This is a confidential draft submission to the U.S. Securities and Exchange Commission pursuant to Section106(a) of the Jumpstart Our Business Startups Act of 2012 on [ ], 2023 and is not being filed publicly under the Securities Act of 1933, as amended.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

KINDLY MD, INC.

(Exact name of registrant as specified in its charter)

| Utah | | 8049 | | 84-3829824 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

230 W 400 South

Suite 201

Salt Lake City, UT 84104

(385) 388-8220

(Address and telephone number of registrant’s principal executive offices)

Timothy Pickett

Chief Executive Officer

230 W 400 South

Suite 201

Salt Lake City, UT 84194

(385)388-8220

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Callie T. Jones, Esq. | Richard A. Friedman, Esq. |

| Brunson Chandler & Jones, PLLC | Stephen Cohen, Esq. |

| 175 South Main Street, Suite 1410 | Sheppard, Mullin, Richter & Hampton LLP |

| Salt Lake City, UT 84111 | 30 Rockefeller Plaza |

| Tel.: (801) 303-5721 | New York, NY 10112-0015 |

| | Tel.: (212) 653-8700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| | |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | |

| | Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED [●], 2023 |

KINDLY MD, INC.

[ ] Units

Each Unit Consisting of One Share of Common Stock

One Warrant to Purchase One Share of Common Stock and

One Non-tradeable Warrant to Purchase One-half of One Share of Common Stock

This is the initial public offering of KindlyMD, Inc. (the “Company,” “KindlyMD,” “we,” “our,” or “us”). We are offering [ ] units (each a “Unit” and collectively, the “Units”), at an initial public offering price of $[ ] per Unit with each Unit consisting of one share of our common stock, no par value (“Common Stock”), one tradeable warrant (each, a “Tradeable Warrant,” collectively, the “Tradeable Warrants”) to purchase one share of Common Stock at an exercise price of $[ ] per share, and one non-tradeable warrant to purchase one-half of one share of Common Stock (each, a “Non-tradeable Warrant,” collectively, the “Non-tradeable Warrants”; together with the Tradeable Warrants, each a “Warrant,” collectively, the “Warrants”) at an anticipated exercise price of $[ ] per share. The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares of our Common Stock and the Warrants comprising the Units are immediately separable upon issuance and will be issued separately. The Warrants included in the Units will be exercisable immediately upon issuance, and will expire [●] years from the date of issuance. This offering also includes the shares of Common Stock issuable from time to time upon exercise of the Warrants. The Warrants will be issued in book-entry form pursuant to a warrant agency agreement between us and [●] as warrant agent.

Prior to this offering, there has been no public market for our Common Stock or Warrants. It is currently estimated that the initial public offering price will be between $ and $ per unit.

In connection with this offering, we have applied to have our Common Stock and Warrants listed on the Nasdaq Capital Market under the symbols “[ ]” and “[ ],” respectively. No assurance can be given that our listing application will be approved or, if we receive approval, that a trading market will develop, if developed, that it will be sustained. If our listing application is not approved by The Nasdaq Stock Market LLC (“Nasdaq”), we will not consummate the offering and will terminate this offering.

While we may be a “controlled company” under the rules of Nasdaq, immediately after consummation of this offering, we do not intend to avail ourselves of the corporate governance exemptions afforded to a “controlled company” under the rules of Nasdaq. See “Risk Factors—Risks Related to Our Common Stock and this Offering.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus. You should carefully consider these risk factors, as well as the information contained in this prospectus, before purchasing any of the securities offered by this prospectus.

| | | Per Unit | | | Total | |

| Offering price | | $ | [ ] | | | $ | [ ] | |

| Underwriter’s discounts and commissions (1) | | $ | [ ] | | | $ | [ ] | |

| Proceeds to our company before expenses | | $ | [ ] | | | $ | [ ] | |

| (1) | We have agreed to issue WallachBeth Capital, LLC, the representative of the underwriters (“WallachBeth” or the “Representative”), warrants to purchase shares of our Common Stock (the “Representative Warrants”), and to reimburse the underwriters for certain expenses. See “Underwriting” on page 61 for additional information regarding total underwriter compensation. |

We have granted the representative of the underwriters an option to purchase from us, at the public offering price, less the underwriting discounts and commissions, up to an additional shares of Common Stock and/or additional Tradeable Warrants to purchase shares of Common Stock, and/or Non-Tradeable Warrants to purchase shares of Common Stock, in any combination thereof, within 45 days from the date of this prospectus to cover over-allotments, if any.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The underwriters expect to deliver the securities against payment in New York, New York on or about __________________, 2023.

Sole Book-Running Manager

TABLE OF CONTENTS

Through and including __________________, 2023 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriter and with respect to their unsold allotments or subscriptions.

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares of Common Stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

You should rely only on the information contained in this prospectus. Neither we nor the placement agent have authorized anyone to provide any information or to make any representations other than those contained in this prospectus we have prepared. We take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date. You should also read this prospectus together with the additional information described under “Where You Can Find More Information.”

Unless the context otherwise requires, we use the terms “we,” “us,” “Company,” “KindlyMD,” “Kindly,” and “our” to refer to Kindly MD, Inc. and its consolidated subsidiaries.

Solely for convenience, our trademarks and tradenames referred to in this prospectus, may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights to these trademarks and tradenames. All other trademarks, service marks and trade names included or incorporated by reference into this prospectus, or the accompanying prospectus are the property of their respective owners.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our Common Stock. You should read the entire prospectus carefully, including the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our combined financial statements and the related notes thereto that are included elsewhere in this prospectus, before making an investment decision. Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “KindlyMD,” the “Company,” “we,” “us,” “Kindly,” and “our” refer to Kindly MD, Inc., and its subsidiaries.

Overview

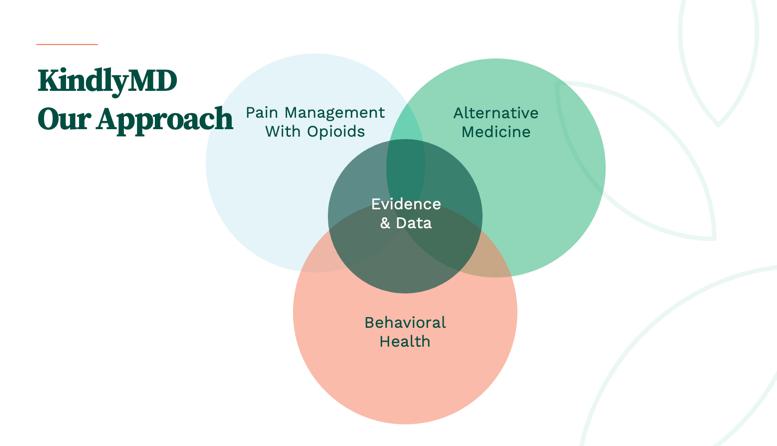

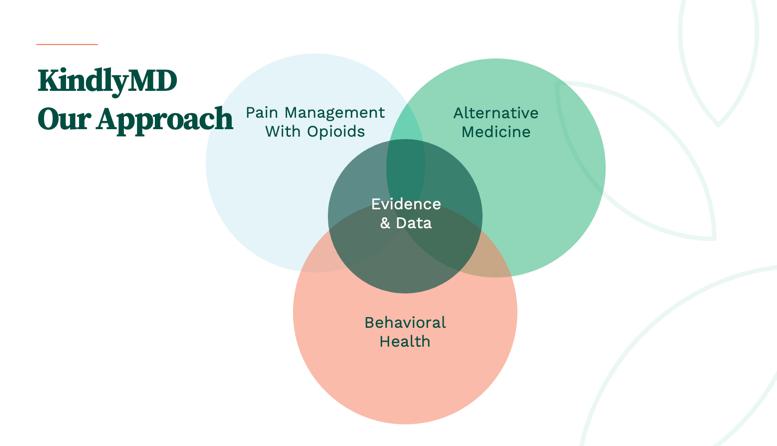

Kindly MD, Inc. (“We”, “Us”, “Company”, KindlyMD” or “Kindly”) is a Utah company formed in 2019. KindlyMD is a healthcare data company, focused on holistic pain management and ending the opioid epidemic. KindlyMD offers direct health care to patients integrating prescription medicine and behavioral health services to reduce opioid use in the chronic pain patient population. Kindly believes these methods will help prevent and reduce addiction and dependency on opiates. Our specialty outpatient clinical services are offered on a subscription and fee-for-service basis to augment traditional healthcare The Company offers evaluation and management, including, but not limited to chronic pain, functional medicine, cognitive behavioral therapy, intravenous infusion therapy, trauma and addiction therapy, recovery support services, overdose education efforts, peer support, limited urgent care, dermatology, preventative medicine, travel services, and hormone therapy. Through its focus on an imbedded model of prescriber and therapist teams, KindlyMD is working to develop patient-specific care programs with a specific mission to reduce opioid use in the patient population while successfully treating patients with effective and evidence based non-opioid alternatives in close conjunction with behavioral therapy.

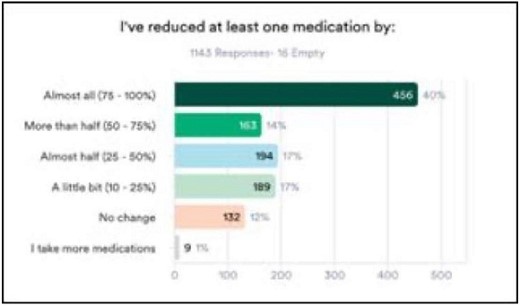

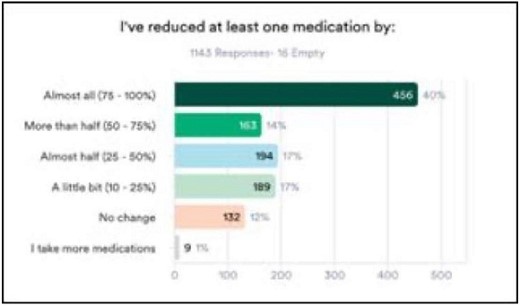

Beyond its treatment of patients, KindlyMD collects data focused on why and how patients turn to alternative treatments to reduce prescription medication use and addiction. The Company captures all relevant datapoints to assist and appropriately treat each individual patient. This also results in valuable data for the Company and the Company’s investors. We strive to become a source for evidence-based guidelines, data, treatment models, and education in the fight against the opioid crisis in America.

Business Revenue Streams

We operate across various revenue streams: (i) medical evaluation and treatment visits for chronic pain and illness, (ii) subscription outpatient medicine (pain clinic medicine and behavioral therapy), (iii) data collection and research, (iv) education partnerships, (vi) online and email campaign marketing revenue, (vii) service affiliate agreements, and (viii) retail sale of dietary supplements, and products.

Further information about our revenue streams can be found in the “Business” section on page 38.

Recent Developments

KindlyMD recently executed a four-year lease for 5,321 square feet of clinic and office space in Murray Utah. This expansion complements our existing clinic location in Millcreek Utah and offers eight more exam and consultation rooms to our local clinical capacity. It also allowed KindlyMD to consolidate a smaller location into a larger location, which will improve the cost-per-patient-visit ratio. We anticipate this expansion to increase revenue opportunity by up to $270,000 per month in the summer of 2023. This additional space coincides with the expansion of services offering to occur in the fall of 2022 to include medication management and imbedded behavioral health services for patients.

Market Opportunity

In the Utah market alone, KindlyMD has a unique opportunity for growth based on service line expansion into pain medicine management, and hormone therapy. Demand for both opioid and non-opioid pain treatment continues to increase due to the growing geriatric population, safe and effective access to non-opioid drugs, and increased prevalence of diagnoses such as osteoarthritis and migraines. Rising demand for surgeries, increasing awareness, availability of treatment options, and the willingness to seek treatment are expected to complement the growth of the population of patients seeking treatment for pain and/or chronic pain medication use. KindlyMD, already a large market share player in the Utah non-opioid treatment space, expects expansion of patients with the inclusion of opioid medication management.

Furthermore, the behavioral therapy industry is slated to grow with the integration of addiction and trauma based cognitive behavioral therapy (CBT) and inclusion of Ketamine and other infusion-based treatment options. Integration of these therapies with traditional pain management will provide a source of revenue as well as behavioral data and clinical research to develop valuable treatment programs, products, and further enhance legislative lobbying efforts toward wider acceptance of safe and effective non-opioid alternative therapies.

Growth Strategy

KindlyMD is leveraging healthcare standards and infrastructure to build a multi-state network of in-person clinics, telemedicine resources, and wholly owned subsidiaries in the pain treatment space. Our expansion approach considers metrics such as prescribing laws and regulations, rates of opioid prescriptions, inclusion of behavioral therapy outcomes, non-opioid alternative medicine access, including medical cannabis, and existing specialty clinic operations in each market. Our goal is to expand into other areas of Utah as well as five additional markets in 2023 through expansion of clinic locations and acquisitions.

KindlyMD collects valuable data from interactions with people online, via telecommunication, in-person patient interactions, and through our products. Clients provide some of this data directly, as do clinicians, and staff by collecting data about interactions, product and medication use, experiences, and behavior. In collecting data from these interactions, we collect and collate data from different contexts and third parties to provide a more seamless, consistent, and uniquely personalized experience, to make informed business decisions, to make clinical decisions, and for other legitimate business purposes. We intend to further use and analyze such data to allow us to become a large and specialized healthcare data company working to reduce opioid use, track product use and sales data, which will be highly valuable to the healthcare industry, the alternative medicine industry, and the pharmaceutical industry.

Competitive Strengths

KindlyMD is one of the largest providers of medical evaluation and management services related to treatment recommendations within the medical cannabis program in Utah. We operate with normative traditional medical standards and practices and set a high standard of care. Kindly MD with year over year profitability to-date, including during the COVID-19 Pandemic. Our leadership team is highly skilled in healthcare technology, customer service, patient care, and high-touch interactions. We value a culture of service to the patient above all.

Our model of healthcare is unique, blending prescribers and licensed behavioral health clinicians into every patient care plan while leveraging non-opioid alternative medicine where indicated. Although there are several large healthcare networks using an integrated model in low-income and high-risk population care, we know of no other large pain clinic in Utah or the US which uses this integration model combined with a willingness to incorporate non-traditional medicine. We are also one of a limited number of specialty providers who allow patients to utilize non-opioid alternative medications, such as medical cannabis, concomitantly with opioids with medical supervision by a licensed integration team.

Our competition, respectively, are traditional medication pain clinics as well as other non-opioid specialty alternative medicine clinics in Utah.

Corporate Information

Our principal executive offices are located at 230 W 400 S, Suite 201 Salt Lake City, UT 84104. Our telephone number is (385)388-8220. Our corporate website address is located at www.kindlymd.com. The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus.

Impact of COVID-19 Pandemic

The recent outbreak of COVID-19 has spread across the globe and is impacting worldwide economic activity. In response to the COVID-19 pandemic, during 2020 and 2021, the Company established policies and protocols to address safety considerations. The extent to which the COVID-19 pandemic will continue to affect the Company’s business, financial condition, liquidity, and the Company’s operating results will depend on future developments, which are highly uncertain and cannot be predicted. It will depend on various factors including the duration and severity of the outbreak, the severity, or variants of COVID-19, including the omicron variant and its subvariants, and the effectiveness, acceptance, and availability of vaccines in countries throughout the world, and new information which may emerge concerning the appropriate responses if and to the extent that the availability of vaccines reduces restrictions imposed during the pandemic.

Inflation Risk

We do not believe that inflation has had a material effect on our business, results of operations, or financial condition. Nonetheless, if our costs were to become subject to significant inflationary pressures, we may not be able to fully offset such higher costs. Our inability or failure to do so could harm our business, results of operations, or financial condition.

Implications of Being a Smaller Reporting Company

As a smaller reporting company, we are eligible for exemptions from various reporting requirements applicable to other public companies that are not smaller reporting companies, including, but not limited to:

| | ● | Reduced disclosure obligations (e.g., matters regarding executive compensation) in our periodic reports, proxy statements and registration statements; and |

| | | |

| | ● | Not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). |

We will remain a smaller reporting company until the end of the fiscal year in which (i) we have a public common equity float of more than $250 million, or (ii) we have annual revenues for the most recently completed fiscal year of more than $100 million plus we have a public common equity float or public float of more than $700 million. We also would not be eligible for status as smaller reporting company if we become an investment company, an asset-backed issuer or a majority-owned subsidiary of a parent company that is not a smaller reporting company.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our shareholders may be different from what you might receive from other public reporting companies in which you hold equity interests.

THE OFFERING

| Issuer: | | Kindly MD, Inc. |

| | | |

| Securities offered(1): | | [ ] Units, at a public offering price of $[ ] per Unit, each consisting of (i) one share of Common Stock, (ii) one Tradeable Warrant to purchase one share of Common Stock and (iii) one Non-tradeable Warrant to purchase one-half of one share of Common Stock. The Units will not be certificated or issued in stand-alone form. The shares of our Common Stock and the Warrants comprising the Units are immediately separable upon issuance and will be issued separately; but will be purchased together in this offering. |

| Description of Warrants included in Units: | | Each Unit consists of one share of Common Stock and two Warrants: one Tradeable Warrant to purchase one share of Common Stock and one Non-tradeable Warrant to purchase one-half of one share of Common Stock. The exercise price of the Tradeable Warrants is $[●] per share ([●]% of the public offering price per Unit), and the exercise price of the Non-tradeable Warrant iswhole $[ ] per share ([ ]% of the public offering price per one Unit). Each Warrant will be exercisable immediately upon issuance and will expire five years after the initial issuance date. The terms of the Warrants will be governed by a warrant agency agreement, dated as of the effective date of this offering, between us and [●], Inc. as the warrant agent (the “Warrant Agent”). This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise of the Warrants. For more information regarding the Warrants, you should carefully read the section titled “Description of Our Securities—Warrants” in this prospectus. |

| | | |

| Over-allotment option | | We have granted the underwriters an option for a period of up to 45 days to purchase, at the public offering price, less underwriting discounts and commissions, up to shares of additional Common Stock, and/or Tradeable Warrants to purchase an additional shares of Common Stock, and/or Non-tradeable Warrants to purchase an additional shares of Common Stock, or any combination of additional shares of Common Stock and Warrants, representing, in the aggregate, up to [ ]% of the number of Units sold in this offering to cover over-allotments, if any. |

| | | |

| Common Stock outstanding before this offering: | | 4,434,596 shares |

| | | |

| Common Stock outstanding after the offering(2): | | [ ] shares (assuming that none of the Warrants are exercised) or shares if the Warrants offered hereby are exercised in full. If the underwriters exercise in full the over-allotment option to purchase an additional shares of Common Stock and/or Warrants to purchase an additional shares of Common Stock, the total number of shares of Common Stock immediately after this offering would be shares (assuming that none of the Warrants are exercised) or shares if the Warrants offered hereby are exercised in full, subject to the assumptions set forth below. |

| | | |

| Use of proceeds: | | We estimate that the net proceeds to us from this offering will be approximately $[ ] million, or approximately $[●] million if the underwriters exercise their over-allotment option in full, assuming an offering price of $[●] per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering primarily for general corporate purposes, including capital expenditures, labor, real estate, marketing and sales, technology development, and other expenses. See “Use of Proceeds” for additional information. |

| | | |

| Underwriters’ compensation: | | In connection with this offering, the underwriters will receive an underwriting discount equal to 9% of the gross proceeds from the sale of Units in the offering. We will also reimburse the underwriters for certain out-of-pocket actual expenses related to the offering and pay them 1.5% of the aggregate sales price sold in the Offering as non-accountable expenses. For additional information regarding our arrangement with the underwriters, please see “Underwriting.” |

| | | |

| Representative Warrants: | | Upon the closing of this offering, we have agreed to issue to WallachBeth warrants that will expire on the fifth anniversary of the commencement date of sales in this offering, entitling the representative to purchase 6% of the number of shares of Common Stock sold in this offering will have an exercise price equal to 115% of the public offering price per Unit set forth on the cover page of this prospectus (or $[ ] per share, which is the midpoint of the price range set forth on the cover page of this prospectus), will provide for a “cashless” exercise, and will contain certain antidilution adjustments (but excluding any price based antidilution). For additional information regarding the representative’s warrants, see “Underwriting—Representative’s Warrants”. |

| Proposed Nasdaq Capital Market trading symbol and listing: | | We have applied to the Nasdaq Capital Market to list our Common Stock under the symbol “[ ]” and our Tradeable Warrants under the symbol “[ ].” No assurance can be given that our listing application will be approved. |

| | | |

| Dividend policy: | | We have not historically paid dividends on our Common Stock and do not anticipate paying dividends on our Common Stock for the foreseeable future. |

| | | |

Transfer agent/Warrant Agent: | | VStock Transfer, LLC |

| | | |

| Risk factors: | | See “Risk Factors” beginning on page 10 and the other information contained in this prospectus for a discussion of factors you should carefully consider before investing in our securities. |

| (1) | The actual number of Units we will offer and the actual price per Unit will be determined based on the actual public offering. |

| (2) | The total number of shares of Common Stock that will be outstanding after this offering is based on 4,434,956 shares of Common Stock outstanding as of April 25; 2023. Unless otherwise indicated, the shares outstanding after this offering excludes the following: |

| | ● | [●] shares of our Common Stock issuable upon the exercise of the Tradeable Warrants, and/or the exercise of Non-tradeable Warrants to be issued as part of the Units; |

| | | |

| | ● | [●] shares of our Common Stock issuable upon exercise of the Representative Warrants. |

Except as otherwise indicated herein, all information in this prospectus assumes, including the number of shares of common stock that will be outstanding after this offering, assumes or gives effect to

| | ● | no exercise by the underwriters of their option to purchase an additional [●] shares of common stock and/or Warrant; |

| | | |

| | ● | no exercise of outstanding options after; |

SUMMARY OF CONSOLIDATED FINANCIAL INFORMATION

The following table summarizes our financial data. The following summary consolidated statements of operations and balance sheet data for the fiscal years ended December 31, 2022 and 2021, have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The historical financial data presented below is not necessarily indicative of our financial results in future periods. You should read the summary consolidated financial data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles, or U.S. GAAP. Our consolidated financial statements have been prepared on a basis consistent with our audited financial statements and include all adjustments, consisting of normal and recurring adjustments that we consider necessary for a fair presentation of the financial position and results of operations as of and for such periods.

Statement of Operations Data:

| | | For the Years Ended

December 31, | |

| | | 2022 | | | 2021 | |

| | | | | | | |

| REVENUE | | $ | 3,787,077 | | | $ | 2,504,319 | |

| | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | |

| Costs of goods sold | | | 152,385 | | | | 87,124 | |

| General and administrative | | | 2,151,563 | | | | 853,582 | |

| Personnel | | | 4,176,542 | | | | 1,502,273 | |

| TOTAL OPERATING EXPENSES | | | 6,480,490 | | | | 2,442,979 | |

| | | | | | | | | |

| INCOME (LOSS) FROM OPERATIONS | | | (2,693,413 | ) | | | 61,340 | |

| | | | | | | | | |

| OTHER INCOME (EXPENSE) | | | | | | | | |

| Other income and expense | | | 152,820 | | | | 87,996 | |

| | | | | | | | | |

| TOTAL OTHER INCOME (EXPENSE) | | | 152,820 | | | | 87,996 | |

| | | | | | | | | |

| INCOME (LOSS) BEFORE INCOME TAXES | | | (2,540,593 | ) | | | 149,336 | |

| | | | | | | | | |

| Provision for income taxes | | | - | | | | - | |

| NET INCOME (LOSS) | | $ | (2,540,593 | ) | | $ | 149,336 | |

| | | | | | | | | |

| NET INCOME (LOSS) PER COMON SHARE-BASIC AND DILUTED | | $ | (1.56 | ) | | $ | - | |

| | | | | | | | | |

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING – BASIC AND DILUTED | | | 1,623,386 | | | | - | |

1 See Note to our financial statements for an explanation of the method used to compute basic and diluted net loss per share.

Balance Sheet Data:

| | | December 31, 2022

(unaudited) | |

| | | Actual | | | Pro

Forma | | | Pro Forma,

As Adjusted(1)(2) | |

| Cash and cash equivalents | | $ | 186,918 | | | $ | | | | $ | | |

| Working capital | | $ | (40,506 | ) | | | | | | | | |

| Total assets | | $ | 1,001,269 | | | | | | | | | |

| Total liabilities | | $ | 620,255 | | | | | | | | | |

| Accumulated deficit | | $ | (2,540,593 | ) | | | | | | | | |

| Total stockholders’ equity | | $ | 381,014 | | | | | | | | | |

1 On a pro forma as adjusted basis to give further effect to our issuance and sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range listed on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

2 Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the price range listed on the cover page of this prospectus, would increase (decrease) the pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders’ equity (deficit) by approximately $ , assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 1.0 million shares in the number of shares offered by us at the assumed initial public offering price per share, the midpoint of the price range listed on the cover page of this prospectus, would increase (decrease) the pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders’ equity (deficit) by approximately $ .

RISK FACTORS

An investment in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks that are described in this section You should also read the sections entitled “Cautionary Note Regarding Forward-Looking Statements” on page 24 of this prospectus. Additional risks not presently known or that we currently deem immaterial could also materially and adversely affect us. You should consult your own financial and legal advisors as to the risks entailed by an investment in our securities and the suitability of investing in our securities in light of your particular circumstances. If any of the risks contained in this prospectus develop into actual events, our assets, business, cash flows, condition (financial or otherwise), credit quality, financial performance, liquidity, long-term performance goals, prospects, and/or results of operations could be materially and adversely affected, the trading price of our Common Stock could decline and you may lose all or part of your investment. Some statements in this prospectus, including such statements in the following risk factors, constitute forward-looking statements.

The Company operates in an environment that involves many risks and uncertainties. The risks and uncertainties described in this section are not the only risks and uncertainties that we face. Additional risks and uncertainties that presently are not considered material or are not known to us, and therefore are not mentioned herein, may impair our business operations. If any of the risks described actually occur, our business, operating results, financial position, and value of our securities could be adversely affected.

RISKS RELATED TO OUR BUSINESS

The novel coronavirus (COVID-19) pandemic may have unexpected effects on our business, financial condition and results of operations.

In March 2020, the World Health Organization declared COVID-19 a global pandemic, and governmental authorities around the world have implemented measures to reduce the spread of COVID-19. These measures have adversely affected workforces, customers, supply chains, consumer sentiment, economies, and financial markets, and, along with decreased consumer spending, have led to an economic downturn across many global economies.

The COVID-19 pandemic has rapidly escalated in the United States, creating significant uncertainty and economic disruption, and leading to record levels of unemployment nationally. Numerous state and local jurisdictions have imposed, and others in the future may impose, shelter-in-place orders, quarantines, shut-downs of non-essential businesses, and similar government orders and restrictions on their residents to control the spread of COVID-19. Such orders or restrictions have resulted in temporary facility closures (including certain of our third-party VRCs), work stoppages, slowdowns and travel restrictions, among other effects, thereby adversely impacting our operations. In addition, we expect to be impacted by a downturn in the United States economy, which could have an adverse impact on discretionary consumer spending and may have a significant impact on our business operations and/or our ability to generate revenues and profits.

In response to the COVID-19 disruptions, we have implemented a number of measures designed to protect the health and safety of our staff and contractors. These measures include restrictions on non-essential business travel, the institution of work-from-home policies wherever feasible and the implementation of strategies for workplace safety at our facilities that remain open. We are following the guidance from public health officials and government agencies, including implementation of enhanced cleaning measures, social distancing guidelines and wearing of masks.

The extent to which COVID-19 ultimately impacts our business, financial condition and results of operations will depend on future developments, which are highly uncertain and unpredictable, including new information which may emerge concerning the severity and duration of the COVID-19 outbreak and the effectiveness of actions taken to contain the COVID-19 outbreak or treat its impact, among others. Additionally, while the extent to which COVID-19 ultimately impacts our operations will depend on a number of factors, many of which will be outside of our control. The COVID-19 outbreak is evolving and new information emerges daily; accordingly, the ultimate consequences of the COVID-19 outbreak cannot be predicted with certainty.

In addition to the COVID-19 disruptions possibility adversely impacting our business and financial results, they may also have the effect of heightening many of the other risks described in “Risk Factors,” including risks relating to changes due to our limited operating history; our ability to generate sufficient revenue, to generate positive cash flow; our relationships with third parties, and many other factors. We will endeavor to minimize these impacts, but there can be no assurance relative to the potential impacts that may be incurred.

Uncertainty of profitability

Our business strategy may result in meaningful volatility of revenues, loses and/or earnings. As we will only develop a limited number of business efforts, services and products at a time, our overall success will depend on a limited number of business initiatives, which may cause variability and unsteady profits and losses depending on the products and/or services offered and their market acceptance.

Our revenues and our profitability may be adversely affected by economic conditions and changes in the market for our products and/or services. Our business is also subject to general economic risks that could adversely impact the results of operations and financial condition.

We may not be able to continue our business as a going concern.

Management plans to raise additional capital through the sale of shares of Common Stock to pursue business development activities, but there are no assurances of success relative to the efforts.

Because of the anticipated nature of the services that we offer and attempt to develop, it is difficult to accurately forecast revenues and operating results and these items could fluctuate in the future due to a number of factors. These factors may include, among other things, the following:

| ● | Our ability to raise sufficient capital to take advantage of opportunities and generate sufficient revenues to cover expenses. |

| | | |

| ● | Our ability to source strong opportunities with sufficient risk adjusted returns. |

| | | |

| ● | Our ability to manage our capital and liquidity requirements based on changing market conditions. |

| | | |

| ● | The amount and timing of operating and other costs and expenses. |

| | | |

| ● | The nature and extent of competition from other companies that may reduce market share and create pressure on pricing and investment return expectations. |

Our business may suffer if we are unable to attract or retain talented personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion, integrity, and good faith of Management, as well as other personnel. We have a small management team, and the loss of a key individual or our inability to attract suitably qualified replacements or additional staff could adversely affect our business. Our success also depends on the ability of Management to form and maintain key commercial relationships within the marketplace. No assurance can be given that key personnel will continue their association or employment with us or that replacement personnel with comparable skills will be found. If we are unable to attract and retain key personnel and additional employees, our business may be adversely affected. We do not maintain key-man life insurance on any of our executive employees.

The loss of key Management personnel could adversely affect our business.

We depend on the continued services of our executive officer and senior consulting team and are responsible for our day-to-day operations. Our success depends in part on our ability to retain executive officers, to compensate executive officers at attractive levels, and to continue to attract additional qualified individuals to our management team. Although we have entered into an employment agreement with our Chief Executive Officer, and do not believe our Chief Executive Officer is planning to leave or retire in the near term, we cannot assure you that he will remain with us. The loss or limitation of the services of any of our executives or members of our senior management team, or the inability to attract additional qualified management personnel, could have a material adverse effect on our business, financial condition, results of operations, or independent associate relations.

The lack of available and cost-effective directors and officer’s insurance coverage in our industry may cause us to be unable to attract and retain qualified executives, and this may result in our inability to further develop our business.

Our business depends on attracting independent directors, executives, and senior management to advance our business plans. We currently do not have directors and officer’s insurance to protect our directors, officers, and the company against the possible third-party claims. This is due to the significant lack of availability of such policies in the cannabis industry at reasonably competitive prices. As a result, the Company and our executive directors and officers are susceptible to liability claims arising by third parties, and as a result, we may be unable to attract and retain qualified independent directors and executive management causing the development of our business plans to be impeded as a result.

Management of growth will be necessary for us to be competitive.

Successful expansion of our business will depend on our ability to effectively attract and manage staff, strategic business relationships, and shareholders. Specifically, we will need to hire skilled management and technical personnel as well as manage partnerships to navigate shifts in the general economic environment. Expansion has the potential to place significant strains on financial, management, and operational resources, yet failure to expand will inhibit our profitability goals.

The failure to enforce and maintain our intellectual property rights could adversely affect the value of the Company.

The success of our business will partially depend on our ability to protect our intellectual property. As of the date hereof, we do not own any federally registered patents or trademarks. The unauthorized use of our intellectual property could diminish the value of our business, which would have a material adverse effect on our financial condition and results of operation.

Laws and regulations affecting the medical marijuana industry are constantly changing, which could detrimentally affect our operation.

Local, state, and federal medical marijuana laws and regulations are broad in scope and subject to evolving interpretations, which could require us to incur substantial costs associated with compliance or alter certain aspects of our business plan. In addition, violations of these laws, or allegations of such violations, could disrupt certain aspects of our business plan and result in a material adverse effect on certain aspects of our planned operations. In addition, it is possible that regulations may be enacted in the future that will be directly applicable to certain aspects of our businesses. We cannot predict the nature of any future laws, regulations, interpretations, or applications, nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on our business.

If we incur substantial liability from litigation, complaints, or enforcement actions, our financial condition could suffer.

Our participation in the medical marijuana industry may lead to litigation, formal or informal complaints, enforcement actions, and inquiries by various federal, state, or local governmental authorities against us. Litigation, complaints, and enforcement actions could consume considerable amounts of financial and other corporate resources, which could have a negative impact on our sales, revenue, profitability, and growth prospects.

There can be no assurance that our current and future strategic alliances or expansions of scope of existing relationships will have a beneficial impact on our business, financial condition and results of operations.

We may enter into strategic alliances and partnerships with third parties that we believe will complement or augment our existing business. Our ability to complete strategic alliances is dependent upon, and may be limited by, the availability of suitable candidates and capital. In addition, strategic alliances could present unforeseen integration obstacles or costs, may not enhance our business and may involve risks that could adversely affect us, including significant amounts of management time that may be diverted from operations in order to pursue and complete such transactions or maintain such strategic alliances. Future strategic alliances could result in the incurrence of additional debt, costs and contingent liabilities, and there can be no assurance that future strategic alliances will achieve, or that our existing strategic alliances will continue to achieve, the expected benefits to our business or that we will be able to consummate future strategic alliances on satisfactory terms, if at all. Any of the foregoing could have a material adverse effect on our business, financial condition and results of operations.

We may be subject to growth-related risks.

We may be subject to growth-related risks, including capacity constraints and pressure on our internal systems and controls. Our ability to manage growth effectively will require us to continue to implement and improve our operational and financial systems and to expand, train and manage our employee base. Our inability to deal with this growth may have a material adverse effect on our business, prospects, revenue, results of operation and financial condition.

We may be subject to litigation.

We may become party to litigation from time to time in the ordinary course of business, which could adversely affect our business. Should any litigation in which we become involved be determined against us, such a decision could adversely affect our ability to continue operating and could potentially use significant resources. Even if we are involved in litigation and win, litigation can redirect significant resources of Kindly MD Inc. and/or its subsidiaries.

We may face unfavorable publicity or consumer perception.

Management believes the pain management, cannabis, and alternative medicine industry is highly dependent upon consumer perception regarding the safety, efficacy and quality of the treatment offered and outcomes produced. Consumer perception of our services may be significantly influenced by scientific research or findings, regulatory investigations, litigation, media attention and other publicity regarding opioids, cannabis, as well as alternative medicine services. There can be no assurance that future scientific research, findings, regulatory proceedings, litigation, media attention or other research findings or publicity will be favorable to the prescription medicine, behavioral therapy industry, cannabis, or alternative medicine market or any particular product, or consistent with earlier publicity. Future research reports, findings, regulatory proceedings, litigation, media attention or other publicity that is perceived as less favorable than, or questions earlier research reports, findings or publicity could have a material adverse effect on the demand for our services. Our dependence upon consumer perceptions means that such adverse reports, whether or not accurate or with merit, could ultimately have a material adverse effect on our business, results of operations, financial condition and cash flows. Further, adverse publicity reports or other media attention regarding the safety, efficacy and quality of treatments in general, or our services specifically, or associating the consumption of prescription or non-prescription medications, cannabis, or any other products with illness or other negative effects or events, could have such a material adverse effect.

We are subject to general economic risks.

Our operations could be affected by the economic context should the unemployment level, interest rates or inflation reach levels that influence consumer trends and spending and, consequently, impact our sales and profitability.

Provisions in our governing documents and Utah law may have an anti-takeover effect, and there are substitutional regulatory limitations on changes of control of bank holding companies.

Our corporate organizational documents and provisions of federal and state law to which we are subject contain certain provisions that could have an anti-takeover effect and may delay, make more difficult or prevent an attempted acquisition that you may favor or an attempted replacement of our board of directors or management.

RISKS OF GOVERNMENT ACTION AND REGULATORY UNCERTAINTY

Our use, disclosure, and other processing of personal information, including health information, is subject to the Health Insurance Portability and Accountability Act (HIPAA), and other federal, state, and foreign data privacy and security laws and regulations, and our failure to comply with those laws and regulations or to appropriately secure the information we hold could result in significant liability or reputational harm and, in turn, a material adverse effect on our client base, customer base and revenue.

In the course of offering personalized health and wellness recommendations, we collect a substantial amount of personalized health information. Numerous state and federal laws and regulations govern the collection, dissemination, use, privacy, confidentiality, security, availability, integrity and other processing of protected health information (PHI), and other types of personal information. For example, HIPAA establishes a set of national privacy and security standards for the protection PHI by health plans, healthcare clearinghouses and certain healthcare providers, referred to as covered entities, and the business associates with whom such covered entities contract for services, as well as their covered subcontractors. When we act in the capacity of a business associate under HIPAA, we execute business associate agreements with our clients.

HIPAA requires covered entities and business associates, such as us, to develop and maintain policies and procedures with respect to PHI that is used or disclosed, including the adoption of administrative, physical and technical safeguards to protect such information.

Violations of HIPAA may result in significant civil and criminal penalties. HIPAA also authorizes state attorneys general to file suit on behalf of their residents. Courts may award damages, costs and attorneys’ fees related to violations of HIPAA in such cases. While HIPAA does not create a private right of action allowing individuals to sue us in civil court for violations of HIPAA, its standards have been used as the basis for duty of care in state civil suits such as those for negligence or recklessness in the misuse or breach of duties related to PHI.

In addition, HIPAA mandates that the Secretary of HHS conduct periodic compliance audits of HIPAA covered entities and business associates for compliance with the HIPAA privacy and security rules.

HIPAA further requires that patients be notified of any unauthorized acquisition, access, use or disclosure of their unsecured PHI that compromises the privacy or security of such information, with certain exceptions related to unintentional or inadvertent use or disclosure by employees or authorized individuals. HIPAA requires such notifications to be made “without unreasonable delay and in no case later than 60 calendar days after discovery of the breach.” If a breach affects 500 patients or more, it must be reported to HHS without unreasonable delay, and HHS will post the name of the breaching entity on its public web site. Breaches affecting 500 patients or more in the same state or jurisdiction must also be reported to the local media. If a breach involves fewer than 500 people, the covered entity must record it in a log and notify HHS at least annually.

In addition to HIPAA, numerous other federal, state, and foreign laws and regulations protect the confidentiality, privacy, availability, integrity and security of health-related and other personal information. These laws and regulations in many cases are more restrictive than, and may not be preempted by, HIPAA and its implementing rules. These laws and regulations are often uncertain, contradictory, and subject to changed or differing interpretations, and we expect new laws, rules and regulations regarding privacy, data protection, and to be proposed and enacted in the future. Further, many state attorneys general are interpreting existing federal and state consumer protection laws to impose evolving standards for the online collection, use, dissemination and security of health-related and other personal information. Courts may also adopt the standards for fair information practices promulgated by the FTC, which concern consumer notice, choice, security and access. Consumer protection laws require us to publish statements that describe how we handle personal information and choices individuals may have about the way we handle their personal information. If such information that we publish is considered untrue, we may be subject to government claims of unfair or deceptive trade practices, which could lead to significant liabilities and consequences. Furthermore, according to the FTC, violating consumers’ privacy rights or failing to take appropriate steps to keep consumers’ personal information secure may constitute unfair acts or practices in or affecting commerce in violation of Section 5(a) of the FTC Act.

We may become subject to the Anti-Kickback Statute, Stark Law, False Claims Act, Civil Monetary Penalties Law and may be subject to analogous provisions of applicable state laws and could face substantial penalties if we fail to comply with such laws.

There are several federal laws addressing fraud and abuse that apply to businesses that receive reimbursement from a federal health care program. There are also a number of similar state laws covering fraud and abuse with respect to, for example, private payors, self-pay and insurance. Currently, we receive a substantial percentage of our revenue from private payors and from Medicare. Accordingly, our business is subject to federal fraud and abuse laws, such as the Anti-Kickback Statute, the Stark Law, the False Claims Act, the Civil Monetary Penalties Law and other similar laws. Moreover, we are already subject to similar state laws. We believe we have operated, and intend to continue to operate, our business in compliance with these laws. However, these laws are subject to modification and changes in interpretation and are enforced by authorities vested with broad discretion. Federal and state enforcement entities have significantly increased their scrutiny of healthcare companies and providers which has led to investigations, prosecutions, convictions and large settlements. We continually monitor developments in this area. If these laws are interpreted in a manner contrary to our interpretation or are reinterpreted or amended, or if new legislation is enacted with respect to healthcare fraud and abuse, illegal remuneration, or similar issues, we may be required to restructure our affected operations to maintain compliance with applicable law. There can be no assurances that any such restructuring will be possible or, if possible, would not have a material adverse effect on our results of operations, financial position, or cash flows.

Anti-Kickback Statute

A federal law commonly referred to as the “Anti-Kickback Statute” prohibits the knowing and willful offer, payment, solicitation or receipt of remuneration, directly or indirectly, in return for the referral of patients or arranging for the referral of patients, or in return for the recommendation, arrangement, purchase, lease or order of items or services that are covered, in whole or in part, by a federal healthcare program such as Medicare or Medicaid. The term “remuneration” has been broadly interpreted to include anything of value such as gifts, discounts, rebates, waiver of payments or providing anything at less than its fair market value. The Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act, or the PPACA, amended the intent requirement of the Anti-Kickback Statute such that a person or entity can be found guilty of violating the statute without actual knowledge of the statute or specific intent to violate the statute. Further, the PPACA now provides that claims submitted in violation of the Anti-Kickback Statute constitute false or fraudulent claims for purposes of the federal False Claims Act, or FCA, including the failure to timely return an overpayment. Many states have adopted similar prohibitions against kickbacks and other practices that are intended to influence the purchase, lease or ordering of healthcare items and services reimbursed by a governmental health program or state Medicaid program. Some of these state prohibitions apply to remuneration for referrals of healthcare items or services reimbursed by any third-party payor, including commercial payors and self-pay patients.

Stark Law

Section 1877 of the Social Security Act, or the Stark Law, prohibits a physician from referring a patient to an entity for certain “designated health services” reimbursable by Medicare if the physician (or close family members) has a financial relationship with that entity, including an ownership or investment interest, a loan or debt relationship or a compensation relationship, unless an exception to the Stark Law is fully satisfied. The designated health services covered by the law include, among others, laboratory and imaging services. Some states have self-referral laws similar to the Stark Law for Medicaid claims and commercial claims.

Violation of the Stark Law may result in prohibition of payment for services rendered, a refund of any Medicare payments for services that resulted from an unlawful referral, $15,000 civil monetary penalties for specified infractions, criminal penalties, and potential exclusion from participation in government healthcare programs, and potential false claims liability. The repayment provisions in the Stark Law are not dependent on the parties having an improper intent; rather, the Stark Law is a strict liability statute and any violation is subject to repayment of all amounts arising out of tainted referrals. If physician self-referral laws are interpreted differently or if other legislative restrictions are issued, we could incur significant sanctions and loss of revenues, or we could have to change our arrangements and operations in a way that could have a material adverse effect on our business, prospects, damage to our reputation, results of operations and financial condition.

False Claims Act

The FCA prohibits providers from, among other things, (1) knowingly presenting or causing to be presented, claims for payments from the Medicare, Medicaid or other federal healthcare programs that are false or fraudulent; (2) knowingly making, using or causing to be made or used, a false record or statement to get a false or fraudulent claim paid or approved by the federal government; or (3) knowingly making, using or causing to be made or used, a false record or statement to avoid, decrease or conceal an obligation to pay money to the federal government. The “qui tam” or “whistleblower” provisions of the FCA allow private individuals to bring actions under the FCA on behalf of the government. These private parties are entitled to share in any amounts recovered by the government, and, as a result, the number of “whistleblower” lawsuits that have been filed against providers has increased significantly in recent years. Defendants found to be liable under the FCA may be required to pay three times the actual damages sustained by the government, plus civil penalties ranging between $5,500 and $11,000 for each separate false claim.

There are many potential bases for liability under the FCA. The government has used the FCA to prosecute Medicare and other government healthcare program fraud such as coding errors, billing for services not provided, and providing care that is not medically necessary or that is substandard in quality. The PPACA also provides that claims submitted in connection with patient referrals that result from violations of the Anti-Kickback Statute constitute false claims for the purpose of the FCA, and some courts have held that a violation of the Stark law can result in FCA liability, as well. In addition, a number of states have adopted their own false claims and whistleblower provisions whereby a private party may file a civil lawsuit in state court. We are required to provide information to our employees and certain contractors about state and federal false claims laws and whistleblower provisions and protections.

Civil Monetary Penalties Law

The Civil Monetary Penalties Law prohibits, among other things, the offering or giving of remuneration to a Medicare or Medicaid beneficiary that the person or entity knows or should know is likely to influence the beneficiary’s selection of a particular provider or supplier of items or services reimbursable by a federal or state healthcare program. This broad provision applies to many kinds of inducements or benefits provided to patients, including complimentary items, services or transportation that are of more than a nominal value. This law could affect how we have to structure our operations and activities.

RISK ASSOCIATED WITH OUR INDUSTRY

Our business and financial performance may be adversely affected by downturns in the target markets that we serve or reduced demand for the types of services we offer.

Demand for our services is often affected by general economic conditions as well as trends in our target markets. These changes may result in decreased demand for our services. The occurrence of these conditions is beyond our ability to control and, when they occur, they may have a significant impact on our results of operations. The inability or unwillingness of our customers to pay a premium for our services due to general economic conditions or a downturn in the economy may have a significant adverse impact on results of operations.

Changes within the cannabis industry or the opioid industry may adversely affect our financial performance.

Changes in the identity, ownership structure and strategic goals of our competitors and the emergence of new competitors in our target markets may harm our financial performance.

The Company’s industry is highly competitive, and we have less capital and resources than many of our competitors which may give them an advantage in marketing services similar to ours or make our services obsolete.

We are involved in a highly competitive industry where we may compete with numerous other companies who offer alternative methods or approaches, who may have far greater resources, more experience, and personnel perhaps more qualified than we do. Such resources may give our competitors an advantage in developing and marketing services similar to ours or services that make our services less desirable to consumers or obsolete. There can be no assurance that we will be able to successfully compete against these other entities.

We may be unable to respond to the rapid technological change in the industry and such change may increase costs and competition that may adversely affect our business.

Rapidly changing technologies, frequent new product and service introductions and evolving industry standards characterize our market. Intense competition in our industry exacerbates these market characteristics. Our future success will depend on our ability to adapt to rapidly changing technologies by continually improving the performance features and reliability of our services. We may experience difficulties that could delay or prevent the successful development, introduction or marketing of our services. In addition, any new enhancements must meet the requirements of our current and prospective customers and must achieve significant market acceptance. We could also incur substantial costs if we need to modify our services or infrastructures to adapt to these changes.

RELATED TO OUR COMMON STOCK

We may need additional capital that will dilute the ownership interest of investors.

We may require additional capital to fund our future business operations. If we raise additional funds through the issuance of equity, equity-related or convertible debt securities, these securities may have rights, preferences or privileges senior to those of the rights of holders of our shares of common stock, who may experience dilution of their ownership interest of our shares of Common Stock. We cannot predict whether additional financing will be available to us on favorable terms when required, or at all. The issuance of additional shares of Common Stock by our board of directors may have the effect of further diluting the proportionate equity interest and voting power of holders of our shares of Common Stock.

We will be controlled by existing shareholders.

Our directors and officers currently in place control a significant portion of our shares. Thus, they will continue to oversee the Company’s operations. As a result, our directors and officers will likely have a significant influence on the affairs and management of the Company, as well as on all matters requiring stockholder approval, including electing and removing members of its board of directors, causing the Company to engage in transactions with affiliated entities, causing or restricting the sale or merger of the Company and changing the company’s dividend policy. Such concentration of ownership and control could have the effect of delaying, deferring, or preventing a change in control of the Company, even when such a change of control would be in the best interests of the company’s other stockholders.

Our voting control is concentrated.

Our senior executives exercise a significant majority of the voting power with respect to our outstanding shares. These executives potentially have the ability to control the outcome of matters submitted to our shareholders for approval, including the election and removal of directors and any arrangement or sale of all or substantially all of our assets.

This concentrated control could delay, defer or prevent a change of control, arrangement or merger or sale of all or substantially all of our assets that our other shareholders may support. Conversely, this concentrated control could allow the holders of the majority of the shares to consummate such a transaction that our other shareholders do not support.

If you purchase Common Stock in this offering, you will incur immediate and substantial dilution in the book value of your shares.

The offering price of the Common Stock is substantially higher than the net tangible book value per share of our Common Stock (attributing no value to the Warrants). Therefore, if you purchase Common Stock in this offering, you will pay a price per share that substantially exceeds our net tangible book value per share after this offering. To the extent outstanding options or warrants are exercised, you will incur further dilution. Based on an assumed offering price of $[ ] per share, which is the midpoint of the price range set forth on the cover page of this prospectus, you will experience immediate dilution of $[ ] per share, representing the difference between our pro forma net tangible book value per share of Common Stock after giving effect to this offering and the offering price. See “Dilution” for further information.

The Warrants are speculative in nature.

The Warrants do not confer any rights of Common Stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of Common Stock at a fixed price. Specifically, each Tradeable Warrant will have an exercise price equal to $ , and each Non-tradeable Warrant will have an exercise price equal to $ per whole share. Moreover, following this offering, the market value of the Warrants is uncertain and there can be no assurance that the market value of the Warrants will equal or exceed their exercise price. Furthermore, each Warrant will expire five years from the original issuance date. In the event our Common Stock price does not exceed the exercise price of the Warrants during the period when the Warrants are exercisable, the Warrants may not have any value.

Holders of the Warrants will have no rights as a holder of our Common Stock until they acquire our Common Stock.

Until you acquire our Common Stock upon exercise of your Warrants, you will have no rights with respect to Common Stock issuable upon exercise of your Warrants. Upon exercise of your Warrants, you will be entitled to exercise the rights of a holder of our Common Stock as to the security exercised only as to matters for which the record date occurs after the exercise.

Provisions of the Warrants could discourage an acquisition of us by a third party.

In addition to the provisions of our amended and restated certificate of formation and amended and restated bylaws, certain provisions of the Warrants could make it more difficult or expensive for a third party to acquire us. The Warrants prohibit us from engaging in certain transactions constituting “fundamental transactions” unless, among other things, the surviving entity assumes our obligations under the Warrants. These and other provisions of the Warrants could prevent or deter a third party from acquiring us even where the acquisition could be beneficial to you.

We have broad discretion in the use of our cash, cash equivalents, and investments, including the net proceeds from this offering, and may not use them effectively.

Our management will have broad discretion in the application of our cash, cash equivalents, and investments, including the net proceeds from this offering, and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse impact on our business, cause the price of our common stock to decline, and delay the development of additional services or the opening of new locations. Pending their use, we may invest our cash, cash equivalents, and investments, including the net proceeds from this offering, in a manner that does not produce income or that loses value.

We do not expect to pay any dividends on our common stock.

We do not anticipate that we will pay any cash dividends to holders of our common stock in the foreseeable future. Instead, we plan to retain any earnings to maintain and expand our existing operations. Accordingly, investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any return on their investment.

RISKS RELATED TO THE OFFERING

Our existing shareholders may experience significant dilution from the sale of our shares of Common Stock.

The perceived risk of dilution may cause our shareholders to sell their shares, which may cause a decline in the price of our shares of Common Stock. By increasing the number of shares offered for sale, material amounts of short selling could further contribute to progressive price declines in our shares of Common Stock.

The issuance of shares of our common stock may have a significant dilutive effect.

Depending on the number of shares we issue, it could have a significant dilutive effect upon our existing shareholders. Although the number of shares that we may issue pursuant to the Purchase Agreement will vary based on our stock price (the higher our stock price, the less shares we have to issue) the information set out below indicates the potential dilutive effect to our shareholders, based on different potential future stock prices, if the full amount of the

Unless the Company becomes public and an active trading market develops for our securities, investors may not be able to sell their shares.

The Company is not a public company and there is not currently an active trading market for our shares of Common Stock and an active trading market may never develop or, if it does develop, may not be maintained. Failure to develop or maintain an active trading market will have a generally negative effect on the price of our shares of Common Stock, and you may be unable to sell your shares of Common Stock or any attempted sale of such shares of Common Stock may have the effect of lowering the market price and therefore your investment could be a partial or complete loss. Investors may have difficulty reselling shares of our Common Stock, either at or above the price they paid for our stock, or even at fair market value.

There could be unidentified risks involved with an investment in our securities.

The foregoing risk factors are not a complete list or explanation of the risks involved with an investment in the securities. Additional risks will likely be experienced that are not presently foreseen by the Company. Prospective investors must not construe this, and the information provided herein as constituting investment, legal, tax or other professional advice. Before making any decision to invest in our securities, you should read this entire prospectus and consult with your own investment, legal, tax and other professional advisors. An investment in our securities is suitable only for investors who can assume the financial risks of an investment in the Company for an indefinite period of time and who can afford to lose their entire investment. The Company makes no representations or warranties of any kind with respect to the likelihood of the success or the business of the Company, the value of our securities, any financial returns that may be generated or any tax benefits or consequences that may result from an investment in the Company.

The market price for the Common Shares may be volatile, which may affect the price at which you could sell the Subordinate Voting Shares.

The market price for securities of cannabis-related companies generally are likely to be volatile. In addition, the market price for the common shares may be subject to wide fluctuations in response to numerous factors beyond our control, including, but not limited to:

| | ● | actual or anticipated fluctuations in our quarterly results of operations; |

| | | |

| | ● | recommendations by securities research analysts; |

| | | |

| | ● | changes in the economic performance or market valuations of companies in the industry in which we operate; |

| | | |

| | ● | addition or departure of our executive officers and other key personnel; |

| | | |

| | ● | release or expiration of transfer restrictions on outstanding Subordinate Voting Shares; |

| | | |

| | ● | sales or perceived sales of additional Subordinate Voting Shares; |

| | | |

| | ● | operating and financial performance that varies from the expectations of management, securities analysts and investors; |

| | | |

| | ● | regulatory changes affecting our industry generally and our business and operations both domestically and abroad; |

| | | |

| | ● | announcements of developments and other material events by us or our competitors; |

| | | |

| | ● | fluctuations in the costs of vital services; |

| | | |

| | ● | changes in global financial markets and global economies and general market conditions; |

| | ● | significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving us or our competitors; |

| | | |

| | ● | operating and share price performance of other companies that investors deem comparable to us or from a lack of market comparable companies; and |