company. In any reorganization or liquidation proceeding relating to such companies, the Fund may lose its entire investment, may be required to accept cash or securities with a value less than the original investment and/or may be required to accept payment over an extended period of time. Troubled company investments and other distressed asset-based investments require active monitoring.

Venture Capital and Growth Equity. We may invest in venture capital and growth equity. Venture capital is usually classified by investments in private companies that have a limited operating history, are attempting to develop or commercialize unproven technologies or implement novel business plans or are not otherwise developed sufficiently to be self-sustaining financially or to become public. Although these investments may offer the opportunity for significant gains, such investments involve a high degree of business and financial risk that can result in substantial losses.

Growth equity is usually classified by investments in private companies that have achieved product-market fit but may still need capital to achieve the desired level of scale before having access to the public markets for financing. As a result of the risks associated with advancing the company’s growth plan, investors can expect a higher return than might be available in the public markets, but also need to recognize the business and financial risks that remain in advancing the company’s commercial aspirations. For both venture capital and growth equity companies, the risks are generally greater than the risks of investing in public companies that may be at a later stage of development.

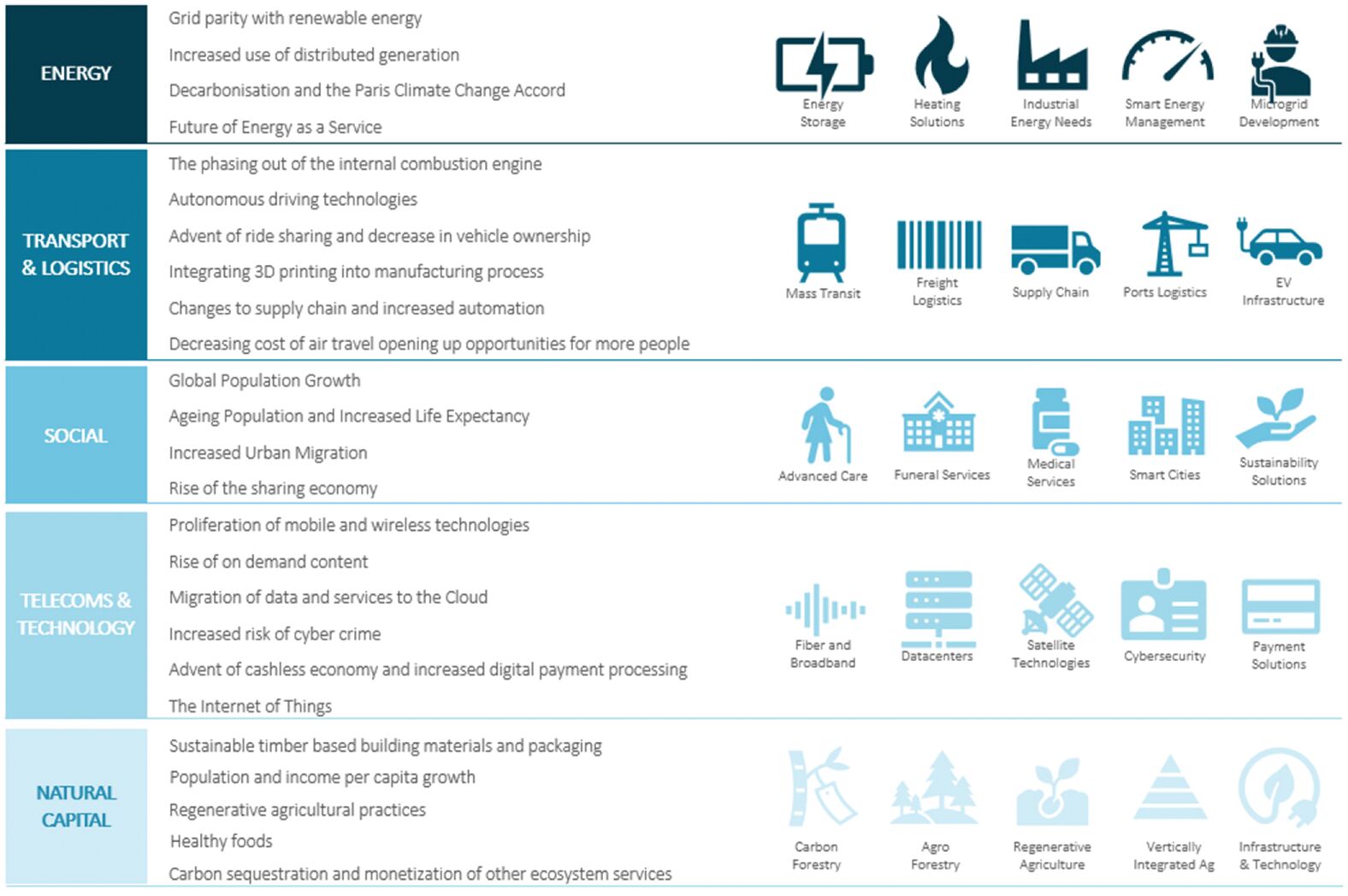

Agriculture and Forestry Sector Risk. Investments in agriculture/farmland are subject to various risks, including adverse changes in national or international economic conditions, adverse local market conditions, adverse natural conditions such as storms, floods, drought, windstorms, hail, temperature extremes, frosts, soil erosion, infestations and blights, failure of irrigation or other mechanical systems used to cultivate the land, financial conditions of tenants, marketability of any particular kind of crop that may be influenced, among other things, by changing consumer tastes and preferences, import and export restrictions or tariffs, casualty or condemnation losses, government subsidy or production programs, buyers and sellers of properties, availability of excess supply of property relative to demand, changes in availability of debt financing, changes in interest rates, real estate tax rates and other operating expenses, environmental laws and regulations, governmental regulation of and risks associated with the use of fertilizers, pesticides, herbicides and other chemicals used in commercial agriculture, zoning laws and other governmental rules and fiscal policies, energy prices, changes in the relative popularity of properties, risk due to dependence on cash flow, as well as acts of God, uninsurable losses and other factors which are beyond the control of the Fund or an Investment Fund.

In addition, the forestry and timber industry is highly cyclical and the market value of timber investments is strongly affected by changes in international economic conditions, interest rates, weather cycles, changing demographics, environmental conditions and government regulations, among other factors. For example, the volume and value of timber that can be harvested from timberlands is limited by natural disasters, fire, volcanic eruptions, insect infestation, disease, ice storms, windstorms, flooding and other events and weather conditions and changes in climate conditions could intensify the effects of any of these factors. Many companies in the timber and forestry industry do not insure against damages to their timberlands. This industry is also subject to stringent U.S. federal, state and local environmental, health and safety laws and regulations. Significant timber deposits are located in emerging markets countries where corruption and security may raise significant risks.

Financial Institutions Risk. Financial institutions in which the Fund may invest, directly or indirectly, are subject to extensive government regulation. This regulation may limit both the amount and types of loans and other financial commitments a financial institution can make, and the interest rates and fees it can charge. In addition, interest and investment rates are highly sensitive and are determined by many factors beyond a financial institution’s control, including general and local economic conditions (such as inflation, recession, money supply and unemployment) and the monetary and fiscal policies of various governmental agencies such as the Federal Reserve Board. These limitations may have a significant impact on the profitability of a financial institution since profitability is attributable, at least in part, to the institution’s ability to make financial commitments such as

40