7.8015 to US$1.00, the exchange rate set forth in the H10 statistical release of the Federal Reserve Board on December 30, 2022. We make no representation that the Hong Kong dollar or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Hong Kong dollars, as the case may be, at any particular rate or at all.

| 3 |

This prospectus contains certain data and information that we obtained from the Frost & Sullivan Report and various other publications. All market and industry data used in this prospectus involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Although we believe the information from industry publications and other third-party sources included in this prospectus is reliable, such information is inherently imprecise. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections titled “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Industry Overview” and “Business.” These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “believe,” “plan,” “expect,” “intend,” “should,” “seek,” “estimate,” “will,” “aim” and “anticipate” or other similar expressions, but these are not the exclusive means of identifying such statements. All statements other than statements of historical facts included in this document, including those regarding future financial position and results, business strategy, plans and objectives of management for future operations (including development plans and dividends) and statements on future industry growth are forward-looking statements. In addition, we and our representatives may from time to time make other oral or written statements that are forward-looking statements, including in our periodic reports that we will file with the SEC, other information sent to our shareholders and other written materials.

These forward-looking statements are subject to risks, uncertainties and assumptions, certain of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Risk Factors” and the following:

| ● | our business and operating strategies and our various measures to implement such strategies; | |

| ● | our operations and business prospects, including development and capital expenditure plans for our existing business; | |

| ● | changes in policies, legislation, regulations or practices in the industry and place in which our Operating Subsidiaries operate that may affect our business operations; | |

| ● | our financial condition, results of operations and dividend policy; | |

| ● | changes in political and economic conditions and competition in the area in which our Operating Subsidiaries operate, including a downturn in the general economy; | |

| ● | the regulatory environment and industry outlook in general; | |

| ● | future developments in the organic and healthy foods market and actions of our competitors; | |

| ● | catastrophic losses from man-made or natural disasters, such as fires, floods, windstorms, earthquakes, diseases, epidemics, other adverse weather conditions or natural disasters, war, international or domestic terrorism, civil disturbances and other political or social occurrences; | |

| ● | the loss of key personnel and the inability to replace such personnel on a timely basis or on terms acceptable to us; | |

| ● | the overall economic environment and general market and economic conditions in Hong Kong; | |

| ● | our ability to execute our strategies; | |

| ● | changes in the need for capital and the availability of financing and capital to fund those needs; | |

| ● | our ability to anticipate and respond to changes in consumer performances, tastes and trends; and | |

| ● | legal, regulatory and other proceedings arising out of our Operating Subsidiaries’ operations. |

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

| 4 |

CONVENTIONS THAT APPLY TO THIS PROSPECTUS

“Memorandum of Association” or “Memorandum”

| the amended and restated memorandum of association of our Company adopted on April 14, 2022, and as supplemented, amended or otherwise modified from time to time, a copy of which is filed as Exhibit 3.2 to this registration statement; | |

“Articles of Association”

| the amended and restated articles of association of our Company adopted on April 14, 2022, as amended from time to time, a copy of which is filed as Exhibit 3.1 to this registration statement; | |

“Business day”

| a day (other than a Saturday, Sunday or public holiday in the U.S.) on which licensed banks in the U.S. are generally open for normal business to the public; | |

“BVI” | the British Virgin Islands; | |

“CAGR” | compound annual growth rate; | |

“CFT Investment” | CFT Investment Holding Limited, a BVI business company incorporated in the BVI with limited liability on December 20, 2018, which is wholly owned by Ms. Cheuk; | |

“China” or the “PRC” | the People’s Republic of China, excluding, for the purpose of this prospectus only, Hong Kong, Macau and Taiwan; | |

“Controlling Shareholders” | CFT Investment and WKW Investment; | |

“Companies Act”

| the Companies Act (as revised) of the Cayman Islands, as amended, supplemented or otherwise modified from time to time; | |

| “Companies Ordinance” | the Companies Ordinance (Chapter 622 of the Laws of Hong Kong), as amended, supplemented or otherwise modified from time to time; | |

| “Company” or “our Company” | Healthy Green Group Holding Limited, an exempted company incorporated in the Cayman Islands as an exempted company with limited liability on December 24, 2018; | |

“Director(s)” | the director(s) of our Company; | |

“ERP” | enterprise resource planning, a modular software system adopted to monitor inventory levels and minimize incidences of overstocking; | |

“Exchange Act” | Securities Exchange Act of 1934, as amended; | |

“FINRA” | Financial Industry Regulatory Authority, Inc.; | |

“Food Factory” | our former food production facility in operation located at Kwai Chung, Hong Kong; | |

“Frost & Sullivan” | Frost & Sullivan Limited, an independent business consulting firm; | |

| “Frost & Sullivan Report” | the market research report commissioned by us and prepared by Frost & Sullivan; | |

“GDD Hong Kong”

| Greendotdot.com Limited, a company incorporated in Hong Kong with limited liability on April 14, 2000, which is an indirect wholly owned subsidiary of our Company; |

| 5 |

“GDD Retail”

| GDD Retail Holding Limited, a BVI business company incorporated in the BVI with limited liability on December 20, 2018, which is a direct wholly owned subsidiary of our Company; | |

“GDP” | gross domestic product; | |

“GMO” | genetically modified organism, an organism whose genome has been altered by the techniques of genetic engineering; | |

“Group,” “our Group,” “we” or “us” | our Company and our subsidiaries, including our Operating Subsidiaries; | |

“HACCP” | hazard analysis critical control point, a management system in which food safety is addressed through the analysis and control of biological, chemical and physical hazards from raw material production, procurement, manufacturing, distribution and consumption of the finished product; | |

“HK$,” “Hong Kong dollars,” “HK dollars” or “HKD” | Hong Kong dollars, the lawful currency of Hong Kong; | |

“Hong Kong” or “HK” | the Hong Kong Special Administrative Region of the PRC; | |

“Independent Third Party(ies) | “a person or company who or which is independent of and is not a 5% beneficial owner (as defined in Rule 13d-3 promulgated under the Exchange Act) of, does not control and is not controlled by or under common control with any 5% owner and is not the spouse or descendant (by birth or adoption) of any 5% beneficial owner of the Company; | |

“IRC” | United States Internal Revenue Code of 1986, as amended; | |

“ISO”

| an abbreviation for a series of quality management and quality assurance standards published by International Organization for Standardization, a non-government organization based in Geneva, Switzerland, for assessing the quality systems of business organizations; | |

“ISO 22000:2005” | an international standard which addresses food safety management; | |

“Kampery Development”

| Kampery Development Limited, a company incorporated in Hong Kong with limited liability on June 27, 1989, which is wholly owned by Mr. Wong; | |

“Kampery F&B”

| Kampery F&B Services Limited, a company incorporated in Hong Kong with limited liability on August 13, 1997, which is a subsidiary of Kampery Development; | |

“Linden Tree”

| Linden Tree Consultancy Limited, a company incorporated in Hong Kong with limited liability on May 20, 2013, which is an indirect wholly owned subsidiary of our Company; | |

“Listing”

| the listing of the Ordinary Shares on the NYSE American or other national securities exchange; | |

“Mr. Cui” | Mr. Cui Qing, an Independent Third Party; | |

“Mr. Wong”

| Mr. Wong Ka Wo, Simon, Chairman, Executive Director and a Controlling Shareholder of our Company; |

| 6 |

“Ms. Cheuk” | Ms. Cheuk Fung Ting, Chief Executive Officer, Executive Director and a Controlling Shareholder of our Company; | |

“MTR” | mass transit railway in Hong Kong; | |

“NYSE American” | An American stock exchange situated in New York City. | |

“OG Wholesales” | OG Wholesales Holding Limited, a BVI business company incorporated in the BVI with limited liability on December 20, 2018, which is a direct wholly owned subsidiary of our Company; | |

“Operating Subsidiaries” | Organic Gardens, GDD Hong Kong and Linden Tree; | |

“Ordinary Shares” | share(s) with par value of US$0.001 per share in the share capital of our Company; | |

| “Organic Gardens” | Organic Gardens International Limited, a company incorporated in Hong Kong with limited liability on March 3, 1999, which is an indirect wholly owned subsidiary of our Company; | |

“POS”

| point of sale, the point where a transaction is finalized or the moment where a customer tenders payment in exchange for goods and services; | |

“Regulation S” | Regulation S under the U.S. Securities Act; | |

“RMB” or “Renminbi” | Renminbi, the lawful currency of the PRC; | |

“Sarbanes Oxley Act” | The Sarbanes-Oxley Act of 2002; | |

“SEC” | the United States Securities and Exchange Commission; | |

“Task Wing” | Task Wing Enterprises Limited, a company incorporated in Hong Kong with limited liability on July 7, 1992, which is wholly-owned by Mr. Wong; | |

“Track Record Period” | the period comprising the two years ended December 31, 2021 and 2022; | |

“Unicorn” | Unicorn Strategies Management Limited, a company incorporated in the BVI and wholly owned by an Independent Third Party; | |

| “U.S.,” “United States” or “US” | the United States of America; | |

| “US$” or “U.S. dollars” | United States dollars, the lawful currency of the United States of America; | |

| “U.S. GAAP” | the generally accepted accounting principles in the United States of America; | |

“U.S. Securities Act” | the United States Securities Act of 1933, as amended; and | |

“WKW Investment” | WKW Investment Limited, a BVI business company incorporated in the BVI with limited liability on December 20, 2018 and wholly-owned by Mr. Wong. |

| 7 |

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated financial statements and notes to those statements, included elsewhere in this prospectus, before deciding to invest in our Ordinary Shares. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.”

Overview

We are a Hong Kong based retailer principally engaged in the sale of natural and organic food under our “Greendotdot” brand. Our Group’s history can be traced back to 1999 when Mr. Wong and Ms. Cheuk started the business of marketing natural and organic foods. The same year, we launched our first retail store with the objective to introduce quality products from local and overseas suppliers to our customers. Over the years, we have been building our “Greendotdot” brand by sourcing, procuring, marketing and selling a wide variety of quality products, which can be broadly classified into (i) packaged foods; (ii) fresh foods; (iii) frozen foods; and (iv) other products such as honey, beverages, edible oils, seasonings and other non-food items.

We offer a diversified portfolio of over 600 products sourced from over 134 suppliers, which we market through established sales channels including 22 retail stores in Hong Kong under our brand “Greendotdot” as of December 31, 2022. The retail stores are strategically located in Metrorail stations, residential areas, or shopping complexes, which are prime locations with high pedestrian traffic. Other established sales channels include our online sales platforms, exhibitions and through supermarkets and department stores, and wholesale sales to bulk-purchase customers.

According to the Frost & Sullivan Report, our Group ranked as the second largest natural and organic food retail chain in Hong Kong in terms of our revenue, translating to a market share of approximately 7.9% in the natural and organic food market in Hong Kong in 2021. For the years ended December 31, 2021 and 2022, our Group’s revenue amounted to approximately HK$159,546,000 (US$20,527,000) and HK$161,453,000 (US$20,729,000), respectively. Our net profit was approximately HK$4,013,000 (US$516,000) and HK$5,880,000 (US$755,000) for the respective years.

Investors in this offering are buying shares of the Cayman Islands company whereas all of our operations are conducted through our Operating Subsidiaries. At no time will the Company’s shareholders directly own shares of the Operating Subsidiaries.

Our Competitive Strengths

Established brand recognition and market position in the growing natural and organic food market

We believe we have a proven business track record and have established strong brand recognition. Since our establishment in 1999, our efforts have led to the recognition of our brand “Greendotdot” as a reputable brand in the market. We believe that the brand image of “Greendotdot” is associated by the public with quality and reliable natural and organic products, which we further believe has reinforced our customers’ confidence in our products. We believe our brand reputation and influence differentiate us from our competitors and have led to our popularity and customer loyalty.

With local consumers’ increasing awareness of the benefits of a healthy diet and knowledge about natural and organic foods, we believe the natural and organic food market will continue to expand. According to the Frost & Sullivan Report, the natural and organic food market in Hong Kong is expected to grow at a CAGR of approximately 13.7% and reach approximately HK$3.8118 billion by the end of 2026. With our brand recognition and customers’ confidence in our products, we believe it will place us in a favorable position to further capture demand in the growing market.

Our ability to identify and vet quality suppliers and our established relationships with existing suppliers

Our suppliers consist of brand owners and manufacturers throughout the world, as well as local suppliers in Hong Kong. In order to enrich our product range and product portfolio, we maintain relationships with our existing suppliers and proactively identify new suppliers by regularly attending international trade fairs, exhibitions and conventions, which provides us access to extensive procurement networks and diversified supplier contacts.

Our Group has implemented a stringent vetting process to assess the suitability and quality of our suppliers, and we conduct business reviews and evaluations of our suppliers on a continual basis. As of December 31, 2022, we had over 134 suppliers on our approved suppliers list. Given that we have developed and maintained a diverse supplier base on our internal list of approved suppliers, we are able to predict changes in product trends effectively and capture opportunities to source a wide variety of quality and distinctive products originating from various countries. The relationships we maintain with our suppliers enable our Group to create and foster stable, long-term relationships with our suppliers which contribute to the success of our Group.

| 8 |

Established sales channels supported by effective marketing and promotion initiatives

We have a diversified portfolio of over 600 products available, and we have established various sales channels to ensure our products reach an extensive customer base. Our sales channels include (i) retail sales via our retail stores in Hong Kong, online sales platforms and exhibitions, and (ii) wholesale sales to bulk-purchase customers. As of December 31, 2022, we operated a chain of 22 retail stores in Hong Kong under our brand “Greendotdot,” strategically located in Metrorail stations, residential areas or shopping complexes, which are prime locations with high pedestrian traffic.

In addition, we also implement multi-dimensional marketing and promotional initiatives to target a large customer base and to deepen market penetration for our products. We closely follow market information and formulate marketing and promotional strategies in order to adapt to fast-changing trends in the market and customer tastes. Our marketing and promotional initiatives include placing advertisements through various media channels, including newspaper, the internet and social media. We also adopt a variety of other advertising methods, including direct mailing, joint promotions with other brands, in-store promotions and promotions at exhibitions. Moreover, we provide training for our sales personnel to ensure they are well-equipped regarding the relevant features of and health information about our products to effectively promote them to our customers.

We believe our established sales channels, supported by our effective marketing and promotional initiatives, provide us with a solid foundation to further increase the market share of our products, strengthen our brand recognition and enhance our ability to compete in the market.

Experienced management team with a proven track record

The members of our senior management team have more than 20 years of experience in the natural and organic food industry. Our Directors believe that our continued growth is attributable to the unique vision regarding market trends and vast knowledge on the latest product information possessed by our experienced management team, which enable our Group to comprehend changing product trends effectively and continually. Our management team is responsible for overseeing different aspects of our operations including procurement, warehouse and transportation management, operation and marketing. The biographies of our Directors and senior management are included herein under “Management – Executive Officers and Directors.”

Our growth strategy

Our Group has formulated the following business strategies to further enhance our market position in the natural and organic food industry and to continue our business expansion:

| ● | expand and reinforce our retail network by setting up new retail stores and refurbishing existing retail stores; | |

| ● | develop our probiotic business; | |

| ● | enhance our brand recognition; | |

| ● | lease a new food factory in Hong Kong; | |

| ● | upgrade our information technology systems; and | |

| ● | explore new business opportunities, including acquisitions. |

Transfers of Cash to and from Our Subsidiaries

Until recently, we had not declared or paid any dividends or made any transfers of assets among us or our Operating Subsidiaries. On June 27, 2022, however, we approved, declared and distributed a special dividend of HK$22 million (approximately US$2.8 million) to our shareholders. This special dividend was mainly distributed from retained profits accumulated from prior years and was paid to offset the amount due from related parties.

We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments.

We are permitted under the laws of the Cayman Islands to provide funding to our Operating Subsidiaries through loans and/or capital contributions without restriction on the amount of the funds loaned or contributed.

Cayman Islands. Subject to Hong Kong law, the Companies Act and our Memorandum and Articles of Association, our Company in general meeting may declare dividends in any currency, but no dividends shall be declared in excess of the amount recommended by our board of directors. Subject to a solvency test, as prescribed in the Companies Act, and the provisions, if any, of the memorandum and articles of association of an exempted company incorporated in the Cayman Islands, an exempted company incorporated in the Cayman Islands may pay dividends and distributions out of its share premium account. In addition, based upon English case law that is likely to be persuasive in the Cayman Islands, dividends may be paid out of profits.

| 9 |

Hong Kong. Under Hong Kong law, dividends may only be paid out of distributable profits (that is, accumulated realized profits less accumulated realized losses) or other distributable reserves. Dividends cannot be paid out of share capital. There are no restrictions or limitations under the laws of Hong Kong imposed on the conversion of HK dollars into foreign currencies and the remittance of currencies out of Hong Kong, nor is there any restriction on foreign exchange to transfer cash between the Company and its subsidiaries, across borders and to U.S. investors, nor are there any restrictions or limitations on distributing earnings from our business and subsidiaries to the Company and U.S. investors. Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us.

For more information, see “Dividends and Dividend Policy,” “Risk Factors” and “Summary Financial Data” and “Consolidated Statements of Changes in Shareholders’ Equity” in the audited financial statements as of and for the year ended December 31, 2022 contained in this prospectus.

Risks and Challenges

Investing in our Ordinary Shares involves risks. The risks summarized below are qualified by reference to “Risk Factors” beginning on page 19 of this prospectus, which you should carefully consider before making a decision to purchase Ordinary Shares. If any of these risks actually occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our Ordinary Shares would likely decline, and you may lose all or part of your investment.

A summary of these risks include but are not limited to the following:

Risks Relating to Our Business

Risks and uncertainties relating to our business, beginning on page 19 of this prospectus, include but are not limited to the following:

| ● | Our business depends significantly on the market recognition of our “Greendotdot” brand. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | Our quality control system to detect defective products may fail and render the products we supply susceptible to food safety issues. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | Our market share and results of operations could be adversely affected if we are unable to respond effectively to changes in consumer preferences and needs. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | Our success depends on our key management personnel, and our business may be harmed if we lose their services. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | We are exposed to risks relating to the commercial real estate rental market, including unpredictable and potentially high occupancy costs. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | We currently rely and will continue to rely on third-party outsourcing partners to perform the packaging processes, which exposes us to a number of risks and uncertainties outside our control. - - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | Any disruption to the supply of products, food ingredients or packaging materials could adversely affect our results of operations. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | Climate change risk can create food shortages or increases in food costs, which can adversely affect our operations and profitability. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | Our business and operations might be adversely affected by security breaches, including any cybersecurity incidents. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | Our Operating Subsidiaries’ operations may be adversely affected by the disruption of logistics services or poor handling of products by third party logistics service providers. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | Significant portions of our inventory are perishable and vulnerable to spoilage and other loss. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | Our Operating Subsidiaries’ business operations could be adversely affected by labor shortages or increases in staff costs. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | Any failure to obtain or renew approvals, licenses and permits required for our Operating Subsidiaries’ operations could materially and adversely affect our business and results of operations. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | We are subject to risk of uncertainties of our future plans to expand to new geographic areas and offer new products. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | Our Operating Subsidiaries do not maintain backup facilities, and their business operations may be disrupted by natural disasters or events beyond their control. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | Measures taken to prevent intellectual property infringement may be insufficient. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | If our Group fails to implement and maintain an effective system of internal controls, our Group may be unable to accurately or timely report our results of operations or prevent fraud, and investor confidence and the market price of our Ordinary Shares may be materially and adversely affected. - (See “Risk Factors—Risks Relating to our Business” on page 19); |

| 10 |

| ● | We may be unable to detect, deter and prevent all instances of fraud or other misconduct committed by our employees or other third parties. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | We may be harmed by negative publicity. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | The war in Ukraine could materially and adversely affect our business and results of operations. - (See “Risk Factors—Risks Relating to our Business” on page 19); | |

| ● | Our Operating Subsidiaries’ business and operations may be materially and adversely affected in the event of a re-occurrence or a prolonged global pandemic outbreak of COVID-19. - (See “Risk Factors—Risks Relating to our Business” on page 19); |

Risks Relating to Our Industry

Risks and uncertainties relating to our industry, beginning on page 24 of this prospectus, include but are not limited to the following:

| ● | Our Operating Subsidiaries are susceptible to foodborne diseases and may be exposed to litigation and negative publicity which may have a material adverse effect on our business operations and financial condition.- (See “Risk Factors—Risks Relating to our Industry” on page 24); | |

| ● | Our Operating Subsidiaries operate in a competitive market, and if they fail to compete effectively, they may lose market share, and our results of operation may be adversely affected. - (See “Risk Factors—Risks Relating to our Industry” on page 24); |

Risks Relating to Doing Business in the Jurisdictions in which our Operating Subsidiaries Operate

Risks and uncertainties relating to doing business in the jurisdiction in which our Operating Subsidiaries operate, beginning on page 25 of this prospectus, include but are not limited to the following:

| ● | Through long arm provisions under the current PRC laws and regulations, the Chinese government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of our Ordinary Shares. Changes in the policies, regulations and rules and the enforcement of laws of the Chinese government may also be quick with little advance notice, and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system cannot be certain. - (See “Risk Factors—Risks Relating to doing Business in the Jurisdictions in which our Operating Subsidiaries Operate” on page 25); | |

| ● | Our Operating Subsidiaries conduct their business in Hong Kong, a Special Administrative Region of the PRC, and some of the suppliers of the Operating Subsidiaries are PRC companies that may have shareholders or directors that are PRC individuals. There are significant legal and operational risks associated with being based in or having the majority of operations in Hong Kong, including that changes in the legal, political and economic policies of the Chinese government, the relations between China and the United States, or Chinese or U.S. regulations may materially and adversely affect our business, financial condition and results of operations. - (See “Risk Factors—Risks Relating to doing Business in the Jurisdictions in which our Operating Subsidiaries Operate” on page 25); | |

| ● | Our Operating Subsidiaries may become subject to a variety of PRC laws and other regulations regarding data security or securities offerings that are conducted overseas and/or other foreign investment in China-based issuers, and any failure to comply with applicable laws and regulations could have a material and adverse effect on our business, financial condition and results of operations and may hinder our ability to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless. - (See “Risk Factors—Risks Relating to doing Business in the Jurisdictions in which our Operating Subsidiaries Operate” on page 25); | |

| ● | The Hong Kong legal system is subject to uncertainties which could limit the legal protections available to our Operating Subsidiaries. - (See “Risk Factors—Risks Relating to doing Business in the Jurisdictions in which our Operating Subsidiaries Operate” on page 25); | |

| ● | We may be affected by adverse changes in the political, economic, regulatory or social conditions in the countries in which we and our customers and suppliers operate. - (See “Risk Factors—Risks Relating to doing Business in the Jurisdictions in which our Operating Subsidiaries Operate” on page 25); | |

| ● | We are exposed to political risks associated with conducting business in Hong Kong. - (See “Risk Factors—Risks Relating to doing Business in the Jurisdictions in which our Operating Subsidiaries Operate” on page 25); |

| 11 |

Risks Related to our Securities and this Offering:

Risks and uncertainties relating to our securities and this offering, beginning on page 28 of this prospectus, include but are not limited to the following:

| ● | Our Ordinary Shares may be prohibited from being traded on a national exchange under the HFCA Act if the PCAOB is unable to inspect our auditors for three consecutive years beginning in 2021. – (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | An active trading market for our Ordinary Shares may not be established or, if established, may not continue, and the trading price for our Ordinary Shares may fluctuate significantly. – (See “Risks Related to our Securities and this Offering”); We may not maintain the listing of our Ordinary Shares on the NYSE American, which could limit investors’ ability to make transactions in our Ordinary Shares and subject us to additional trading restrictions. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | The trading price of our Ordinary Shares may be volatile, which could result in substantial losses to investors. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | If securities or industry analysts do not publish research or reports about our business, or if they adversely change their recommendations regarding our Ordinary Shares, the market price for our shares and trading volume could decline. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | The sale or availability for sale of substantial amounts of our Ordinary Shares could adversely affect their market price. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | Short selling may drive down the market price of our Ordinary Shares. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | Because we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation of our Ordinary Shares for a return on your investment. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | Because our public offering price is substantially higher than our net tangible book value per Ordinary Share, you will experience immediate and substantial dilution. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | You must rely on the judgment of our management as to the uses of the net proceeds from this offering, and such uses may not produce income or increase our share price. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | If we are classified as a passive foreign investment company, United States taxpayers who own our securities may have adverse United States federal income tax consequences. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | Our Controlling Shareholders have substantial influence over the Company. Their interests may not be aligned with the interests of our other shareholders, and it could prevent or cause a change of control or other transactions. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | We will be a “controlled company” within the meaning of the NYSE American corporate governance rules and, as a result, will rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | As a company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that may differ significantly from certain requirements under the NYSE American Company Guide. These practices may afford less protection to shareholders than they would enjoy if we complied fully with the NYSE American Company Guide corporate governance listing standards. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | Certain judgments obtained against us by our shareholders may not be enforceable. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | We are an emerging growth company within the meaning of the Securities Act and may take advantage of certain reduced reporting requirements. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to United States domestic public companies. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses. - (See “Risks Related to our Securities and this Offering” on page 28); | |

| ● | We will incur significantly increased costs and devote substantial management time as a result of the listing of our Ordinary Shares on the NYSE American. - (See “Risks Related to our Securities and this Offering” on page 28). |

Holding Foreign Companies Accountable Act (the “HFCA Act”)

The HFCA Act was enacted on December 18, 2020. The HFCA Act states if the SEC determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit the company’s shares from being traded on a national securities exchange or in the over-the-counter trading market in the United States.

On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCA Act. A company will be required to comply with these rules if the SEC identifies it as having a “non- inspection” year under a process to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCA Act, including the listing and trading prohibitions described above.

On June 22, 2021, the U.S. Senate passed a bill which, if passed by the U.S. House of Representatives and signed into law, would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two years.

On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions.

On December 16, 2021, the PCAOB announced the PCAOB HFCA Act determinations (the “PCAOB determinations”) relating to the PCAOB’s inability to inspect or investigate completely registered public accounting firms headquartered in mainland China of the PRC or Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in the PRC or Hong Kong.

| 12 |

Our auditor, JP Centurion & Partners PLT, the independent registered public accounting firm that issues the audit report included in this prospectus, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess JP Centurion & Partners PLT’s compliance with applicable professional standards. JP Centurion & Partners PLT is headquartered in Malaysia and has been inspected by the PCAOB on a regular basis, with the last inspection in 2020. Therefore, we believe that, as of the date of this prospectus, our auditor is not subject to the PCAOB determinations. See “Risk Factors — Risks Related to Our Securities and this Offering — Our Ordinary Shares may be prohibited from being traded on a national exchange under the HFCA Act if the PCAOB is unable to inspect our auditors for three consecutive years beginning in 2021” on page 28. The delisting of our Ordinary Shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. We cannot assure you whether the NYSE American or other regulatory authorities will apply additional or more stringent criteria to us. Such uncertainty could cause the market price of our Ordinary Shares to be materially and adversely affected.

On August 26, 2022, the PCAOB signed a Statement of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the People’s Republic of China, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong completely, consistent with U.S law. It includes three provisions that, if abided by, would grant the PCAOB complete access for the first time: (i) the PCAOB has sole discretion to select the firms, audit engagements and potential violations it inspects and investigates – without consultation with, or input from, Chinese authorities; (ii) procedures are in place for PCAOB inspectors and investigators to view complete audit work papers with all information included and for the PCAOB to retain information as needed; and (iii) the PCAOB has direct access to interview and take testimony from all personnel associated with the audits the PCAOB inspects or investigates.

On December 15, 2022, the PCAOB announced that it has completed a test inspection of two selected auditing firms in mainland China and Hong Kong and has voted to vacate its previous Determination Report, which concluded in December 2021 that the PCAOB could not inspect or investigate completely registered public accounting firms based in mainland China or Hong Kong. On December 23, 2022, the AHFCAA was enacted, which amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three and such act was signed into law on December 29, 2022. However, if in the future the PCAOB is prohibited from conducting complete inspections and investigations of PCAOB-registered public accounting firms in mainland China and Hong Kong, then the companies audited by those registered public accounting firms could be subject to a trading prohibition on U.S. markets pursuant to the Holding Foreign Companies Accountable Act.

Recent Regulatory Development in the PRC

Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in China with little advance notice, including cracking down on certain activities in the securities market, enhancing supervision over Chinese-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement.

For example, on June 10, 2021, the Standing Committee of the National People’s Congress enacted the PRC Data Security Law, which took effect on September 1, 2021. The law requires data collection to be conducted in a legitimate and proper manner and stipulates that, for the purpose of data protection, data processing activities must be conducted based on data classification and hierarchical protection system for data security.

On July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued a document to crack down on certain activities in the securities markets to promote the high-quality development of the capital markets, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over Chinese-based companies listed overseas and to establish and improve the system of extraterritorial application of the PRC securities laws.

On August 20, 2021, the 30th meeting of the Standing Committee of the 13th National People’s Congress voted and passed the “Personal Information Protection Law of the People’s Republic of China,” or the “PRC Personal Information Protection Law,” which became effective on November 1, 2021. The PRC Personal Information Protection Law applies to the processing of personal information of natural persons within the territory of China that is carried out outside of China where (i) such processing is for the purpose of providing products or services for natural persons within China; (ii) such processing is to analyze or evaluate the behavior of natural persons within China; or (iii) there are any other circumstances stipulated by related laws and administrative regulations.

On December 24, 2021, the China Securities Regulatory Commission (“CSRC”), together with other relevant government authorities in China issued the Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) and the Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (“Draft Overseas Listing Regulations”). The Draft Overseas Listing Regulations require that a PRC domestic enterprise seeking to issue and list its shares overseas (“Overseas Issuance and Listing”) shall complete the filing procedures of and submit the relevant information to CSRC. The Overseas Issuance and Listing includes direct and indirect issuance and listing. Where an enterprise whose principal business activities are conducted in the PRC seeks to issue and list its shares in the name of an overseas enterprise (“Overseas Issuer”) on the basis of the equity, assets, income or other similar rights and interests of the relevant PRC domestic enterprise, such activities shall be deemed an indirect overseas issuance and listing (“Indirect Overseas Issuance and Listing”) under the Draft Overseas Listing Regulations.

| 13 |

On December 28, 2021, the CAC jointly with the relevant authorities formally published Measures for Cybersecurity Review (2021) which took effect on February 15, 2022, replacing the former Measures for Cybersecurity Review (2020) issued on July 10, 2021. Measures for Cybersecurity Review (2021) stipulates that operators of critical information infrastructure purchasing network products and services, and online platform operators (together with the operators of critical information infrastructure, the “Operators”) carrying out data processing activities that affect or may affect national security shall conduct a cybersecurity review, and any online platform operator who controls more than one million users’ personal information must undergo a cybersecurity review by the cybersecurity review office if it seeks to be listed in a foreign country.