U POWER LIMITED March 2023 Roadshow Presentation Free Writing Prospectus dated March 14, 2023 Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended Relating to Preliminary Prospectus dated March 13 , 2023 Registration Statement No. 333 - 268949

2 This free writing prospectus relates to the proposed public offering of ordinary shares ( “ Ordinary Shares ” ) of U Power Limited ( “ we ” , “ us ” , or “ our ” ) and should be read together with the Registration Statement we filed with the U . S . Securities and Exchange Commission (the “ SEC ” ) for the offering to which this presentation relates and may be accessed through the following web link : https : //www . sec . gov/Archives/edgar/data/ 1939780 / 000121390023019529 /ff 12023 a 3 _upowerltd . htm The Registration Statement has not yet become effective . Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have with the SEC in their entirety for more complete information about us and the offering . You may get these documents for free by visiting EDGAR on the SEC website at http : //www . sec . gov . Alternatively, we or our underwriter will arrange to send you the prospectus if you contact AMTD Wealth Management Solutions Group Limited, 23 /F Nexxus Building, 41 Connaught Road Central, Hong Kong, or by calling + 852 - 3163 - 3288 , or contact U Power Limited via email : ir@upower . com . Free Writing Prospectus Statement

3 This presentation contains forward - looking statements that reflect our current expectations and views of future events . These forward - looking statements relate to events that involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from those expressed or implied by these statements . You can identify some of these forward - looking statements by words or phrases such as “ may, ” “ will, ” “ could, ” “ expect, ” “ anticipate, ” “ aim, ” “ estimate, ” “ intend, ” “ plan, ” “ believe, ” “ is/are likely to, ” “ propose, ” “ potential, ” “ continue ” or other similar expressions . We have based these forward - looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs . The forward - looking statements relate to, among other things : our goals and strategies ; our business and operating strategies and plans for the development of existing and new businesses, ability to implement such strategies and plans and expected time ; our future business development, financial condition and results of operations ; expected changes in our revenues, costs or expenditures ; our dividend policy ; our expectations regarding demand for and market acceptance of our products and services ; our expectations regarding our relationships with our clients, business partners and third - parties ; the trends in, expected growth in and market size of the automobile sourcing industry, and the electric vehicle industry in China ; our ability to maintain and enhance our market position ; our ability to continue to develop new technologies and/or upgrade our existing technologies ; developments in, or changes to, laws, regulations, governmental policies, incentives and taxation affecting our operations ; relevant governmental policies and regulations relating to our businesses and industry ; competitive environment, competitive landscape and potential competitor behavior in our industry ; overall industry outlook in our industry ; our ability to attract, train and retain executives and other employees ; our proposed use of proceeds from this offering ; the development of the global financial and capital markets ; fluctuations in inflation, interest rates and exchange rates ; general business, political, social and economic conditions in China and the overseas markets we have business ; the future development of the COVID - 19 pandemic and its impact on our business and industry ; and assumptions underlying or related to any of the foregoing . These forward - looking statements involve various risks and uncertainties . Although we believe that our expectations expressed in these forward - looking statements are reasonable, our expectations and our actual results could be materially different from our expectations . You should read carefully the factors described in the “ Risk Factors ” section of the prospectus contained in the Registration Statement to better understand the risks and uncertainties inherent in our business and any forward - looking statements . Statistical data referenced in this presentation may also include projections based on a number of assumptions . The Chinese automotive sourcing industry and the Chinese electric vehicle industry and its power solutions market may not grow at the rate projected by market data, or at all . Failure of these markets to grow at the projected rate may have a material and adverse effect on our business and the market price of the ordinary shares . In addition, the rapidly evolving nature of the Chinese automotive sourcing industry, and the Chinese electric vehicle industry and its power solutions market results in significant uncertainties for any projections or estimates relating to the growth prospects or future condition of our market . Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions . You should not rely upon forward - looking statements as predictions of future events . The forward - looking statements in this presentation are made based on events and information as of the date of this presentation . Except as required by law, we undertake no obligation to update or revise publicly any forward - looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events . You should read this presentation and the documents that we refer to herein with the understanding that our actual future results or performance may materially differ from what we expect . Forward Looking Statements

4 Offering Summary Issuer • U Power Limited Listing Venue • Nasdaq Capital Markets (Stock Code: “ UCAR ” ) Offering Type Price Range Use of Proceeds Joint Bookrunners • Initial Public Offering • $6.00 - $8.00 per ordinary share • 40% for developing and marketing of UOTTA - powered EVs; • 30% for manufacturing and developing UOTTA - powered battery - swapping stations; • 20% for developing and upgrading UOTTA technologies; and • 10% for working capital • AMTD Wealth Management Solutions Group Limited • WestPark Capital, Inc. • 2,500,000 o rdinary shares • Over - allotment option: 15% Shares Offered Lock - up • 180 days for the directors, executive officers and existing shareholders holding 5% or more of the Company ’ s ordinary share Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

Table of Contents Investment Highlights 14. Growth Strategies 20. Financial Highlights 22 . Appendix 26 . 10 . Business Overview Company Overview 6 .

Company Overview

Our Vision Become an EV market player primarily focused on our proprietary battery - swapping technology, or UOTTA technology, to provide a comprehensive battery power solution for EVs Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

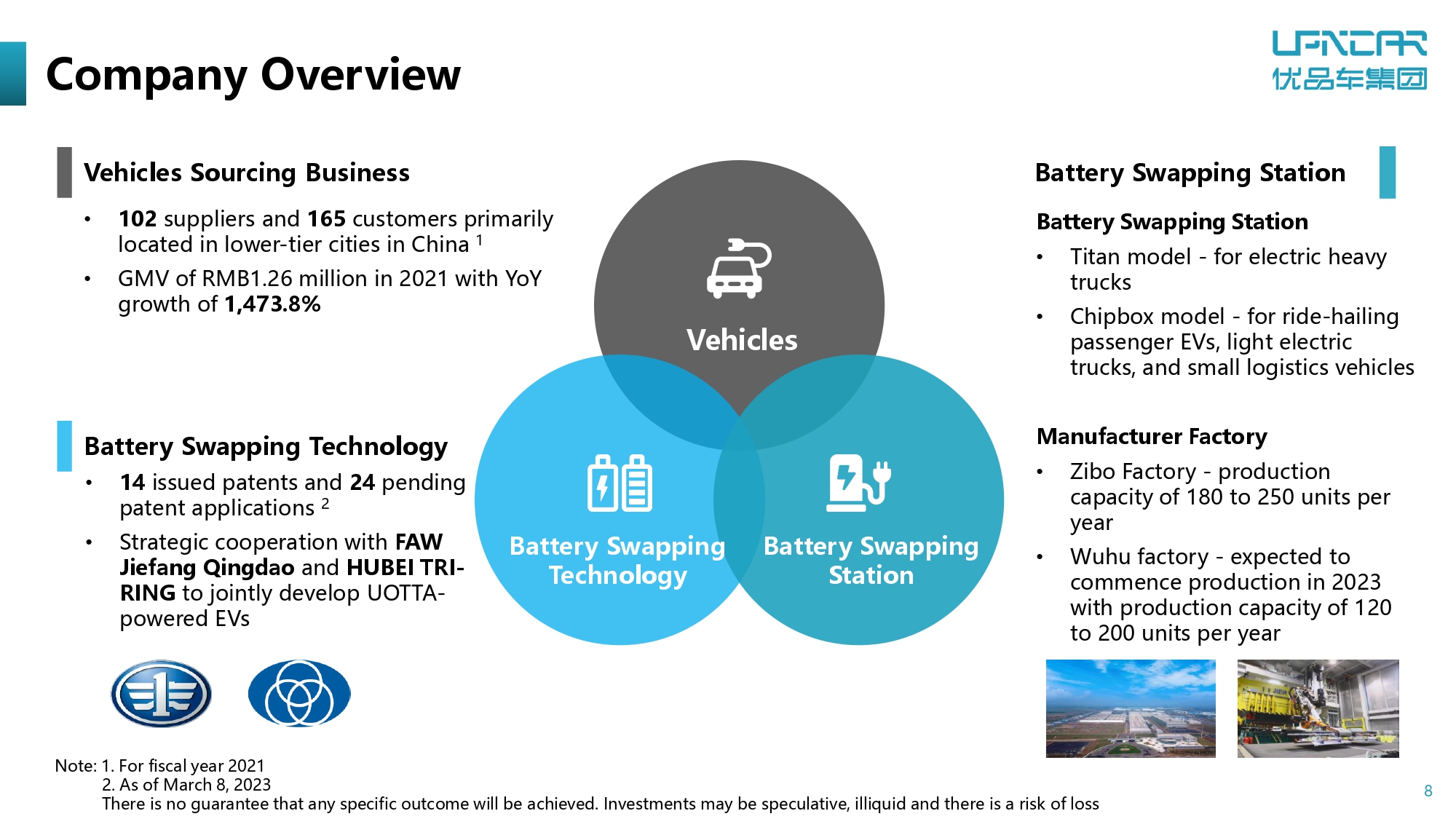

8 Company Overview Vehicles Sourcing Business Vehicles Battery Swapping Technology Battery Swapping Station • 102 suppliers and 165 customers primarily located in lower - tier cities in China 1 • GMV of RMB 1.26 million in 2021 with YoY growth of 1,473.8% • 14 issued patents and 24 pending patent applications 2 • Strategic cooperation with FAW Jiefang Qingdao and HUBEI TRI - RING to jointly develop UOTTA - powered EVs Battery Swapping Technology Battery Swapping Station Battery Swapping Station • Titan model - for e lectric heavy trucks • Chipbox model - for ride - hailing passenger EVs, light electric trucks, and small logistics vehicles Manufacturer Factory • Zibo Factory - production capacity of 180 to 250 units per year • Wuhu factory - expected to commence production in 2023 with production capacity of 120 to 200 units per year N ote : 1. F or fiscal year 2021 2. As of March 8, 2023 There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there i s a risk of loss

9 Key Milestones • Our subsidiary, Anhui Yousheng New Energy, was established in Shanghai • Since our commencement, we have principally engaged in the provision of vehicle sourcing services • We gradually shifted our focus from the vehicle sourcing business to the development of our proprietary battery - swapping technology, or UOTTA technology 2013 • We started cooperating with major automobile manufactures to jointly develop UOTTA - powered EVs by adapting selected EV models with our UOTTA technology • We started to generate revenue from sales of battery swapping stations • In August 2021, we completed the construction of our own battery - swapping station factory in Zibo City, Shandong Province 2021 2020 2022 • Our Zibo factory commenced manufacturing UOTTA battery - swapping stations in January 2022 • We started operating a battery - swapping station, pursuant to our station cooperation agreement with Quanzhou Xinao in Quanzhou City, Fujian Province Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

Business Overview

11 Vehicle Sourcing Business 102 1 Suppliers Vehicle Wholesalers Automobile Manufacturers 165 1 Customers SME Dealers Individual Customers Total GMV 2 in 2021: RMB1,262,417 Total Unit s Sold in 2021: 1,252 Total GMV 2 in 2020: RMB80,216 Total Unit s Sold in 2020: 57 Note: 1. For fiscal year 2021 2. “ GMV ” are to “ Gross Merchandise Value ” There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there i s a risk of loss We charge a commission that is calculated based on the purchase price of each purchase order We broker sales of vehicles between automobile wholesalers and buyers, including small and medium sized vehicle dealers ( “ SME dealers ” ) and individual customers primarily located in the lower - tier cities in China

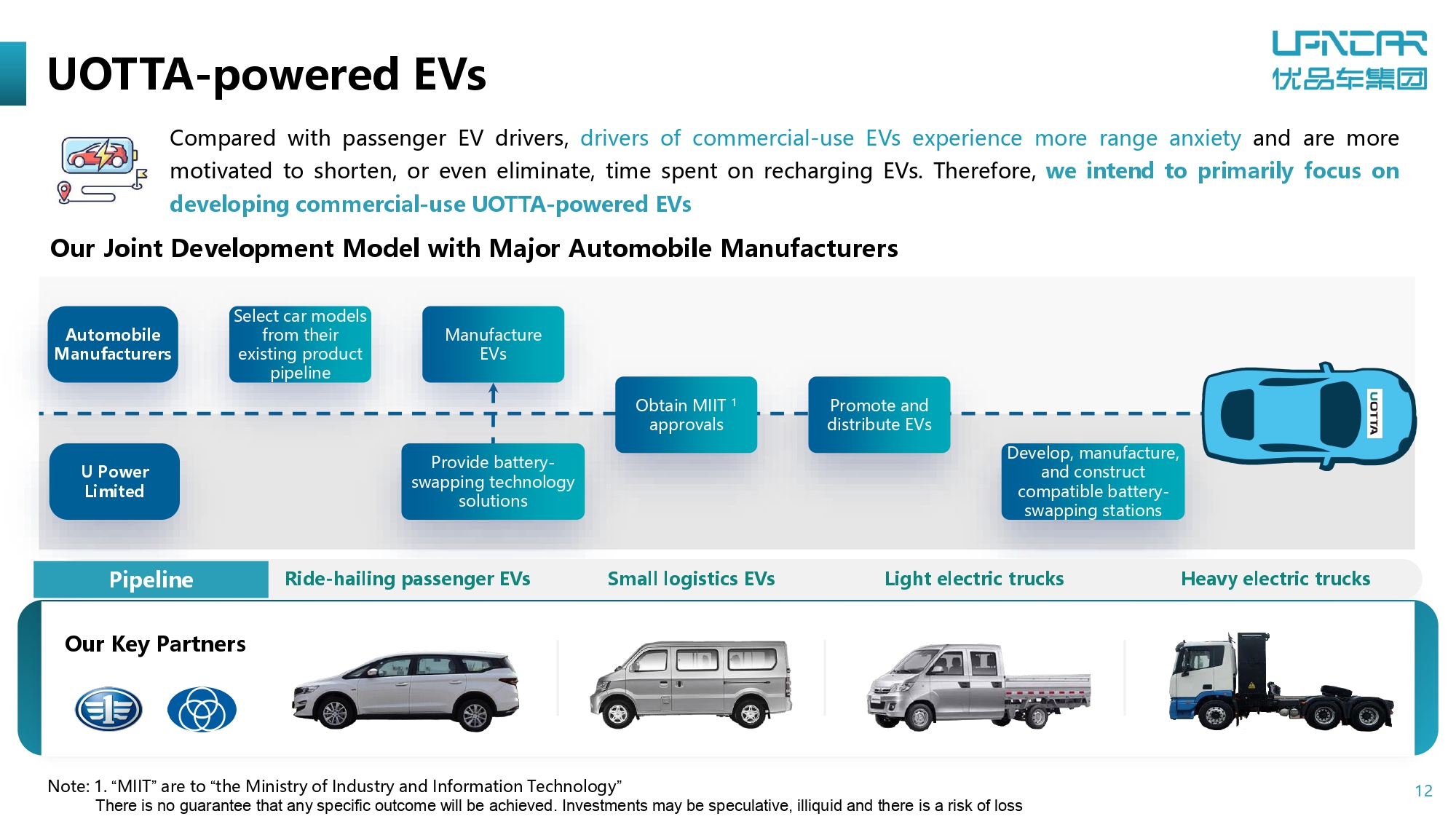

12 UOTTA - powered EVs C ompared with passenger EV drivers, drivers of commercial - use EVs experience more range anxiety and are more motivated to shorten, or even eliminate, time spent on recharging EVs . Therefore, we intend to primarily focus on developing commercial - use UOTTA - powered EVs Automobile Manufacturers Select car model s from their existing product pipeline Manufacture EVs Provide battery - swapping technology solutions Develop, manufacture, and construct compatible battery - swapping stations Obtain MIIT 1 approvals Promote and distribute EVs U Power Limited Our Joint Development Model with Major Automobile Manufacturers Pipeline Ride - hailing passenger EVs Small logistics EVs Light electric trucks Heavy electric trucks Our Key Partners N ote : 1. “ MIIT ” are to “ the Ministry of Industry and Information Technology ” There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

13 UOTTA Battery - Swapping Stations Two types of UOTTA Battery - swapping Stations T itan Model • For electric heavy trucks • 6 to 8 parking spaces • 60 square meters • RMB2,500,000 to 3,500,000 per unit Chipbox Model • For ride - hailing passenger EVs, light electric trucks, and small logistics vehicles • 8 - 10 parking spaces • 90 square meters • RMB2,200,000 to 3,000,000 per unit Precise positioning Rapid disassembly Compact integration and flexible deployment Battery replacement within several minutes Zibo Battery - swapping Station Factory • Commenced production in January 2022 • 180 to 250 units per year Wuhu Battery - swapping Station Factory • To commence production by June 2023 • 120 to 200 units per year Manufacturing of Battery - swapping Stations Cooperation with Partners • W e entered into cooperation agreements with two battery - swapping station manufacturers for the joint development and manufacturing of UOTTA battery - swapping stations O ur Own Factory • The manufacturing process in our own factory is mainly assembly of parts and components procured from our cooperating battery - swapping station manufacturers Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

Investment Highlights

15 A V ehicle Sourcing N etwork in Lower - tier C ities in China Investment Highlights Overview UOTTA Battery - swapping Technology Strong Cooperation with Key Partners, Including Major Automakers and Battery Developers in China Visionary and Experienced Management Team with Strong Commitment Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

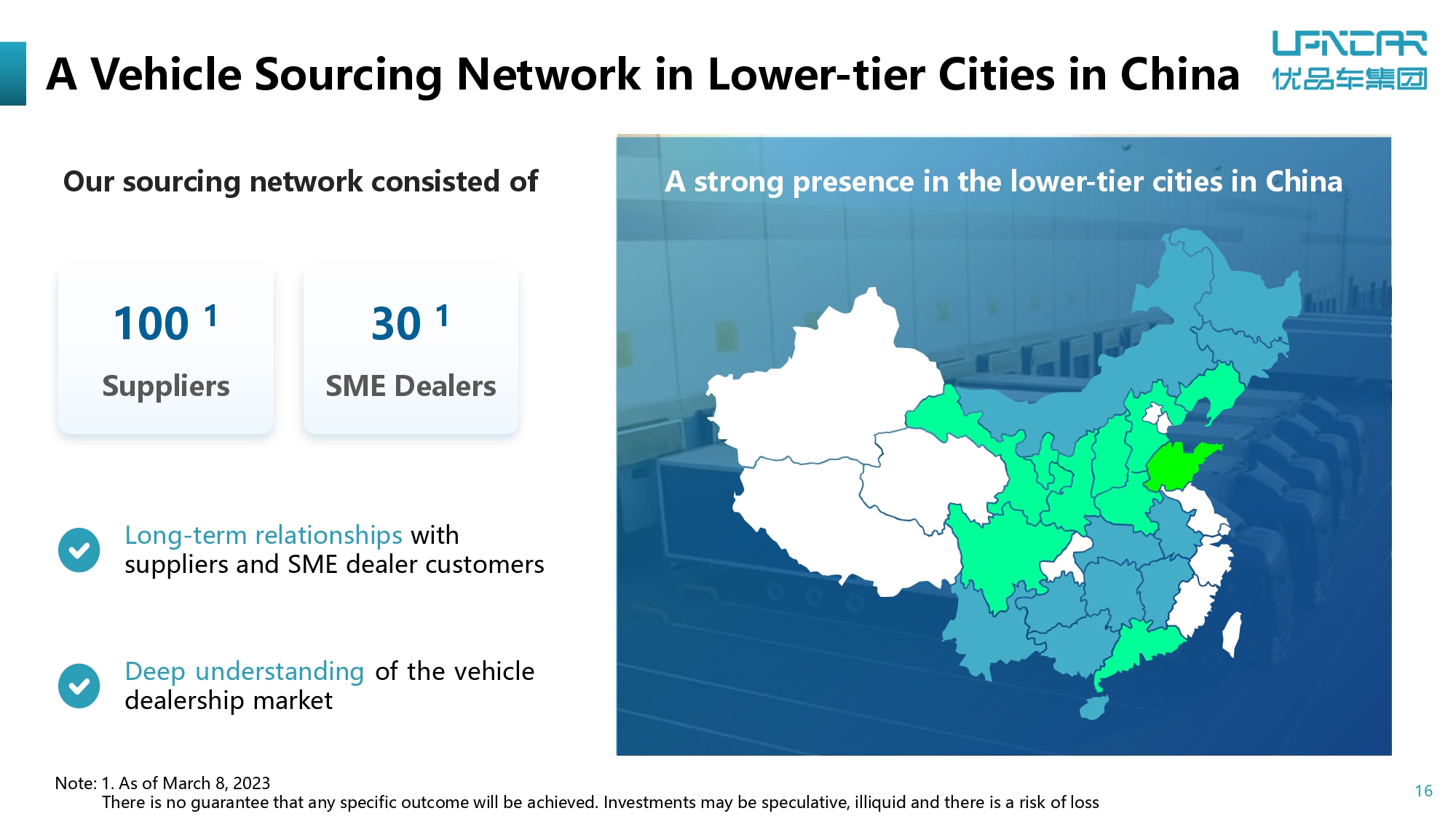

16 A V ehicle Sourcing N etwork in Lower - tier C ities in China A strong presence in the lower - tier cities in China 100 1 S uppliers 30 1 SME Dealers Long - term relationships with suppliers and SME dealer customers Deep understanding of the vehicle dealership market Our sourcing network consisted of N ote : 1 . As of March 8, 2023 There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there i s a risk of loss

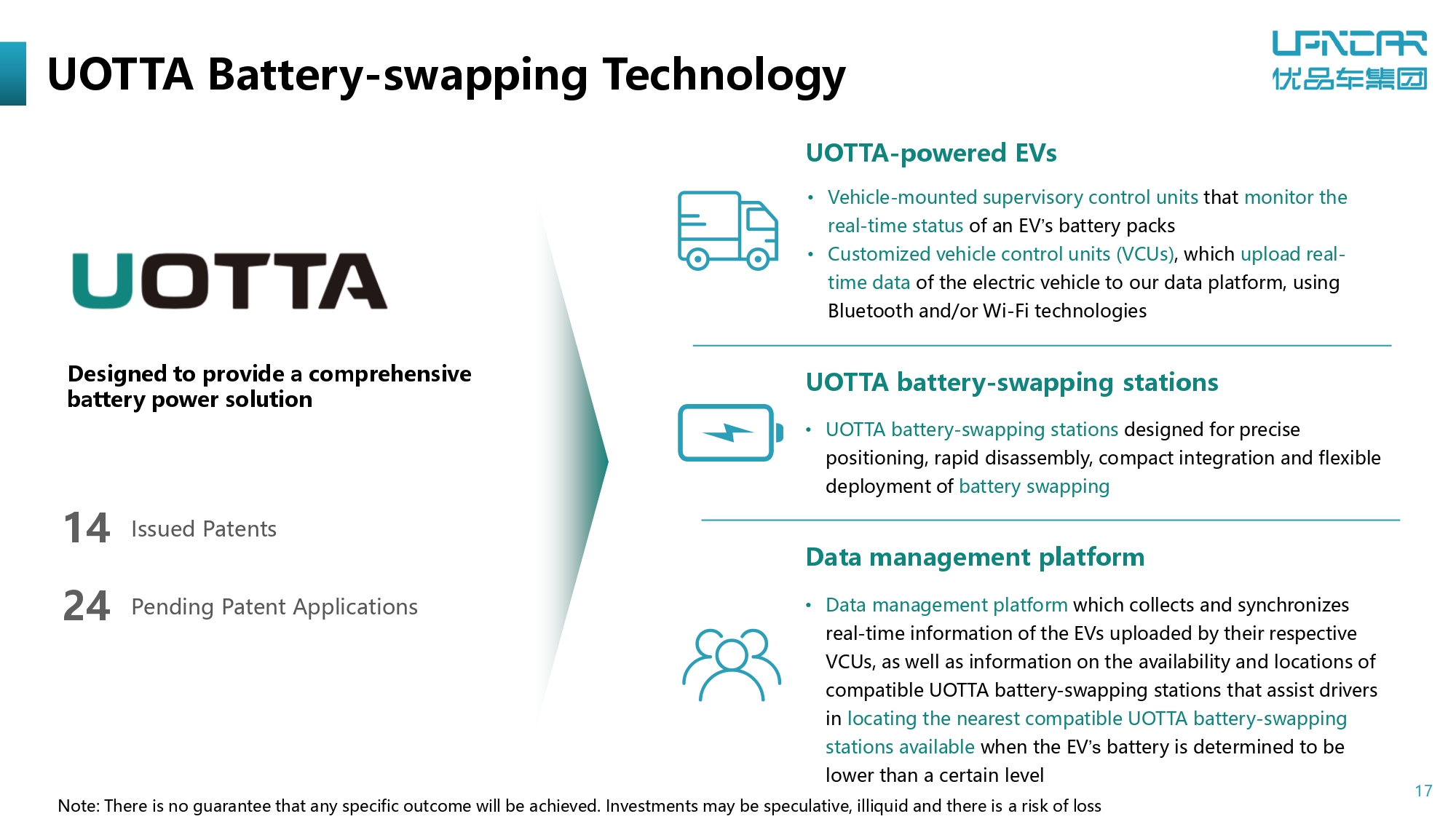

17 UOTTA Battery - swapping Technology Designed to provide a comprehensive battery power solution 24 Pending Patent Applications Issued Patents 14 UOTTA - powered EVs • Vehicle - mounted supervisory control units that monitor the real - time status of an EV ’ s battery packs • Customized vehicle control units (VCUs) , which upload real - time data of the electric vehicle to our data platform, using Bluetooth and/or Wi - Fi technologies UOTTA battery - swapping stations • UOTTA battery - swapping stations designed for precise positioning, rapid disassembly, compact integration and flexible deployment of battery swapping • Data management platform which collects and synchronizes real - time information of the EVs uploaded by their respective VCUs, as well as information on the availability and locations of compatible UOTTA battery - swapping stations that assist drivers in locating the nearest compatible UOTTA battery - swapping station s available when the EV ’s battery is determined to be lower than a certain level Data management platform Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

18 Strong Cooperation with Key P artners , Including M ajor Automakers and Battery D evelopers in China We believe we are one of the few companies that are able to develop such strong relationships with these major manufacturers Leverage expertise and industry know - how Ensure product meet strict quality standard Key Partners of Battery Developers and Manufacturer s Ruipu Energy Co., Ltd Key Partners of Automobile Manufacturers FAW Jiefang Qingdao Automotive Co., Ltd HUBEI TRI - RING Motor Co., Ltd Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

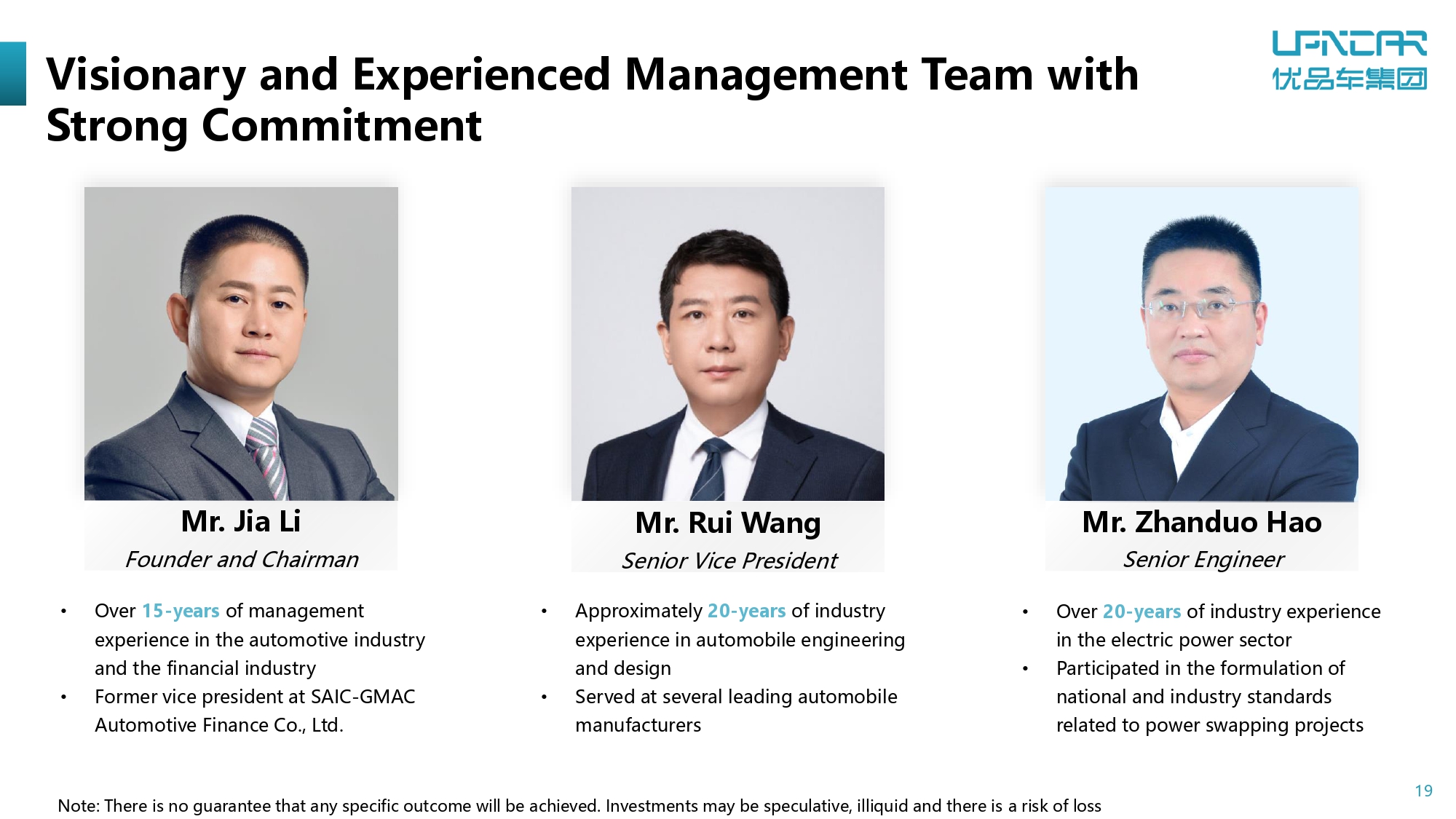

19 Visionary and Experienced Management T eam with Strong C ommitment Mr. Jia Li Founder and Chairman • Over 15 - years of management experience in the automotive industry and the financial industry • Former vice president at SAIC - GMAC Automotive Finance Co., Ltd. Mr. Rui Wang Senior Vice President • Approximately 20 - years of industry experience in automobile engineering and design • Served at several leading automobile manufacturers Mr. Zhanduo Hao Senior Engineer • O ver 20 - years of industry experience in the electric power sector • Participated in the formulation of national and industry standards related to power swapping projects Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

Growth Strategies

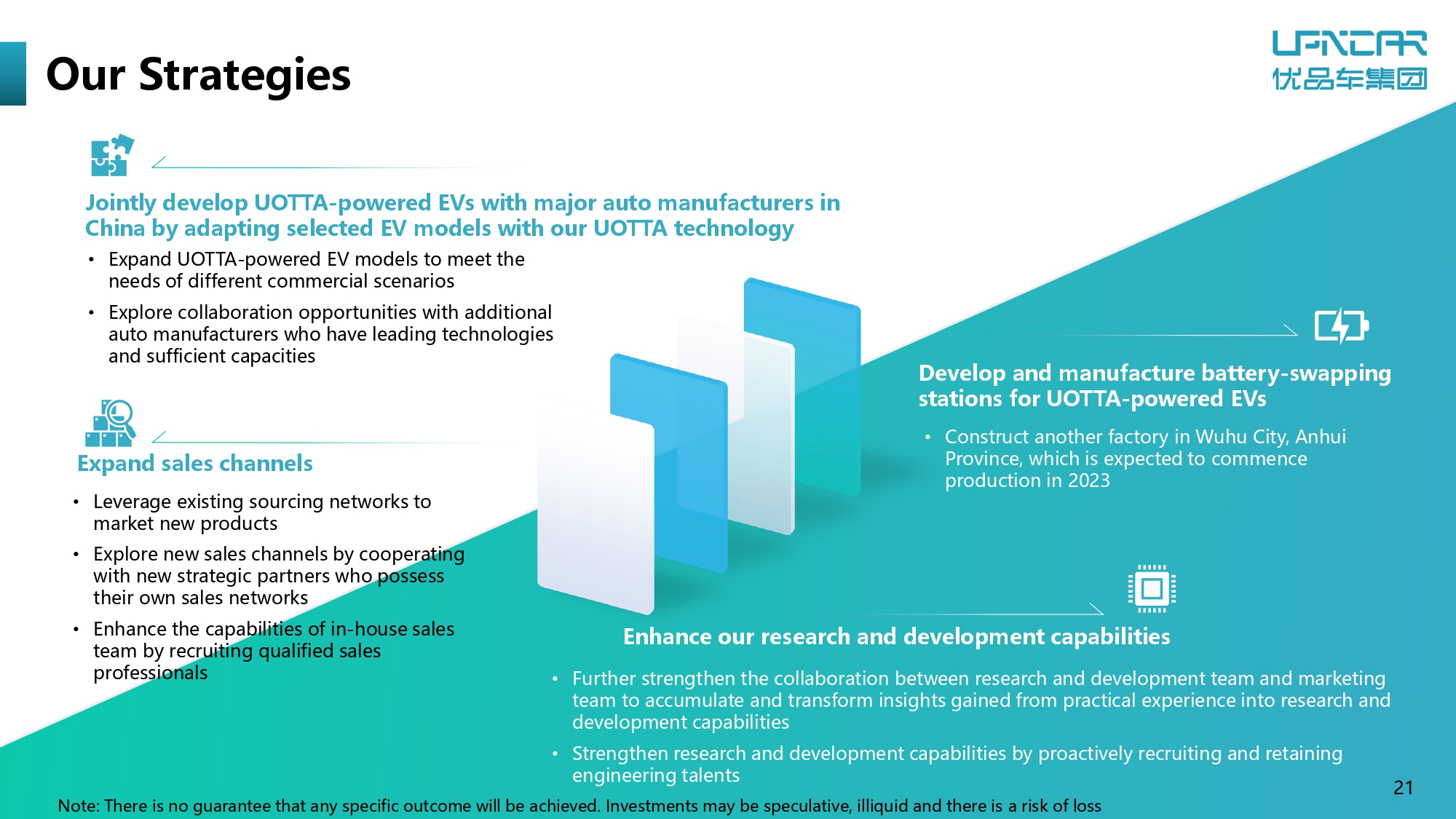

21 Our Strategies • Expand UOTTA - powered EV models to meet the needs of different commercial scenarios • Explore collaboration opportunities with additional auto manufacturers who have leading technologies and sufficient capacities Jointly develop UOTTA - powered EVs with major auto manufacturers in China by adapting selected EV models with our UOTTA technology • Leverage existing sourcing networks to market new products • Explore new sales channels by cooperating with new strategic partners who possess their own sales networks • Enhance the capabilities of in - house sales team by recruiting qualified sales professionals Expand sales channels Develop and manufacture battery - swapping stations for UOTTA - powered EVs • Construct another factory in Wuhu City, Anhui Province, which is expected to commence production in 2023 Enhance our research and development capabilities • Further strengthen the collaboration between research and development team and marketing team to accumulate and transform insights gained from practical experience into research and development capabilities • Strengthen research and development capabilities by proactively recruiting and retaining engineering talents 21 Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

Financial Overview

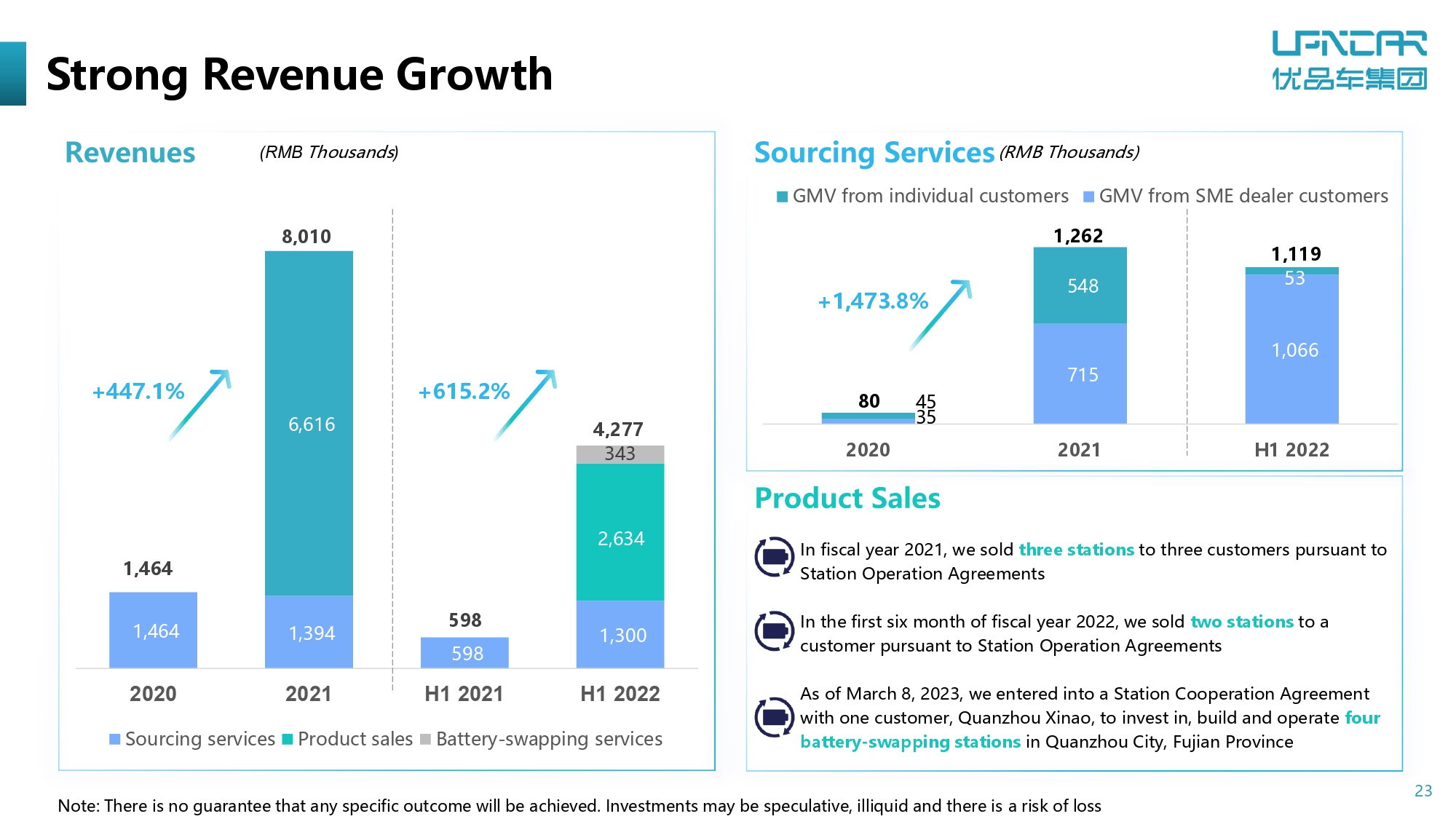

23 Strong Revenue Growth 1,464 1,394 598 1,300 6,616 2,634 343 1,464 8,010 598 4,277 2020 2021 H1 2021 H1 2022 Sourcing services Product sales Battery-swapping services (RMB Thousands ) +447.1% +615.2% (RMB Thousands) 35 715 1,066 45 548 53 80 1,262 1,119 2020 2021 H1 2022 GMV from individual customers GMV from SME dealer customers +1,473.8% In fiscal year 2021, we sold three stations to three customers pursuant to Station Operation Agreements In the first six month of fiscal year 2022, we sold two stations to a customer pursuant to Station Operation Agreements As of March 8, 2023, we entered into a Station Cooperation Agreement with one customer, Quanzhou Xinao , to invest in, build and operate four battery - swapping stations in Quanzhou City , Fujian Province Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

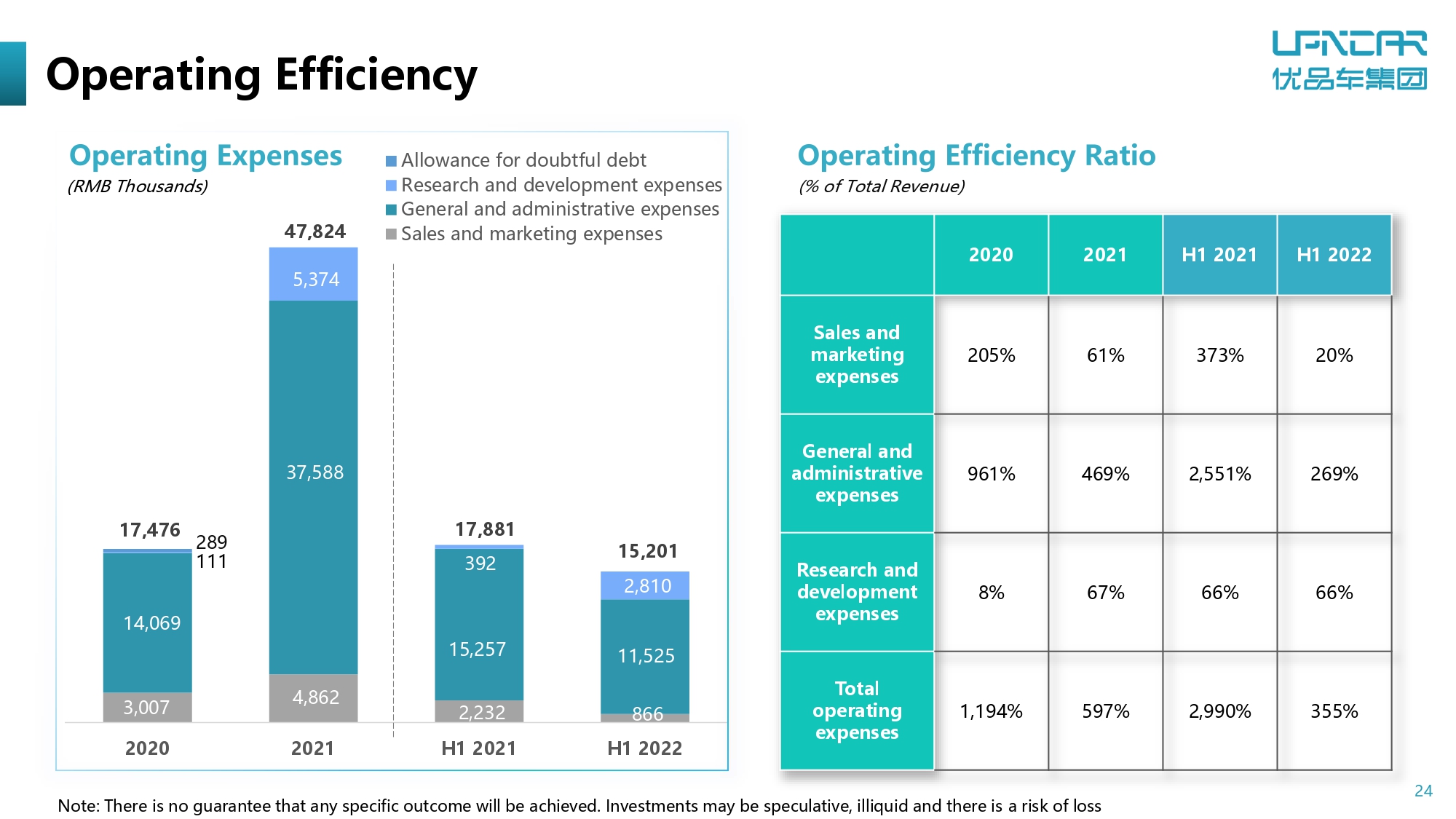

24 Operating Efficiency 3,007 4,862 2,232 866 14,069 37,588 15,257 11,525 111 5,374 392 2,810 17,476 47,824 17,881 15,201 - 10,000 20,000 30,000 40,000 50,000 60,000 2020 2021 H1 2021 H1 2022 Allowance for doubtful debt Research and development expenses General and administrative expenses Sales and marketing expenses (% of Total Revenue) (RMB Thousands) 2020 2021 H1 2021 H1 2022 Sales and marketing expenses 205% 61% 373% 20% General and administrative expenses 961% 469% 2,551% 269% Research and development expenses 8% 67% 66% 66% Total operating expenses 1,194% 597% 2,990% 355% 289 Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

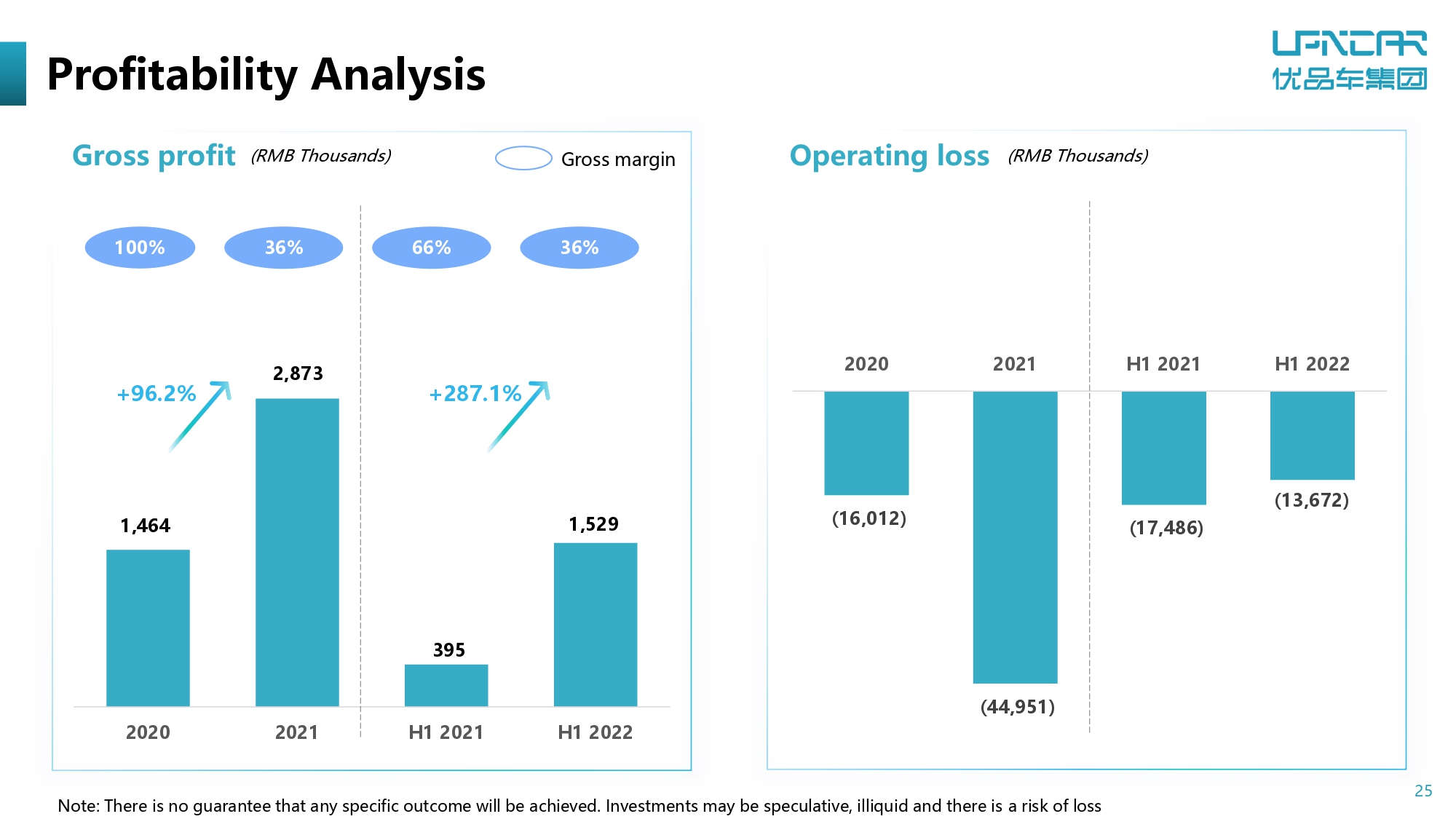

25 Profitability Analysis (RMB Thousands) Gross margin ( RMB Thousands) 1,464 2,873 395 1,529 2020 2021 H1 2021 H1 2022 36 % 100 % +96.2% + 287.1 % 66 % 36% (16,012) (44,951) (17,486) (13,672) 2020 2021 H1 2021 H1 2022 Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

Consolidated Financials

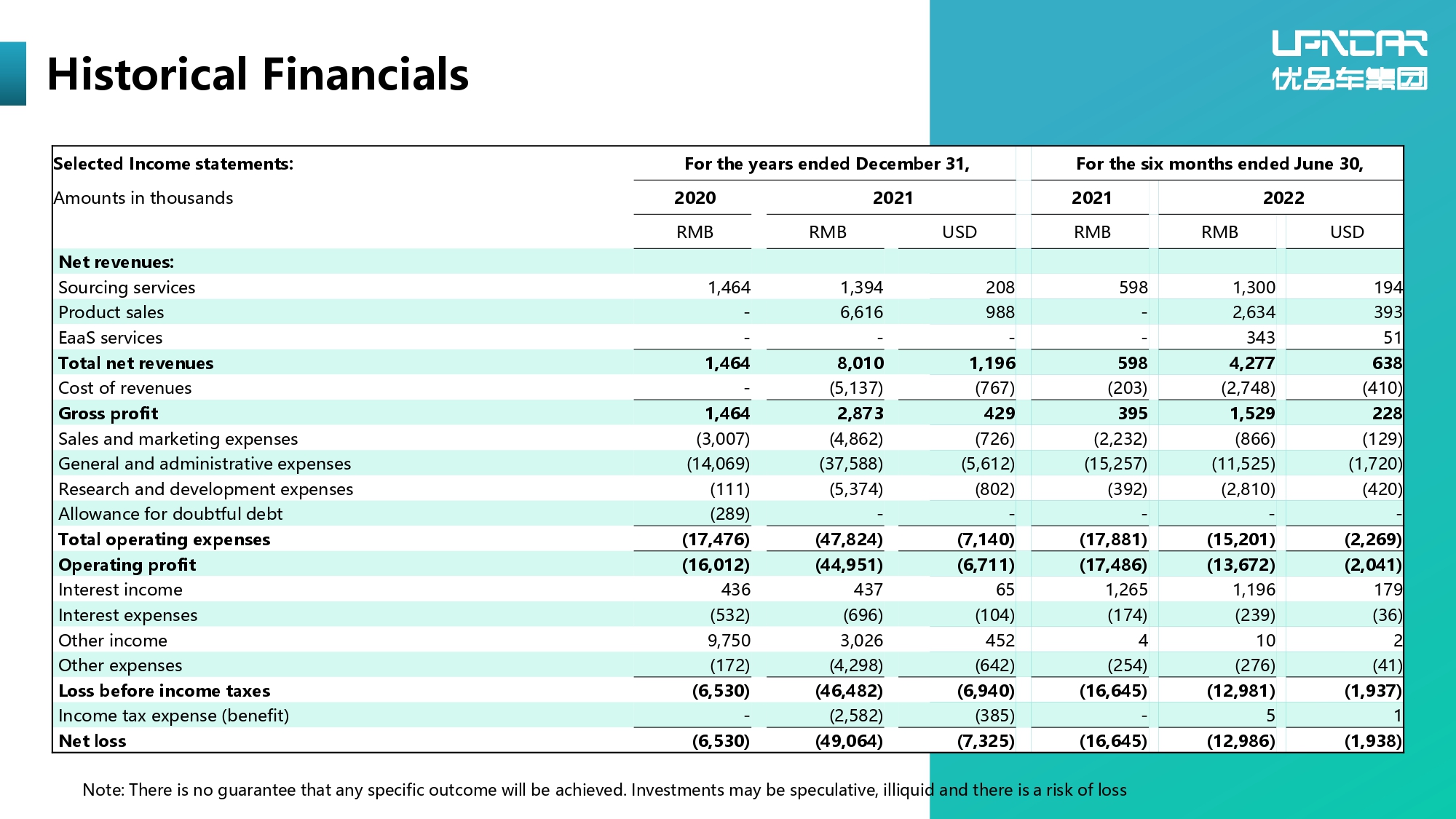

27 Historical Financials S elected Income statements : For the years ended December 31, For the six months ended June 30, Amounts in thousand s 2020 2021 2021 2022 RMB RMB USD RMB RMB USD Net revenues: Sourcing services 1,464 1,394 208 598 1,300 194 Product sales - 6,616 988 - 2,634 393 EaaS services - - - - 343 51 Total net revenues 1,464 8,010 1,196 598 4,277 638 Cost of revenues - (5,137) (767) (203) (2,748) (410) Gross profit 1,464 2,873 429 395 1,529 228 Sales and marketing expenses (3,007) (4,862) (726) (2,232) (866) (129) General and administrative expenses (14,069) (37,588) (5,612) (15,257) (11,525) (1,720) Research and development expenses (111) (5,374) (802) (392) (2,810) (420) Allowance for doubtful debt (289) - - - - - Total operating expenses (17,476) (47,824) (7,140) (17,881) (15,201) (2,269) Operating profit (16,012) (44,951) (6,711) (17,486) (13,672) (2,041) Interest income 436 437 65 1,265 1,196 179 Interest expenses (532) (696) (104) (174) (239) (36) Other income 9,750 3,026 452 4 10 2 Other expenses (172) (4,298) (642) (254) (276) (41) Loss before income taxes (6,530) (46,482) (6,940) (16,645) (12,981) (1,937) Income tax expense (benefit) - (2,582) (385) - 5 1 Net loss (6,530) (49,064) (7,325) (16,645) (12,986) (1,938) Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

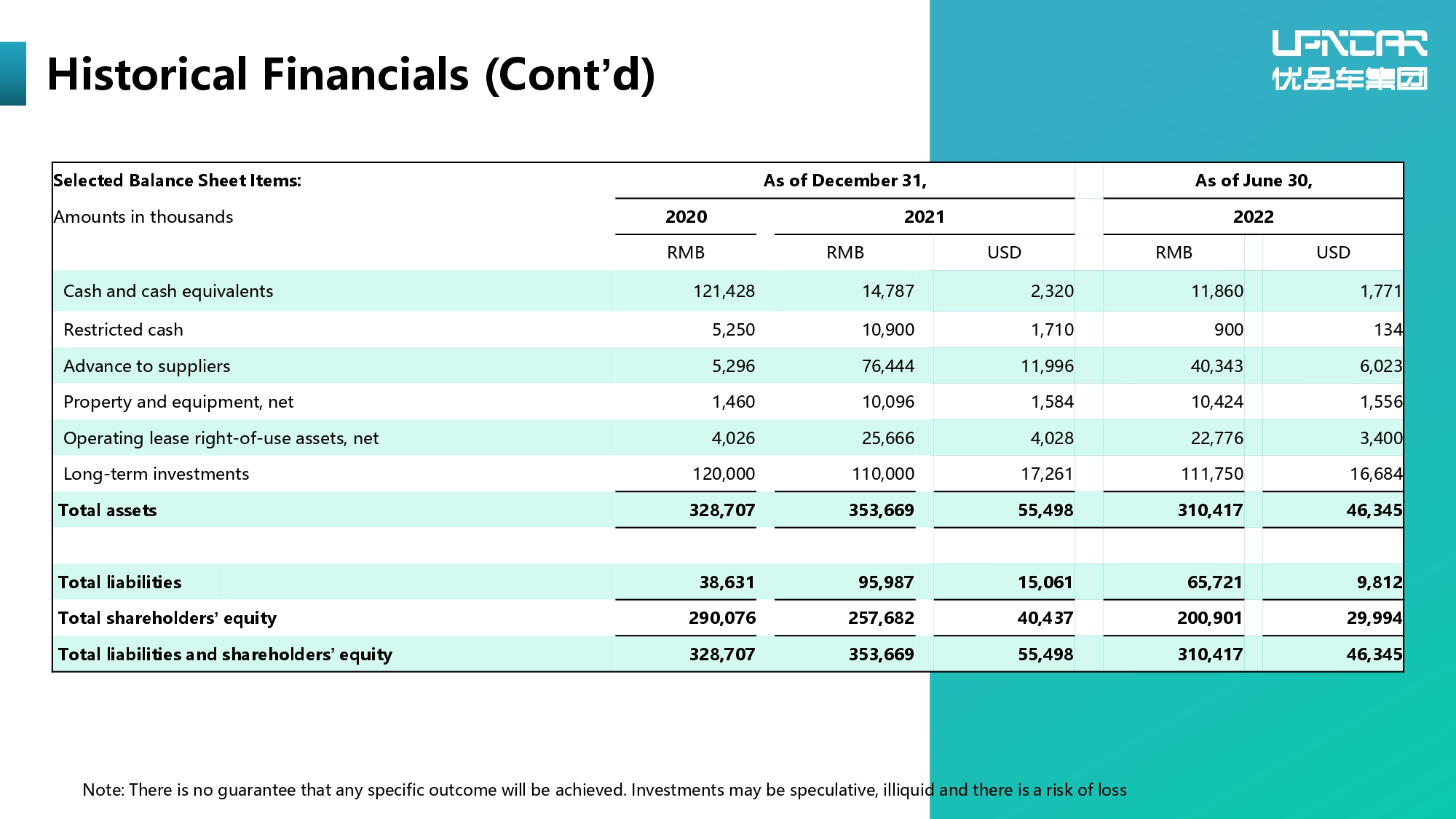

28 Historical Financials (Cont ’ d) Selected Balance Sheet Items: As of December 31, As of June 30, Amounts in thousands 2020 2021 2022 RMB RMB USD RMB USD Cash and cash equivalents 121,428 14,787 2,320 11,860 1,771 Restricted cash 5,250 10,900 1,710 900 134 Advance to suppliers 5,296 76,444 11,996 40,343 6,023 Property and equipment, net 1,460 10,096 1,584 10,424 1,556 Operating lease right - of - use assets, net 4,026 25,666 4,028 22,776 3,400 Long - term investments 120,000 110,000 17,261 111,750 16,684 Total assets 328,707 353,669 55,498 310,417 46,345 Total liabilities 38,631 95,987 15,061 65,721 9,812 Total shareholders ’ equity 290,076 257,682 40,437 200,901 29,994 Total liabilities and shareholders ’ equity 328,707 353,669 55,498 310,417 46,345 Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

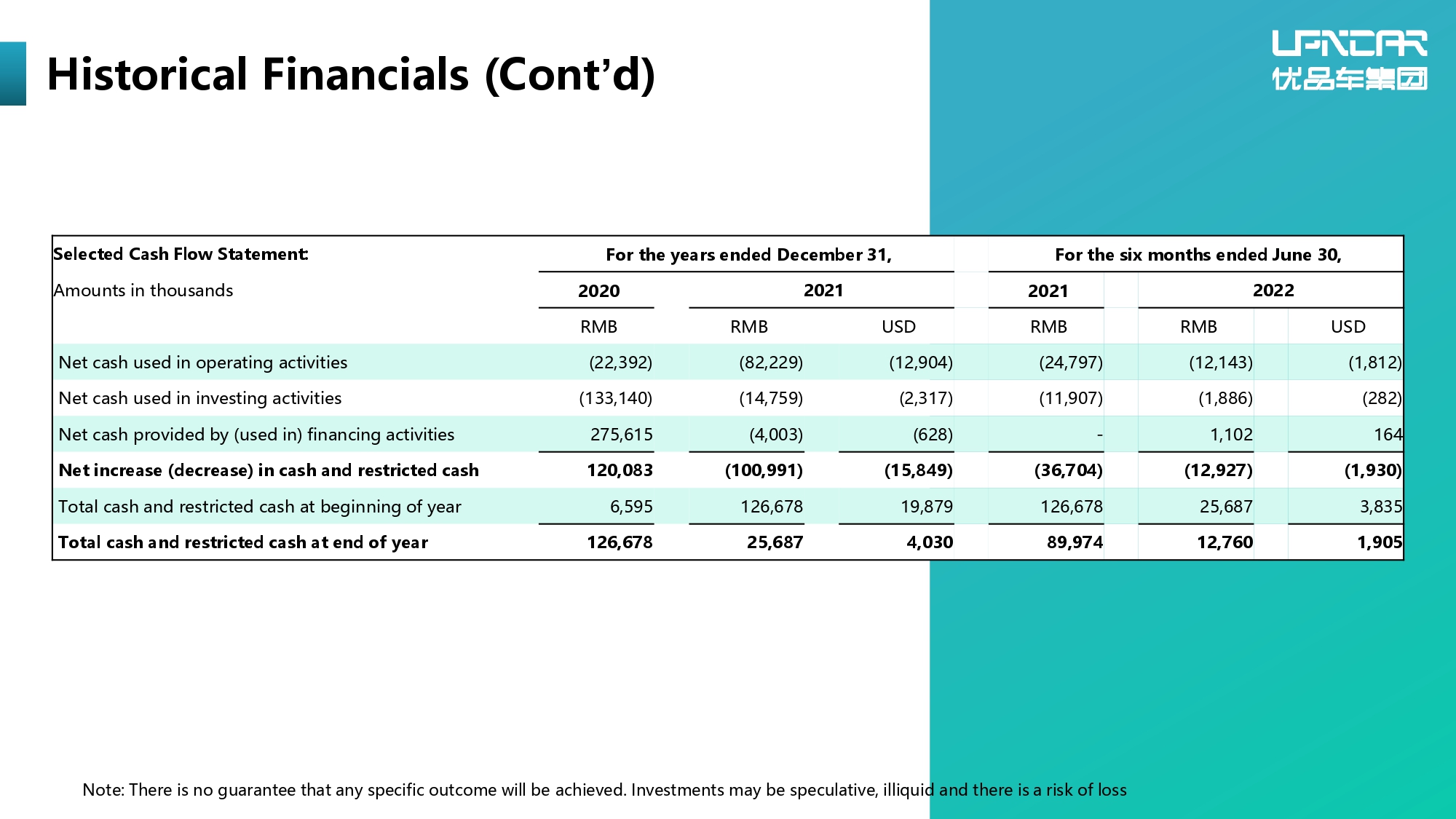

29 Historical Financials (Cont ’ d) Selected Cash Flow Statement: For the years ended December 31, For the six months ended June 30, Amounts in thousands 2020 2021 2021 2022 RMB RMB USD RMB RMB USD Net cash used in operating activities (22,392) (82,229) (12,904) (24,797) (12,143) (1,812) Net cash used in investing activities (133,140) (14,759) (2,317) (11,907) (1,886) (282) Net cash provided by (used in) financing activities 275,615 (4,003) (628) - 1,102 164 Net increase (decrease) in cash and restricted cash 120,083 (100,991) (15,849) (36,704) (12,927) (1,930) Total cash and restricted cash at beginning of year 6,595 126,678 19,879 126,678 25,687 3,835 Total cash and restricted cash at end of year 126,678 25,687 4,030 89,974 12,760 1,905 Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

Consolidated Financials Industry Overview

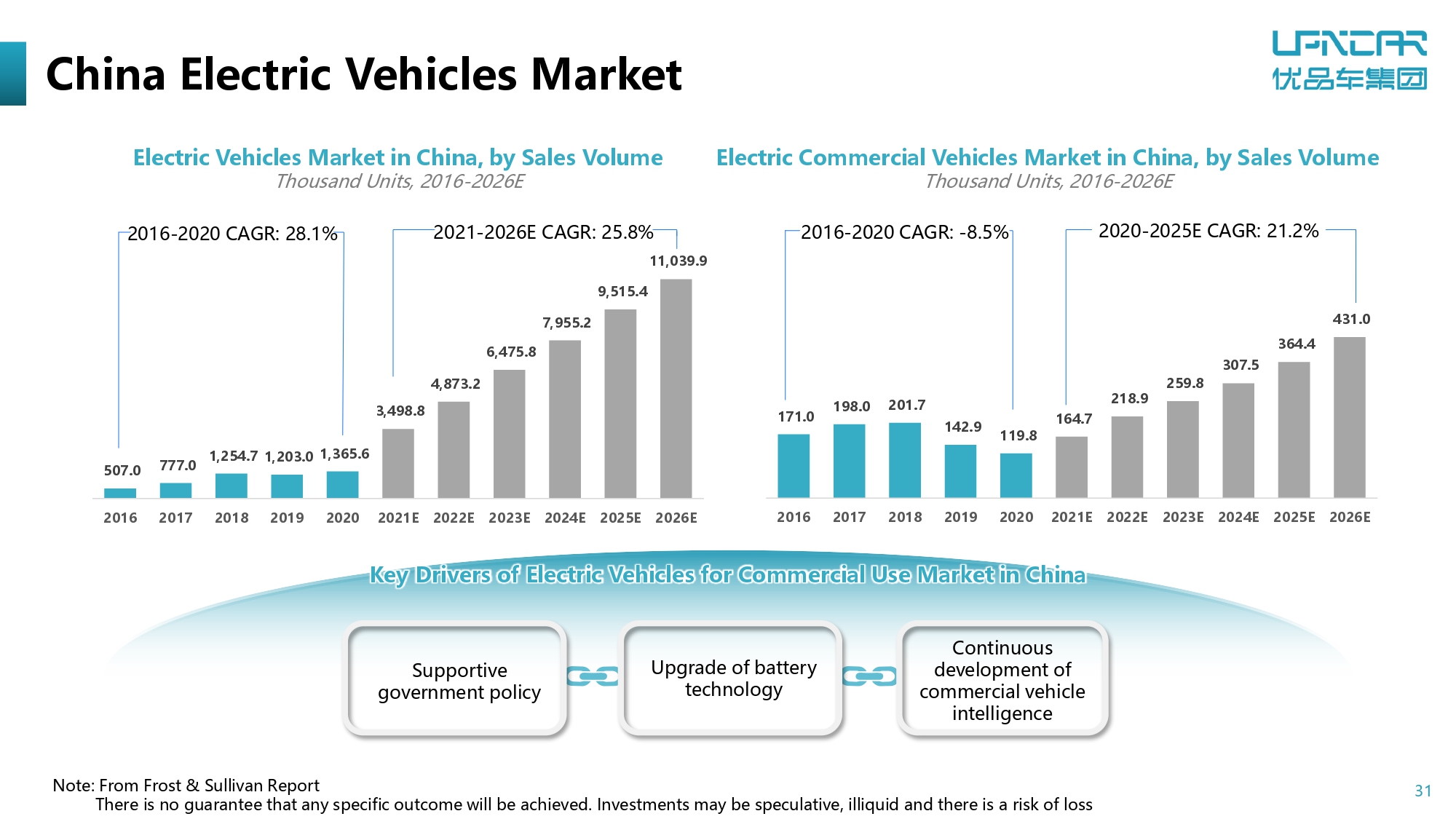

31 507.0 777.0 1,254.7 1,203.0 1,365.6 3,498.8 4,873.2 6,475.8 7,955.2 9,515.4 11,039.9 2016 2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E 2026E Electric Vehicles Market in China, by Sales Volume Thousand Units, 2016 - 2026E Electric Commercial Vehicles Market in China, by Sales Volume Thousand Units, 2016 - 2026E 2021 - 2026E CAGR: 25.8% 2016 - 2020 CAGR: - 8.5 % 2020 - 2025E CAGR: 21 .2% 2016 - 2020 CAGR: 28.1% China Electric Vehicles Market 171.0 198.0 201.7 142.9 119.8 164.7 218.9 259.8 307.5 364.4 431.0 2016 2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E 2026E Supportive government policy Continuous development of commercial vehicle intelligence Upgrade of battery technology Key Drivers of Electric Vehicles for Commercial Use Market in China N ote : From Frost & Sullivan Report There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

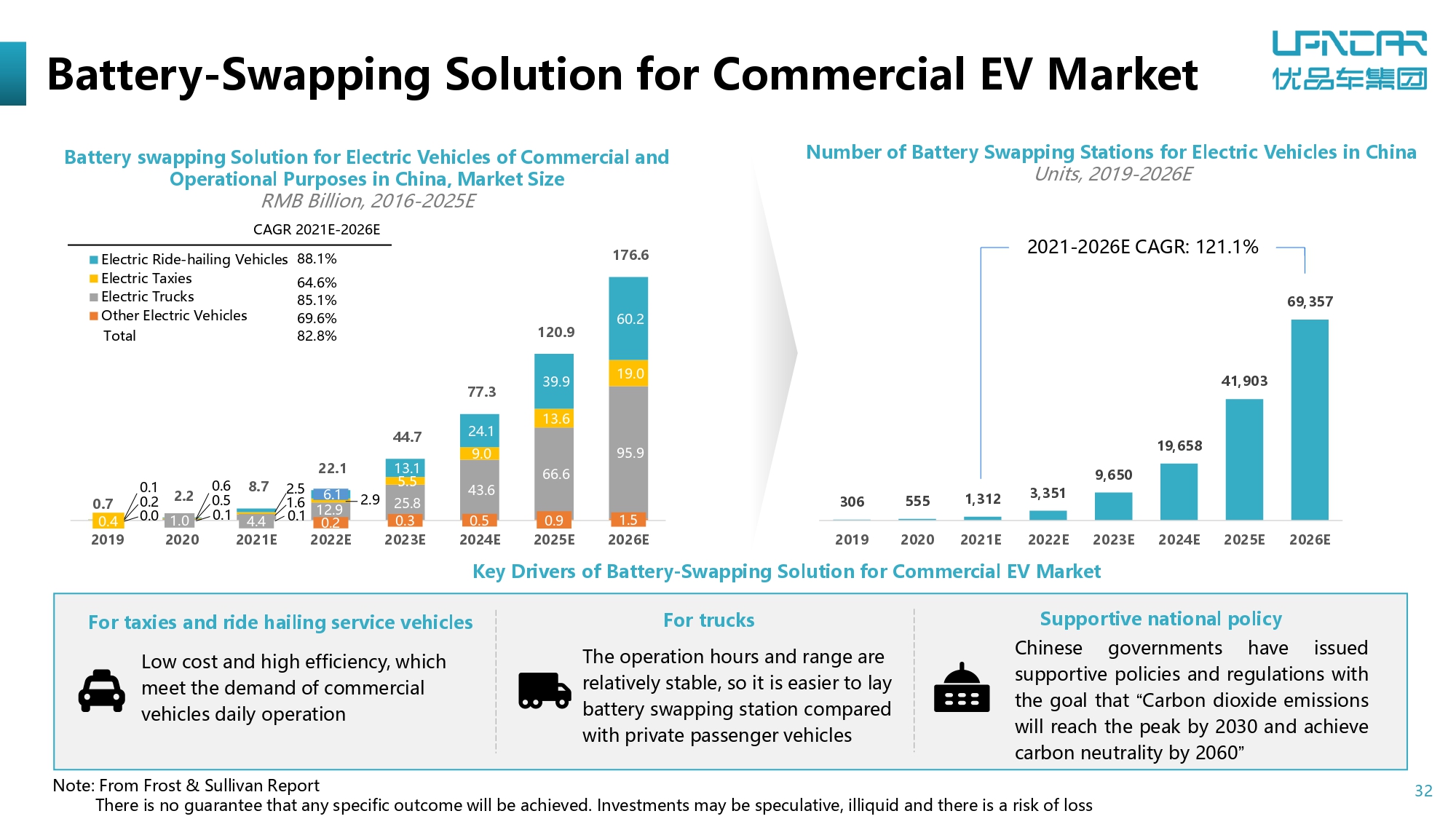

32 Key Drivers of Battery - Swapping Solution for Commercial EV Market Battery - Swapping Solution for Commercial EV Market Battery swapping Solution for Electric Vehicles of Commercial and Operational Purposes in China, Market Size RMB Billion, 2016 - 2025E L ow cost and high efficiency, which meet the demand of commercial vehicles daily operation For taxies and ride hailing service vehicles For trucks The operation hours and range are relatively stable, so it is easier to lay battery swapping station compared with private passenger vehicles Supportive national policy Chin ese governments have issued supportive policies and regulations w ith the goal that “ Carbon dioxide emissions will reach the peak by 2030 and achieve carbon neutrality by 2060 ” 0.1 0.2 0.3 0.5 0.9 1.5 1.0 4.4 12.9 25.8 43.6 66.6 95.9 0.4 0.6 2.9 5.5 9.0 13.6 19.0 0.5 6.1 13.1 24.1 39.9 60.2 0.7 2.2 8.7 22.1 44.7 77.3 120.9 176.6 2019 2020 2021E 2022E 2023E 2024E 2025E 2026E Electric Ride-hailing Vehicles Electric Taxies Electric Trucks Other Electric Vehicles 0.2 0.1 0.0 1.6 2.5 0.1 CAGR 2021E - 2026E 88.1% 64.6% 85.1% 69.6% Total 82.8% Number of Battery Swapping Stations for Electric Vehicles in China Units , 2019 - 2026E 306 555 1,312 3,351 9,650 19,658 41,903 69,357 2019 2020 2021E 2022E 2023E 2024E 2025E 2026E 2021 - 2026E CAGR: 121.1% N ote : From Frost & Sullivan Report There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

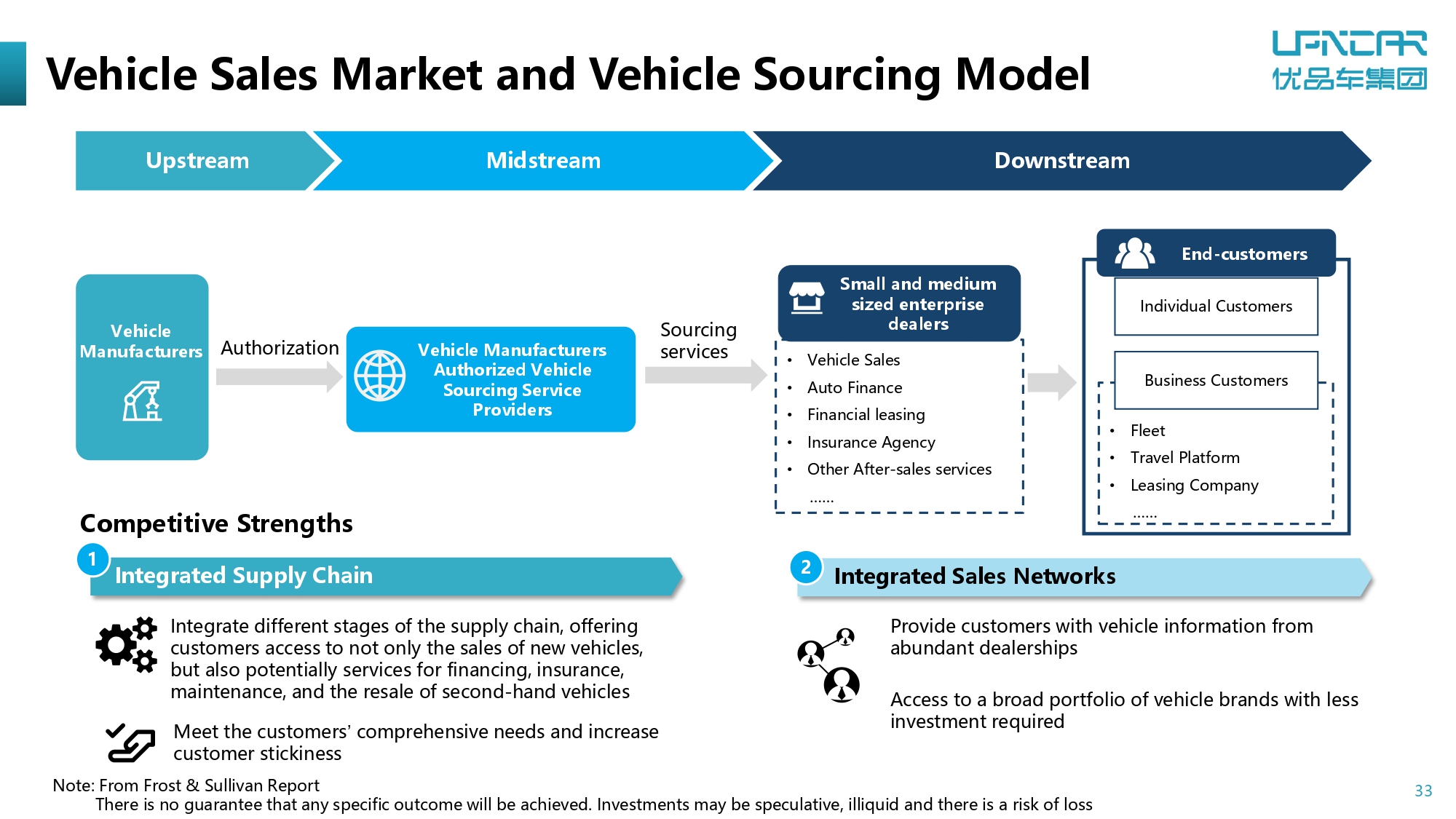

33 Vehicle Sales Market and Vehicle Sourcing Model • Fleet • T ravel Platform • L easing Company …… Upstream Midstream Downstream Individual Customers Business Customers Sourcing services • Vehicle Sales • A uto Finance • Financial leasing • Insurance Agency • Other After - sales services …… Authorization Competitive Strengths Integrated Supply Chain 1 Integrated Sales Networks 2 Vehicle Manufacturers Vehicle Manufacturers Authorized Vehicle Sourcing Service Providers S mall and medium sized enterprise dealers End - customers Integrate different stages of the supply chain, offering customers access to not only the sales of new vehicles, but also potentially services for financing, insurance, maintenance, and the resale of second - hand vehicles Meet the customers ’ comprehensive needs and increase customer stickiness Provide customers with vehicle information from abundant dealerships Access to a broad portfolio of vehicle brands with less investment required N ote : From Frost & Sullivan Report There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss

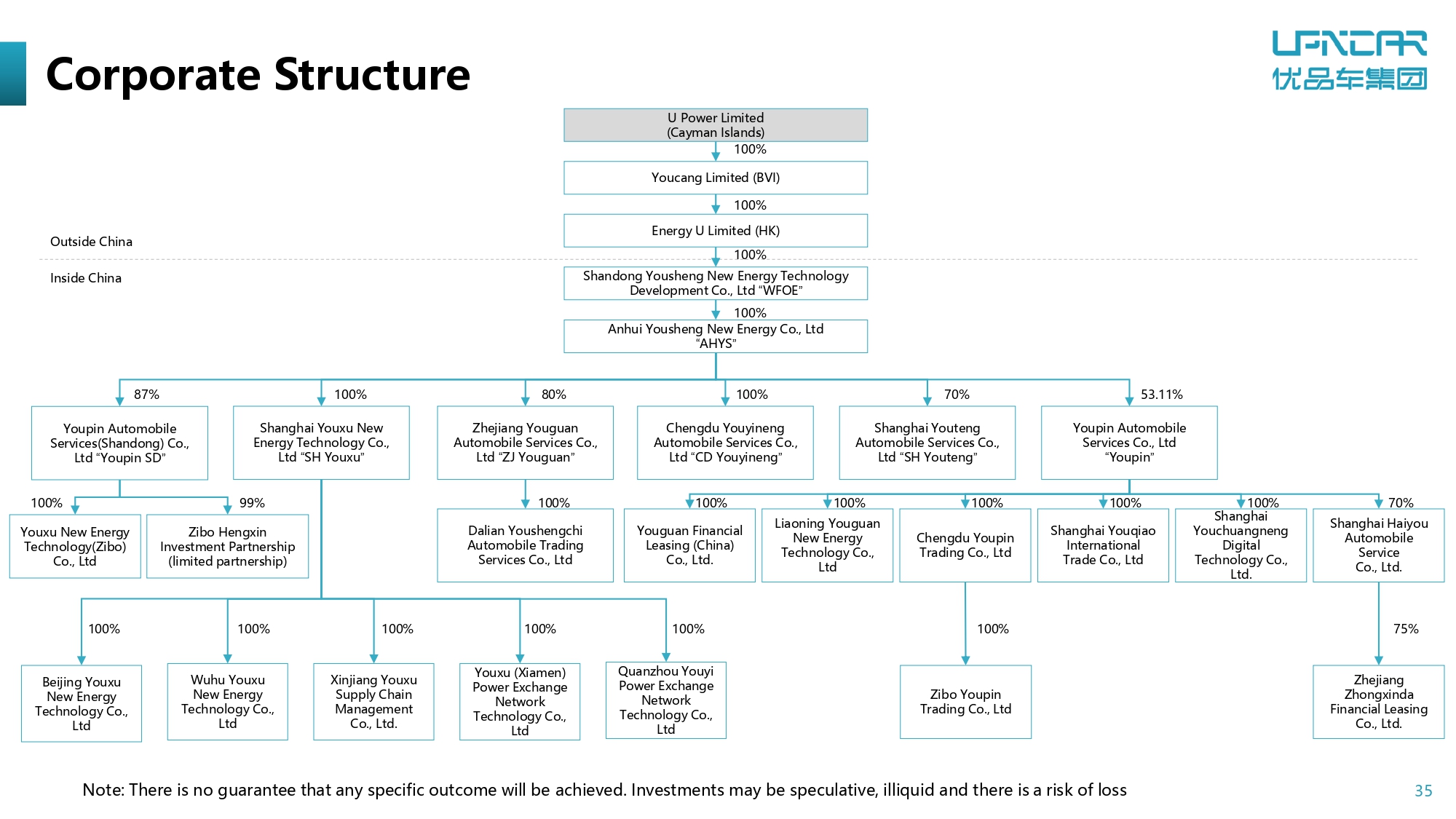

Corporate Structure

35 U Power Limited (Cayman Islands) Youcang Limited (BVI) Energy U Limited ( HK ) Shanghai Youxu New Energy Technology Co., Ltd “ SH Youxu ” Youpin Automobile Services(Shandong ) Co., Ltd “ Youpin SD ” Zhejiang Youguan Automobile Services Co., Ltd “ ZJ Youguan ” Youguan Financial Leasing (China) Co., Ltd. Beijing Youxu New Energy Technology Co., Ltd Wuhu Youxu New Energy Technology Co., Ltd Xinjiang Youxu Supply Chain Management Co., Ltd. Youxu (Xiamen) Power Exchange N etwork Technology Co., Ltd Quanzhou Youyi Power Exchange Network Technology Co., Ltd 100% Outside China Inside China Corporate Structure Shandong Yousheng New Energy Technology Development Co., Ltd “ WFOE ” Anhui Yousheng New Energy Co., Ltd “ AHYS ” Shanghai Youteng Automobile Services Co., Ltd “ SH Youteng ” Chengdu Youyineng Automobile Services Co., Ltd “ CD Youyineng ” Youpin Automobile Services Co., Ltd “ Youpin ” Youxu New Energy Technology(Zibo) Co., Ltd Zibo Hengxin Investment Partnership (limited partnership) Liaoning Youguan New Energy Technology Co., Ltd Shanghai Youqiao International Trade Co., Ltd Chengdu Youpin Trading Co., Ltd Shanghai Youchuangneng Digital Technology Co., Ltd. Dalian Youshengchi Automobile T rading Services Co., Ltd Zibo Youpin Trading Co., Ltd 100% 100% 100% 100% 100% 99% 87% 100% 80% 70% 100% 53.11% 100% 100% 100% 100% 100 % 100% 100% 100% 100% 100% 100% Shanghai Haiyou Automobile Service Co., Ltd. 70 % Zhejiang Zhongxinda Financial Leasing Co., Ltd. 75 % Note: There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss