UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 20-F

(Mark One)

| | | | | |

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2024

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | | | | |

| o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report:

Commission File Number: 001-41635

Lavoro Limited

(Exact name of Registrant as specified in its charter)

| | | | | |

| Not Applicable | Cayman Islands |

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Av. Dr. Cardoso de Melo, 1450, 4th floor, office 401

São Paulo—SP, Brazil, 04548-005

(Address of principal executive offices)

Julian Garrido Del Val Neto, Chief Financial Officer

Av. Dr. Cardoso de Melo, 1450, 4th floor, office 401

São Paulo—SP, Brazil, 04548-005

Tel: +55 (11) 4280-0709

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Class A ordinary shares, par value $0.001 per share | | LVRO | | The Nasdaq Stock Market LLC |

| Warrants to purchase Class A ordinary shares, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 per share | | LVROW | | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: As of June 30, 2024, the issuer had 116,608,329 Class A ordinary shares and 10,083,592 warrants to purchase Class A ordinary shares outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x |

| Non-accelerated filer | | ¨ | | Emerging growth company | | ¨ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

¨ U.S. GAAP

x International Financial Reporting Standards as issued by the International Accounting Standards Board

¨ Other

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

TABLE OF CONTENTS

____________________________________

| | | | | |

| Page |

| Frequently Used Terms | ii |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

FREQUENTLY USED TERMS

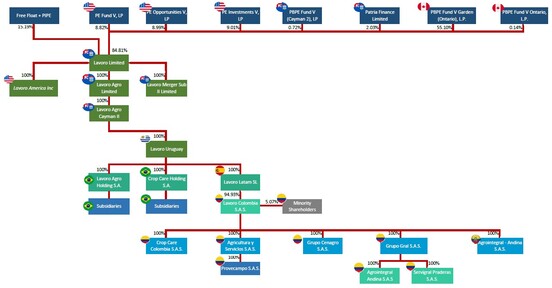

Throughout this annual report, unless otherwise stated or unless the context otherwise requires, the term “the Registrant” refers to Lavoro Limited, a Cayman Islands exempted company, and the terms “we,” “us,” “our,” “the Company,” “our company,” “Lavoro” or “Lavoro Group” refer to Lavoro Limited together with its subsidiaries, composed of: Lavoro Agro Limited, Lavoro Merger Sub II Ltd., Lavoro Agro Holding S.A., or Lavoro Brazil, and its subsidiaries, Crop Care Holding S.A., or Crop Care, and its subsidiaries, and Lavoro Colombia S.A.S., or Lavoro Colombia, and its subsidiaries. Unless the context requires otherwise, all references to “our financial statements” mean the financial statements of the Registrant included herein.

In addition, in this document, unless otherwise stated or unless the context otherwise requires:

“A&R Registration Rights Agreement” means the Amended and Restated Registration Rights Agreement, entered into by the Registrant and the Sponsor on the Closing Date, pursuant to which that certain Registration Rights Agreement, dated as of August 13, 2021, was amended and restated in its entirety as of the Closing Date.

“bag” means a unit of measurement equal to: (i) 60 kilograms or 2.36 bushels of grains, i.e., the products that our farmer clients produce; (ii) 40 kilograms of seeds, i.e., an input that we sell.

“Brazil” means the Federative Republic of Brazil.

“Brazilian government” means the federal government of Brazil.

“Business Combination” means the Mergers and the other transactions contemplated by the Business Combination Agreement, collectively, including the PIPE Investment.

“Business Combination Agreement” means the Business Combination Agreement, dated as of September 14, 2022, as may be amended, supplemented, or otherwise modified from time to time, by and among TPB SPAC, the Registrant, First Merger Sub, Second Merger Sub, Third Merger Sub and Lavoro Agro Limited.

“CDI Rate” means the Brazilian interbank deposit (certificado de depósito interbancário) rate, which is an average of interbank overnight deposit interest rates in Brazil.

“Central Bank” means the Brazilian Central Bank (Banco Central do Brasil).

“Closing” means the closing of the transactions contemplated by the Business Combination Agreement.

“Closing Date” means February 28, 2023, the date of the Closing.

“Code” means the Internal Revenue Code of 1986, as amended.

“Companies Act” means the Companies Act (As Revised) of the Cayman Islands.

“Conab” refers to the Brazilian National Food Supply Company (Companhia Nacional de Abastecimento).

“Continental” refers to Continental Stock Transfer & Trust Company, the Company’s transfer agent.

“COPOM” means the Brazilian Monetary Policy Committee (Comitê de Política Monetária do Banco Central).

“COVID-19” or the “COVID-19 pandemic” means SARS-CoV-2 or COVID-19, and any evolutions or mutations thereof or other epidemics, pandemics or disease outbreaks.

“CPI” means the Colombia Consumer Price Index (Índice de Precios al Consumidor).

“DTF Rate” means the Colombian investment rate (certificado de depósito a término), which is an average of interbank and financial corporation loan rates.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“FGV” means the Getulio Vargas Foundation (Fundação Getulio Vargas).

“First Effective Time” means the time at which the First Merger became effective.

“First Merger” means the merger of First Merger Sub with and into TPB SPAC pursuant to the Business Combination Agreement, with TPB SPAC surviving as a directly wholly owned subsidiary of the Registrant.

“First Merger Sub” means Lavoro Merger Sub I Limited, a Cayman Islands exempted company and a direct, wholly owned subsidiary of the Registrant prior to the consummation of the Business Combination.

“Forward Purchase Agreements” means the separate forward share purchase agreements entered into on February 21, 2023 by TPB SPAC and certain equity holders of TPB SPAC, pursuant to which TPB SPAC (or Second Merger Sub, as successor-in-interest to TPB SPAC following the Closing) agreed to purchase in the aggregate, on the date that is 24 months after the Closing Date, i.e. on February 28, 2025, 2,830,750 Ordinary Shares then held by the referred to equity holders of TPB SPAC. See “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions—Transactions Related to the Business Combination—Forward Purchase Agreements.”

Our “governing documents” refers to our memorandum and articles of association, as amended and restated from time to time.

A “hectare” is a unit of measurement equal to 2.471 acres.

“IASB” means the International Accounting Standards Board.

“IBGE” means the Brazilian Institute for Geography and Statistics (Instituto Brasileiro de Geografia e Estatística).

“IBR Rate” means the Colombia banking reference rate (Indicador Bancario de Referencia).

“ICMS” means the Brazilian tax on the circulation of goods and services (imposto sobre a circulação de mercadorias e serviços).

“IFRS” means International Financial Reporting Standards, as issued by the International Accounting Standards Board, or IASB.

“IGP-M” means the General Market Price Index (Índice Geral de Preços – Mercado), which is published by FGV.

“Investment Company Act” means the Investment Company Act of 1940, as amended.

“Investment Funds” means a group of Cayman Islands, Delaware and Ontario entities, which are the record holders of certain of our Ordinary Shares. The Investment Funds are ultimately controlled by Patria, which may be deemed to beneficially own the Investment Funds. See “Item 7. Major Shareholders and Related Party Transactions—A. Major Shareholders.”

“IPCA” means the National Consumer Price Index (Índice Nacional de Preços ao Consumidor Amplo), which is published by the IBGE.

“Lavoro Agro Limited” means Lavoro Agro Limited, an exempted company incorporated with limited liability in the Cayman Islands.

“Lavoro Agro Limited Shares” means the common shares, par value US$1.00 per share, of Lavoro Agro Limited.

“Lavoro Original Shareholders” means the Investment Funds and Patria Finance, collectively.

“Lavoro Share Plan” means the Lavoro Agro Holding S.A. Long-Term Incentive Policy (Política de Incentivo de Longo Prazo da Lavoro Agro Holding S.A.).

“management” or our “management team” means the officers of the Company.

“Mergers” means the First Merger, Second Merger and Third Merger, collectively.

“Minimum viable product,” or “MVP,” is a development technique in which a version of a new product is developed with sufficient features to be usable by early customers who can then provide feedback for future product development. The concept will be used to validate a market need for the product and for incremental developments.

“Nasdaq” means The Nasdaq Stock Market LLC.

“Ordinary Shares” means the Class A ordinary shares, par value US$0.001 per share, of the Company.

“Patria” means Patria Investments Limited, a Cayman Islands exempted company with limited liability, and its affiliates (including Patria Finance).

“Patria Finance” means Patria Finance Limited, a Cayman Islands exempted company with limited liability.

“PCAOB” means the Public Company Accounting Oversight Board.

“Private Warrants” means the 4,071,507 warrants issued by the Company, each exercisable at US$11.50 per one Ordinary Share, all of which are held by the Sponsor.

“Public Warrants” means the 6,012,085 warrants issued by the Company, each exercisable at US$11.50 per one Ordinary Share, and which are traded on Nasdaq under the symbol “LVROW.”

“RTVs” refer to Lavoro’s technical sales representatives (Representante Técnico de Vendas), who are linked to its retail stores, and who develop commercial relationships with farmers.

“SEC” means the U.S. Securities and Exchange Commission.

“SELIC rate” means the Brazilian interest rate established by the Brazilian Special Clearance and Custody System (Sistema Especial de Liquidação e Custódia).

“Second Effective Time” means the time at which the Second Merger became effective.

“Second Merger” means the merger of TPB SPAC with and into Second Merger Sub pursuant to the Business Combination Agreement, with Second Merger Sub surviving as our directly wholly owned subsidiary.

“Second Merger Sub” means Lavoro Merger Sub II Limited, a Cayman Islands exempted company and our direct, wholly owned subsidiary prior to the consummation of the Business Combination.

“Securities Act” means the Securities Act of 1933, as amended.

“SPAC Class A Ordinary Shares” means the Class A ordinary shares, par value US$0.0001 per share, of TPB SPAC.

“SPAC Class B Ordinary Shares” means the Class B ordinary shares, par value US$0.0001 per share, of TPB SPAC.

“SPAC Mergers” means the First Merger and Second Merger.

“SPAC Ordinary Shares” means the SPAC Class A Ordinary Shares and SPAC Class B Ordinary Shares, collectively.

“SPAC Private Warrants” means the 4,071,507 private placement warrants issued by TPB SPAC and held by the Sponsor to acquire SPAC Class A Ordinary Shares that were outstanding immediately prior to the First Effective Time.

“SPAC Public Warrants” means the 6,012,085 public warrants issued by TPB SPAC to acquire SPAC Class A Ordinary Shares that were outstanding immediately prior to the First Effective Time.

“Sponsor” means TPB Acquisition Sponsor I, LLC, a Delaware limited liability company.

“Sponsor Letter Agreement” means that certain Sponsor Letter Agreement, dated August 13, 2021, by and among Sponsor, TPB SPAC and TPB SPAC’s directors and officers (as amended on September 14, 2022 and February 28, 2023 by and among the Sponsor, TPB SPAC, TPB SPAC’s directors and officers, Lavoro Agro Limited and the Registrant, and as further amended on March 22, 2023 by and among the Sponsor, Second Merger Sub (as successor to TPB SPAC), The Production Board, Lavoro Agro Limited and the Registrant).

“The Production Board” means The Production Board, LLC, a Delaware limited liability company.

“TIB Rate” means the Colombian interbank deposit rate (Tasa Interbancaria).

“tonne” is a unit of measurement equal to 1,000 kilograms, 1.10 short tons or 0.98 long tons.

“TPB PIPE Investment” means the entry by us and TPB SPAC into a subscription agreement with The Production Board, pursuant to which The Production Board agreed to subscribe for and purchase, and TPB SPAC agreed to issue an aggregate of 10,000,000 SPAC Class A Ordinary Shares at a price of US$10.00 per share.

“TPB SPAC” means TPB Acquisition Corporation I, a Cayman Islands exempted company with limited liability.

“Third Effective Time” means the time at which the Third Merger became effective.

“Third Merger” means the merger of Third Merger Sub with and into Lavoro Agro Limited pursuant to the Business Combination Agreement, with Lavoro Agro Limited surviving as a directly wholly owned subsidiary of the Registrant.

“Third Merger Sub” means Lavoro Merger Sub III Limited, a Cayman Islands exempted company and a direct, wholly owned subsidiary of the Registrant prior to the consummation of the Business Combination.

“Trust Account” means that certain trust account that held certain funds maintained and invested pursuant to that certain Investment Management Trust Account Agreement dated August 13, 2021, by and between TPB SPAC and Continental.

“U.S. GAAP” means United States generally accepted accounting principles.

“Warrant Agreement” means the warrant agreement covering the Warrants, which is filed as an exhibit hereto and is incorporated by reference herein.

“Warrants” means the 10,083,592 warrants issued by us, consisting of 6,012,085 Public Warrants and 4,071,507 Private Warrants.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Overview

The Registrant was incorporated to become the holding entity of the Lavoro Group to effect the Business Combination. Prior to the consummation of the Business Combination on February 28, 2023, the Registrant had only nominal assets and liabilities and no material contingent liabilities or commitments and did not conduct any material activities other than those incident to its formation and certain matters related to the Business Combination, such as the making of certain required securities law filings. The Registrant continues not to have any assets other than its direct equity interests in its wholly-owned subsidiaries, Lavoro Merger Sub II Limited and Lavoro Agro Limited.

The Business Combination was accounted for as a capital reorganization. Under this method of accounting, TPB SPAC was treated as the “acquired” company for financial reporting purposes, and the Registrant was the accounting “acquirer.” The net assets of TPB SPAC were stated at historical cost, with no goodwill or other intangible assets recorded. The Business Combination, which is not within the scope of IFRS 3—Business Combinations, or IFRS 3, since TPB SPAC does not meet the definition of a “business” pursuant to IFRS 3, is accounted for within the scope of IFRS 2—Share-Based Payments, or IFRS 2. Any excess of fair value of the Registrant’s Ordinary Shares issued over the fair value of TPB SPAC identifiable net assets acquired represents compensation for the service of a stock exchange listing for its shares and is expensed as incurred.

The corporate reorganizations undertaken in connection with the Business Combination were accounted for using the predecessor method of accounting, and, as a result, our consolidated financial statements are presented “as if” the historical combined consolidated operations of Lavoro Brazil, Crop Care and Lavoro Colombia were the predecessor operations of the Registrant. Under the predecessor method, the historical operations of the Lavoro Group prior to our corporate reorganizations are deemed to be those of the Registrant. Thus, our consolidated financial statements reflect:

•the historical operating results and financial position of Lavoro Brazil, Crop Care and Lavoro Colombia on a combined basis prior to our corporate reorganizations

•the assets and liabilities of Lavoro Brazil, Crop Care and Lavoro Colombia at their historical cost; and

•the Registrant’s earnings per share for all years presented. The number of Ordinary Shares issued by the Registrant, as a result of our corporate reorganizations, is reflected retroactively, for purposes of calculating earnings per share in all prior years presented.

Our Financial Statements

We maintain our books and records in Brazilian reais, the presentation currency of our financial statements and also the functional currency of the Registrant. The functional currency for the majority of our subsidiaries is also the Brazilian real, except that companies located in Colombia have the Colombian peso (“COP”) as their reporting currency. The financial statements of our Colombian subsidiaries are translated into Brazilian reais as follows:

i.assets and liabilities for each statement of financial position presented are translated at the closing exchange rate at the date of that statement of financial position;

ii.income and expenses for each statement of profit or loss are translated at the respective average monthly exchange rate; and

iii.exchange rate differences arising from this translation are recognized in other comprehensive income.

Our financial statements presented in this annual report are the consolidated financial statements of the Registrant. Our audited consolidated financial statements were prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. IFRS differs from the United States generally accepted accounting principles, or U.S. GAAP, in certain material respects and thus may not be comparable to financial information presented by U.S. companies.

Our audited consolidated financial statements as of June 30, 2024 and 2023 and for the three years in the period ended June 30, 2024, together with the notes thereto, included elsewhere in this annual report, are referred to herein as our audited consolidated financial statements or simply as our financial statements. Our financial information should be read in conjunction with “Item 5. Operating and Financial Review and Prospects,” and our audited consolidated financial statements, including the notes thereto, included elsewhere in this annual report.

Our fiscal year ends on June 30. References in this annual report to a fiscal year, such as “fiscal year 2024,” or “FY24” relate to our fiscal year, the year ended June 30, 2024.

Reportable Segments

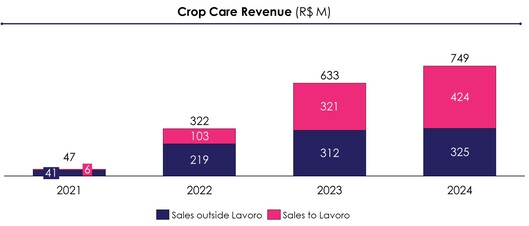

We have three reportable segments: Brazil Ag Retail (formely Brazil Cluster), which comprises companies dedicated to the distribution of agricultural inputs such as crop protection, seeds, fertilizers and specialty products, in Brazil; Latam Ag Retail (formely LATAM Cluster), which includes companies dedicated to the distribution of agricultural inputs outside Brazil (primarily in Colombia); and Crop Care (formely Crop Care Cluster), which includes companies that manufacture and distribute our own portfolio of private label specialty products (i.e., biologicals, adjuvants, specialty fertilizers, and other specialty products), and import and distribute off-patent crop protection products. The table below sets forth the entities that comprised each of our three reportable segments as of June 30, 2024:

| | |

| Brazil Ag Retail |

| Facirolli Comércio e Representações S.A. |

| Cultivar Agrícola – Comércio, Importação e Exportação S.A. |

| Produtec Comércio e Representações S.A. |

| Produtiva Agronegócios Comércio e Representação Ltda. |

| Qualiciclo Agrícola S.A. |

| Lavoro Agrocomercial S.A. |

| Agrocontato Comércio e Representações de Produtos Agropecuários S.A. |

| PCO – Comércio, Importação, Exportação e Agropecuária Ltda. |

| Agrovenci – Comércio, Importação, Exportação e Agropecuária Ltda. |

| Agrovenci Distribuidora de Insumos Agrícolas Ltda. |

| Central Agricola Rural Distribuidora de Defensivos Ltda. |

| Denorpi Distribuidora de Insumos Agrícolas Ltda. |

| Deragro Distribuidora de Insumos Agrícolas Ltda. |

| Desempar Participações Ltda. |

| Desempar Tecnologia Ltda. |

| Futuragro Distribuidora de Insumos Agrícolas Ltda. |

| Distribuidora Pitangueiras de Produtos Agropecuários S.A. |

| Plenafértil Distribuidora de Insumos Agrícolas Ltda. |

| Realce Distribuidora de Insumos Agrícolas Ltda. |

| Nova Geração Comércio de Produtos Agrícolas Ltda. |

| Lavoro Agro Holding S.A. |

| Floema Soluções Nutricionais de Cultivos Ltda. |

| Sollo Sul Insumos Agrícolas Ltda. |

| Dissul Insumos Agrícolas Ltda. |

| Casa Trevo Comercial Agrícola Ltda. |

| Casa Trevo Participações S.A. |

| CATR Comercial Agrícola Ltda. |

| Referência Agroinsumos Ltda |

| | |

| Brazil Ag Retail |

| Lavoro Agro Fundo de Investimento nas Cadeias Produtivas Agroindustriais (FIAGRO) - Direitos Creditórios |

| CORAM - Comércio e Representações Agrícolas Ltda. |

| | |

| Latam Ag Retail |

| Agrointegral Andina S.A.S. |

| Agroquímicos para la Agricultura Colombiana S.A.S. |

| Agricultura y Servicios S.A.S. |

| Cenagral S.A.S. |

| Grupo Cenagro S.A.S. |

| Servigral Praderas S.A.S. |

| Lavoro Colombia S.A.S. |

| Grupo Gral S.A.S. |

| Provecampo S.A.S. |

| Crop Care Colombia S.A.S. |

| | |

| Crop Care |

| Agrobiológica Sustentabilidade S.A. |

| Agrobiológica Soluções Naturais Ltda. |

| Perterra Insumos Agropecuários S.A. |

| Perterra Trading S.A. |

| Union Agro S.A. |

| Crop Care Holding S.A. (Brasil) |

| Araci Administradora de Bens S.A. |

| Cromo Indústria Química Ltda. |

Acquisitions

As of the date of this annual report, we have completed the acquisition of the 27 following groups or companies since our inception: (1) Grupo Gral (comprising Agrointegral Andina S.A.S., Agroquímicos para la Agricultura Colombiana S.A.S., and Servigral Praderas S.A.S.); (2) Lavoro Agrocomercial; (3) Distribuidora Pitangueiras de Produtos Agropecuários S.A., or Pitangueiras; (4) Impacto Insumos Agrícola Ltda. (later merged into Lavoro Agrocomercial); (5) Agrovenci – Comércio, Importação, Exportação e Agropecuária Ltda., or Agrovenci; (6) Agrocontato Comércio e Representações de Produtos Agropecuários S.A. and PCO – Comércio, Importação, Exportação e Agropecuária Ltda., or Agrovale (which, together with Agrovenci, is referred to as the AGP Group); (7) Agricultura y Servicios S.A.S., or AgSe, and Fertilizantes Líquidos y Servicios S.A.S., or Fertilyser (which, together, are referred to as the AgSe Group); (8) Produtec Comércio e Representações S.A., or Produtec; (9) Agrobiológica Soluções; (10) Central Agricola Rural Distribuidora de Defensivos Ltda., or Central Agrícola; (11) Integra (as defined below); (12) Qualicitrus (as defined below); (13) América (as defined below); (14) Desempar (as defined below); (15) Cultivar (as defined below); (16) Cenagro/Cenagral (as defined below); (17) Produttiva (as defined below); (18) Union Agro (as defined below); (19) AgroZap (as defined below); (20) Nova Geração (as defined below); (21) Floema (as defined below); (22) Provecampo (as defined below); (23) Casa Trevo and CATR (as defined below); (24) Sollo Sul and Dissul (both as defined below), (25) Cromo Química (as defined below), (26) Referência Agro (as defined below), and (27) Coram (as defined below).

The following is a description of acquisitions completed in the fiscal years ended June 30, 2024, 2023 and 2022, and thereafter. For more information, see notes 22 and 33 to our audited consolidated financial statements included elsewhere in this annual report.

Acquisitions Completed in the Fiscal Year Ended June 30, 2022

On June 23, 2021, we entered into an agreement to acquire 100.0% of Produtiva Agronegócios Comércio e Representações S.A., or Produttiva, a company specializing in the sale of pesticides, seeds and foliar fertilizers as well as providing technical assistance to farmers in choosing products for planting. The total purchase price of R$86.9 million was divided as follows: (i) R$36.4 million was paid in cash on the closing date; (ii) R$22.5 million was paid in shares issued by Produtec to the selling shareholders on the closing date; and (iii) R$28.0 million was paid on the first anniversary of the closing date. The transaction closed on September 2, 2021.

On July 26, 2021, we entered into an agreement to acquire 73.0% of Union Agro, a company specializing in the production and distribution of special fertilizer. The total purchase price of R$124.0 million was divided as follows: (i) R$103.8 million was paid in cash on the closing date; and (ii) R$20.2 million was paid in cash within 12 months of the closing date. The transaction closed on October 28, 2021.

On July 28, 2021, we entered into an agreement to acquire 100.0% of each of Grupo Cenagro S.A.S., or Cenagro, and Cenagral S.A.S., or Cenagral, companies specializing in the sale of crop protection products, fertilizer, specialties, and seeds, and related services. The purchase price was the equivalent in Colombian pesos to R$44.2 million, of which: (i) the equivalent in Colombian pesos to R$32.1 million was paid in cash on the closing date; and (ii) the equivalent in Colombian pesos to R$12.1 million was paid in cash on the first anniversary of the closing date. The transaction closed on August 31, 2021.

On August 5, 2021, we entered into an agreement to acquire 75.0% of Facirolli Comércio e Representações Ltda., or AgroZap, a company specializing in the sale of agricultural inputs and related services. The total purchase price of R$41.0 million was divided as follows: (i) R$18.8 million was paid in cash on the closing date; and (ii) R$22.1 million was paid in cash within 12 months of the closing date. The transaction closed on January 7, 2022.

On December 24, 2021, we entered into an agreement to acquire 70.0% of Nova Geração Comércio de Produtos Agrícolas Ltda., or Nova Geração, a company specializing in the sale of agricultural inputs and related services. The total purchase price of R$30.7 million was divided as follows: (i) R$15.6 million was paid in cash on the closing date; (ii) R$7.8 million was paid in shares issued by Nova Geração to the selling shareholders on the closing date; and (iii) R$7.3 million was paid in cash within 12 months of the closing date. The transaction closed on April 6, 2022.

Acquisitions Completed in the Fiscal Year Ended June 30, 2023

On March 22, 2022, we entered into an agreement to acquire 100.0% of Floema Soluções Nutricionais de Cultivos Ltda., or Floema, a company specializing in the sale of agricultural inputs and related services. The purchase price for 70% of Floema’s ownership interests is equivalent to R$27.6 million, of which: (i) R$20.7 million was payable in cash on the closing date, remaining subject to a preliminary price adjustment (which when calculated, was equivalent to a negative amount of R$9.5 million, resulting in a net payment in cash on the closing date amounting to R$11.2 million); and (ii) R$6.9 million was paid in cash on the first anniversary of the closing date (i.e. August 4, 2023), subject to a final price adjustment (to be calculated in the future). The purchase price for the remaining 30% of Floema’s ownership interests was paid in shares issued by AgroZap to the selling shareholders on the closing date, valued at R$11.8 million. The selling shareholders were also entitled to an earn-out of up to R$28.8 million, which was determined on the closing date to amount to R$18.8 million, of which: (i) R$14.1 million was paid in cash on the closing date; and (ii) R$4.7 million was paid in cash on the first anniversary of the closing date. Accordingly, on the closing date: (i) R$25.3 million was paid in cash; and (ii) R$12.3 million was paid in shares issued by AgroZap to the selling shareholders. The remaining R$11.6 million is subject to a final price adjustment and monetary adjustment and is payable in cash on the first anniversary of the closing date. The transaction closed on August 4, 2022.

On May 5, 2022, we entered into an agreement to acquire 85.0% of Casa Trevo Participações S.A. (including its subsidiary Casa Trevo Comercial Agrícola Ltda.), or Casa Trevo, and CATR Comercial Agrícola Ltda., or CATR, a

Brazilian-based group of companies specializing in the sale of crop protection products, fertilizers, seeds, and other agricultural inputs. The total purchase price of R$42.5 million was divided as follows: (i) R$23.6 million was paid in cash on the closing date; and (ii) R$18.9 million is payable in cash in one annual installment within 12 months of the closing date. The transaction closed on August 31, 2022.

On June 16, 2022, we entered into an agreement to acquire 100% of Provecampo S.A.S., or Provecampo, a Colombian-based company specializing in the wholesale trade of basic chemical products, rubber and plastics in primary forms and chemical products for agricultural use. The total purchase price of R$21.7 million was divided as follows: (i) R$14.2 million was paid in cash on the closing date; and (ii) R$7.5 million is payable in cash in two equal annual installments within 24 months of the closing date. The transaction closed on July 29, 2022.

On July 22, 2022, we entered into an agreement to acquire 100% of Sollo Sul Insumos Agrícolas Ltda., or Sollo Sul, and Dissul Insumos Agrícolas Ltda., or Dissul, Brazilian-based companies specializing in the sale of crop protection products, fertilizers, seeds, and other agricultural inputs. The total purchase price of R$105.9 million was divided as follows: (i) R$53.0 million was paid in cash on the closing date; and (ii) R$53.0 million is payable in cash in two equal annual installments within 24 months of the closing date. The transaction closed on November 30, 2022.

On January 13, 2023, our subsidiary Crop Care entered into an agreement for the acquisition of a 70% interest in Cromo Indústria Química Ltda., or Cromo Química, a company specialized in the production of high-performance adjuvants. The purchase price of the acquisition totaled R$21.7 million, and is expected to be paid in cash in three installments: R$8.1 million on the closing date, R$10.8 million a year after the closing date and R$5.4 million two years after the closing date, all as adjusted by the IPCA. The transaction closed on May 31, 2023.

Acquisitions Completed in the Fiscal Year Ended June 30, 2024

On February 28, 2023, we entered into an agreement to acquire a 70% equity interest in Referência Agroinsumos Ltda., or Referência Agro, an agricultural inputs distributor doing business in the south of Brazil. The purchase price for this transaction (as adjusted) is R$102.1 million, of which R$67.1 million was paid on the closing date and R$35.0 million was paid one year after the closing date. The transaction closed on July 31, 2023. Because we acquired Referência Agro through our subsidiary Pitangueiras, we currently beneficially own 66.5% of Referência Agro.

On July 24, 2023, we entered into an agreement for the acquisition of CORAM - Comércio e Representações Agrícolas Ltda., (“CORAM”), establishing the terms and other conditions for its acquisition The acquisition was completed on November 30, 2023. The purchase price for this transaction (as adjusted) was R$$49.9 million, of which R$20.0 million was paid on the closing date and R$29.9 million is expected to be paid one year after the closing date. We currently indirectly own 72.17% of CORAM through Qualiciclo Agrícola S.A. which directly owns a 100% interest at CORAM.

Special Note Regarding Non-IFRS Financial Measures

This annual report presents our Adjusted EBITDA, Adjusted EBITDA Margin, Net Debt , and Net Debt /Adjusted EBITDA Ratio, and their respective reconciliations for the convenience of investors, which are non-IFRS financial measures. A non-IFRS financial measure is generally defined as a numerical measure of historical or future financial performance, financial position, or cash flow that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable IFRS measure. We present non-IFRS financial measures to aid the reader to evaluate our business, financial condition, results of operations and prospects.

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA is defined as (loss) profit for the year, adjusted for finance income (costs), income taxes current and deferred, depreciation and amortization. We also adjust this measure for certain revenues or expenses that are excluded when management evaluates the performance of our day-to-day operations, namely (i) share of profit of an associate; (ii) fair value on inventories sold from acquired companies; (iii) M&A expenses that in management’s judgment do not necessarily occur on a regular basis, (iv) gain on bargain purchases, which are also

related to purchase price allocation of past acquisitions; (v) listing and other expenses recognized in connection with the Business Combination, (vi) share-based compensation expenses, (vii) one-off bonuses paid out to our employees recognized across multiple quarters in the fiscal years ending June 30, 2023, and 2024, and (viii) expenses paid to Patria in relation to management consultancy services in connection with acquisition transactions. Adjusted EBITDA Margin is calculated as Adjusted EBITDA as a percentage of revenue for the year.

We believe Adjusted EBITDA and Adjusted EBITDA Margin to be useful metrics for the reader, as (1) they are key indicators used internally by management to evaluate the performance of our day-to-day operations, and (2) provide additional information about trends in our operating performance prior to considering the impact of capital structure, depreciation, amortization and taxation on our results, as well as the effects of certain items or events that may be non-cash, and/or non-operational in nature, which management considers may hinder period-to-period comparability and obscure underlying performance of the Company. Since these measures are not explicitly defined under IFRS, our calculation of Adjusted EBITDA and Adjusted EBITDA Margin may vary from that of other companies, including industry peers, affecting comparability.

Net Debt and Net Debt /Adjusted EBITDA Ratio

Net Debt is calculated as borrowings (current and non-current) plus payables for the acquisition of subsidiaries (current and non-current), obligations to FIAGRO quota holders, obligations to Agribusiness Receivables Certificates (CRA) quota holders (current and non-current), warrant liabilities and liability for FPA shares, less cash equivalents and restricted cash. Net Debt /Adjusted EBITDA Ratio, also a non-IFRS financial measure, is calculated as Net Debt divided by Adjusted EBITDA. We believe that Net Debt /Adjusted EBITDA Ratio is an important measure to monitor leverage and evaluate our financial position. With respect to Net Debt we subtract cash and cash equivalents from the IFRS measure, since these assets can be used to reduce our outstanding borrowings. Additionally, restricted cash is excluded from the IFRS measure as it is designated for the settlement of our FPA share liability. A limitation associated with using Net Debt is that it subtracts cash and equivalents and restricted cash and therefore may imply that there is less Company debt than the comparable IFRS measures indicate. We believe that investors may find it useful to monitor leverage and evaluate our financial position using Net Debt and Net Debt /Adjusted EBITDA Ratio, although these measures are not explicitly defined under IFRS.

The non-IFRS financial measures described in this annual report should not be viewed in isolation and are not a substitute for the IFRS measures of earnings. Additionally, our calculation of Adjusted EBITDA, Adjusted EBITDA Margin, Net Debt, and Net Debt /Adjusted EBITDA Ratio may be different from the calculation used by other companies, including our competitors in the agricultural industry, and therefore, our measures may not be comparable to those of other companies. See “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Non-IFRS Financial Measures and Reconciliations” for a reconciliation of our Adjusted EBITDA, Adjusted EBITDA Margin, Net Debt, and Net Debt /Adjusted EBITDA Ratio to our (loss) profit for the year.

Financial Information in U.S. Dollars

Solely for the convenience of the reader, we have translated some of the amounts included in this annual report from reais into U.S. dollars. You should not construe these translations as representations by us that the amounts actually represent these U.S. dollar amounts or could be converted into U.S. dollars at the rates indicated. Unless otherwise indicated, we have translated real amounts into U.S. dollars using a rate of R$5.5589 to US$1.00, the commercial selling rate for U.S. dollars as of June 30, 2024, as reported by the Central Bank. See “Item 3. Key Information—D. Risk Factors—Risks Relating to Latin America—Exchange rate instability may impact our ability to hedge exchange rate risk, which may lead to interest rate volatility and have a material adverse effect on the price of our Ordinary Shares.”

Rounding

Rounding adjustments have been made to some of the figures included in this annual report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them; consequently, certain figures may add up to be more or less than the total amount and certain percentages may add up to be more or less than 100%. In particular and without limitation, amounts expressed in millions contained in this annual report have been rounded to a single decimal place for the convenience of readers.

Industry and Market Data

This annual report contains data related to economic conditions in the market in which we operate. The information contained in this annual report concerning economic conditions is based on publicly available information from third-party sources that we believe to be reasonable. Market data and certain industry forecast data used in this annual report were obtained from internal reports and studies, where appropriate, as well as estimates, market research, publicly available information (including information available from the SEC’s website) and industry publications. We obtained the information included in this annual report relating to the industry in which we operate, as well as the estimates concerning market shares, through internal research, public information and publications on the industry prepared by official public sources, such as the IBGE, the FAO and the USDA, among others, as well as private sources, such as consulting and research companies in the Brazilian agricultural industry, among others.

Market data used throughout this annual report is based on management’s knowledge of the industry and the good faith estimates of management. All of management’s estimates presented are based on industry sources, including analyst reports and management’s knowledge. We also relied, to the extent available, upon management’s review of independent industry surveys and publications prepared by a number of sources and other publicly available information. We are responsible for all of the disclosure in this annual report and we believe that each of the publications, studies and surveys used throughout this annual report are prepared by reputable sources and are generally reliable, though we have not independently verified market and industry data from third-party sources. None of the publications, reports or other published industry sources referred to in this annual report were commissioned by us or prepared at our request. We have not sought or obtained the consent of any of these sources to include such market data in this annual report. All of the market data used in this annual report involves a number of assumptions and limitations and therefore is inherently uncertain and imprecise, and you are cautioned not to give undue weight to such estimates. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Item 3. Key Information—D. Risk Factors” in this annual report. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties.

FORWARD-LOOKING STATEMENTS

This annual report contains a number of forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this annual report, including statements regarding our future financial position, results of operations, business strategy and plans and objectives of management for future operations, are forward-looking statements. Any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are also forward-looking statements. In some cases, you can identify forward-looking statements by words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “strategy,” “future,” “opportunity,” “may,” “target,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or similar expressions that predict or indicate future events or trends or that are not statements of historical matters.

Forward-looking statements include, without limitation, our expectations concerning the outlook for our business, productivity, plans and goals for future operational improvements and capital investments, operational performance, future market conditions or economic performance and developments in the capital and credit markets and expected future financial performance, as well as any information concerning possible or assumed future results of our operations as set forth in the sections of this annual report.

The forward-looking statements are based on the current expectations of our management and are inherently subject to uncertainties and changes in circumstance and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in “Item 3. Key Information—D. Risk Factors,” those discussed and identified in public filings made with the SEC by us and the following important factors:

•general economic, financial, political, demographic and business conditions in Brazil, as well as any other countries we may serve in the future and their impact on our business;

•geopolitical risk, including the political environment in Brazil and impacts of the ongoing conflict between Russia and Ukraine;

•the possibility that we may be adversely affected by other economic factors, particularly in Brazil;

•fluctuations in interest, inflation and exchange rates in Brazil and any other countries we may serve in the future;

•competition in the agricultural industry;

•our ability to implement its business strategy;

•our ability to adapt to the rapid pace of technological changes in the agricultural industry;

•the reliability, performance, functionality and quality of our products and services;

•our ability to obtain certain licenses, grants, registrations and authorizations issued by government authorities for certain aspects of its operations;

•our ability to continue attracting and retaining new appropriately-skilled employees;

•our capitalization and level of indebtedness;

•the interests of our controlling shareholder;

•changes in government regulations applicable to the agricultural industry in Brazil and elsewhere;

•our ability to compete and conduct its business in the future;

•the success of operating initiatives, including advertising and promotional efforts and new product, service and concept development by us and our competitors;

•changes in consumer demand regarding agricultural products, customer experience and technological advances, and our ability to innovate to respond to such changes;

•changes in labor, distribution and other operating costs;

•our compliance with, and changes to, government laws, regulations and tax matters that currently apply to us;

•our ability to implement business plans, growth strategy and other expectations in the future;

•litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and demands on our resources, including potential litigation regarding the Business Combination;

•public health crises, such as the COVID-19 pandemic; and

•other factors that may affect our financial condition, liquidity and results of operations.

Should one or more of these risks or uncertainties materialize, or should any of the assumptions made by our management prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

We caution you against placing undue reliance on forward-looking statements, which reflect current beliefs and are based on information currently available as of the date a forward-looking statement is made. Forward-looking statements set forth herein speak only as of the date of this annual report. We do not undertake any obligation to revise forward-looking statements to reflect future events, changes in circumstances, or changes in beliefs. In the event that any forward-looking statement is updated, no inference should be made that we will make additional updates with respect to that statement, related matters, or any other forward-looking statements. Any corrections or revisions and other important assumptions and factors that could cause actual results to differ materially from forward-looking statements, including discussions of significant risk factors, may appear in our public filings with the SEC, which are or will be (as appropriate) accessible at www.sec.gov, and which you are advised to consult.

Market, ranking and industry data used throughout this annual report, including statements regarding market size and technology/data adoption rates, is based on the good faith estimates of our management, which in turn are based upon our management’s review of internal surveys, independent industry surveys and publications and other third-party research and publicly available information, as indicated. Industry reports, publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates.

In some cases, we do not expressly refer to the sources from which this data is derived. While we have compiled, extracted, and reproduced industry data from these sources and are not aware of any misstatements regarding the industry data presented herein, we have not independently verified the data. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements. Moreover, estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Item 3. Key Information—D. Risk Factors” of this annual report.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A.[Reserved]

B.Capitalization and Indebtedness

Not applicable.

C.Reasons for the Offer and Use of Proceeds

Not applicable.

D.Risk Factors

Summary Risk Factors

The following summarizes the principal factors that make an investment in our company speculative or risky, all of which are more fully described in the risk factors below. This summary should be read in conjunction with the risk factors below and should not be relied upon as an exhaustive summary of the material risks facing our business. The following factors could result in harm to our business, reputation, revenue, financial results, and prospects, among other impacts:

Risks Relating to Our Business and Industry

•We may be adversely affected by global market and economic conditions.

•Our operating results are highly dependent upon and fluctuate based upon business and economic conditions and governmental policies affecting the agricultural industry in which we or our customers operate. These factors are outside of our control and may significantly affect our profitability.

•Our business is highly seasonal and affected by adverse weather conditions and other factors beyond our control, which may cause our sales and operating results to fluctuate significantly.

•Climate change may have an adverse effect on agribusiness in Latin America and on us.

•We do not control the activities of our customers, and facts or circumstances that may occur as a result of their actions or omissions could harm our reputation and sales.

•We operate in a competitive market. If we are unable to compete effectively, our financial results will suffer.

•We may not be successful in selling or marketing the agricultural products that we offer in the markets in which we operate.

•If we are unable to retain our existing customers or attract new customers, including through opening new stores and geographic expansion, our business, financial condition and results of operations will be adversely affected.

•Our business depends on a well-regarded and widely known brand, and any failure to maintain, protect and enhance our brand would harm our business, financial condition and results of operations.

•If we fail to manage our growth effectively, our business could be harmed.

•Our continued international expansion efforts may not be successful, or may subject our business to increased risks.

•Our results of operations and operating metrics may fluctuate and we may continue to generate losses, which may cause the market price of our Ordinary Shares to decline.

Risks Relating to Acquisitions and Financial Information

•Any acquisition, partnership or joint venture we make or enter into could disrupt our business and harm our financial condition.

•Our recent acquisitions and the comparability of our results may make it difficult for investors to evaluate our business, financial condition, results of operations and prospects.

Risks Relating to Legal and Regulatory Matters, Privacy, Litigation and Cybersecurity

•Our business and the commercialization of our products are subject to various government regulations and agricultural, environmental, health and safety authorities and industry standards, and we or our collaborators may be unable to obtain, or may face delays in obtaining, necessary regulatory approvals.

•Our operations are subject to various health and environmental risks associated with our production, handling, transportation, storage and commercialization.

•Environmental, health and safety and food and agricultural input laws and regulations to which we are subject may become more stringent over time. This could increase the effects on us of these laws and regulations, and the increased effects could be materially adverse to our business, operations, liquidity and/or results of operations.

Risks Relating to Latin America

•We are subject to risks relating to our significant presence in Latin American countries.

•Latin America has experienced, and may continue to experience, adverse economic or political conditions that may impact our business, financial condition and results of operations.

•The Brazilian federal government has exercised, and continues to exercise, significant influence over the Brazilian economy. This influence, as well as Brazil’s political and economic conditions, could harm us and the price of our Ordinary Shares.

Risks Relating to Our Ordinary Shares and Warrants

•We incur increased costs as a result of operating as a public company.

•We may be required to take write-downs or write-offs, restructuring and impairment or other charges that could have a significant negative effect on our financial condition, results of operations and share price, which could cause you to lose some or all of your investment.

•The Lavoro Original Shareholders beneficially own approximately 84.8% of the outstanding Ordinary Shares, and control certain matters requiring shareholder approval. This concentration of ownership and voting power will limit your ability to influence corporate matters.

•As a foreign private issuer, we have different disclosure, Nasdaq corporate governance standards and other requirements than U.S. domestic registrants.

•The Ordinary Shares registered for resale represent a substantial percentage of our outstanding Ordinary Shares and the sale of such securities could cause the market price of our Ordinary Shares to decline significantly.

•We are a Cayman Islands exempted company with limited liability. The rights of our shareholders, including with respect to fiduciary duties and corporate opportunities, may be different from the rights of shareholders governed by the laws of U.S. jurisdictions.

•The exercise of our Warrants for our Ordinary Shares would increase the number of shares eligible for

resale in the public market and result in dilution to our shareholders.

•We may redeem your unexpired Warrants prior to their exercise at a time that is disadvantageous to you, thereby making your Warrants worthless.

Risks Relating to Our Business and Industry

We may be adversely affected by global market and economic conditions.

Our ability to continue to develop and grow our business, build proprietary distribution channels and generate revenues from product sales may be adversely affected by global economic conditions in the future, including instability in financial and credit markets, declining consumer and business confidence, fluctuating commodity prices and interest rates, volatile exchange rates and other challenges that could affect the global economy such as the changing financial regulatory environment. For example, our customers may experience deterioration of their businesses, cash flow shortages or difficulties obtaining financing, which could adversely affect the demand for our agricultural products and services. Changes in the prices of certain commodity products could result in higher overall costs along the agricultural supply chain, which may negatively affect our ability to commercialize our products due to a reduction in demand by our clients. Additionally, negative fluctuations in commodity prices could have an impact on growers’ purchasing decisions and negatively affect their ability and decisions to purchase our agricultural input products and services. We cannot anticipate all of the ways in which the current economic climate and financial market conditions could adversely impact our business and may not be able to anticipate or react to changing costs by adjusting our practices, which could cause our operating results to deteriorate. Any downturn in the global market or general economic conditions could have a material adverse effect on our results of operations, financial condition and business. See also “—Risks Relating to Latin America—Disruption or volatility in global financial and credit markets could have a material adverse effect on us.”

Our operating results are highly dependent upon and fluctuate based upon business and economic conditions and governmental policies affecting the agricultural industry in which we or our customers operate. These factors are outside of our control and may significantly affect our profitability.

Our operating results in particular, and agricultural production and trade flows more generally, are subject to factors outside our control that could adversely affect our operations and profitability. Therefore, the sale of our products may be adversely affected by circumstances beyond our control. The most important of these factors are:

•weather, climatic variations and field conditions (particularly during periods of traditionally high agricultural and planting activity);

•quantities of crop nutrients imported and exported;

•cost increases by our suppliers and service providers for the agricultural inputs and services required in our activities, which may lead to decreased customer demand;

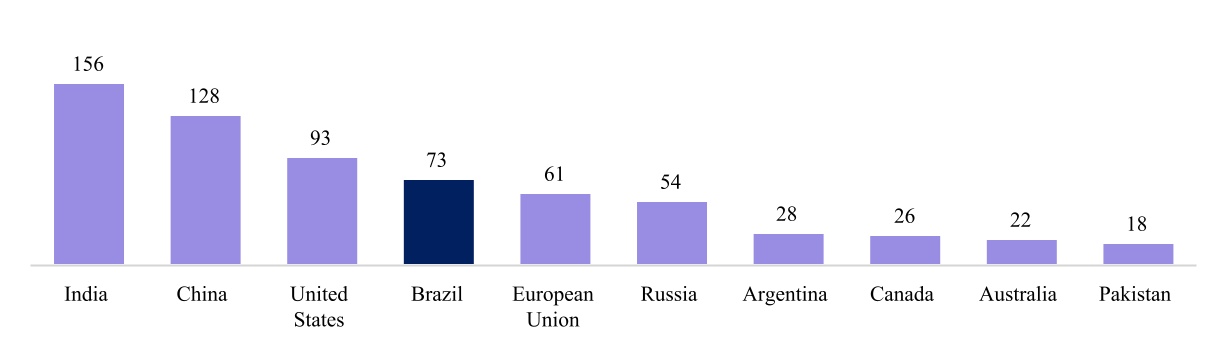

•current and expected agricultural commodity inventories and prices (such as soybean and corn), which are heavily influenced by worldwide markets, with the United States, China, Brazil, Argentina and the European Union being the largest producers and consumers of these commodities; and

•governmental policies and approvals of technologies affecting the agricultural industry, such as farm and biofuel policies, taxes, tariffs, duties, subsidies, incentives and import and export restrictions on agricultural

commodities and commodity products, which may directly or indirectly influence the location or number of hectares planted, the level of inventories, the mix of crops planted or crop prices and the volume and types of imports and exports or otherwise negatively affect our operating results.

International market conditions, which are outside of our control, may significantly influence our operating results. The international market for agricultural inputs is influenced by such factors as the relative value of the U.S. dollar and its impact upon the cost of importing agricultural inputs; foreign agricultural policies, including subsidy policies; the existence of, or changes in, import or foreign currency exchange barriers in certain foreign markets; changes in the hard currency demands of certain countries; and other regulatory policies of foreign governments; as well as the laws and policies affecting foreign trade and investment, including use of tariffs.

Moreover, our private label products use some basic raw materials, most of them mineral commodities, such as yellow phosphorus, acetic acid, CCMP (2-chloro-5-chloromethylpyridine), DMPAT (Dimethyl thiophosphoramidate), and manganese. These raw materials may suffer price increases in amounts higher than those expected by us, including changes to tax rates or the creation of new taxes, which can cause a decrease in the profitability of our products and, consequently, adversely affect our financial condition. Additionally, some of our raw materials are purchased in the foreign market and, therefore, their prices are linked to the variation of the dollar. If there is an increase in the price of the main raw materials that we or our suppliers use in the production process, our and/or their results of operations could be negatively impacted.

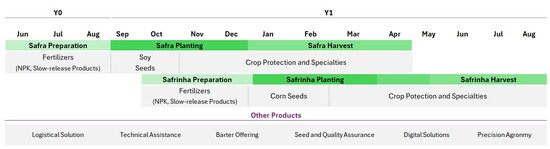

Our business is highly seasonal and affected by adverse weather conditions and other factors beyond our control, which may cause our sales and operating results to fluctuate significantly.

The sale of our products is dependent upon planting and growing seasons, which vary from year to year, and are expected to result in both highly seasonal patterns and substantial fluctuations in quarterly sales and profitability. Demand for our products is typically strongest between October and December, with a second period of strong demand between January and March. The seasonality of agricultural inputs demand results in our sales volumes and net sales typically being the highest during the South American spring and summer seasons (in particular, between December and February) and our working capital requirements typically being the highest just after the end of the spring season.

Weather conditions and natural disasters, such as heavy rains, hail, floods, frost, windstorms, drought or fire, as well as other factors beyond our control, such as demand conditions, availability of supply, food safety concerns, product recalls and government regulations also affect decisions by our distributors, direct customers and end users about the types and amounts of products to use and the timing of harvesting and planting. Disruptions may lead to delays in harvesting or planting by growers which can result in pushing orders to a future quarter, which could negatively affect results for the quarter in question and cause fluctuations in our operating results.

Moreover, we are exposed to the risk and significant cost of maintaining inventory if, due to the aforementioned reasons, the activities of our customers decrease. We cannot assure you that we will be able to distribute sufficient products during the year to meet the demand of our customers in peak seasons, nor that our customers will rapidly react to unexpected climate changes, which may adversely affect the demand for our products. Climate changes directly affect the planting schedule and demand of our customers and their crop yield and, as a result, adversely affect their financial condition and their ability to meet their obligations with us.

The overall level of seasonality in our business is difficult to evaluate as a result of our expansion into new geographical territories, the introduction of new products and the timing of introductions of new products. It is possible that our business may be more seasonal or experience seasonality in different periods than anticipated. Other factors may also contribute to the unpredictability of our operating results, including the size and timing of significant transactions. For example, as mentioned above, our most profitable months tend to be October, November and December in a given calendar year. If we acquire a large target between January and June of a given year, we would be missing its best performing months, and, therefore, our annual accounting statements for the fiscal year ended June 30 would not fully reflect the positive impact of the acquisition. Additionally, the delay or deferral of use of our agricultural products and services and the fiscal or quarterly budget cycles of our direct customers and end users may also impact the seasonality of our results. Customers may purchase large quantities of

our products in a particular quarter to store and use over long periods of time or time their purchases to manage their inventories, which may cause significant fluctuations in our operating results for a particular quarter or year.

If seasonal demand exceeds our expectations, we will not have enough product volumes and our customers may acquire products from our competitors, which would negatively impact our profitability. If seasonal demand is less than we expect, we will be left with excess inventory and higher working capital and liquidity requirements. The degree of the seasonality of our business can change significantly from year to year due to conditions in the agricultural industry and other factors.

Climate change may have an adverse effect on agribusiness in Latin America and on us.

We are subject to risks related to climate change which are commonly grouped into physical risk and transition risk categories.

Physical risks include the impact that climate change could have on our operations, the operations of our customers, and our supply chain. The impact of climate change is uncertain and may be harmful due to changes in rainfall patterns and intensity, shortage of water, changes in sea levels, and changes in global temperature, significant changes in the presence, pressure and impact of diseases and pests on crops, among others. These physical impacts may vary depending on the location and intensity of climate events, comprising acute risks, including increased severity of extreme climate events, and chronic risks, deriving from long-term changes in climate patterns. These acute or recurrent physical impacts can cause significant losses to farmers in Latin America. It can increase the non-payment risk by current and future customers. Similarly, they may limit geographic expansion strategies in certain regions, and consequently require significant changes in our business strategy. We cannot assure you that any losses caused by climate change effects on the crops of our customers will be recovered, even in following seasons, considering current productivity standards. As a result, we may be materially adversely affected and our financial results may significantly vary each year. Physical risks from climate change may also result in operational or supply chain delays, depending on the nature of the event. These events may impact the demand for our products, availability and/or cost of resource inputs, materials or insurance or increase the costs to our operations.

Transition risks relate to the risk inherent in changing strategies, policies or investments as society and industry work to reduce the reliance on carbon and impact on the climate, and depend on political, regulatory, legal, technological, and market responses. Impacts of transition risks include, among other things, portfolio changes, policy constraints on carbon emissions, imposition of carbon pricing mechanisms and carbon taxes, enhanced reporting obligations, risks associated with investments in new technologies, costs to transition to lower emissions technologies, stranded assets, diminished access to capital and financing, water restrictions, land use restrictions or incentives, changing consumer behavior, needs and preferences, and market demand and supply shifts. There are also reputational risks associated with climate change including our stakeholders’ perception of our role in the transition to a lower- carbon economy.

Climate change laws could also increase our costs and have an impact on our financial condition and the results of operations. The adoption of a national or international policy to limit greenhouse gas emissions for some industries may require significant investments for implementation. Several countries, including Brazil, may adopt a carbon pricing regime through a regulated market or by creating an emission tax, or by combining these two factors. This could result in a regulated carbon market, which may impose limits on greenhouse gas emissions for various industries and businesses, including their suppliers and customers (i.e., in line with an extended value chain concept).

There can be no assurance that our efforts to anticipate the costs associated with mitigating the physical risks of climate change and ability to work with governments and industry on potential regulatory requirements associated with climate change will be effective or that climate change or related governmental policy action in response to climate change will not have an adverse impact on our business and negatively impact our strategy, financial condition, results of operations, and/or cash flows, and our reputation and stakeholders’ support.

We do not control the activities of our customers, and facts or circumstances that may occur as a result of their actions or omissions could harm our reputation and sales.

Environmental and social concerns worldwide are continuing to rise. Tracts of land cleared for the harvesting of crops cause deforestation. To this effect, we do not control our customers or their environmental or other practices. A violation of environmental, health, labor, agricultural or other laws by our customers or business partners, or an environmental or public health incident at customer locations, including acts of deforestation, or any failure of these third parties to follow generally accepted ethical business practices, or even human rights violation concerning to labor conditions, could create negative publicity and harm our reputation. In addition, we may be required to seek alternative customers if these violations or failures were to occur. Although we conduct periodic due diligence of our customers’ compliance with environmental, health, safety, labor, agricultural laws or practices, we may be unable to detect related violations and our due diligence practices may not be sufficient to ensure our customers’ compliance with environmental laws or practices. Any conduct or actions that our customers could take could reduce demand for our products, harm our ability to meet demand or harm our reputation, brand image, business, financial condition or results of operations.

We operate in a competitive market. If we are unable to compete effectively, our financial results will suffer.

We currently face competition in the markets in which we operate. The market for agricultural inputs is competitive and evolving. The influence of the agricultural sector in Brazil and in other Latin American markets has been increasing, including in the Brazilian retail market of agricultural inputs, due to the creation of groups resulting from mergers and acquisitions, the entry of international players in Brazil and Latin America, and competition among farmer cooperatives. Additionally, agricultural inputs suppliers may intensify their strategy of making direct sales to farmers or even decide to progress in the value chain, becoming retailers of agricultural inputs. If we are unable to adapt to changes in the competitive landscape in the markets in which we operate, or intend to operate in the future, and this leads to loss of markets and/or difficulties in the operation of our business, our results of operations and business may be adversely affected.

Moreover, the advancement and adoption of technology and digital innovations in agriculture and across the value chain have increased and are expected to further accelerate as grower demographics shift and pressures from consumer preferences, governments, and climate change initiatives evolve. Some emerging trends include the development of seeds that require less crop nutrients, development of full or partial substitutes for our products, or developments in the application of crop nutrients such as improved nutrient use or efficiency through use of precision agriculture. If we are unable to provide new products and services to satisfy emerging trends, it may adversely affect our financial condition, results of operations, and cash flows. Further, digital innovations and use of new technology in the agriculture market, among other things, by new or existing competitors could alter the competitive environment, resulting in existing business models being disrupted, which may adversely impact our operations and financial performance.

Our ability to compete effectively and to achieve commercial success depends, in part, on our ability to control inventory and other supply-related costs; marketing costs and go to market strategy through our distribution channels; effectively price and market our products; successfully develop an effective marketing program and an efficient supply chain; obtain and commercialize new products and maintain an attractive product portfolio; among other factors. We may not be successful in achieving these factors and any such failure may adversely affect our business, results of operations and financial condition.

We may not be successful in selling or marketing the agricultural products that we offer in the markets in which we operate.

Our success depends on our ability to continue to identify, obtain and commercialize the agricultural products we offer in the markets in which we operate, including agricultural inputs with attractive and high-value characteristics and technologies. We commit substantial efforts and resources to locate and source products that we seek to bring to the markets in which we operate, and we may not be successful in obtaining or commercializing such products at the same pricing or market conditions. Also, if the agricultural products we sell are unsuccessful in achieving their desired effect or no longer perform according to our customers’ expectations, our customers’ demand for our products may be affected, which could materially and adversely affect our business, financial condition, results of operations and growth strategy.

Therefore, our success depends on our ability to (i) develop and distribute new products and technologies that are attractive to farmers, our final consumers, (ii) control expenses without affecting sales, (iii) predict and effectively respond to the products, prices and marketing sold by our competitors, (iv) develop marketing programs that meet the needs and desires of farmers and (v) maintain an efficient marketing and distribution system. There can be no assurances that our sales or marketing strategies will continue to be effective or that the amount we invest in RTV training and marketing activities will result in a corresponding increase in sales of our products. If our sales and marketing initiatives are not successful, including our ability to leverage new digital channels, we will have incurred significant expenses without the benefit of higher revenues.