ITEM 4.INFORMATION ON THE COMPANY

A. | History and Development of the Company |

Metals Acquisition Limited was incorporated under the laws of Jersey, Channel Islands on July 29, 2022. Our registered office is 3rd Floor, 44 Esplanade, St Helier, Jersey, JE4 9WG and our place of business is 1 Louth Rd, Cobar, NSW, 2835 (which is the address of the CSA Copper Mine). Our telephone number is +44 1534 514 000 and our agent for service of process in the United States is Puglisi & Associates, 850 Library Avenue, Suite 204, Newark, Delaware 19711.

Our website address is https://www.metalsacquisition.com/. The information on our website is not incorporated by reference into this Annual Report, and you should not consider information contained on our website to be a part of this Annual Report. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers, such as us, that file electronically, with the SEC at www.sec.gov.

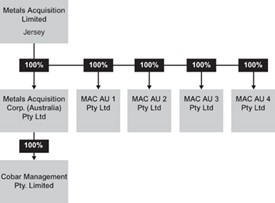

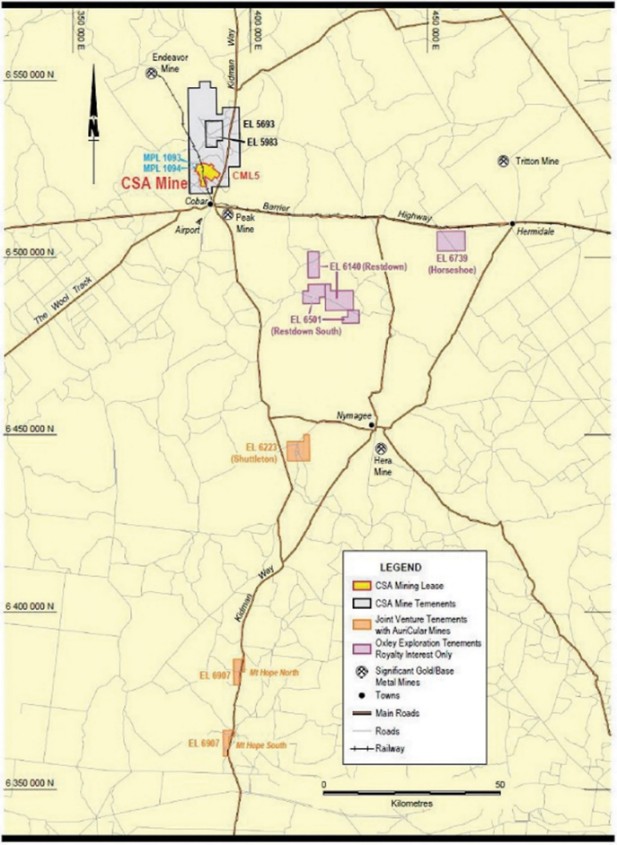

On June 15, 2023, we consummated our Business Combination pursuant to the Share Sale Agreement, pursuant to which MAC-Sub acquired from Glencore 100% of the issued share capital of CMPL, which owns and operates the CSA Copper Mine near Cobar, New South Wales, Australia. Immediately prior to the Business Combination, MAC merged with and into us. Following the Business Combination, we continued as the surviving company, and CMPL became an indirect subsidiary of us.

As part of the Business Combination: (i) each issued and outstanding MAC Class A Ordinary Share and MAC Class B Ordinary Share was converted into one Ordinary Share, and (ii) each issued and outstanding whole warrant to purchase MAC Class A Ordinary Shares was converted into one Warrant at an exercise price of $11.50 per share, subject to the same terms and conditions existing prior to such conversion.

In connection with the execution and delivery of the Share Sale Agreement, MAC entered into Subscription Agreements with the Initial PIPE Investors, pursuant to which the Initial PIPE Investors agreed to subscribe for and purchase, and MAC agreed to issue and sell to the Initial PIPE Investors an aggregate of 22,951,747 Ordinary Shares at a price of $10.00 per share, for aggregate gross proceeds of $229,517,470. Four of the Initial PIPE Investors were officers and directors of MAC and one of the Initial PIPE Investors was also an affiliate of the Sponsor and they agreed to subscribe for 230,000 Ordinary Shares in the aggregate, at a purchase price of $10.00 per share, for aggregate gross proceeds of $2,300,000 all pursuant to the Subscription Agreements on the same terms and conditions as all other Initial PIPE Investors. Such subscribed shares were converted into Ordinary Shares in connection with the Business Combination. The Initial PIPE Investors were also granted customary registration rights in connection with the Initial PIPE Financing.

In connection with the Subscription Agreements, the Sponsor agreed to transfer an aggregate of 988,333 shares of Class B common stock of MAC that it held and agreed to sell 500,000 MAC private placement warrants at a price of $1.50 for each MAC private placement warrant to certain investors who agreed to subscribe for a significant number of Ordinary Shares.

MAC-Sub (as borrower), we and MAC (as guarantors) and Sprott (as lender) entered into a Mezzanine Loan Note Facility Agreement dated March 10, 2023 pursuant to which Sprott made available a US$135 million loan facility agreement available to MAC-Sub, for funding purposes in connection with the Business Combination (the “Mezz Facility”). In connection with the Mezz Facility, we, MAC, Sprott Private Resource Lending II (Collector), LP (the “Equity Subscriber”) and Sprott Private Resource Lending II (Collector-2), LP (the “Warrant Subscriber”), entered into a subscription agreement (the “Sprott Subscription Agreement”) pursuant to which the Equity Subscriber committed to purchase 1,500,000 Ordinary Shares at a purchase price of $10.00 per share and an aggregate purchase price of $15,000,000. In addition, in accordance with the terms of the Mezz Facility, the Warrant Subscriber received 3,187,500 warrants to purchase Ordinary Shares (the “Financing Warrants”) once the Mezz Facility began. Each Financing Warrant entitles the holder to purchase one Ordinary Share.

In accordance with ASX Listing Rule 4.10.3, we disclose the following information in relation to the stock exchanges which the Company’s securities are quoted. The Business Combination was consummated on June 15, 2023 and on June 16, 2023, the Ordinary Shares and Public Warrants commenced trading on the NYSE under the symbols “MTAL” and “MTAL.WS,” respectively. On February 20, 2024, we commenced trading CDIs on the ASX under the symbol “MAC.”