acceptance, guarantee or similar credit transaction, in each case, that has been drawn or claimed against, (f) all obligations of such Person in respect of banker’s acceptances issued or created, (g) all interest rate and currency swaps, caps, collars and similar agreements or hedging devices under which payments are obligated to be made by such Person, whether periodically or upon the happening of a contingency, (h) all obligations secured by an Lien on any property of such Person, (i) any premiums, prepayment fees or other penalties, fees, costs or expenses associated with payment of any Indebtedness of such Person and (j) all obligation described in clauses (a) through (i) above of any other Person which is directly or indirectly guaranteed by such Person or which such Person has agreed (contingently or otherwise) to purchase or otherwise acquire or in respect of which it has otherwise assured a creditor against loss.

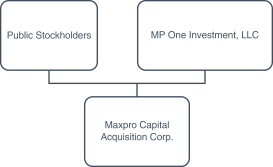

“Insider Letter” means the letter dated October 7, 2021 to the SPAC from MP One Investment, LLC and other parties, as filed as Exhibit 10.1 to the Current Report on Form 8-K filed by the SPAC with the SEC on October 14, 2021.

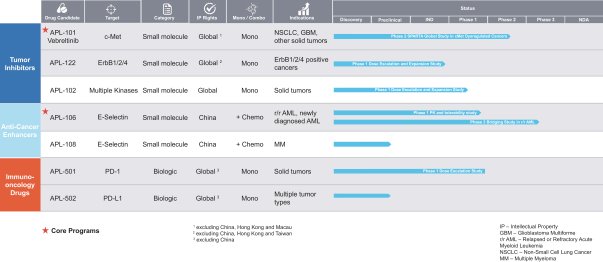

“Intellectual Property” means all of the following as they exist in any jurisdiction throughout the world: Patents, Trademarks, Copyrights, Trade Secrets, Internet Assets, Software and other intangible rights recognized as protectable intellectual property under the Laws of any country.

“Internet Assets” means any and all domain name registrations, web sites and web addresses and related rights, items and documentation related thereto, and applications for registration therefor.

“IPO” means the initial public offering of SPAC Public Units pursuant to the IPO Prospectus.

“IPO Prospectus” means the final prospectus of the SPAC, dated as of October 7, 2021, and filed with the SEC on October 8, 2021 (File No. 333-258091).

“IRS” means the U.S. Internal Revenue Service (or any successor Governmental Authority).

“Key Management” means each of Guo-Liang Yu, Sanjeev Redkar, Kin-Hung Peony Yu and Jane Wang.

“Knowledge” means, with respect to (i) the Company, the actual knowledge of the Persons listed on Schedule 1.1(a), after reasonable inquiry or (ii) any other Party, (A) if an entity, the actual knowledge of its directors and executive officers, after reasonable inquiry, or (B) if a natural person, the actual knowledge of such Party after reasonable inquiry.

“Law” means any federal, state, local, municipal, foreign or other law, statute, legislation, ordinance, code, edict, decree, proclamation, treaty, convention, rule, regulation, writ, injunction, Order or Consent that is or has been issued, enacted, adopted, passed, approved, promulgated, made, implemented or otherwise put into effect by or under the authority of any Governmental Authority.

“Liabilities” means any and all liabilities, Indebtedness, Actions or obligations of any nature (whether absolute, accrued, contingent or otherwise, whether known or unknown, whether direct or indirect, whether matured or unmatured, whether due or to become due and whether or not required to be recorded or reflected on a balance sheet under GAAP or IFRS (as applicable based on the accounting principles used by the applicable Person) or other applicable accounting standards), including Tax liabilities due, except Transaction Expenses.

“Lien” means any mortgage, pledge, security interest, attachment, right of first refusal, option, proxy, voting trust, encumbrance, lien or charge of any kind (including any conditional sale or other title retention agreement or lease in the nature thereof), restriction (whether on voting, sale, transfer, disposition or otherwise), any subordination arrangement in favor of another Person, or any filing or agreement to file a financing statement as debtor under the Uniform Commercial Code or any similar Law.

Annex A-56